Following the 2008 financial crisis, President Barack Obama signed into effect the Dodd-Frank Wall Street Reform and Consumer Protection Act on July 21, 2010. The act contains stated goals of eliminating too large to fail and promoting financial stability. . This thesis then examines how the Liquidation Authority Order and its Single Point of Entry Strategy has the unintended consequence of encouraging too much to fail.

Finally, in Chapter IV, I examine why the Volcker Rule was enacted and the resulting effects of increased compliance costs for firms and reduced profitability from the proprietary trading ban. In the end, I conclude that the Dodd Frank Act has not achieved the set goals and, in addition, has several negative consequences. The thesis highlights the key areas in which the Dodd Frank Act affects systemically important financial institutions.

Background

Fundamentally, the government's role is to establish legislation that protects consumers and ensures stability in the financial system. This confusion occasionally hinders innovation in the financial services sector and investment in some sectors of the economy. The law established the Office of the Comptroller of the Coin (OCC), which gave the federal government an active role in the supervision of commercial banks.

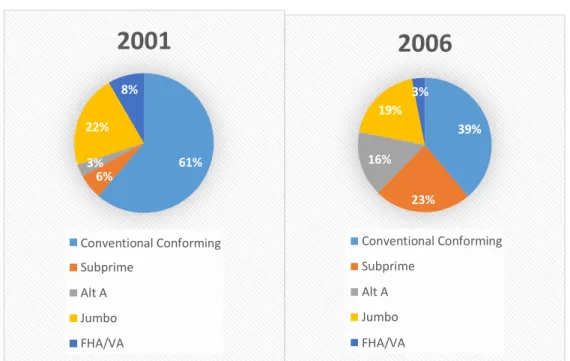

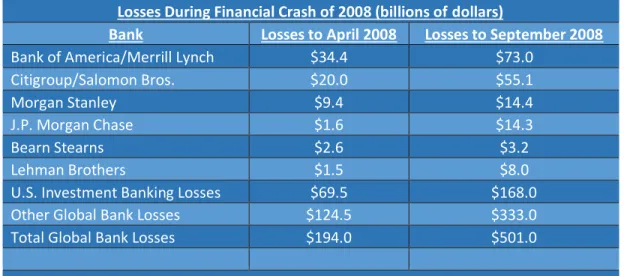

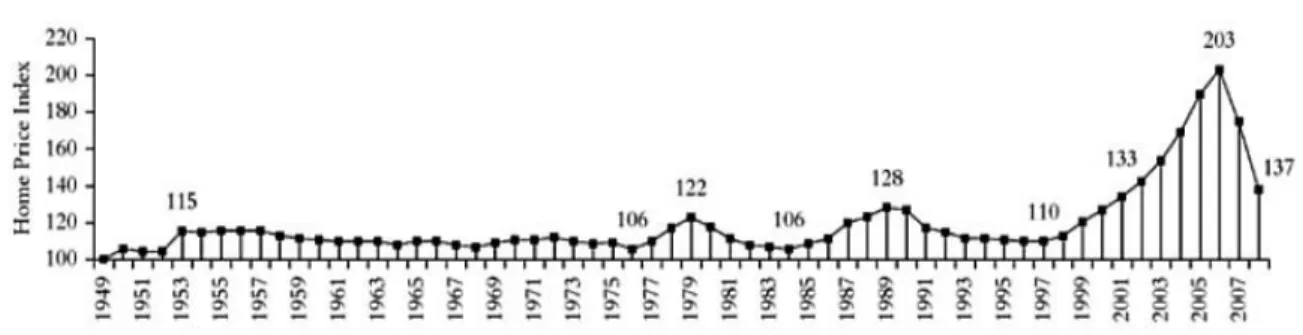

Empirical studies show that passage of the act reduces exposure to systemic risk across the financial services industry. Consequently, the value of the underlying assets in MBS products began to decline as delinquency rates on subprime loans rose. As the financial sector suffered massive losses, the rest of the global economy suffered as a result.

The onset of the financial crises of 2008 brought many topics to the forefront of financial legislation arguments. In the following chapters we will examine the impact of the Dodd-Frank Act on systemically important financial institutions.

Title I

The Dodd-Frank Act adds to Basel III's capital requirements and requires banks to provide minimum leverage and capital ratios. The relevant federal banking agencies shall establish minimum leverage capital requirements on a consolidated basis for insured depository institutions, depository holding companies, and nonbank financial companies supervised by the Board of Governors. The minimum leverage capital requirements determined under this paragraph shall not be less than the general leverage capital requirements, which shall serve as the basis for any capital requirements that the agency may require, nor quantitatively greater. lower than the applicable total leverage limit. - the principal requirements that were in effect for insured depository institutions as of the effective date of this Act” (US Congress, 2010).

