Bank Indonesia 7

thAnnual International Seminar

“Global Financial Tsunami:

What Can We Do?”

June 13 - 14, 2009 Nusa Dua, Bali Indonesia

BANK INDONESIA Jakarta

2009

ii

Contents

iii Contents vi Foreword viii Background xvii Opening xxii Keynote Speec

Session 1: Financial Tsunami: Reconsidering the Role o

Macroeconomic Policy 1

3 Can the tools of Conventional Macroeconomic Policies be Enough to Reverse the Downturn of the Global Economies:

Challenges for the Authorities?

Sri Mulyani Indrawati

10 Fiscal Policy for the Crisis: What Should be Considered?

Carlo Cottarelli

16 Avoiding a Prolonged Slump: The Urgency of Safety Net and Reemployment of Workforce Laid-off in Recession

Dr. Atiur Rahman

21 Question and Answer Session

Session 2: Financial Tsunami: How to Avoid a

Prolonged Slump 25

27 Financial System and Transmission Mechanism of Monetary Policy: How to address the Increasing risk Perception

Miranda S. Goeltom

iv

38 Implications of the Global Financial Crisis for Developing Countries √ Its Impact, Priorities in Policy Response

Mohammad Zia M. Qureshi

45 Question and Answer Session

Session 3: Abuse of Advanced Financial Products:

Market Imperfections or Poor Regulation and

Supervision? 49

51 Large Complex Financial Institutions: Too Big to Manage? Too Big to Regulate? Advanced Financial Products: Market Imperfections and Meanness of Derivatives

Gita Wirjawan

55 Credit Rating Agencies» New Paradigm: The Way to go Forward

R. Ravimohan

64 Large Complex Financial Institutions; Too Big to Manage? Too Big to Regulate?

Simon Morris

69 Question and Answer Session

Session 4: The Importance of a Financial Sector

Continuity Plan: Options and Obstacles 75

77 Financial Architecture: Designing a Market for Indonesia»s Financial Sector

Stephen Grenville

82 Rising Importance of Islamic Finance: Another Prong for Financial Stability

Bambang Permadi Brodjonegoro

87 The Financial Crisis √ Opportunities for Financial inclusion

Alfred Hannig

91 Question and Answer Session

Session 5: Panel Discussion √ Rebuilding a Strong and

Sound Financial System 99

101 Addressing Financial Tsunami: Latin American Experience

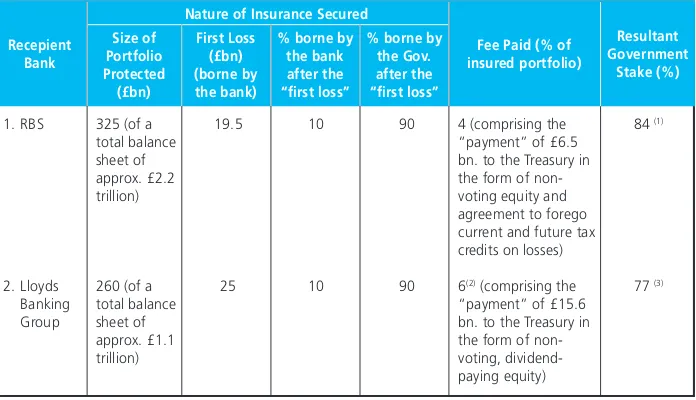

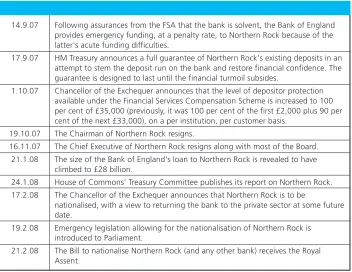

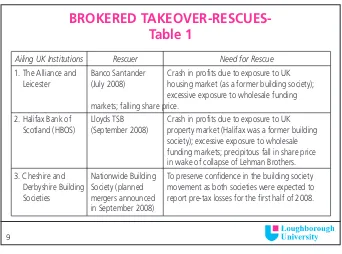

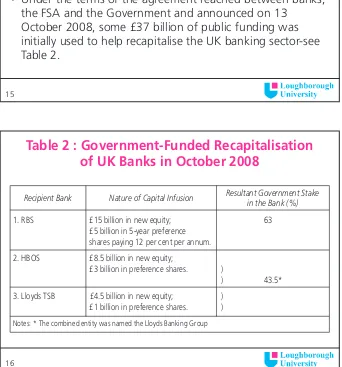

Maximillian J.B. Hall

113 Towards Better Financial Supervisory Regime: Perspective of Indonesia

Halim Alamsyah

119 Resolving Cross-Border Bank Problems: East Asian Case

Michael Pomerleano

123 Question and Answer Session 129 Closing Remarks

Attachments 139

141 Presentation/Paper

vi

Foreword

The global financial crisis that beset the world economy in the last quarter of 2008 has severely undermined market confidence in the global financial system. As we are aware, this crisis stems from the sub-prime mortgage debacle in the United States triggered the ongoing global financial crisis in 2008-2009. This was primarily attributable to a lack of compliance to prudential principles when extending loans. Certain sections of the populace who were not actually feasible to receive housing loans (often called NINJA: no income, no job and no assets) were readily offered loans with easy repayment terms. When the interest rate charged was low, there were no signs of credit default. However, in line with rising interest rates in the United States in the mid 2000s, the NINJA»s inability to repay their loans became more visible. This resulted in widespread credit default in 2007, peaking in 2008.

Although the sub-prime turmoil in the United States did not represent the greatest share of total loans, these particular loans sparked a lack of confidence in financial derivative products based on such loans. The derivative products were sold in quantities far exceeding their underlying assets. Consequently, when these loans had problem, financial institutions that held or guaranteed these derivatives incurred huge losses. This ultimately led to the downfall and subsequent bankruptcy of Lehman Brothers in 2008. As derivative products were sold globally, not only were financial institutions in the United States affected, but also financial institutions in numerous other countries collapsed particularly in developed countries. Therefore, we were not surprised when we witnessed the crisis propagate rapidly across many countries. The collapse of market confidence was not merely limited to derivative products based on sub-prime mortgages, but it also shadowed the global financial institutions themselves and eventually to the prospects of overall economic growth.

origin, which spurred a liquidity drought in global financial markets. Such conditions fanned the flames of the crisis, ultimately becoming the infernal global financial crisis we know today.

Various countries affected by the enduring financial crisis took the full panoply of policy measures, both on the fiscal and monetary sides. From a fiscal standpoint, almost all countries affected by the financial crisis increased their fiscal deficits to finance two anticipatory measures. First, governments intervened to support the financial sector by bailing out financial institutions and private corporations. Secondly, governments intervened to boost aggregate demand. Meanwhile, from a monetary perspective, central banks lowered their policy rates in order to foster stronger aggregate demand. Central banks also formulated an array of policies in the banking field to ensure bank resilience against the crisis, therefore, enabling the banks to lead the economic recovery process.

With the plethora of efforts instituted to overcome the global crisis, each country certainly faced a number of constraints. Therefore, Bank Indonesia»s Annual International Seminar in 2009, entitled ≈Global Financial Tsunami: What Can We Do?∆ constitutes an excellent and timely forum to exchange ideas, views and experiences among public policymakers, experts in the field of economics, finance and business, and academics from around the world. I sincerely hope the results of the seminar, as documented in these proceedings, contribute some of the most salient and best ideas not only to overcome the obstacles we face in terms of restoring global financial conditions, but also to construct a better financial system to prevent the same crisis from happening.

