Through primary and secondary research, I was able to determine that fraud is a rapidly developing problem present in all parts of the world; however, it is possible to combat fraud and its perpetrators by being aware, informed, involved and proactive. Fraud is defined as, “a false representation of a matter of fact—whether by word or conduct, by false or misleading pretense, or by concealment of what ought to have been disclosed—that deceives and is intended to deceive another so that the individual will act upon it to her or his legal detriment” (“Fraud.”). Employment fraud is often referred to as insider fraud and the terms are used interchangeably.

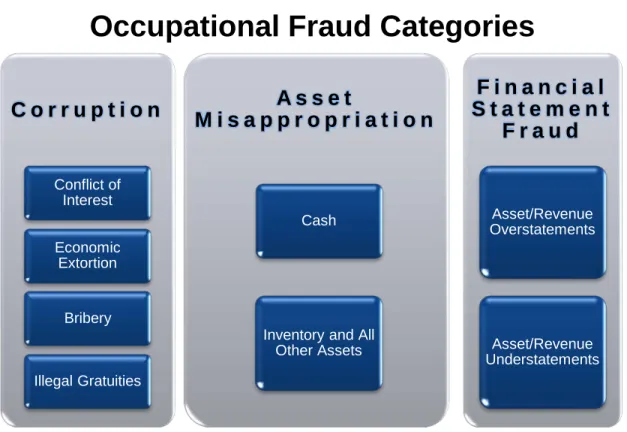

An example of internal fraud is when a company employee withdraws cash from the cash register. Occupational fraud is divided into three main categories: corruption, asset misappropriation, and financial statement fraud.

Occupational Fraud Categories

The ACFE report found that misappropriation of assets is the most common type of fraud involving 87 percent of reported cases and the least costly with an average loss of $120,000. In general, misappropriation of assets is the taking of assets and is accomplished by the various methods listed previously. According to PwC's 2014 Global Economic Crime Survey, 78 percent of hospitality and leisure survey participants experienced asset misappropriation.

A common example of property misuse in the hospitality industry is the theft of food and drink. Additionally, financial statement fraud is evident in the hospitality industry as management manipulates financial data to achieve.

Fraud Cycle

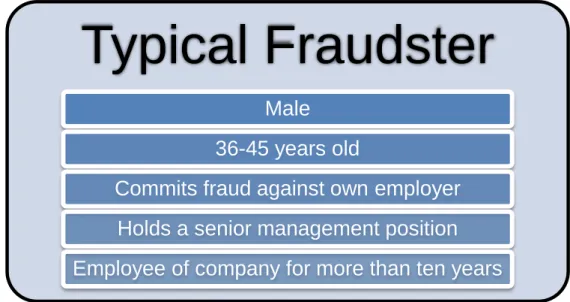

Outbound fraud, particularly credit card and identity theft, is becoming an increasingly important issue for the hospitality industry. Additionally, ACFE's Report to the Nations on Fraud and Abuse at Work: Global Fraud Study 2012 provided information on typical fraudsters. According to the ACFE report, more than three-quarters of fraudsters belonged to one of the following six departments: accounting (22 percent), operations (17.4 percent), sales (12.8 percent), executive/senior management (11.9 percent), customer service (6.9 percent) or purchase (6.7 percent).

Also, regarding the authors' highest level of education, 36.9 percent had a college degree, 25.3 percent a high school diploma or less, 20.5 percent some college, and 16.9 percent . The report also concluded that 87.3 percent of the perpetrators had a clear criminal background and 83.7 percent of the perpetrators had never been punished or fired in the field of work.

