Rp'Juta Rp'Juta Rp'Juta Rp'Juta Rp'Juta Rp'Juta Rp'Juta Rp'Juta Rp'Juta Rp'Juta. Lihat catatan atas laporan keuangan konsolidasi yaitu Lihat catatan terlampir atas laporan keuangan konsolidasi.

UMUM GENERAL

Perseroan mencatatkan saham hasil dividen saham ini di Bursa Efek Indonesia pada tanggal 22 Juli 2016. Perseroan mencatatkan saham hasil dividen saham ini di Bursa Efek Indonesia pada tanggal 20 Juli 2017.

PENERAPAN STANDAR AKUNTANSI KEUANGAN BARU DAN REVISI (PSAK) DAN

Pada tanggal 20 Juli 2017, perseroan mencatatkan seluruh saham tambahannya di Bursa Efek Indonesia. Pada tanggal 31 Maret 2021, seluruh saham perseroan telah dicatatkan di Bursa Efek Indonesia.

ADOPTION OF NEW AND REVISED STATEMENTS OF FINANCIAL ACCOUNTING

Sebelum Penggunaan yang Diintensikan PSAK 16 (Amendment) Tangible fixed assets: proceeds before intended use Sampai met tanggal penerbitan laporan. As of the date of issue of the consolidated financial statements, the consequences of the application of these standards, amendments and interpretations to the consolidated financial statements are not known or cannot reasonably be estimated by management.

IKHTISAR KEBIJAKAN AKUNTANSI YANG

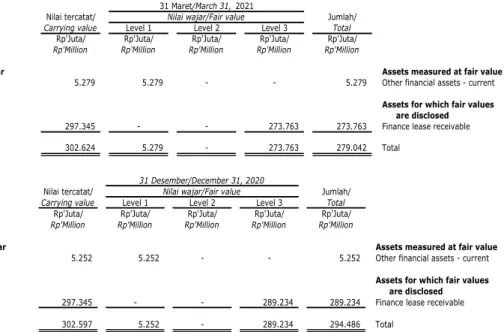

The entity and the reporting entity are members of the same group (meaning that each parent, subsidiary and co-subsidiary is related to each other). Financial assets and financial liabilities are recognized on the consolidated statement of financial position when the Group becomes a party to the contractual terms of the instrument. The difference between the carrying amount of the financial liability that has been derecognised and the consideration paid and payable is recognized in profit or loss.

The Group assesses whether a contract was or contains a lease at the inception of the contract. Amounts due from lessees under finance leases are recognized as receivables at the amount of the Group's net investment in the leases. A portion of the Group's sales, categorized as hardware and other revenue, is accounted for as product revenue.

The provisions are valued at the best estimate of the amount expected to become due.

PERTIMBANGAN KRITIS AKUNTANSI DAN

Basic earnings per share are calculated by dividing the net profit for the year, attributable to the owners of the Company, by the weighted average number of shares outstanding during the year. Diluted earnings per share are calculated by dividing the net profit attributable to the owners of the Company by the weighted average number of shares outstanding, adjusted for the effects of all potential ordinary shares that could lead to dilution. v. Operating segments are identified based on internal reports on Group components that are regularly reviewed by the key operating decision maker to allocate resources to the segments and assess their performance.

While the assumptions used in estimating the allowance for impairment are believed to be appropriate and reasonable, significant changes in these assumptions could materially affect the estimate of the allowance for impairment, which would ultimately affect as a result of the Group's operations. Actual results that differ from the Group's assumptions are recognized in the statement of financial position to reflect the full value of the plan deficit or surplus.

