Most of the recent studies in Indonesia have examined FDI spillovers in terms of firms' productivity and efficiency gains, through which incoming foreign firms can motivate (positive spillover) or conversely demotivate (negative spillover) local firms (see Sari et al., 2016; Sari , 2019; Suyanto et al., 2014). A greater growth in the market share of foreign firms means greater demand for skilled labor, which is associated with wage differentials, consistent with predictions in Indonesia (Javorcik et al., 2012; Sjöholm and Lipsey, 2006; Lee and Wie, 2015). Our approach differs from Chen et al. 2011): they used capital ownership, such as foreign-owned and state-owned capital, to capture FDI.

Meanwhile, similar to evidence found elsewhere in Southeast Asia (Nguyen, 2019), Chen et al. 2011) found evidence of negative FDI spillovers on wages for domestic firms in China, suggesting that FDI discourages wage growth in local firms. In Vietnam, Nguyen et al. 2019) demonstrated that FDI inflows put downward pressure on domestic firms' wage rates through spillover effects and disruption capability, finding that a 1 percent increase in foreign capital leads to a 2.03 percent decrease in salaries for local firms. 2019) all find that industry- and firm-specific characteristics explain substantial variation in the wage impact of FDI in several Asian countries. Studies such as Chen et al. 2011) focuses primarily on horizontal spillovers within industry and province, but not on potential effects within clusters of similar technological intensity.

Since large companies can use more advanced technology (Charoenrat et al., 2013; Ciani et al., 2020; Toma, 2020), they can compete with foreign companies in wage negotiations in the labor market for highly skilled workers. The control of FOR has been mentioned in previous studies (Arnold and Javorcik, 2009; Esquivias and Harianto, 2020; Javorcik et al., 2012) that state that foreign firms are more likely to offer higher wages. This study uses 10% as a threshold, for which reference is made to the 2009 OECD study and Javorcik et al.

Meanwhile, the interaction between FOR and FS refers to the study of Sari et al. Furthermore, the finding is relevant to the arguments of Li et al. 2021), who stated that spillover effects can be geographically clustered, as such agglomeration as occurs with MNEs drives away labor costs and increases competitive pressures for workers within clusters. In this sense, although foreign firms in the pharmaceutical industry (for example) offer higher wages, this will not significantly affect the wages of domestic firms in a similar technological group, eg, the chemical industry.

High-skilled workers can benefit to a greater extent from the presence of foreign companies than production workers, as the wage premium indicates, in line with earlier studies in Indonesia (Sjöholm, 2017; Javorcik et al., 2012; Lee and Wie, 2015). A similar effect was pointed out in earlier studies in Indonesia, where foreign firms and exporters reported higher productivity, which enabled them to offer higher wage premiums to workers (Arnold and Javorcik, 2009; Esquivias and Harianto, 2020; Javorcik et al., 2012 ). Studies across other geographies (Beenstock et al., 2017) have also shown polarization on wages for workers in high-skill and capital-intensive sectors compared to labor-intensive industries.

2 The study of (Sari et al., 2016) also found a similar result for the case of firm productivity. 2016) found that for foreign firms with a 10% threshold perform better productivity, but a higher foreign share in foreign affiliates of foreign firms is associated with lower productivity. In previous studies, domestic firms often exhibited lower technical efficiency than large and foreign firms, likely related to their less efficient workers (Sari et al., 2016; Yasin, 2021). Larger firms employ more workers, use higher capital and use more advanced technology to achieve higher efficiency and productivity, supporting previous studies measuring the impact of FDI spillovers on wages is the size categorization of the firm by number of employees (e.g., Wiboonchutikula et al., 2016; Widodo et al., 2015).

The literature points out that labor costs in Indonesia have increased rapidly, although this is not always accompanied by increases in productivity (Sugiharti et al., 2019).