Finally, I would like to thank the speakers who contributed their ideas and experiences at the seminar. Similarly, I also appreciate the participation of the audience who contributed to the fruitful discussions during the seminar.

Jakarta, 23 October 2009

viii

Background

The global economy is sliding into recession; downshifting rapidly in response to tighter credit conditions, deteriorating wealth and weaker property markets, ignited by the US financial crisis that erupted just last year. The root of the crisis stretches back to the middle part of the decade during the lengthy period of above-trend global growth. An important driver was the easy stance of global monetary policy, in which the world»s central banks maintained extremely low policy rates, leading well into expansion. The persistence of low short-term interest rates, combined with low inflation and strong stable economic growth, fueled a surge in investor risk appetite, as seen in booming stock markets and record low credit spreads. This macroeconomic backdrop also promoted a boom in select housing markets, boosting housing construction in certain markets and house prices more broadly. As global resource utilization climbed to multi-decade highs, central banks gradually began to normalize their policy stances.

Over the course of 2008, the foundations of economic expansion were eroded by the ongoing stress in credit markets. Recently, the shocks to the economy have intensified. Even as oil prices have tumbled, the stress in money and credit markets has increased markedly, and global growth is slowing quickly. Corporate health has deteriorated as higher cost pressures have built, and corporations have begun to cut back their expenditure to restore their margins. The drags in the global financial system are powerful and are doing damage to the economy in an unprecedented and hard-to-gauge manner. Many economists are shocked by this sudden crisis, though a few economists did accurately predict it as the global economy has been overshadowed by asset bubbles for the last several years.

inflation is below the target corridor. It is for the financial market regulator to persuade financial institutions to strengthen their precautionary measures, for example by raising lending rates, to respond to the bubble.

Depth and duration: how deep and how long will it go?

The depth and duration of a recession is determined by the size of the negative shocks, the degree of vulnerability, the policy response and other developments that help the economy find a trough and recover. One key challenge in gauging the depth and duration of the current recession is calibrating the magnitude of the financial shock hitting the region and determining its impact on the real economy. Over the past year, higher borrowing costs and tighter credit availability have weighed on growth but not by a huge amount. However, the degree of dysfunction in money and credit markets in recent months has created the possibility of a much sharper downturn in growth as short-term funding simply becomes unavailable.

Previous experience - especially in Scandinavia in the early 1990s - suggests that a sizable financial and banking shock can contribute to a deep recession. The other key challenge in gauging the depth and duration of the current recession is that the cushions that would typically arrest a sharp cyclical downturn are largely absent. Usually, when the economy starts to slow dramatically,nit experiences a number of troughs and then recovers. Normally, the most important cushion is the easing of monetary policy, which triggers a broader easing of financial conditions and credit availability. Improved terms of trade can be another source of support and some help recently stemmed from the dramatic decline in energy prices. However, this seems to be occurring in part because of weaker global demand, so the benefit in the near term for household purchasing power may be offset by weaker exports.

Could this phenomenon be a big matter for emerging

countries?

x

Fortunately, the picture is not universally dire though most emerging economies will experience a slowdown. Of course, some will surely face deep recessions but many are confronting the present crisis in stronger shape than ever before, armed with large reserves, flexible currencies and strong budgets. Good policy - both at home and in the rich world - can help avoid a crisis. One reason for hope is that the direct economic fallout from the rich world»s disaster is manageable. Falling demand in America and Europe hurt exports, particularly in Asia and Mexico. Commodity prices have fallen: oil is down nearly 80% from its peak and many crops and metals have fared even worse. That has a mixed effect. Although it hurts commodity-exporters from Russia to South America, it helps commodity importers in Asia and reduces inflation fears everywhere.

The more dangerous shock is financial. Wealth is being squeezed as asset prices decline. China»s house prices, for instance, have started falling. This will dampen domestic confidence, even though consumers are much less indebted than they are in the rich world. Elsewhere, the sudden dearth of foreign-bank lending and the flight of hedge funds and other investors from bond markets have slammed the brakes on credit growth. And just as booming credit once underpinned strong domestic spending, so tighter credit will mean weaker domestic demand. The rich world»s bank bail-outs may limit the squeeze but the flow of capital to the emerging world will slow. The Institute of International Finance, a bankers» group, expects a 30% decline in net flows of private capital compared to last year.

Emerging markets, entering the crisis from very different positions, are vulnerable to the financial crisis in at least three ways. Their exports of goods and services will suffer as the world economy slows. Their net imports of capital will also falter, forcing countries that live beyond their means to cut spending. And even some countries, living roughly within their means but having gross liabilities to the rest of the world, are facing difficulties in rolling over their liabilities. In this third group, the banks are short of dollars even if the country as a whole is not. Long before Lehman Brothers collapsed in mid-September 2008, prompting the world»s money markets to seize up, the currencies of commodity exporters had already started to tumble.

What can we learn from the crisis and what kind of policy

response is required?

cutting interest rates, lowering taxes and increasing public spending - be enough? The standard response to a demand shock is to use monetary policy: cut interest rates and increase money supply. Lower interest rates spur spending by making saving less rewarding. Banks will usually offer more and cheaper loans to firms and households.

The banks are the conduit between central-bank policy and the wider economy. The trouble is, the conduit is blocked. Despite deep cuts in interest rates by the Federal Reserve, the cost of bank credit for American firms and households has not dropped by much. Investors are wary of lending to banks for even a few months because of the risk that they may go bust or run out of cash. Banks have no appetite to lend to each other for the same reason (and fear of their own demise is leading them to hoard cash). The spread between what banks pay for overnight central-bank cash and what they pay to borrow for three months is therefore far above pre-crisis levels. And the latter rate is the reference point for loans to customers.

Officials worldwide took additional steps to stabilize the financial system. Central banks continue to operate along two channels. So far, central banks in developed economies have stepped up liquidity operations and brought down policy rates significantly. Meanwhile, central banks in emerging economies have shifted from an inflation to a growth bias, with very little tightening expected in the near future. Global monetary policy is projected to stay accommodative until next year when the crisis is expected to endure. If global growth regains a trend-exceeding pace in 2009, monetary authorities may choose to act more aggressively.

Sound macro fundamentals: is it enough to maintain financial

stability?

xii

fundamentals. Credit conditions may be too lax at times and far too restrictive at others for protracted periods. Spending and real activity may be subject to much wider swings than would otherwise be the case.

By having clear understanding of financial instability, central banks and other authorities are expected to play two distinct roles in the pursuit of financial stability -prevention of instability and management of the consequences once markets become unstable. In the area of prevention, perhaps the single most important measure a central bank can take is to foster a conducive macroeconomic environment with low and stable inflation and sustainable economic growth. In the absence of such desirable macro fundamentals, the risks of financial instability are almost certainly higher and the effects of financial instability when it arises are all the more pernicious. Beyond conducting sound macro policy, central banks have traditionally been involved in several activities, such as formulating appropriate financial regulations, implementing effective bank supervision and operating or overseeing efficient payment systems, all of which help attenuate the risks of financial instability.

