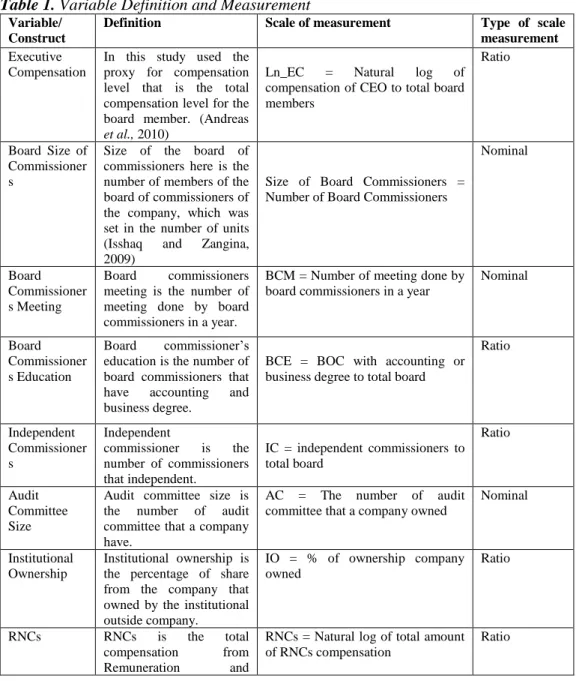

Many companies are now increasingly aware of the importance of implementing Corporate Social Responsibility (CSR) as part of their business strategy and as the embodiment of the company's interest in society. Company size Company size is a scale that can be classified according to company size in many ways. In this study, company size is the size of the company examined by the auditor and is calculated using the total assets owned by.

Based on the research of Sudaryanto (2011), Melisa (2013) and Elda (2013), CSR disclosure activities have a significant impact on the company's financial performance.

Hypothesis Testing 3

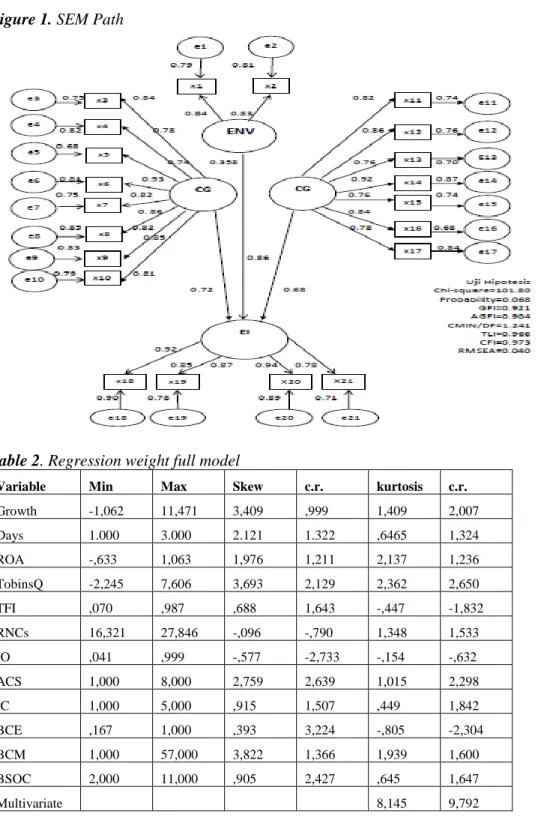

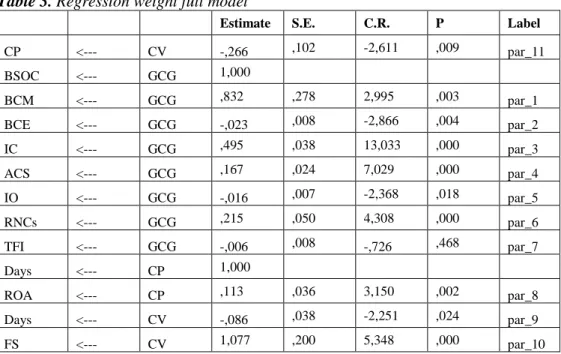

Laksana, Hersugondo, Robiyanto 101 Descriptive analysis shows that the value of CSR is good, it shows that the CSR implemented by the company can be well received by the community. There is a suspicion that the socially responsible disclosure of the company is carried out in accordance with the system and values that apply to the community and explains that the company must disclose corporate governance to create a good corporate image for investors.

