The primary objective of capital structure management is to maximize the total value of the company's outstanding debt and equity. The debt ratio is equal to the ratio of the company's total liabilities to its total assets.

Violations of Assumption 2

Indeed, there may be negative consequences for firms that choose an inappropriate capital structure, meaning that in effect at least one of the two M&M assumptions is violated.

Violations of Assumption 1

The cost of equity and the weighted average cost of capital with tax-deductible interest expense. This in turn means that the value of the firm increases with the use of debt financing and correspondingly that the firm's weighted average cost of capital decreases.

The Tradeoff Theory and the Optimal Capital Structure

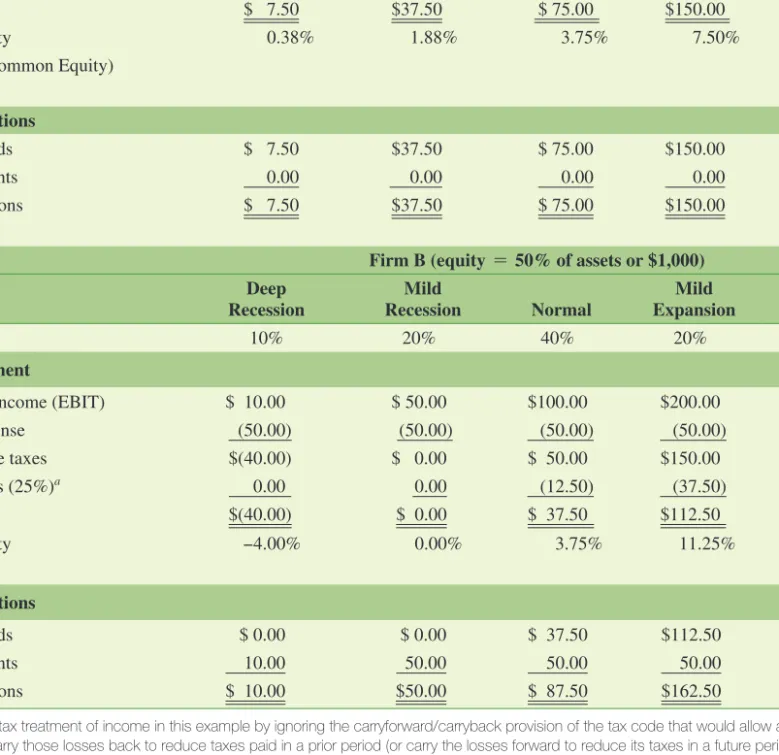

In both a mild and a deep recession, Company B will be subject to what economists call deadweight costs, which reduce the total amount of cash flows that the company can distribute to its debt and equity owners. With debt financing, the company is contractually obligated to pay interest and principal to the lender in accordance with the terms of the debt agreement (bond payment). As a result, the probability that the firm will default on its debt obligations increases as the firm increases the proportion of its capital structure that consists of debt financing.

Capital Structure Decisions and Agency Costs

The firm first relies on internal sources of financing, or the retention of the firm's earnings. At point A, the real market value of the leveraged firm is maximized, and the firm's weighted average cost of capital is at a minimum. In this last scenario, the optimal amount of debt for the firm is found where fixed value is maximized.

Why Do Capital Structures Differ Across Industries?

In this scenario, debt payments are tax deductible, but there are no agency costs, bankruptcies or financial distress. In this scenario, debt affects firm value due to interest tax savings and the costs of agency, bankruptcies and financial distress. In particular, there are a number of companies with capital structures that contain very little debt, even though they could benefit from the tax deductibility of interest payments and have very little increase in the likelihood of financial distress costs.