Under the heading of crisis management, central banks can alter monetary policy to forestall or mitigate the consequences of financial instability for the economy. When such instability slides into crisis, they can employ their basic tools to help alleviate liquidity pressures and restore public confidence. Liquidity pressures can be addressed, for example, through provision of reserves via open market operations and direct lending to depository institutions. Other monetary policy tools can be employed, such as possibly cutting reserve requirements and, of course, lowering policy interest rates to provide a boost to the economy.

7

thBank Indonesia International Seminar on June 13-14, 2009

Based on this background, this year Bank Indonesia is organizing the 7th annual

international seminar. Bank Indonesia has been organizing this prestigious event since 2001 with various subject matters, specifically in the scope of Central bank policies. The seminar is not commercial and attended by international and domestic participants. Some of distinguished speakers and Noble laureates delivered presentations in the previous events were John B. Taylor, Joseph E Stiglitz, Finn E. Kydland, and Andrew D Crocket. The event was held in Bali, The Island of Paradise, surrounded by beautiful scenery and cultural uniqueness.

events were John B. Taylor, Joseph E Stiglitz, Finn E. Kydland, and Andrew D Crocket. This year, the seminar is the 7th annual international seminar that will be held on

June 13th-14th, 2009 in Bali, the Island of Paradise, surrounded by beautiful scenery

and cultural uniqueness. The objectives of this year»s seminar are:

sharing knowledge on the recent issues of global financial crisis and its impact on macroeconomy

elaborating the consequences and challenges for real sector in the shake of financial crisis

addressing the strategies/policies to rescue financial and real sector from the negative impact of financial crisis

discussing the implications of financial crisis to domestic economy and efforts to save the most effected emerging countries.

raising the importance of crisis continuity plan in financial sector resolution finding solution on how to rebuild-up strong and healthy financial system

The targeted participants of this seminar are central bankers, academicians, bureaucrats, financial institution analysts, financial institution regulators, banking community, research institutions, and representatives from international institutions. They are expected to gain substantial insights from prominent resource persons who are experts on these issues, while having opportunities to exchange views and share their own countries» experiences in dealing with the recent issues discussed.

The seminar will comprise the global financial crisis, as this will bring damage to economic activities. The substance of the seminar will be elaborated in five sessions within one and a half day seminar.

Run Down of the Seminar

xiv

Financial innovations led to lending to risky borrowers. As the crisis hit, global liquidity becomes tight and ignites external adjustment. The global capital flows to safety place and generates turbulence in financial market as well as foreign exchange market. Some macroeconomic policies √ conventional and inconventional policies √ have been employed to mitigate the devastating impact of the crisis. Nevertheless, some questions remain amidst the uncertainty, i.e. (1) will this turbulence take a longer and deeper recession? (2) how the policymakers should deal with the impacts of the uncertainty in the liquidity of global financial markets to maintain the external balance of the economy, (3) will the tools of conventional macroeconomic policies be enough to reverse the downturn of the global economies?

The second session The second session The second session The second session

The second session will discuss how to avoid a prolonged slump. The many aspects considered possible impact to the economy caused by the financial crisis. Central banks and governments are facing a new set of questions. The global economy is sliding into recession. However, it is decreasing more rapidly in response to tighter credit conditions. Now central banks, governments, and market players, are facing a new set of questions. First, what»s wrong with current framework of global financial architecture? Second, should a new paradigm of monetary and banking system be found to avoid repercusion of financial crisis? Third, how the policymakers should (re)consider the role of monetary and financial sector policies in the work of transmission mechanism to the real sector. Another concern is how emerging economies identify indicators to be monitored in order to avoid deeper crisis.

The third session The third session The third session The third session

diverge sharply and for prolonged periods from fundamentals, credit conditions may be too lax at times and at other times far too restrictive, and spending and real activity may be subject to much wider swings than would otherwise be the case.

The forth session The forth session The forth session The forth session

The forth session will discuss the importance of crisis continuity plan in financial sector resolution. Is there any Options & Obstacles? This session will therefore focus on building effective crisis resolution and management covering the wide array of macro and micro-level policy measures. The session will conclude on the need of concerted efforts in global scales and strategies to pursue financial stability in the aftermath of the crisis. If scared banks, firms and households cling more tightly to cash rather than lend it or spend it, the downturn will deepen. The more confidence weakens and asset prices fall, the more eager is the rush into cash. At the extreme, the demand for cash is so strong than not even interest rates at zero can get the economy moving. When standard monetary-policy responses reach their limit, new banking resolution measures and fiscal options, such as liquidity injection to distressed banks, cutting taxes and increasing public spending, come into play. One reason is that although it may be easy to increase public spending in bad times it is hard to reduce it when the economy revives. Tax cuts might be saved, or spent on imports. And continued budget deficits harm private enterprise by soaking up savings, pushing up interest rates and ≈crowding out∆ private investment. Job cuts, slumping asset prices and a worsening credit drought affect decreasing consumer spending too. If firms fear that others will cut back their spending, it will make them still more cautious. Then, leaving equipment and workers idle, and depressing tax revenues. A pre-emptive fiscal stimulus may help prevent that√and shore up the government»s tax base. If conventional monetary and fiscal policy fail, what is then? Pessimists point when a lesson in how a deflating asset-price bubble and a vast overhang of debt can defeat all that monetary and fiscal policy can throw at it. At the ASEM October 30th,

2008, the seventh such biennial gathering since 1996, China echoed calls for concerted international action. But, it had few ideas to offer on what this should involve. More regulation of the international financial system, unadventurously proposed.

The fifth session The fifth session The fifth session The fifth session

xvi

Honorable Minister Indrawati, Gov. Atiur Rachman, and Jacob Frenkel, Distinguished Speakers, Guests and Participants,

Ladies and Gentlemen,

Good afternoon and greeting to you all,

It is indeed an honor and a great pleasure for me to welcome all of you to this the 7th Bank Indonesia Annual International Seminar, entitled ≈Global Financial

Tsunami: What Can We Do?∆. Let me also welcome our distinguished guests and participants from abroad to our country and especially to Bali. I hope that you will have the time to experience this beautiful island while you are here. I also extend sincere gratitude and thanks to all speakers who will share their valuable time and insights over the next two days.

Ladies and Gentlemen,

Global Financial Crisis

We are meeting today in challenging times. The global economy is being drawn deeper into the most serious crisis in our life time. So devastating has the global financial crisis been it was billed as the most dramatic since the Great Depression of the 1930s. The most commonly used objective to describe the current financial crisis is ≈unprecedented∆. It is unprecedented in terms of speed at which events unfolded and triggered a series of domino effects, the scale of the impact

Opening Remarks

Miranda S. Goeltom

Acting Governor, the Central Bank of Indonesiaxviii

authorities around the world. This has been demonstrated in the policy responses taken to overcome the crisis, which is incredibly complex and certainly costly. IMF projected global economic growth to plummet from 3.2% in 2008 to -1.3% in 2009, whereas economic growth in developed countries is estimated to be even worse, contracting to -3.8%. IMF also predicted that total losses stemming from the current global financial crisis will reach US$4 trillion, two-thirds of which is from the banking sector.

In such a deep global crisis, we must seek ways to survive and, subsequently, return to our previously hard won growth and stability. This is exactly the time when collective action is needed most, so that we can survive this global financial tsunami, and emerge stronger. Given the depth and systemic nature of the crisis, a wait-and-see approach or simply hoping that recovery will take place on its own is utterly unacceptable.

