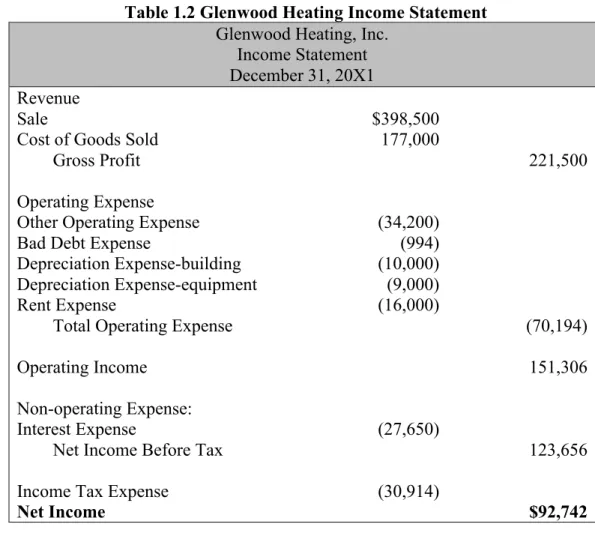

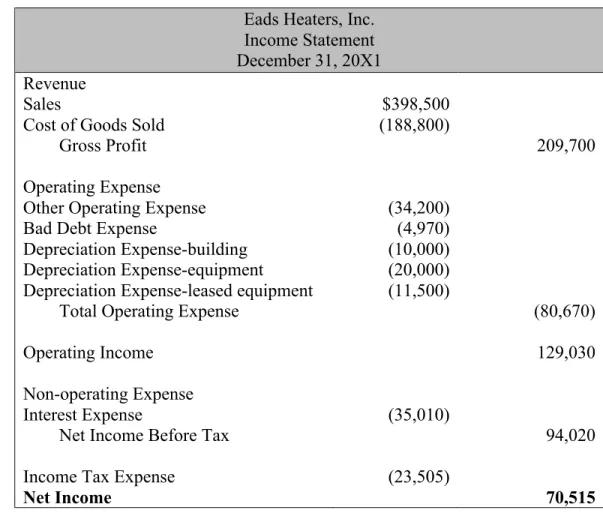

This is one of the main reasons why their income statements are not the same. However, this does not mean that Glenwood will always have a higher net income than Eads overtime, but for the first year of operation the prices of the goods were lower at the beginning of the period and higher at the end of the period, allowing Glenwood and lower costs of goods sold.

Molson Coors Brewing Company

-operating section: Second part of the income statement that reports income and expenses as a result of the company's secondary activities. Income Taxes: The third part of the income statement that reports federal and state taxes imposed on the company's income from continuing operations.

Pearson plc

Provision for bad and doubtful debts is a balance sheet account -Receivables is a balance sheet account. Prepare the journal entries to record account sales and collection activity for debtors on this account during the year.

Aero Company

In this problem, we have been given information about a company, and from this information we should construct a statement of cash flows and a balance sheet. I posted the limited information we got at the beginning, followed by two statements I created, along with an explanation and a key to the calculations. You can choose to do it however you like, but I find it easier to list them all, record them on my line, and then add or subtract net income.

There was an increase of $20,800 in accounts receivable using the 2016 and 2017 year-end numbers found in the introduction. Adding the depreciation expense, loss on sale of equipment, change in accounts payable, and subtracting the change in accounts receivable gives a total of $6,200 to add to net income. We have a net total of $20,000 in funding activity, which we will combine with other totals.

Adding them together gives us a total of $50,200 for a net increase in money over the period.

Palfinger AG

Because of Palfinger's size, they have considerable property, plant and equipment (PPE). In this case, I outlined and explained a number of scenarios related to Palfinger's property, plant and equipment and how this is reflected in the company's financial statements. This can be found in the notes to the financial statements under "accumulated depreciation and impairment".

We calculated this figure by subtracting the accumulated depreciation from the cost of the PPE. What is the total income statement impact of the equipment for the two years Palfinger owned it. This is because the net worth of the PPE would be less than the amount it was sold for.

Compare the total two-year impact of the equipment on the income statement under the two depreciation policies.

Volvo Group

The case focuses on the intangible assets of the company's financial statements, mainly in the software and development part of the assets. I found this somewhat surprising because I thought the International Rule would help non-US companies to be able to amortize some development costs if they could prove the slightest future economic benefit of the find. In research and development expenses, you will probably find a lot of research spending on making greener cars and trucks and also spending on developing greener parts for vehicles.