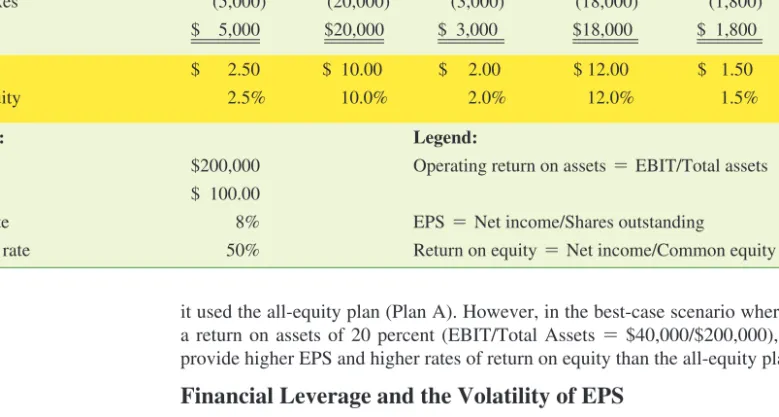

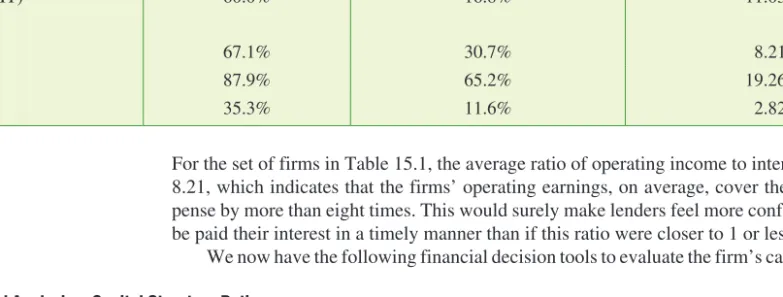

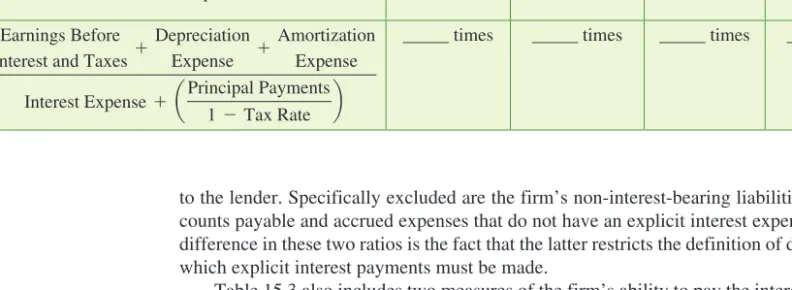

The first measure is the multiple of interest earned ratio, which is equal to the ratio of the firm's net operating income or EBIT to interest expense. A firm's capital structure decisions affect both the level and volatility of the firm's reported EPS. The benchmarking process involves calculating a set of leverage ratios for the firm under three scenarios: (1) before each new financing episode (the firm as it exists today), (2) with equity financing, and (3) with debt financing. .

Benchmarking a Financing Decision

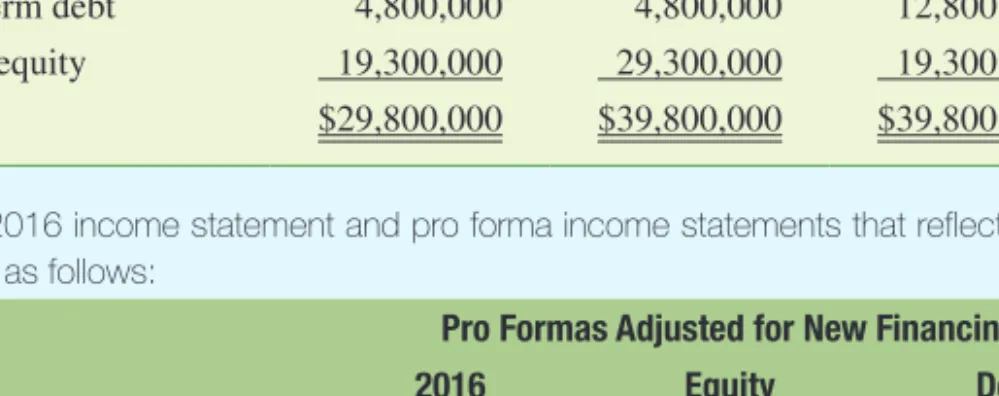

For example, the debt ratio will decrease from 35.2 percent to 26.4 percent if equity is used, or increase to 51.5 percent if debt is used. Comparing Sister Sarah's capital structure to these standards, it becomes clear that the debt alternative is a more aggressive use of debt financing than the industry norm. ANSWER: The debt ratio is 46.1 percent, the interest-bearing debt ratio is 33.5 percent, the times interest-earned ratio is 15.63, and the EBITDA coverage ratio is 4.10.

Financial Leverage and the Level of EPS

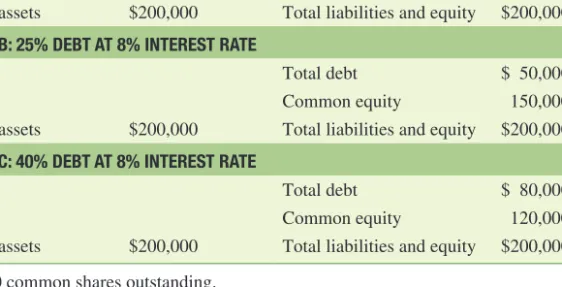

The founders of a newly formed company, House of Toast, Inc., estimate that the company will need $200,000 to purchase the assets needed to get the business up and running. Moderate financial leverage equal to 25 percent of assets ($50,000) is borrowed using a debt issue that carries an interest rate of 8 percent and requires the payment of annual interest. The debt issue carries an interest rate of 8 percent and requires the payment of annual interest.

