There are three types of peer-to-peer financing such as peer-to-peer lending, peer-to-peer fundraising and crowd-funding. Indonesia Peer-to-Peer Lending Market Research Report, Industry Research Report, Market Key Players, Future Outlook.

Peer to Peer fundraising

Crowdfunding and equity crowdfunding are designed for startups to raise capital in an extremely competitive venture capital environment. Crowdfunding Unlike lenders, investors do not expect to get a specific amount of money back, but their return is tied to the performance of the company in which it is invested.

Popular/famous Global P2P Lending platform

- Funding Circle

- Prosper

- Upstart

- Lending Club

- Kiva

- Yirendai

Lending Club offers a unique investment method to investor by offering an automatic investment process and also a manual investment process by choosing own investment (Delbridge, 2019). It is a peer-to-peer lending platform that is not for profit, but helps those underserved communities thrive.

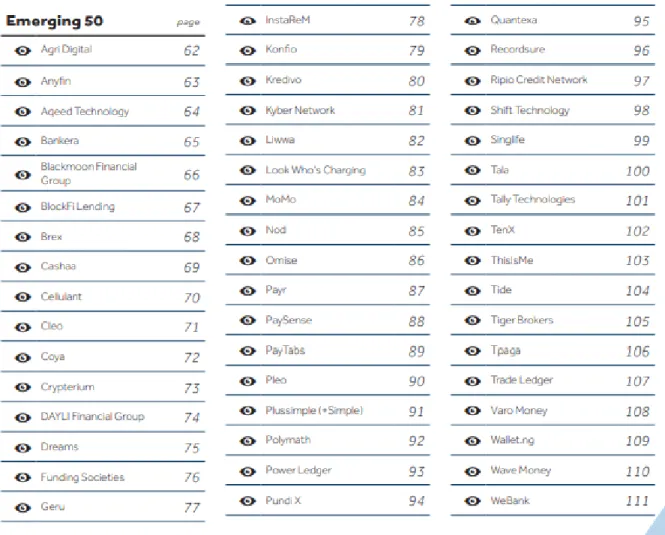

P2P Market in Malaysia

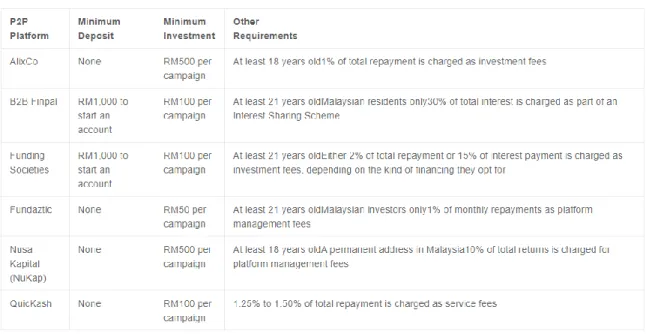

From the RM40,000,000 fund raised between November 2016 and January 2018, the funding companies take a 51% stake, contributing half of the total lending in the P2P lending market in Malaysia. At the end of March 2019, almost RM350 million in alternative financing is available to Malaysian micro, small and medium enterprises from the equity crowdfunding and P2P lending market (FINTECH Malaysia, 2019).

Funding Societies Malaysia

Fundaztic

Fundaztic is operated by Peoplender Sdn Bhd, which registers as a peer-to-peer funding platform. Fundaztic is suitable for new investors because it requires only a low minimum investment amount and offers Fundaztic Bonus to increase the actual number of investments of new investors.

QuicKash

AlixCo

Nusa Kapital

This fund requires an exclusion investment in products such as alcohol, pork-related products, pornography, gambling, military equipment or weapons. The Sharia-compliant fund also included a clean-up process by donating certain types of illegal income, such as interest received.

B2B FinPal

Problem Statement

As P2P lending brings the economy into a new trend, it is interesting to examine the country's awareness and acceptance of the new economic model. Therefore, this article will analyze the global research trend on P2P lending to outline the current topic of concern for each country.

Research Objective

Research Question

Term of Definition

Significances of study

Chapter Layout/ Structure of the report

Discussion will show a forecast of future research trend on P2P lending and how it contributes to the researcher.