Ladies and Gentlemen,

Common Historical Perspective of the Crisis

In the past, when the world caught a cold, Indonesia and countries in the region got pneumonia; today it is the other way around, our countries got a cold while the developed world is suffering from bird-flu. While Indonesia and countries in the region have withstood the effect of an international crisis like never before, that is no reason for complacency.

History teaches us that various crises have occurred repeatedly in line with the natural business cycle. We recognize several types of financial crisis, such as a currency crisis, debt crisis or banking crisis. Examples of a currency crisis include the ones that plagued countries under the European Monetary System (EMS) in 1992-93 and Mexico in 1994-95; debt crises ravaged Mexico in 1973-82 and Argentina in 1978-81 and 2001-02, as well as Russia and Brazil in 1998-99; and banking crises beset countries across Europe and the US in the 19th century and early 20th century. On several

identifiable. From a number of empirical facts it can be concluded that although crises are occurring repeatedly, there is no indication that they will transpire periodically, as a characteristic of the actual business cycle itself. However, empirical observations of Western European history over the last 400 years show that financial crises occur, on average, at approximately 10-year intervals. Meanwhile, regarding the economic recovery process out of a financial crisis, a recent study demonstrates that a deep and protracted financial crisis affects the price of assets, output growth and level of unemployment. In this case, the affect of a financial crisis on a decline in employment and house prices lasts an average of 5 to 6 years, whereas the affect on output is shorter at an average of 2 years.

The current global financial crisis is a stark warning to us concerning how the dynamics of the global economy and its risks are highly interconnected. In this case, contagion not only spreads through linkages in trade and finance but also through complex interaction among various risks, as depicted in the near-perfect correlation of market and asset classes that was uncorrelated when conditions were benign, and eventually amplified uncertainty and lead to a more difficult decision-making process. While there are numerous cases that can explain why and how financial crises transpire, there are many fundamental issues that we are yet to understand. To this end, a number of arduous challenges have emerged from the ongoing global financial crisis that force public authorities to institute not only short-term but also long-term policy responses.

Ladies and Gentlemen,

Policy Responses

xx

Amidst such ramifications and negative feedback, we need to anticipate that this unfolding crisis will take considerably longer than previously envisaged. In my opinion, it is of utmost importance to seek deeper understanding of at least three inter-related issues: (1) the underlying structural weaknesses, (2) the merit of policy response; and (3) the underdeveloped institutional structure and system. Those three issues, I believe, are inherent in this ongoing crisis.

Much has been accomplished. Wide-ranging and often unconventional policy responses have been taken to contain the downturn in output. In the near term, we are already doing much involving the provision of fiscal stimuli and liquidity to contain the financial crisis. While underlining the importance of fiscal stimuli, we also need to ensure long-term fiscal sustainability. Along with this, measures to repair and reinforce the financial sector must be taken. This medium-term measure is vital in order to prevent a similar situation in the future and to provide sustainable economic growth. We must remember that the economy will only recover if supported by a functioning financial sector.

Despite the inevitable current preoccupation with the near-term, we also need to remain focused on the structural reforms required to achieve higher sustainable output growth and to strengthen the long-term capacity. With greater potential for unexpected short-term economic risks, policy focus must be anchored towards long-term economic interests. The implementation of such policy signals is our commitment to stay focused on the long-term and press ahead with the structural reform agenda. But, will appropriate macroeconomic policies and a strengthened regulatory and supervisory framework be able to prevent future financial crises? I personally think that we should not simplify the issues and presume that better regulations, more effective supervision and longer-term stability-oriented macroeconomic policy would suffice to eliminate the cyclical features of the financial system and the build-up of financial imbalances in the future. I strongly believe that market participants have an equally important role to play √ and self-interest √ in addressing some of the emerging weaknesses in the financial system and in strengthening market discipline. In this regard, better flow of information in the market would enable authorities to safeguard financial stability and other prudential aspects, as well as reduce the procyclicality impacts of financial sector behaviour. Therefore, there will be more resilience and we will be better prepared when new shocks hit in the future.

when it eventually begins. Global equities climbed to their highest levels of the year, oil rose to around $70 a barrel, the Baltic Dry Index √an indicator of shipping activityƒ has risen sixfold from its December nadir and corporate bond spreads narrowed to levels last seen in October 2008, while US-Treasury bond yields touched fresh six-month highs. The latter indicator can be seen as a sign of economic optimism as investors abandon the safety of government bonds for riskier assets.

There has been speculation that a trough has possibly been reached in few countries, providing evidence of ≈green shoots∆. We also witness many signs of a slowing in the pace of contraction and increasing expectations of an economic recovery. These positive financial and economic indicators encouraged hopes that ≈the Great Recession∆ might be coming to an end. Finally, it seems there is «a light at the end of the tunnel». Has the crisis reached rock bottom? Have we passed the worst? Is the crisis behind us? And if so, should we now concentrate more on the «exit policy» and related measures to alleviate the mounting inflationary pressures??

Ladies and Gentlemen,

xxii

Ladies and Gentlemen,

Let me conclude my brief remarks by saying that from the point of view of an emerging economy central banker, such as myself, we are indeed living in changing times. Dealing with this global financial crisis is of paramount importance. Many of our working assumptions are constantly being challenged by this new reality. This requires sound policy judgements on our part and, more importantly, courage to implement bold measures which perhaps no one has instituted previously.

Therefore, the challenge ahead is to get the action plan implemented expeditiously, decisively and concertedly with equal allertness of the challenges to establish a proper and adequate exit policy. Despite the daunting tasks that we are assuming, I would prefer to remain sanguine. I recognize we need to remain vigilant and stand ready to make changes along the way as we may encounter the unexpected.

I sincerely hope that this Seminar will be fruitful in generating valuable insight and new ideas in dealing with global financial crises. Therefore, I guess you will agree with me that it is interesting to listen and learn from the vast experience of a world known economist and former IMF Chief Economist, a noted and well regarded former central bank governor, and Chairman of Group of Thirty, Dr. Jacob Frenkel. Before I close my remarks, let me bring up an interesting note about Bali. The water found here on this paradise island is extremely addictive; once you have tried it once you will succumb to the island»s exotic wonders and return time and time again. So, once is never enough. I urge you to make the most of your visit and explore the magnificent sights, tastes and sounds of the island, with the hope that the memories you take away are unforgettable.

Keynote Speech

The subject could not be timelier. Global Financial Tsunami: What can we do? Every word in the title is informative. Global means that we cannot find the answer in one point; that it is global. It is financial, therefore, it is not in a given factory or office. It is in the amorphous financial market where things are moving very quickly and where memories and psychologies are

very important players. Tsunami; I do not need to tell people in Asia what that means. Then comes the challenge; what can we do? This also beckons the question; what should we do? We means all of us. This is not a prescription to the USA or Europe or Asia or any specific player. It is a prescription to all the players. It is in this regard that it is first timely and second relevant. I want to take you back two or three years ago to international conferences all over the world. What was said in these conferences? It was argued at the time that home prices in the USA have risen too quickly and it is not sustainable. It was argued that the dollar was too strong and not sustainable. It was argued that the US current account deficit was rising and was too big. It was argued that the Chinese currency needed to appreciate, etc. Fast-forward to the present and indeed we can see that home prices stopped rising and have collapsed. The US dollar stopped rising and in fact actually weakened. Even the current account deficit has shrunk slightly and Asian currencies have

Jacob A. Frenkel

Chairman, G30

What do we learn from the Present Crisis?