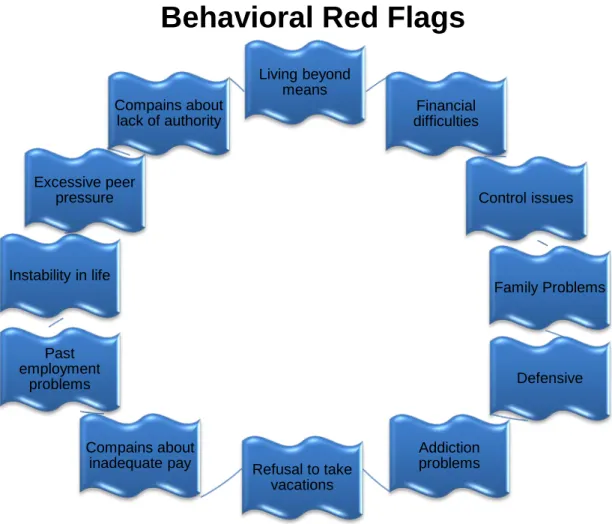

Behavioral Red Flags

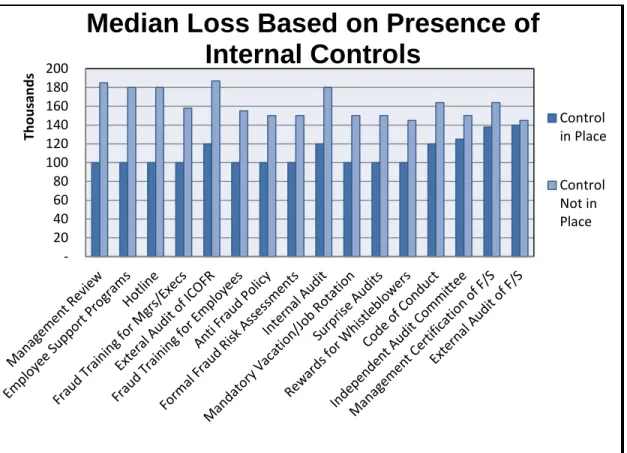

The control system must be effective in the sense that the internal control measures are enforced and regulated. So the single most important aspect of internal controls by design is to enforce the system. The ACFE completed a study in the Report to the Nations on Occupational Fraud and Abuse: 2012 Global Fraud Study and identified the difference that internal controls can make.

As illustrated by the graph, there is an average difference of $830,000 in losses for having internal controls present versus not having internal controls present. When internal controls are effective and efficient, they are ideal for reducing fraud, increasing the reliability of financial reporting, and at the same time complying with laws and codes. ii) Laws and Codes of Ethics.

Median Loss Based on Presence of Internal Controls

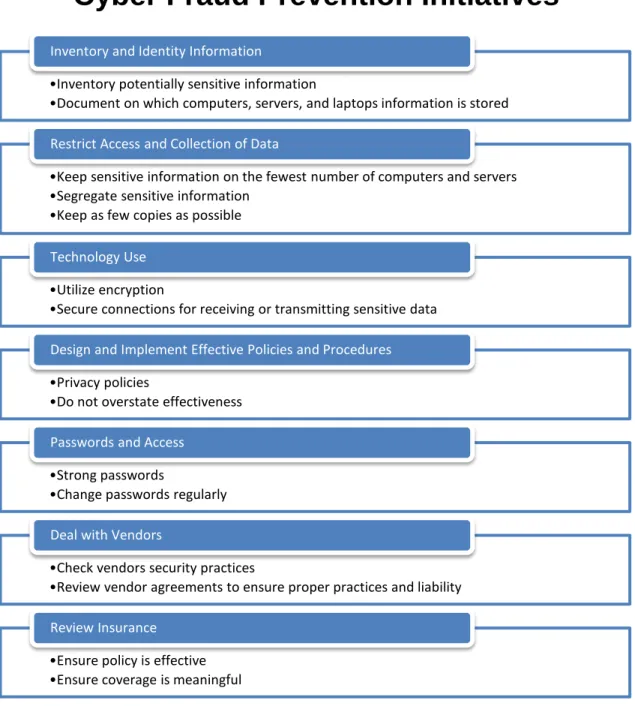

Cyber fraud is also known as Internet fraud and occurs when fraudsters engage in fraudulent activity through computers and Internet connections. For accounting purposes, the main problem with cyber fraud is the hacking of identities and financial data. Due to the lack of updated legislation, cyber fraud is on the rise.

Unfortunately, the hospitality industry is a target for cyber fraud due to the large amount of confidential and financial information stored. The following are basic initiatives the hospitality industry can take to prevent cyber fraud (Braun).

Cyber Fraud Prevention Initiatives

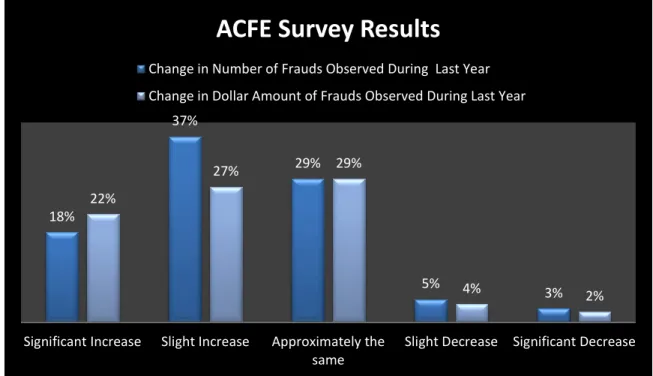

As the economy recovers, it is reasonable to predict that fraud will decrease. ii) Economy. In March 2009, the Association of Certified Fraud Examiners (ACFE) randomly distributed a survey of 6,000 Certified Fraud Examiners (CFEs) in the United States. Through research, ACFE has found that fraud rates have increased following the economic downturn.

Additionally, the ACFE concluded that the increase in fraud resulted from an increase in the pressure faced by large numbers of individuals. Of the 507 surveys used to compile the data, 70 percent believed the incidence of employee theft would continue to rise in the coming year. ACFE's key finding is more than 80 percent of respondents said they believe there is more fraud during periods of economic distress.

The media has played an astronomical role in disclosing information about widespread cases of accounting fraud in the country. The media continued to use the cases to inform the public about the company's response and the legal consequences faced by fraudsters and victims. Every detail of the court proceedings involving Enron and Madoff was covered by the media from beginning to end.