Conclusion

LITERATURE REVIEW

Introduction

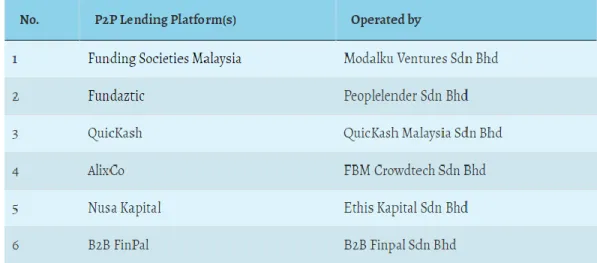

Fintech

- Fintech Ecosystem

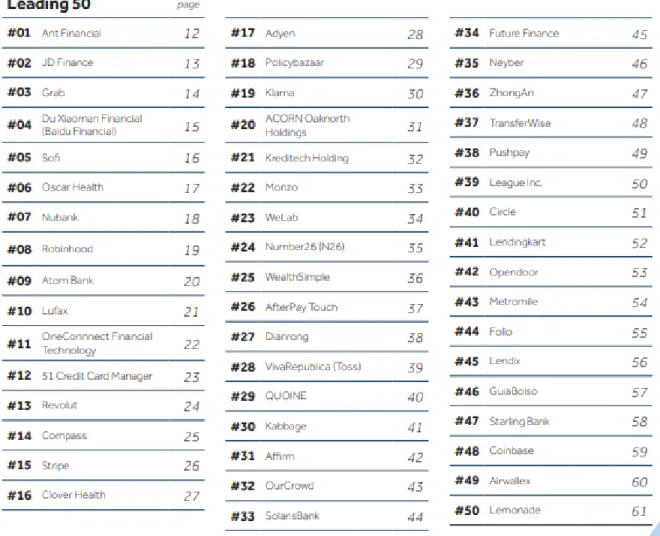

- The Global Fintech Innovators

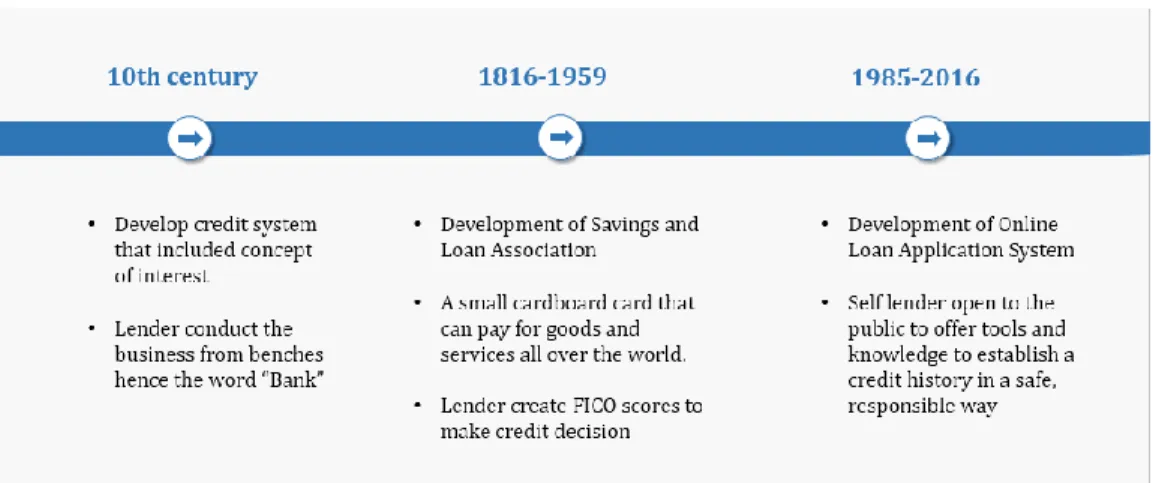

In the 21st century, FinTech emerged and it applied to the technology used by financial institutions in their backend system. FinTech is formally known as financial technology, which used to describe the new technology designed to improve and automate the delivery of and used financial services.

