The purpose of this article is to study the financial reporting systems of some listed companies. In Section 1, the quality of these companies' financial reporting systems is carefully examined and evaluated. In addition, earnings management and accounting matters relating to income taxes are discussed separately.

The second part discusses appropriate internal control systems that can help companies mitigate the adverse effects of inaccurate and ineffective financial reporting. I discuss the anticipated work plan in terms of hours of effort for each task required to audit the internal control system.

Overview of potential earnings management strategies

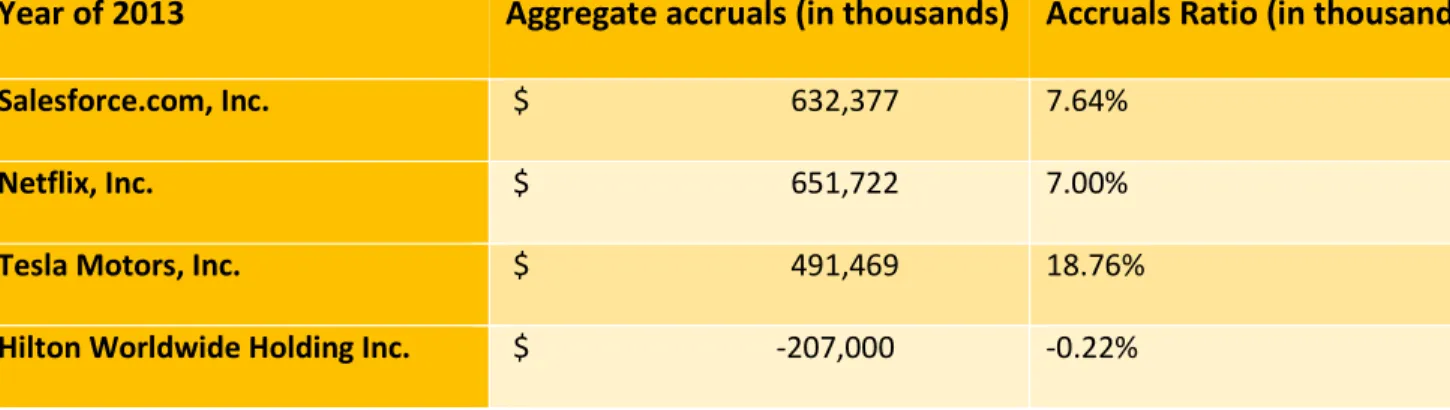

In addition to the possible discovery strategies and suggestions listed in Table 2, the topic of revenue recognition is also related to earnings management activities. Earnings restatements from 1997 to 2002 occurred for nearly 10 percent of companies listed on the three major stock exchanges, and revenue recognition was the most common category of violations.2 Revenue is recognized when it is 1) realized or realizable and 2 ) deserved. The accounting literature on revenue recognition includes both broad conceptual discussions as well as some industry-specific guidance.

Among the companies this paper evaluates, Salesforce.com, Inc.'s revenue recognition position is sound as realizable and earned. Salesforce.com is a company that provides cloud computing solutions for businesses. The company offers platform services as a major revenue generator. Salesforce.com, Inc.'s revenue recognition policies include three perspectives: 1) revenue related to subscription and support;. 2009-13, "Revenue Recognition (Topic 605), Multiple-Deliverable Revenue Arrangement----a consensus of the FASB Emerging Issues Task Force" (ASU 2009-13), objective and realizable evidence of the fair value of the deliverables that to be delivered is no longer required to account for deliveries in a multiple delivery arrangement separately.

The revenue recognition policies for all four companies are broadly in line with the industry standard.

Potential earnings strategies associate with deferred tax asset and valuation

All taxable income produced by the operations of the firm is possible under the category "b", except for income arising from the reversal of taxable temporary. The effect of qualifying tax planning strategies must be recognized when determining the amount of a valuation allowance. In most cases, including the four companies this paper evaluates, the companies only mention the fact that corresponding tax planning strategies have been used to utilize future taxable income to recognize benefits from future deductible amounts.

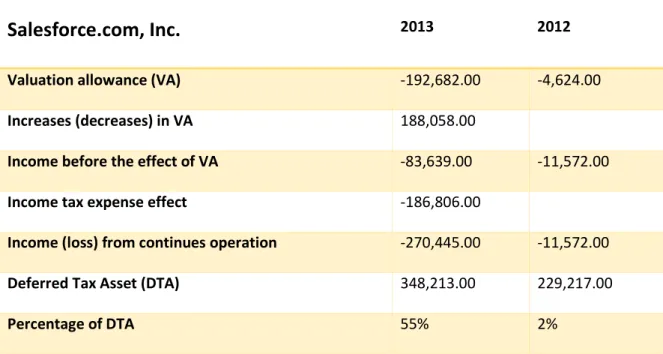

In assessing our ability to recover our deferred tax assets, in whole or in part, we consider all available positive and negative evidence, including our past operating results, and our forecast of future earnings, future taxable income and prudent and feasible tax planning strategies. Indicated by the previous research, one notable thing is that the generation of deferred tax assets that are considered unrealizable and the concomitant increase in the valuation allowance have no net effect on earnings. Income tax Expense= Income tax due + increase in deferred tax liability (decrease in deferred tax asset) – increase in deferred tax asset (increase in deferred tax liability).

When deferred tax assets are recognized and provided for in the same accounting period, there is no net effect on income tax expense other than a decrease or increase in income tax expense related to the increase in the deferred asset. Therefore, it is important to be aware that all changes to the recorded value adjustment do not affect taxes on income from current operations. The effect of income tax expense' refers to the increase or decrease in income tax expense resulting from a change in a valuation allowance.