A perspective of Central Bankers and

xxiv

Still we are saying we are facing a tsunami. If it is so good then how come it is so bad? Did we get too much of a good thing or did we miss something that is very important that goes beyond the general platitude? We are all focused today on financial markets and I was asked as I came in whether I saw green shoots. To tell you the truth, 4% of the male population has some difficulties in identifying the colour green; it is a colour that is tough. Those 4%, myself included, always want to see a slightly stronger colour before they claim victory. So yes, perhaps this situation is somewhat better but I think it would be a grave mistake; we should not suffer from amnesia because very soon we will forget what we failed just a few months ago. There are two types of investors: those with short memories and those with no memories. That is true not only of investors but also of politicians, writers and practically everyone. One of the defense mechanisms of humans is to suppress bad news and highlight the good news and to clinch to anything that develops that looks a little bit green. So one of the things that we should remember as we move on is that there were real fundamental reasons for this crisis that go beyond the Wall Street of yesterday or tomorrow.

In many IMF forums the communiqués always said that the current account imbalances are not sustainable, etc, however, they were permitted to last for too long. In my own judgment some of the vulnerability that the international financial system has developed reflects the accumulated imbalances in the world economy that have increased the vulnerability of the world and have transformed automatically the challenges that happen on one side of the ocean to the other side of the ocean, and have transformed economic and financial matters into political matters, geopolitically. How else can so much focus be explained on the Chinese exchange rate today or Japanese surpluses two decades ago. These things have always appeared when external imbalance have been allowed to accumulate for too long a period.

Maybe the problem is over. By the way, if we look at employment or growth it would never occur to us that the problem is over. But from the financial markets we get that picture. In fact, what has characterized financial markets during the past year or so is that risk has become much more of a subject. Indeed, we see that credit market spreads in the US and elsewhere have expanded significantly and this was the story that occupied everyone»s mind. We saw that there was a period when all the news reported the risk, which is the spread between LIBOR and T-Bills, had increased until September last year. September last year (2008) will go into the history of financial markets as the turning point. This was the time when the American Government and the Federal Reserve allowed Lehman Brothers to collapse. There are many explanations, some are legalistic and some are formal, be that as it may this was the biggest policy blunder that has changed the face of the world financial markets. Lehman transformed the debate from «too large to fail» to a new concept known as «too interconnected to fail». If you are interconnected and something happens here it immediately transmits itself to the rest of the market. Indeed, we can see the spike at the end of last year that created the liquidity crisis and brought about increasing spreads all over the world. No more decoupling in the sense that if things happen in USA they happen in the rest of the world. Not only in the industrial world but also the emerging world. Yes it is true that China will recover first, maybe, but it has affected each and every player; industrial markets and emerging markets alike.

How did it all happen? The reason I ask is not to study economic history but rather to draw some lessons from it. Everyone talks about the sub-prime debacle. Indeed the problem started in the US markets where sub-prime loans became more and more prominent in lending, especially for mortgages. This is a pie chart that explains how loans were classified.

Subprime, 7.9%

Alt-A, 2.2% FHA/VA, 5.6% Prime, 78.8% 2003 2004 Subprime, 18.2%

Alt-A, 6.3% FHA/VA, 18.2% Prime, 58.9% 2005 Subprime, 20.0%

Alt-A, 12.2% FHA/VA,2.9%

Prime, 53.2%

xxvi

It can be seen that sub-prime during the year 2003 was less than 8% of the mortgages issued. Then in 2004 and 2005 sub-prime jumped to nearly 20%. Please keep in mind that up to 2004 the percentage of lending that was associated with lower quality loans was about 7-8%. They went up to 20% we will need to ask why and what happened. Then in 2006 sub-prime remained at about 20% but subsequently declined again to 7% or so.

2007

Subprime, 7.9%

Alt-A,

11.3% FHA/VA,4.2%

Prime, 62.1% 2006 Subprime, 20.1% Alt-A, 13.4% FHA/VA, 2.7% Prime, 49.3%

Source: Inside Mortgage Finance, Last update February 8, 2008

Chart 2. U.S. Mortgage Market: 2006-2007 Chart 2. U.S. Mortgage Market: 2006-2007 Chart 2. U.S. Mortgage Market: 2006-2007 Chart 2. U.S. Mortgage Market: 2006-2007 Chart 2. U.S. Mortgage Market: 2006-2007

In order to fix ideas about the orders of magnitude of the problem we must realize that it is clustered in the years 2004, 2005 and 2006, when a much larger proportion of loans were of a lower quality. Those who coined the word sub-prime were marketing geniuses. There is a restaurant in New York that sells prime steak, rare quality steak. Those people who do not wish to spend half of their fortune on prime steak can buy first-rate steak, which is also very good steak and known as sub-prime steak. Then in the mortgage market it was marketed as sub-prime and people thought it was still very good. The fact of the matter is that in retrospect many of these loans should not be referred to as sub-prime loans but rather not creditworthy loans.

about this evokes the question of how we could just allow such an important role to an industry that we know is not run properly or competitively. In principle we could say that that is the private sector and we should just let the Darwinian rules of the jungle prevail and the market will find who to trust and who to not. However, the authorities have given rating agencies a specific, formal role. In Basel, when they decide which capital is Tier 1, Tier 2 or everything that matters concerning how much reserves need to be held, the decision is based on the ratings agencies» assessment. Therefore, the fundamentals say that the authorities have delegated to the rating agencies a very important role and this has created a situation which is, at best, not helpful.

Many of the reform proposals that have developed since that time indeed deal with the question of how we can improve the rating agencies» functioning and yet maintain the public good that is generated by such a function. There is a tendency to draw a distinction between institutional investors and retail investors. Institutional investors are groups that we expect to have their own capacity to assess risk. However, it is the retail investors that need to be protected, which then becomes a policy issue.

In a fundamental sense the risk of these mortgages has not been incorporated into the decisions properly because those who issued them did not end up holding them. This is the originate and distribute model. If you are not holding the risk you do not have the incentive to assess fully the effect. Many were not even held on the balance sheet. Therefore, if you do not see it, it does not exist. Again, many of the revisions and reforms will address these questions, namely that everything must be on the balance sheet, etc. An environment was created, especially in the USA, where getting a mortgage loan was unrelated to the respective capacity to service the loan. In fact, to not be eligible for a mortgage loan was perceived to be abnormal. After all, 105% loans were available meaning that equity was not even required. Prices went up and people were insisting that they could not afford to take a loan (perhaps they were even unemployed), however, the bank still pushed the loans on such people because if they took the loan then they would have a capital gain. Such conditions persisted without anyone to keep things in check.

xxviii

creating the fuel for spending and low savings in USA. Then came the day of reckoning and housing prices collapsed. As housing prices collapsed the value of wealth of the households also collapsed. If the value of wealth of the households collapses then loans cannot be serviced and a rising rate of delinquencies occurs in the market. This forces the banks to take over the houses, which raises the rate of foreclosures. This is the moment that needs to be emphasized; we started with a sectoral problem in the housing market, which moved to the mortgage sector of the loans. Once delinquencies and foreclosures begin, suddenly the value of assets on the balance sheets of banks shrinks. When the value of assets shrinks credit must be curtailed, which creates a credit crunch. To whom? To everyone; it is no longer just the housing market. We have moved from the housing sector to the mortgage sector to the banking sector and the entire economy. If, however, it is affecting the entire economy the question is why it spreads outside of USA? The answer is because the packaged cocktails were sold abroad. That is how European banks got involved. Paradoxically, the fortune of the banks on the countries that are less aggressive in finding exotic investments were saved. This is important to remember. It is not always an aggressive stance, taking exotic things, that is necessarily the best thing for the shareholders. As a result, we have seen nearly ever year up to the very recent past that write-downs and losses have increased by more than the capital that was raised by the banks. The current situation on the three continents is shown in the chart below.