Crowdfunding & P2P Lending

- Limitation for service provider, investor, borrowers

- Challenges & Opportunity in P2P lending

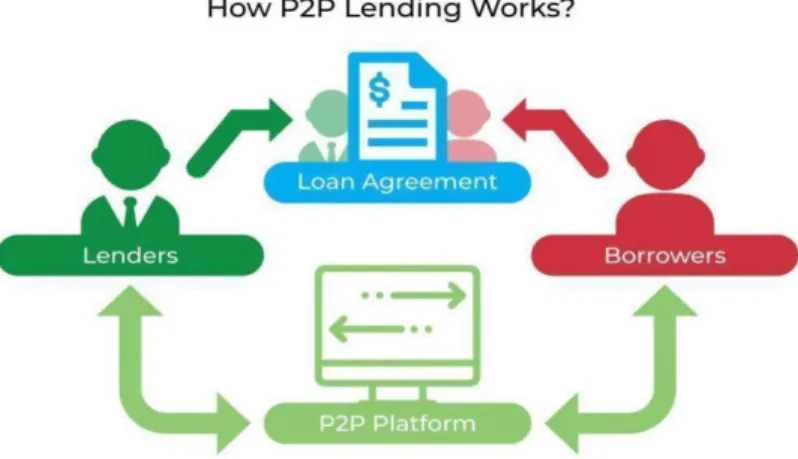

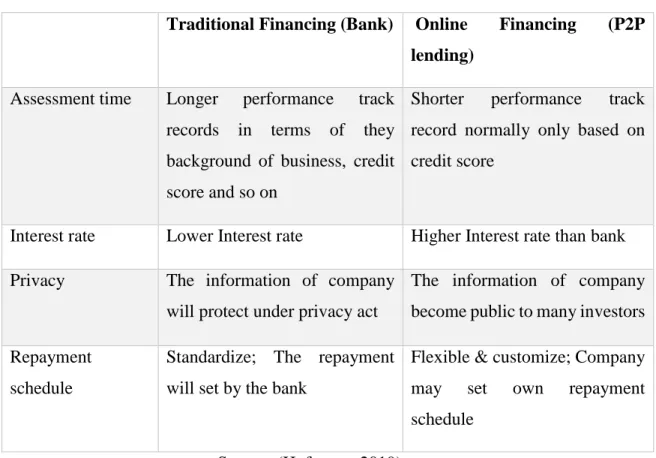

A P2P loan offers a flexible loan repayment schedule, repayment period and interest rate to each of the borrowers according to their needs (Hofmann, 2019). Long-term investment in a P2P lending project is a burden and a risk for the investor (Schneider, 2019).

Bibliometric Study

- Keyword/ Discipline

- Co-authorship

- Publication

However, P2P lending is rooted through lenders and borrowers in the real economy, which can eliminate unnecessary complexity and middlemen. In the 1950s, American psychologists used bibliometrics to count the number of their publications in their discipline, and this set the stage for pioneering matrix jobs in the future (Agarwal, Durairajanayagam, Tatagari, et al, 2016). In research collaboration there will be a goal, either to bring a specific product in the form of an article or individual achievement in this research 3.

Co-authorship in papers brings immutable and verifiable benefits, as the collaboration is based on bibliometric records that enable replication of results in the same datasets. A research paper describes a result or outcome of a research, when the research paper is published in a journal or conference, then consider a published research paper or known as publication (from the previous IEEE Associate Editor, Konstantinides).

Pattern of Authorship and Research collaboration

In collaboration with the researcher, the degree of cooperation and forms of cooperation will be calculated to understand the research trend in P2P lending. Degree of collaboration is defined by the number of collaborating authors appearing in a paper consisting of a single author, 2 or more authors, while types of collaboration examine the nature of countries and institutions involved in joint publications. There are 3 types of collaboration, which are internal organizational collaboration, inter-organizational collaboration (local collaboration) and international collaboration.

Interorganizational collaboration also known as local collaboration is that researchers collaborate with other researchers from the different local institutions. The degree of collaboration to investigate the research usually involves single authorship, two or more authorships in this research sector.

