Strengthening

Commitments

Memperbaharui Semangat. Memperkuat Komitmen

2015

Laporan Tahunan

TERPURUKNYA HARGA MINYAK MENTAH

DUNIA SEJAK AWAL TAHUN 2015 MEMBERIKAN

TANTANGAN BERAT BAGI PERUSAHAAN

-PERUSAHAAN DI SEKTOR MIGAS TIDAK

TERKECUALI PERTAMINA. UNTUK MENOPANG

STABILITAS PERUSAHAAN DI TENGAH KONDISI

TERSEBUT

,

PERTAMINA MENCANANGKAN

PROGRAM 5 PRIORITAS STRATEGIS YANG TERDIRI

DARI PENGEMBANGAN SEKTOR HULU

,

EFISIENSI

DI SEMUA LINI

,

PENINGKATAN KAPASITAS

KILANG DAN PETROKIMIA

,

PENGEMBANGAN

INFRASTRUKTUR DAN MARKETING

,

SERTA

PERBAIKAN STRUKTUR KEUANGAN.

MELALUI BERBAGAI INISIATIF BREAKTHROUGH

PROJECT DI KELIMA ASPEK PRIORITAS STRATEGIS

YANG DICANANGKAN

,

PERTAMINA MAMPU

MENUTUP TAHUN 2015 DENGAN MEMBUKUKAN

KINERJA YANG CUKUP MEMUASKAN BAIK

DARI OPERASIONAL

,

FINANSIAL MAUPUN NON

FINANSIAL. TAHUN 2015 DENGAN DEMIKIAN

MENJADI TAHUN PEMBUKTIAN BAGI PERTAMINA

BAHWA KONDISI KRISIS TIDAK MENYURUTKAN

SEMANGAT

,

NAMUN JUSTRU MEMBULATKAN

TEKAD DI SELURUH JAJARAN PERSEROAN UNTUK

BERJUANG LEBIH KERAS DALAM KOMITMEN

Analisa dan Pembahasan Manajemen

Management’

s Discussion and Analysis

Tata Kelola Perusahaan

Corporate Gover

nance

Tanggung Jawab Sosial Perusahaan

Corporate Social Responsibility

Laporan Keuangan

Financial Repor

t

Infor

masi Lain-lain

Other Infor

The sharp decline in global crude prices since the beginning of

2015 presented a very considerable challenge to oil and gas

companies worldwide, including Pertamina. In order to maintain

operational stability in those challenging times, Pertamina

embarked on the 5 Strategic Priorities work program: expansion

in upstream, eficiencies at all lines of activity, increasing

reinery capacity, development of infrastructure & marketing, and

improvement of inancial structure.

With breakthrough project initiatives in the 5 Strategic Priorities,

Pertamina was able to show satisfactory performance in 2015

in terms of operations, inancial and non-inancial. The year

2015 was thus a successful proving ground for Pertamina:

notwithstanding the crisis situation, our ighting spirit remained

undaunted throughout the organization, strengthening our resolve

to strive ever harder towards our common commitments in ensuring

energy self-suficiency for the beneit of the people and nation of

Indonesia.

Reenergizing Spirit

Strengthening

2

Kesinambungan

Tema

Entrusted with the New Energy

The theme ‘Entrusted with the New Energy’ does not refer just to new and renewable energy - although Pertamina is serious about developing those sources of energy in Indonesia. Rather, it also illustrates how internal developments and progress throughout 2012 have injected Pertamina with ‘new energy’ towards accelerated and sustainable growth going ahead. It also means that, as Indonesia’s National Oil Company (NOC), Pertamina is indeed entrusted with safeguarding the nation’s energy self-suficiency - a mission that is being achieved as Pertamina moves nearer its vision of becoming a World-Class Energy Company and Asia Energy Champion by 2025.

The Next Step Beyond

The theme ‘The Next Step Beyond’ is meant to illustrate how Pertamina continues to innovate, to create and to work, overcoming existing limitations, and moving on to the steps beyond. These steps are based on Pertamina’s Renewable Spirit for the continuing transformation of the Company in all areas, towards the realization of our new vision, “Becoming a World Class National Energy Company”.

Towards Global Recognition

In 2013, Pertamina succeeded in posting overall improvement in its performance, including a number of achievements and progress that have strengthened our standing at the international communities, bringing us ever closer to our aspirations of Asian Energy Champion 2025, and taking an active role in elevating the people and nation of Indonesia to stand among the ranks of developed countries in the world.

The theme of Pertamina’s 2013 Annual Report, “Towards Global Recognition”, relects on our business initiatives as well as progress and achievement during the year that have earned recognition at the international level.

Entrusted with the New Energy

Ungkapan ‘Entrusted with the New Energy’ lebih dari sekedar merujuk pada energi baru dan terbarukan - meskipun Pertamina tengah berupaya mengembangkan sumber-sumber energi tersebut di Indonesia saat ini. Ungkapan tersebut juga mencerminkan bagaimana perkembangan dan kemajuan di internal Pertamina selama tahun 2012 telah memberikan ‘energi baru’ bagi kami untuk mencapai akselerasi pertumbuhan yang berkelanjutan ke depan. Selain itu, sebagai National Oil Company (NOC), Pertamina memang dipercaya untuk menjaga kemandirian energi nasional - sebuah amanat yang semakin nyata bersama dengan langkah-langkah Pertamina menuju visinya menjadi ‘Perusahaan Energi Kelas Dunia’ dan ‘Asia Energy Champion’ di tahun 2025.

The Next Step Beyond

Ungkapan ‘The Next Step Beyond’ dimaksudkan untuk menggambarkan bagaimana Pertamina terus berinovasi, berkreasi dan berkarya, mengatasi batasan-batasan yang ada, melangkah dengan berwawasan jauh ke depan. Langkah-langkah yang berlandaskan Semangat Terbarukan Pertamina untuk terus bertransformasi di segala bidang, menuju perwujudan pasti dari visi baru kami, “Menjadi Perusahaan Energi Nasional Kelas Dunia”.

Towards Global Recognition

Pada tahun 2013, Pertamina berhasil membukukan peningkatan kinerja secara keseluruhan, termasuk beberapa pencapaian dan kemajuan yang semakin mengukuhkan keberadaan Pertamina di mata dunia, semakin mendekatkan Pertamina pada aspirasi Asian Energy Champion 2025, dan berperan aktif dalam mendukung bangsa dan negara Indonesia berdiri sejajar dengan negara-negara maju di dunia. Tema Laporan Tahunan Pertamina tahun 2013, “Towards Global Recognition”, menggambarkan pencapaian prestasi serta inisiatif Pertamina dalam menerapkan strategi bisnisnya sehingga mampu mendapatkan kepercayaan dan pengakuan dunia internasional.

2013

2012

2011

Analisa dan Pembahasan Manajemen

Management’

s Discussion and Analysis

Tata Kelola Perusahaan

Corporate Gover

nance

Tanggung Jawab Sosial Perusahaan

Corporate Social Responsibility

Laporan Keuangan

Financial Repor

t

Infor

masi Lain-lain

Other Infor

Inspiring Indonesia to The World

In 2014, like other oil and gas companies, Pertamina faced a number of challenges. The political dynamics in the Middle East and the decline in oil prices negatively impacted many corporations, including Pertamina. Pertamina’s room for growth was also limited by other factors such as political changes, government policies, and bureaucratic licensing. However, Pertamina was able to manage all these challenges and stands strong as the Nation’s enterprise providing inspiration for Indonesia.

Pertamina consistently implemented the “aggressive upstream, proitable downstream“ growth strategy, with emphasis on eficiency and production optimization as well as the strengthening of GCG. The theme of “Inspiring Indonesia to the World” in Annual Report 2014 was chosen to convey the moving-forward of global energy issues and to inspire others as an energy provider. Obviously, this step needs to be supported by all stakeholders to jointly address the challenges, manage opportunities, and share lessons learned on the international energy stage.

Reenergizing Spirit, Strengthening Commitments

The sharp decline in global crude prices since early 2015 presented considerable challenges to oil and gas companies including Pertamina. To maintain operational stability in those challenging times, Pertamina embarked on the 5 Strategic Priorities program: expansion in upstream, eficiencies at all lines of activity, increasing reinery capacity, development of infrastructure & marketing, and improvement of inancial structure.

With breakthrough project initiatives in the 5 Strategic Priorities, Pertamina was able to show satisfactory performance in 2015 in terms of operations, inancial and non-inancial. The year 2015 was thus a successful proving ground for Pertamina: notwithstanding the crisis situation, our ighting spirit remained undaunted throughout the organization, strengthening our resolve to strive ever harder towards our common commitments in ensuring energy self-suficiency for the beneit of the people and nation of Indonesia.

Menginspirasi Indonesia, Mendunia

Saat menjalani tahun 2014, Pertamina menghadapi berbagai tantangan, mulai dari dampak negatif akibat turunnya harga minyak mentah dunia sampai terbatasnya ruang pertumbuhan akibat perubahan politik, kebijakan pemerintah, dan birokrasi perijinan. Namun demikian, sebagai sebuah perusahaan kelas dunia, Pertamina mampu mengelola tantangan menjadi sebuah kesempatan, dan tetap kokoh berdiri sebagai sebuah Perusahaan milik Negeri yang memberikan inspirasi bagi Indonesia.

Pertamina konsisten menerapkan strategi pertumbuhan “aggressive upstream, proitable downstream“, dengan penekanan pada eisiensi dan optimalisasi produksi serta penguatan kinerja tata kelola perusahaan yang baik (GCG). Kami mengangkat tema “Inspiring Indonesia to the World“ pada Laporan Tahunan 2014 untuk mengiringi laju pergerakan isu energi global dan berbagi inspirasi sebagai penyedia energi. Tentunya, langkah ini perlu didukung oleh semua pemangku kepentingan untuk bersama mengatasi tantangan, mengelola kesempatan, dan berbagi pembelajaran menuju pentas energi internasional.

