kang

INDO

BALA

REPO

FIRST QU

ONES

ANC

ORT

UARTER 2

SIA’S

E OF

2010

S

PAY

YMEN

NTS

Contact Address:

Balance of Payments Bureau

Directorate of Economic and Monetary Statistics Bank Indonesia

Sjafruddin Prawiranegara Tower, 16th Floor Jl. M.H. Thamrin No. 2

Jakarta 10350

Phone : (021) 3817088

Fax : (021) 3800134

E-mail : BNP@bi.go.id

INDONESIA’S

BALANCE OF PAYMENTS

REPORT

FIRST QUARTER 2010

SUMMARY ……… 1

INDONESIA’S BALANCE OF PAYMENTS IN Q1/2010, AND ITS CONTRIBUTING FACTORS ……… 3

CURRENT ACCOUNT 1. Non-Oil and Gas Trade Balance ……… 5

1.1. Non-Oil and Gas Exports ……… 6

1.2. Non-Oil and Gas Imports ……… 11

2. Oil and Gas Trade Balance ……… 13

2.1. Oil ……… 13

2.2. Gas ……… 14

3. Services Account ……… 15

4. Income Account ……… 16

5. Current Transfers ……… 17

CAPITAL AND FINANCIAL ACCOUNT 1. Capital Account ……… 19

2. Financial Account ……… 19

2.1. Public Sector ……… 20

2.2. Private Sector ……… 25

RESERVE ASSETS ……… 29

INDICATORS OF EXTERNAL SUSTAINABILITY ……… 31

LIST OF TABLES

Page Page

Table 1 Indonesia’s Balance of Payments and Several Economic Indicators in Q1/2010

4 Table 16 Imports of Non-Oil and Gas Based on Major Countries of Origin (C&F)

11

Table 2 Growth of Non-Oil and Gas Exports by Sector 6 Table 17 Imports of Consumption Goods Based on Major Countries of Origin (C&F)

12

Table 3 Exports to Major Destination Countries 6 Table 18 Imports of Raw Material Based on Major Coutries of Origin (C&F)

12

Table 4 GDP Growth (%, yoy) of Several Non-Oil and Gas Export Destination Countries

6 Table 19 Imports of Capital Goods Based on Major Countries of Origin (C&F)

13

Table 5 Export Growth of Major Non-Oil and Gas Commodities

7 Table 20 Oil Trade Balance 13

Table 6 Rubber Exports to Several Major Countries of Destination

7 Table 21 Demand and Supply of World Oil 14

Table 7 Coal Exports to Major Countries of Destination

8 Table 22 Gas Trade Balance 15

Table 8 Exports of TTP to Several Major Countries of Destination

8 Table 23 Non Investment Grant 18

Table 9 Exports of Machinery and Mechanical Appliances to Several Major Countries of Destination

8 Table 24 Investment Grant 19

Table 10 Copper Exports to Several Major Countries of Destination

9 Table 25 Indonesia’s Sovereign Rating 20

Table 11 CPO Exports to Major Countries of Destination

9 Table 26 Government Program Loan Position by Major Creditors

23

Table 12 Exports of Chemical Products to Major Countries of Destination

10 Table 27 Government Project Loan Position by Major Creditors

24

Table 13 Electronic Exports to Major Countries of Destination

10 Table 28 Government Foreign Loan Position by Major Creditors

24

Table 14 Paper Exports to Major Countries of Destination

11 Table 29 Government Foreign Loan Position by Major Currencies

24

Table 15 Imports of Non-Oil and Gas Based on Types of Goods (C&F)

LIST OF CHARTS

Page Page

Chart 1 Current Account 5 Chart 18 BI Rate and Fed Fund Rate 21

Chart 2 Non-Oil and Gas Trade Balance 6 Chart 19 SBI Rate 21

Chart 3 World Rubber Price 7 Chart 20 SUN & SBI Owned by Foreign Investors 22

Chart 4 World Coal Price 7 Chart 21 Disbursement and Repayment of

Government Loan

22

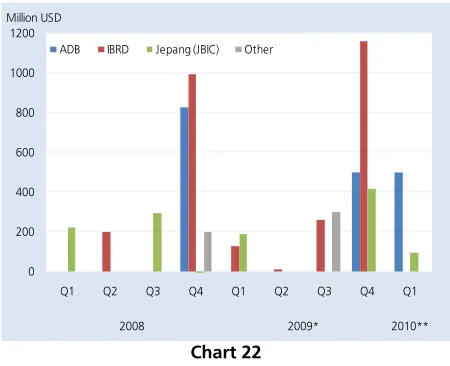

Chart 5 World Copper Price 9 Chart 22 Program Loan Disbursement 23

Chart 6 World CPO Price 10 Chart 23 Project Loan Disbursement 23

Chart 7 Economic Growth and Non-Oil and Gas Imports

11 Chart 24 Government Foreign Loan Position 24

Chart 8 World Oil Prices 14 Chart 25 Financial Account of Private Sector 25

Chart 9 Fuel Consumption 14 Chart 26 Foreign Direct Investment 26

Chart 10 Services Account 15 Chart 27 Foreign Direct Investment (net) based on Country of Origin

26

Chart 11 Travel Services 15 Chart 28 Foreign Direct Investment (net) based on Economic Sector

26

Chart 12 Income Account 16 Chart 29 Oil and Gas Foreign Direct Investment (Net) 27

Chart 13 Workers’ Remittances 17 Chart 30 Non-Oil and Gas Foreign Direct Investment 27

Chart 14 Capital and Financial Account 19 Chart 31 Foreign Transaction in Indonesia Stock Exchange and Indonesia Stock Index

28

Chart 15 Growth of Capital and Financial Account by Sector

20 Chart 32 Loan Disbursement and Repayment of Private Sector

28

Chart 16 Financial Account of Public Sector 20 Chart 33 Reserves Assets 29

SUMMARY

In the first quarter of 2010, Indonesia's balance of payments charted yet another surplus at a robust USD6.6

billion, marking significant improvement over the Q4/2009 surplus recorded at USD4.0 billion. Key to the upbeat

performance in the balance of payments was both surpluses in the current account and the capital and financial

account. In response, international reserves at end-Q1/2010 mounted to USD71.8 billion, equivalent to 5.7 months

of imports and official external debt service payments.

In Q1/2010, the current account registered a USD1.6 billion surplus, down from the Q4/2009 surplus at

USD3.6 billion. The reduced current account surplus is explained primarily by a downturn in the balance of trade

caused by rising imports of oil and gas as well as non-oil and gas. Surging non-oil and gas imports were reflected

not only in consumer goods, but also in increasing imports of raw materials and capital goods in support of growing

domestic production and investment. At the same time, oil imports also climbed in response to accelerated domestic

economic activity. On the other hand, non-oil and gas exports grew ahead of initial expectations on the improved

recovery in the world economy led by vibrant economic growth at the regional level. However, growth in non-oil

and gas exports (35.5%, yoy) fell short of the steep rise in non-oil and gas imports (44.5%, yoy). Even so, the

current account still managed a respectable surplus, bolstered in part by the reduction in the services deficit related

to lower overseas travel by Indonesians, which had soared in the preceding quarter due to the hajj pilgrimage

season.

In Q1/2010, the capital and financial account registered a USD4.3 billion surplus, up significantly from the

Q4/2009 surplus of USD1.3 billion. Key to this increased surplus was more vigorous performance in direct

investment and portfolio investments. Direct investment climbed mainly in response to the more conducive

investment climate, improved macroeconomic conditions and government measures to streamline procedures for

foreign investors in Indonesia. Improved global liquidity conditions and relatively attractive yield fueled inflows of

foreign portfolio capital and contributed to the successful issuance of government’s foreign currency bonds. Added

boost for the capital and financial account surplus came from a comparatively high draw down of private sector

external borrowings in response to improved access for Indonesian companies to financing sources on international

financial markets.

The global economic recovery, mainly the rapid growth of Asian region, contributed to the improvement in

Indonesia’s balance of payments in Q1/2010 that recorded a USD6.6 billion surplus, higher than the USD4.0 billion

surplus in Q4/2009. This positive performance was bolstered by current account surplus of USD1.6 billion and capital

and financial accounts surplus of USD4.3 billion. This conducive economic condition contributed to the upward

trend of non oil-gas export. On the other side, the increasing domestic demand as reflected from high economic

growth and the rising need of imported-base export raw material led import to grow higher than export.

Consequently, current account recorded a lower surplus compared to the preceding quarter. This surplus, however,

was still relatively high due to the reduction in the services and income account deficits.

