List of Contents

16

60

Financial Highlights Share Highlights Share Performance MilestonesSignificant Events in 2016 List of Contents

Theme of the Year Disclaimer and Scope of Responsibility

INTRODUCTION

Board of Commissioners’ Report Profile of Board of Commissioners Board of Directors’ Report Profile of Board of Directors

MANAGEMENT REPORTS

Overview

Structure of Corporate Governance General Meeting of Shareholders (GMS) Board of Commissioners

Board of Directors

[image:2.595.290.591.60.306.2]Assessment on the Board of Commissioners Assessment on the Board of Directors’ Performance

Table of Affiliation Audit Committee Corporate Secretary Internal Audit Public Accountant Risk Management Legal Disputes

Information of Administrative Sanction Access to Corporate Information and Data

GOOD CORPORATE GOVERNANCE

Social and Community Sector Employment Responsibility

CORPORATE SOCIAL

RESPONSIBILITY

Company Identity Company in Brief

Vision, Mission, and Corporate Core Values Corporate Structure

Structure of The Group

Composition of Share Ownership Human Resources

Occupational Health and Safety Information Technology

Supporting Professional Institutions Addresses of Branch Offices and Agents Work Area and Operational Map

MANAGEMENT REPORTS

Shipping Industry Outlook Operational Review

Operational Review on Business Segments Investment Performance Review in 2016 Income Statements

Solvability And Receivables Collectability Capital Structure And Policy On Capital Structure

Business Outlook Marketing Aspects

Cash Dividend Policy and Distribution Material Information on Investment,

MANAGEMENT DISCUSSION

AND ANALYSIS

PERFORMANCE

HIGHLIGHTS 2016

Expansion, Divestment, Business Merger/ Consolidation, Acquisition, or Debt/Capital Restructuring Material Obligation For Goods and Capital Investment

Amendment in Regulations

Amendment in Accounting Standards

STATEMENT OF

ENABLING INDONESIA

THROUGH CONNECTIVITY

P ov a o o o y ovav, o v a a

s v o a s a o s o a

y’s solid commitment. Now,

Disclaimer and Scope of

Responsibility

This Annual Report contains statements of financial

condition, operational results, projections, plans, strategies, policies, as well as the Company’s objectives, categorized as forward statements in the implementation of prevailing legislation, where historical things are exception.

The statements have possibilities of risk, uncertainty, and can lead to actual developments that are materially different from the ones reported. Prospective statements in this Annual Report are based on various assumptions regarding current and future conditions, and also the Company’s business environment. The Company provides no guarantee that documents that have been validated will bring certain results as expectated.

2016

PERFORMANCE

HIGHLIGHTS

The National Network

!t"# $ $ % &"'" ! %(" & )

y

FINANCIAL

HIGHLIGHTS

Consolidated Statements of Financial Position

Total Assets

Total Liabilities

Total Equities

2.525.662 1.530.986 994.676

1.782.061

967.395

814.666

58,51

118,75

54,29

17,80

19,56

38,93

1.626.838

1.092.953

533.885

49,49

204, 72

67,18

12,52

13,38

38,14

DESCRIPTION

2016

2015

2014

(in million Rupiah)

(in million Rupiah)

Income Statement

2016

2015

2014

Sales Revenue

Gross Profit

Operating Income

Net Income

Total Comprehensive Income (Losses) Attributable to Owner of the Parent Entity

Total Comprehensive Income (Losses) Attributable to Non-Controlling Interest

42,28 153,92 60,62 9,17 13,85 23,28

Financial and Operating Ratios (%)

2016

2015

2014

In %

Current Ratio

Debt to Equity Ratio

Debt to Total Asset Ratio

Return on Assets

Return on Revenue

Return on Equity

321,402 1.141.030.000 1.141.030.000

203

284.175

1.141.030.000

1.141.030.000

278

270.104

1.141.030.000

1.141.030.000

178

Others

2016

2015

2014

(in million Rupiah)

Sales Volume (TEUs)

Outstanding Shares (number of shares)

Weighted Average of Outstanding Shares (shares)

Earning Per Share (Rupiah)

1.671.905 444.055 303.847 231.521

231.308

213

1.621.364

453.693

407.999

317.174

316.970

204

1.522.131

387.854

323.422

203.631

203.059

CHARTS OF

FINANCIAL HIGHLIGHTS

(In Million Rupiah)2016 2014 2015

Total Assets

* + -* -+ . . * / + 0 2 * + 3 . / / + 0 2 * + 3 . / 2016 2014 2015Total Liabilities

/ + -4 3 + 5 2 . 5 . 0 , 4 5 -2016 2014 2015Total Equity

5 5 6 7 . 0 . 2 / 6 7 . . . 2016 2014 2015Sales Revenue

/ + . 0 / + 5 3 -/ + . * / + 4 . 6 2016 2014 2015Net Income

* 4 / + -* / 4 / 0 , / 0 6 2016 2014 2015Sales Volume (TEUs)

ORMANCE

2015

Highest(Rp)

2,285

2,100

1,760

2,200

Lowest (Rp)

1,730

1,495

1,250

1,380

Closing (Rp)

1,800

1,650

1,430

1,950

Average Volume

41,325,900

30,252,300

9,421,100

14,772,800

Q1

Q2

Q3

Q4

2016

Highest(Rp)

Lowest (Rp)

Closing (Rp)

Average Volume 2,000

1,945 1,720 1,765

1,710 1,370 1,375 1,365

1,900 1,475 1,385 1,750

5,966,100 24,302,500 98,310,800 116,655,700

Period

500

0

10.000.000

0 4500

5000 5500 6000

4000

3500

3000

2500

2000

1500

1000

90.000.000

80.000.000 100.000.000 110.000.000 120.000.000

70.000.000

60.000.000

50.000.000

40.000.000

30.000.000

20.000.000

2015

Closing Price2016

Average Volume

Closing Price

Average Volume

1987

F8 9:;<; =y Harto Khusumo

and Koentojo, the Company was initially founded with KM Latoa as the first ship which was afterwards replaced by KM Teluk Mas.

2002

TEMAS Line received Adi Karya Bahari Pralabda Award from Minister of Transportation and Telecommunications for its achievement in Marine Transportation.

2003

The Company listed its shares on Indonesia Stock Exchange and became a public company with ticker code “TMAS”. In October 2015, Director of TEMAS Line, Mr. Harto Khusumo, received an award for Indonesian Best Entrepreneur from Ernst &Young for Entrepreneurial Spirit Category.

2004

The Company received Value Creator Award from SWA Magazine and MarkPlus & Co. for the category of best public companies with assets less than Rp1 trillion.

2005

Apart from being unanimously crowned as the Model of National Shipping Company in the year of 2005 by Ministry of Transportation of the Republic of Indonesia, The Company also received Value Creator Award (EVA) from SWA Magazine and MarkPlus & Co for its notable achievement in creating added value for its business.

2006 – 2012

The Company rejuvenated its fleet by reducing 12 units of ships and adding 23 units of ships, consisting of 6 units of used ships and 17 units of new building ships.

2013

January

The Company acquired 99.67% shares of PT Escorindo Stevedoring, a stevedoring company in North Jakarta that operates in Tanjung Priok Port, to improve the Company’s performance.

June

To improve service quality to customers, the Company purchased 2,500 units of new Food Grade Container, specifically for transporting products of foods, beverages and pharmaceuticals.

2014

June

The structure of the Company’s Executive Board changed to:

Board of Directors:

President Director Harto Khusumo Director Faty Khusumo Director Ganny Zheng Director

Teddy AriefSetiawan

Board of Commissioners:

President Commissioner

Wong Chau Lin

Independent Commissioner

Edward Simangunsong

Independent Commissioner

Alfred Natsir

September

1. The Handover of KM Spring

Mas with capacity of 16,705 DWT - 1,560 TEUs.

