Oki Farhadinata, SE as Supervisor of Apprenticeship Training at Badan Pendangan Daerah (BAPENDA) in Bengkalis Regency within Rural and Urban Areas and Building Tax Technical Implementation Units. All the staff of Badan Pendanta Daerah (BAPENDA) in Bengkalis Regency within Rural and Urban and Building Tax Technical Implementation Units who already provide the author with guidance and lots of experience while he was in training. All lecturers and staff at the Statens Polytekniske Læreanstalt in Bengkalis who have collaborated in the lecture process for the preparation of this apprentice report.

During his apprenticeship at Badan Pendapatan Daerah (BAPENDA) in Bengkalis region, the author gained many lessons and knowledge from the office staff.

INTRODUCTION

Background of the Apprenticeship

To prepare the student to be ready for use in this field, the International Business Administration Study Program requires students to participate in the apprenticeship both in government agencies and private agencies for 4 (four) months. The International Business Administration Study Program hopes that the students with the apprenticeship can know what the real business world is like and can add insight to each student to become more skilled, responsive and able to compete and be effective in the future. Based on the above, the author, as a student of the International Business Administration Study Program, chose to do the apprenticeship at the Badan Pendanta Daerah (BAPENDA) in Bengkalis Regency.

During his apprenticeship, the author was placed in the Technical Implementation Unit for Rural and Urban Land and Building Taxes.

Purposes of the Apprenticeship

D4-International Business Administration Study Program is engaged in Economics and Business, where students learn about the business world, along with its purpose, both in terms of handling papers, administration, management, finance, human resources, towards the corporate world. Every student who has completed the internship is required to make a work report during the internship so that the students are responsible for the result obtained from these activities. To find the obstacle and solutions during the implementation of the practice in Badan Pendanta Daerah (BAPENDA) of Bengkalis Regency.