Memperbaharui Semangat, Memperkuat Komitmen Terpuruknya harga minyak mentah dunia sejak awal tahun 2015 memberikan tantangan berat bagi perusahaan-perusahaan di sektor migas tidak terkecuali Pertamina. Untuk menopang stabilitas perusahaan di tengah kondisi tersebut, Pertamina mencanangkan program 5 prioritas strategis yang terdiri dari pengembangan sektor hulu, eisiensi di semua lini, peningkatan kapasitas kilang dan petrokimia, pengembangan infrastruktur dan marketing, serta perbaikan struktur keuangan.

Melalui berbagai inisiatif breakthrough project di kelima aspek prioritas strategis yang dicanangkan, Pertamina mampu menutup tahun 2015 dengan membukukan kinerja yang cukup memuaskan baik dari operasional, inansial maupun non inansial. Tahun 2015 dengan demikian menjadi tahun pembuktian bagi Pertamina bahwa kondisi krisis tidak menyurutkan semangat, namun justru membulatkan tekad di seluruh jajaran Perseroan untuk berjuang lebih keras dalam komitmen bersama mewujudkan kemandirian energi bagi bangsa dan negara Indonesia.

2014

2015

Strengthening

Commitments

Memperbaharui Semangat. Memperkuat Komitmen

4

Memperbaharui Semangat, Memperkuat Komitmen

Reenergizing Spirit, Strengthening Commitments Kesinambungan Tema

Continuity of Themes Daftar Isi Contents

5 Pilar Prioritas Strategis 5 Pillars of Strategic Priorities Peran Pertamina dalam Kemandirian Energi Nasional

Pertamina’s Role in the National Energy Independence Ikhtisar Kinerja Keuangan Financial Performance Highlights Ikhtisar Kinerja Operasional Operational Performance Highlights Ikhtisar Kinerja Obligasi Bonds Performance Highlights Penghargaan 2015 2015 Awards Sertiikasi 2015 2015 Certiication 10 Keunggulan Kami 10 Our Excellences

Rencana Jangka Panjang Perusahaan Long Term Corporate Plan

Peristiwa Penting Event Highlights Laporan Dewan Komisaris Board of Commissioners’ Report Proil Dewan Komisaris Board of Commissioners’ Proile

Proil Mantan Komisaris/Komisaris Non-Aktif Former Commissioner/Nonactive Commissioner’s Proile

Laporan Tugas Pengawasan Dewan Komisaris The Board of Commissioners Supervisory Report Laporan Direksi

Board of Directors’ Report Proil Direksi

Board of Directors’ Proile

Pernyataan Direksi dan Dewan Komisaris tentang Tanggung Jawab atas Laporan Tahunan 2015 PT Pertamina (Persero) Statement of the Board of Directors and the Board of Commissioners’ Responsibility on PT Pertamina (Persero)’s Annual Report 2015 Pernyataan Komisaris Non Aktif Tentang Tanggung Jawab atas Laporan Tahunan 2015 PT Pertamina (Persero) Statement of Nonactive The Board of Commissioners’ Responsibility on PT Pertamina (Persero)’s Annual Report 2015

1 2 4 6 18 20 22 26 28 33 34 36 38 58 68 70 72 90 100 104 106 Proil Perusahaan Company Proile

Pertamina dari Waktu ke Waktu Pertamina Record of Events Sejarah Perusahaan Company History

Visi, Misi, Tujuan dan Tata Nilai Vision, Mission, Goals and Values Tata Nilai Unggulan 6C The 6C Excellent Values Bidang Usaha, Produk dan Jasa Business, Products and Services Kegiatan Usaha Terintegrasi Pertamina Pertamina Integrated Business Activities Produk dan Jasa yang Dihasilkan Products and Services Produced Produk dan Jasa Berdasarkan Lini Bisnis dan Target Pasar

Product and Service based on Business Line and Market Target

Kegiatan Usaha Sektor Hulu Upstream Business Sector

Kegiatan Usaha Sektor Gas, Energi Baru dan Terbarukan

Gas, New and Renewable Energy Business Sector

Kegiatan Usaha Sektor Pengolahan Reinery Business Sector

Kegiatan Usaha Sektor Pemasaran Marketing Business Sector Usaha Perkapalan Shipping Business Integrated Supply Chain Integrated Supply Chain Struktur Organisasi Organizational Structure Proile Sumber Daya Manusia Human Resources Proile Struktur Grup Perusahaan Company’s Group Structure Daftar Entitas Anak List of Subsidiaries Komposisi Pemegang Saham dan Kronologi Pencatatan Saham Composition of Shareholders and Stock Listing Chronology

Kronologi Pencatatan Efek Lainnya Chronology of Other Listed Securities Website Perusahaan Coorporate Website 110 111 112 114 115 116 118 120 121 122 134 140 144 152 158 162 164 168 170 174 175 176

Ikhtisar Pertamina 2015 Proil Perusahaan

Pertamina Highlights 2015 Company Proile

Contents

Daftar

Isi

108

CATATAN UNTUK PEMBACA LAPORAN

• Tabel, graik, dan infograik pada laporan ini memaparkan data numerik dengan standar Bahasa Inggris.

NOTE TO READERS OF THE REPORT

• In all tables, graphs, and infographs presenting numeric data, the English standard is used.

PERINGATAN ATAS PERNYATAAN-PERNYATAAN MENGENAI MASA DEPAN

Dalam dokumen ini mungkin terdapat rencana, proyeksi, strategi dan tujuan Perseroan tertentu, yang bukan merupakan pernyataan fakta historis dan perlu dipahami sebagai pernyataan mengenai masa depan. Pernyataan mengenai masa depan tergantung pada risiko dan ketidakpastian yang dapat menyebabkan keadaan dan hasil aktual Perseroan di masa depan berbeda dari yang diharapkan atau diindikasikan. Tidak ada jaminan bahwa hasil yang diantisipasi oleh Perseroan atau diindikasikan oleh pernyataan-pernyataan mengenai masa depan, akan tercapai.

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

Analisa dan Pembahasan Manajemen

Management’

s Discussion and Analysis

Tata Kelola Perusahaan

Corporate Gover

nance

Tanggung Jawab Sosial Perusahaan

Corporate Social Responsibility

Laporan Keuangan Financial Repor t Infor masi Lain-lain Other Infor

Tinjauan Industri dan Faktor Eksternal

External Factors and Industrial Review

Tinjauan Kinerja Usaha

Business Performance Review

Tinjauan Kinerja Keuangan

Financial Performance Review

Tinjauan Hutang Piutang Debts and Receivables Review Ketaatan Sebagai Wajib Pajak Tax Compliance

Struktur Modal dan Kebijakan Manajemen atas Struktur Modal

Capital Structure and Management Policy on Capital Structure

Kebijakan Dividen Dividend Policy

Program Kepemilikan Saham oleh Karyawan dan/atau Manajemen

Employee and/or Management Stock Ownership Program (ESOP/MSOP)

Penggunaan Dana Hasil Penawaran Umum Utilization of Funds from Public Offering Target 2016

Target 2016

Transaksi Material Benturan Kepentingan dan/atau Transaksi dengan Pihak Ailiasi Material Conlict of Interest Transactions and/or Transactions with Afiliates

Perubahan Kebijakan Akuntansi Changes of Accounting Policy Ikatan Material Investasi Barang Modal Material Binding of Capital Goods Informasi dan Fakta Material yang Terjadi Setelah Tanggal Laporan Akuntan Material Information and Facts Occurring after The Date of Accountants’ Report

Investasi Barang Modal pada Tahun Buku Terakhir

Capital Goods Investment in the Latest Fiscal Year Prospek Usaha

Business Prospects Aspek Pemasaran Marketing Aspects

Investasi, Ekspansi, Divestasi, Penggabungan/ Peleburan Usaha, Akuisisi atau Restrukturisasi Utang/Modal

Investment, Expansion, Divestment, Mergers, Acquisitions or Debts/Capital Restructuring Perubahan Peraturan Perundang-undangan yang Berpengaruh Signiikan terhadap Perusahaan

Change in Regulation which have a Signiicant Effect on the Company

Kebijakan Kelangsungan Usaha Business Continuity Policy

Tinjauan Pendukung Usaha

Supporting Business Review

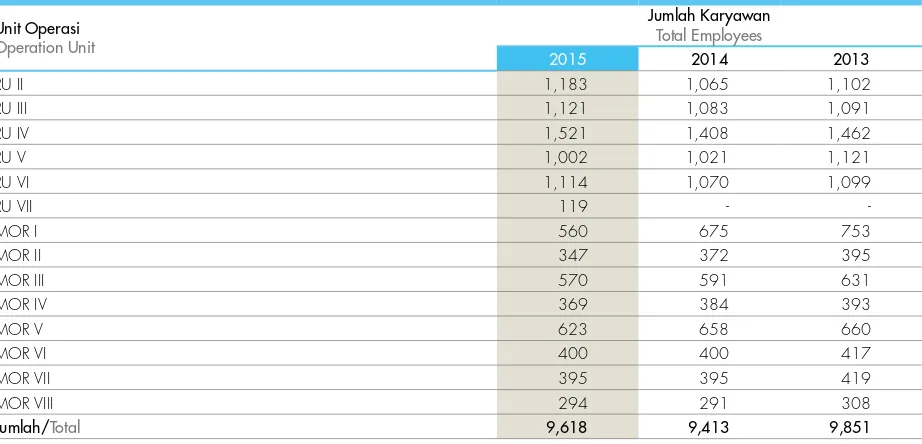

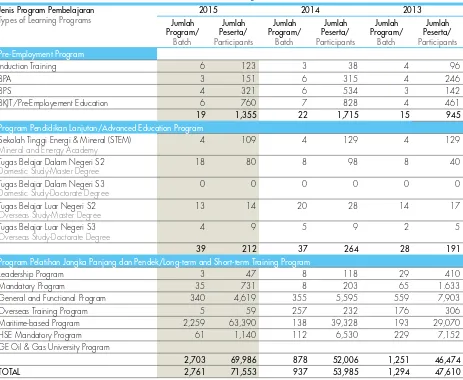

Fungsi Sumber Daya Manusia Human Resources Function Fungsi Aset Manajemen Asset Management Function Fungsi Corporate Shared Service Corporate Shared Service Function Fungsi Quality System and Knowledge