2. Signing The MOU of Pendulum Route (sea toll) for the route of Belawan– Tanjung Priok–Tanjung Perak–Makassar–Bitung, to realize a continuous synergy among Shipping, Pelindo I (Belawan International Container Terminal), Pelindo III (Surabaya Container Terminal), and Pelindo IV (Makassar Container Terminal and Bitung Container Terminal).

October

1. Signed MOU to purchase 3,000 units of 20ft Food Grade and 500 units of High Cube container.

2. Received an award from

IPC (International Port Container) for the category of Best Shipping Line in Pontianak.

November

Opened new route of Jakarta-Dumai

2015

March

Signed an order contract of constructing 6 units of new ship to increase the Company’s capacity.

June

1. Opened a new route from Surabaya–Palu

September

> ? @hB CDE GH Iy bought a

shophouse in Banjarmasin as the Company’s Branch Office.

2. The Company’s Head Office moved to a new building.

October

The Company signed a Memorandum of Understanding (MoU) with PT Pelabuhan Tanjung Priok regarding Cooperation in Stevedoring Activities in Tanjung Priok Port.

November

1. Obtained TOP Infrastructure

Award 2015 for the category of TOP Infrastructure on Transportation 2015.

2. The Company purchased MV Sungai Mas ex PWM Valparaiso’s with the capacity of 28,876 DWT, 2,135 TEUs.

December

SIGNIFICANT

EVENTS IN 2016

January

Delivery of MV Sungai Mas

ex PWM Valparaiso with a

capacity of 28,876 DWT,

2,135 TEUs.

May

Received Investor

Award for the

category of

Infrastructure

Sector.

February

1. Delivery of KM Teluk

Mas and KM Kisik

Mas, 2 of 6 new

building vessels.

2. Opening new routes

of Timika and

Merauke

April

July

Opening new route of

Malahayati.

November

1. Delivery of KM Segara

Mas ex Conti Emden

with capacity of 38,103

DWT, 2,702 TEUs.

2. Delivery of KM Ayer Mas

and KM Muara Mas, the

5th and 6th fleet of 6

new fleets in order.

3. Opening new route of

Tual

June

1. 1. Delivery of KM Curug Mas

and KM Bahar Mas, the 3rd

and 4th fleet out of 6 new

fleets in order.

2. Opening new route of Serui.

3. Opening new route of Kumai

and Sampit.

October

Delivery of KM Sendang Mas ex

Larentia with capacity of 38,121

DWT, 2,702 TEUs.

December

MANAGEMENT

REPORTS

JKL MLNO Q RNSQ UV U W XUYLMVZ LV S

[MU\ MNZZL Q V N]KQ LY Q V\ ^_^SNQ V N`O L

NVb Lc_Q SN`O L b LYLO Ud ZLV S

SK MU_\KU_ S fVbUV L^Q N ^ LMYL N^

ZU SQ YNSQ UV WU M gU NMb U W iQ ML]SU M^

SU ]UV SMQ `_SL WU M d M

osperity

REPORT OF

THE BOARD OF

COMMISSIONERS

Wong Chau Lin

Dear Valued Shareholders,

One of the influential parameters that greatly affected the Company’s achievement in 2016 came from national economic growth that reached 5%, which was particularly sufficient to constantly generate the domestic economy. A fairly restrained inflation and a relatively steady rupiah exchange to US Dollar contribute as well. Aside from the abovementioned factors, The other supporting factor, likewise, the price of fuel as the largest component of the Company’s operating cost remained constant. During 2016, domestic politics and security condition remained relatively under control, allowing the Company to run its activity well and carry out expansion for further development.

However, global economy for the year showed a contrast situation where its continued sluggish climate caused difficulties for some global shipping industries. Most of them were forced to downsize their business capacity. Those who did not survive would certainly cease to operate, and it was reflected on the sales of ships with cheap price in global market.

“

We, as the Board Commissioners voluntarily dedicate

ourselves as an advisor and counterpart for Directors in

determining important policies for Company.

A different story happened in national shipping industry or domestic transportation. Supported by above mentioned parameters, domestic transportation, containerized shipping in particular, grew well. Growth in container freight was also encouraged by the Government program of Sea Toll policy, ports development and advancement, mainly in Eastern Indonesia. Nevertheless, the important thing for TEMAS Line was the competition factor among domestic providers of container transportation throughout the year 2016 that would certainly affect the Company’s performance.

Board of Commissioners’ Performance

Alfred Natsir

Independent Commissioner

Wong Chau Lin

President Commissioner

Edward Simangunsong

Independent Commissioner action if required. In our Monthly Meeting, we have

supervised financial. operational performances, and the performance of main production equipment (ships& tools).We have to ensure that Internal Control,Risk Management and Good Corporate Governance (GCG) are well implemented. In addition to our main duty, the Board of Commissioners also provides itself as an advisor, a counterpart for the Board of Directors in making Company’s important policies, such as addition of vessels, equipment, route opening, and feasibility study of investment.

As for improving the human resources’ professionalism, integrity and competency, we would like to be the resourceful mentor. With the collaboration of the Board of Commissioners, Board of Directors and all the Company’s organs, it is expected that the Company could continue to grow in the midst of tighter competition, especially in the industry of domestic containerized shipping line.

Evaluation on the Company’s Performance

The Company’s key performance indicators in 2016 can be described as follows: cargo volume amounted to 321,402 TEUs, increased 13.10% if compared to 2015; net profit for the year was Rp231,521 million or down 27.01% from 2015; total cash was Rp32,968 million or higher 25.9% than cash in 2015; and total assets reached Rp2,525,662 million or increased 29.4% compared to 2015. These performance indicators in 2016 demonstrated that the Company has been in progress in carrying out the mission toward the dream vision.

Addition of Main Production Equipment

Wong Chau Lin

j k

esident Commissioner

On behalf of the Board of Commissioner,

Outlook on Business ProspectWe see an optimistic growth on domestic container transportation under favorable government policies that are supportive to economic improvement, including sea toll policy to prioritize and promote an integrated ocean freight, infrastructure development policy for the port in particular, simplification in licensing, new energy over tax amnesty policy, invitation to foreign investors for economic and infrastructure development, eradication and prevention of corruption, including in transportation sector. All of these create an optimism, mainly for domestic container transportation. Accordingly, the Company has set a strategy to seize the growing opportunities through providing a pendulum service of the nation, developing new services, adding vessels, tools and containers, planning efficient and effective shipping service. Organization policy and human resources development have also been prepared so as to make the Company more confident in welcoming the future success.

Closing

To end our report, the Board of Commissioners would like to convey appreciation and gratitude to the Board of Directors, all employees of TEMAS Line and Subsidiaries who have dedicated their hard work. Similar appreciation goes to the Shareholders and Government who always support, to PT Pelindo I, II, III, and IV, and subsidiaries for the given cooperation. To the customers for their trust to keep using the Temasline’s services, hopefully our partnership in the future could be better. In the end, together we can contribute for the advancement and prosperity of the Republic of Indonesia.

PROFILE OF

BOARD OF COMMISSIONERS

Wong Chau Lin

President Commissioner

Alfred Natsir

Independent Commissioner

He has served as Independent Commissioner of TEMAS Line since June 6, 2014, based on Decree of EGMS Resolution No. 26 dated on July 4, 2014. Graduated with Bachelor of Civil Engineering from ITB Bandung, he started his career as Employment Staff at Department of Transportation (1977); Planning Division Staff at Directorate General of Marine Transportation (1978); Head Division of Engineering and Project at Maluku and South Kalimantan Ports (1983); Head of Engineering Division at Perum Pelabuhan IV Makassar (1990); Head of Sub-Directorate of Port Building at Perum Pelabuhan IV, Makassar (1992); Senior Manager of Business Development at PT Pelindo IV, Makassar (2000); Director at PT Pelabuhan Indonesia IV (Persero), Makassar (2002-2009); and President Director at PT Pelabuhan Indonesia I (Persero), Medan (2011-2013).

Edward Simangunsong

Independent Commissioner

Harto Khusumo

lmesident Director

BOARD OF

Dear Valued Shareholders,

nime flies and we have passed through the year 2016.