Conclusion

This analysis aims to identify the preferred degree and types of research collaboration among researchers on P2P related research topics.

RESEARCH METHODOLOGY

- Introduction

- Research Design

- Descriptive Research

- Quantitative Analysis

- Sampling Design

- Data Collection Method

- Secondary Data

- Data Search

- Data Processing

- Research Instrument/ Data Analysis Tool

- Data Analysis

- Trend Analysis: Time-series

- Citation Analysis

- Count of paper; Productivity

- Specialization: collaboration indicator (co-authorship)

- Descriptive Analysis: Frequency Analysis, Mean Analysis

- Conclusion

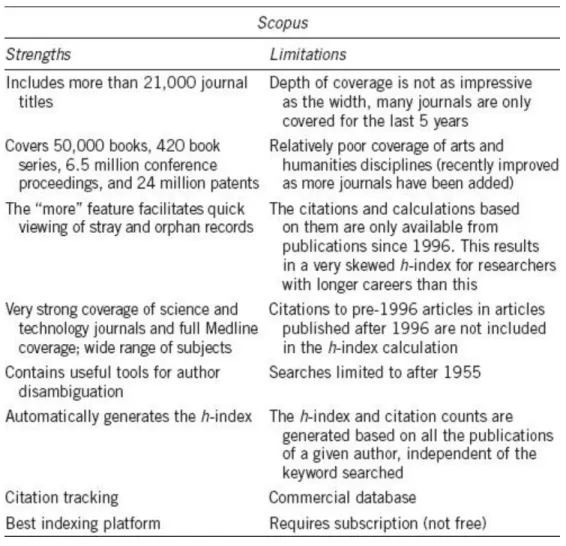

In addition, UTAR students also have access to the Scopus database, which is also one of the important factors in accessibility. Data for the past decade is compiled from 2010 to 2019 to show a broader and clearer picture of the P2P lending research trend with 10 years of data. Calculation of percentage on data analysis, such as percentage for types of participation, publication by content areas to see the result of a certain proportion of the whole.

It can view the evolution of P2P loan publication over time and predict the future movement of the subject. Citation analysis is calculating the number of times an article is cited in other work to study the impact and influence of the research publication or author in the specific industry.

DATA ANALYSIS

Introduction

Productivity/Publication Analysis

- Publication by year

- Publication by Document Types

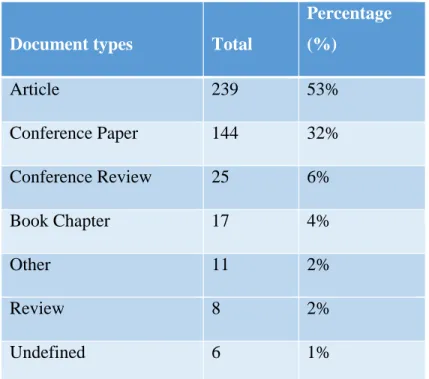

In P2P lending publication, articles and conference papers are used more frequently, accounting for 53% and 32%, respectively, over the decades from 2010 to 2019. The line chart above shows the trend of P2P lending publication by document type from time to time over the ten years up to 2019 Oct. 2019 to October.

P2P Lending Research Publication by Document Types by year

Publication by Subject Area

Followed by Business, Management and Accounting with 145 papers, Economics, Econometrics and Finance with 123 papers, Social Sciences with 81 papers and Decision Sciences with 78 papers. Computer Science Business, Management and Accounting Economics, Econometrics and Finance Social Sciences Decision Sciences Mathematics Engineering Material Sciences Psychology Arts and Humanities Environmental Sciences Physics and Astronomy Agricultural and Biological Sciences.

Publication of P2P lending by subject area

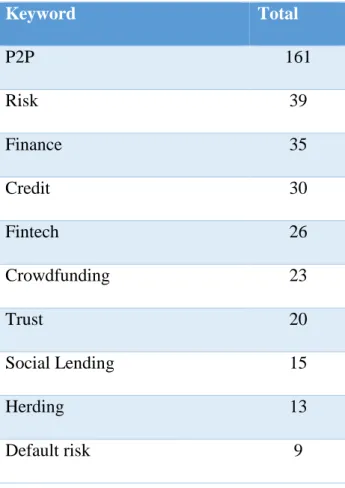

Publication by Keyword

During the ten-year period, publication on the subject of "risk", "finance", "credit" and "trust".