The contracted surplus of current account was compensated by capital and financial accounts that

experiencing a higher surplus compared to the previous quarter due to the support of portfolio and direct

investments performance. In Q1/2010, the relatively stable domestic macroeconomic condition and the improved

liquidity condition in global market contributed to the mounting inflow of portfolio investment and direct

investment. In line with this development of Indonesia’s balance of payment, the amount of foreign reserves at the

end of the period (March 2010) rose to USD71.8 billion (USD66.1 billion in Q4/2009) or equivalent to 5.7 months of

imports and official debt service payments.

The following factors contributed to the Indonesia’s balance of payments during Q1/2010:

• World economy continued to accelerate and more distributed. China, being the main engine of Asian

economy, registered a 11.9% (y.o.y) economic growth. Improvement was also shown by several

macroeconomic indicators in several developed countries such as the US, Japan and European Union countries.

• The strengthening world demand accompanied by global economic recovery led to hike in prices of several

primary export commodities. Prices of commodities such as rubber, copper, coal and CPO experienced increases

while the unit price of crude oil export rose from USD73.1/barrel to USD75.2/barrel. Similar condition was also

reflected from the price of LNG.

• Indonesian GDP also improved from 5.4% to 5.7% (y.o.y) in the reporting period. Investment sector posted

more important contribution to GDP growth than consumption sector.

• Indonesian inflation at the end of March 2010 was recorded at 3.4%. The relatively maintained inflation

during the reporting period was attributed to the policy of Bank Indonesia to sustain BI rate at 6.5% since

mid-2009. This stable inflation contributed to the strengthening Rupiah exchange rate against USD from an average

rate of Rp9,473 (Q4/2009) to Rp9,254 (Q1/2010). The domestic inflation was also influenced by external factor

related to low inflation in several Indonesian trading partners.

• In Q1/2010, oil production reached 0.955 million barrels per day (mbpd), slightly higher than 0.951 mbpd in

the preceding quarter. Meanwhile, oil consumption contracted to 82.8 million barrel from 89.7 million barrel.

This drop was driven by seasonal factors such as a number of religious celebrations and end of year activities in

Q4/2009.

Table 1

Indonesia’s Balance of Payments and

Several Economic Indicators in Q1/2010

2010

Total Q1 Q2 Q3 Q4 Total Q1

WORLD ECONOMIC INDICATORS

Economic Growth

‐ United States of America % (y.o.y) 2.1 0.4 ‐3.3 ‐3.8 ‐2.6 0.1 ‐2.4 2.5

‐ Japan % (y.o.y) 3.5 ‐1.2 ‐8.9 ‐5.7 ‐5.2 ‐1.0 ‐5.2 n.a

‐ European Union % (y.o.y) 2.8 0.5 ‐5.0 ‐4.9 ‐4.1 ‐2.2 ‐4.1 0.5

‐ Singapore % (y.o.y) 8.5 1.8 ‐8.9 ‐1.7 1.8 3.8 ‐1.3 15.5

‐ China % (y.o.y) 12.1 9.1 6.2 7.9 9.1 10.7 8.5 11.9

World Price Commodity

‐ Crude Oil (OPEC) USD/barel 69.1 94.5 43.0 58.7 67.6 74.3 61.1 75.5

‐ Coal USD/metric ton 66 127 72 66 71 78 72 95

‐ Copper USD/metric ton 7,118 6,956 3,428 4,663 5,859 6,648 5,150 7,232

‐ CPO USD/ton 780 949 577 743 679 732 683 808

‐ Rubber cent USD/kg 248 284 166 187 221 285 215 345

International Interest Rates ¹⁾

‐ United States of America % (y.o.y) 5.1 2.1 0.25 0.25 0.25 0.25 0.30 0.25

‐ Japan % (y.o.y) 0.5 0.5 0.1 0.1 0.1 0.1 0.1 0.1

‐ European Union % (y.o.y) 3.9 3.9 1.8 1.1 1.0 1.1 1.3 0.0

‐ Singapore % (y.o.y) 2.7 1.3 0.7 0.7 0.7 0.7 0.7 0.7

‐ China % (y.o.y) 6.8 7.0 5.3 5.3 5.3 5.3 5.3 5.3

Inflation ²⁾

‐ United States of America % (y.o.y) 4.1 0.1 ‐0.4 ‐1.4 ‐1.3 2.7 2.7 ‐0.4

‐ Japan % (y.o.y) 0.7 0.4 ‐0.3 ‐1.8 ‐2.2 ‐1.7 ‐1.7 ‐0.3

‐ European Union % (y.o.y) 3.1 1.6 0.6 ‐0.1 ‐0.3 0.9 0.9 0.6

‐ Singapore % (y.o.y) 4.4 4.3 1.6 ‐0.5 ‐0.4 0.2 0.2 1.6

‐ China % (y.o.y) 6.5 1.2 ‐1.2 ‐1.7 ‐0.8 1.9 1.9 ‐1.2

DOMESTIC ECONOMIC INDICATORS

GDP % (y.o.y) 6.3 6.0 4.5 4.1 4.2 5.4 4.5 5.7

CPI Inflation ²⁾ % (y.o.y) 6.6 11.1 7.9 3.7 2.8 2.8 2.8 3.4

Exchange Rates ¹⁾ (Rp/USD) 9,140 9,700 11,631 10,531 10,002 9,473 10,395 9,254

Average Price of Crude Oil Export USD/barel 70.1 93.5 41.8 56.9 66.5 73.1 59.6 75.2

Oil Production mbpd 0.952 0.976 0.962 0.941 0.943 0.951 0.949 0.955

Fuel Consumption mbpy 382.8 381.4 80.7 84.5 88.3 89.7 343.1 82.8

Gas Export (LNG) mbtu 1,080 1,068 257 228 244 301 1,030 277

Gas Export Average Price (LNG) USD/mbtu 9.0 11.9 5.5 6.3 8.2 7.8 7.0 7.8

BI Rate 1) % (annual) 8.6 8.7 8.25 7.25 6.58 6.50 7.15 6.50

INDONESIAN BALANCE OF PAYMENTS

‐ Current Account million USD 10,492 126 2,508 2,480 2,157 3,602 10,746 1,554

‐ Capital and Financial Account million USD 3,593 ‐1,832 1,593 ‐1,822 2,507 1,270 3,548 4,297

‐ Total million USD 14,085 ‐1,706 4,101 658 4,664 4,872 14,294 5,851

‐ Net Errors and Omissions million USD ‐1,370 ‐239 ‐146 394 ‐1,118 ‐918 ‐1,788 770

‐ Overall Balance million USD 12,715 ‐1,945 3,955 1,052 3,546 3,954 12,506 6,621

‐ Foreign Exchange Reserves million USD 56,920 51,639 54,840 57,576 62,287 66,105 66,105 71,823

Source: CEIC, IMF, World Bank, Bank Indonesia, and other sources

¹⁾ an interest rate policy sets by central bank / monetary authority (calculated as the average monthly) ²⁾ end‐month position of the relevant quarter

In Q1/2010 current account posted a USD1.6

billion surplus, lower than the USD3.6 billion surplus in

the preceding quarter. This was mainly due to the

contracted surplus in non-oil & gas and oil & gas trade

balances.

Chart 1 Current Account

The decreased surplus in non-oil & gas trade

balance was related to the declining export value in the

midst of higher non-oil & gas imports compared to the

preceding quarter. These development of exports was

also due to seasonal factors occurring every first

quarter. The annual growth of exports, however, still

indicated a high increase (35.5%) compared to the

previous quarter (17.5%). Meanwhile, the non-oil & gas

imports jumped in response to the rising of domestic

economic growth and demand of raw materials for

exports. The surge in investment and production

activities were led to the rising import demand for

consumption goods, raw materials and capital goods.

On annual basis, the growth of non-oil and gas imports

exceeded the exports growth .

Oil & gas trade balance posted a contracted

surplus compared to Q4/2009, mainly due to the

increasing demand of oil imports in line with the

mounted economic growth and the decreased LNG

export volume pursuant to the transfer of gas

production to fulfill domestic demand.

Meanwhile, services balance deficit slightly

decreased due to the declining of Indonesian travelers

abroad that marked a sharp increase in the preceding

quarter due to seasonal factor such as hajj pilgrimage.

The downturn of income balance deficit was mainly due

to the decrease of government and private debt service

payments.

1. Non-Oil Gas Trade Balance

In Q1/2010 non-oil and gas trade balance recorded

a USD5.9 billion surplus, lower than the USD8.4 billion

surplus in Q4/2009. The declining surplus was

affected by export performance that recorded

a negative growth of 4.6% (q.t.q) which was presumed

due to seasonal pattern. In the contrary, non-oil and

gas imports grew positive 5.8% (q.t.q) in line with

the upward trend of investment and production

activities.