Therefore, we are grateful to God the Almighty that even under uneasy conditions, the Company could successfully move on with all the existing challenges.

Our journey in 2016 was not easy, particularly in shipping industry. Global shipping industry underwent a challenging period due to slowdown in global economic growth at only 2.3% according to the World Bank. Decrease of global mining and offshore production created an impact on transportation industry in general, and shipping industry in particular. As the result, many of the world’s shipping companes experienced downsizing capacity. In fact, some world’s giant shipping companies suffered losses, or even bankruptcy.

Slowdown in global economic growthand crisis in world’s shipping industry also influenced national shipping industry as well. However, the Company’s Board of Directors remained confident with Indonesia’s economic growth and development. Many infrastructure projects are currently in progress to support the Government’s Sea Toll Program. Furthermore, Indonesia’s Central Bureau of Statistics recorded that economic growth in Indonesia reached to 5.02%, while the economic growth in Maluku and Papua recorded at 13%. In this case, the Board of Directors could see the potential development, coupled with huge Indonesian population that mostly is within the category of young population. Thus, there is an opportunity for increased demand towards daily consumption needs, which requires thorough distribution lines, since Indonesia is an archipelago country connected by the sea.

The integrated and continuous improvement in infrastructure development by the Government is expected to facilitate the distribution flows of products and services nationwide, which in turn could reduce logistics cost from Sabang to Merauke. Realization of the Government Program for equal development in all regions of Indonesia becomes the driver for the Board of Directors to contribute for the developmet of the nation.

Company’s Performance in 2016

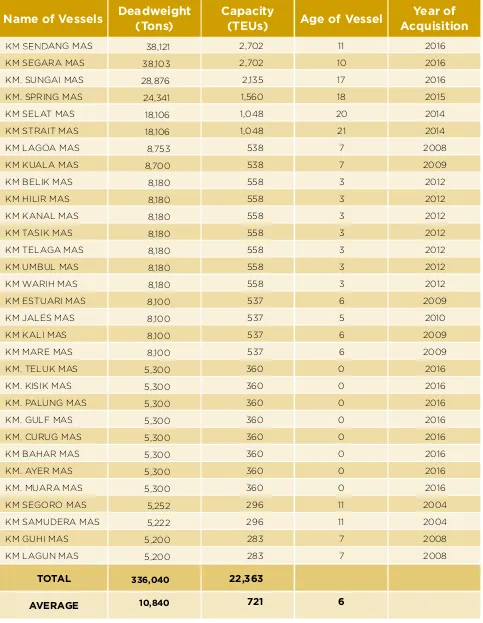

The Company has implemented some strategic actions in order to participate supporting the Sea Toll Program initiated by the Government. The establishment of National Network is our initial strategic step in 2016, by opening 7 new ports of Timika, Merauke, Serui, Kumai, Sampit, Malahayati, and Tual. The opening of the ports certainly needs a fleet to provide route services, and therefore the Company has made investment by using its capital expenditures to add a number of fleets and other supporting equipment. The additional 3 large ships with capacity of 2,700 TEUs and 4 ships with capacity of 360 TEUs –as continued building project of 6 new ships in 2015– were prepared to support market penetration. Thus, the number of Company’s owned vessels increased to 31 units with total capacity of 22,363 TEUs compared to 2015 with 22 units with total capacity of 12,838 TEUs. The number of ports served also increased from 20 ports in 2015 to 27 ports in 2016. Other supporting facilities were also added, including containers, stevedoring equipment, and land for container depot. With the additional supporting facilities, the operational activities would be effectively and efficiently conducted.

“

TEMAS Line has been the pioneer and continuously committed

By 2016, the Pendulum Service initiated in 2013 has been developed to become S4 Service and A3 Service. S4 Service with the route of Belawan-Jakarta-Surabaya-Makassar-Bitung-Palu, is served with 4 units of ships, and A3 Service with the route of Belawan-Jakarta-Surabaya-Makassar-Ambon, is served with 3 units of ships in the first quarter of 2017. Meanwhile, small-sized ships will serve as feeder service/loop service to smaller ports.

From financial side, compared to 2015 the Company’s Service revenue increased 3.15% at the end of 2016, from Rp1,621 billion to Rp1,672 billion. While Income attributable to the Owner of Parent Entity declined 27.01%, from Rp316.9 billion in 2015 to Rp231.3 billion in 2016. The decline of Company’s Income was due to market penetration for some new ports’ service, where the price experienced a significant decline. New acquired ships were not also able to generate revenue in such a short time. The Company’s total assets reached Rp1,782 billion in 2015 to become Rp2,525.6 billion or increased 41.73% in 2016.

To provide timely shipping schedule, we have always cooperated with Pelindo and Port Operator to improve stevedoring performance in all ports. Accordingly, the Company has signed a Memorandum of Understanding (MOU) of Pendulum Service with five Port Operators of Terminal Petikemas Domestik Belawan (TPKDB), Pelabuhan Tanjung Priok (PTP), Terminal Petikemas Surabaya (TPS), Terminal Petikemas Makassar (TPM) and Terminal Petikemas Bitung (TPB). With this collaboration of the Company and five Port Operators, it is expected that the customers have an assurance regarding the service schedules provided by the Company, to help them making better planning for their business activities.

Harto Khusumo

Direktur Utama

Teddy Arief Setiawan

Direktur Komersial

Faty Khusumo

Direktur Pengelola

Ganny Zheng

On behalf of the Board of Directors,

Harto Khusumo

President Director

Business ProspectWith the implementation of Pendulum Service S4 and A3 that connects all Port Hubs with consistently scheduled ships, interisland goods distribution in the entire regions of Indonesia will be better, coupled with future developed routes that will realize an integrated Sea Toll and quicker transit time of delivery. Goods distribution from economic centres will reach out to remote areas so that logistics cost could really be reduced and price disparity between the center and the regions, western and eastern regions of Indonesia, can be decreased. The wheels of economy will spin faster and prosperity can be equally realized.

Backed by 31 fleets of vessel with total capacity of 22,363 TEUs serving 27 ports throughout Indonesia, the Company can offer more alternatives to customers, so that demand for services to remote areas and small ports can be fulfilled properly. The Company’s National Network that is in progress and will continue to be carried out, is our contribution to realize more varied limitless connectivity for marine cargo transportation of Indonesia’s Sea Toll. The Company will continue to innovate and create solutions for logistics industry and distribution of economic goods.

With the new investment, TEMAS Line will stand strong to realize Fixed Schedule and On-Time Delivery throughout Indonesia, in which it has been the long expectation in the National Logistics Industry. Therefore, we invite all relevant parties, from customers, port operators, regulators, employees and ship crews, to build a synergized cooperation in realizing Indonesia as the strong maritime country.

Harto Khusumo

p q

esident Director

He served as President Director of the Company since December 16, 2002, based on Decree of AGMS Resolution No. 23. He had previously served in several positions, such as Commissioner at PT Dermaga Emas Jaya (1989-1990); Director at TEMAS Line (1987-2002); Director at PT Pelayaran Tirtamas Express (2000-2003); and President Director at PT Temas Lestari (2002-2003). Currently, Harto Khusumo also serves as Commissioner at PT Bongkar Muat Olah Jasa Trisari Andal (since 2003); Commissioner at PT Pelayaran Tirtamas Express (since 2003); and Commissioner at PT Temas Lestari (since 2003). He was awarded as Entrepreneur of the Year for Entrepreneurial Spirit from Ernst & Young in 2003. He was graduated from senior high school in Surabaya in 1965.

