In other words, Chen et al. 2016) use firms' investments in assuring the quality of their financial information, proxied by higher audit fees, to signal a higher level of credibility of voluntary CSR disclosure. In China, on the contrary, CSR disclosure is still in the early stages of development (Kuo et al., 2012). Similar to Chen et al. 2016), we find a positive relationship between voluntary independent CSR reports and higher audit fees.

Our findings suggest that the driving factor for the positive association between voluntary CSR disclosure and higher audit costs in China is the view of audit risk, rather than the complementary view. These findings further support the audit risk perspective in explaining the positive association between voluntary disclosure of CSR and higher audit costs in China. While the complementary relationship between CSR reporting and the quality of financial reporting, as presented by Chen et al. 2016) could be applicable in the US, we provide an alternative theoretical framework to test the predicted positive relationship between CSR voluntary disclosure and explain higher audit costs in China.

Other previous research also provides strong evidence for a positive relationship between voluntary CSR disclosure and the quality of financial information (Chih et al., 2008; The audit risk argument is built on the supply view of auditing and predicts a positive relationship between voluntary CSR disclosure and audit fees for two reasons: H3a: The association between voluntary CSR disclosure and higher audit fees is more pronounced in non-SOEs than in SOE firms in China.

H3b: There is a negative relationship between voluntary CSR disclosure and financial information quality in non-SOEs in China.

Research design, sample and summary statistics 1 Research models and variable definitions

Sample selection

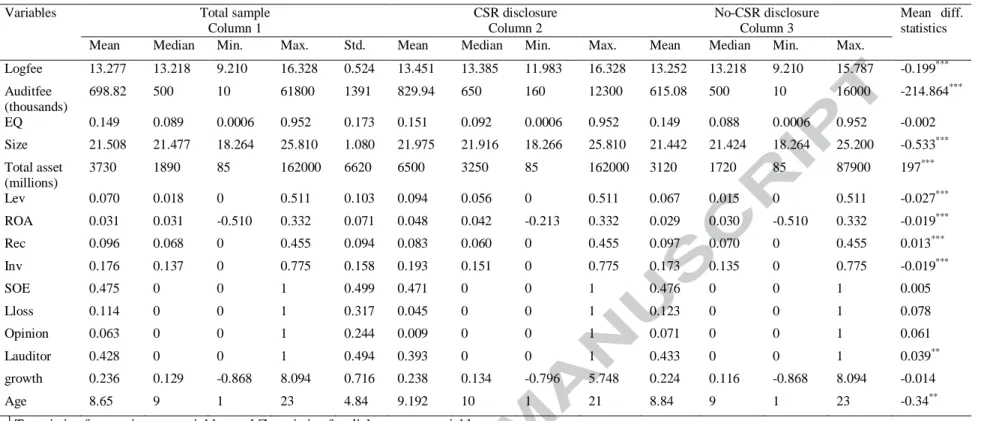

From an initial sample of 12,788 firm-year observations obtained from the China Securities Market and Accounting Research (CSMAR) database, we excluded 270 financial institutions because the modeling of their audit fees and earnings quality differs from that of other industry sectors. Firms that were required by the authorities to disclose stand-alone CSR reports during the sample period were also excluded from the sample. The final sample consists of 7341 company-year observations, including 909 company-years of voluntarily issued stand-alone CSR reports.

7 The Shanghai and Shenzhen Stock Exchanges issued circular on listed firms' preparation for 2008 annual financial reports, requiring a subset of listed firms (i.e. Shanghai Stock Exchange corporate governance index firms, cross-listed firms and financial and insurance firms, Shenzhen composite index companies) to submit standalone CSR reports to issue starting in December 2008. Results indicate that CSR reporting increased and CSR performance improved during the sample period. This trend is consistent with the description in the Blue Book in China, which reported a similar increase in the number of firms publishing CSR reports.

The 909 fixed-year observations of stand-alone CSR reports published during the sample period represent 12.38 percent of the sample. The audit fee (log fee) is higher in firms that issue CSR reports compared to firms that do not issue CSR reports. This result provides evidence consistent with the positive relationship between CSR disclosure and audit fees.

Univariate tests indicate that there is no difference in earnings quality (EQ) between firms that issue CSR reports and firms that do not issue CSR reports. We find that firms that issue CSR reports tend to be larger, older, exhibit higher returns on total assets, have lower accounts receivable, hold more long-term liability, and are less likely to hire top-10 auditors. Consistent with the above univariate tests, the variable DKSV is significantly positively correlated with the level of audit fees and not significantly associated with earnings quality (EQ).

Furthermore, consistent with existing research that lower earnings quality is associated with higher audit fees, we find that EQ is positively related to audit fees (logfee). As found in previous research, there is a high correlation (0.6419) between audit fees (logfee) and firm size (size). In the further analysis section, we divide the sample by size and repeat our hypothesis testing to further control for the possible influence of firm size.