Struktur, Prinsip dan Landasan Tata Kelola Governance Structure, Principles and Foundation Rapat Umum Pemegang Saham (RUPS) General Meeting of the Shareholders (GMS) Dewan Komisaris

Board of Commissioners Direksi

Board of Directors

Assessment terhadap Dewan Komisaris dan Direksi

Assessment towards Board of Commissioners and Board of Directors

Kebijakan Remunerasi bagi Dewan Komisaris dan Direksi

Remuneration Policy for the Board of Commissioners and the Board of Directors Rapat Dewan Komisaris, Direksi dan Rapat Gabungan

Meeting of the Board of Commissioners, the Board of Directors and Joint Meeting Hubungan Ailiasi antara Anggota Direksi, Dewan Komisaris, dan Pemegang Saham Utama dan/atau Pengendali

Afiliations between Members of the Board of Directors, the Board of Commissioners, and Shareholders and/or Controlling Shareholders Komite Audit

Audit Committee

Komite Nominasi dan Remunerasi Nomination and Remuneration Committee Komite Pemantau Manajemen Risiko Risk Management Oversight Committee Komite Lainnya

Other Committees Sekretaris Dewan Komisaris Board of Commissioners’ Secretary Sekretaris Perusahaan Corporate Secretary

Fungsi Internal Audit (Unit Audit Internal) Internal Audit Function

Akuntan Publik Public Accountant Manajemen Risiko Risk Management Sistem Pengendalian Intern Internal Control System

Perkara Penting yang Sedang Dihadapi Signiicant Legal Cases in Progress Akses Informasi dan Data Perusahaan Access to Information and Company’s Data Kode Perilaku

Code of Conduct Whistleblowing System Whistleblowing System

Hasil Penilaian Penerapan GCG di Pertamina Pertamina Assessment to GCG Implementation

Landasan, Prinsip dan Strategi Tanggung Jawab Sosial Perusahaan

Corporate Social Responsibility Foundation, Principles and Strategy

Tanggung Jawab Sosial Perusahaan terhadap Lingkungan Hidup Corporate Social Responsibility for the Environment

Tanggung Jawab Sosial Perusahaan terhadap Ketenagakerjaan dan Kesehatan dan Keselamatan Kerja Corporate Social Responsibility for Employment and Occupational Health and Safety Tanggung Jawab Sosial Perusahaan terhadap Konsumen

Corporate Social Responsibility for Consumer Issues

Tanggung Jawab Sosial Perusahaan terhadap Pengembangan Sosial dan Kemasyarakatan

Corporate Social Responsibility for Social and Community Development 180 188 216 230 237 238 239 241 241 242 243 244 244 245 245 246 248 250 251 254 256 258 271 276 283 290 308 313 326 339 343 345 348 352 361 367 374 375 378 385 394 396 406 409 411 414 417 420 425 432 439 447 450

Laporan Keuangan Konsolidasian PT Pertamina (Persero) dan Entitas Anak

Consolidated Financial Statements of PT Pertamina (Persero) and Subsidiaries 456

Laporan Keuangan

Financial Report

178

288

422

455

Nama dan Alamat Perwakilan, Cabang, dan Anak Perusahaan

Name and Address of Representatives, Branches, and Subsidiaries

Nama dan Alamat Lembaga dan/atau Profesi Penunjang Pasar Modal

Name and Address of Institutions and/or Supporting Professionals in Capital Market Daftar Istilah

Glossary of Terms

Rekomendasi Annual Report Award 2014 Annual Report Award 2014 Recomendation Referensi Silang Kriteria Annual Report Award (ARA) ke Peraturan Otoritas Jasa Keuangan (d/h Bapepam dan LK) No. X.K.6

Cross References Annual Report Award Criterias to the Financial Services Authority (previously Bapepam and LK) Regulation No. X.K.6 678 682 684 686 687 Informasi Lain-lain

6

1

2

3

4

Visi Menjadi Perusahaan Energi Nasional Kelas Dunia

Mewujudkan Kemandirian Energi Nasional

Vision to be the World-Class National Energy Company

Realizing National Energy Independence

5

Pillars of Strategic Priorities

Pilar

Prioritas Strategis

01 Pengembangan Sektor Hulu 02 Eisiensi di Semua Lini 03 Peningkatan Kapasitas Kilang dan Petrokimia

Expand Upstream Activities • Acquisition and development

of Indonesia’s main blocks: Mahakam, Cepu, ONWJ • International development:

Algeria, other International M&A • Geothermal and New &

Renewable energy development acceleration

• Operations excellence (Drilling, EOR, Eficiency)

• Exploration

Enterprise-Wide Eficiencies • Reformation of crude and oil

product procurement (strong ISC function in Jakarta)

• Reduce volume losses in all lines of operations: upstream, reinery, sea and land transportation • Streamlining of corporate

functions

• Procurement centralization • Marketing centralization

Increase Reining and Petrochemical Capacity

• Reinery upgrade (Reinery Development Master Plan) • Grass Root Reinery Project • Revitalization and integration of

private reinery

04 Pengembangan Infrastruktur dan Marketing

• Peningkatan kapasitas storage & terminal

• Pengembangan jaringan SPBU & pemasaran bertaraf internasional • Pengembangan infrastruktur receiving

& regasiikasi LNG serta SPBG

• Marketing Operation Excellence

• Go International

• Upgrade kilang (Reinery

Development Master Plan) • Kilang baru (Grass Root Reinery

Project)

• Revitalisasi & integrasi kilang swasta • Reformasi pengadaan minyak

mentah & produk minyak (ISC kuat di Jakarta)

• Penekanan losses di semua lini

operasi, hulu, kilang, transportasi laut & darat

• Streamlining fungsi-fungsi

korporasi

• Sentralisasi pengadaan • Sentralisasi marketing • Pengambilalihan dan

pengembangan blok utama Indonesia: Mahakam, Cepu, ONWJ

• Pengembangan internasional: Algeria, M&A Internasional lain • Akselerasi pengembangan

Geothermal & EBT • Operations Excellence

Analisa dan Pembahasan Manajemen

Management’

s Discussion and Analysis

Tata Kelola Perusahaan

Corporate Gover

nance

Tanggung Jawab Sosial Perusahaan

Corporate Social Responsibility

Laporan Keuangan

Financial Repor

t

Infor

masi Lain-lain

Other Infor

5

Nasional Kelas Dunia’ dan aspirasi Asian Energy Champion 2025.

Kapabilitas inovasi dan kreativitas juga telah memungkinkan Pertamina untuk bertahan di tengah beratnya tantangan kondisi lingkungan bisnis dalam dua tahun terakhir ini, terutama terkait dengan merosotnya harga minyak mentah dunia dan tekanan terhadap nilai tukar Rupiah.

Tanggap terhadap tantangan tersebut, manajemen Pertamina pada akhir tahun 2014 menggulirkan program kerja 5 Pilar Prioritas Strategis.

Pertamina kemudian telah menetapkan sejumlah inisiatif dalam bentuk BTP untuk setiap pilar strategis. Pada dasarnya, inisiatif-inisiatif tersebut merupakan upaya perbaikan proses secara berkesinambungan yang akan menghasilkan penghematan biaya ataupun penambahan pendapatan, maupun sebagai investasi jangka panjang yang krusial bagi pencapaian visi dan misi Pertamina.

Total terdapat 16 inisiatif BTP yang dilaksanakan sepanjang 2015 dalam kerangka 5 Pilar Prioritas Strategis Pertamina.

Secara keseluruhan, proyek-proyek tersebut telah memberikan hasil signiikan dengan total nilai kontribusi inansial berupa eisiensi maupun pendapatan sebesar USD608,41 Juta yang sangat berdampak signiikan pada proitabilitas Pertamina di tahun 2015.

2015 Initiative - Innovative in Overcoming Challenges

Over the years, Pertamina actively encourage growth and development of a culture of innovation as one of the effective ways to build a sustainable competitive advantage. Innovation and creativity is expressed among others in the form of development initiatives of Breakthrough Project (BTP).

In the long term, the implementation of the BTP will be the riser steps in the transformation of Pertamina towards achieving the vision of ‘To be a World-Class National Energy Company ‘ and the aspirations of the Asian Energy Champion 2025.

Innovation and creativity capabilities has also allowed Pertamina to survive in the middle of the severity of the challenges of the business environment in the last two years, mainly related to the decline in world crude oil prices and the pressure on Indonesian Rupiah.

Responsive to these challenges, Pertamina’s management at the end of 2014 implemented the work program of 5 Pillars of Strategic Priorities.

Pertamina then have established a number of initiatives in the form of BTP for each strategic pillar. Basically, these initiatives constitute continuous process improvement efforts that will result in cost savings or additional revenue, as well as long-term investment that is crucial for achieving the vision and mission of Pertamina.

In total there are 16 BTP initiatives undertaken throughout 2015 within the framework of the 5 Pillars of Strategic Priorities of Pertamina.

Overall, these projects have provided a signiicant creation with a total value of inancial contribution in the form of eficiency and revenues of USD608.41 million which is a very signiicant impact on the proitability of Pertamina in 2015.