Faty Khusumo

Managing Director

She was appointed as Director of the Company since June 6, 2014, based on Decree of AGMS Resolution No. 26 dated on July 4, 2014. Faty Khusumo started her career as Commissioner at PT Pelayaran Tirtamas Express (1993-2003), then as Commissioner at PT Olah Jasa Andal (1997-2012), Commissioner of PT Pelayaran Tempuran Emas (1999-2002), and Director at PT Tempuran Emas (2002-2003). Currently, she has also served as President Director of PT Temas Lestari (since 2003). Faty Khusumo was graduated as Bachelor of Business Administration from Pepperdine University, Malibu, CA, USA (1998) and received her Master of Corporate Finance from Case Western Reserve University, Cleveland, Ohio, USA (1999).

PROFILE OF

Ganny

Zheng

r uwx wzux {| u}~ z}

w ed as Director of the Company since June 6, 2014, based

on Decree of AGMS Resolution No. 26 dated on July 4, 2014. Ganny Zheng started his career as Accounting Staff at Stein Devisser & Mintz, New York, USA (1996-1999); and had served as Account Manager at Intergraph, Singapore (1999-2003). Currently, he is also appointed as Director of PT Pelayaran Tirtamas Express since 2003. Ganny Zheng was graduated with Bachelor of Mechanical Engineering from Rutgers University, New Jersey, USA, 1996, and Master of Business Administration in Finance and Investment from Zicklin School of Business, City University of New York, USA, 1998.

Teddy

Arief

Setiawan

Commercial Director

COMPANY

PROFILE

sels of ours with their capacity

of 22,363 TEUs has been a great help

for us to serve 27 ports in Indonesia.

Moreover, Company can also provide

a lot of choices for Customers

so that all their needs in almost all

regions of Indonesia

OMPANY

IDENTITY

Company’s Name

PT Pelayaran Tempuran Emas Tbk

Shipping

Established on September 17, 1987, under

the name of PT Tempuran Emas

Decree No. C2-2545.HT.01.01.TH’88

dated on March 22, 1988

PT Pelayaran Tempuran Emas Tbk

Jakarta Head Office Jl. Yos Sudarso Kav. 33 Sunter Jaya, Tanjung Priok Jakarta 14350

Phone : (62-21) 430 2388

Fax : (62-21) 4393 8658

Email : corp.sec@temasline.com

Website : www.temasline.com

Rp570.000.000.000

Rp142.628.750.000

Non-Management

• PT Temas Lestari: 80,84%

Management

• Wong Chau Lin: 0,01%

• Harto Khusumo: 0,02%

• Teddy Arief Setiawan: 0,01%

• Ganny Zheng: 0,40%

Publik: 18,72%

Line of Business

Date of Establishment

Ownership

Deed of Establishment

Authorized Capital

Issued and Paid-Up Capital

T

¡¢y’s involment in shipping industrydated back to the time when Harto Khusumo and Koentojo agreed to set up a first shipping company in Indonesia that pioneered in containerized cargo delivery via sea transportation, under initial name of PT Tempuran Emas on September 17, 1987.

Six years later, the Company managed to transform into a public company by joining the Indonesia Stock Exchange in 2003 with the name of TEMAS Line and stock code of “TMAS”. TEMAS Line listed its shares on June 25, 2003, through offering 451,000,000 shares, making the Company first national containerized shipping line listed in the Indonesia Stock Exchange since July 9, 2003. The Company’s name then changed into PT Pelayaran Tempuran Emas Tbk until today.

The Company initiated its business through the provision of container transportation services by rental vessels. TEMAS Line’s rapid growth required the Company to keep on strengthening its position and competitiveness in the industry. Growing number of fleet and more expansive range of services have become TEMAS Line’s service excellence, backed by

TEMAS LINE

AT GLANCE

heavy equipment of stevedoring activities, such as Harbour Mobile Crane (HMC), Reach Stakers, Empty Container Handler and Forklift Container. Today, the Company has become one of leading companies in Indonesia’s shipping industry, providing integrated services with modern fleet of ships and supporting owned equipment.

In line with the dynamics of national shipping industry development, the Company continues to expand its services by developing the business lines of shipping management, agency, and stevedoring services that are operated through four Subsidiaries, namely PT Olah Jasa Trisari Andal that is engaged in depots management; PT Pelayaran Tirtamas Express in shipping management; Anemi Maritime Co. Ltd. (Anemi) in lease of containers management; and PT Escorindo Stevedoring in stevedoring services.

and Samarinda, as well as establishing 15 (fifteen) agencies in Malahayati, Batam, Dumai, Palembang, Sampit, Kumai, Balikpapan, Palu, Kupang, Manokwari, Tual, Timika, Merauke, Biak and Serui. Consequently, the number of fleet and supporting facilities are also growing. Up to the year 2016, the Company’s total owned containers have reached 30,631 units, consisting of 9,421 units of food grade containers and 21,210 units of non-food grade containers. The number of the fleet reached 31 ships with a total cargo capacity of 22,363 TEUs.

Line of Business

According to Article 3 of the Company’s Articles ofAssociation, the business activity of TEMAS Line is tomanage shipping services, to initiate and to organize anational shipping company engaged with transportation ofgoods, vehicles, passengers, and animals, with ships, bothwithin and outside the country.

Products and Services

TABLE OF VESSELS

£¤¥ ¦§¨ANG MAS

KM SEGARA MAS

KM. SUNGAI MAS

KM. SPRING MAS

KM SELAT MAS

KM STRAIT MAS

KM LAGOA MAS

KM KUALA MAS

KM BELIK MAS

KM HILIR MAS

KM KANAL MAS

KM TASIK MAS

KM TELAGA MAS

KM UMBUL MAS

KM WARIH MAS

KM ESTUARI MAS

KM JALES MAS

KM KALI MAS

KM MARE MAS

KM. TELUK MAS

KM. KISIK MAS

KM. PALUNG MAS

KM. GULF MAS

KM. CURUG MAS

KM BAHAR MAS

KM. AYER MAS

KM. MUARA MAS

KM SEGORO MAS

KM SAMUDERA MAS

KM GUHI MAS

KM LAGUN MAS

TOTAL

AVERAGE

11 10 17 18 20 21 7 7 3 3 3 3 3 3 3 6 5 6 6 0 0 0 0 0 0 0 0 11 11 7 76

38,121 38,103 28,876 24,341 18,106 18,106 8,753 8,700 8,180 8,180 8,180 8,180 8,180 8,180 8,180 8,100 8,100 8,100 8,100 5,300 5,300 5,300 5,300 5,300 5,300 5,300 5,300 5,252 5,222 5,200 5,200 336,040 10,840 2016 2016 2016 2015 2014 2014 2008 2009 2012 2012 2012 2012 2012 2012 2012 2009 2010 2009 2009 2016 2016 2016 2016 2016 2016 2016 2016 2004 2004 2008 2008 2,702 2,702 2,135 1,560 1,048 1,048 538 538 558 558 558 558 558 558 558 537 537 537 537 360 360 360 360 360 360 360 360 296 296 283 28322,363

721

Name of Vessels

Deadweight

(Tons)

Year of

Acquisition

Capacity

Visi

©ª«¬ª ®¬¯°¬± ª²³´ °µ¶¶ µ· ¸¹ª ® ¶º ·

y in

Indonesia by 2017.

Misi

Professional

»¼½¾ ¿À ¿½Á¾ÂýÀÄ

signed duty and

responsibilities in accordance with their

expertise and skills.

Effective

To achieve target performance in a timely

manner by utilizing all existing resources.

Discipline

To comply and conform to the prevailing rules

and procedures in all activities.

CORPORATE

CORE VALUES

Enthusiasm

To continuously strive and be vivacious in

attaining achievement and meeting all targets.

Loyalty

To be fully dedicated in developing the

Company and attaining mutual welfare.