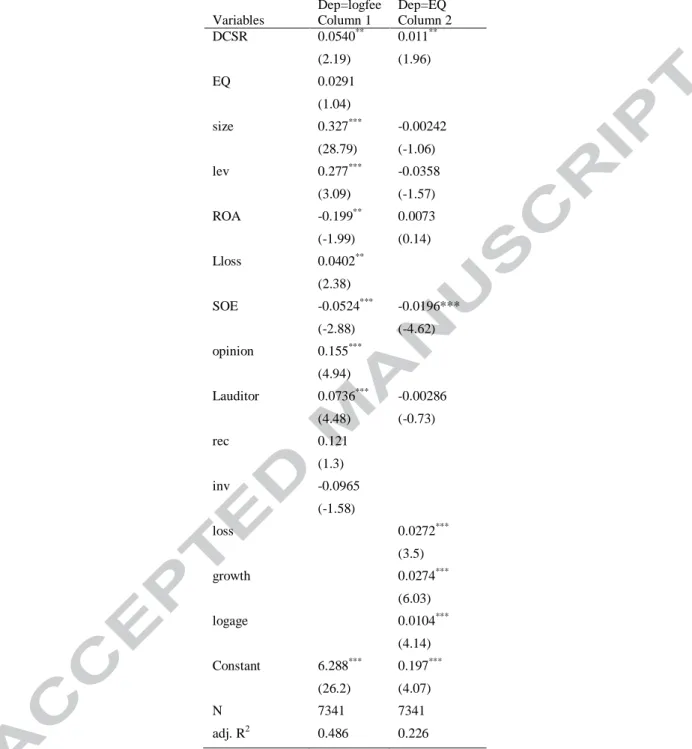

The relationship between voluntary stand-alone CSR reporting and audit fees

The relationship between voluntary stand-alone CSR reporting and earnings quality Table 5 Column 2 presents the regression results for the association between the absolute

In summary, the estimation results from equation (2) show that firms that issue stand-alone CSR reports engage more in earnings management. The results provide supporting evidence for the audit risk perspective that voluntary CSR reporting in China is often associated with window dressing.8.

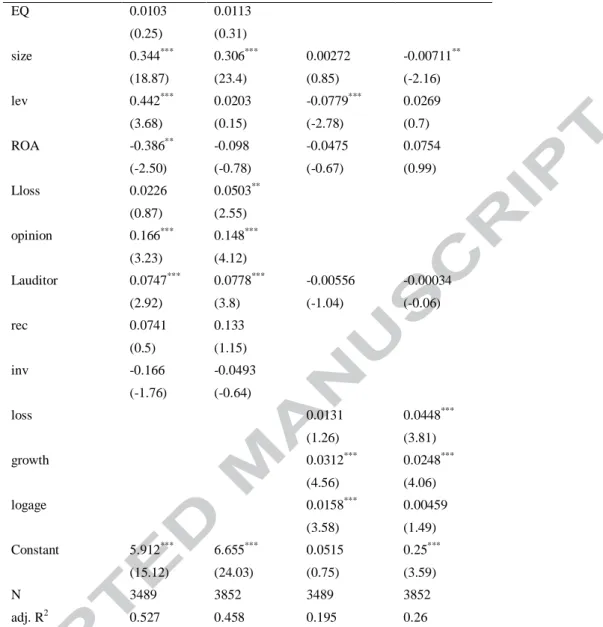

Differential impacts of voluntary stand-alone CSR reporting on audit fees (earnings quality) in SOEs versus non-SOEs

CSR disclosure for window covering purposes and auditors charge higher fees from non-SOEs in response to increased audit risk and greater audit effort.

CSR performance ratings

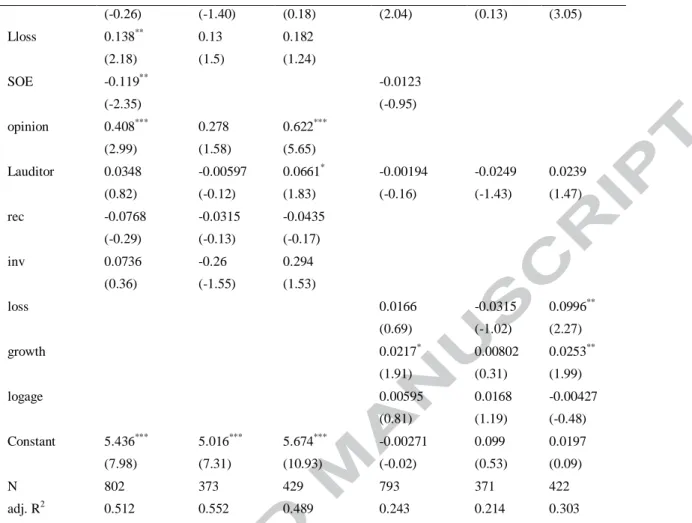

Length of CSR reports

The analyzes are undertaken on a sub-sample of 825 firms that issued CSR reports during the sample period. The F-test indicates that the coefficients on Hpage differ significantly across the two subsamples (F-value=2.65).