CONCLUSION

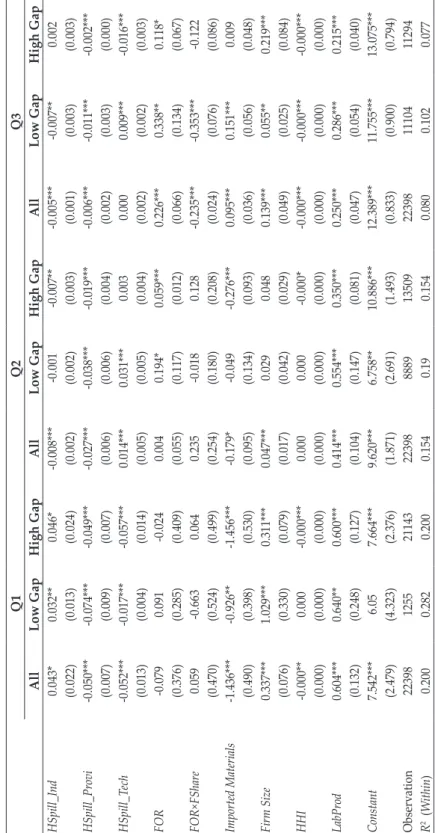

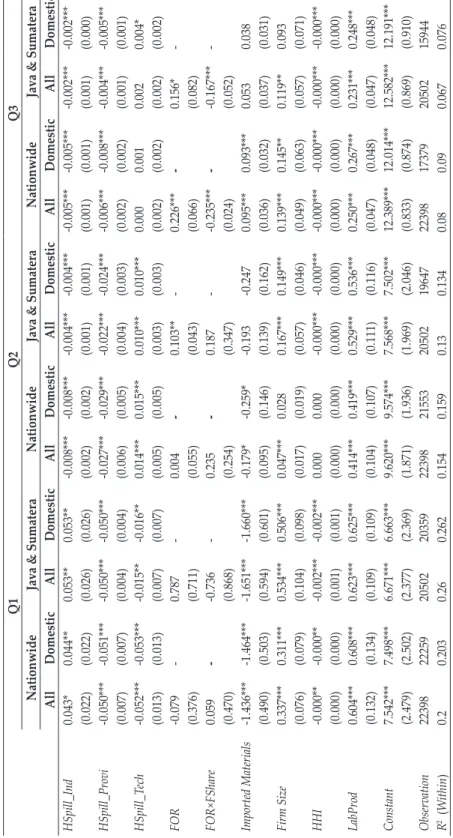

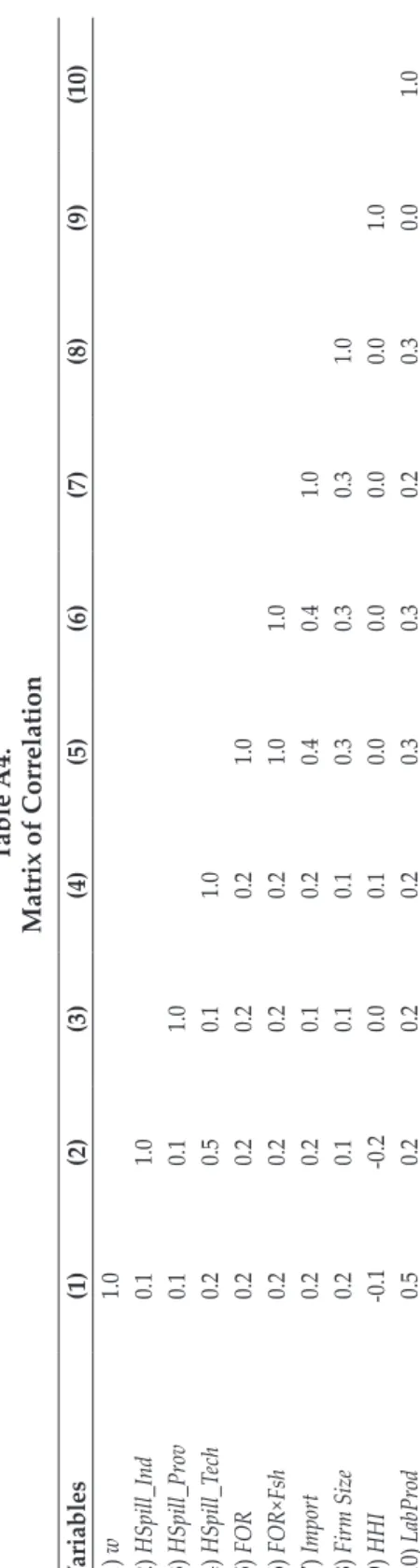

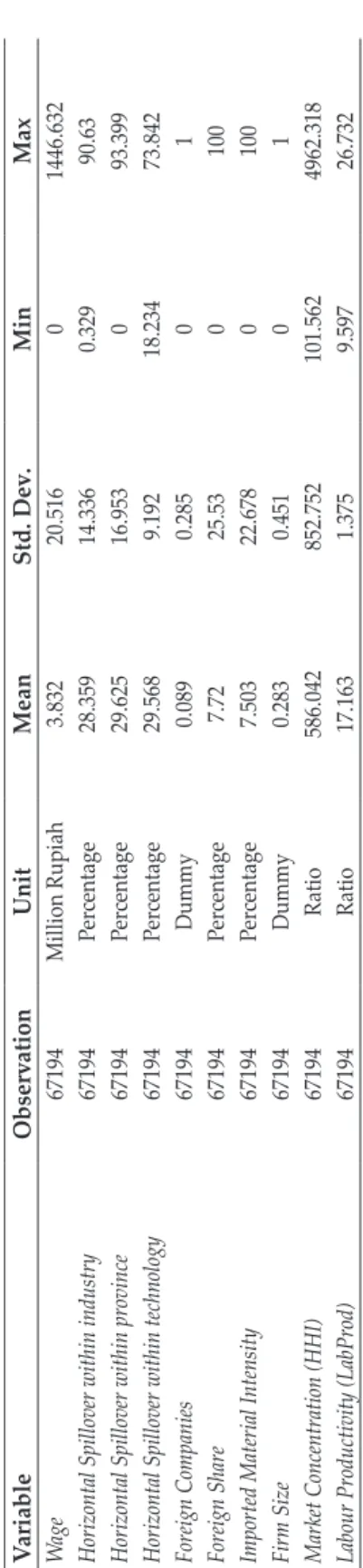

As Java & Sumatra panel data are used, we calculate new horizontal spillovers for all dimensions (within-industry, within-province and within-technology), firm size and market concentration (HHI). According to Table 8 (Java – Sumatra column), we find that horizontal spillovers for all dimensions reveal robust estimates for each size group, shown by a relatively similar sign and magnitude of the coefficient compared to Table 6. At the same time, research and development activities can also be strengthened for local businesses to accommodate these highly skilled workers in improving business productivity.

Finally, while our study covered robust findings on the impact of spillovers on wages, our model did not account for the dynamic behavior of spillovers on wages, such as the lag with