The purpose of this study is to analyze the influence of Enterprise Risk Management (ERM) Implementation on Bank Profitability Performance in the banking industry. The result of this study confirms that ERM index has a positive influence on Bank profitability performance. However, this study still cannot confirm the influence of ERM dimension on Bank profitability performance due to inconsistent results.

Therefore, this study encourages future researchers to conduct a deeper investigation on the impact of ERM implementation on bank profitability performance with a wider range of samples.

INTRODUCTION

- Background

- Need of Study

- Problem Statement

- Research Questions

- Research Objectives

- Significance of Study

- Limitation

- Thesis Organization

Since ERM is not a general academic topic to discuss, the researchers feel the need for this research. Therefore, this study discusses ERM implementation and its impact on bank profitability to gain a better understanding of this topic. This study helps to provide understanding and insights regarding the relationship between the ERM index and the ERM dimensions relative to net interest margin and return on assets.

This study can be used to support further studies regarding ERM Implementation and Bank Profitability Performance.

LITERATURE REVIEW

Grand Theory

- Enterprise Risk Management

- ERM Index

- ERM Dimension

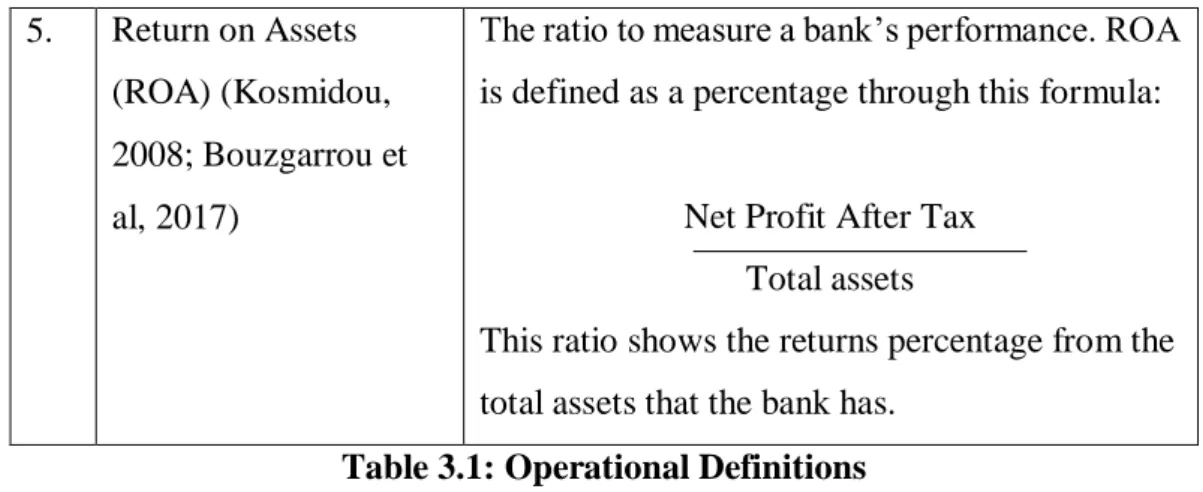

- Bank Profitability Performance

Internal environment - The internal environment is the basis of how risks are assessed and managed by the people, such as the risk management philosophy and risk appetite. Risk Assessment - Risks are analyzed by considering the likelihood of them occurring and how much it could affect the business as a basis for determining how it will be managed. All actions that a company chooses are elaborated in action plans to deal with the risks themselves.

These action plans will be made based on the companies' risk tolerances and risk appetite (COSO, 2004).