However, based on annual growth, non-oil

and gas exports still recorded an accelerated

growth compared to Q4/2009. Export growth of

non-oil and gas improved from 17.5% (y.o.y) in

Q4/2009 to 35.5% (y.o.y) in the reporting period.

Meanwhile, non-oil and gas imports experienced a

significant increase from -8.4% (y.o.y) to 44.5% (y.o.y)

in Q1/2010.

-5,000 -3,000 -1,000 1,000 3,000 5,000 7,000 9,000 11,000

Q.1 Q.2 Q.3 Q.4 Q.1 Q.2 Q.3 Q.4 Q.1 Q.2 Q.3 Q.4 Q.1

2007 2008 2009* 2010**

million USD

Chart 2

Non-Oil and Gas Trade Balance

1.1. Non-Oil and Gas Exports

In Q1/2010, non-oil and gas exports reached

USD27.8 billion, decreased by 4.6% (q.t.q) compared to

the previous quarter (USD29.1 billion). The weakening

performance of export value was related to mining and

manufacturing exports which declined by 4.2% and

-6.6% (q.t.q) respectively. Meanwhile exports in

agricultural sector still posted a positive growth of 5.4%

from the previous period.

Table 2

Growth of Non-Oil and Gas Exports by Sector

Although exports in mining and manufacturing

sectors declined from the previous quarter, all sectors

still posted positive annual growth. Agricultural sector

recorded a growth of 52.2% (y.o.y) far higher than

previous period (6.3%, y.o.y). Manufacturing sector

posted a growth of 29.1% (y.o.y), showed an

improvement compared to the preceding quarter

(7.6%, y.o.y). Meanwhile, mining sector grew by

50.1% (y.o.y), slower than the previous period (55.9%).

The declining of non-oil & gas exports was also

reflected from the export performance to several major

countries of destination, such as Japan (decreased by

9.9%, q.t.q) and Singapore (decreased by 0.8%, q.t.q).

On annual basis, however, export performance to major

countries of destination still recorded a positive growth

in line with the improving economic condition in

Europe, Asia and America.

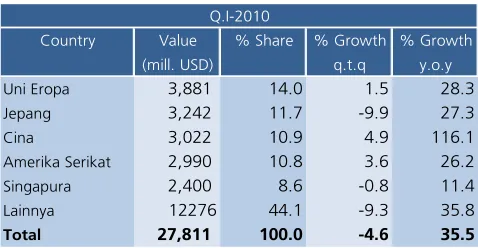

Table 3

Exports to Major Destination Countries

The annual growth of exports was in line with the

prediction of improving economic activities in major

countries of destination during the reporting period

compared to previous year.

Table 4

GDP Growth (%, yoy) of

Several Non-Oil and Gas Export Destination Countries

Several commodities supporting the performance

of non-oil and gas exports in this period were: rubber,

coal, textile and textile products and machinery &

mechanic. The increased exports of those commodities

were partly supported by price factor (rubber, coal and

1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 9,000 3,000 8,000 13,000 18,000 23,000 28,000 33,000 38,000

Q.1 Q.2 Q.3 Q.4 Q.1 Q.2 Q.3 Q.4 Q.1 Q.2 Q.3 Q.4 Q.1

2007 2008 2009* 2010**

million USD million USD

Exports Imports Non Oil & Gas Trade Balance (RHS)

Q4 Q1 Q4 Q1 Q4 Q1

Agriculture

Value 11.6 12.9 16.9 5.4 6.3 52.2

Volume 2.4 2.0 9.9 -18.4 12.9 25.5

Mining

Value 27.7 27.8 12.4 -4.2 55.9 50.1

Volume 83.5 87.6 15.3 2.8 53.2 89.9

Manufacturing

Value 59.6 58.3 13.6 -6.6 7.6 29.1

Volume 14.1 10.5 16.7 -27.6 14.3 -1.6

Total

Value 100.0 100.0 13.8 -4.6 17.5 35.5

Volume 100.0 100.0 15.3 -2.0 45.0 71.5 % Share % Growth % Growth

(q.t.q) (y.o.y)

Country Value % Share % Growth % Growth

(mill. USD) q.t.q y.o.y

Uni Eropa 3,881 14.0 1.5 28.3

Jepang 3,242 11.7 -9.9 27.3

Cina 3,022 10.9 4.9 116.1

Amerika Serikat 2,990 10.8 3.6 26.2

Singapura 2,400 8.6 -0.8 11.4

Lainnya 12276 44.1 -9.3 35.8

Total 27,811 100.0 -4.6 35.5

Q.I-2010

Singapore ‐9.5 ‐3.3 0.6 5.1 8.9

Japan ‐8.6 ‐6.0 ‐4.7 ‐1.2 2.6

China 6.1 7.9 8.9 10.4 11.1

USA ‐3.3 ‐3.8 ‐2.6 0.1 2.5

Euro Zone ‐5.0 ‐4.8 ‐4.1 ‐1.7 0.7

Source: Consensus Forecast *) provisional figures

2009 2010

machinery and mechanical appliances) and volume

(textile and textile products).

Table 5

Export Growth of Major Non-Oil and Gas Commodities

Rubber

Rubber exports in Q1/2010 reached USD1.5 billion

or grew by 44.5% from the preceding period. The

increase of rubber export value was contributed by the

rise of rubber price by 21.6%.

Rubber price in Q1/2010 reached USD346.1

cent/kg, higher than USD284.7 cent/kg in Q4/2009. The

rise in rubber price was supported by the increasing

rubber demand in line with the recovery of world

automotive industries. This increasing demand was also

reflected from export volume that grew by 8.5% from

the previous period. The rise in price was also triggered

by the limited rubber supply due to the high rainfall in

the producing countries (Indonesia, Malaysia and

Thailand).

Chart 3 World Rubber Price

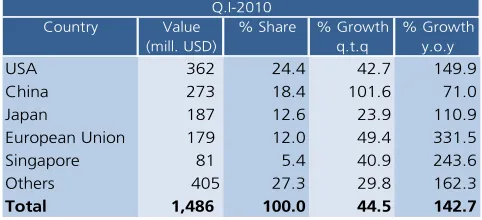

On annual basis, rubber exports grew by 142.7%

in contradiction with the preceding period (-0.6%,

y.o.y). The main export destination were the United

States (share of 24.4%), China (18.4%) and Japan

(12.6%).

Table 6

Rubber Exports to Several Major Countries of Destination

Coal

Coal exports in Q1/2010 reached USD4.2 billion or

grew by 4.0% from the previous quarter. The

performance of coal exports was supported by the rise

in coal price during the reporting period. The coal price

reached USD95.2/MTon or rose by 22.6% from the

previous period (USD77.7 M/Ton). This condition was in

line with the strengthening world oil price that

ultimately pushed other commodity prices went up.

Chart 4 World Coal Price

On the other side, demand of coal also showed an

increase as reflected from the growth of exports volume

by 2.8% (q.t.q) from the preceding period. The demand

Q4 Q1 Q4 Q1 Q4 Q1 Q4 Q1 Q4 Q1 Q4 Q1

Rubber 4.2 3.0 0.5 0.5 26.4 44.5 ‐6.8 8.5 ‐0.6 142.7 8.9 20.4

Copper 3.4 7.7 0.7 0.7 23.7‐10.5 13.3 ‐9.7 215.6 50.2 141.8 ‐1.7

Coal 12.6 12.4 69.2 72.7 8.1 4.0 11.7 2.8 29.0 64.6 50.3 124.5

CPO 11.7 8.2 0.1 0.0 29.6‐35.6 26.1‐42.1 20.9 34.3 12.6 ‐6.5

Chemical Product 6.0 6.0 2.4 1.9 17.6 ‐2.0 22.3‐22.4 28.7 52.4 49.0 21.0

Electrical Appl. 10.3 9.8 0.2 0.2 4.2 ‐4.0 9.3 ‐3.4 16.2 41.7 20.3 43.6

Paper 4.3 4.7 1.7 1.6 19.8 ‐2.9 15.5 ‐8.3 15.9 24.0 13.3 ‐4.0

Mach. & Mechanic 8.7 7.5 0.3 0.3 11.5 7.2 52.0 ‐6.5 ‐24.9 13.5 ‐45.6 1.2

Nickel 1.5 1.0 3.5 4.1‐15.2‐57.8 11.5 14.5 16.8‐13.0 127.6 273.3

Textile & Tex. Prod 9.3 10.9 0.5 0.5 ‐0.8 8.1 7.4 4.1 6.0 18.7 24.3 23.5

Share (%) % Growth (q.t.q) % Growth (y.o.y)

Value Volume Value Volume Value Volume

0 50 100 150 200 250 300 350 400

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1

2007 2008 2009 2010

c/kg

Country Value % Share % Growth % Growth

(mill. USD) q.t.q y.o.y

USA 362 24.4 42.7 149.9

China 273 18.4 101.6 71.0

Japan 187 12.6 23.9 110.9

European Union 179 12.0 49.4 331.5

Singapore 81 5.4 40.9 243.6

Others 405 27.3 29.8 162.3

Total 1,486 100.0 44.5 142.7

Q.I-2010 0 20 40 60 80 100 120 140 160 180

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1

2007 2008 2009 2010

for Indonesia’s coal mainly came from China (share

28.1%), Japan (15.4%) and South Korea (13.3%). On

annual basis, coal exports jumped from 29% (y.o.y) in

Q4/2009 to 64.6% (y.o.y) in the reporting period.

