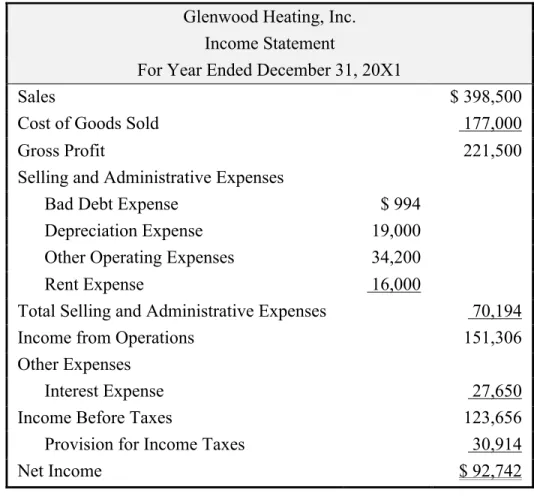

After analyzing the financial statements and reports of the two companies, investors may initially lean towards Glenwood Heating, Inc. Direct answers to the case questions can be found in Appendix 2, following this summary.

Case Questions and Answers Concepts

Molson Coors reports sales and net sales to show the effect of excise taxes imposed on their sales revenue. What is the difference between "Other income (expenses), net," which is classified as a nonoperating expense, and "Special items, net," which Molson Coors classifies as an operating expense.

Case Questions and Answers Concepts

The correction of the value of doubtful liabilities is included in the business part of the income statement. Adjustments to the value of sales revenue and corrections will be in the income statement in the business section under sales revenue.

Exerpts from Interest Tables

To analyze a company's property, plant and equipment (PPE) account, the user must be aware of the type of company. This is important because account material varies from industry to industry and even between companies in the same industry. In this case, users explore what is included in the PPE account of Palfinger AG.

The first set concerns the general concepts and the second focuses on the process of recording these assets and their respective costs. The complete list of questions and answers can be found in Appendix 5: Case Questions and Answers, following this summary. The company will include PPE, which will be able to fit their operation as a company that manufactures various large products; including hydraulic equipment, several types of cranes and other construction solutions.

Palfinger's operations, we can assume that they will register large warehouse and construction yard properties and facilities to manufacture and store their products. For their equipment, we can assume that this account will include large and heavy machinery used in the production process for the type of products they offer. The second set of questions first considers property, plant and equipment calculations, particularly depreciation, grants and disposals.

Case Questions and Answers Concepts

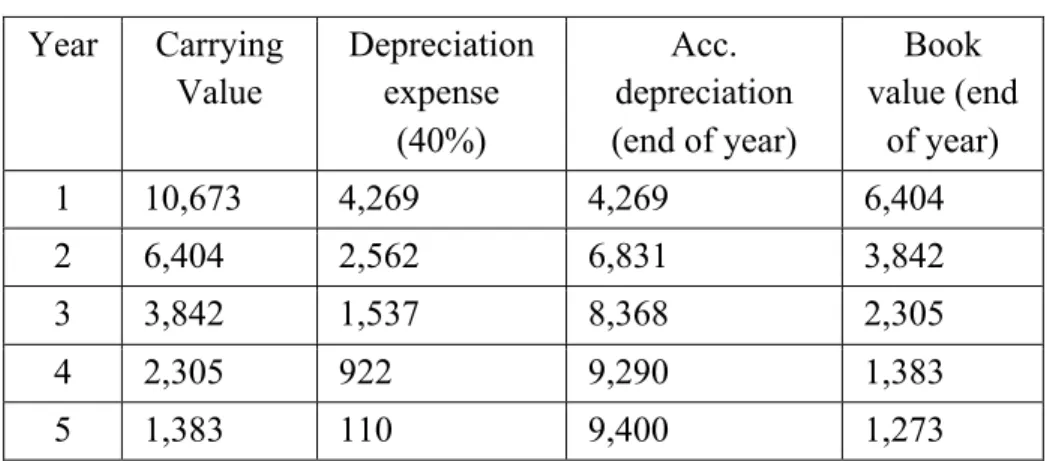

Seen in the notes to the financial statements, the useful life expectancy is 8-50 years for buildings, 3-15 years for plant and machinery, and 3-10 years for fixtures, fittings and equipment. They are deducted from the carrying value of the EAT account to recognize the fair value of the asset. Palfinger would realize a profit of €154 as the book value of the assets sold equaled €1,501 and they received €1,655 for the assets.