Develop Marketing and Distribution Infrastructure

• Enhancement of storage and terminal capacities

• Development of Public Fuel Filling Station (SPBU) and world-class marketing network

• Development of LNG Receiving & Regasiication facility as well as SPBG (Fuel Gas Filling Station) • Marketing Operation Excellence • Go International

05 Perbaikan Struktur Keuangan

Improvement in Financial Structure • Settlement of receivables to the

Government

• Alignment of short-term and long-term funding strategies

• Management of investment planning & evaluation

• Penyelesaian piutang ke negara • Penyelarasan strategi pembiayaan

jangka pendek dan panjang • Pengelolaan perencanaan &

8

International Achievements

•

Expansion of Upstream Sector

Pengembangan

Sektor Hulu

01

Pencapaian Domestik

Total Nett Production 37.1 MBOEPD

Total Nett Production 38.5 MBOEPD Total Net Produksi

37,1 MBOEPD

Total Net Produksi 38,5 MBOEPD

Pencapaian Internasional

Total Nett Production 38.6 MBOEPD Total Net Produksi 38,6 MBOEPD Malaysia

Irak

Aljazair

02 02

03

03

04

01 Memperoleh pengelolaan Blok Mahakam mulai 1 01 Januari 2018

Obtained the Block Mahakam management started on 1 January 2018

Memperoleh pengelolaan Blok Kampar mulai 1 Januari 2016

Obtained the Block Kampar management started on 1 January 2016

Perpanjangan Blok ONWJ (PI 73,5%) mulai 19 Januari 2017

Extension on Block ONWJ (PI 73.5%) started on 19 January 2017

Akuisisi 100% Blok NSO dan Blok NSB, efektif sejak 1 Januari 2015

100% acquisition of Block NSO and Block NSB,

Akuisisi 15% Blok East Sepinggan pada 8 Desember 2014

15% acquisition of Block East Sepinggan on 8 December 2014

Akusisi 7,483068% participating interest di Blok Offshore Southeast Sumatera (OSES), efektif sejak 24 Oktober 2014

7.483068% acquisition of the participating interest of Block Offshore Southeast Sumatera (OSES), effective since 24 October 2014

Memperoleh pengelolaan Blok Siak mulai 26 Mei 2014

Obtained the Block Siak management since 26 May 2014

2015

2014

Analisa dan Pembahasan Manajemen

Management’

s Discussion and Analysis

Tata Kelola Perusahaan

Corporate Gover

nance

Tanggung Jawab Sosial Perusahaan

Corporate Social Responsibility

Laporan Keuangan

Financial Repor

t

Infor

masi Lain-lain

Other Infor

Target: crude production of 165,000 BOPD

Target: monetization of oil and gas resources at WMO

Target: monetization of 85 MMSCFD gas in Matindok & 250 MMSCFD in Senoro

Target: monetization of 310 MMSCFD gas in Senoro

Target: monetization of 105 MMSCFD gas in Matindok

Target: develop geothermal potential Banyu Urip

Development Target: produksi minyak mentah 165.000 BOPD

WMO POD Integrasi-1 Target: monetasi temuan cadangan migas di WMO

Donggi Senoro LNG Plant

Target: monetasi gas area Matindok 85 MMSCFD & Senoro 250 MMSCFD

Senoro Gas Development

Target: monetisasi gas area Senoro 310 MMSCFD

Matindok Gas Development

Target: monetasi gas area Matindok 105 MMSCFD

Ulubelu unit 3 & 4 Target: pengembangan potensi geothermal

01 04

02 05

03 06

6 Proyek Prioritas Hulu

6 Upstream Priority Projects

02 02

03 03

04

04

05 01 Akuisisi 11,5% Blok Natuna Sea A pada 6 Desember 01

2013

11.5% acquisition of Block Natuna Sea A on 6 December 2013

Akuisisi 33,75% Blok Ambalat, 33,75% Blok Bukat dan 35% Blok Nunukan pada 15 Februari 2013

33.75% acquisition of Block Ambalat, 33.75% on Block Bukat and 35% Block Nunukan on 15 February 2013

Penambahan 5,0295% participating interest PT PHE ONWJ di Blok ONWJ pada 2 Mei 2013

5.0295% additional on the participating interest of PT PHE ONWJ di Block ONWJ on 2 May 2013

Akuisisi 15% Blok Babar Selaru, pada 14 Mei 2013

15% acquisition of Block Babar Selaru, on 14 May 2013

Akusisi 15% Blok Kalyani pada 19 Agustus 2013

Perpanjangan blok West Madura offshore (PI 80%) mulai 6 Mei 2011

Extension on Block West Madura offshore (PI 80%) started on 6 May 2011

Akusisi 7,25% Blok ONWJ dan 13,0674% Blok OSES pada 30 September 2010

7.25% acquisition of Block ONWJ and 13.0674% Block OSES on 30 September 2010

Akuisisi 46% Blok ONWJ pada tahun 2009

46% acquisition of Block ONWJ in 2009

Akuisisi 11,5% Blok Natuna Sea Blok A pada 6 Desember 2013

11.5% acquisition of Block Natuna Sea Blok A on 6 December 2013

Akusisi 7,483068% Blok OSES

7.483068% acquisition of Block OSES

10

02

Di tengah kondisi terpuruknya

harga minyak mentah dunia

saat ini, eisiensi operasional

menjadi strategi kunci bagi

perusahaan migas untuk dapat

bertahan. Sejumlah langkah yang

ditempuh Pertamina antara lain

adalah reformasi pengadaan

minyak mentah dan produk

minyak, sentralisasi pengadaan,

sentralisasi pemasaran, dan

pembenahan tata kelola arus

minyak.

Enterprise-Wide Eficiency

Efisiensi di

Semua Lini

Analisa dan Pembahasan Manajemen

Management’

s Discussion and Analysis

Tata Kelola Perusahaan

Corporate Gover

nance

Tanggung Jawab Sosial Perusahaan

Corporate Social Responsibility

Laporan Keuangan

Financial Repor

t

Infor

masi Lain-lain

Other Infor

Sentralisasi Procurement

(dalam juta USD)

PTKAM (Pembenahan Tata Kelola

Arus Minyak)

(dalam juta USD)Perubahan Pengadaan Crude &

Produk oleh ISC

(dalam juta USD)Centralized Procurement (in million USD)

PTKAM (Oil Flow Revitalization) (in million USD)

Procurement of Crude & Product by ISC (in million USD)

90

200

91.7 90

255.2

208.0

Target

Target Target Target

Target Target

Realisasi

Realization Realization Realization

12

Peningkatan

Kapasitas Kilang

Produksi LPG Produksi Premium

RON 88

03

61

MB/hari440

TSD950

TSD91

MB/hariRFCC

(Residual Fluid Catalytic Cracking)9,100

700

61,000

480

Penyerapan Tenaga Kerja Produksi HOMC

Produksi Premium Produksi LPG

Labour Usage

Labour Usage

Pekerja

Worker

MB/day

TSD TSD

MB/day

Production of Premium Production of LPG

Production of LPG Production of Premium

RON 88

Production of HOMC

Penyerapan Tenaga Kerja

Worker

Pekerja

TPPI Terintegrasi

Increasing Reinery Capacity

10,000

TPPI Reinery Integrated

MT/hari

barel/hari

barrel/day

barel/hari

Analisa dan Pembahasan Manajemen

Management’

s Discussion and Analysis

Tata Kelola Perusahaan

Corporate Gover

nance

Tanggung Jawab Sosial Perusahaan

Corporate Social Responsibility

Laporan Keuangan

Financial Repor

t

Infor

masi Lain-lain

Other Infor

Pekerja

Worker Gasoline Speciications

RDMP

(Reinery Development Master Plan)& GRR

(Grass Root Reinery)RFCC : Residual Fluid Catalytic Cracking GRR : Grass Root Reinery RDMP : Reinery Development Master Plan

400-900

Spesiikasi Bensin

RON

88

RON

92

91,000

91,000

2015

Cumulative Reining Capacity

(Current design capacity)

1,000

RFCC at RU-IV

(EXISTING)

2016 2017 2018

1,0

juta /million

BPSD

2015

2,3

juta /million

BPSD

2025 2019

1,100

RDMP RU-V Balikpapan

(UPGRADE)

2020

1,400

GRR East (Bontang)

(NEW)

2021

1,700

GRR West 1 (Tuban)

(NEW)

2022

1,720

RDMP RU-IV Cilacap

(UPGRADE)

2023

2,000

RDMP RU-II Dumai,

RDMP RU-IV Balongan

(UPGRADE)

2024

2,300

GRR West 2

(NEW)

barel/hari

barrel/daybarel/hari

barrel/dayLabour Usage

14

Bangladesh

01

East Timor

03

Cambodia

02

Japan

04

Oman

08

Singapore

09

Nepal

06

Nigeria

07 12

Thailand

Philipines

11

Yemen

13

Australia

14

14 Negara yang menjadi

tujuan ekspor Pelumas

Pertamina

Official

Technical

Partner

Pengembangan

Infrastruktur

dan Pemasaran

2,248

Total number of Pertalite outlet as of December 2015

Market share Pertalite to total Premium

Total jumlah outlet Pertalite per Desember 2015

Penguasaan pasar Pertalite terhadap total Premium

PERTALITE

04

10%

*

Development of Infrastructure and Marketing

*di SPBU yang menjual Pertalite

*at SPBUs that sell Pertalite

Analisa dan Pembahasan Manajemen

Management’

s Discussion and Analysis

Tata Kelola Perusahaan

Corporate Gover

nance

Tanggung Jawab Sosial Perusahaan

Corporate Social Responsibility

Laporan Keuangan

Financial Repor

t

Infor

masi Lain-lain

Other Infor

13

12

11

10 14

03 09 07

08 06

01

05 02

04

• Penambahan storage BBM: 670.000 KL

• Proses pembangunan TBBM: Sambu: 300 .000 KL, Tanjung Uban: 200.000 KL, Tuban: 100.000 KL, Balongan: 70.000 KL

• Additional fuel storage capacity: 670,000 KL

• Construction of Fuel Terminal: Sambu: 300,000 KL, Tanjung Uban: 200,000 KL, Tuban: 100,000 KL, Balongan: 70,000 KL

RENCANA PEMBANGUNAN PIPA, KAPAL, DAN

STORAGE

DEVELOPMENT PLAN FOR PIPELINE, SHIPS AND STORAGE

• Gas production 1,650 mmscfd

• Committed supply of LNG equivalent to 2,500 mmscfd in 2019 • Gas transmission pipeline up to 2018=2,900 km

1. Pattimura (17,500 dwt), 2. Parigi (17,500 dwt), 3. Pasaman (17,500 dwt), 4. Panderman (17,500 dwt), 5. Papandayan (17,500 dwt), 6. Pangrango (17,500 dwt),

PENAMBAHAN 11 UNIT KAPAL MILIK

ADDITION OF 11 UNITS OF OWNED SHIPSKapasitas produksi LOBP LOBP production capacity

02

Kapasitas produksi VM VM production capacity

17,280 MT/tahun MT/year

Kapasitas produksi LBO Grup I/II

LBO production capacity Group I/II

05

Sertiikasi Certiication

ISO 9000,14000 LOBP, ISO 17025

03

Base Oil Group III dari kilang Dumai Base Oil Group III production from Dumai RU

360,000 MT/tahun MT/year

> Kerja sama fuel supply agreement dengan PT Adaro Indonesia > Kerja sama fuel facilities agreement dengan PT Indonesia Bulk terminal.