Table 7

Coal Exports to Several Major Countries of Destination

Textile and Textile Product

Textile and Textile Product (TTP) exports started to

show a positive growth. In Q1/2010, TTP exports

reached USD2.6 billion or grew by 8.1% from the

preceding period. This growth was sustained by the

export volume increased by 4.1% (q.t.q). The improving

economic condition of developed countries was

presumed sustaining the performance of TTP exports, as

reflected in the exports to the United States and

European Union with market shares of 38.9% and

16.5% respectively.

Table 8

Exports of TTP to Several Major Countries of Destination

The improved TTP export performance was also

shown on its annual growth which rose from 6.0%

(y.o.y) in Q4/2009 to 18.7% (y.o.y) in the reporting

quarter.

Machinery and Mechanical Appliances

Exports of machinery & mechanical appliances in

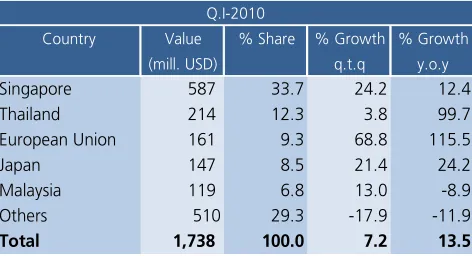

Q1/2010 reached USD1.7 billion, grew by 7.2% from

the preceding period (USD1.6 billion). The main export

destinations were Singapore, Thailand and European

Union, with market shares of 33.7%, 12.3% and 9.3%

respectively.

Table 9

Exports of Machinery and Mechanic to Several Major Countries of Destination

Machinery and mechanical appliances exports

showed a significant improvement compared to the

same period in the previous year. In Q1/2010,

machinery and mechanical appliances exports climbed

by 13.5% (y.o.y) in contradiction with the preceding

period (-24%, y.o.y).

Meanwhile, despite the positive annual growth,

several major commodities experienced slowing

performance on quarterly basis such as: copper, CPO,

chemical products, electronic and paper. The

decreased export performance of those commodities

due to seasonal factor.

Copper

In Q1/2010, copper exports reached USD2.4 billion

or decreased by 10.5% from the previous quarter. The

declining was triggered by the diminish of export

volume by 9.7% as related to declining exports to

several importing countries such as South Korea and

Japan with a downturn of 41.4% (q.t.q) and 21.1%

(q.t.q) respectively.

Country Value % Share % Growth % Growth

(mill. USD) q.t.q y.o.y

USA 1,176 28.1 12.3 1185.1

European Union 644 15.4 24.6 35.8

Japan 557 13.3 14.4 82.2

South Korea 496 11.9 10.3 -8.2

China 338 8.1 -22.1 0.6

Others 969 23.2 -10.6 22.3

Total 4,179 100.0 4.0 64.6

Q.I-2010

Country Value % Share % Growth % Growth

(mill. USD) q.t.q y.o.y

USA 1,029 38.9 14.2 16.7

European Union 435 16.5 -1.7 5.8

Japan 144 5.4 5.2 26.1

South Korea 107 4.1 13.8 63.4

China 63 2.4 11.9 47.5

Others 867 32.8 6.2 21.5

Total 2,646 100.0 8.1 18.7

Q.I-2010

Country Value % Share % Growth % Growth

(mill. USD) q.t.q y.o.y

Singapore 587 33.7 24.2 12.4

Thailand 214 12.3 3.8 99.7

European Union 161 9.3 68.8 115.5

Japan 147 8.5 21.4 24.2

Malaysia 119 6.8 13.0 -8.9

Others 510 29.3 -17.9 -11.9

Total 1,738 100.0 7.2 13.5

Table 10

Copper Exports to Several Major Countries of Destination

On annual basis, however, copper exports still

posted a positive growth albeit in lower magnitude than

the preceding period, from 215.6% (y.o.y) in Q4/2009

to 50.2% (y.o.y) in the reporting period.

Chart 5 World Copper Price

The copper price rose by 8.8% to USD7,232/MTon

compared to USD6,648/MTon in the preceding quarter.

The increasing price was contributed by the rising

demand from Asia, mainly from China. Although

China’s consumption on copper this year is projected to

reach 39% of total world copper consumption (about

18 million tons), China had not been included as major

destination countries for Indonesia copper exports.

China utilizes copper to back the construction industry,

energy infrastructure development and other industrial

activities.

CPO

After reaching its peak in September-October last

year, in line with the CPO production cycle, the

production of CPO in the beginning of the year became

lower. As a result, the value of exports of CPO also

decreased 35.6% (q.t.q) to USD2.3 billion from the

previous period (USD3.5 billion). Nevertheless,

compared to the same period in the previous year, CPO

exports continued to improve, with growth in Q1/2010

reached 34.3% (y.o.y), higher than the previous period

(20.9%, y.o.y).

The weakening exports performance in the

reporting period compared to previous periods occurred

in almost all major destination countries, such as

India, European Union, and China. Besides the declining

in CPO production as cyclical factor, the decrease of

CPO exports to the European region was related to the

negative campaign on Indonesian CPO regarding

the issues of land clearing and environmental

degradation.

Table 11

CPO Exports to Major Countries of Destination

Although the export volume decreased

compared to the previous quarter, CPO price

rose by 10.3% (q.t.q) which sustained the downturn

of export value. In this period, CPO price elevated

to USD808/Mton from USD732/Mton in Q4/2009,

driven by increased demand from India and China.

CPO consumption in both countries was estimated

to reach 7.3 million tons (India) and 750 thousand

tons (China). Currently, Indonesia has controlled

Country Value % Share % Growth % Growth

(mill. USD) q.t.q y.o.y

Japan 693 29.3 -21.1 40.3

European Union 367 15.5 151.8 36.0

South Korea 348 14.7 -41.4 93.6

India 249 10.5 13.3 58.7

Malaysia 230 9.7 20.9 331.2

Others 477 20.2 -22.1 13.5

Total 2,363 100.0 -10.5 50.2

Q.I-2010

3,000 4,000 5,000 6,000 7,000 8,000 9,000

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1

2007 2008 2009 2010

USD/MTon

Country Value % Share % Growth % Growth

(mill. USD) q.t.q y.o.y

India 716 31.5 -34.4 17.0

European Union 451 19.8 -32.8 50.2

China 246 10.8 -40.9 -10.6

Malaysia 168 7.4 -44.5 257.3

Singapore 144 6.3 17.2 158.2

Others 546 24.0 -40.7 36.3

Total 2,271 100.0 -35.6 34.3

83% CPO’s market in India, while in China, Indonesia

ranks the second supplier after Malaysia with a share

of 31.5%.

Chart 6 World CPO Price

Chemical Products

In Q1/2010, export of chemical products

reached USD1.9 billion or contracted by 2.0%

(q.t.q.), primarily as a result of declining export volume

(-22.4%, q.t.q). The down sliding exports occurred

mainly to Malaysia and European Union. On annual

basis, however, the exports performance of chemical

products still improved and grew by 52.4% (y.o.y) in

Q1/2010 higher than the preceding period (28.7%,

y.o.y).

Exports performance of chemical products and

products containing chemical materials to European

Union (EU) was slightly hampered by the

implementation of REACH (Registration, Evaluation,

and Authorization of Chemicals) by the European

Union. REACH was the new regulation on the safe

use of chemical materials. REACH was gradually

applied since June 2007 until year 2018. Currently,

REACH is still in the stage of registration and each

product entering EU countries shall be accompanied

by reports that contain data of raw material

composition of the products, mainly related to any

chemical content. This report is then registered to the

ECHA (European Chemicals Agency).