Significances of the Apprenticeship

- Significances for Student

- Significances for State Polytechnic of Bengkalis

- Significances for the Company

GENERAL DESCRIPTION OF THE COMPANY

- Company Profile

- Vision and Mission

- Vision of Badan Pendapatan Daerah (BAPENDA) of Bengkalis

- Mission of Badan Pendapatan Daerah (BAPENDA) of Bengkalis

- Kind of Business

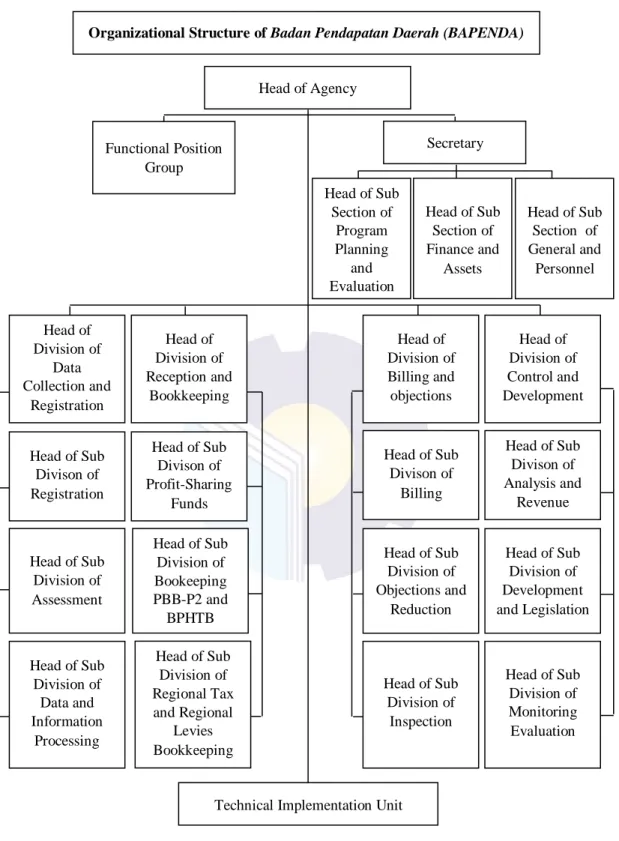

- Organizational Structure

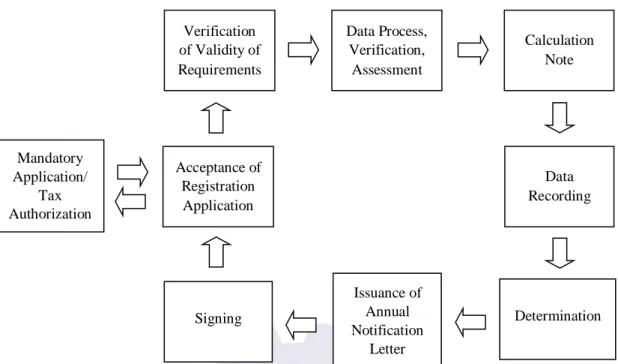

- The Working Process

- Document Used for Activity

The vision of the Badan Pendapatan Daerah (BAPENDA) of Bengkalis Regency is "the realization of reliable and responsible regional revenue management". 12 Each working position in the organizational structure of the Badan Pendapatan Daerah (BAPENDA) of Bengkalis Regency has duties and functions to achieve organizational goals. The head of the agency is responsible for directing, coordinating and supervising the implementation of regional autonomy in the field of regional tax collection in accordance with the provisions of the legislation.

The secretary has the task of assisting and being responsible to the head of the agency in carrying out the secretarial management of the agency. The general personnel sub-department has the task of assisting the secretary in managing the households, administration and staffing of the agency. Data Collection and Registration has the task of assisting the head of the agency in the formulation and implementation of policies, evaluation and reporting of data collection and registration, assessment and processing of regional tax data.

The data and information processing sub-sector is tasked with assisting the head of the sector in formulating and implementing policies and technical guidelines in the field of data and information processing. The Billing and Objections Division is tasked with assisting the agency head in formulating and implementing policies, evaluating and reporting on collection, objections and regional revenue control. 19 The billing sub-department is tasked with assisting the head of the sector in preparing materials for policy formulation and implementation, assessment and reporting on local tax collection.

The objections and reductions sub-department is tasked with assisting the head of the department in preparing materials for policy formulation and implementation, evaluating and reporting on the settlement of regional tax objections. The audit subsector has the task of assisting the head of the sector in the formulation and implementation of policies and technical guidelines in the field of inspection. The Evaluation Monitoring Sub-Department is tasked with assisting the Head of Sector in formulating and implementing policies and technical guidelines in the field of evaluation monitoring.

The Technical Implementation Unit is tasked with carrying out technical operational activities of the agency in the area of revenue services.

SCOPE OF THE APPRENTICESHIP

Job Description

Place of Apprenticeship

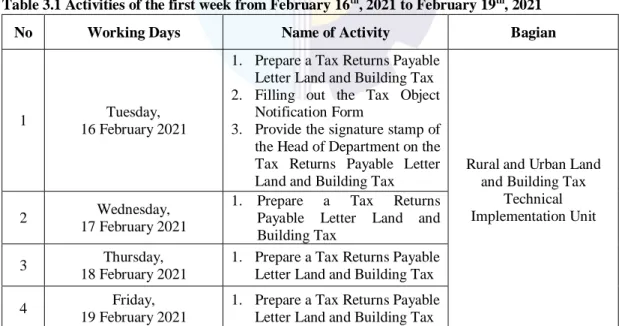

During the practical work, the author was placed in the subdivision of land and building tax in rural and urban areas. Practical work activities are carried out for approximately 4 (four) months, starting from February 15, 2021 to June 30, 2021.