11 Since the income tax expense was increased, it is unlikely to say that managers used the valuation allowance account to increase earnings and avoid losses. Percentage of DTA” refers to the ratio of valuation allowance to deferred tax asset in a certain year. Salesforce.com, Inc. 's valuation allowance increased 78.34 times more than deferred tax assets in 2013, resulting in a change in percentage of DTA of 53%.

If the valuation allowance that increased in the current year did not ultimately result in future losses (ie income next year increases substantially or disproportionately). If the company's predicted effective tax rate in subsequent years would be inaccurate without the valuation allowance decrease.

Real activity earnings management concept

Other research also provides evidence that the most common approach CEOs are willing to use to increase short-term profits is to reduce R&D costs. Because the cost of R&D are immediate expenses (not subject to depreciation), companies can reduce expenses by reducing the cost of R&D, which will increase profits as a result. Reducing R&D can be an effective approach to increase a company's short-term performance, however, long-term performance for the company may be affected by this approach.

One of the strategies to accelerate sales in a short period of time is to use "channel stuffing". Channel stuffing is sending products at deep discounts to get customers (mostly wholesalers) to accept those goods, especially at the end of a period. As a result, the marketing channels will be filled with the product, but the earnings will increase in a short time.

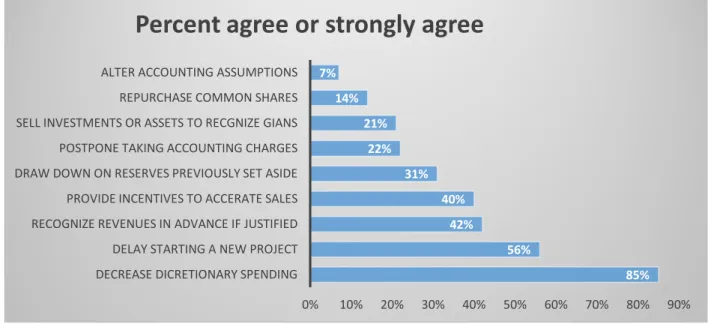

14Based on the question of "within a permitted by GAAP, what choice can you make if your company falls below the desired earnings target this quarter?" Based on a survey of 401 financial managers. In order to minimize the deception of the external financial community, when managers use this strategy, a reasonable and appropriate allowance for sales proceeds must be established. Although compared to real activities earnings management, accrual-based earnings management is more expensive.15 Most firms tend to mix the use of both approaches to achieve certain earnings target or market expectation.

Strategies to accomplish earnings management in terms of different functional

Early revenue recognition techniques such as bill-and-hold, channel stuffing, and out-of-period selling are always considered a potential earnings management tool by sales and marketing executives. From the perspective of real operations earnings management, sales incentives such as discounts are often used by managers to boost end-of-period sales to achieve sales goals. Based on the information in Figure 1, offering sales incentives to accelerate sales is one of the top five choices a manager would make to boost sales in the short term.

Sales-related issues can be a particular problem in some industries, such as mail order. Costs such as shipping, handling, and insurance may be included as part of revenue. In that case, the actual costs are included in the sales costs. Profit strategies related to the functional area of production are commonly associated with inventory and cost of goods sold (COGS).

The LIFO (last in last out) method is usually used considering the lower tax payment under the situation of falling inventory costs. This will cause the LIFO inventory to be much lower than the current cost of the inventory, resulting in large tax savings. Because lower taxes are paid, "real economic effect". in this case it is cash flow).19 Cost of goods sold is closely related to inventory costs and the adopted inventory valuation method.

The role of facilities management in achieving financial reporting or real activity earnings management is also important. Residual values, useful lives and the depreciation method are all subject to managers' judgment to some extent. Alternative techniques therefore generally exist between straight-line and various accelerated methods, estimated useful life and estimated residual value.

Internal controls system development to circumvent the opportunities for

Risk assessment is the identification and analysis of significant risks for the achievement of objectives, which forms the basis for determining how risks should be managed.23 Conducting risk assessment interviews with specific financial and business units is necessary to identify and determine significant accounts and disclosures and relevant assertions and selection of controls for testing. There is a direct relationship between the level of risk that there could be a material weakness in a particular area of an organization's internal control and the amount of attention that would be given to that area.24 Risk assessment scale and. Therefore, the entity's business process, business operating lines and financial reporting systems must be examined.

However, a general audit blueprint for financial reporting audit can be discussed and implemented on the observations about general industrial business process and specific financial reporting disclosures. In the annual report of Salesforce.com, Inc., commonalities can be found for specific risk consideration of the business process. For Netflix, Inc., intellectual property rights related to the Internet technology are the main area on which the risk assessment procedure should focus.

Our intellectual property rights extend to our technology, business processes and content on our website. A company's internal control over financial reporting is a process designed to provide reasonable assurance about the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles.26 Internal Control of a company on financial reporting should include such policies and procedures that (1) relate to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the company's assets; (2) provide reasonable assurance that transactions are recorded as necessary to permit the preparation of financial statements in accordance with generally. 26 PCAOB Staff Views, An audit of internal control over financial reporting that is integrated with an audit of financial statements: Guidance for auditors of smaller public companies, January 2009.

This study examines the quality of financial reporting by assessing potential earnings manipulation strategies that managers might employ. A general audit framework for internal control and financial reporting is also designed to limit potential deviations in profit figures. I conclude that all four companies follow the general guidelines in their own sector, compared to their competitors in the sectors, which all four companies follow.

In addition, I investigate the year-over-year change in valuation allowance for each of the four companies and identify some signals that point to possible earnings management activities. Third, I finalize the general systems of internal controls with special emphasis on the quality and accuracy of financial reporting.