(Billions USD, Accumulated value starting Q3/07)

1000 900 800 700 600 500 400 300 200 100 0

Europe Asia Americas

Writedowns & Credit Losses Capital Raised

Source: Bloomberg, Quarterly, Last update Jun 9, 2009

Chart 3. Cumulative Write-downs & Credit Losses vs. Chart 3. Cumulative Write-downs & Credit Losses vs.Chart 3. Cumulative Write-downs & Credit Losses vs. Chart 3. Cumulative Write-downs & Credit Losses vs.Chart 3. Cumulative Write-downs & Credit Losses vs.

Capital Raised: By Region Capital Raised: By Region Capital Raised: By Region Capital Raised: By Region Capital Raised: By Region

correct but let us not forget that the same banking system that received new liquidity also got new losses and withdrawals. Therefore, in net terms there was still a shortage. It is not the case in Asia or Europe but it is still the case in USA. This is the story of the credit crunch. Let us not be surprised, at the beginning, that we see that output is performing poorly. I would like to take a short detour into the output side.

Global growth, as was revised most recently by the IMF, is showing a dismal picture. The year of 2009 is a year that most of us would like to forget. It is a year in which global growth is in negative territory and even the optimists say that in 2010 hopefully we may see some positive growth but still nothing that comes close to what we used to see some years ago. If we look at the industrial countries we will see that practically all industrial countries in the world are in negative territory when it comes to growth. By the same token, all of them are showing improvement as we move into 2010. However, it would be premature to open the champagne just yet. The same holds true, in principle, for emerging countries and developing countries. What we see there is that every group of countries sees a decline in growth this year and practically all see a slight improvement in growth next year.

As has been the case in the past few years Asia is leading the pack. If we want to compare the changes in the centre of gravity in the world that has taken place in the last 20 years we can look at the share of world output that is produced on the various continents.

Chart 4. Global GDP Shares Chart 4. Global GDP SharesChart 4. Global GDP Shares Chart 4. Global GDP SharesChart 4. Global GDP Shares

1990

EU, 27.4% Brazil,

3.1% 2.8% China,India, 3.6% Japan, 9.1% USA, 22.8% 2008 EU, 22.1% Brazil, 2.9% India,5.0%

China, 11.4% USA, 20.1% Japan, 6.4%

Source: IMF, Last update May 2009

xxx

Chart 5. Accumulation of Foreign Exchange Reserves ($B) Chart 5. Accumulation of Foreign Exchange Reserves ($B) Chart 5. Accumulation of Foreign Exchange Reserves ($B) Chart 5. Accumulation of Foreign Exchange Reserves ($B) Chart 5. Accumulation of Foreign Exchange Reserves ($B)

It is important to remember that while the industrial world continues to argue about itself, it has already been a number of years since most growth in the world has emanated from developing countries. In fact last year more than 70% of world output came from developing countries and less than 30% came from industrial countries. This is very important because as we see unemployment rates spiraling dramatically in Europe and USA we will likely see that, as the recovery begins, it will probably be what is known as a jobless recovery, namely employment will be the last sector that will show improvement. Output will pick up first. This is important because in many of these countries employment is probably the most important politically sensitive economic variable. If this is combined with the most worrying thing that has happened in the last year, trade, then we will really start to lose sleep.

The volume of international trade this year is collapsing. It is shrinking by more than 10 percentage points compared to what it used to be in the past. If we are lucky, next year world trade will remain unchanged at a much lower level. That is very dangerous. There is a huge amount of hypocrisy in this discussion. Everyone from industrial countries is speaking about the importance of open borders and open trade and that that is the best recipe to spread the wellbeing of the world to developing countries. However, the reality is that when it comes to decisions they do not do it. The reason why we should worry about this is because in times of recession or a slowdown it is the breeding ground for protectionism and the greatest enemies of trade.

This brings me to the biggest problem that has affected us in the past, that of external imbalances. We witnessed a period when the US deficit was growing while Asia, together with the oil producing countries, managed to save, which gave us a kind of equilibrium. With the changes that have taken place, this element is changing

$B 2,200 2,000 1,800 1,600 1,400 1,200 1,000 800 600 400 200 0 Stock May 2009

China Japan Russia Taiwan South Korea

$1,954 $992 $386 $313 $226 $B 1,350 Flow

2005 - 2009

China Japan Russia Taiwan South Korea

more than what is required by external balance and USA is ≈dis-saving∆ by much more.

The chart above showing foreign exchange reserves demonstrates that between China and Japan there is the largest holdings of foreign exchange reserves. China is holding approximately US$ 2 trillion worth of foreign exchange reserves while Japan is holding about US$ 1 trillion. Must of China»s accumulation has taken place in the last two years. I would not worry about it if it were sustainable. But I am worried about it because it means that if the Chinese decided to change the composition of their foreign exchange holdings, which is now very heavy into US dollars, this could create a huge financial tsunami. The tsunami is not just in the financial market but can also appear in the foreign exchange market. That is why the calls for the reexamination of the international monetary system are indeed relevant. If we look today at the foreign holdings of US Treasury Bills we will see how it is divided across countries. China and Japan have most of the foreign holdings, each with about 25% of US Treasury Bills outstanding by foreign countries.

Inflation, which was a major topic until a few years ago, is now much less of a concern all over the world. But I would be careful. We have never in history had a situation where monetary expansion was so rapid and so vast that eventually it did not translate itself into inflation. Those who come from countries that in the past have suffered from high inflation do not need to be convinced but I can tell you that many countries in Europe and the USA have forgotten what inflation is, which is dangerous. The reality is that as the world has witnessed a significant slowdown, all central banks have expended the money supply very rapidly and lowered interest

Traditional Liquidity Measures Treasuries

New Bank Liquidity Facilities Money Market Facilities Direct Lending Activity

(Liquidity Measures, in $ bil.)

2500 2000 1500 1000 500 0

Jul Sep Nov Jan Mar May Jul Sep Nov Jan Mar May

2007 2008 2009

xxxii

rates to practically zero. However, there is something new. In the old days the US Federal Reserve and the Bank of England held practically only treasury bills of the government, which is the best asset that they could hold. They bought T-Bills from the government in order to increase money supply and sold T-Bills to reduce money supply. T-bills are a very liquid, high-quality asset. What has happened in the past year or two in UK, USA and some countries of Europe is that this has changed dramatically. The chart below shows the holdings of T-Bills.