(Sewa & pemanfaatan terminal BBM milik IBT)

> Fuel supply agreement with PT Adaro Indonesia > Fuel facilities agreement with PT Indonesia Bulk terminal

(Lease and utilization of fuel terminal owned by IBT)

ALIANSI STRATEGIS

STRATEGIC ALLIANCES16

Perbaikan

Struktur

Keuangan

05

608.41

Realisasi | Realization Desember|December

2015

(dalam juta USD | in million USD)

Cumulative Financial Impact Progress

480.01

Target Desember|December

2015

500.42

Target BTP | BTP

2015

Improvement in Financial Structure

126.75%

Untuk memperbaiki struktur keuangan, Pertamina antara lain

melakukan penyelarasan strategi pembiayaan jangka panjang

dan jangka pendek, percepatan penyelesaian piutang ke negara,

optimisasi aset non-produktif, kerja sama transaksi lindung nilai valuta

asing dengan beberapa bank nasional, dan beberapa implementasi

aktivitas roadmap menuju World Class Treasury Centre.

Analisa dan Pembahasan Manajemen

Management’

s Discussion and Analysis

Tata Kelola Perusahaan

Corporate Gover

nance

Tanggung Jawab Sosial Perusahaan

Corporate Social Responsibility

Laporan Keuangan

Financial Repor

t

Infor

masi Lain-lain

Other Infor

LABA BERSIH (dalam miliar USD)

EBITDA (dalam miliar USD)

EBITDA MARGIN/YTD (dalam presentase)

PENDAPATAN (dalam miliar USD)

Revenue (in billion USD)

EBITDA MARGIN/YTD (in percentage)

EBITDA (in billion USD)

Net Income (in billion USD)

Kinerja Finansial Konsolidasian 2015

10.67

0.94

8.77

0.03

21.79 2.32

10.66

0.57

32.00 3.55

11.09

0.91

41.76 5.13

TW/Q I TW/Q II TW/Q III TW/Q IV

TW/Q I TW/Q II TW/Q III TW/Q IV TW/Q I TW/Q II TW/Q III TW/Q IV

TW/Q I TW/Q II TW/Q III TW/Q IV

18

Pertamina’s role in the National Energy Independence

Peran

Pertamina

dalam

Kemandirian

Energi

Nasional

Upaya yang dilakukan dalam menjaga pasokan BBM seiring peningkatan kebutuhan BBM di Indonesia dari tahun ke tahun antara lain:

The Strategy to Maintain Fuel Oil Supply (Indonesia’s Fuel Oil

Demand vs Pertamina’s Fuel Oil Supply)

To maintain fuel oil supply in accordance to the rising fuel demand in Indonesia from year to year, the Company performs the following efforts:

Dalam menjamin distribusi BBM di Indonesia, Pertamina menjalankan fungsi selaku logistic provider bagi lini bisnisnya, mulai dari penerimaan, pengelolaan dan penyimpanan hingga penyaluran produk untuk memenuhi kebutuhan konsumen, melalui pengoperasian dan pengelolaan infrastruktur sebagai berikut:

Ensuring the Distribution of Fuel Oil in Indonesia

To ensure the distribution of fuel oil in Indonesia, Pertamina conducts its function as the logistic provider for its business lines, namely from acceptance, management and storage to the distribution of products in order to meet the needs of consumers. This is performed through the operation and management of the following infrastructure:

01

02

• Peningkatan Kapasitas Storage & Upgrading Fasilitas Terminal BBM (TBBM)

• Otomatisasi suplai dan logistik secara menyeluruh (End-to-end data automation)

• Optimalisasi Master Program dan Pola Suplai BBM

• Pengembangan Pasar Storage Internasional

• Menerapkan PROPER & Pertamina Operation & Service Excellence (POSE) di setiap TBBM.

• Improve storage capacity & upgrade the Fuel Oil Terminal Facilities (TBBM)

• Automation of supply and logistics as a whole (End-to-end data automation)

• Master Program and Fuel Oil Supply Pattern Optimization

• International Storage Market

Development

• Applying PROPER & Pertamina Operation & Service Excellence (POSE) in all TBBM.

Menjamin Distribusi BBM ke Seluruh Pelosok Indonesia

Strategi Menjaga Pasokan BBM (Demand BBM di

Indonesia vs Supply BBM oleh Pertamina)

112

Fuel Terminal Fuel Terminal

17

unit Ship to Ship Transfer (STS)

unit Ship to Ship Transfer (STS)

5270

Retail Fuel Station

Retail Fuel Station

214

Dermaga Piers63

Aviation Fuel Terminal

Aviation Fuel Terminal

135

Terminal Khusus Special Terminals

65

unit Tanker Milik dan 151 unit Tanker

19

12

Unit Central Buoy Mooring (CBM)

Unit Central Buoy Mooring (CBM)

197

Unit Kapal Kecil Ringan (KKR)

Analisa dan Pembahasan Manajemen

Management’

s Discussion and Analysis

Tata Kelola Perusahaan

Corporate Gover

nance

Tanggung Jawab Sosial Perusahaan

Corporate Social Responsibility

Laporan Keuangan

Financial Repor

t

Infor

masi Lain-lain

Other Infor

Direktorat Gas, Energi Baru dan Terbarukan mengelola bisnis Gas, Power, dan NRE sebagai core business Pertamina untuk memperkuat business positioning dan daya saing, mengoptimalkan proit serta mendukung business sustainability Perseroan.

Strategi:

The Development of Renewable Energy for Future Generations

The Directorate of Gas, New and Renewable Energy manages Pertamina’s core business namely Gas, Power, and NRE in order to strengthen business positioning and competitiveness, optimize proitability and to support the Company’s business sustainability.Strategy:

Pertamina tidak hanya berkontribusi pada ketahanan energi. Perseroan juga memberikan kontribusi besar kepada negara melalui dividen dan pajak yang dibayarkan. Setoran dividen dan pajak kepada negara di tahun 2015 adalah sebesar Rp6,25 triliun dan Rp71,62 triliun.

Tax and Dividend Payments to Government

Pertamina did not only contribute in the energy security. The Company also provides large contribution to the state through dividend and tax paid. Dividend and tax deposits to state in 2015 were amounting to Rp6.25 Trillion and Rp71.62 Trillion.

03

04

1. Mengembangkan penguasaan pasar Gas, Power, dan NRE dengan mengamankan sisi pasokan, serta meng-create dan memperluas pasar untuk mengembangkan skala bisnis melalui optimalisasi bisnis eksisting dan penguasaan resources baru. 2. Ekspansi pasar baru untuk mengakselerasi

bisnis Direktorat GEBT di bidang Gas, Power, dan NRE

3. Mengembangkan resources dan bisnis baru sebagai new growth engine

4. Ekspansi pasar baru untuk mengakselerasi bisnis Direktorat GEBT di bidang Gas, Power, dan NRE

5. Mengembangkan resources dan bisnis baru sebagai new growth engine.

1. Developing control on Gas, Power, and NRE by securing supply, and creating and expanding market to develop business scale through optimization on the existing business and control on new resources.

2. Expanding new market to accelerate business of the Directorate of GEBT in Gas, Power, and NRE sectors

3. Developing resources and new business as new growth engine

4. Expanding new market to accelerate business of the Directorate of GEBT in bidang Gas, Power, and NRE sectors 5. Developing resources and new business as

new growth engine.

Pembayaran Pajak dan Dividen ke Pemerintah

20

Financial Performance Highlights

Ikhtisar

Kinerja

Keuangan

* Disajikan kembali, akibat penerapan retrospektif PSAK No 24 “Imbalan Kerja” dan PSAK No 66 “Pengaturan Bersama” As restated due to the retrospective implementation of SFAS 24 “Employee Beneits” and SFAS 66 “Joint Control” ** Beban Usaha terdiri dari Beban Penjualan dan Pemasaran serta Beban Umum dan Administrasi

Operating Expenses consist of Selling and Marketing Expenses and General and Adminitrative Expenses *** Dalam Laporan Tahunan ini disajikan sebagai Laba Bersih

In the Annual Report is presented as Net Income

**** Dalam Laporan Tahunan ini disajikan sebagai Laba Bersih Per Saham

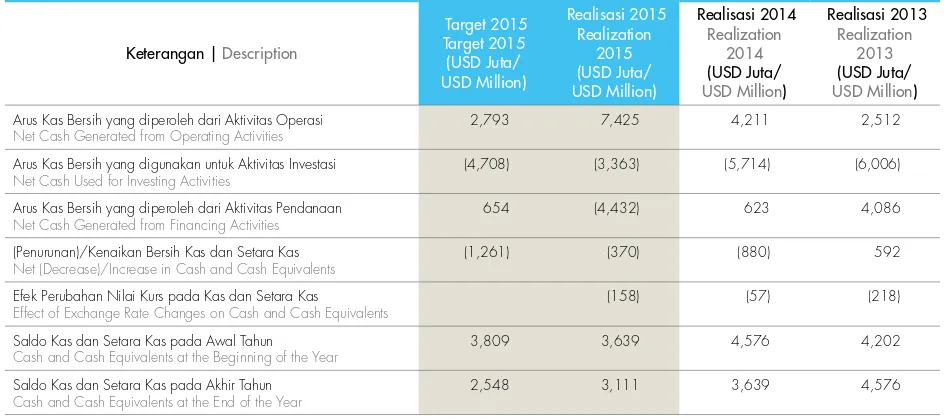

Keterangan 2015 2014* 2013* 2012 2011 Description

LAPORAN LABA RUGI (dalam jutaan USD) CONSOLIDATED INCOME STATEMENT (in million USD)