Table 12

Exports of Chemical Products to Major Countries of Destination

Electrical Appliances

Exports of electronic products in Q1/2010

reached USD2.9 billion or dropped by 4.0% from the

previous quarter. The decreased exports value was in

line with the declining volume of 3.4%.

The decline in export was mainly to Japan (down

15.9%), United States (-12.2%) and Hong Kong

(-7.1%). The competition from China diminished

Indonesian’s portion of electronic exports. On an annual

basis, however, the performance of electronic exports

still grew 41.7% (y.o.y), higher than the previous

quarter (16.2%, y.o.y).

Table 13

Electronic Exports to Major Countries of Destination

Paper

Paper exports in Q1/2010 reached USD1.2 billion

or dropped by 2.9% from the previous quarter.

Although paper prices in the international market

increased, the value of exports declined due to the

decreased volume of 8.3% (q.t.q), as the result of lower

supply of raw materials. Raw materials that had to be 0

200 400 600 800 1,000 1,200 1,400

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1

2007 2008 2009 2010

USD/MTon Country Value % Share % Growth % Growth

(mill. USD) q.t.q y.o.y

China 316 16.7 21.7 107.4

Japan 158 8.4 17.7 69.0

European Union 184 9.7 -2.0 56.0

Malaysia 136 7.2 -3.9 21.3

Singapore 130 6.9 11.6 89.2

Others 965 51.1 -11.3 38.9

Total 1,889 100.0 -2.0 52.4

Q.I-2010

Country Value % Share % Growth % Growth

(mill. USD) q.t.q y.o.y

Singapore 646 22.6 1.4 33.4

European Union 418 14.6 -6.8 56.4

Japan 336 11.8 -15.9 31.7

USA 324 11.3 -12.2 20.7

Hongkong 135 4.7 -7.1 106.1

Others 998 34.9 2.1 47.8

Total 2,857 100.0 -4.0 41.7

imported was conifer, a sort of wood with long and

sharp leaves, used as raw materials of pulp. Although

paper exports declined compared to previous period

(q.t.q), but compared to the same period in the

previous year, the export performance recorded positive

growth (24.0%, y.o.y), higher than the preceding

period (15.9%,y.o.y).

Paper exports in this period was mainly intended to

China (share 14.5%), Japan (11.4%) and South Korea

(6.8%).

Table 14

Paper Exports to Major Countries of Destination

1.2. Non-Oil and Gas Imports

In Q1/2010, non-oil & gas imports reached

USD22.0 billion (f.o.b), higher than USD20.8 billion

(f.o.b) in the preceding quarter. The increase of non oil

and gas imports was also reflected in the annual growth

that jumped from -8.4 % (y.o.y) in Q4/2009 to 44.5%

(y.o.y) in the reporting period which was driven by rising

domestic demand.

Chart 7

Economic Growth and Non-Oil and Gas Imports

Imports of consumption goods increased by

25.9% (q.t.q), followed by imports of raw material

which also rose by 6.7% (q.t.q). Meanwhile, imports of

capital goods fell 0.9% from the preceding period.

Table 15

Imports of Non-Oil and Gas Based on Types of Goods (C&F)

Most of the imported goods were from Asian

region such as China, Japan, and Singapore. The other

countries of origin of Indonesian imports were the

United States and the European Union.

Table 16

Imports of Non-Oil and Gas Based on Major Countries of Origin (C&F)

Imports of Consumption Goods

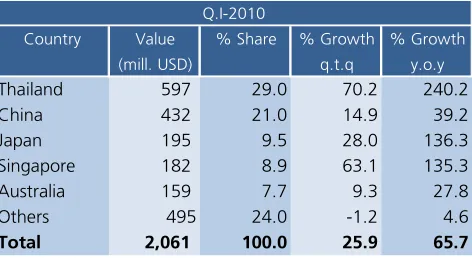

In Q1/2010, imports of consumption goods posted

USD2.1 billion or grew by 25.9% compared to the

preceding quarter. Consumer goods that mostly

imported were semi-durable goods, processed foods &

beverages for household, milk and dairy products,

motor vehicles and non-industrial transport equipment.

Country Value % Share % Growth % Growth

(mill. USD) q.t.q y.o.y

China 174 14.5 -10.9 4.3

Japan 137 11.4 1.3 18.1

South Korea 82 6.8 1.1 127.5

Malaysia 81 6.7 26.2 42.2

USA 60 5.0 -24.9 20.5

Others 667 55.5 -2.1 22.9

Total 1,202 100.0 -2.9 24.0

Q.I-2010 -40 -30 -20 -10 0 10 20 30 40 50 4.0 4.5 5.0 5.5 6.0 6.5

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1*

2008 2009* 2010

Gross Domestic Product Non Oil & Gas Growth (y.o.y) - RHS

%, y.o.y %, y.o.y

Sumber: DSM dan DKM

Q4 Q1 Q4 Q1 Q4 Q1

Consumption Goods

Value 7.3 8.6 -7.7 25.9 -14.6 65.7

Volume 4.5 7.8 -3.3 72.8 8.0 78.7

Raw Material

Value 66.3 66.9 10.2 6.7 -9.3 52.2

Volume 91.0 88.7 8.6 -2.5 21.3 66.7

Capital Goods

Value 25.4 23.7 13.2 -0.9 -5.3 22.1

Volume 4.5 3.5 27.8 -23.8 13.9 -6.7

Total

Value 100.0 100.0 9.5 5.8 -8.4 44.5

Volume 100.0 100.0 8.7 -0.1 20.3 63.1

% Share % Growth % Growth (q.t.q) (y.o.y)

Country Value % Share % Growth % Growth

(mill. USD) q.t.q y.o.y

China 4,101 17.2 3.2 48.9

Japan 3,509 14.7 22.1 65.6

Singapore 2,777 11.6 14.0 26.5

USA 2,227 9.3 1.3 39.1

European Union 2,033 8.5 -12.4 7.2

Others 9249 38.7 5.4 55.0

Total 23,896 100.0 5.8 44.5

On annual basis, imports of consumption goods

grew significantly from -14.6% (y.o.y) in Q4/2009 to

65.7% (y.o.y) in the reporting period. Imports of

consumption goods were mainly from Thailand (share

29.0%), China (21.0%), and Japan (9.5%). Types of

commodity imported from China were foods, beverages

and shoes.

Table 17

Imports of Consumption Goods Based on Major Countries of Origin (C&F)

Imports of Raw Materials

Imports of raw materials in Q1/2010 reached

USD16.0 billion (C&F), grew by 6.7% compared to

the previous period. The strengthening in imports

of raw materials was presumed in line with the increase

in production activities in manufacturing sector during

the reporting period. Compared to the same period in

the previous year, imports of raw materials grew rapidly

from -9.3% (y.o.y) in Q4/2009 to 52.2% (y.o.y).

Primary imported raw materials was hydrocarbon

which was chemical raw materials for pharmaceutical

industry. These raw materials have yet to be produced

domestically and imported from abroad. Besides

hydrocarbon chemicals, other imported raw materials in

Q1/2010 were spare-parts and accessories. Imports of

raw materials were mainly from Japan (share 14.8%),

China (12.8%) and Singapore (12.4%).

Table 18

Imports of Raw Material Based on Major Coutries of Origin (C&F)

Imports of Capital Goods

Imports of capital goods in Q1/2010 reached

USD5.7 billion (C&F) or fell 0.9% from the preceding

period. Types of imported capital goods in this period

were telecommunications equipment, aircraft and

equipment, motor vehicles for transportation industry

and electronic machinery & apparatus. The increasing

activities in communication technology and

transportation, as well as growth in the commercial

aviation industry in Indonesia encouraged imports of

these capital goods. Most capital goods were imported

from China (share 25.3%), Japan (15.3%) and the

United States (14.3%).

Although lower than the previous period, but

capital goods imports on an annual basis increased

significantly. The growth of capital goods imports

amounted to 22.1% (y.o.y), in contrast to the previous

quarter at -5.3% (y.o.y). The increase in imports was in

line with improving production and investment activities

in the country.