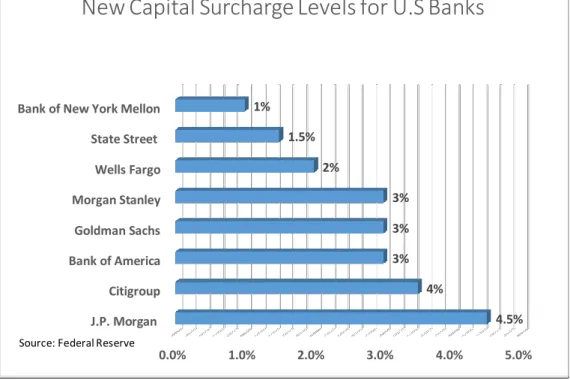

Adopted in 2013, Basel III is a banking regulatory framework for members of the Banking Supervisory Committee (the US is a member) that nearly doubled capital requirements for global member banks. These increased Title I capital requirements affect SIFIs in four ways: capital additions, tax effects, capital increases, and shadow banking. The Dodd-Frank capital requirements implement a related Basel Committee standard in the US and add an additional layer of capital requirements (beyond the required 15 percent) for global systemically important GSIB banks (see Figure 3) to supplement their reliance on short-term wholesale funding.

More recently, a study by Martinez-Miera and Suarez (2014) confirmed Kashyap's conclusion by showing how capital requirements can help reduce systemic risk-taking and thus reduce the costs and frequency of systemic crises. According to Martinez-Miera and Suarez, the data suggests that higher bank capital requirements lead to lower bank capital losses by reducing the share of funds going to inefficient investments. I believe that the costs of higher capital requirements outweigh the benefits of more equity.

The increase in the cost of capital requirements will continue to create a negative drag on the economy and force banks to take some sort of compensatory action, such as increasing service rates or reducing costs (Assessing the Cost of Financial Regulation, 2012) . Second, data suggest that an even more drastic effect of capital requirements is that secondary IPOs typically come at a discount. A long-term look at the effects of capital requirements leads me to conclude that the increased leverage ratios would limit a bank's ability to raise capital in a cost-effective manner.

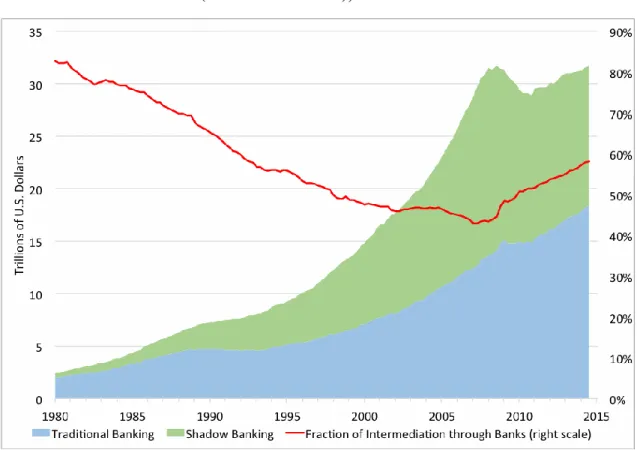

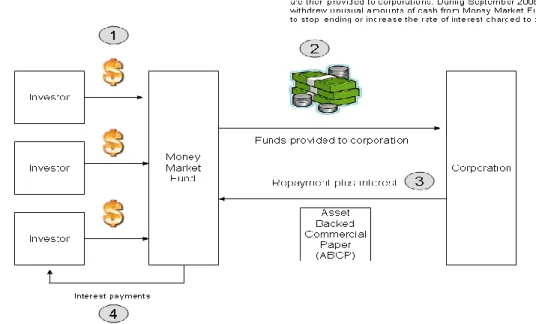

As lawmakers introduce higher capital requirements for banks, one option banks may consider is investing in shadow banking activities. I believe that rising capital requirements will continue to encourage banks to increase their exposure to shadow banking activities in pursuit of return on equity. As shadow banking activities increase, so does the leverage of the loans to MMFs, making SIFIs riskier.