The blue line shows the holding of T-Bills of the US Federal Reserve. The red portion shows how much the balance sheet of the Federal Reserve expanded but not through holding T-Bills. Now, suddenly other papers are being held, including commercial papers of quality that are very different than before. There is a rationale that says «we cannot allow the liquidity crunch to disturb completely the ability of corporations to borrow so we buy their papers». This beckons the question of how they will exit from this situation. This is true not only in US but also in UK and to a lesser extent in ECB. It is critical to see what happens to the assets on the balance sheet of the central bank because it is not just the assets of the central bank but also other liquidity measures. The mountain depicted on the chart above shows how total liquidity of the Federal Reserve has expanded. In the past it was associated with the accumulation of T-Bills but the red part demonstrates that it is now composed of a very different thing.

What does this mean? It means that when the Federal Reserve need to exit they will need to sell these kinds of corporate papers NOT T-Bills. Suddenly they will have a direct impact on the stock market and such assets are somewhat less liquid, which makes the exit more challenging.

completely unprecedented and frankly if it had happened in developing countries I know what the IMF would have said. This is the reality. In my opinion it is right to have an expansionary fiscal and monetary policy but I also recognize that unless you specify at the beginning how you are going to exit then the very policy being introduced is not going to be very effective.

For example, the government wants to stimulate demand. So as the government stimulates demand it says «you private sector don»t do it, so we»ll have a larger deficit and»we»ll call it a stimulus budget.» What is the typical taxpayer thinking to himself? He is thinking that the government has come in and increased the budget deficit and will probably need to finance it but how will they finance it? They will either increase their taxes and make the taxpayer poorer or they will raise interest rates, which also makes the taxpayer poorer. If the taxpayer is poorer then they are unable to spend as much as was planned. As a result the government increases its spending basically telling the private sector that it is to be taxed. Therefore, the private sector cuts its spending. Clearly this is not a stimulus budget. It would be a stimulus if the government, as it enters the game, explains that it will be a sort detour that will not stay in place for too long because the spending will be done on something that is very effective at increasing the productive capacity of the economy for the future, namely on railways, on infrastructure, innovation and education. Therefore, when the stimulus budget is brought to an end there will be a stronger, more robust foundation, which will enable the economy to continue growing rather than fall away as the floor under it is collapsing. This is the missing element.

The same is true with the Fed but to a lesser extent. The Fed is much more explicit about explaining that it is increasing its balance sheet but only temporarily. For the Fed it is easier because congress is a much more complicated thing in all economies. I can tell you, therefore, that the risks today are emanating primarily from the poorly specified exit strategy. If the exit strategy is specified properly then there is more chance to succeed with the various stimulus budgets.

xxxiv

from the planet Mars came down to earth today not knowing history or anything they would not write the definition of free market based on what we see in USA.

The US Government definitely do not want to leave the foundation of free enterprise and market economy this is just a detour. But in order to convince everyone in the market that this is just a detour the exit needs to be specified. Third is protectionism, which I have already mentioned. We have had a lot of procyclical features in our system. We had an accounting system that when things went bad assets had to be marked down to make things even worse. That is procyclical. We had had credit ratings that when things went bad, in order to protect their own reputation, they downgraded ratings, which made things even worse. I am just trying to say that we need to have a checklist of how to avoid procyclical characteristics to economic policy, including the accounting, so that when they happen they do not exaggerate things. We clearly had leverage that was completely out of balance and out of sense. We need to improve risk management and transparency. Someone once said that transparency is the situation in which what you see is what you get and what you don»t see gets you.

Too many things got us, not because we decided in the wrong think but they were not sufficiently put in front of us to make a reasonable decision. Balance sheets became meaningless because things were off balance sheet. With the current situation of the balance sheet on the left side nothing goes right and on the right side nothing goes left. We need to ensure that the mechanisms used to convey information about the financial position, which is the balance sheet, income statement, etc, are not distorting the information because without it everyone will make wild guesses and that is when spreads become much too large.

old roads that were not designed for these cars. When there was an accident there was a very old police officer but no court and no violators. What this means is that before you put the new car on the road you must also consult the systemic features. Are the roads wide enough? Are the stop signs clear enough? Are the police officers knowledgeable enough? Only once this has been addressed can we put a car that has passed all of its tests but not the systemic tests onto the road and perhaps it will be ok. So we should be careful of not condemning the good cars to death rather than asking what the systemic challenges are for it. When it comes to regulations, they must also become more modern. Financial markets are moving at a vey fast speed and developing at a very fast speed and most of the regulators and supervisors went to school when the previous cars were invented, not when the current cars were invented. Therefore the regulations themselves must be a dynamic body of knowledge and the regulators must renew and rejuvenate their knowledge. When there is a global, interconnected market regulators and supervisors must have their mechanisms for interaction. But in order to have such mechanisms there must be consistency among regulations on different sides of the globe. If not then a case of regulatory arbitrage occurs where decisions are made not just according to the cost-benefit analysis of the product itself but according to which regulatory loop-hole or tax haven are best, which is not the best long-term criterion. That is why the harmonization of regulations to avoid regulatory arbitrage is important. The bodies that allow regulators from all over the world to meet and compare notes are important.

I asked Mervin King to explain to me what important lesson he draws from what has happened recently and precipitated the collapse of Northern Rock. It turns out that the most important element that a central bank needs to deal and perhaps prevent such accidents is timely information; timely information that the bank supervisors should have the authority to collect and the ability to implement upon.

xxxvi

minimize the number of crises. We know they will come and we have done our best to prevent three. But we will still have two.

Maximillian J.B. Hall

Prof. Frenkel talked a lot about exit strategies. I think he agreed with my statement about the likely return of stagflation. What does that imply for the design of exit strategies on a monetary and fiscal front? A third exit strategy not focused on was a withdrawal of the state from ownership of private financial institutions. Can you give your views on that?

Response from Jacob Frenkel

We have now had a huge expansion on the monetary and fiscal side, systemically speaking. If this will not work then the temptation is to do more of the same. This would be wrong because we need to understand that the reason why the huge expansion of liquidity has not worked. It is not because of a shortage of liquidity. When the banks got that liquidity they kept it without lending it. The banks were not sure whether they would be repaid. Furthermore, the borrowers did not want to borrow and invest because they were unsure of the economic outlook. Confidence and trust is required and then the same amount of liquidity would be more than enough to fuel the machinery. How to enhance confidence and trust? If the problem was not solved by more money it will not be solved by even more money. That is the rationale for focusing so much recently on regulatory reform and clarification of the rules of the game in terms of public property rights, exposure, capital requirement ratios, etc. So focus on confidence and trust.

xxxviii

Jaseem Ahmed, Asian Development Bank

Prof. Frenkel, you made a very powerful observation about how the Federal Reserve, as it expanded its balance sheet, changed the composition on its asset side. It no longer simply holds treasuries but also very risky private sector securities. Is there a risk that the Federal Reserve could lose its operational autonomy to the extent it has it unless it has explicit understanding with the Treasury on the Treasury standing by to make up any losses that might be incurred.

Regarding the exit strategy from a situation in which the US Fed Reserve has pumped in massive amounts of excess reserves, I am just wondering whether this is as difficult as I initially thought that you were implying. Would it not be possible for the Federal Reserve to use a policy of remunerated reserves or taxes on reserves to influence the behaviour of banks? Therefore, if it was worried that banks were in fact going to expand the money supply it could step in and offer a remuneration that is higher than the policy rate. Conversely, if it was worried that the banks were not lending enough could it not decide to impose a tax?