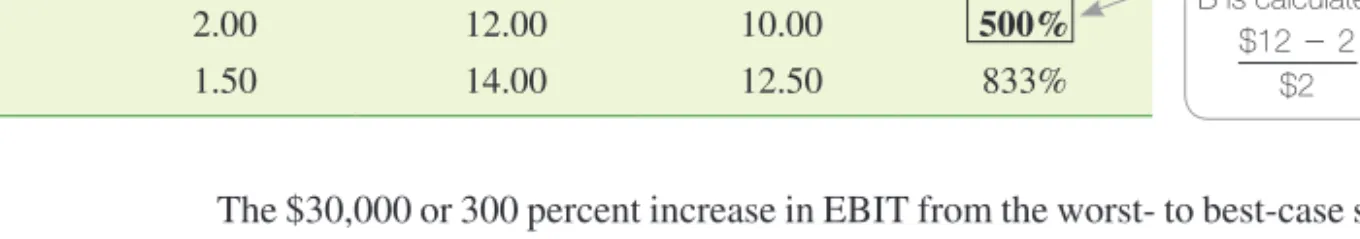

Financial Leverage and the Volatility of EPS

But in the best-case scenario where the company earns a return on assets of 20 percent (EBIT/Total Assets Plans B and C provide higher EPS and higher return on equity than the all-stock plan. The EBIT-EPS chart (sometimes called the the earnings range) is the main tool used to evaluate the effects of capital structure choices on earnings per share.

Evaluating the Effect of Financing Decisions on EPS

The first thing you'll want to consider is whether the debt plan produces a higher level of EPS for the most likely range of EBIT values you expect in the future. Within the range of $21,000 to $40,000 for EBIT, House of Toast can expect the debt plan to provide the same or higher (but more volatile) EPS for the firm. The added volatility in EPS for the debt alternative is evident in the slope of the EBIT-EPS line corresponding to the debt financing plan in Figure 15.7.

Computing EPS Indifference Points for Capital Structure Alternatives

Clearly, maintaining the ability to issue debt or equity securities without pushing the company's capital structure to the limits of the company's debt capacity is an important consideration for these practicing CFOs. The next most important factor for CFOs is the company's credit rating. In fact, bankruptcy concerns and the company's relationship with customers and suppliers are also cited as factors influencing the choice of capital structure.

Capital Structures Around the World

Finally, slightly less than 50 percent of CFOs listed the tax benefits of debt financing as an important influence on their capital structure choice. By leasing, the firm makes rental payments for the use of the equipment, but does not own or acquire title to it. Therefore, our discussion of the lease-versus-buy choice will focus on the imperfections that make leasing more or less favorable.

How Does Buying Differ from Leasing?

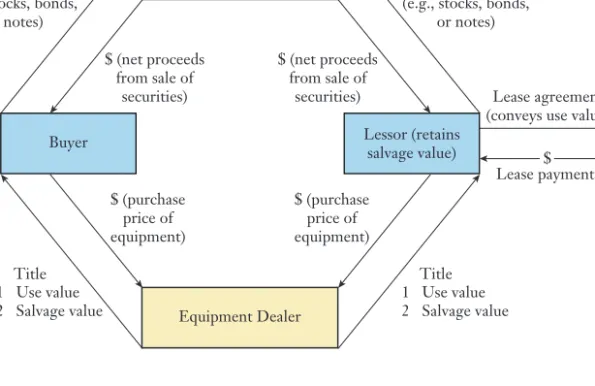

The company acquiring the use of the equipment is now called the lessee, and the entity leasing the equipment is the lessor. The lessor may be an independent leasing company, the equipment dealer, or the financial institution that provides financing for the purchase of the leased equipment. The important thing to note about the lease agreement is that use of the equipment is transferred to the lessee, while ownership of the equipment is not transferred.

Why Would a Firm Choose Leasing Versus Buying?

Now let's calculate the future value of the stream of lease payments using the same rate of 8 percent. An important driver of the advantage of renting versus buying is the estimated residual value. Another factor that drives the cost of renting versus buying is the interest rate included in the loan to buy versus the lease rate used in calculating the lease payments.