KAS DAN SETARA KAS CASH AND CASH EQUIVALENTS

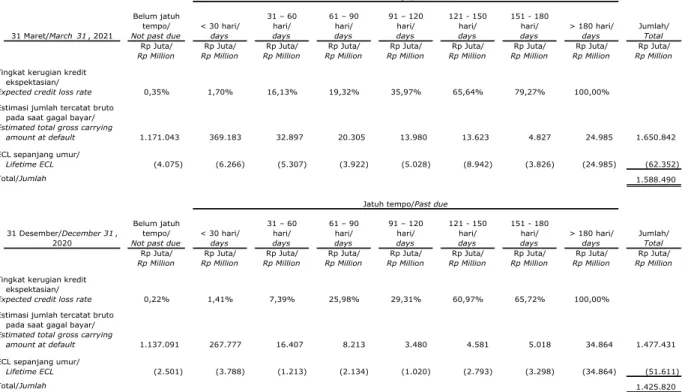

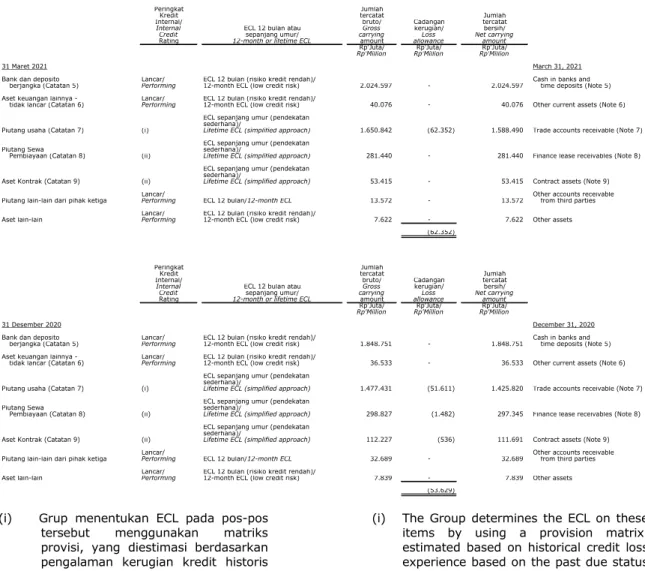

Pledged deposits represent deposits placed with certain banks, which are used as a bank guarantee for tenders and letters of credit and to meet the sales needs of the Group's customers. Before accepting any new customer, the Group assesses the credit quality of the potential customer to determine the customer's creditworthiness and payment terms. The Group has recognized a 100% impairment allowance for all receivables that are more than 180 days past due, as past experience has shown that these receivables are generally more difficult to collect.

The following table details the risk profile of trade receivables from customer contracts based on the Group's provisioning matrix. When determining the impairment loss allowance, the Group took into account any change in the credit quality of trade receivables from the date of initial credit approval to the end of the reporting period.

PIUTANG SEWA PEMBIAYAAN FINANCE LEASE RECEIVABLES Grup melakukan transaksi sewa pembiayaan atas

None of the financial lease receivables at the end of the reporting period are due, and taking into account the historical default experience and the future prospects of the industries in which the lessees operate, together with the value of collateral over these financial lease receivables. When calculating the provision for impairment, the group takes into account any change in the credit quality of the finance lease receivable from the date the credit was originally granted to the end of the accounting period. Management always estimates the loss allowance on contract assets at an amount equal to the lifetime ECL, taking into account the historical default experience and future prospects of the relevant customer industries.

None of the amounts due from customers at the end of the reporting period are due. There has been no material change in the gross amounts of contract assets that have affected the estimation of the loss allowance.

Bagian kepemilikan grup Bagian kepemilikan grup Nilai buku bagian grup Nilai buku bagian grup.

ASET TETAP PROPERTY AND EQUIPMENT 1 Januari 2021/ Penambahan/ Pengurangan/ 31 Maret 2021/

Manajemen menilai bahwa nilai pertanggungan tersebut cukup untuk menutup kerugian atas aset yang dipertanggungkan. Manajemen menilai bahwa nilai pertanggungan asuransi tersebut cukup untuk menutup kemungkinan kerugian atas aset yang dipertanggungkan.

BIAYA YANG MASIH HARUS DIBAYAR ACCRUED EXPENSES

Grup mengakuinya sebagai kewajiban kontraktual. sampai periode tersebut selesai. iii) Pendapatan yang berkaitan dengan jasa pemeliharaan peralatan diakui sepanjang waktu meskipun pelanggan membayar penuh di muka atas jasa tersebut. Liabilitas kontrak diakui atas pendapatan yang berkaitan dengan jasa instalasi pada saat transaksi penjualan awal dan diakui selama periode jasa. iii) Pendapatan yang berkaitan dengan jasa pemeliharaan peralatan diakui sepanjang waktu meskipun pelanggan membayar penuh di muka atas jasa tersebut. Liabilitas kontrak diakui atas pendapatan yang berkaitan dengan jasa instalasi pada saat transaksi penjualan awal dan dilepaskan selama periode jasa.

LIABILITAS IMBALAN KERJA EMPLOYEE BENEFITS OBLIGATION Entitas Grup yang berdomisili di Indonesia

Kerugian actuarial yang timbuk Actuarial loss arising from changes in demographics dari perawakan asansiim - 2.477 in demographic assumptions. Important actuarial assumptions for determining the defined liability include the discount rate and expected salary increase. The sensitivity analysis below has been determined based on reasonably possible changes in the relevant assumptions occurring at the end of the reporting period, while holding all other assumptions unchanged.

The above sensitivity analysis may not be representative of the actual change in the defined benefit obligation as it is unlikely that the change in assumptions will occur in isolation from each other as some of the assumptions may be correlated. In the presentation of the above sensitivity analysis, the present value of the defined benefit obligation has also been calculated using the projected unit credit method at the end of the reporting period, which is the same as that used in the calculation of the defined benefit obligation recognized in the statement of the financial position.