Innovative

Chairmain of Audit Commitee

Edward Simangunsong

Human Resources

Ship Management Finance &

Accounting HR GA

System & Ship Management

System Management

Corporate Secretary

Marthalia Vigita

LEGAL

Operation & Marketing

Liner Operation

Operation Development

Container & Depot Mgmt

Branches

Head of Internal Audit

Susan Natalia

Directors

Managing Director : Faty Khusumo

Commercial Director : Teddy Arief Setiawan

Finance Director : Ganny Zheng

President Director

Harto Khusumo

Controller Accounting & Tax Finance & Treasury

Organization & People Development

General Affairs Board of Commissioner

President Commissioner : Wong Chau Lin

Independent Commissioner : • Edward Simangunsong:

Publik

80.84%

19.16%

0.31%

99.69% 99.80% 99.00% 99.67%

0.33%

1.00% 0.20%

Harto Khusumo

Harto Khusumo PT Pelayaran

Tirtamas Express

Anemi Maritime

Co.Ltd

PT BM Olah Jasa Trisari

Andal

PT Escorindo Stevedoring Temas Lestari

PT Pelayaran Tempuran Emas Tbk

19.16%

80.84% PT Temas Lestari

Public

TRUCTURE OF COMPANY’S GROUP

TABLE OF SHAREHOLDERS’ COMPOSITION

SHAREHOLDERS COMPOSITION

SHARE LISTING CHRONOLOGY

Shareholding

(%) Amount (Rp)

80.84

0.0Ò

ÓÔÓÕ

ÓÔÓÒ

ÓÔ Ö Ó

Ò×Ô7Õ ÒÓÓ

115.306.619.500

8.687.500

30.816.500

13.872.500

565.443.125

26.703.310.875

142.628.750.000 Shareholders

(Par value of Rp125)

Non Management

PT Temas Lestari

Management

Wong Chau Lin

Harto Khusumo

Teddy Arief Setiawan

Ganny Zheng

Public TOTAL

Shares Issued and Fully Paid

922,452,956

69,500

246,532

110,680

4,523,545

213,626,787

1,141,030,000

Operational Status

Number of Additional Shares

Ownership (%)

Number of Accumulative Shares Operating

Operating

Operating

Operating

99,00

99,69

99,67

99,80 Subsidiary

Description

PT Perusahaan Bongkar Muat Olah Jasa Trisari Andal

PT Pelayaran Tirtamas Express

PT Escorindo Stevedoring

Anemi Maritime Co. Ltd.

Line of Business

Listing Date

Depot Management Services

Shipping Management

Stevedoring Services

Container Leasing

55.000.000

396.000.000

45.100.000

496.100 000

148.830.000

55.000.000

451.000.000

496.100.000

992.200.000

1.141.030.000 Initial Public Offering

Listing

Bonus Share

Stock Split

Stock Dividend

9 Juli 2003

9 Juli 2003

19 Juli 2005

17 Maret 2006

I

Ø ÙÚØÛ ÜÚÝÞ ÝÞÛ ßàáâã Øä åæ çè æÚØÛ ææ éêàÜÝÞ á ãêëÛì çä ÚØíêÛ ãæ ÚØé Ø èáçÛê àî îÙÛÛ Ý ã Øìshipping lines, TEMAS Line is constantly

working to organize and manage reliable and

professional human resources (HR) in order

that the whole business unit’s activities can

operate optimally. Thus, the productivity and

effectiveness of TEMAS Line performance will

continue to grow and increase.

Consistently, the Company continues the

development program and performance

improvement, especially in providing a

satisfactory operational excellence to all

customers. The operational excellence can only

be provided by reliable, loyal, competent and

highly dedicated manpower. Not only as the

Company’s human capital to achieve the vision

and mission, the Company’s employees are

also the Company’s major asset in improving

competitiveness in the middle of business

dynamics and challenging tighter competition.

HUMAN RESOURCES

DEVELOPMENT

In order to develop its employees, the

Company has set competence standards and

qualifications for each key function in the

Company’s organization as a shipping company.

In general, the competence standards applied

in the Company include Core Competence, as

the basic competence the entire employees

should own; Functional Competence, as a

competence with specific roles and functions;

and Leadership Competence, which should

be owned by leaders in the organization of

the Company. All competence standards are

the elaboration of the Company’s business

requirement and objectives in short, medium

and long terms.

2016

At Office ï ð ñ 47 59 364 250 737 In Vessels 62 185 309 55 611 Total 15 2 109 59 364 250 185 309 55 1,3482015

At Office 14 5 35 54 246 295 - - - 649 In Vessels 46 132 220 42 440 Total 14 5 81 54 246 295 132 220 42 1,089 Directors’ Management General ManagerManager/Equal to Manager

Supervisor/Equal to Supervisor

Staff Non-Staff Officer/Engineer Rating Trainee Total

Position

2016

17 211 70 404 35 737 56 185 17 350 3 611 73 396 87 754 38 1,3482015

13 174 58 369 35 649 30 43 84 280 3 440 43 217 142 649 38 1,089> Master Degree

Bachelor Degree

Diploma

Senior High or Equivalent

< Senior High

Total

Education

2016

410 327 737 611 611 410 938 1,3482015

367 282 649 440 440 367 722 1,089 Permanent Temporary TotalEmployement Status

COMPOSITION OF THE EMPLOYEES

Based on Education

Based on Employement Status

Employee Turnover Rate

òó ôõõôö÷ ø ùúôûôúü ó ø ý ø ùþÿ ýS S þø úôÿ ö t ôúó

ÿ ùùc õø úôÿ öø þ óS ø þúó øö ýø S úü ø ùúÿ úó ø ú ôý

ûS ü ôe õÿ úø ö ú úÿ úóS ýc ùùSýý ÿ øùÿe õø öüyý

bc ý ôöSýý ÷ÿt úó øö ýcýúøôöøb ôþôúü. ö ÿ S

úÿ S ø þôS ôúý ùÿee ôúeS ö ú ø ö S úS e ôöø úôÿ ö

TEMAS Line continually strives to improve the

productivity of their employees through the

implementation of a management system for

Occupational Health and Safety (OHS).

The Company applies the OHS provisions based

on the rules contained in the International

Safety Management (ISM) Code issued by the

International Maritime Organization (IMO), an

agency under the United Nations. The Company

has also been certified with the Document of

Compliance (DOC) and Safety Management

Certificate (SMC) for each of its owned vessels.

In every shipping activity, the Company

always applies strict procedures as an effort in

preventing potential and possibly detrimental

incidents. The OHS procedure is implemented

through various activities in regular basis, such

as fleet inspection and supervision, provision

and distribution of protective tools, installation

of safety marking in ships, safety equipment

against fire accident, as well as preparation

and anticipation for emergency situations.

Periodically, the Company also conducts OHS

training and crew assistance.

Beside the application of standard safety

procedures, the ISM Code also requires that

the crews in charge are in good physical and

mental condition all the time. Therefore, medical

examination is always carried out for every crew

to acquire notification letter of health that must

be updated within a certain period. Thanks to

the application of standard safety procedures,

the number of work accidents or incidents that

can harm the Company’s shipping operation

can be reduced. As the result, throughout 2016

TEMAS Line has never suffered work accident

or harmful incident in its shipping operation.

OCCUPATIONAL HEALTH

INF

ORMATION

TECHNOLOGY

The Company’s business success could not be apart from a reliable information technology support. For the Company as a services provider, information technology becomes one of the main keys in accelerating information and performing effectiveness that leads to increase the level of customer satisfaction. Therefore, the utilization of latest, appropriate, and integrated information technology becomes the Company’s priority in the information technology sector in relation with the shipping industry.

Currently, TEMAS Line has activated “TEMAS Accurate” system that serves to closely monitor an operated container’s position. By applying this system, the movement of a container can be monitored in real time. Also, forecast calculation for container availability can be measured precisely, and estimation on demurrage, detention, and storage can be more accurately to reduce the risk of losses. More than that, this container tracking system has been applied into mobile version so it can be accessed online through various gadgets.

The development of the Company’s information technology is also implemented to the financial services system through the application of Oracle-based “I-FAST” program for accounting and finance recording system that enables to produce more integrated and efficient financial statements. Maintenance process for vessels will also be more measured and controlled withShip Management System. In addition, customers are also facilitated with monitoring feature towards container movement and automation in transaction of renting container from email and sms notification.