Publication by Continent

Publication by Countries

Among all countries involved in scholarly publications on P2P lending from 2010 to 2019 (up to October), China is the leading country, publishing 35.4%. At 22.2%, the United States is the second highest productivity country in P2P lending, followed by the United Kingdom (4.4%), South Korea (3.2%) and Hong Kong (3.0%). Only two countries had more than a hundred scholarly publications on P2P lending, while Malaysia has no publication on the topic of P2P lending from 2010 to October 2019.

Publication by Journals

Electronic Commerce Research and Applications 11 ACM International Conference Proceeding Series 9 Lecture Notes In Computer Science Inclusive Subseries Lecture Notes In Artificial Intelligence And Lecture Notes In. The leading journal of P2P lending publication is Electronic Commerce Research and Applications, publishing a total of 11 articles within 2010 to 2019, followed by 9 articles published under ACM International Conference Proceeding and Lecture Notes In Computer Science, including subseries Lecture Notes In Artificial Intelligence And Lecture Notes of Bioinformatics, 6 paper Research and 5. ging Markets Finance And Trade, IEEE Access, Iop Conference Series Materials Science and Engineering and Management Science.

Publication by Publisher

Publication by Institutions

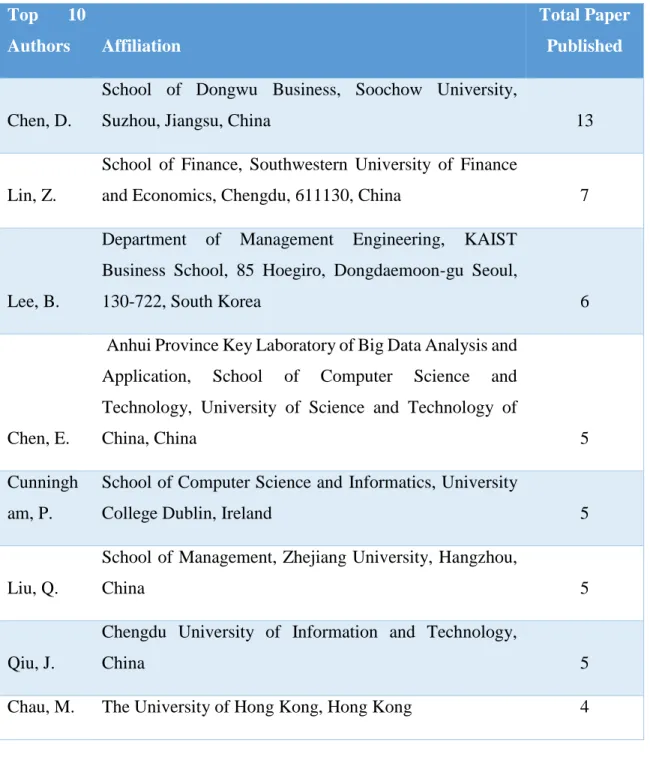

There are about 160 organizations that contributed to P2P lending research within the year 2010 to 2019. Among the top 20 productive institutions that published articles on P2P lending in 2011 and 2019, China University is an institution that contributes a total of 84% of author engagement among the top 20 productive institutions, and only 16% of the university came from Hong Kong and the United States.