Leasing or Buying Your Next Car

To come up with the lease payments, we assumed the landlord's cost of capital (the rental rate) to be 8 percent, assumed the same $12,000 resale value at the end of the lease, ignored any tax benefit that might tip the balance toward rent - buy or sell, and assume that the lessor will break exactly equal on the transaction. For example, let's assume that Barry can arrange his own loan at a rate of only 6 percent, while the lease payments include a built-in cost of 8 percent. The lease-versus-buy choice depends on a comparison of the total costs of the alternatives.

Analysis of the Automobile Lease-or-Buy Decision

However, after making 60 monthly lease payments of $333.45, Barry will have to surrender the CR-V. Excluding taxes and transaction costs, rental and purchase costs are the same if the lessor breaks the transaction. Cost differences in leasing versus buying arise from changes in the integrated cost of money (interest rates) and the estimated residual value of the leased asset.

In this particular case, Barry is neither better off nor worse off by leasing or buying the CR-V. P Principle 2: There is a risk-return trade-off Managers sometimes take on more debt in their capital structures in an attempt to increase the return shareholders receive. But as we know from principle 2, the increased return is offset by an increased risk, which gives an increased return requirement.

Applying the Principles of Finance to Chapter 15

P Principle 3: Cash flows are the source of value. The importance of capital structure is determined by whether the choice of capital structure affects the cash flows that can be distributed to debt and equity holders. P Principle 5: Individuals respond to incentives Increased debt and the consequent need to cover interest payments limit managers' discretionary spending and thus add discipline to spending decisions that helps avoid agency problems.

Chapter Summaries

Explain why firms have different capital structures and how capital structure influences a firm’s weighted average cost of capital

SUMMARY: According to the Modigliani and Miller (M&M) assumptions, a firm's financing mix or capital structure has no effect on firm value. However, when we relax the M&M assumptions, we learn that capital structure can be an important factor in determining firm value. The first stage consists of comparing the firm's capital structure against that of one or more competing firms that are thought to share the same level of overall business risk.

Study Questions

Under the terms of the M&M capital structure theory, the firm's financing decisions do not affect the firm's value. Discuss the possible violations of both basic assumptions supporting M&M capital structure theory. What are the company's debt ratio and interest-bearing debt ratio for its current capital structure?

Study Problems

Adjusting a Firm's Capital Structure) Curley's Fried Chicken Kitchen operates two Southern cuisine restaurants in St. Louis. Louis, Missouri and has the following financial structure: Describing a Firm's Capital Structure) (Related to Checkpoint 15.1 on page 534)Home Depot, Inc. HD), operates as a home improvement retailer primarily in the United States. Describing a Firm's Capital Structure) Subsidiaries of Lowe's Companies, Inc. operate as a home improvement retailer in the United States and Canada.

Capital Structure Theory

If Home Depot has common equity with a market value of $44.9 billion and no excess cash, what is the firm's debt-to-enterprise-value ratio. Hint: Assume that the market value of the firm's interest-bearing debt is equal to its book value.) 15–6. Hint: Assume that the market value of the firm's interest-bearing debt is equal to its book value.) c. Optional).

Making Financing Decisions

The debt funds raised under Plan B have no fixed maturity date, as this amount of financial leverage is considered a permanent part of the company's capital structure. The use of financial leverage is considered to be a permanent part of the company's capitalization, so no fixed expiration date is required for the analysis. A detailed financial analysis of the firm's prospects suggests that the long-term EBIT will be over $300,000 annually.

Mini-Case

You have been asked to comment on the likely share price at the end of 2017. You know that there are 4 million shares in issue with a par value of £0.50 and that the price earnings ratio is 10; this is still based on the 2015 income statement as the 2016 figures have not yet been released to the market. If the directors project an operating profit of £3 million for 2017 and estimate that the company will still incur an interest expense of £2 million for 2017, other things being equal, and allow no market or real-world systematics. unsystematic further change (the theoretical world of M&M), what will be the likely percentage change in the share price.

Appendix: Demonstrating the Modigliani and Miller Theorem

Arbitrage and the Valuation of Levered and Unlevered Firms

Panels C and D identify the arbitrage opportunities that arise when firm B's equity is undervalued and overvalued, respectively. Company B's equity valuation today ($millions). Panel B) Company B's equity is correctly valued at a $35 million investment in Company B. So, if Company B's equity is valued at $35 million, you would not care whether to buy stock in either company.

Summing Up