Penjualan dan Pendapatan Usaha Lainnya 41,763 69,996 71,170 70,924 67,297 Sales and Other Operating Revenues Beban Pokok Penjualan dan Beban Langsung Lainnya

serta Beban Usaha ** 37,842 65,558 66,431 66,160 61,944

Cost of Sales, Other Direct Costs and Operating Expenses*

Laba Usaha 3,921 4,438 4,739 4,764 5,353 Income from Operations

Penghasilan (Beban) Lain-Lain Bersih (914) (650) 227 38 (849) Other Income (Expense) - Nett Laba Sebelum Beban Pajak Penghasilan 3,007 3,788 4,966 4,802 4,504 Income Before Income Tax Expense Beban Pajak Penghasilan 1,565 2,311 1,957 2,036 2,099 Income Tax Expense Laba Tahun Berjalan 1,442 1,477 3,009 2,766 2,405 Income for the Year Pendapatan (Beban) Komprehensif Lainnya, Bersih

setelah Pajak (298) (61) (171) (14) (6)

Other Comprehensive Income (Expense), Nett of Tax Jumlah Pendapatan Komprehensif 1,144 1,416 2,838 2,752 2,399 Total Comprehensive Income

Laba yang Dapat Diatribusikan kepada: Income Attributable to:

Pemilik Entitas Induk*** 1,420 1,447 3,003 2,761 2,399 Owners of the Parent **

Kepentingan Non pengendali 22 30 6 5 6 Non-controlling Interest

Jumlah Pendapatan Komprehensif yang dapat Diatribusikan kepada:

Total Comprehensive Income Attributable to:

Pemilik Entitas Induk 1,154 1,397 2,839 2,750 2,393 Owners of the Parent Kepentingan Non pengendali (10) 19 (1) 2 6 Non-controlling Interest

EBITDA 5,130 5,728 6,561 6,057 5,592 EBITDA

LAPORAN POSISI KEUANGAN KONSOLIDASIAN (dalam jutaan USD)

CONSOLIDATED FINANCIAL POSITION

(in million USD)

Aset Lancar 14,330 20,493 24,113 22,026 17,638 Current Assets

Aset Tidak Lancar 31,189 30,203 25,394 18,933 17,286 Non-current Assets

Jumlah Aset 45,519 50,696 49,507 40,959 34,924 Total Assets

Liabilitas Jangka Pendek 8,547 13,746 16,572 14,150 12,772 Short-term Liabilities Liabilitas Jangka Panjang 17,497 18,135 14,771 11,616 8,869 Long-term Liabilities

Liabilitas 26,044 31,881 31,343 25,766 21,641 Total Liabilities

Ekuitas 19,475 18,815 18,164 15,193 13,283 Total Equities

Jumlah Liabilitas dan Ekuitas 45,519 50,696 49,507 40,959 34,924 Total of Liabilities and Equities

Modal Kerja Bersih 5,783 6,747 7,541 7,876 4,866 Net Working Capital

Jumlah Investasi pada Entitas Asosiasi 499 275 600 337 262 Total of Investments in Associated Entities

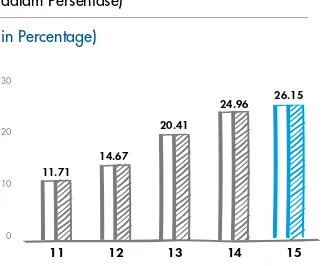

RASIO KEUANGAN - KEPUTUSAN MENTERI BUMN NO.100 (dalam persentase)

FINANCIAL RATIO - DECREE NO.100 OF THE MINISTER OF SOEs (in percentage)

ROE 11.71 14.30 28.48 30.01 29.04 ROE

ROI 12.90 13.13 14.67 *****16.10 17.27 ROI

Rasio Kas 38.19 27.52 28.54 30.82 26.38 Cash Ratio

Rasio Lancar 167.67 149.09 145.50 155.66 138.09 Current Ratio

Periode Kolektibilitas (hari) 42 38 42 34 30 Collection Period (days) Perputaran Persediaan (hari) 38 37 47 46 42 Inventory Turnover (days) Total Aset Turn Over 106.18 161.21 160.57 189.58 209.68 Total Assets Turn Over Total Modal Sendiri terhadap Total Aset 40.50 34.95 32.37 31.92 33.14 Total of Equity to Total Asset

RASIO KEUANGAN (dalam persentase) FINANCIAL RATIO (in percentage)

Rasio Liabilitas terhadap Ekuitas****** 71.23 94.76 84.87 67.05 55.15 Debt to Equity Ratio****** Rasio Liabilitas terhadap Aset****** 30.18 34.79 31.01 24.75 20.86 Debt to Assets Ratio****** Rasio Liabilitas Jangka Panjang terhadap

Ekuitas****** 61.73 67.97 55.87 39.74 30.97

Long-term Debt to Equity Ratio******

Rasio Liabilitas Jangka Panjang terhadap Aset****** 26.15 24.96 20.41 14.67 11.71 Long-term Debt to Assets Ratio****** Rasio Laba (Rugi) terhadap Jumlah Aset (ROA) 3.12 2.85 6.07 6.70 6.87 Return on Assets (ROA) Rasio Laba (Rugi) terhadap Pendapatan 3.36 2.06 4.17 3.87 3.56 Net Proit Margin

LABA & LABA KOMPREHENSIF PER SAHAM INCOME & COMPREHENSIVE INCOME PER SHARE

Jumlah Lembar Saham (dalam satuan lembar saham) 83,090,697 83,090,697 83,090,697 83,090,697 82,569,779 Total Number of Shares (in unit)

Laba per Saham (dalam USD) **** 17.09 17.41 36.14 33.22 29.06 Earning per Share (in USD) ***

Laba Komprehensif per Saham (dalam USD) 13.88 16.82 34.17 33.09 28.98 Comprehensive Earning per Share (in USD)

NILAI KURS RUPIAH TERHADAP US DOLLAR EXCHANGE RATE OF RP TO USD

(dalam Rupiah angka penuh) (full igures in Rupiah)

Analisa dan Pembahasan Manajemen

Management’

s Discussion and Analysis

Tata Kelola Perusahaan

Corporate Gover

nance

Tanggung Jawab Sosial Perusahaan

Corporate Social Responsibility

Laporan Keuangan

Financial Repor

t

Infor

masi Lain-lain

Other Infor

Penjualan dan Pendapatan Usaha Lainnya Sales and Other Operating Revenues (in USD Million)

15 14 13 12 11

67,297 70,924 69,996

41,763

71,170

Laba Bersih Net Income (in USD Million)

15 14 13 12 11

2,399 2,761

1,447 1,420

3,003

ROI (dalam persentase)

ROI (in percentage)

15 14 13 12 11

17.27 16.10

13.13 12.90

14.67

Aset (dalam USD Juta)

Total Assets (in USD Million)

15 14 13 12 11

34,924 40,959

50,696

45,519

49,507

ROE (dalam persentase)

ROE (in percentage)

15 14 13 12 11

29.04 30.01

14.30

11.71

28.48

Ekuitas (dalam USD Juta)

Total Equities (in USD Million)

15 14 13 12 11

13,283 15,193

22

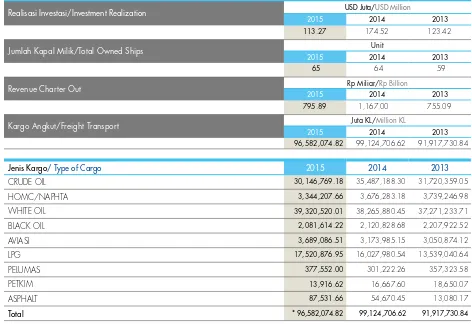

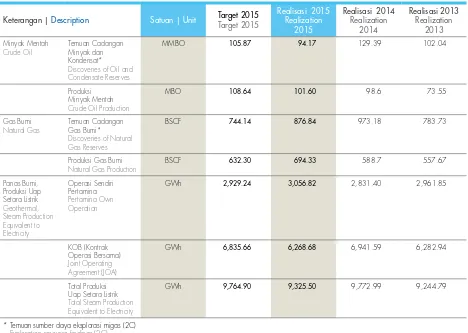

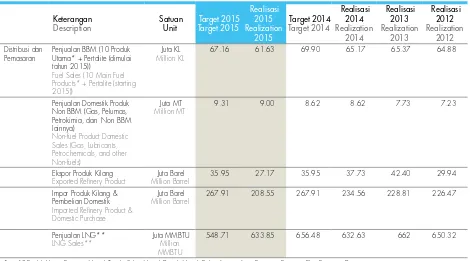

Deskripsi Satuan 2015 2014 2013

Minyak Mentah Temuan Cadangan Minyak dan Kondensat* MMBO 94.17 129.39 102.04 Produksi Minyak Mentah MMBO 101.60 98.61**** 73.55 Gas Bumi Temuan Cadangan Gas Bumi* BSCFG 876.84 973.18 783.73 Produksi Gas Bumi BSCF 694.33 588.67 557.67 Panas Bumi, Produksi Uap

Setara Listrik Operasi Sendiri Pertamina GWh 3,056.82 2,831.40 2.961.85 KOB (Kontrak Operasi Bersama) GWh 6,268.68 6,941.59 6,282.94 Total Produksi Uap Setara Listrik GWh 9,325.50 9,772.99 9,244.79 Pengolahan Kilang Pengolahan Minyak Mentah, Gas & Intermedia Juta Barel 305.95 314.42 314.03

Volume Produksi BBM

(10 Produk Utama)*** Juta Barel 241.07 241.16 239.04 Volume Produksi Non BBM (Petrokimia, Solvent dan

NBBM) Juta Barel 23.41 22.18 21.74 Distribusi & Pemasaran Penjualan BBM (10 Produk Utama*** + Pertalite

(dimulai tahun 2015)) Juta KL 61.63 65.17 65.37 Penjualan Domestik Produk Non BBM