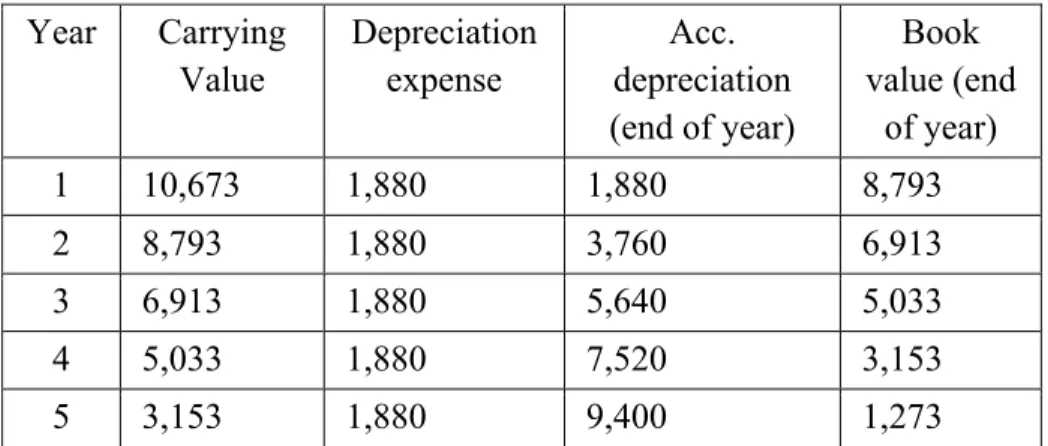

What is the total impact of the equipment on the income statement for the two years that Palfinger owned it. Consider the gain or loss on disposal as well as the total depreciation recorded on the equipment (ie the amount from Part I.ii.). Compare the total two-year impact of the equipment on the income statement under both depreciation policies.

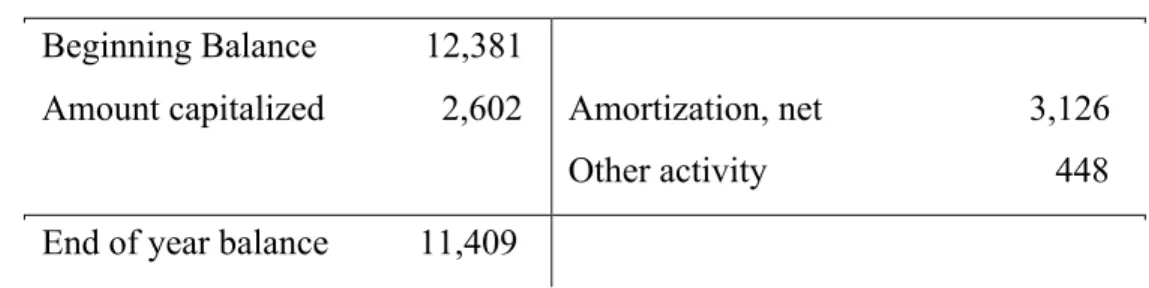

The reason it is equal is because essentially the impact on the income statement is the cost of the asset (€10,673) minus the amount received for the sale (€7,500). This case analyzes the financial statements of Volvo Group, specifically the effect of the research and development (R&D) activities. Descriptions of the R&D activities are provided in an IAS 38 extract attached in the case.

Case Questions and Answers Concepts

Journalists seem to be a large portion of Fusion Tables users because of this mapping feature. Google Fusion Tables helps auditors ensure the completeness, existence, and valuation of a client's financial reports. Tax planning is the next part of the case that will illustrate how Fusion Tables can help in a business environment.

Tax accountants can certainly benefit from the same Fusion Tables tools discussed in the audit examples. Fusion Tables helps advisors present, share and store up-to-date data on these industry regulations. The advisory team can simply add a column in Fusion Tables showing the locations or boundaries of the scheme and then add a map.

To ensure that a client can easily understand the data and the consultant's solution, the visualization tool in Fusion Tables will be helpful. Fusion Tables also allows users to create business cards and publish current data and images to other websites. Tax accountants will want to implement Fusion Tables because it allows for the consolidation of data from multiple sources.

Case Questions and Answers Concepts

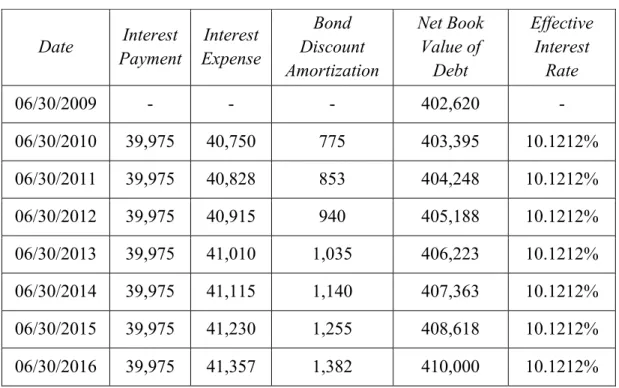

Prepare the journal entry Rite Aid should have made when these notes were issued. Determine the total amount of interest expense recorded by Rite Aid on these notes for the year ended February 27, 2010. Note that there is a cash and noncash portion of the interest expense on these notes because they were issued at a discount.