Title II

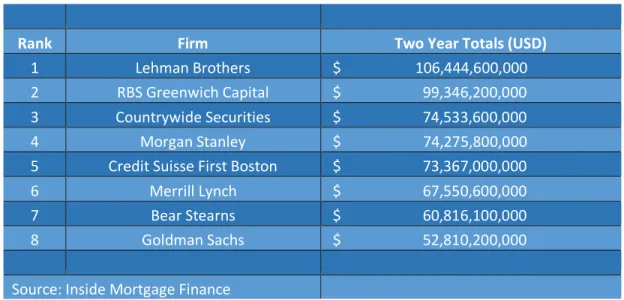

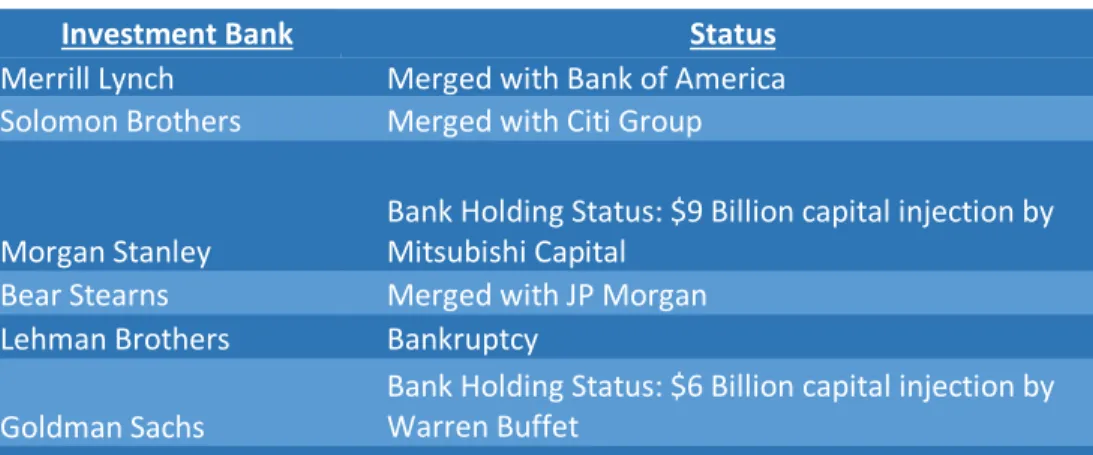

When Lehman Brothers failed in 2008, the firm went through a liquidation of the firm's assets in bankruptcy. It is the purpose of this title to provide the necessary authority to liquidate distressed financial companies that pose a significant risk to the financial stability of the United States in a manner that mitigates such risk and minimizes moral hazard. The authority in this section shall be exercised in the manner which best accomplishes such purpose so that—. 1) creditors and shareholders bear the financial company's losses.

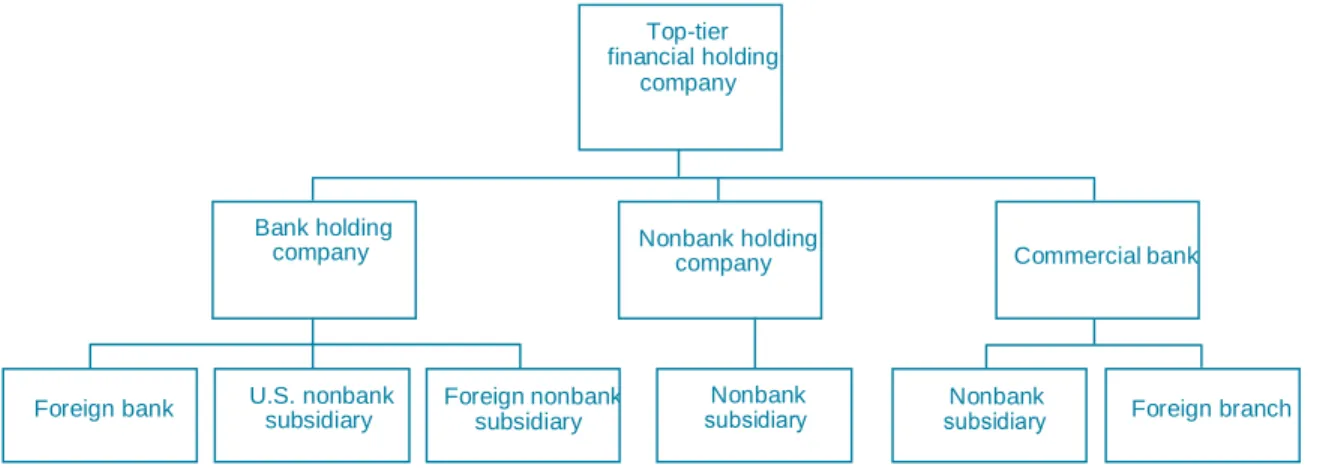

When a systemically important financial institution is approaching bankruptcy, the OLA process will begin once it is approved by a two-thirds vote of the Federal Reserve Board, a two-thirds vote of the FDIC, and the Treasury Secretary. The OLA then gives the Federal Deposit Insurance Corporation (FDIC) control over the liquidation process of a CFC. The single point of entry strategy is actually the process of the FDIC stepping in only at the holding company level of a failing SIFI while keeping most or all of the firm's subsidiaries intact.