Share Registrar

PT ADIMITRA JASA KORPORA Rukan Kirana Boutique Office Jl. Kirana Avenue III Blok F3 No. 5 Kelapa Gading

Jakarta Utara 14250

Notary Office

HERDIMANSYAH CHAIDIRSYAH, S.H. Jl. Pelepah Elok 1 Blok. QA 2 No. 12 Kelapa Gading

Jakarta Utara 14240

SRI ISMIYATI, SH., M.Kn

Rukan Artha Gading Niaga, Blok B, No. 7-8 Jl. Boulevard Artha Gading, Kelapa Gading Barat, Jakarta Utara

ESTER A. FERDINANDUS, SH Jl. Boulevard Barat Raya Blok C-67

Komplek Plaza Kelapa gading Ruko Inkopal, Jakarta Utara

Dr. IRAWAN SOERODJO, SH. MSi Jl. K.H. Zainul Arifin No.2

Komp. Ketapang Indah Blok B-2, No. 4-5, Jakarta 11140

MYRA YUWONO

Jl. Kyai Maja Blok E No. 11A Kebayoran Baru

Jakarta Selatan 12120

STEPHANIE WILAMARTA, SH., MH Jl. Raya Boulevard Barat

Plaza Kelapa Gading Blok G No. 5 Kelapa Gading

Jakarta Utara

BADARUSYAMSI, SH., MKn

Komplek Ruko Mutiara Faza Blok RD4 Jl. Raya Condet No. 27,

Jakarta Timur 13760

ANTONIUS WAHONO. P,SH

Gedung Maspion Plaza Lt.3, Unit 3A Jl. Gunung Sahari Raya Kav. 18 Jakarta Utara 14420

RUDY SISWANTO, SH Plaza Maspion Lt. 6-H,

JL. Gunung Sahari Raya Kav.18, Pademangan Barat

Jakarta Utara 14420

AGUSTINA DJUNAEDI, SH

Jl. Wolter Monginsidi, RT.1/RW.4, Petogogan, Kebayoran Baru

Jakarta Selatan 12170

ANITA ANGGAWIDJAJA, SH Jl.Genteng Kali 77A

Surabaya, Jawa Timur 60275

Rating Agency

KJPP Iwan Bachron & Rekan Pusat Niaga Duta Mas Fatmawati Blok D1 No. 29

Jl. RS. Fatmawati Raya No. 39 Jakarta 12150

Public Accountant

KAP Purwantono, Sungkoro & Surja

Gedung Bursa Efek Indonesia Tower II, Lantai 7 Jl. Jendral Sudirman Kav. 52-53

Jakarta

Banking

PT Bank Mandiri (Persero), Tbk. PT Bank Syariah Mandiri (Persero) PT Bank Danamon Indonesia, Tbk.

PT Bank Nasional Indonesia (Persero) Tbk

SUPPORTING PROFESSIONAL

ADDRESS OF BRANCH AND

AGENCY OFFICES

Ambon

Gd. PT Pelabuhan Indonesia IV Ambon, LT.1 Phone. (+62-911) 353 055, 348 880

Fax. (+62-911) 34179

Banjarmasin

JL. Soetoyo S, RT 1 RW 1, No.1

Kel. Telaga biru, Kec. Banjarmasin Barat Banjarmasin 70119

Phone. (0511) 336 4038 Fax. (0511) 336 4125

Belawan

Jl. Krakatau Simpang Cemara No.A-4 Kel. Pulo Brayan Barat, Kec. Medan Utara Medan 20238

Phone. (+62-61) 663 1102 Fax. (+62-61) 663 4739

Bitung

Jl. 46 S.H. Sarundajang

Kel. Bitung Barat 2, Kec. Maesa Kota Bitung Sulawesi Utara 95512

Phone. (+62-438) 36747, 31255 Fax. (+62-438) 32357

Jayapura

Jl. Argapura Kanon No. 8 RT. 03 RW. 01

Kel. Argapura, Kec. Jayapura Selatan 99222 Phone. (+62-967) 521271

Fax. (+62-967) 550924

Makassar

Jl. Sultan Abdullah No. 75 Makassar 90212, Indonesia

Phone. (+62-411) 457 324, 457 325, 446 153, 446 013 Fax. (+62-411) 446 154

Branch Offices’ Address

Pekanbaru

Jl. Nenas/Utama No. 19A-2 Kel. Jadirejo Kec. Sukajadi, Pekanbaru 28113, Indonesia Phone. (+62-761) 23 624 Fax. (+62-761) 27 291

Pontianak

Jl. Gusti Hamzah No.8 Pontianak 78117, Indonesia Phone. (+62-561) 747 703 Fax. (+62-561) 746 274

Surabaya

Jl. Perak Timur No 216-A Surabaya 60165

Phone. (+62-31) 328 2525 Fax. (+62-31) 328 2524

Samarinda

Jl. Untung Suropati Blok C No. 3 Samarinda, Kalimantan Timur Phone. 085230100355

Sorong

Jl. Ahmad Yani Kuda Laut

Komp. PT. Perikanan Nusantara Ex. Usaha Mina Sorong Kota. Papua Barat 98414

Batam

Mega Cipta Industrial Park Blok A No. 3

Batu Ampar, Batam

Phone. (+62-778) 751 3899, 705 9838

Fax. (+62-981) 21608

Biak

Jl. Jend. Sudirman No.6 Biak, Papua

Phone. (+62-981) 21724 Fax. (+62-981) 21608

Dumai

Jl. Jendral Sudirman No. 318 Dumai - Riau

Phone. (+62-765) 439 660 Fax. (+62-765) 439 663

Kupang

PT Taruna Kusan Kupang Jl. Sunan Gunung Jati No. 18, Nusa Tenggara Timur Phone. (+62-380) 832 115 Fax. (+62-380) 831 718

Manokwari PT. Luas LINE Jl. Siliwangi No. 11 Manokwari

Phone. (+62-986) 212 2558 Fax. (+62-986) 212 906

Agency Offices’ Address

Palembang

Jl. AKBP Cek Agus 1344 F Palembang

Phone. (+62-711) 369 920, 367 997 Fax. (+62-711) 364 451

Balikpapan

PT Armada Samudera Raya Jl. Arjuna No. 9 - Samarinda Phone. (+62-541) 707 8452 Fax. (+62-541) 203 020

Timika

PT. Pelayaran Tempuran Emas Tbk Jl. Hasanudin Timika, Papua Phone. (+62-971) 323250 Fax. (+62-21) 411 876

Palu

PT Metta Maju Perkasa Jl. Sungai Lewara 37,Palu, Sulawesi Tengah

Phone. (+62-21) 411 800 / 411 880 Fax. (+62-21) 411 876

Merauke PT. LUAS LINE

Jl. Ermasu No. 5 Merauke, Papua Phone. (+62-971) 323250

Malahayati

PT Pelayaran Sea Asih Lines Jl. Sultan Iskandar Muda, Punge Ujung, Kec. Meuraxa Banda Aceh 23234

Phone. 08126962990

Sampit

PT Lintas Mitra Bahari Jl. A. Yani No. 12

Sampit, Kalimantan Tengah Phone. 0531-31343

Kumai

PT Pelayaran Haluan Segara Line Komp. Kumai Damai,

Gg. Rambutan No. 40

Kel. Sei Tendang, Kec. Kumai Kobar Kalimantan Tengah 74181

Phone. 0532-23648

Tual

PT Dharma Indah BTN UN Indah Blok D/23 Tual, Maluku

Phone. 081343023095

Serui

Malahayati

Lhokseumawe

Sampit

Kumai

W

ORK AREA AND

OPERATIONAL MAP

Makassar Makassar Makassar Makassar Makassar Makassar Makassar Makassar Palu Kupang Papua Ambon Bitung Surabaya Jakarta Jayapura 4x 4x 4x 4x 4x 4x 4x 4x LoadingPort UnloadingPort