Citation Analysis

- Top Cited Journal Articles

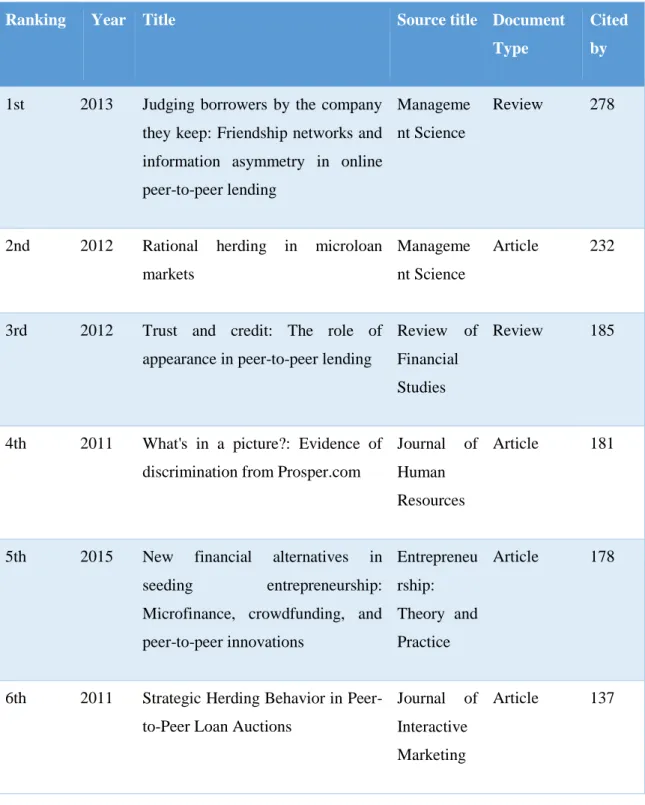

1. 2013 Judging borrowers by the company they keep: friendship networks and information asymmetry in online peer-to-peer lending. 10/2011 Tell me a good story and I might lend you money: The role of narrative in peer-to-peer lending decisions. The most cited articles are entitled "Judging borrowers by the company they keep: Friendship networks and information asymmetry in online peer-to-peer lending", which was cited 278 times in the Scopus database by the end of the data collection period of this paper.

Evidence of Prosper.com Discrimination” in 2011 (citation 181), “New financial alternatives in seeding entrepreneurship: Microfinance, crowdfunding, and peer-to-peer innovations” in 2015 (citation 178), “Strategic Herding Behavior in Peer-to-Peer Loan Auctions Journal” in 2011 (citation 137), “Herding behavior in online P2P lending: An emp irical study Electronic Commerce Research and Applications". According to the top 20 cited articles, herd behavior, bias, discrimination and trust are the most common research topic on P2P lending.

Authorship Analysis

- Top Productive Authors

- Types of Authorship

- Types of Collaboration

- Global Collaboration by Country

- Global Collaboration of China

In P2P lending research publications over the past decades, co-authorship has always been greater than single authorship. In 2010, 100% of P2P lent publications are in author collaboration with a total of 10 publications. The second preferred collaboration ratio for P2P publication lending is global collaboration (26%) with authors from different institutions in different countries, followed by domestic collaboration (24%) with people from different institutions but within the same home areas and.

There are a total of 32 countries involved in the global collaboration on the publication of P2P loans from 2010 to 2019 (as of October). France, Brazil, Japan have 3 authors in global collaboration on P2P lending publication and country that has 2 authors participating in global collaboration are Mexico, Canada and Spain.

Conclusion

DISCUSSION, CONCLUSION AND IMPLICATIONS

- Introduction

- Discussion of Major Study/Findings

- Identify the emerging topic and trend of scientific publications on P2P lending

- Determine the Top Publication that Support Scientific Publication on P2P Lending

- Investigates the pattern of co-authorship and research collaboration on the topic of P2P lending

- Implications of the Study

- Limitations of the Study

- Recommendations for Future Research

- Conclusion

This can provide researchers with comprehensive information about the possibility of their future study on P2P lending. This analysis can help the researcher identify the leader among institutions in the P2P lending publication. Southwestern University of Finance and Economics is the leading institution supporting P2P lending publications.

The word productive is used because they have made a significant contribution to the P2P lending research publication. Furthermore, this research also provides an overview of the collaboration pattern and trend overtime on P2P lending publication. Retrieved from https://www.lendingworks.co.uk/finance-guides/p2p-lending/peer-to-peer-lending-advantages-disadvantages-borrowers.

Retrieved from https://www.prnewswire.com/in/news-releases/peer-to-peer-p2p-lending-market-global-report-2019-market-key-players-size-share-trend-and-forecasts-to html.