Conclusions, limitations, recommendations

Limitation of the study does not analyze the impact of corporate governance on company performance. Return distributions and weekly effects on the stock market in Thailand. The day of week effect, week 4 effect and Rogalski effect testing against returns on LQ-45 stocks in the Indonesian stock market.

Comparison of "Turn-of-the-month" and Lunar New Year Return Effects in Three Chinese Markets: Hong Kong, Shanghai and Shenzhen.

INDEPENDENT COMMISSIONERS, AUDIT COMMITTEE AND OWNERSHIP

STRUCTURE UPON THE EXTENT OF CSR DISCLOSURE", The Accounting Journal of

COMMISSIONER AND AUDIT COMMITTEE ON VALUE OF FIRM TO ISLAMIC SOCIAL

Instructor

The test of the day-of-the-week effect and the turn of the month effect using a garc approach: evidence from the Indonesian capital market Hersugondo, H. The day-of-the-week effect, week four effect and Rogalski Effect Testing Against Returns on LQ-45 Stocks on the Indonesian Stock Exchange, pp. Yield distributions and the day-of-the-week effects on the Thailand stock exchange.

The institutionalization of the concept of corporate social responsibility: Possibilities and prospects. http://www.ersj.eu/index.php?option=com_docman&task=doc_download&gid=561&Itemid=154.

Call for Papers

Conferences

Workshops

Takeover Defenses in the United Kingdom

- Introduction

- UK Takeover Regulation

- Frustrating Actions 1. Rule 21 UK takeover code

- Restructuring defenses and target repurchases framework

- Litigation framework

- Defensive Actions

- Defense document framework

- Lobbying framework

- Seeking alternative bids framework

- Profit forecasts framework

- Conclusions, Proposals, Recommendations

Pursuant to Rule 21.1, the board of directors of the target company may not, without prior approval of the shareholders, use defenses that could prevent the takeover. 107 the offer or deprives the target shareholders of the right to decide on the merits of the offer. In addition, the Notes to Rule 21.1 of the UK Takeover Code provide further guidance in relation to prohibitions on takeover defences.

To begin with, the defense of crown jewels involves the sale of the most valuable assets of the target company (Zarin and Yang, 2011). Therefore, they are prohibited under rule 21.1 (b) of the UK Takeover Code if there is no shareholder approval. If the target board succeeds and the hostile bidder withdraws the offer, the shareholders of the target company face a large loss of profits.

The effectiveness of tactical litigation can also be a profit maximization of target shareholders (Ogowewo, 2007). It should also include the strategic plan of the hostile bidder and the consequences it may have on the target company. Thus, the objective is eventually won by the hostile bidder due to the cooperation of the White Knight with the original bidder.

Profit announcements are another way for a target board to adversely influence shareholders against a takeover bid and are governed by Rule 28 of the UK Takeover Code. The target company's board of directors can use takeover defenses in the event of a potential hostile takeover.

Country Risk on the Bank Borrowing Cost Dispersion Within the Euro Area during the Financial and Debt Crises