Kind and Description of the Activity

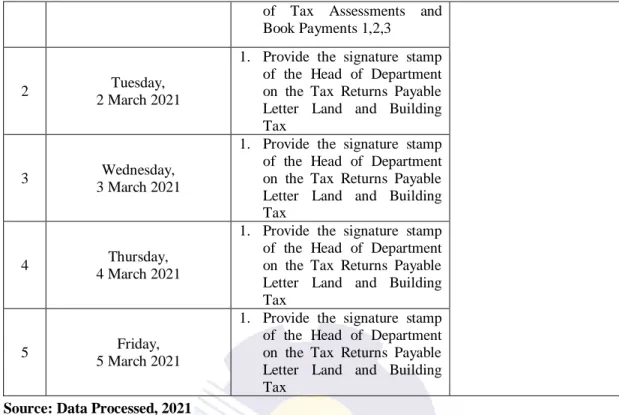

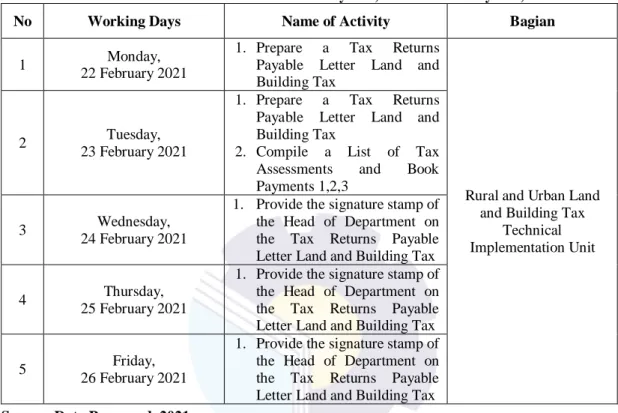

Enter the department manager's signature stamp on the tax declaration letter Land and building tax. Enter the department manager's signature stamp on the land and building tax return letter Source: Databehandlet, 2021. Enter the department manager's signature stamp on the land and building tax return letter 2.

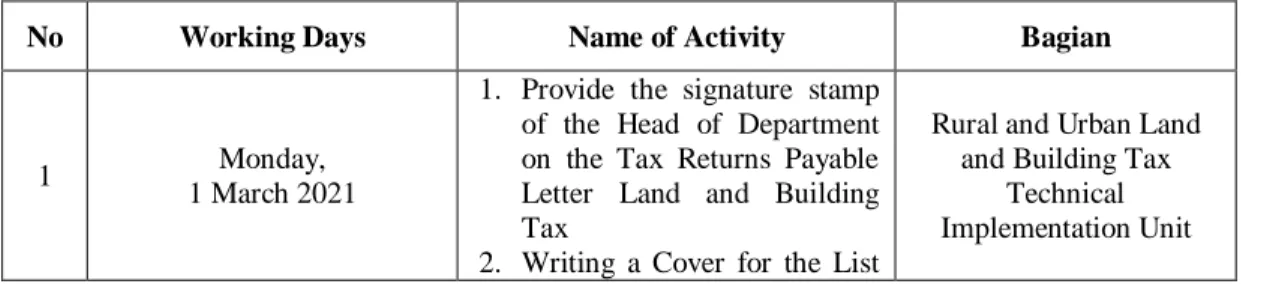

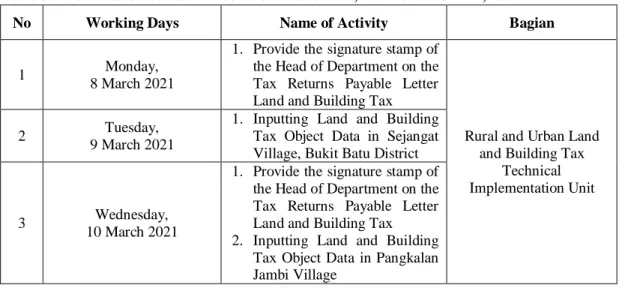

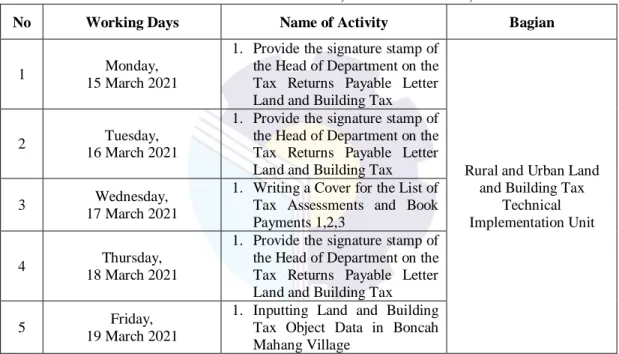

This week, the author was tasked with stamping the signature of the head of the department on the land and construction tax return letter prepared by district court, and entering land and construction tax object data in Sejangat Village, Bukit Batu District and tax object data Pangkalan Jambi Village. This week, the author was instructed to sign the Head of Department's signature on the Land and Building Tax Declaration Letter drawn up per subdistrict court, to write the cover for the List of assessments and book payments 1, 2,3, and to enter land and construction tax object data in Boncah Mahang Village. This week the author was tasked with entering property data for land and construction taxation for PT.

