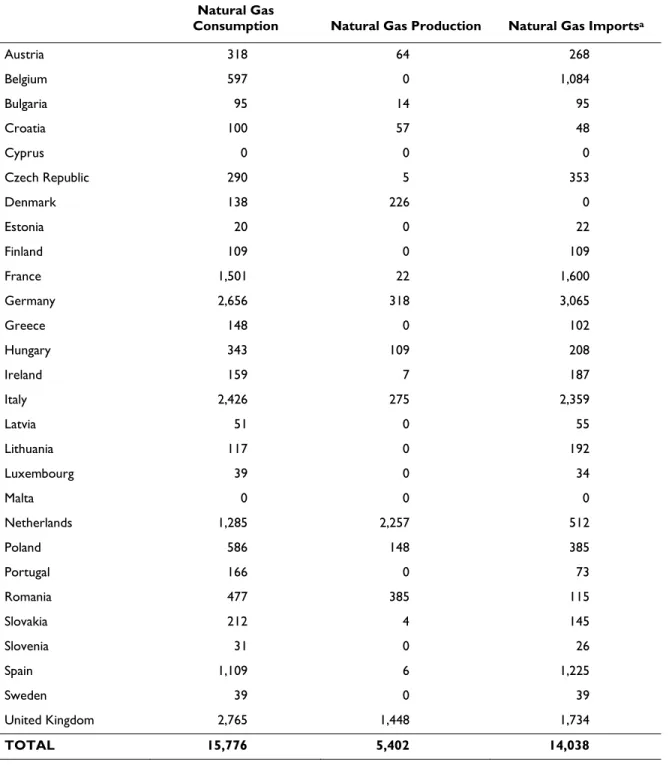

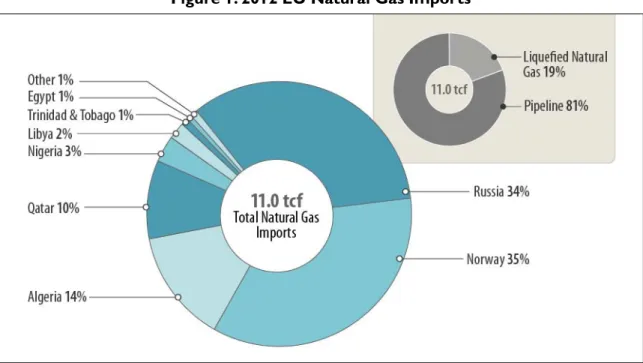

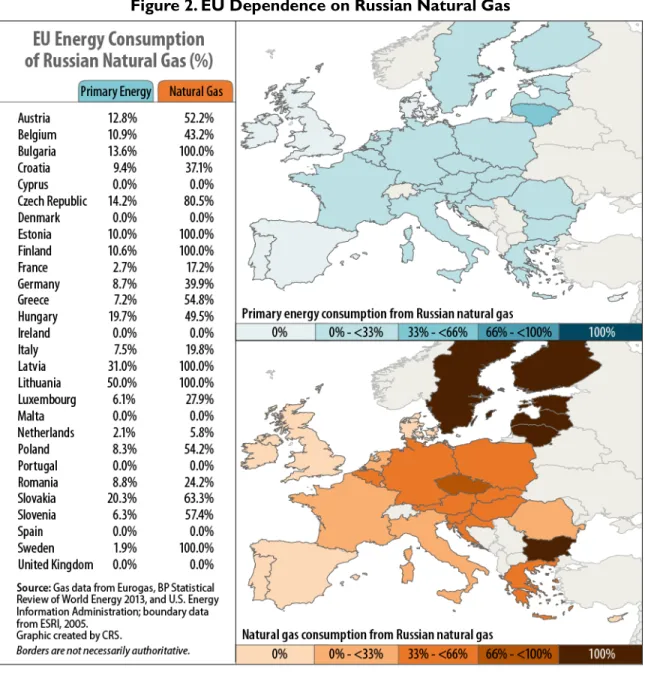

A key element of the EU's energy supply strategy has been to switch to greater use of natural gas. Russia has not been idle when it comes to protecting its share of the European natural gas market. Nevertheless, although supplying natural gas to Europe from the Caspian Region and Central Asia is a goal of several U.S.

