LAMPIRAN A

Daftar Populasi dan Sampel Perusahaan Pertambangan Batubara Periode

2011-2013

LAMPIRAN B

DATA FIRM SIZE

LAMPIRAN C

DATA

EARNING PER SHARE

No

Kode

Nama Perusahaan

Tahun Penelitian Sampel

2011

2012

2013

13 ITMG Indo Tambangraya Megah Tbk. 4352,64 3674,60 2437,80

14 KKGI Resources Alam Indonesia Tbk. 450,00 232,08 219,00

LAMPIRAN D

DATA

BOOK TO MARKET RATIO

No

Kode

Nama Perusahaan

Tahun Penelitian Sampel

2011

2012

2013

16 PKPK Perdana Karya Perkasa Tbk.

LAMPIRAN E

DATA

DIVIDEND PAYOUT RATIO

LAMPIRAN F

DATA

RETURN

SAHAM

No

Kode

Nama Perusahaan

Tahun Penelitian Sampel

2011

2012

2013

13 ITMG Indo Tambangraya Megah Tbk. -12100,00 2900,00 -13050,00

14 KKGI Resources Alam Indonesia Tbk. 2750,00 -3975,00 -425,00

15 MYOH Samindo Resources Tbk. 990,00 -550,00 -350,00

16 PKPK Perdana Karya Perkasa Tbk.

LAMPIRAN G

HASIL PENGOLAHAN DATA

Statistik Dekriptif

FirmSize EPS BtM DPR Return

Mean Statistic 12.4735 302.1988 6.7030 .2353 -850.0702

Std. Error .12353 111.50032 1.17417 .05993 419.94791 Std.

Deviation

Statistic .93261 841.80899 8.86479 .45244 3170.53723

Variance Statistic .870 708642.373 78.584 .205 1.005E7

Skewness Statistic -.795 3.557 2.587 2.971 -1.953

Std. Error .316 .316 .316 .316 .316

Kurtosis Statistic .501 13.554 8.743 11.402 6.637

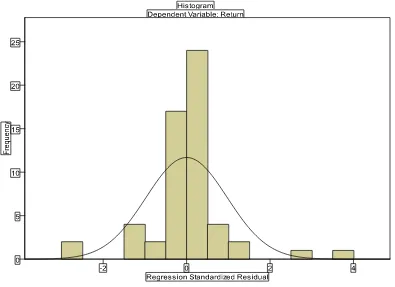

Grafik Histogram Sebelum Transformasi

Normal P-Plot Sebelum Transformasi

One Sample Kolmogorov Smirnov Test sebelum Transformasi

One-Sample Kolmogorov-Smirnov Test

Unstandardized Residual

N 57

Normal Parametersa,b Mean .0000000

Std. Deviation 2.70162815E3

Most Extreme Differences Absolute .217

Positive .217

Negative -.177

Kolmogorov-Smirnov Z 1.640

Asymp. Sig. (2-tailed) .009

a. Test distribution is Normal. b. Calculated from data.

One Sample Kolmogorov Smirnov Test setelah Transformasi

One-Sample Kolmogorov-Smirnov Test

Unstandardized Residual

N 11

Normal Parametersa,b Mean .0000000

Std. Deviation 19.40802211

Most Extreme Differences Absolute .153

Positive .153

Negative -.087

Kolmogorov-Smirnov Z .506

Asymp. Sig. (2-tailed) .960

Hasil Pengujian Multikolinearitas

Coefficientsa

Model Unstandardized

Coefficients

1 (Constant

)

1046.071 482.047 2.170 .067

FST -292.076 140.016 -.759 -2.086 .075 .498 2.008

EPST 2.013 .744 1.181 2.705 .030 .346 2.894

BtMT -8.836 10.343 -.324 -.854 .421 .457 2.188

Diagram Scatterplot Sebelum Transformasi

Hasil Uji Durbin-Watson Sebelum Transformasi

Model Summaryb

Model

R R Square

Adjusted R Square

Std. Error of the Estimate

Durbin-Watson

1 .523a .274 .233 2777.03691 2.153

a. Predictors: (Constant), BtM, FirmSize, EPS b. Dependent Variable: Return

Hasil Uji Durbin-Watson Setelah Transformasi

Model Summaryb Model

R R Square

Adjusted R Square

Std. Error of the

Estimate Durbin-Watson

dimension0 1 .734

a .539 .341 23.19702 1.723

Uji Koefisien Determinasi

Hasil Uji F

ANOVAb

Model Sum of Squares df Mean Square F Sig.

1 Regression 4397.329 3 1465.776 2.724 .124a

Residual 3766.713 7 538.102

Total 8164.042 10

a. Predictors: (Constant), BtMT, FST, EPST b. Dependent Variable: ReturnT

Hasil Uji t

Coefficientsa Model

Unstandardized Coefficients

Standardized

a. Dependent Variable: ReturnT

Model Summaryb Model

R R Square

Adjusted R Square

Std. Error of the Estimate dimension0 1 .734

a .539 .341 23.19702

Hasil Uji Residual

Coefficientsa Model

Unstandardized Coefficients

Standardized