- Literature review

- Methodology

- Data

- Estimation Results

- Estimation of the model for the whole period

- Rolling Estimation results

- Conclusions

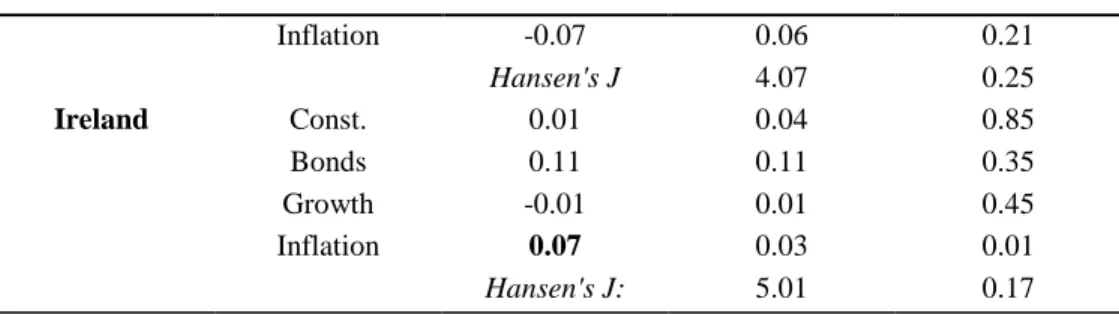

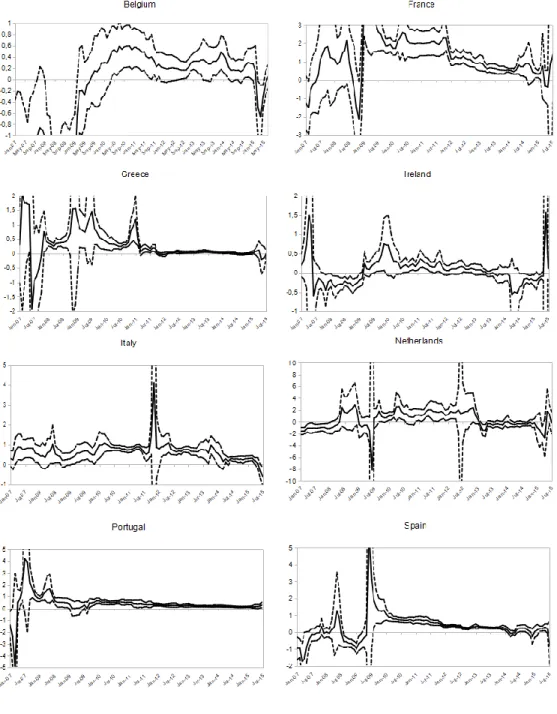

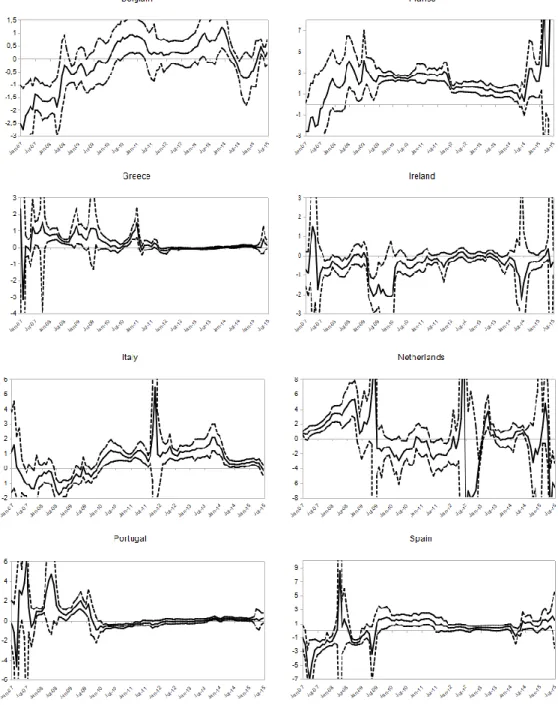

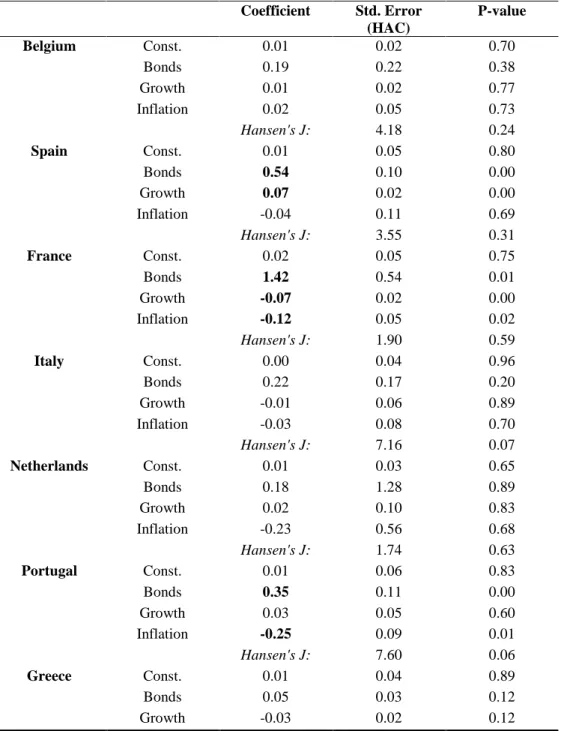

The purpose of this study is to assess the impact of country-specific risk factors, as measured by sovereign bond yield spreads, on the spread of borrowing costs in the euro area. We use recently produced indicators of the borrowing costs of non-financial institutions and households for long-term and short-term borrowing (ECB 2013). Specifically, bond yield spreads are shown to be a significant factor in borrowing cost differentials for only a few subperiods.