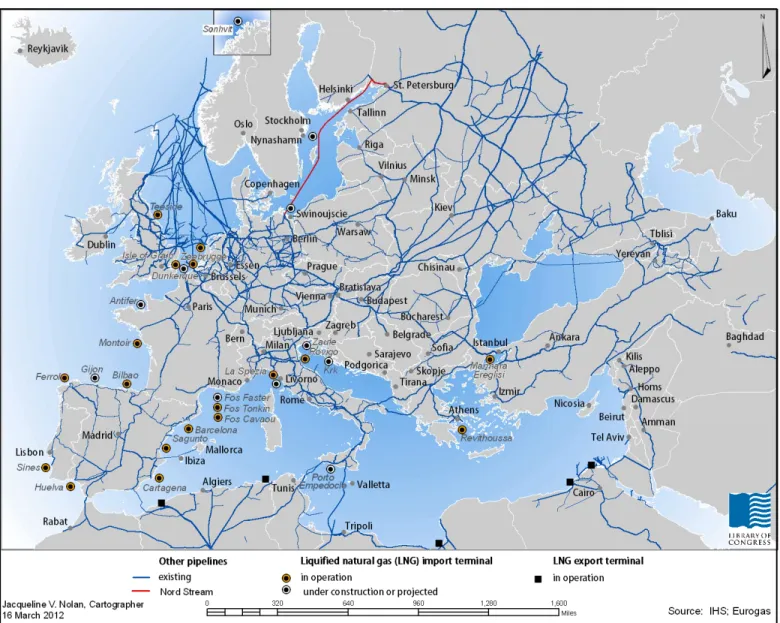

At least until recently, most Russian natural gas exports to Europe went through Ukraine and Belarus. Russia has long been and is expected to continue to be a major supplier of natural gas to Europe. Observers expect natural gas to play an important role in Europe-Russia relations for decades to come.

Russia’s Role 20

In 2012, President Putin estimated that half of total Russian government revenue came from oil and natural gas taxes. Gazprom offers natural gas to the Russian domestic market at subsidized prices, which also politically strengthens the ruling elite. In addition to their financial benefits, Russian natural gas exports to Europe and Eurasia may have important psychological benefits for the Russian elite.

Russia's long-standing hopes of supplying large volumes of natural gas to China via pipelines has been thwarted by China's unwillingness to pay the price that Europe pays for Russian natural gas.25 Gazprom's key customers have been able to obtain better contract terms in recent years. enforcing, tying part of the natural gas price to natural gas spot prices rather than solely to oil. In the mid and late 2000s, many European countries experienced several unexpected power cuts due to confrontations between Russia and the major pipeline transit states Ukraine and Belarus over problems with the supply and transit of natural gas.

Before the opening of Nord Stream, around 80% of Europe's natural gas imports from Russia went through Ukrainian pipelines. A similar Russian-Ukrainian dispute had led to a natural gas cut-off to Europe in early 2006. A new natural gas pipeline is the aforementioned Nord Stream, which transports natural gas from Russia to.

In December 2011, Gazprom struck a deal to buy the 50% of Beltransgaz (Belarus' natural gas pipeline transport company) that it did not own, in exchange for reduced gas prices. Historically, Russia has attempted to varying degrees to thwart any project that would bring non-Russian natural gas supplies to Europe.

