Related to the impact of the global financial crisis, many studies have been carried out mainly on transmission through the stock market, the currency market and the bond market. However, research on the transmission of the global financial crisis through international bank lending is not widely available (Aiyar 2011). From these conditions, it is essential to examine the impact of the global financial crisis through international bank loans in Indonesia.

Research on the impact of the global shock on the financial sector in Indonesia was conducted and viewed from different aspects in the financial sector.

Internal and External Capital Market Banking and Balance Sheet

In independent domestic banks, the global transmission of the shock may occur by reducing cross-border loans from global banks, which go directly to domestic banks. Without access to other finance, the loans granted by domestic banks contract with the funds received cross-border on the decline.

International Bank Lending Research

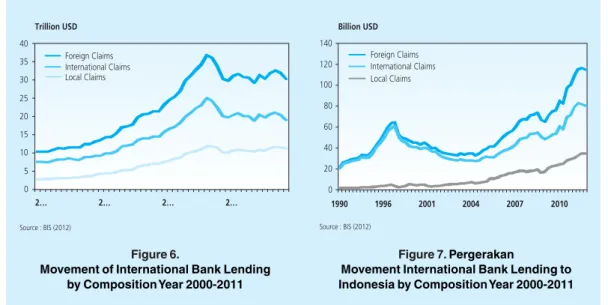

The study aimed to determine at the time of the 2008-2009 global crisis whether a decline in cross-border lending from developed to developing countries, for local claims made to foreign affiliates in the host country and domestic claims made by domestic banks, was due to the shock from cross-border lending. The same was found for local claims provided by foreign subsidiaries in the host country. The crisis had thus been transferred from developed countries to developing countries through a reduction in cross-border lending and local claims from foreign subsidiaries.

It can be concluded that international bank lending has a shock transmission path from developed to developing countries characterized by reduced cross-border lending by global banks, declining local claims by foreign affiliates in the host country and a decline in loans made by local banks are granted. a result of a decline in cross-border funding from domestic banks. The study was conducted along with the international bank loans and microloans to foreign banks in the host country. Δlogeise is the difference in the logarithm of international bank loans from banks in the home country to the host country j; Δlogclaimsi,t is the lag of the dependent variable.

The dependent variable loan growth is the growth of the bank lending affiliates either branch or subsidiary in the host country. The study concluded that international bank lending in the form of cross-border lending is a crisis transmission path represented by the significant and negative crisis dummy variable in the foreign claims equation to Indonesia (Equation 13). This confirms the role of the global banks that direct cross-border lending is a transmission path for shock.

METHODOLOGY 3.1. Data

Empirical Model of the Global Financial Shock Impact against the Cross- Border Lending

To determine the impact of a global shock on bank lending (financing) to Indonesia, identifying the determinants of international bank lending to Indonesia will be used by adopting a model used by Pontines and Siregar (2012). Where claims are financial assets (ie the only item on the balance sheet), this includes cash and deposits with other banks, as well as loans and advances against non-bank liabilities and bank ownership, but excludes derivatives and off-balance sheet transactions. The dependent variable Δlogclaimsi,t is the change in international bank lending from country i to Indonesia.

If a recession in developed countries means there is less chance of profit in the country, the bank will increase lending to Indonesia and the sign of growth will be negative. The sign of the coefficient for interest rates in developed countries is expected to be negative. The coefficient of this variable is expected to be negative, while TED with increasing numbers means that the global liquidity crisis would reduce bank lending to Indonesia.

This variable is the interaction between growth in developed countries and exposure to domestic banks from Indonesia. The growth rate in developed countries is represented by the shock that occurs in a country characterized by an overall deterioration in growth. EXPOSURE BIS - CEIC Indicators to capture the reactions of global banking in the country due to the shock of the international activities of its lending bank.

Testing the Impact of Global Banking Placement to Indonesia on the Credit Behavior via Foreign Affiliates

The dependent variable of the model is credit granted by foreign banks in Indonesia (host economy). The independent variables include macroeconomic conditions of the country of origin of foreign banks and Indonesia, as the push and pull factors. These variables are GDP of the country of origin of foreign banks (growthhomei,t) and the interest rate the country of origin (intratehomei,t) as well as the analogue of the domestic variables, namely GDP Indonesia (growthhosti,t) and interest rates ( intratehosti,t).