Frequency (per month) Surabaya Surabaya Surabaya Surabaya Surabaya Surabaya Surabaya Surabaya Surabaya Surabaya Surabaya Surabaya Banjarmasin Makassar Bitung Jayapura Balikpapan Samarinda Ambon Palu Sampit Kumai Tarakan Papua 5x 12x 4x 4x 4x 6x 4x 4x 5x 5x 2x 4x Loading

Port UnloadingPort

Frequency (per month) Jakarta Jakarta Jakarta Jakarta Jakarta Jakarta Jakarta Jakarta Jakarta Jakarta Jakarta Jakarta Jakarta Jakarta Jakarta Pontianak Pekanbaru Dumai Palembang Banjarmasin Batam Balikpapan Samarinda Belawan Surabaya Makassar Bitung Papua Malahayati Lhokseumawe 8x 4x 4x 4x 4x 3x 4x 4x 8x 12x 8x 4x 4x 2x 2x Loading

Merauke

Timika

Tual

Dobo

Serui

Nabire

Fakfak

Palu

Pendulum Service Service S4

J a w J a a a s

Service A3

J a wan-Jakarta-Surabaya-Makassar-Ambon

Serving 32 Ports Sumatera

Malahayati

Lhokseumawe

Belawan

Dumai

Pekanbaru

Batam

Palembang

Jawa

Jakarta

Surabaya

Kalimantan

Pontianak

Kumai

Sampit

Banjarmasin

Balikpapan

Samarinda

Sulawesi

Makassar

Palu

Bitung

NTB

Kupang

Kep. Ambon

Ambon

Tual

Dobo

Papua

Sorong

Manokwari

Fakfak

Nabire

Timika

Merauke

Biak

Serui

Nabire

MANAGEMENT

ANALYSIS AND

DISCUSSION

TEMAS Line shall stand

strong and upright to fully

implement

Fixed Schedule

and

On -time Delivery

Review On Shipping Industry

National maritime industry, particularly shipping industry, is a strategic sector as a bridge to unite the islands scattered throughout Indonesia. Therefore, the people of the national shipping believes that the Government is very aware and pays attention to the existence and contribution of shipping industry in supporting the economy development of Indonesia. And this has been realized in the progress of two main programs, namely Sea Toll and World’s Maritime Axis.

According to the Indonesian National Shipowners’ Association (INSA), the Government measure also includes private shipping entrepreneurs to drive interisland connectivity and encourage an initiative of one-price commodity in the entire Country. So hopefully, the people in remote areas can also enjoy the same situation as felt in major cities. In addition, the cabotage principle that requires the entire interport and interisland transportation in Indonesia to use national flag, has been applied well by national shipping companies.

Based on the data of Ministry of Transportation, the population of national fleets until May 2016 amounted to 20,687 units or increased to 242% compared to 6,041 units in 2005. The number of national shipping companies until May 2016 also increased significantly, from 1,591 companies in 2005 to 3,296 companies or grew 107%.

However, the national shipping industry remained facing a big challenge to make Indonesia the Nation of World’s Maritime Axis. A possible effort to make is to implement ‘beyond cabotage’ for the shipping entrepreneurs to compete in international sea transportation, especially for export-import commodities transportation. It is expected that the next Government’s economic policy will give a positive impact on the national maritime industry and shipping entrepreneurs in particular.

Operational Review

Shipping management and stevedoring services remained the core business operation for the Company during 2016. The business development strategy of TEMAS Line increasingly emphasized on strengthening the shipping management, especially in the stevedoring services, through Subsidiary of PT Escorindo, and Depot Services Management by PT Olah Jasa Trisari Andal. While for lease of

MANAGEMENT ANALYSIS AND

DISCUSSION

containers services and other shipping services, the Company has operated other two Subsidiaries of Anemi Maritime Co. Ltd. (Anemi) and PT Pelayaran Tirtamas Express.

With careful, comprehensive, and integrated management and coordination between the Company and entire Subsidiaries, the Company is very confident to be able to further improve the performance optimization to obtain better business results.

Operational Review On Business Segments

The integrated solution with “safe and on time delivery” assurance is the TEMAS Line’s commitment to operational activities as the provider of innovative, competitive, and reliable shipping services in Indonesia. In particular, the Company is engaged in comprehensive container transportation through domestic linesfor cargo delivery of goods and commodities. Today, the mechanism of goods delivery has undergone further development on demand.

• Stevedoring Services in Jakarta

During 2016, the Company’s stevedoring services in Jakarta conducted by the Subsidiary of PT Escorindo Stevedoring experienced significant performance in terms of both volume and speed. The throughput increased to 6.70% from 307,319 TEUs in 2015 to 328,100 TEUs in 2016. The increase in throughput imposed to the increase of Stevedoring Services’ net income to be Rp241.7 billion or 17.50% increase from last year’s Rp205.7 billion.

• Shipping Management

As the Company’s Subsidiary, PT Pelayaran Tirtamas Express is entrusted to provide shipping management services including the provision of professional crews, procurement of spare parts and other vessel’s needs, conducting ship maintenance, and fulfillment of safety standards and shipping regulations.

• Lease of ContainersManagement

As one of the preeminent TEMAS Line services, Lease of Containers Management is offered with integrated and fully containerized services. Recent available containers reached a total of 30,631 TEUs, an increase of 18% from 25,916 TEUs in 2015.

• Container Terminal

The Company owns container terminals in some national ports, such as in Tanjung Priok of Jakarta, Tanjung Perak of Surabaya, Makassar, Belawan, Bitung, and Pontianak.

Review of Investment Performance in 2016

Investment activity has been the Company’s significant strategy to improve its productivity as well as revenues. In 2016, TEMAS Line has been carrying out the investment activity through the purchase of 6 new building ships entirely delivered to the Company

ASSETS

TEMAS Line’s total assets in the end of December 2016 amounted to Rp2,525,662 million that came from Current Assets of Rp275,648 million and Non-Current Assets of Rp2,250,014 million. The Total Assets increased by Rp743,601 million or 41.73% compared to Total Assets of 2015 that amounted to Rp1,782,061 million.

Current Assets

The Company’s Current Assets in 2016 increased Rp4,496 million from previous year’s amount of Rp271,152 million, or up to 1.66%. The increase was mainly due to increased inventories – net, other current assets and tax advances.

Fixed Assets

Fixed assets increased 48.49% in 2016 to Rp2,166,137 million compared to last year’s fixed assets that was recorded at Rp1,458,800 million due to additional fixed assets of containers, vehicles, office building, vessels, and vessel maintenance.

Non-Current Assets

Due to additional fixed assets of containers, vehicles, office building, vessels and vessel maintenance, as well as additional deferred tax assets, the Company increased its non-current assets of 2016 amounting to Rp739.105 million or 48.92% compared to last year’s non-current assets of Rp1,510,909 million.

Total Assets

Until December 31, 2016, TEMAS Line recorded an increase in total assets of Rp743,601 million or 41.73% of total assets compared to last year, as the impact of increased non-current assets.

Liabilitas

The TEMAS Line’s liabilities recorded an increase of Rp563,592 million at the end of 2016. The number showed a decrease of 58.26% from last year.

Short Term Liabilities

In 2016, the Company recorded its short-term liabilities at Rp652,010 million, showing an increase of 40.69% or about Rp188,584 million compared to 2015 with the recorded short-term liabilities at Rp463,426 million. This was due to decrease in short-term bank loans, related parties trade payables and write-off unwound derivative liability.

Long Term Liabilities

The total of long-term liabilities of TEMAS Line in 2016 experienced an increase of Rp375,007 million to Rp878,976 million, an increase of 74.41%. Last year, the Company’s long-term liabilities amounted to Rp503,969 million.

Total Liability

TEMAS Line recorded total liabilities of Rp1,530,987 million in 2016. The number increased by Rp563,592 million or 58.26% compared to 2015’s total liabilities of Rp967,395 million.