(Gas,Pelumas, Petrokomia, dan Non BBM lainnya) Juta MT 9.00 8.62 7.73 Kargo Angkut (tidak termasuk kegiatan charter out) Juta KL 96.58 99.12 91.92 Ekspor Produk Juta Barel 27.17 37.73 42.4 Impor Produk & Pembelian Domestik Juta Barel 208.55 234.56 228.81 Penjualan LNG** Juta MMBTU 633.85 632.63 662

* Temuan sumber daya eksplorasi migas (2C) ** Termasuk penjualan domestik Nusantara Regas

*** 10 Produk Utama: Premium, Minyak Tanah, Solar, Minyak Diesel, Minyak Bakar, Avigas, Avtur, Pertamax, Pertamax Plus, Pertamina Dex **** Disajikan kembali karena perubahan metode pencatatan

Operational Perfomance Highlights

Ikhtisar

Kinerja

Operasional

Temuan Cadangan Minyak dan Kondensat* (MMBO)

Discoveries of Oil and Condensate Reserves* (MMBO)

15 14 13 12 11

343.34

108.70 129.39

94.17

102.04

Temuan Cadangan Gas Bumi* (BSCFG)

Discoveries of Natural Gas Reserves* (BSCFG)

Produksi Minyak Mentah (MMBO)

Crude Oil Production (MMBO)

15 14 13 12 11

70.63 71.76

98.61 101.60

73.55

Produksi Gas Bumi (BSCF)

Natural Gas Production (BSCF)

15 14 13 12 11

558.60 563.15 588.67

694.33

557.67

15 14 13 12 11

769.54

964.10 973.18

876.84

Analisa dan Pembahasan Manajemen

Management’

s Discussion and Analysis

Tata Kelola Perusahaan

Corporate Gover

nance

Tanggung Jawab Sosial Perusahaan

Corporate Social Responsibility

Laporan Keuangan

Financial Repor

t

Infor

masi Lain-lain

Other Infor

108.70 343.34 MMBO Discoveries of Oil and Condensate Reserves* Crude Oil

71.76 70.63 MMBO Crude Oil Production

964.10 769.54 BSCFG Discoveries of Natural Gas Reserves* Natural Gas

563.15 558.60 BSCF Natural Gas Production

2,216.81**** 2,014.95**** GWh Pertamina Owned Operations Geothermal, Steam Production Equivalent to Electricity

7,081.20 7,082.54 GWh JOA (Joint Operating Agreement)

9,206.31 9,088.62 GWh Total Steam Production Equivalent to Electricity

308.12 308.80 Million Barrel Crude Oil, Gas and Intermediate Processing Reinery Product

238.76 237.04 Million Barrel Fuel Production Volume (10 Main Fuel Products)***

23.56 25.11 Million Barrel Non-fuel Production Volume (Petrochemical, Solvent and Non-fuel Products)

64.88 64.60 Million KL Fuel Sales (10 Main Fuel Products*** +

Pertalite (starting 2015)) Sales and Distribution

7.23 6.46 Million MT Domestic Sales of Non-fuel Products

(Gas, Lubricants, Petrochemical, and other Non-fuel)

88.89 81.93 Million KL Transportation Cargo (excluded charter out activities)

29.94 31.54 Million Barrel Export of Products

226.47 212.70 Million Barrel Import of Products and Domestic Purchase

650.32 813.71 Million MMBTU LNG Sales**

* Exploration Resource Finding (2C) ** Including domestic sales of Nusantara Regas *** 10 Main Fuel Products: Premium, Kerosene, High Speed Diesel, Industrial/Marine Diesel Oil, Industrial/Marine Fuel Oil, Avigas, Avtur, Pertamax, Pertamax Plus, Pertamina Dex **** Restated due to change in the method of accounting record

Total Produksi Uap Setara Listrik

(GWh)

Total Steam Production Equivalent to Electricity

(GWh)

15 14 13 12 11

9,088.62 9,206.31 9,244.79 9,772.99 9,325.50

Produksi Uap Setara Listrik, Kontrak Operasi Bersama

(KOB) (GWh)

Steam Production Equivalent to Electricity, Joint Operating Agreement (JOA) (GWh)

15 14 13 12 11

7,082.54 7,081.20 6,941.59 6,268.68 6,282.94

Pengolahan Minyak Mentah, Gas & Intermedia

(Juta Barel)

Crude Oil, Gas and Intermediate Processing

(Million Barrel)

15 14 13 12 11

308.80 308.12 314.03 314.42 305.95

Volume Produksi BBM (10 Produk Utama)

(Juta Barel)

Fuel Production Volume (10 Main Fuel Products)

(Million Barrel)

15 14 13 12 11

24

Penjualan Domestik Produk Non BBM

(Gas, Pelumas, Petrokimia, dan Non BBM lainnya) (Juta MT)

Domestic Sales of Non-fuel Product

(Gas, Lubricants, Petrochemical and other Non-fuel) (Million MT)

15 14 13 12 11

6.46 7.23

8.62 9.00 7.73

Penjualan BBM

(10 Produk Utama) (Juta KL)

Fuel Sales

(10 Main Fuel Products) (Million KL)

15 14 13 12 11

64.60 64.88 65.37 65.17 61.63

Produksi Uap Setara Listrik, Operasi Sendiri Pertamina

(GWh)

Steam Production Equivalent to Electricity, Pertamina Owned Operation (GWh)

15 14 13 12 11

2,006.08 2,125.11

2,831.40 3,056.82 2,961.85

Volume Produksi Non BBM

(Petrokimia, Solvent dan NBBM) (Juta Barel)

Non-fuel Production Volume

(Petrochemical, Solvent and Non-fuel Products) (Million Barrel)

15 14 13 12 11

25.11 23.56

22.18 23.41 21.74

Produksi Minyak Mentah

Produksi minyak mentah naik 3,03% dari 98,61 MMBO tahun 2014 menjadi 101,60 MMBO.

Production of Crude

Production of crude increased 3.03% to 101.60 MMBO, from 98.61 MMBO in 2014.

101.60

MMBO

MMBO

Produksi Gas Bumi

Produksi gas bumi naik 17,95% dari 588,67 BSCF tahun 2014 menjadi 694,33 BSCF.

Production of Natural Gas

Production of natural gas increased 17.95% to 694.33 BSCF, from 588.67 BSCF in 2014.

694.33

BSCF

BSCF

PROPER Emas

Sebanyak 159 unit usaha telah mengikuti PROPER dengan 6 diantaranya memperoleh PROPER Emas tahun 2015 dari Kementerian Lingkungan Hidup Republik Indonesia.

Gold PROPER

A total of 159 business units participated in PROPER 2015, of which 6 units were awarded the Gold PROPER from the Ministry of Environment, the Republic of Indonesia.

6

Gold PROPER

PROPER Emas

Analisa dan Pembahasan Manajemen

Management’

s Discussion and Analysis

Tata Kelola Perusahaan

Corporate Gover

nance

Tanggung Jawab Sosial Perusahaan

Corporate Social Responsibility

Laporan Keuangan

Financial Repor

t

Infor

masi Lain-lain

Other Infor

Penjualan LNG *

(Juta MMBTU)

LNG Sales *

(Million MMBTU)

15 14 13 12 11

813.71

650.32 662.00 632.63 633.85

Impor Produk Kilang & Pembelian Domestik

(Juta Barel)

Import of Reinery Products & Domestic Purchase

(Million Barrel)

15 14 13 12 11

212.70 226.47

234.56

208.55

228.81

Ekspor Produk Kilang

(Juta Barel)

Export of Reinery Products

(Million Barrel)

15 14 13 12 11

31.54 29.94

37.73

27.17

42.40

Nilai Assessment GCG tahun 2015

Nilai assessment GCG tahun 2015 adalah 94,50%, meningkat sebesar 0,07% dibandingkan dengan Nilai assessment GCG tahun 2014 sebesar 94,43% dengan kualiikasi “Sangat Baik”.

Value of the GCG Assessment in 2015 Value of the GCG assessment in 2015 was 94.50%, up 0.07% compared to the value of the GCG assessment in 2014 of 94.43% with “Excellent”qualiication.

94.50

FORTUNE GLOBAL 500 TAHUN 2015

Diakui sebagai salah satu perusahaan Fortune Global 500, peringkat ke130 pada tahun 2015

FORTUNE GLOBAL 500 YEAR 2015

Recognized as one of the Fortune Global 500 companies, the 130th rating in 2015

130

RATING PERCENTAGE

PERINGKAT PERSEN

Jumlah Aset

Jumlah aset per akhir tahun 2015

Total Assets

Total assets as of year-end 2015

45,519

MILLION USD

JUTA USD

* Termasuk Penjualan Domestik Nusantara Regas

26

Keterangan

Pertamina Global Bond 2014

PTM 2044

Pertamina Global Bond 2013

PTM 2043

Pertamina Global Bond 2012

PTM 2042

Pertamina Global Bond 2011

PTM 2041

Jumlah Obligasi yang Beredar USD1.500 Miliar/USD1.500 Billion USD1.625 Miliar/ USD1.625 Billion USD1.250 Miliar/USD1.250 Billion USD0.500 Miliar/ USD0.500 Billion Tahun Terbit 2014 2013 2012 2011 Tenor 30 Tahun/30 Years 30 Tahun/30 Years 30 Tahun/30 Years 30 Tahun/30 Years

Tanggal Terbit 30 Mei 2014/30 May 2014 20 Mei 2013/20 May 2013 3 Mei 2012/3 May 2012 27 Mei 2011/27 May 2011 Tanggal Jatuh Tempo 30 Mei 2044/30 May 2014 20 Mei 2043/20 May 2043 3 Mei 2042/3 May 2042 27 Mei 2041/27 May 2041 Harga Penerbitan 100% 100% 98.63% 98.38%

Tabel Peringkat Obligasi Pertamina

Table of Pertamina’s Bond Ratings

Nama Obligasi Bond’s Name

Peringkat (Saat Penerbitan) Ratings (at Issuance)

Pertamina Global Bond 2014 (PTM 2044)

• BB+ Stable Outlook by S&P • BBB- Stable Outlook by Fitch • Baa3 Stable Outlook by Moody’s