If the expense occurred during the development stage of a new product and Volvo can benefit economically in the future, then that expense can. Volvo will first need to consider the useful life of the R&D costs per period, just as in the EAT accounts. In the IFRS case, they allow companies to capitalize on some development costs, which if the companies can precisely state that these costs will be beneficial for the future, they can capitalize.

GAAP which requires all research and development costs to be expensed in the year they are incurred.

Tableau

This was the easiest part because over the course of my research I was impressed with how many factors Tableau has and how useful they were to a business and an accountant. This will also improve the client-accountant relationship as Tableau will reduce time for certain parts of the system. Overall, I learned and highlighted the benefits of Tableau software for the accounting profession.

When Tableau was founded, the main goal of the software was to make data understandable to everyone. One of the main benefits of Tableau for auditing is that it is very user-friendly, which means that clients will understand the software and will not need a long learning period. Tableau can also tell a tax consultant and clients where the tax amount will go.

This can be beneficial if the company wants to cut their budget and can show which areas of the company accumulate more tax than others and could potentially reduce costs with this.

Rite Aid

Speculate why Rite Aid has many different types of debt with different interest rates. There are two main reasons why Rite Aid would have different types of debt and different rates. It's obvious because the book value of the note doesn't change from year to year in Rite Aid's financial statements.

Prepare the journal entry that Rite Aid must have made when these notes were issued. Determine the total amount of interest expense recorded by Rite Aid on these notes for the year ended February 27, 2010. Assume that Rite Aid uses the effective interest method to account for this debt.

Based on the above information, prepare the journal entry that Rite Aid would have recorded on February 27, 2010, to accrue interest expense on these notes.

Merck & Co., Inc

Common shares are usually issued by a company to raise capital, which the issuing of these shares, investors also receive voting rights on a board of directors that can determine how the company should do business. We also calculated how many dividends payable the company has based on the dividends declared and how much cash was issued for the dividends. It also shows that the company is doing well and can afford to return dividends to investors.

This is a normal occurrence because the way the share price is calculated is affected when the company relieves itself of some liquid assets. When a company issues shares, they usually come with a voting power for the company and how it should be run. If the company buys back certain shares, they may gain more control and a majority in the voting process and may be less reliable in relation to investors' opinions.

This will help the company keep track of how much it has spent on the shares and if and when it issues them back, it will also be useful to see how much they gain or lose from this refund.

State Street Corporation

If the market value of available-for-sale securities increased by $1 during the reporting period, what journal entry would the company record. A company would debit available-for-sale investment security for $1 and credit unrealized gain/loss equity for $1. Consider the balance sheet account “Investment securities available for sale” and the related disclosures in Note 4.

What is the amount of net unrealized gains or losses on the available-for-sale securities held by State Street on December 31, 2012. What was the amount of net realized gains (losses) from sales of available-for-sale securities for 2012 Show the journal entry that State Street made to record the purchase of available-for-sale securities for 2012.

Show the journal entry State Street made to record the sale of available-for-sale securities for 2012.

ZAGG Inc

In this case our main objective was to investigate the income tax expenses and deferred accounts of ZAGG. You calculate the amount by dividing the amount of income tax paid by the taxable income. Explain in general terms why a company reports deferred income taxes as part of total income tax expense.

Depending on the circumstances, this can increase or decrease the income tax expense depending on whether a company will recognize more deferred tax assets or deferred tax liabilities. Deferred income tax valuation allowance is a balance sheet item that offsets a portion of a value of a company's deferred tax asset. Using the information in the third table in Note 8, decompose the amount of “net deferred income tax” recorded in the income tax journal entry in part f.

As indicated earlier, the effective income tax rate may deviate from the statutory rate.

Apple, Inc

In this case, we focus on the revenue recognition principle that a company must follow. After deciphering the difference between the two, we looked at the ASC 606 statement that FASB and IASB released a joint statement on the revenue recognition principle. Although Apple is the seller, they will account for it differently based on the elements of the contract, when the item will be received and if a third party is also in the equation.

Specific accounts related to revenue recognition would be accounts receivable and specific revenues would be credited. Do they appear to be consistent with the revenue recognition criteria you described in part b above? What are multi-element contracts and why do they pose revenue recognition problems for companies?

The sales prices paid by the customer are sent by Apple to the third party and are not part of Apple's revenue.