Southern Corridor: Issues and Background 30

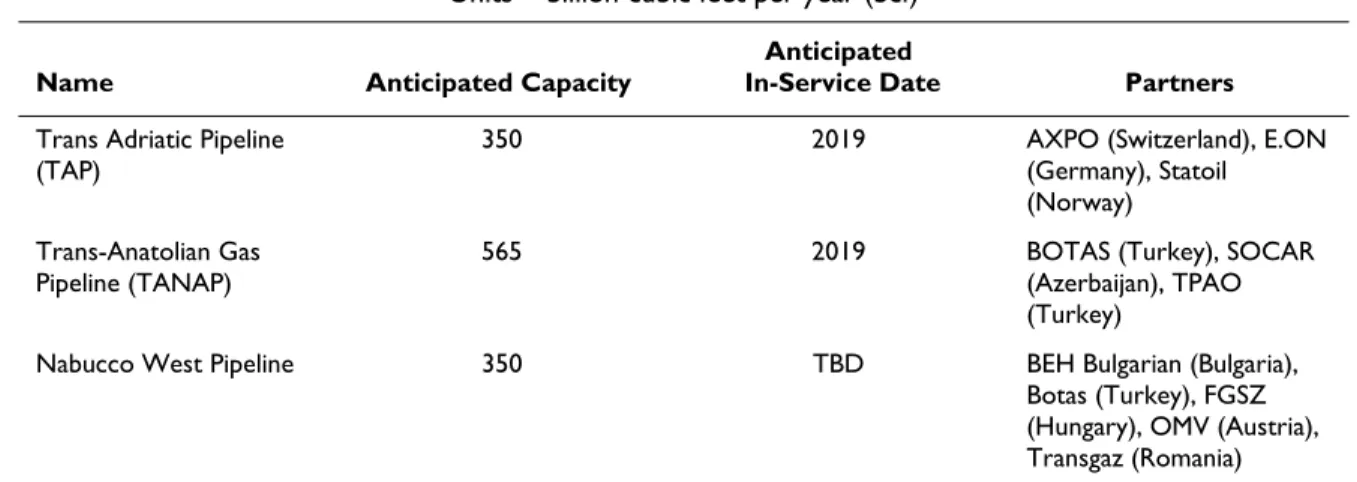

The project's output is expected to be 247 bcf per year, with 71 bcf of natural gas used from Romania and the rest from other EU countries. Some of the tensions between Turkey and Azerbaijan related to energy issues appeared to be resolved in June 2010, during President Aliyev's visit to Turkey, when the two countries signed agreements on the sale and transportation of Azerbaijani natural gas to Turkey and other countries. others through Turkey. A memorandum of understanding was signed allowing Azerbaijan to end direct sales with Greece, Bulgaria and Syria including natural gas transiting Turkey.

President Aliyev and European Commission President Jose Manuel Barroso signed a joint statement committing Azerbaijan to supply significant amounts of natural gas to the European Union in the long term. In early October 2011, the State Oil Company of Azerbaijan (SOCAR) had received final proposals for natural gas export pipelines from the second phase of the development of the Shah Deniz offshore oil and natural gas fields. SOCAR and other members of the Shah Deniz consortium stated that they would make a decision on a pipeline within weeks.

On October 25, 2011, Azerbaijan and Turkey announced that they had signed agreements on the final terms for the Shah Deniz phase 2 natural gas transit through the Southern Corridor. Another important agreement provided for the possible construction of a new "Trans-Anatolia" natural gas pipeline, so that natural gas from Shah Deniz Phase 2 would not have to pass through the Turkish pipeline system. SOCAR is initially slated for an 80 percent stake in the consortium, although other companies, primarily members of the Shah Deniz consortium, may be invited to join later.

To strengthen the prospects of building the Nabucco West pipeline, the Shah Deniz consortium agreed with the Nabucco consortium in January 2013 to finance up to half of the pipeline. In September 2011, the Council of the European Union approved the opening of negotiations with Azerbaijan and Turkmenistan to facilitate an agreement on the construction of a trans-Caspian gas pipeline.

Potential Sources of Alternative Supplies

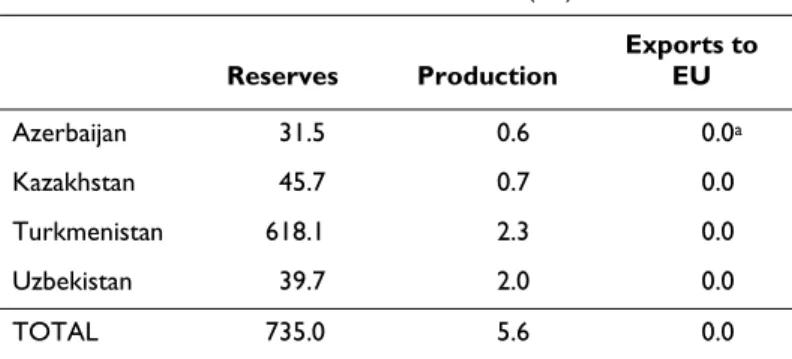

Turkmenistan in China exists, but China needs to improve its domestic supply network to provide natural gas to coastal industrial areas. Azerbaijan exports natural gas to Turkey, which then sends part of it to Greece. The natural gas will come from the development of phase 2 of Azerbaijan's Shah Deniz field, which is located in the Caspian Sea.

According to the BP Statistical Review, Kazakhstan exported about 406 bcf of natural gas from its western fields mostly to Russia in 2011. Nevertheless, Kazakhstan plans to boost its natural gas exports to Russia and China in coming years. However, Turkmenistan's pursuit of alternative export routes for its natural gas has pitted it against some of the other Caspian countries.

In September 2011, the Council of the EU approved the opening of talks with Azerbaijan and Turkmenistan to facilitate an agreement on the construction of a trans-Caspian natural gas pipeline. Finally, Turkmen President Berdimuhamedow has also revived his predecessor's proposal to build a natural gas pipeline through Afghanistan to Pakistan and India (TAPI). However, it has used its Soviet-era natural gas pipeline network to export some natural gas to Russia and other Central Asian states (Kazakhstan, Kyrgyzstan and Tajikistan).

40 According to the BP Statistical Review, actual Turkmen natural gas exports to Iran were approximately 230 bcf in 2010. Uzbekistan also signed a framework agreement to eventually supply 353 bcf of natural gas per year through the pipeline.