Pertamina Global Bond 2013 (PTM 2043)

• BB+ Positive Outlook by S&P • BBB- Stable Outlook by Fitch • Baa3 Stable Outlook by Moody’s

Pertamina Global Bond 2013 (PTM 2023)

• BB+ Positive Outlook by S&P • BBB- Stable Outlook by Fitch • Baa3 Stable Outlook by Moody’s

Pertamina Global Bond 2012 (PTM 2042)

• BB+ Positive Outlook by S&P • BBB- Stable Outlook by Fitch • Baa3 Stable Outlook by Moody’s

Pertamina Global Bond 2012 (PTM 2022)

• BB+ Positive Outlook by S&P • BBB- Stable Outlook by Fitch • Baa3 Stable Outlook by Moody’s

Pertamina Global Bond 2011 (PTM 2041)

• BB+ Positive Outlook by S&P • BBB- Stable Outlook by Fitch • Ba1 Stable Outlook by Moody’s

Pertamina Global Bond 2011 (PTM 2021)

• BB+ Positive Outlook by S&P • BBB- Stable Outlook by Fitch • Ba1 Stable Outlook by Moody’s

Bonds Performance Highlights

Ikhtisar

Kinerja

Obligasi

Analisa dan Pembahasan Manajemen

Management’

s Discussion and Analysis

Tata Kelola Perusahaan

Corporate Gover

nance

Tanggung Jawab Sosial Perusahaan

Corporate Social Responsibility

Laporan Keuangan

Financial Repor

t

Infor

masi Lain-lain

Other Infor

In recent years, Pertamina issued a number of bonds as presented in the table below:

Pertamina Global Bond 2013

PTM 2023

Pertamina Global Bond 2012

PTM 2022

Pertamina Global Bond 2011

PTM 2021

Description

USD1.625 Miliar /

USD1.625 Billion USD1.250 Miliar /USD1.250 Billion USD1.000 Miliar / USD1.000 Billion Amount of Outstanding Bonds

2013 2012 2011 Issuance Year

10 Tahun/10 Years 10 Tahun/10 Years 10 Tahun/10 Years Tenor

20 Mei 2013/

20 May 2013 3 Mei 2012/3 May 2012 23 Mei 2011/23 May 2011 Issuance Date

20 Mei 2023/

20 May 2023 3 Mei 2022/3 May 2022 23 Mei 2021/23 May 2021 Due Date

28

Infobank Digital Brand Award 2015: Tingkat Awareness Publik Masih Besar kepada Pertamina

26 Maret 2015

Pertamina dianugrahi penghargaan tertinggi Brand Award kategori BUMN, di acara penghargaan infobank digital brand award (IDBA) of the year 2015.

Infobank Digital Brand Award 2015: Public Still Has Great Awareness Level to Pertamina

26 March 2015

Pertamina was awarded the top Brand Award of SOE (BUMN), in the ceremony award of Infobank Digital Brand Award (IDBA) of the year 2015.

Anugrah KONI 2015, Bukti Pertamina Konsisten Dukung Olahraga Indonesia

30 Maret 2015

Pertamina menerima penghargaan dari KONI sebagai instansi dengan dedikasi yang konsisten dalam memajukan dunia olahraga Indonesia.

KONI Award 2015, as the Proof of Pertamina which consistently Supports Indonesian Sport

30 March 2015

Pertamina received award from KONI as the institution which has consistent dedication in promoting Indonesian sport world.

Pertamina Boyong

Penghargaan The Best Green Award 2015

4 Juni 2015

Pertamina menerima Indonesia Green Awards pada ajang The La Toi School CSR karena dinilai sebagai perusahan yang mampu melakukan program ramah lingkungan.

Pertamina was recognized with The Best Green Award 2015

4 June 2015

Pertamina received the Indonesia Green Awards in The La Toi School CSR event as a company which was able to conduct environment friendly programme.

Dua Penghargaan Service Excellence untuk Pertamina 500 000

9 April 2015

Contact pertamina 500 000 dinobatkan sebagai Centers Services Excellence dan Email Centers Services Excellence 2015 yang digelar oleh Carre dan Majalah Service Excellence. Two Service Excellence Awards for Pertamina 500 000

9 April 2015

Contact Pertamina 500 000 was awarded as the recognized Centers Services Excellence and Email Centers Services Excellence 2015 which was held by Carre and Excellence Service Magazine.

Pertamina Kembali Raih IMAC 2015

15 April 2015

Pertamina dianugrahi sebagai Indonesia Most Admired Companies 2015 di Hotel Le Meridien Jakarta. Pertamina Achieved IMAC 2015 Again

15 April 2015

Pertamina was awarded as the Indonesia Most Admired Companies 2015 at Hotel Le Meridien Jakarta

05 06 07 08

2015 Awards

Penghargaan

2015

KOMET Pertamina Kembali Go International

13 - 15 Januari 2015

Prestasi membanggakan tersebut diraih Pertamina pada perhelatan 2014 MAKE Award Presentation Ceremony, yang diselenggarakan 13-15 Januari 2015 di Hongkong. Dua puluh lembaga serta perusahaan di berbagai negara di Asia didaulat menerima trophy penghargaan sebagai “The Winner of 2014 Asian MAKE Award”

KOMET Pertamina is Go International Again

13 - 15 January 2015

The remarkable achievement was achieved by Pertamina in the event of 2014 MAKE Award Presentation Ceremony, which was held on 13-15 January 2013-15 in Hong Kong. Twenty institutions and companies from various countries in Asia were recognized to receive award trophies as “The Winner of 2014 Asian MAKE Award”.

PGE Raih Tiga Penghargaan CSR Awards 2015

17 Maret 2015

Untuk pertama kalinya di Indonesia, institusi pendidikan secara independen memberikan penghargaan kepada para pelaku usaha yang menjalankan tanggung jawab sosial atau CSR sesuai dengan pedoman ISO 26000. Penghargaan CECT CSR Awards ini diberikan oleh Center for Entrepreneurship, Change and Third Sector

PGE Awarded by Three CSR Awards 2015

17 March 2015

For the irst time in Indonesia, education institution was independently awarded to business players who conduct social responsibility or CSR programme in accordance with ISO 26000 guidance. Recognition of this CECT CSR Awards given by Center for Entrepreneurship, Change and Third Sector.

Best Community Programme Award untuk RU V Balikpapan

19 - 20 Maret 2015

Reinery Unit V Balikpapan kembali meraih prestasi dalam ajang penghargaan Corporate Social Responsibility (CSR) prestisius tingkat internasional: The Global CSR Summit and Awards 2015.

Best Community Programme Award for RU V Balikpapan

19 - 20 March 2015

Reinery Unit V Balikpapan again got another the achievement of the prestigious International Level of Corporate Social Responsibility (CSR) award: The Global CSR Summit and Awards 2015.

Analisa dan Pembahasan Manajemen

Management’

s Discussion and Analysis

Tata Kelola Perusahaan

Corporate Gover

nance

Tanggung Jawab Sosial Perusahaan

Corporate Social Responsibility

Laporan Keuangan Financial Repor t Infor masi Lain-lain Other Infor

Contact Pertamina Raih 2 Peringkat Gold

4 Juni 2015

Contact Pertamina 500 000 berhasil meraih dua Peringkat Gold dalam ajang The Best Contact Center Indonesia (TBCCI) 2015.

Contact Pertamina Achieved 2 Gold Ranks

4 June 2015

Contact Pertamina 500 000 succeed in achieving two Gold Ranks in The Best Contact Center Indonesia (TBCCI) 2015

Pertamina Mempertahankan Predikat Perusahaan Paling Dikagumi

10 Juni 2015

Pertamina berhasil meraih 3 penghargaan prestisius dalam Corporate Image Award 2015 untuk kategori Lubricant, Oil & Gas, dan Gas Station. Penghargaan ini merupakan rangkaian dari IMAC Award yang diselenggarakan oleh Frontier Consulting Group dan Tempo Group.

Pertamina Kept the Predicate as the Most Admired Company

10 June 2015

Pertamina has succeeded to achieve 3 prestigious awards in Corporate Image Award 2015 for the category of Lubricant, Oil & Gas, and Gas Station. This award was a series of IMAC Award which was held by Frontier Consulting Group and Tempo Group.

Pertamina Raih The Best Choice di Autocar Reader’s Choice Award

10 Juni 2015

Pertamina mendapat penghargaan The Best Choice dalam Autocar Reader’s Choice Awards (ARCA).

Pertamina Achieved The Best Choice in Autocar Reader’s Choice Award

10 June 2015

Pertamina was recognized as The Best Choice in Autocar Reader’s Choice Awards (ARCA)

Pertamina Borong

Penghargaan di Ajang GPMB Award 2015

29 Juli 2015

Pertamina menerima 10 penghargaan GPMB 2015 yang diberikan oleh Corporate Forum for Community Development, bekerja sama dengan Kementerian Koordinator bidang Pembangunan Manusia dan Kebudayaan RI. Pertamina Obtained Various Awards in GPMB Award 2015

29 July 2015

Pertamina received 10 of the GPMB 2015 awards granted by Corporate Forum for Community Development, in cooperation with the Coordinating Ministry of Human and Culture Development of the Republic of Indonesia.

Pertamina Raih Stand Terbaik di GPMB Expo 2015

2 Agustus 2015

Stand Pertamina dinobatkan menjadi stand terbaik di ajang Gelar Pemberdayaan Masyarakat Berbasis Budaya Expo & Award 2015.

Pertamina Achieved the Best Stand at GPMB Expo 2015

2 August 2015

The Pertamina Stand was recognized as the best stand in an event titled Culture-based Society Empowerment Expo & Award 2015.

Pertamina Raih CSR Award Sindo 2015

6 Agustus 2015

Pertamina meraih penghargaan CSR Award Sindo 2015 untuk kategori Overall Excelence. Pertamina EP, Pada kesempatan yang sama. Juga mendapatkan penghargaan sebagai The Best Enviromental Excellence. Penilaian dilakukan berdasarkan hasil evaluasi serta