Equity

The increase in the Company’s net profit influenced the increase in equity percentage. Until the end of 2016, TEMAS Line’s total equity was Rp994,676 million which increased Rp180,010 million or 22.1% from the period of 2015 at Rp814,666 million.

Revenue

Proceeds from Non-Operational Cash Flow

In 2016, proceeds from non-operational cash flow of TEMAS Line amounted to Rp385,450 million, a decline of Rp53,657 million or 12.22% from last year at Rp439,107 million. Meanwhile, net revenue became Rp1,671,905 million which increased by Rp50,541 million or 3.12% from the period of 2015 of Rp1,621,364 million.

Cash Flows from Operating Activities

Net cash flows generated from operating activities consist of cash received from interest, customers, and insurance claims; and cash paid to suppliers, employees and vessel crews, and payments for interest, taxes, and operating expenses. In 2016, TEMAS Line managed to obtain net cash from operating activities by Rp392,381 million or decrease to 7.98% from 2015 that obtained Rp426,429 million.

Cash Flows for Investing Activities

Net cash flows for investing activities are used for addition of short-term investment, fixed assets, and non-current assets. Net cash flows for investing activities in 2016 amounted to Rp795,784 million or up to 1,350.57% from 2015 that reached Rp54,860 million, due to decrease in proceeds from disposal of fixed assets and increase in acquisitions of fixed assets.

Cash Flows for Financing Activities

Net cash flows for financing activities is cash received from capital deposit and loan payments, which in 2016 amounted to Rp410,334 million, increasing 6.8% from 2015 that amounted to Rp384,247 million due to obtaining bank loans.

INCOME STATEMENTS

Gross Profit

The Company’s total gross profit amounted to Rp444,055 million in 2016 as a decrease of Rp9,638 million or equivalent to 2.12% compared to 2015’s amount of Rp453,694 million.

Operating Expenses

Operating expenses in 2016 showed a number of Rp110,080 million which was an increase of Rp13,453 million from the last year’s amount of Rp96,627 million. The increased operating expenses was equivalent to 13.92%, mainly due to increased salaries and employees benefits expenses, and rent expense.

Net Income

TEMAS Line managed to obtain net income in 2016 amounted to Rp231,521 million, which declined by 27% or Rp85,653 million, compared to net income for the year 2015 recorded at Rp317,174 million. The decrease was primarily due to an increase in cost of services and operating expenses.

Other Comprehensive Revenue

Due to exchange rate differences translation, other comprehensive expenses in 2016 decreased Rp11,887 million compared to the year 2015 which earned Rp15,750 million, or decrease by 75.47%.

SOLVENCY AND COLLECTABILITY

Solvency

The Company always maintains its liquidity ratio so that the ability to meet liabilities can be properly managed. While to maintain ability in fulfilling all liabilities, the Company’s solvency ratio is used by meeting entire liabilities to all assets and meeting entire liabilities toward equity.

1. Liquidity Ratio

The Company’s ability to meet Short-term Liabilities is reflected by comparing Current Assets to total Short-term Liabilities. In 2016, TEMAS Line’s Current Assets was recorded at Rp275,648 million, that if compared to 2015’s amount of Rp271,152 million, showing an increase of 1.66%. Short-term liabilities of TEMAS Line and Subsidiaries in 2016 at the amount of Rp652,010 million increased 40.69% compared to 2015 at the amount of Rp463,426 million. Therefore, TEMAS Line’s liquidity ratio became 42.28% as of December 31, 2016. This liquidity ratio was lower than last year’s liquidity ratio of 58.5%.

2. Solvency

Comparison of consolidated liabilities to consolidated equity with consolidated liabilities to total consolidated assets becomes a reference in determining solvency rasio that demonstrates the Company’s ability to meet all liabilities. Until the end of 2016 and 2015, comparison between total liabilities with total assets of TEMAS Line and Subsidiaries amounted to 60.62% and 54.28% respectively. Whereas, comparison of total liabilities to total equity amounted to 153.92% and 118.75% respectively.The resulting solvency ratio shows an increase reflecting the impact of additional bank loans.

3. Collectability

The Company’s effectiveness in implementing collectability policy strongly influences the level of customers’ timeliness to make payment, which in the end determines collectability level of the Company’s accounts receivables. In 2016, TEMAS Line’s collectability level showed a constant effectiveness of AR Collection Division in collecting debts with the period of 39 days.

2015 2016

Cash Flows from operating Activities

Cash Flows from Investing Activities

Cash Flows from Financing Activities

392.380.798.612

(795.784.086.252)

410.334.228.921

426.429.247.543

(54.859.779.229)

(384.247.210.383)

The Income Statements of TEMAS Line can be described as follows:

Profitability

TEMAS Line’s profitability or operating margin is generated from operating income divided by net sales. The Company’s profitability in 2016 was recorded at 18.17%, lower than 25.16% in 2015. Payload volume as well as addition of new routes and fleet of ships that were not in pair with decrease in price, became the main factors in decreasing profitability. Shipping segment dominated the profitability for the Company by its 84.71% contribution.

CASH FLOWS

CAPITAL STRUCTURE AND POLICY ON CAPITAL STRUCTURE

Capital Structure

Capital structure of TEMAS Line as for December 31, 2016, consisted of authorized capital of Rp570,000,000,000 with the amount of paid-up at Rp142,628,750,000. Further information of the Company’s capital structure can be seen in the following table:

Material Obligation For Goods And Capital Investment

TEMAS Line has conducted several material obligations in 2016, in the form of building 3 units of new ship and purchasing 4 units of used ship, along with land purchase for container terminal.

Comparison Between Target/Projectionand Realization

The comparison between the target/projection established by the Company at the beginning of the year and the realization at the end of the fiscal year can be seen in the following table:

Authorized Capital

Unpaid Capital

Paid-UP Capital

Increase in Debt Securities

Retained Earnings

Appropriated outher Comprehensive income

Unappropriated outher Comprehensive income

Comprehensive income

Net equity attribution to owners of the Parent Entity

Non- Controlling Interests

Total Equity

570.000.000.000

427.371.250.000

142,628,750,000

145,603,049,314

34,823,179,931

589,933,190,599

(99,488,884,785)

813,499,285,059

1,166,475,743

814,665,760,802

2016

570.000.000.000

427.371.250.000

142,628,750,000

145,603,049,314

34,823,179,931

773.660.578.307

(103.349.363.063)

993.366.194.489

1.309.521.748

994.675.716.237

2015

2016 REALIZATION INITIAL BUDGET

Volume (TEUs)

Service Revenue (Rp)

Oprational Expenses (Rp)

Net Profit (Rp)

350.000

1.872.000.000.000

1.514.470.270.000

250.000.000.000

321.402

1.671.905.016.010

1.227.850.405.646

Significant Increases/Decreases from Net Sales/ Income

The Company’s net income demonstated a significant increase throughout 2016, due to increasing payload volume of 13% after the opening of new routes, namely Timika, Merauke, Serui, Kumai, Sampit, Malahayati, and Tual, coupled with maintaining and developing Pendulum Route services already started in 2013.

Subsequent Events Of Material Information And Facts

During 2016, the Company has no material information and facts occurred in the business activities after accountant’s reporting date.

BUSINESS OUTLOOK

The potential of shipping industry remains very promising, both nationwide as well as worldwide. Interisland, even international, distribution of goods is still more effective and efficient by using ocean freight. On the other hand, regional economic growth in Indonesia is increasingly developing and providing its own potential to create interregional and interisland transactions.

The establishment of the Government program in making Indonesia as one of the world’s maritime fulcrum along with the Asean Free Trade Area (AFTA 2015) will provide opportunities for TEMAS Line to seize more customers from existing trade activities. However, this can only be supported by more professional system of performance management. Higher market expectation demands TEMAS Line to prioritize punctuality and safety of the goods in accordance with the Company’s commitment of ‘safe and on-time shipping delivery’.

As an anticipative measure, TEMAS Line strives to prepare for the development of fleet and provision of more adequate supporting facilities. This is another implementation of strategic planning established since fiv