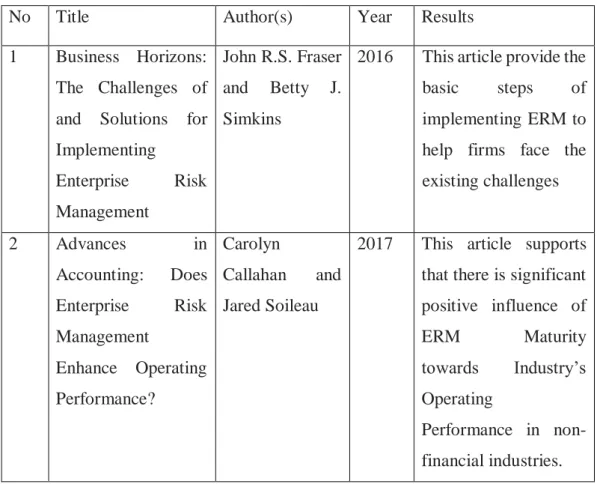

Previous Studies

According to Fitsum Ghebregiorgis and Asmerom Atewebrhan, ROA is a widely used formula for evaluating bank profitability. 2015 This article explains the role of ERM in credit cooperative banks to achieve social and economic objectives. In addition, this article also suggests some necessary practical steps to achieve the goals.

2009 This article argued that ERM and performance can only have a positive impact if they are influenced by 5 firm-specific factors. In this article, Liem used 4 state-owned commercial banks in Indonesia and 3 common bank performance measures (NIM, ROA, EM) as research subjects.

Research Gap

RESEARCH METHODOLOGY

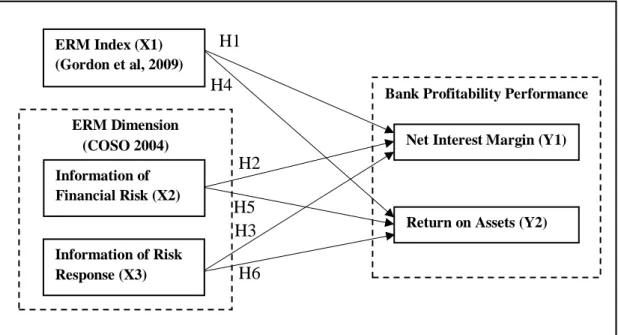

- Theoretical Framework

- Hypothesis

- Operational Definitions

- Research Design

- Panel Data

- Random Effect

- Research Instrument

- Data Sampling

- Data Collection Method

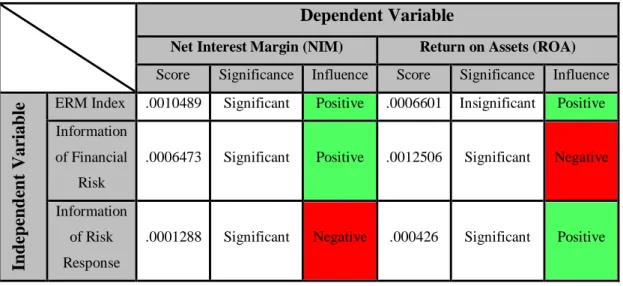

H4: Financial risk information has a positive impact on return on assets H5: Risk response information has a positive impact on net interest margin. H1: The ERM index has a positive impact on the Net Interest Margin H2: The ERM index has a positive impact on the Return on Assets. 34 However, this study cannot confirm that Financial Risk Information has a positive impact on bank profitability performance.

From the 2nd regression, financial risk information has a negative influence on bank profitability performance. The findings show that risk response information does not have a positive influence on the net interest margin. On the other hand, financial risk information also does not have a positive influence on return on assets.

H1: ERM index has positive influence on net interest margin H1 is accepted because there is a significant positive influence of ERM. H3 is accepted because there is a significant positive impact of financial risk information on the net interest margin. H5 is rejected because there is a significant negative impact of risk response information on net interest margin.

H6 is accepted because there is a significant positive impact of risk response information on asset returns. According to the findings of the 1st and 2nd hypothesis, the ERM index has a proven positive influence on the bank's profitability performance.

DISCUSSION

Bank Profile

Australia and New Zealand Banking Group Limited, abbreviated as ANZ, is one of the Big 4 banks in Australia, headquartered at ANZ Center Melbourne, Level 9, 833 Collins Street, DOCKLANDS, VIC, AUSTRALIA, 3008. This bank with a balance sheet of A was previously established as the Bank of Australasia in 1835 until merging with the Union Bank of Australia in 1951 to become what it is today. To grow even further, in 1969, on September 30 to be exact, ANZ issued its first share to enter the capital market.