Country Value % Share % Growth % Growth

(mill. USD) q.t.q y.o.y

Thailand 597 29.0 70.2 240.2

China 432 21.0 14.9 39.2

Japan 195 9.5 28.0 136.3

Singapore 182 8.9 63.1 135.3

Australia 159 7.7 9.3 27.8

Others 495 24.0 -1.2 4.6

Total 2,061 100.0 25.9 65.7

Q.I-2010

Country Value % Share % Growth % Growth

(mill. USD) q.t.q y.o.y

Japan 2,372 14.8 24.3 72.7

China 2,049 12.8 -3.5 55.7

Singapore 1,979 12.4 36.2 36.6

USA 1,226 7.7 7.7 51.0

European Union 1,049 6.6 0.8 26.9

Others 7,310 45.7 0.0 54.6

Total 15,986 100.0 6.7 52.2

Table 19

Imports of Capital Goods Based on Major Countries of Origin (C&F)

2. Oil and Gas Trade Balance

In Q1/2010, oil and gas trade balance posted a

USD2.1 billion surplus, lower than USD3.0 billion

surplus recorded in Q4/2009. The improved of domestic

economic activities in Q1/2010, as reflected from the

economic growth of 5.7% (y.o.y), contributed to the

increase of oil import. In the midst of declining oil

export performance, this condition caused a higher

deficit in oil trade balance. Meanwhile, the surplus of

gas trade balance has also contracted due to the

decrease in LNG export volume and the transfer of LPG

production to fulfill the domestic demand. The higher

demand on LPG related to the conversion program from

fuel to LPG had led to a higher imports of LPG

compared to Q4/2009.

2.1. Oil

Oil trade balance experienced a USD732 million

deficit in Q1/2010, higher than deficit USD85 million in

Q4/2009, mainly due to the increasing of oil import

volume that was in line with the acceleration

ofdomestic economic activities. The increasing of oil

import volume was also driven by disturbance of

domestic fuel supply due to the maintenance of the

main refinery.

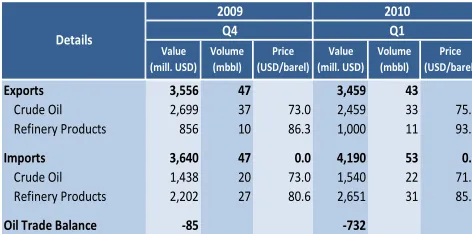

Table 20 Oil Trade Balance

Oil exports during the reporting period was

recorded USD3.5 billion or contracted by 7.4%

compared to the preceding quarter. This was mainly

due to the decrease of crude oil exports from USD2.7

billion to USD2.5 billion. Indonesian crude oil export

destinations were mainly Australia, Japan, United State

and Korea.

Oil imports was recorded USD4.2 billion, higher

than the preceding quarter (USD3.6 billion). This

increase, both for crude oil and refinery products, was

presumed to fulfill domestic oil demand as the

implication of the escalating domestic activities. The

increasing of oil import was also driven by interference

of domestic fuel supply due to the refinery maintenance

activities. The upturn of oil import was also contributed

by the increase of oil prices. In line with world oil price

movement, the average of import oil price¹ during the

reporting period rose from USD77.4/barrel to

USD79.5/barrel.

Similar to the previous periods, crude oil import

was used as intake to several refineries such as Cilacap,

Balikpapan and Balongan, being the main refineries of

oil domestic supply. Crude oil for refinery intake were

mainly originated from Saudi Arabia (Arab Light Crude),

Sudan (Nile Blend) and crude oil from Brunei, China and

Malaysia.

Country Value % Share % Growth % Growth

(mill. USD) q.t.q y.o.y

China 1,436 25.3 8.7 46.3

Japan 870 15.3 15.4 53.5

USA 813 14.3 -8.7 28.6

Singapore 498 8.8 -35.7 -10.0

Thailand 411 7.2 21.8 208.5

Others 1,644 29.0 -0.2 -7.6

Total 5,672 100.0 -0.9 22.1

Q.I-2010

Exports 3,556 47 3,459 43

Crude Oil 2,699 37 73.0 2,459 33 75.1

Refinery Products 856 10 86.3 1,000 11 93.5

Imports 3,640 47 0.0 4,190 53 0.0

Crude Oil 1,438 20 73.0 1,540 22 71.4

Refinery Products 2,202 27 80.6 2,651 31 85.1

Oil Trade Balance ‐85 ‐732

Sources: BPMigas & PT Pertamina (Processed)

Table 21

Demand and Supply of World Oil

The increasing of world oil price was reflected

from the movement of crude oil price of OPEC basket

and WTI with an average rise from respectively

USD74.3/barrel and USD76.1/barrel to USD75.5/barrel

and USD78.7/barrel. Several economic variables in

various countries indicates the world economic recovery

became the main contributing factor that pushed

upward trend of world oil price movement, even

though there was a Greek debt crises along that period.

Based on OPEC report, oil demand in Q1/2010 was

lower than the preceding period. However, demand

was still increased compared to the same period in the

previous year. By assuming that OPEC still provides oil in

accordance with the volume of Q4/2009, the

increasing demand indicated that there would be a

deficit in the world oil balance. This condition was

confirmed that oil price movement was triggered by the

expectation of improving economic growth.

Chart 8 World Oil Prices

In the reporting period, the average Indonesian

oil production reached 0.955 million barrel per day

(mbpd), higher than the production of the previous

quarter (0.951 mbpd). This condition was driven,

among others, by the implementation of steps

in optimizing production with the objective of

sustaining natural declining in old wells which

experiencing 12% drop every year. Despite the

increase in the reporting period, this production,

however, was still lower than the target stated in the

revised 2010 government budget or APBN-P 2010

(0.965 mbpd).

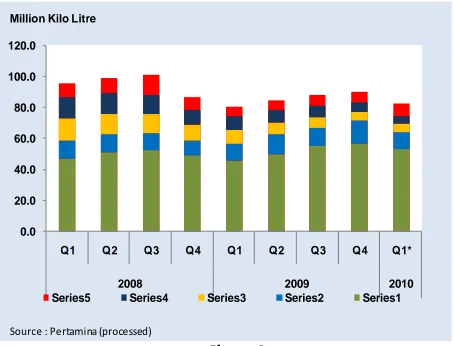

On the other hand, fuel consumption during the

reporting period decreased to 82.8 million barrel or

lower than Q4/2009 (89.7 million barrel). The fall in fuel

consumption during Q1/2010 was driven by the

decrease in use by industrial, household and

transportation sectors. The condition pertaining to the

first two sectors, industrial and household, was

presumed due to the policy of fuel conversion to

LPG/gas. Fuel consumption by electrical sector (PLN)

was still high due to, among others, the limited gas

supply for domestic market.

Chart 9 Fuel Consumption

2.2. Gas

Gas trade balance, as the main support of oil and

gas trade balance, recorded a USD2.8 billion surplus,

lower than USD3.1 billion surplus in Q4/2009. Based on 2010

Q1 Q2 Q3 Q4 Q1

Oil Demand

Northern America 25.5 24.2 23.5 22.9 23.2 23.4 23.6

China 7.6 8.0 7.6 8.4 8.6 8.3 8.1

Western Europe 15.3 15.3 14.9 14.2 14.6 14.8 14.5

Others 37.6 38.2 38.0 37.7 38.3 39.0 38.5

Total Oil Demand 86.0 85.7 84.0 83.2 84.7 85.5 84.7 Oil Supply

OPEC 30.2 31.2 28.5 28.5 28.9 29.0 0.0

Non OPEC 54.5 54.5 55.2 55.0 55.4 56.0 56.1

Total Oil Supply 84.7 85.7 83.8 83.5 84.3 85.0 n.a

Netto Demand ‐ Supply ‐1.4 0.0 ‐0.4 0.3 ‐0.4 ‐0.5 n.a

Source: OPEC Oil Monthly Report ‐ Januari 2010 Details

(in mbpd) 2007 2008

2009 30 40 50 60 70 80 90 100 110 120 130 140

Jul Sep Nov Jan Mar May Jul Sep Nov Jan Mar May Jul Sep Nov Jan Mar

2008 2009 2010

USD/barel

SLC

Indonesia's Export Price WTI

OPEC

Source: OPEC, Ditjen Migas

0.0 20.0 40.0 60.0 80.0 100.0 120.0

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1*

2008 2009 2010

Series5 Series4 Series3 Series2 Series1 Million Kilo Litre

its components, LNG and natural gas export still made

the biggest contribution in reaching gas trade balance

performance. Meanwhile, the declining surplus was

influenced by the decreasing LNG export volume

(seasonal factor) and the transfer of LPG export

production in order to fulfill domestic LPG demand.