The first step of the resolution process continues as the parent holding company's assets, secured debt, and short-term debt are transferred to a newly created FDIC. These obligations are satisfied through a process called “securities-for-claim,” which is explained in the FDIC resolution document: “through a securities-for-claims exchange, the claims of creditors in receivership would be satisfied by the issuance of securities representing the debt and equity of the new holding company”. One of the most criticized consequences of the Single Point of Entry Strategy (SPOE) is that it increases the chance of a large and complex financial institution becoming 'too big to fail' (TBTF).

For example, while all CFC subsidiaries are fully operational, creditors will be protected in the short term. SPOE encourages greater reliance on short-term debt because under SPOE, the FDIC's bridge holding company assumes all of the CFC's short-term debt. Moreover, the unregulated liabilities of the shadow banks would fall among the protected short-term creditors, thereby encouraging firms to use more short-term debt (including shadow liabilities), thereby increasing the risk of the firm (Wilmarth Jr., 2015).

Also, bail-in bondholders will be investors who invest in the private markets (Federal Register, 2013).

Title IV

After much criticism from banks regarding the implementation of Title IV, in 2013 the Securities and Exchange Commission issued the “Final Rule” focusing only on the Volcker Rule. And the sum of the banking entity's ownership interests in the co-investment fund and the related hedged fund shall not exceed 3% of the sum of the ownership interests held by all investors in the co-investment fund and the related hedged fund. (Treasury Department, 2013)". This rule is the closest provision to reinstatement of the Glass-Steagall Act of 1933, which separated commercial and investment banks.

Although well-intentioned, the Volcker Rule is considered by many to be the most controversial of the many rules in financial regulation of the Dodd Frank Act. The initial proposals of the Volcker Rule drew more than 18,000 comment letters to the SEC (Puzzanghera, 2015). Part of the controversy regarding the implementation of the rule is the unclear direction of the law.

Too narrow a definition of proprietary trading will undermine the Volcker Rule, and too broad a definition can weaken financial markets. As US Treasury Secretary Timothy Geithner said in testimony before the Congressional Oversight Committee, "most of the losses that were substantial did not come from [equity trading] activity." Paul Volcker, a leading proponent of the proprietary trading ban, also acknowledged that proprietary trading was not central to the crisis and was quoted in a 2010 speech at the Peterson Institute for International Economics as saying: Proponents of the Volcker Rule expressed, that the commercial side of investment banks will have to choose between traditional banking or proprietary trading and will return to healthy deposit-taking and lending services (Skeel, The New Financial Deal, 2011, pp. 86-87).

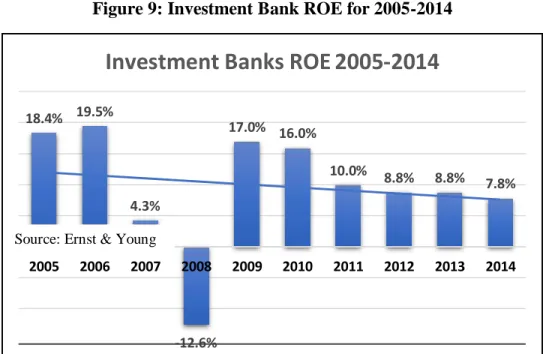

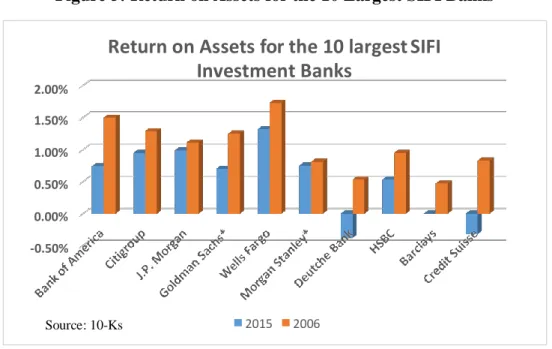

As a result of this mandatory compliance program, the Office of the Comptroller of Currencies released a study showing that costs associated with compliance and reporting requirements will have a market value impact of between $402 million and $541 million per year through at least 2017 (Office of the Comptroller of Currency). the Comptroller of Currency, 2011). To analyze the different increases in compliance costs, I collected the reported compliance costs of eight of the ten largest financial institutions, as shown on the next two pages. I think it's important to note the dramatic decline in return on equity after the passage of the Dodd-Frank Act in 2010.

Because of the increased probability of default between banks, I think the Volcker rule hurts the US. Based on my research on Dodd-Frank, systemically important financial institutions will experience some form of financial burden due to the new regulations. The Dodd-Frank Act has well-intended goals to promote market stability, but I believe that the current rules are not helping to achieve the stated goals of the Dodd-Frank Act.