Since its initial public offering (IPO), ANZ has grown to become the third largest bank by market capitalization at A$73.74 billion by number of shares, after Commonwealth Bank and Westpac Banking Corporation. Established since 1911 by the Commonwealth Bank Act 1911, the Commonwealth Bank of Australia or simply as the Commonwealth Bank is an Australian multinational bank with the largest market capitalization in Australia. Despite the significantly smaller amount of shares outstanding, the Commonwealth Bank proved their dominance in Australia's banking sectors with a market capitalization of A$120.66 billion.

25 Following ANZ, National Australia Bank Limited, better known as NAB, is Australia's fourth-largest bank by market capitalization. In 1982, the National Bank of Australasia and the Commercial Banking Company of Sydney merged to form National Commercial Banking Corporation of Australia Limited until it was renamed National Australia Bank Limited. Before the merger, on January 1, 1974, this bank was listed on the stock exchange.

Only until 1982 when they merged with Commercial Bank of Australia, renaming themselves Westpac. Westpac is proving its worth as Australia's first bank and is the second largest bank by market capitalization.

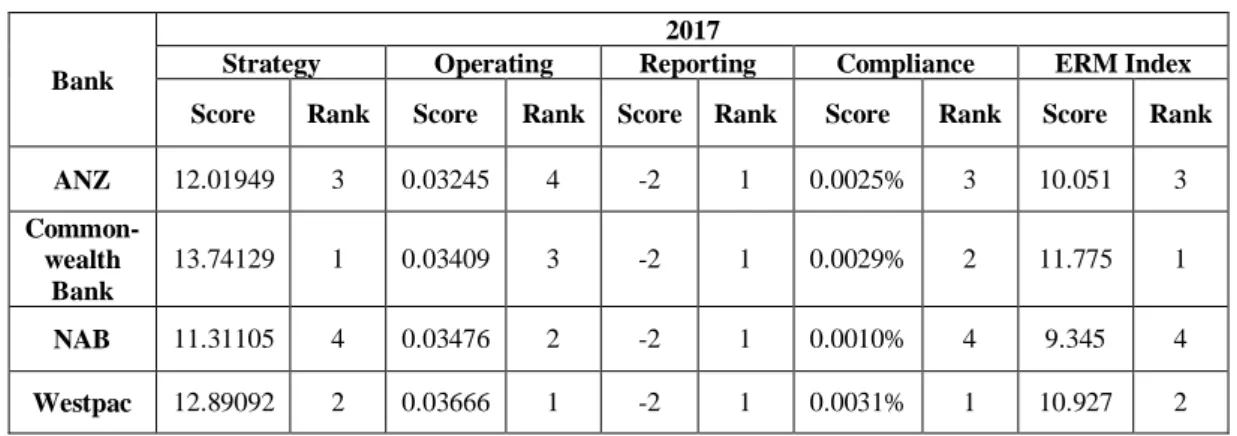

Descriptive Analysis

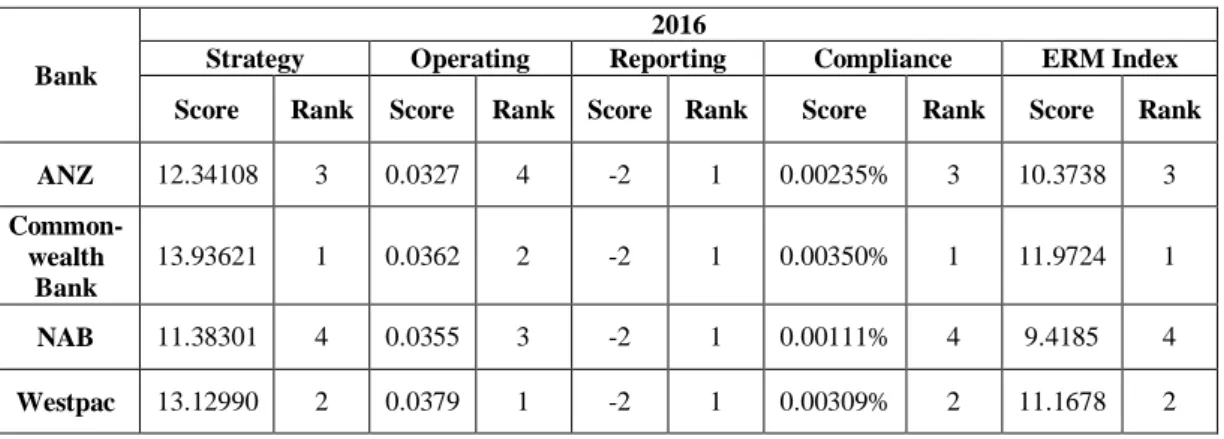

Being the largest bank in Australia, Commonwealth Bank proved their quality through ERM index in 2016. In fact, Westpac is the one to beat Commonwealth Bank in industry index. This ERM index result is quite expected considering their ranking of market capitalization where Commonwealth Bank leads the industry and NAB is the last out of the top 4 banks in Australia.

From the strategy and compliance index, the result is similar to the calculated ERM index. If we remember how the strategy describes the relationship between the market and the bank, as the first bank in Australia, there is no doubt that Commonwealth Bank customers have a lot of confidence in their bank. 28 In 2017, Westpac is still dominated by the 2016 champion, the Commonwealth Bank, despite its excellent performance with the ERM index.

Looking at the reporting index and the strategy index, the result is similar to last year, with the Commonwealth Bank coming out on top followed by Westpac, ANZ and NAB in descending order. As can be seen from the result, it seems that in 2017 the Commonwealth Bank did not perform well in some indices. However, through the total calculation of the ERM Index, Commonwealth Bank still stands at the top proving once again its worth as the best bank in Australia.

By market capitalization and supported by ERM Index research, Commonwealth Bank stands firmly at the top. Despite being Australia's oldest bank, Westpac still falls short of the champion.

Statistics Results & Discussion

The first regression resulting in both the ERM index and the ERM (financial risk and risk response information) dimensions have a significant impact on the net interest margin. This result supports the study by Liem (2018), which states that ERM implementation has a positive impact on bank profitability. This result is in line with the study by Liem (2018) which states that ERM implementation has a positive impact on bank profitability.