All cargo of LNG and natural gas products was

exported in fulfillment of the current contract. Exported

LNG during the reporting period was recorded USD2.2

billion, lower than the previous quarter amounting to

USD2.3 billion. This decrease was pertaining to the

declining export volume from 301 million mmbtu to

277 million mmbtu while natural gas posted a slight

increase from 78 million mbtu (USD824 million) in

Q4/2009 to 84 million mbtu (USD853 million). Domestic

demand for LPG grew as the implication of household

fuel conversion program from kerosene to LPG. In

response to this program, there was no LPG export in

Q1/2010.

Table 22 Gas Trade Balance

3. Services Account

The deficit on services account in Q1/2010 reached

USD3.6 billion, lower than the deficit in the preceding

quarter (deficit of USD4.6 billion). The decreased deficit

was among others triggered by the improved surplus of

travel services pertaining to the decrease of Indonesian

travelers abroad, which had soared in the previous

quarter related to hajj pilgrimage season. Meanwhile,

in line with the increase of domestic economic activities,

the transportation expenses related to imported goods

rose during the reporting period. The improved

domestic economic activities also raised the deficit of

construction and financial services.

Chart 10 Services Account

In contradiction with the deficit of USD41 million

in Q4/2009, tourism sector (travel services) recorded a

USD364 million surplus. Travel expenses fell from

USD1.7 billion to USD1.3 billion due to the absence of

foreign exchange expenses for hajj pilgrimage in the

reporting period. Meanwhile, foreign exchange revenue

from international travelers visiting Indonesia declined

to USD1.6 billion compared to the previous quarter

(USD1.7 billion).

Chart 11 Travel Services

The number of international travelers visiting

Indonesia (inbound traveler) in Q1/2010 reached 1,642

thousand people, slightly lower than 1,726 thousand Exports

LNG 2,326 301 7.8 2,169 277 7.8

LPG 48 88 545.5 ‐ ‐ ‐

Natural Gas 824 78 10.5 853 84 10.1

Trade Balance 3,091 2,812

Exports 3,198 3,022

Imports 107 210

* LNG and Natural gas in million mmbtu, LPG in thousand Metric Ton ** LNG and Natural Gas in USD/million mmbtu, LPG in USD/thousand Metric Ton Source: BPMIGAS

2009 Details Value (million USD) Tw. IV Volume* 2010 Tw. I Value

(million USD) Volume* Price** Price** -5000 -4000 -3000 -2000 -1000 0 1000

Q.1 Q.2 Q.3 Q.4 Q.1 Q.2 Q.3 Q.4 Q.1 Q.2 Q.3 Q.4 Q.1

2007 2008 2009* 2010*

Transportation Travel Other services Services, net million USD

-1,000.00 -800.00 -600.00 -400.00 -200.00 0.00 200.00 400.00 600.00 800.00

J F M AM J J A S O N D J F M AM J J A S O N D J F M AM J J A S O N D J F M

2007 2008 2009 2010

people in Q4/2009 but still better than the same

period in the previous year (1,464 thousand people).

Several international tourism events organized by

Ministry of Culture and Tourism contributed to

the inflow of inbound travelers to Indonesia. Several

examples of international events are Strait Regata,

international water sport competition in Batam, Borneo

International Kite Festival in Balikpapan in February with

the participation of 15 countries and The Java Jazz

Festival in Jakarta in March involving 65 international

musicians.

Unlike the previous quarter, majority inbound

traveler are from Malaysia (share of 16.2%), Singapore

(14.8%) and Australia (10.4%). Bali was still the favorite

destination of international travelers visiting Indonesia

(share of 34.8%), followed by Jakarta (26.2%) and

Batam (15.0%).

The number of Indonesian people going abroad in

Q1/2010 also dropped from 1,673 thousand people to

1,486 thousand people. The significant downturn was

related to the absence of hajj pilgrimage season. The

drop was followed by the decrease of foreign exchange

expenses from USD1,742 million to USD1,253 million.

Asia-Oceania countries remained the main

destination of Indonesian travelers, such as Singapore

(share of 31.5%), Malaysia (27.5%), Australia (8.4%)

and Thailand (5.0%). For North American region, the

US (3.6%) was still the main destination of Indonesian

travelers.

In Q1/2010, transportation services recorded a

USD2,931 million deficit, slightly higher than in

Q4/2009 (deficit of USD2,848 million). This increased

deficit was mainly triggered by the expanding foreign

exchange expenses for freight services related to the

rise of imports. The effort in minimizing this deficit

through the empowerment of national shipping

industry (cabotage) was still restrained by several issues

such as lack of domestic banking support for fleet

procurement, especially related to the obligation of

providing additional collateral (such as in the form of

land or house certificate) amounting to as high as 60%

of the total loan. .

Other business services in the reporting period

recorded a lower deficit (deficit of USD0.4 billion)

than the preceding period (deficit of USD1.0 billion).

This declining deficit was mainly driven by the

lowering rental expenses of heavy equipment and

transportation equipment. As in the previous years,

transportation and mining companies generally

settled their payments with foreign partners for the

operational leasing of heavy/transportation equipment

at the end of every years.

4. Income Account

The income account in Q1/2010 posted a USD4.0

billion deficit, lower than USD4.6 billion deficit in the

preceding quarter. The declining deficit was mainly

triggered by the decrease of dividend payments of

direct investment and interest payments of other

investment. This was despite of the increase of interest

payments of portfolio investment. In the mean time, net

transaction pursuant to compensation of employees,

generated from the difference between salaries of

Indonesian labor working abroad for period less than

one year and salaries of foreigners working in Indonesia

with the same duration, during the reporting period

was relatively stable.

Chart 12 Income Account -5,000

-4,500 -4,000 -3,500 -3,000 -2,500 -2,000 -1,500 -1,000 -500 0

Q.1 Q.2 Q.3 Q.4 Q.1 Q.2 Q.3 Q.4 Q.1 Q.2 Q.3 Q.4 Q.1

2007 2008 2009* 2010*

Income, net Inv. Income DI Income

The income from direct investment posted a

USD2.6 billion deficit, lower than USD2.7 billion in the

preceding quarter. The drop in deficit was mainly

triggered by the decrease of profit transfer of oil and

gas companies to USD1.3 billion from USD1.4 billion in

the previous period. This condition was related to the

payment schedule of profit transfer that was generally

implemented during the last quarter of the year.

Income from other investment also recorded

a declining deficit, reaching USD0.4 billion from

USD0.9 billion previously. This was due to

interest payment schedule of government loan

which was generally lower in Q1 and Q3. In the same

period, the lowering corporate interest payment in line

with the declining position of foreign debt in the

preceding quarter had decreased the deficit of other

investment income.

On the other hand, the income from portfolio

investment posted a USD809 million deficit in Q1/2010,

higher than USD790 million in the preceding quarter.

The rise in deficit was mainly triggered by the increase

of interest payment of domestic bonds owned by

non-residents.

In line with the growth of foreign ownership

on government bonds denominated in Rupiah

(SUN) and Bank Indonesia Certificate (SBI), the

payment of SUN coupons in Q1/2010 increase to

USD784 million compared to USD427 million in the

preceding period, and the payment of SBI interest to

non-residents also increased from USD90 million to

USD122 million.

5. Current Transfers

In Q1/2010, the current transfer posted a USD1.2

billion surplus slightly lower than USD1.3 billion in the

previous quarter. This lowering surplus was contributed

by the declining of remittance inflows from Indonesian

working abroad, and after taking into account the

remittance outflows of foreigners working in Indonesia.

The other related factor was the drop of

non-investment grant received by the government from

donor institutions during the reporting period.

Chart 13 Workers’ Remittances

In the reporting period, revenues from remittances

of Indonesian working abroad reached USD1,650

million, lower than USD1,707 million in the previous

quarter. This decreased inflows of remittances was

presumed related to the diminishing number of

Indonesian workers abroad since mid 2009 up to the

reporting period. Likewise, outflows from remittances

of foreign workers in Indonesia slightly declined from

USD445 million to USD441 million.

In the mean time, the total inflows related to

non-investment grants reached USD52 million in the

reporting quarter, lower than USD61 million in 4/2009.

Most of the grants were received by Non-Government

Organization (NGO) managed by private sector. Grants

received by private sector during this quarter were,

among others, the aid from German government

amounting to Euro7.5 million (around USD10 million) to

the Indonesian Forest Ecosystem Conservation

Foundation (KEHI) for the safety and protection of

tropical rain forest in Sumatera and an amount of

USD65 thousand from Japanese government to the

Faculty of Letters of Dr. Soetomo University related to

-1000 -500 0 500 1000 1500 2000

Q.1 Q.2 Q.3 Q.4 Q.1 Q.2 Q.3 Q.4 Q.1 Q.2 Q.3 Q.4 Q.1

2007 2008 2009* 2010*

the supply of language laboratory equipment. During

the same period, the government also received a

USD182 thousand grant from the Japanese government

destinated for the regional government of East

Java for the school renovation in Jombang, Mojokerto

and Sidoarjo.