79 Neri (2013) examines, among other things, the impact of sovereign risk on the costs of borrowing in various euro area countries. In this way we can isolate the impact of country risk from the impact of the other variables on borrowing costs. In addition, we apply a rolling estimation of the model to better understand the evolution of the impact of sovereign risk on the cost of borrowing.

Moreover, with these estimated series, we may be able to observe possible trends in the process of convergence (or divergence) of the cost of borrowing in particular countries. On the other hand, the results are not so similar when examining the evolution of the coefficients referring to long-term borrowing cost differences. Consequently, the increase in the spread of bank borrowing costs observed in the euro area during the current financial turbulence cannot be explained by increased sovereign risks.

An empirical analysis of national differences in euro area retail bank interest rates. The impact of the sovereign debt crisis on bank lending rates in the euro area.

Analysis of the Influencing Factors on the Farmers’ Take-up of Greenhouse Agricultural Insurance Cover: A Case Study

- Survey

- Sample Size

- Official Document Analysis

- Interview

- Restrictions of the Study

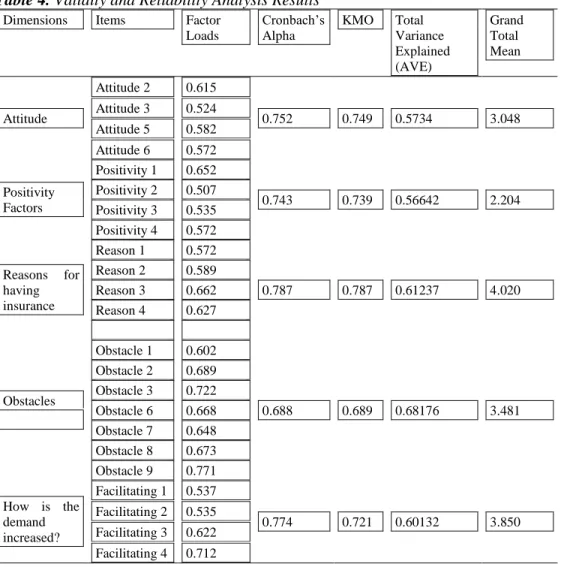

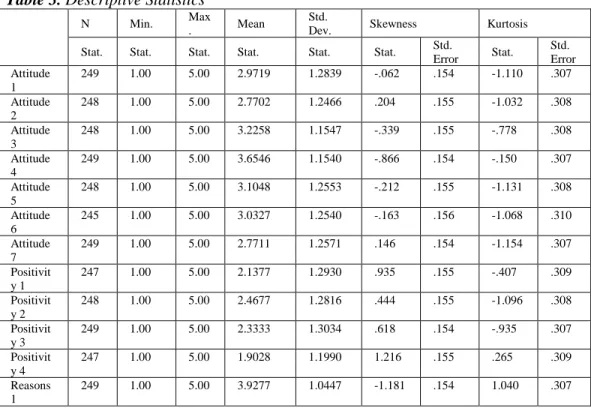

This is because there was a tornado in the county two years before the study period. Attitude Farmers' attitude towards agricultural insurance (statements 1-7) Positivity Farmers' positive view of current insurance (statements 8-11) Reasons The farmer's need to purchase insurance cover (statements 12-15) Obstacle Farmers' difficulties in taking out insurance cover (statements 16-24 ). Would the establishment of a farmer's advisory center increase my willingness to take out Tarsim insurance (statement 30).