This result does not support Liem's (2018) study, which states that ERM Implementation has a positive impact on Bank Profitability Performance. Having information on financial risk proves that a bank has realized the risk that could threaten them financially. To understand more about the relationship between ERM Index and ERM dimensions to bank profitability performance, the research conducted another test with different proxies of Bank Profitability Performance.

According to the 2nd regression, similar to the previous test, the ERM index has a positive impact on ROA. Similarly, accepting Hypothesis 6 in Regression 2, this study could not confirm that risk response information has a positive effect on bank profitability performance. Unlike the previous test, where the hypothesis was rejected due to the negative impact of risk response information on bank profitability performance, regression 2 shows a positive result.

Therefore, out of the three independent variables, this study could only confirm the impact of the ERM index on bank profitability performance. The other 2, including financial risk information and risk response information, still show inconsistent results.

Conclusion

Because of this, this study recommends future researchers to investigate this discrepancy result on a larger scale. To identify the main research questions, this study analyzes the impact of ERM Implementation on Bank Profitability Performance with the help of 6 hypotheses. H2 : The ERM Index has a positive impact on return on assets H2 is accepted because there is a significant positive impact of the ERM Index on return on assets.

H4 is rejected because there is a significant negative impact of financial risk information on asset returns. 36 Moreover, by comparing the above results, this study confirms that the ERM index has a positive impact on bank profitability performance. However, not all components of ERM implementation have a positive impact on the bank's profitability performance.

This study still cannot confirm the influence of ERM dimensions on bank profitability. Therefore, further research with a larger sample size is needed to better understand the impact of ERM implementation on bank profitability. Since there are still some discrepancies and inconsistencies between the regression results, the researcher recommends future researchers to analyze more deeply regarding the influence of ERM implementation and bank profitability, especially when the proxy of the Bank Profitability variable is replaced.

In addition, as this study only focuses on the top 4 banks in Australia, it is recommended that future research be conducted with a wider range of samples to provide a better result and understanding. Reprint of: The Impact of Enterprise Risk Management on the Marginal Cost of Risk Reduction: Evidence from the Insurance Industry.

CONCLUSION

Conclusion

Recommendation

Measuring Bank Profitability, Risk and Efficiency: The Case of Commercial Bank of Eritrea and Housing and.