Table 23 Non Investment Grant

(Million USD) Non Investment Grant

(Current Transfers) Q.1. Q.2. Q.3. Q.4. Q.1.

Total 73 31 40 61 52

Government 4 14 20 52 3

Private 69 17 20 9 49

Source: Financial Department

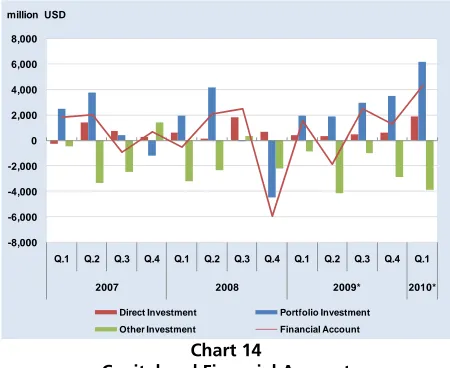

In line with the strengthening global liquidity,

capital and financial account in Q1/2010 posted a

significant surplus of USD4.3 billion, higher than

USD1.3 billion surplus in the previous quarter. This

improved performance was driven by the inflow of

portfolio investment and direct investment despite the

growing deficit in other investment.

Chart 14

Capital and Financial Account

The increase of portfolio investment surplus

was contributed by the increasing foreign

ownership on government bonds denominated in

Rupiah (SUN) and Bank Indonesia Certificate (SBI). The

sound and relatively stable domestic macroeconomic

condition, the weakening US dollar exchange rate and

Greek sovereign debt problem were among the

contributing factors of foreign capital inflows to

Asian region including Indonesia. The strengthening

Indonesian investment climate and economic

prospect, reflected on the improved sovereign

rating of Indonesia from BB to BB+ by Fitch Ratings,

has supported inflows of direct and portfolio

investment.

1. Capital Account

The capital account in Q1/2010 recorded a USD18

million surplus, slightly higher than a USD14 million

surplus in the previous quarter. This surplus was

contributed mainly by investment grants such as those

for construction of schools, housing and armaments.

Table 24 Investment Grant

2. Financial Account

The financial account in Q1/2010 recorded a

USD4.3 billion surplus, jumped from the preceding

period (USD1.3 billion surplus). This improvement was

attributed by the surplus in portfolio investment and

direct investment which was higher than the increase of

deficit in other investment. The improved condition of

global liquidity and favorable rate of return had driven

capital inflows of portfolio investment. It was reflected

in the purchase of domestic securities by foreign

investors such as SUN and SBI as well as foreign

currency-denominated government bond. The increase

surplus both of public portfolio investment and public

other investment supported the amplify surplus of

financial account in public sector amounting to USD6.7

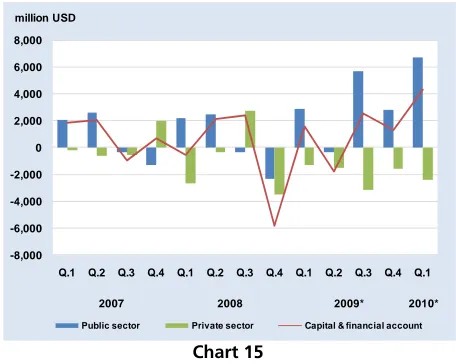

billion. The surplus in public sector managed to -8,000

-6,000 -4,000 -2,000 0 2,000 4,000 6,000 8,000

Q.1 Q.2 Q.3 Q.4 Q.1 Q.2 Q.3 Q.4 Q.1 Q.2 Q.3 Q.4 Q.1

2007 2008 2009* 2010*

Direct Investment Portfolio Investment

Other Investment Financial Account million USD

(Million USD)

Investment Grant

(Capital Transfers) Q.1. Q.2. Q.3. Q.4. Q.1.

Total 19 29 34 14 18

Government 2 3 4 2 0

Private 17 26 30 12 18

Source: Financial Department

2010* 2009*

compensate the deficit (USD2.4 billion) of financial

account in private sector.

Chart 15

Capital and Financial Account by Sector

2.1 Public Sector

During the period of Q1/2010, financial account in

public sector recorded USD6.7 billion surplus, higher

than the preceding period (USD2.8 billion surplus). This

increased surplus was triggered by the surpluses of

portfolio investment and other investment.

Chart 16

Financial Account of Public Sector

Portfolio Investment

Portfolio investment in public sector recorded a

USD6.6 billion surplus, higher than a USD2.4 billion

surplus in the preceding quarter. This surplus was

mainly resulted from the purchase of SBI and

government’s rupiah bond (SUN) by foreign investors

and supported by the issuance of foreign

currency-denominated government bonds.

Transaction on SBI by foreign investor during the

reporting period recorded a USD2.0 billion surplus,

higher than the USD0.8 billion surplus in the preceding

period. SUN transaction also recorded an increased

surplus from USD1.4 billion to USD2.4 billion. Foreign

capital inflows on SBI or SUN was supported by the

improving external factors and the stable of domestic

macroeconomic development.

The improvement of global market was driven by

the clear solution with regards to Greek fiscal deficit

financing involving the European Union and IMF and

the ongoing improvement on global economic

fundamental. This improved condition of global

financial market subsequently contributed to the

foreign capital inflows to domestic market.

Meanwhile, the strengthened domestic economy

and investment climate supported a better risk

perception for domestic investment which was reflected

in Indonesian rating improvement granted by

international rating agency, Fitch and S&P. Fitch rose

Indonesian long term credit rating from BB to BB+ with

stable outlook. In addition, Fitch also raised Indonesia’s

country ceiling rating from BB+ to BBB, while rating for

short-term credit remained at B. S&P also raised

Indonesia’s sovereign credit rating from BB- to BB with

positive outlook. With reference to this achievement, it

should not be long for Indonesia to reach investment

grade.

Table 25

Indonesia’s Sovereign Rating

-8,000 -6,000 -4,000 -2,000 0 2,000 4,000 6,000 8,000

Q.1 Q.2 Q.3 Q.4 Q.1 Q.2 Q.3 Q.4 Q.1 Q.2 Q.3 Q.4 Q.1

2007 2008 2009* 2010*

Public sector Private sector Capital & financial account

million USD -4000 -2000 0 2000 4000 6000 8000

Q.1 Q.2 Q.3 Q.4 Q.1 Q.2 Q.3 Q.4 Q.1 Q.2 Q.3 Q.4 Q.1

2007 2008 2009* 2010*

Portfolio Investment Other Investment Financial Account

million USD

October 22, 2007 Ba3 July 26, 2006 BB- January 27, 2005

BB-December 23, 2008 Ba3* November 7, 2008 BB-* February 14, 2008 BB

June 11, 2009 Ba3** October 23, 2009 BB-*** January 21, 2009 BB*

September 16, 2009 Ba2 March 12, 2010 BB January 25, 2010 BB+

October 12, 2006 BB September 7, 2007 BB

October 31, 2007 BB+ September 25, 2008 BB*

January, 2009 BB+* February 5, 2009 BB**

October 7, 2009 BB+* July 7, 2009 BB+

* rating affirmation

** outlook revised from positive to stable *** outlook revised from stable to positive Note: Foreign Currency Long Term Debt

Rating and Investment

Information (R&I) Japan Credit Rating Agency

The improved risk perception was also indicated by

several risk indicators that remained at the low level.

Indonesia’s Credit Default Swap (CDS), as one of risk

indicators, still remained at low level (163 bps). Similar

tendency was reflected from yield spread between

Indonesian government bond and US T-Note

experiencing a decline. The same condition was also

indicated by Emerging Markets Bond Index Global

(EMBIG) movement that showing a downturn tendency

from level 294 bps at the end of the previous reporting

period to 261 bps at the end of Q1/2010.

Chart 17

Indonesia’s Yield Global Bond and US T-Note

The ongoing improvement of risk perception in

the reporting period bolstered the attractiveness

of rupiah-denominated investments. The yield of rupiah

were reflected in the level of Uncovered Interest Parity

(UIP) which was kept at 6.33%, still the

highest compared to other Asian countries. Covered

Interest Parity (CIP) indicator at the end of reporting

period stood at 4.69%, the highest level in the same

region.

The attractiveness of rupiah-denominated

investment can be shown on the spread of Bank

Indonesia (BI) rate and Fed Fund Rate, as one of

references of interest rate for global investors. Up to

the end of the reporting period, BI rate was sustained at

6.5%, while the Fed still