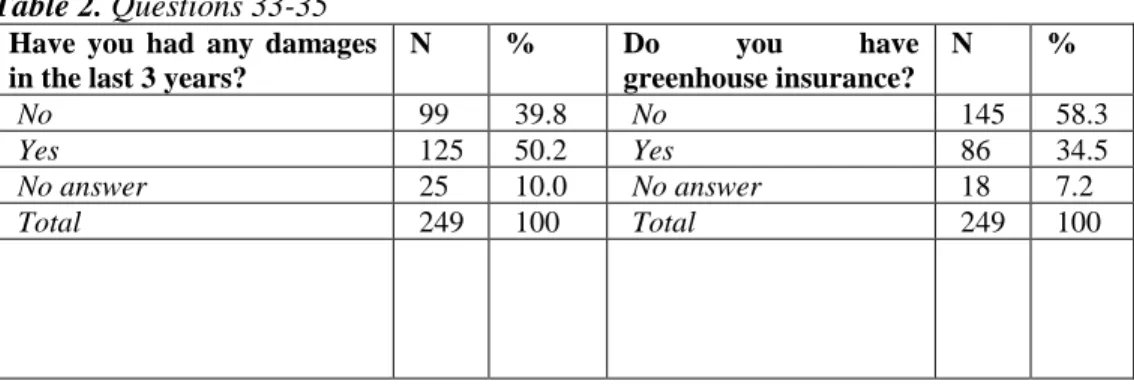

Analysis of the influencing factors on farmers' use of greenhouse agricultural insurance coverage: a case study. In total, the survey was administered to 644 farmers using a non-probability, purposive and snowball sampling (Tongco, 2007) to recruit participants, however, during 2 periods only 281 of the farmers participated in the survey. In the first period between the 15th and 25th January 2018, 192 farmers participated and returned the surveys.

32 surveys had errors and were excluded from the evaluation and 249 questionnaires were used in the study. Only one open question was asked, that is "what are the influencing factors when you decide to take up an insurance cover and the problems you encounter with the Tarsim Insurance". As discussed in the literature, under normal circumstances, the biggest influencing factor that can affect farmers for taking up agricultural insurance coverage is the expectation of damage that can be caused by natural disasters.

Moreover, although 644 farmers were asked to participate in the agricultural insurance survey, most of the farmers avoided participating in the survey and answered in an irritated voice that they did not understand these things. Therefore, it is assumed that the majority of farmers who did not answer the survey questions do not have insurance.

Findings and Analysis 1 Survey Findings

- Official Data Analysis Findings

- Interview Findings

H0: Farmers' intention to take out greenhouse agricultural insurance coverage (Statement 31) will not change with claim experience in the past three years (Statement 32); H1: Farmers' intention to take out greenhouse agricultural insurance coverage (Statement 31) will change with the loss experience in the past three years (Statement 32). H0: Farmers' intention to undertake Greenhouse Agriculture Insurance (Statement 31) will not be influenced by farmers' 'Attitude Scale';.

H1: Farmers' intention to obtain greenhouse agricultural insurance coverage (statement 31) will be influenced by farmers' 'degree of attitudes'. H0: Having an agricultural insurance coverage (statement 33) will not be affected by the 'level of attitudes' of farmers;. H0: Farmers' intention to obtain greenhouse agricultural insurance coverage (statement 31) will not be affected by farmers' 'positivity rate';.

H1: The farmers' intention to adopt greenhouse agricultural insurance coverage (statement 31) will be influenced by the farmers' 'Positivity Scale'. H0: Having an agricultural insurance cover (statement 33) will not be influenced by the farmers' 'Positivity Scale';. H0: Having an agricultural insurance cover (statement 33) will not be affected by the farmers' 'Reasons Scale';.

H0: Having agricultural insurance coverage (Statement 33) ) will not be affected by farmers' 'Obstacles Scale';. H0: Having an agricultural insurance coverage (statement 33) will not be affected by farmers' 'Facilitating scale';.

Conclusions and Recommendations

Management and Economics: Celal Bayar University Journal of the Faculty of Economics and Administrative Sciences. 4 Attitude 4 The guidance of the Tarsim officials increases my willingness to take out Tarsim insurance. 12 Reason 1 A high risk of climate-related damage in the future increases my desire to insure.

23 Obstacle 8 The complexity of legal procedures in the insurance process is an obstacle to the use of Tarsim insurance coverage. 31 Intention I am thinking of taking up a Tarsim insurance cover next year 32- Have you had any damage in the last 3 years due to Rain-Tornado etc. The title of the manuscript should be simple and free of jargon, which captures the main message conveyed by the paper.

The abstract and conclusions should be 1) self-contained in the sense that they do not depend on anything (such as explanations of acronyms and technical terms) explained only in the main text, 2) understandable and interesting to non-specialists. , and 3) clearly convey the relevance of your work to real-world problems. Tables and captions must be included in the main text on first submission and must be numbered with Arabic numerals. Citation: References in the main text must, within brackets, indicate the author(s) surname and the year of publication.

Inter-vulnerability of financial institutions and households in the national financial security assessment system. Employment management policies in single industrial cities in light of existing problems of precarious employment.