Despite the end of the trials, the media continues to inform the public about all information in these cases and possible new cases. The most important aspect of the media regarding accounting fraud is the fact that the media strongly emphasizes the consequences and losses incurred in cases of fraud.

ACFE Survey Results

Furthermore, the exposure of large amounts of losses encourages business people to pay more attention to internal controls and signs of fraud. Typically, the media is only interested in major scandals involving an astronomical amount of money. Because of this, many fraudsters still engage in fraudulent activities thinking that small amounts will not be a big deal.

The overwhelming majority of fraud matters are consultative in nature and offer no opinion of any kind (Glenn). The typical fees associated with such a commitment are generally in the low five thousand ranges and are very rarely discounted due to fast approaching customer service (Glenn). With the advent of technology, many employers are now issuing employees with laptops, mobile phones and personal email accounts.

Big data” refers to the large amount of information stored as one file or within a single location. In addition, accountants have to sift through large amounts of information when they are on a fraud investigation or a consultation. Fortunately, with the advent of technology, various programs have been created to help with the analysis of big data.

When a company is exposed to undetected fraud for a significant period of time, the financial losses increase compared to if the fraud had been detected at an earlier time. Furthermore, when fraud is present, financial statements must be reissued, have a prior period adjustment, or possibly be audited by the Public Company Accounting Oversight Board (PCAOB). In addition, taxable income could have been misreported when the business was subject to fraud; therefore, tax returns may need to be changed to.

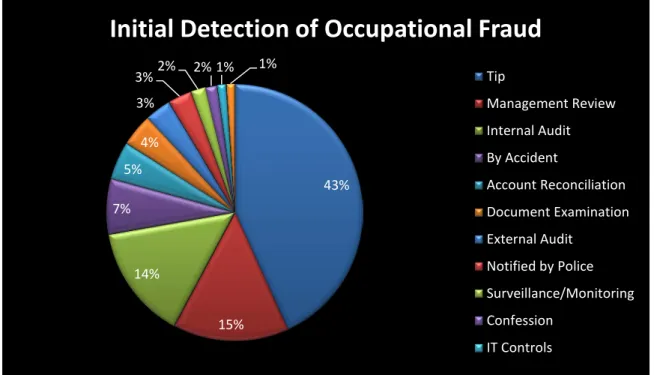

Initial Detection of Occupational Fraud

The manager of XYZ Company noticed that the inventory in the hotel dining room was decreasing much faster than usual and did not match the sales reports. The goal of an investigation is to "resolve allegations or indications of fraud when all the facts are unknown or unclear" (2014 Fraud Investigator Handbook). When planning a fraud investigation, ABC's fraud team will determine the general objective of the investigation.

As the ABC business advisor, I will emphasize the importance of a fraud prevention system specifically for food and beverage supply with qualitative and quantitative support. According to the Report to the Nations on Occupational Fraud and Abuse: 2012 Global Fraud Study, the median loss for asset misappropriation is We will charge the client $15,000 per year for a five-year contract to implement the fraud prevention program and keep the program current with routine checks.

Furthermore, over the five-year period the potential customer is likely to lose about $600,000 without a fraud prevention program. Our proposed fraud prevention plan includes internal controls, inventory checks, computer generated reports, installation of security cameras, fraud awareness education and training, fraud hotline and employee background checks. In addition, our fraud prevention program includes the implementation of computer-generated reports that compare inventory counts, sales and disposals.

To improve XYZ's personal fraud prevention program, we would help install security cameras in dining halls. Fraud awareness education and training has proven to be very effective in the workplace. At ABC, we will be dedicated to assisting XYZ with all of its anti-fraud program measures.

In the event that your company changes its size of operation, we will ensure that your fraud prevention program is appropriate for your operations at that time. This portfolio is a compilation of cases and competitions compiled during Fall 2013 related to ACCY 420.

She was a very close friend of the company's family and confided personally, wholeheartedly, to Shawn Murray, the owner of Aloha Termite and Pest Control. There was no segregation of duties; Rodrigues completed all the financial work without review by anyone but herself. Most importantly, the business owner should have completed a background check and called previous employers.

The complexity of the case made me realize that sometimes there can be an unlimited list of stakeholders, because stakeholders are basically anyone affected by the company. One of the assignments in particular was to prepare tax returns for a large company, while advising them on what to do in the future to maximize their income. The purpose of the assignment was not to label every assignment, but to actually realize that the question of whether it concerns tax, audit or advice is not always as clear as it seems.

From the assignments, I didn't mislabel any; however, I missed the point that there was an aggregation service on a few. Often the tax team may need the advice of the advisory or audit team and vice versa. The other focus of the presentation was on the different types of consulting work in the field.

The main objective of the case was to determine which journal entries to decide to test out. I traced the journal entries and was able to conclude that I could reasonably ensure that none of the journal entries were fraudulent. It was extremely intriguing because I have never heard of this subject from an accounting point of view.

One of the most important things I learned is that accountants can play an extremely important role in entrepreneurial projects. If you use CUP, it is also imperative to compare prices with other companies to get an idea of the right price to charge.