The expected sign of Indonesia's variable real GDP coefficient is positive, with real GDP growth encouraging foreign banks to increase lending in Indonesia. In addition to the macro variables, the variable balance sheet of each of the foreign banks operating domestically is also incorporated in the model. One of the bank balance sheet indicators used includes profitability as measured by NIM (net interest margin).

The higher the placement of the bank in the form of Securities, it will reduce the portion of the loan. The dummy variable is intended to test the implications of the global financial crisis on the stability of foreign bank loans in the form of branches and mixed foreign banks, where a value of 1 is given to a foreign bank and 0 to a mix of foreign banks. branches. Interaction of the dummy organizational form of foreign banks with the dummy global crisis was done to see if there is a difference in the organizational form of a bank to mitigate the current crisis during a financial crisis in the parent bank.

RESULTS AND ANALYSIS 4.1. Descriptive Analysis

Measuring the Impact of the Global Financial Shock Against Cross- Border Lending

To determine the impact of the global shock on Indonesia's financing, dynamic panel model equations were used to estimate the determinants of cross-border lending to Indonesia. A unit root test was performed on the variables in the equation to determine cross-border lending to Indonesia and in general the variables were stationary. Based on the estimates, it was found that the economic growth in Indonesia was positive and had a significant impact on Indonesia's bank lending at 1% confidence level.

Indonesia's economic growth came from pull factors for the flow of bank loans to Indonesia. The resulting coefficient was positive as expected, but not statistically significant to affect bank lending to Indonesia. This is confirmed by the importance of the risk variables of Indonesia represented by variable. This variable is positive and significant, which means the lower the risk in Indonesia, the higher bank loans to Indonesia.

Global liquidity conditions represented by the TEDt variable are also significant and have a negative impact on bank lending to Indonesia. As global liquidity decreased, so did the flow of bank loans to Indonesia, as indicated by the negative coefficient of TEDt. This confirmed the role of international bank loans in transferring the shock that occurred in the lending country to Indonesia.

The Impact of the Global Banking Placement to Indonesia Concerning Credit Behavior of Foreign Affiliates

It means that in the event of a shock, a country is characterized by a declining growth rate, where the response to global bank lending to Indonesia would decrease due to the increased exposure of Indonesia's banking system. Based on the parameter coefficient estimates, the value of the coefficient of dynamic variables is logloani,t-. Based on the A-B model estimates above, the effect of both home and host (domestic) country economic conditions on foreign and joint venture bank lending can be seen.

The economic condition of the GDP and interest rate of the host country (Indonesia) was an attraction factor for foreign bank/joint venture lending. The positive sign from Indonesia's GDP and floating rate was in line with the expected direction. Meanwhile, the floating rate of the home country (country of origin of foreign banks) showed a negative sign but was not significant.

Meanwhile, bank size was positive and significant, meaning the larger foreign bank-affiliated assets, the more likely they were to add loans. There was a positive and significant influence of the NIM and its size, consistent with the findings by Pontines (2012) using panel data from five ASEAN countries plus Korea. These findings suggested that the bank subsidiary has a more "crisis mitigating impact" on the economy of Indonesia (host), especially when the source of the shock comes from the global bank's financial condition (parent) than foreign banks.

CONCLUSION

When the economic growth of the country increases, foreign banks tend to expand lending (international lending) to other countries, including Indonesia. When choosing portfolio optimization for the placement of bank assets, ownership variables in interbank money market securities or in the stock markets were significant and negative. Factors that can explain this were the fixed costs, which were irreversible and high, which led the foreign direct investment banks to set up branches in the host country.

This made it difficult for international banks to "cut and run" in both host and home countries during the crisis. Second, based on examining the determinants of Indonesia's financing, international factors have shown a significant impact on bank lending as pull factors and push factors, such as economic growth in the source country and Indonesia. This means that bank lending directly (cross-border) transfers the shock from developed countries to Indonesia.

In the event of a crisis in the parent bank's country, loans from foreign subsidiaries seemed to contract. However, it is known that the estimation of foreign affiliates in the form of subsidiaries (locally incorporated) appeared more resistant to the shock of the financial turmoil that occurred in the (home) country compared to the parent bank in the form of a branch office. . When there is a shock in the home country (parent bank), banks in developed countries reduced bank lending activity in Indonesia.