The non-cash portion of interest expense is the amortization of the discount during the year. Consider both the cash and discounted (non-cash) portions of the interest expense from part iii above. To calculate the effective interest rate, simply divide the interest expense by the carrying value.

Assume that Rite Aid issued these notes on June 30, 2009, and that the company pays interest on June 30 of each year. Based on the above information, prepare the journal entry that Rite Aid would have recorded on February 27, 2010, to calculate interest expense on these notes. The sum of these amounts equals the interest expense for the eight months between June and February.

Case Questions and Answers Concepts

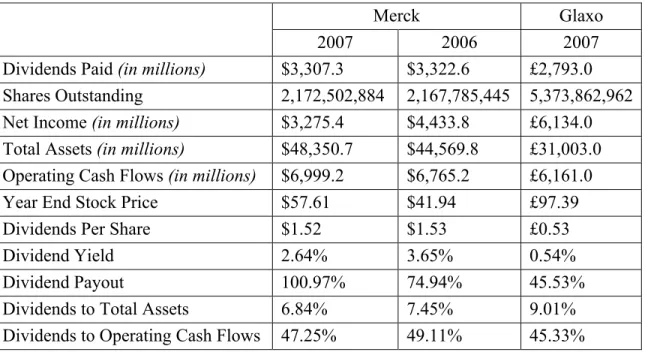

It is listed as one of the five common reasons why corporations buy back their own stock. The debit to retained earnings ($3,310.7 million) was found in Merck's statement of retained earnings, listed as dividends declared on common stock. Next, the cash amount ($3,307.3 million) is found in the Statement of Cash Flows, listed as Dividends paid to shareholders.

Finally, dividends payable ($3.4 million) is found by calculating the difference between retained earnings and cash amounts. It would be inappropriate for Merck, or any company, to classify treasury stock as an asset. The financial statements of State Street Corporation will be used in this case for a better understanding and analysis of marketable securities.

However, this case demonstrates how the different types of securities are accounted for differently and their effect on the financial statements. Then the second part applies our understanding of the investments to State Street's financial statements. This is where we see the different valuation methods used and the holding gains and losses from the investments.

Case Questions and Answers Concepts

The name “available for sale” describes their function, which is fulfilled until management decides to sell them. If the market value of the securities available for sale increased by $1 during the reporting period, what journal entry would the company record? Consider the balance sheet account 'Investment securities held to maturity' and the related notes in Note 4.

Note the balance sheet account “Available-for-sale investment securities” and the related disclosures in note 4. This statement represents the market value of the securities as they are available for sale and indicates that they are shown at fair value in the notes. What is the amount of net unrealized gains or losses on available-for-sale securities held by State Street as of December 31, 2012.

What was the amount of net realized gains (losses) on the sale of available-for-sale securities for 2012. Show the journal entry that State Street made to record the purchase of available-for-sale securities for 2012. Show State Street's journal entry to record the sale of available-for-sale securities for 2012.

Case Questions and Answers Concepts

A deferred tax asset reflects a future deductible amount caused by a temporary difference where the taxable income will be less than the book income. Meanwhile, a deferred tax liability represents a future taxable amount caused by a temporary difference where the taxable income will be higher than the book income. A deferred tax liability may arise from the accounting of accounts receivable from income that has been recognized for book purposes.

In short, when taxable income does not equal book income, a deferred tax asset or liability is credited or debited to the income tax journal entry. By adding this line to the entry, the company increases or decreases the income taxes payable, calling it a deferred tax asset or liability. After the amount of deferred tax has been recorded for the future periods to accumulate the temporary difference, the accounting result will equal the taxable income and the difference will then be reversed.

Because deferred tax assets and liabilities are reported on the income statement, they can provide users with useful future tax information. If a company has a deferred tax asset that is unlikely to be realized, the account must be reduced by a contra account (allowance to reduce deferred tax asset to expected realizable value). The deferred tax asset in the journal entry above is found by the net effect of the deferred tax asset with the deferred tax liability.

Case Questions and Answers Concepts

Does it seem to match the revenue recognition criteria you described in part b above? The new revenue standards are not expected to have a material impact on the amount and timing of revenue recognized in the company's consolidated financial statements.” What are multiple element contracts and why do they present revenue recognition problems for companies.

This amount is then included in net sales on the financial statements, and the sales price determined by the third party is not included in the financial statements. However, the new revenue recognition standard takes into account the principal-agent relationship and indicators to determine the entity's role in the transaction. As noted in the previous answer, the standard provides five indicators on when to recognize revenue.

Similar to iTunes tracks, the new revenue recognition standard considers principal-agent relationships when a third party is involved. This update changes how Apple recognizes revenue in the intended case and can be found in section 606-10-25 of the new standard. Apple discloses in Note 1 of the case that revenue from gift cards is recorded as deferred until the customer redeems the gift card.