This week, the writer was given the task of stamping the signature of the Head of Department on the Tax Return Payable Letter Land and Building Tax compiled by entering the sub-district, land and building tax object data in Talang Mandi Village. This week the writer was tasked with entering land and building tax object data in Tanjung Kapal Village. This week the author was tasked to enter data mutation of land and building tax objects in Rupat Village.

Make a copy of the Invoice Letter for Land and Construction Tax Details for Telkomsel Bengkalis Regency 2020. This week, the author was instructed to make a copy of the Invoice Letter for Land and Construction Tax Details for Telkomsel Bengkalis Regency 2020, and create data Contact person PT.

System and Procedures

- The Working System

- Working Procedures

The purpose of land and building tax is land and buildings in urban and rural areas. If in the taxpayer data and the tax object there is a building, click record LSPOP available on the page. The last step in completing the service is to enter the identity of the taxpayer and the tax object according to the available data.

Complete the tax object notification letter (for changes in land data) and attachments to the tax object notification letter (for changes in building data). Attach a photo of the taxable object to reveal the original condition of the taxable object. Then go back to the previous page, select service completion and enter the specified service number in the given column and click process.

44 6) Wait for the table containing the tax object number to appear, if .. is displayed, you can enter the data according to the information of the taxpayer and the tax object that has been determined by successively clicking on the available tax object number and then clicking record SPOP and enter the form number. If there is a building in the data on the taxpayer and the tax object, then click on the LSPOP record available on the page. If all identities are entered and data has been entered, click Assign Mutation Tax Object Number at the bottom of the page.

The list of collections of tax assessments is a list of sets containing information on the name of the taxpayer, the location of the tax object, the number of the tax object and the amount of taxes paid by village. The list of tax assessment series that was printed will be arranged in the order of books 1, 2, 3 and will be given a cover and written by hand according to the sub-districts in Bengkalis Regency.

Obstacles and Solutions of Apprenticeship

- Obstacles

- Solutions

When a failure occurs on the SISMIOP server, interns must provide information to other staff in the office to restart the server to be used. When printing documents or data, the printer in the room is often damaged, so trainees must use other employee printers. When paper is not available in the process of printing documents or data, interns must provide information to employees to provide paper that will be used to print documents or data.

Students ask other staff who have experience in using SISMIOP server so that students can learn and know more about SISMIOP server. Provide the department head's signature stamp on the tax return payable letter. Design and write the cover of the List of Tax Assessments and Payments for Books 1,2,3.

The practical work program is carried out at the Badan Pendapatan Daerah (BAPENDA) or Regional Revenue Agency of Bengkalis Regency, precisely in the Rural and Urban Land and Building Tax Technical Implementation Unit. The practical work program is carried out for approximately 4 (four) months from 15 February 2021 to 30 July 2021. All these systems make it easier to do work on the part of the Rural and Urban Land and Building Tax Technical Implementation Unit.

During the implementation of the practical works, some obstacles have occurred, namely the frequent occurrence of errors in the SISMIOP server, damage to the printer engine, and misunderstanding in the use of the SISMIOP server.

CONCLUSION AND SUGGESTION

Conclusion

Suggestion

Apprenticeship Reply Letter

Apprenticeship Placement Letter

Apprenticeship Statement Letter

Apprenticeship Assessment Sheet

Apprenticeship Certificate

Apprenticeship Revision List

List of Apprenticeship Attendance Sheet

Daily Activities of Apprenticeship

Photo with Employees of Technical Implementation Unit PBB-P2