Response from Jacob Frenkel

Of course it is possible and it is in general much easier to exit in a monetary policy world than a fiscal policy world. Not least of the reasons is the reality that fiscal policy is not any more so much at the hand of the person in charge. He/she needs the parliament or congress, etc.

While it is possible to change the rate of remuneration, etc I would not make it common practice in the future because it invites much more intrusive fine-tuning rather than drawing up the rules in advance and letting the market play. I prefer to leave taxation to the fiscal authorities and monetary policy to the monetary authorities. In the mechanism used is to implement monetary policy through taxation then the sharp division is lost.

Considering the social consequences of the crisis, you explained that the last solution of the various problems will be unemployment. When you advise policymakers, governments, etc what could you say to them and simultaneously anticipate the solution of this tremendous social problem of unemployment?

Response from Jacob Frenkel

You come from a part of the world that has been plagued by unemployment and sensitivity. First, we need to recognize that this is the most important and challenging issue. It is not only about numbers, unemployment represents the weakest part of our society. As such, it is easy to resolve the next generation by giving them lots of education today but we still need to deal with the problem of today. Having safety nets within the public policy arena is something that is becoming more and more recognized as a must. The only difference between different schools of thought is how to mobilize the resources to such a safety net. I am a great believer that we must budget them in advance. If it is included in the budget and therefore assessed in terms of the appropriate priorities of various objectives, rather than spending on defense for example, then this is a very well reasoned decision and I personally applaud such actions. I believe that all societies must make such a decision. I do, however, worry about an open checkbook that implies ≈let me have a budget and if there is then a problem I will find the means to mobilize the resources.∆ This never works and is a recipe for exceeding the budget. Those who agree we need to budget it do not agree that we do not need to have a safety net. In order to have an effective safety net it has to be budgeted.

Michael Pomerleano

You dealt with micro causes; credit ratings, etc. One could argue that there were much more fundamental, structural issues like the imbalances, the entry of China or the low interest rates. Perhaps you could comment on this?

xl

Thirdly, in your capacity as the chairman of the G-30 I, frankly, feel that the reforms are merely cosmetics on the fringes. Everyday people are backtracking from structural reforms. What is the position of the G-30 on that?

Response from Jacob Frenkel

It is a fundamental question indeed; how come we did not see it? Unfortunately we will have the opportunity to answer the very same question during the next crisis. I think that those of you who read the history of wars one realizes that normally the problem is not the failure of the intelligence agency to accumulate information. It is the failure to interpret the information or the lack of political courage to act upon it. Looking at the savings and loans crisis in USA, everyone knew that this was a hot potato that was going to explode. The same is true with the dotcom bubble and the Nasdaq bubble. We have quite a few bubbles that were known to be non-sustainable so the question is a little bit more general. I feel that there really is a failure to recognize the model as an analyst.

An atheist was driving in Paris looking for a parking space on the Champs-Élysées next to the Arc de Triomphe. At some stage he raised his hands in despair and pleaded ≈God if You are there, help me find a parking space and if you do I will start worshipping You and stop being an atheist.∆ As he finished this thought a car pulled out and a beautiful parking space became available. As he pulled in he said ≈God, no need I have found one!∆ He did not understand the model of cause and effect. I feel that the issue of cause and effect is the most difficult issue in economics, in science etc.

Regarding commitment to the reforms, it is all related. Economic reforms are tough because normally the beneficiaries will be the next generation of leaders; the pain is at the beginning. There has been no single economic proposition up to the present day that has been more embraced as true than protectionism is bad. And yet there was no single proposition that was so refuted in actions day in and day out.

can be low with no danger to inflation because cheap products will come from abroad. This was an error but not an error of inflationary assessment. It was not an error about the availability of foreign capital. It was an error of not recognizing that when you give investors low yields you also give then incentives to look for higher yields elsewhere. There is one general theorem that even USA could not change, which is that higher yields typically come with higher risk. Basically, investors were encouraged to take higher risks and this risk was not internalized into the decision-making process as it was packaged and sold elsewhere, but it remained in the system. This was the one major blunder: lack of attention to risk and then letting it explode the way that it did.

Adrianus Mooy

We have labeled this crisis as a financial tsunami but I think it is more of a tsunami in terms of its impacts, not in terms of its causes. A tsunami is a natural phenomena but this crisis is a man made phenomena. What is wrong? Is the system wrong or the people running it (regulators, policymakers or operators)?

All the efforts so far have addressed the impact but I would like to know whether we have adequately addressed the causes? What is your view?

Response from Jacob Frenkel

xlii

The World Economic & Financial

System: Risks & Prospects

1 AIG

Dr. Jacob A. Frenkel

Chairman & CEO Group of Thirty (G30)

Bank Indonesia 7th Annual International Seminar ≈Global Financial Tsunami: What Can We Do?∆

Bali, Indonesia, June 13-14, 2009

Global Financial Markets

AIG

Global Equity Markets

3 AIG

Source: Bloomberg, Market Data, Last Update Jun 09 2009

S&P 500 Dow Jones

(close - price)

6,000 7,000 8,000 9,000 10,000 11,000 12,000 13,000 14,000

(close - price)

600 800 1,000 1,200 1,400 1,600

2006 2007 2008

Standard & Poors 500 Composite Index (Right) Dow Jones Industrial Average Index (Left)

Global Equity Markets

Source: Bloomberg, Market Data, Last Update Jun 09 2009

Europe

(US$ returns, 12/31/2008 = 100)

40 60 80 100 120 140 160 180

Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul

2007 2008 2009

Latin America

Asia

xliv

U.S. Credit Market Spreads

5 AIG

Spread between 3 Month LIBOR & T-Bills

AIG

Source: Barclay's Capital, weekly averages, last observation Jun 10 2009

©FactSet Research Systems

(percentage points) 0 2 4 6 8 10 12 14 16 18 20

May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May BarCap High Yield Spreads vs. Treasuries

BarCap High Grade Spreads vs. Treasuries

High Yield 9.4

High Grade 3.0

Source: Federal Reserve, Reuters, last observation Jun 06 2009

Countrywide Financial"Risks

Bankruptcy" Foreclosures accelerate from 5.5% to 6.9%

First Federal Reserve Auction,

$20bn Bear Stearns Collapses

IndyMac seized by US

Regulators Lehman Brothers files for Bankruptcy Wave of redemptions in Money Market Funds (basis points) 0 50 100 150 200 250 300 350 400 450 500

7/07 10/07 1/08 4/08 7/08 10/08 1/09 4/09

Emerging Market Credit Spreads

7 AIG

Subprime Crisis, Housing, and Banks

Source: JP Morgan, last observation Jun 09 2009Latin America

Europe

Asia

(Basis points, index 1/1/2007=100)

0 200 400 600 800 1,000

Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul

2007 2008 2009

Latin America Europe Asia

Size of the Subprime Market

Housing Prices and Household Wealth

Delinquencies and Foreclosures

xlvi

U.S. Mortgage Market: 2003-2005

9 AIG

U.S. Mortgage Market: 2006-2007

AIG

Source: Inside Mortgage Finance, Last update February 8, 2008 Subprime,

7.9%

Alt-A, 2.2% FHA/VA, 5.6% Prime, 78.8% 2003 2004 Subprime, 18.2%

Alt-A, 6.3% FHA/VA, 18.2% Prime, 58.9% 2005 Subprime, 20.0% Alt-A, 12.2% FHA/VA, 2.9% Prime, 53.2%

S