which spillovers from FDI could affect domestic wage levels. Thai Manufacturing Technical Efficiency of Small and Medium Enterprises: Evidence from Company-Level Industrial Census Data. Clarification of the terms and limits of the contributions of common and dynamic capabilities to relative business performance.

Inward Foreign Direct Investment and Local Wages: The Case of Vietnam's Wholesale and Retail Industry. Do multinationals push up domestic firms' wages in the Italian manufacturing sector. Foreign direct investment and technical efficiency in the Indonesian pharmaceutical sector: Firm-level evidence.

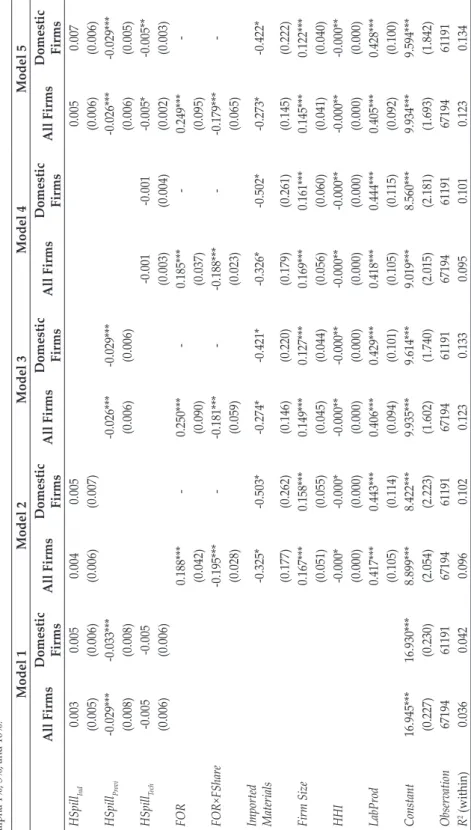

The trading activities of the firm to promote technical efficiency and total factor productivity: The growth accounting and the stochastic frontier approach. The column All firms refers to all observations (both foreign and local firms), while the column Domestic firms only includes observations for local firms.