PENGHASILAN KOMPREHENSIF LAIN OTHER COMPREHENSIVE INCOME Akun ini meliputi penghasilan komprehensif lain

KEPENTINGAN NONPENGENDALI NON-CONTROLLING INTEREST 31 Maret/ 31 Desember/

Selisih kurs sehubungan dengan perubahan mata uang fungsional entitas anak dari dolar AS ke rupiah Indonesia pada tahun sebelumnya diakui secara langsung dalam penghasilan komprehensif lain dan diakumulasikan dalam cadangan penjabaran mata uang asing dan direklasifikasi ke laba rugi penjualan. Berdasarkan Rapat Umum Pemegang Saham Tahunan Perseroan yang diselenggarakan pada tanggal 26 Juni 2020 dan dituangkan dalam akta No. 150 tanggal 26 Juni 2020 oleh Christina Dwi Utami S.H., M.Hum., MKN., Notaris di Jakarta, pemegang saham menyetujui pembayaran dividen tunai final tahun 2020 sebesar Rp33 per saham dengan jumlah dividen sebesar Rp81.027 juta.

On the basis of the shareholders' meeting of the company on June 26, 2020 and stated in the notarial document no. 150 dated June 26, 2020 Christine Dwi Utami S.H., M.Hum., MKN., Notary Public in Jakarta, the shareholders approved the final cash dividend distribution for 2020 of Rp. 33 per share with a total dividend of Rp. 81,027 million.

PENDAPATAN BERSIH DAN BEBAN POKOK

PT Asus Technology Indonesia Batam 729 PT Asus Technology Indonesia Batam PT Asus Technology Indonesia Jakarta 591.614 PT Asus Technology Indonesia Jakarta. PT Asus Technology Indonesia Batam 52.742 PT Asus Technology Indonesia Batam PT Asus Technology Indonesia Jakarta 273.416 PT Asus Technology Indonesia Jakarta.

Rp'Juta Rp'Juta Rp'Juta Rp'Juta Rp'Juta Rp'Juta Rp'Juta Rp'Juta Rp'Juta. Peraturan Pemerintah Pengganti Undang-Undang Nomor 1 Tahun 2020 tentang Kebijakan Keuangan Negara dan Stabilitas Sistem Keuangan dalam rangka penanggulangan penyakit virus corona tahun 2019 (“COVID-19”) dan/atau ancaman terhadap perekonomian nasional dan/atau stabilitas sistem keuangan (“Perpu No. .1/2020”) mulai berlaku pada tanggal 31 Maret 2020. 1 Tahun 2020 tentang Kebijakan Keuangan Negara dan Stabilitas Sistem Keuangan Dalam Rangka Penanganan Corona Virus Disease 2019 (“COVID-19”) dan/atau Ancaman Terhadap Perekonomian Nasional dan/atau Stabilitas Sistem Keuangan (“Perpu No. 1/2020” ) mulai berlaku pada tanggal 31 Maret 2020.

In 2020, the General Directorate of Taxes ("DGT") approved the company's objection regarding the overpayment of corporate income tax for 2018 in the amount of Rp 831 million, instead of Rp 3,641 million previously recorded in the company's financial statements as a tax claim income. . In 2020, the General Directorate of Taxes ("DGT") approved SMI's objection regarding the overpayment of corporate income tax for 2018 in the amount of Rp 7,109 million, which was previously recorded in SMI's financial statements as a claim for income tax in 2018.

Pada tahun 2020, Direktorat Jenderal Pajak (DJP) mengabulkan keberatan SMI atas lebih bayar pajak badan tahun 2018 sebesar Rp7.109 yang sebelumnya dicatat sebagai taksiran pajak tahun 2018.

REKONSILIASI LIABILITAS YANG TIMBUL

Pada tanggal pelaporan, kewajiban pembelian dicatat sebagai bagian dari utang kepada pemasok (catatan 14), yaitu sebesar 0,03% dari seluruh liabilitas pada tanggal 31/03/2021 (31/12).

IKATAN

COMMITMENTS

ASET DAN LIABILITAS MONETER DALAM MATA UANG ASING

MONETARY ASSETS AND LIABILITIES DENOMINATED IN FOREIGN CURRENCIES

PERJANJIAN-PERJANJIAN PENTING SIGNIFICANT AGREEMENTS a. Grup ditunjuk sebagai distributor di

INSTRUMEN KEUANGAN, MANAJEMEN RISIKO

The Group's net open foreign currency exposure at the reporting date is disclosed in Note 34. The carrying amount of financial assets recorded in the consolidated financial statements, after deducting any allowance for losses, represents the Group's exposure to credit risk. The Group has adopted procedures to extend credit terms to customers and to monitor its credit risk.

The contractual term is based on the earliest date on which the Group may have to pay. The Group's capital structure consists of cash and cash equivalents (Note 5), other long-term financial assets (Note 6), debt, consisting of lease liabilities (Note 18) and shareholders of the holding company, consisting of share capital (Note 20), additional paid-in capital (Note 21), retained earnings, other.

KONDISI INDUSTRI INDUSTRY CONDITION Seiring dengan kondisi pandemi Covid-19 yang

TANGGUNG JAWAB MANAJEMEN DAN PERSETUJUAN ATAS LAPORAN KEUANGAN

MANAGEMENT RESPONSIBILITY AND APPROVAL OF CONSOLIDATED FINANCIAL