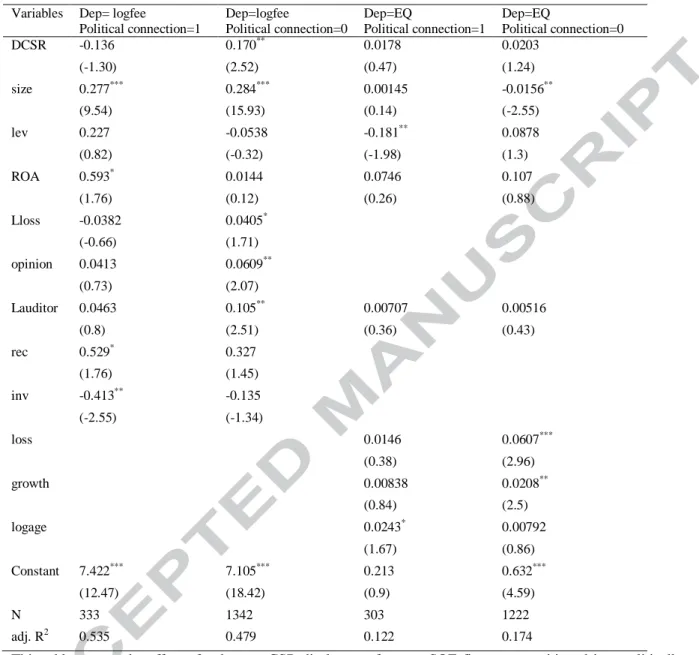

Political connections in non-SOE firms

Endogeneity issue

To do this, we use the same probit model that was used in the first stage of the Heckman procedure. To obtain a closer match, we set the caliper as 0.25 standard deviation of the propensity score following recommendations from previous studies (Ho et al., 2007). After the matching is completed, we perform a balance test to check the difference in the distribution of the control variables between the treated and control firms in the matched sample.

The untabulated results indicate a balance achieved between the treated and control companies regarding the characteristics of the companies controlled in the probit regression. In the second stage, we reestimate the basic regressions (including regression 1 and 2) on the sample obtained from the first stage. The propensity score matching procedure suggests that non-state-owned firms that issue stand-alone CSR reports pay higher audit fees and provides little support for the findings that these firms are associated with higher levels of earnings management.

The influence of firm size

This study examines the relationship between voluntary CSR reporting and audit costs in China. Building on Chen et al. 2016), who find a positive relationship between CSR reporting and audit costs in the US, and on the unique institutional environment in China, where CSR reporting is still in its early stages of development, we propose two competing theories that both lead to a positive relationship between voluntary disclosure of CSR and audit costs. From the audit risk perspective, it is argued that voluntary disclosure of CSR is used by some companies as a strategic tool for window dressing, and therefore these companies are more likely to be associated with higher audit fees due to the higher perceived audit risk.

The findings of this study support the audit risk perspective in explaining the positive association between voluntary CSR disclosure and higher audit fees in China. Chinese companies that issue independent CSR reports are associated with higher earnings management and are charged higher audit fees. In addition, the positive associations between CSR reporting and audit fees and earnings management are more significant for non-state-owned firms, indicating that CSR reporting is used by such firms more as a means to create the appearance of integrity and legitimacy, but not as a genuine expression of commitment to stakeholders.

Our study complements and extends Chen et al. 2016) by proposing and empirically testing an alternative theoretical explanation for the positive association between audit costs and stand-alone CSR reporting in China. This table shows the results of estimations of the relationship between voluntary stand-alone CSR reporting and audit fee levels in column 1 and the relationship between CSR reporting and revenue quality in column 2. Detailed definitions for all variables are listed in Annex A. T statistics are listed in brackets below the coefficients. This table reports the effect of CSR performance assessment on audit fees, as well as the relationship between CSR performance assessments and revenue quality based on total sample, SOEs and non-SOEs, respectively.

This table reports the effect of the length of CSR reports on audit fees as well as the relationship between the length of CSR reports and earnings quality based on the total sample, SOEs and non-SOEs, respectively. This table reports the effect of voluntary CSR reports on audit fees as well as the relationship between CSR reports and earnings quality based on the total sample, SOEs and non-SOEs, respectively. Top-6 national audit firms are those whose audit fees are ranked in the top 6 according to CICPA's annual statistics.

A Research Report on Corporate Social Responsibility in China, Beijing China: Social Sciences Academic Press (China). Voluntary non-financial disclosure and the cost of equity capital: The initiation of corporate social responsibility reporting. Evidence from an audit risk model: Do auditors increase audit fees in the presence of internal control deficiencies.