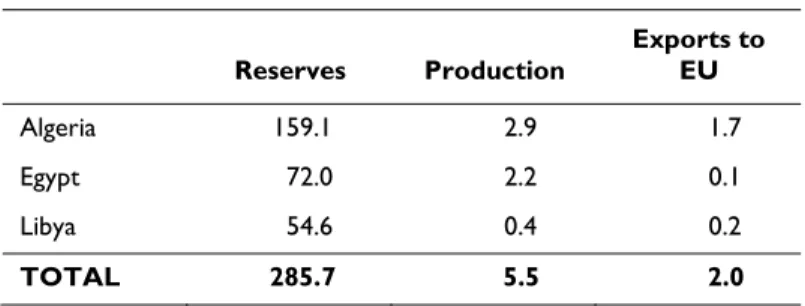

North Africa: Opportunities Amid Uncertainty

In 2005, the China National Petroleum Corporation (CNPC) and Uzbekistan's state-owned Uzbekneftegaz announced that they would form a joint venture to develop oil and natural gas resources. A production-sharing consortium consisting of Uzbekneftegaz, Lukoil, the Korea National Oil Corporation, and CNPC is exploring natural gas in the Aral Sea region. The four-day hostage crisis that began when terrorists seized a natural gas connection with foreign workers (including US) in southeastern Algeria on January 16, 2013 underscores stability.

Depending on the development of its unconventional natural gas resources and its conventional resources, Algeria could become a more important producer and exporter of natural gas. Medgaz, Algeria exports natural gas to Europe through the 425 bcf Maghreb-Europe pipeline to Spain. Since 2005, demand for natural gas in Egypt has been on the rise, growing almost 57% over the time period.

Depending on the orientation of a new government, if it promotes Western investment in Egypt's energy sector and the government addresses its natural gas subsidies, this deterioration of Egypt's natural gas sector could be reversed. The civil war halted natural gas production, but production has since resumed and appears to be recovering faster than most analysts had predicted. 46 For more information on Egypt's energy sector, see CRS Report R41632, Implications of Egypt's Turmoil on Global Oil and Natural Gas Supply, by Michael Ratner, and for more information on current events in Egypt, see CRS Report RL33003, Egypt: Background and U.S.

Libya has one natural gas pipeline to Europe, Greenstream, which was closed during the recent unrest, as well as an LNG export terminal. Italy received almost all of Libya's natural gas exports in 2011, while Libya accounted for about 3% of Italy's natural gas imports.

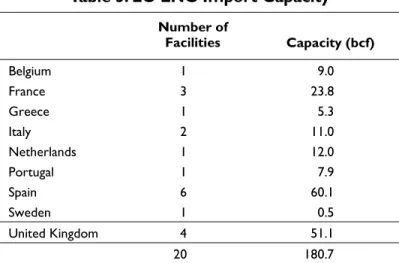

Liquefied Natural Gas Imports

However, domestic consumption, especially for electricity generation, could increase natural gas consumption in Libya, which has been stable over the past decade according to the EIA.48. The LNG export projects, if all built today, would make the United States the largest exporter of LNG. The proposed projects are in various stages of the regulatory approval process, with only one under construction.

Any LNG volume from the United States would benefit the market, including Europe, by providing a new supplier to consumers. For parts of Europe, especially the Baltic region and Central Europe, where the United States enjoys strong and friendly relations, any decision to export the United States is one of the few countries that does not link the price of natural gas to the price of oil. and therefore may increase the pressure to decouple the two goods.

Most of the natural gas sold in the world, whether by pipeline or as LNG, is sold under long-term contracts and indexed to the price of oil.

More Distant Alternatives

LNG to the region would be welcome as a potential offset to their dependence on Russian gas. In addition to strengthening other sources of energy supply from other regions, experts point to several additional factors that could reduce European dependence on Russian sources. The development of "unconventional" natural gas deposits, including shale gas, in Europe and elsewhere, which have previously been difficult to develop, could diversify supply and lower prices.

The EIA estimated the EU's technically recoverable shale gas reserves at nearly 500 tcf, supply for more than 25 years at current consumption levels.49 The growth of the spot market for natural gas and the development of liquefied natural gas infrastructure in Europe could also help diversify supply. and reduce dependence on Russian-controlled pipelines. Finally, the development of alternative energy sources within Europe, in particular hydropower, marine energy, biomass, wind energy, solar energy and geothermal energy, could all contribute to further diversification of Europe's energy supply, thereby increasing the overall demand for natural gas. to decrease.

Prospects for Diversification

The type and nature of the new governments will have an impact on natural gas development in each country, as their energy sectors appear to offer a significant potential source of economic growth and income. Both countries have large natural gas resources, but historical political constraints have limited the development of these resources. The US and Europe are in a position to help both countries reform their regulatory regimes for natural gas development as well as establish oversight from non-.

However, neither Israel nor Cyprus has any experience in developing large-scale natural gas projects.

Author Contact Information

Acknowledgments