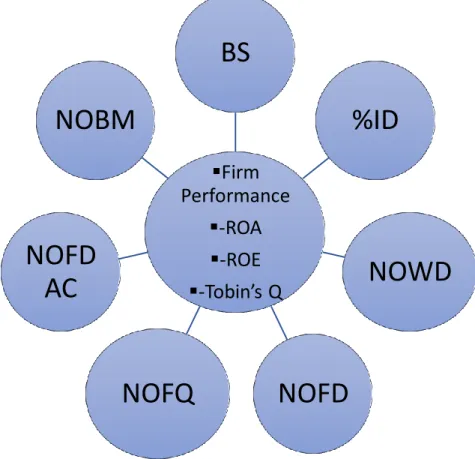

The title of the thesis is Boardroom Globalization among Family Controlled Companies in Bursa Malaysia (an update) and Singapore: The Effect of Corporate Governance on Firm Performance. The main purpose of this research project is to investigate the independent variable affecting firm performance among family controlled in Malaysia and Singapore. Throughout this project, seven variables have been identified which are the number of board sizes (BS), the percentage of independent directors (%ID), the number of female directors (NOWD), the number of foreign directors (NOFD), the number of qualifications foreign. (NOFQ), the number of foreign directors on the audit committee (NOFDAC), and the number of board meetings (NOBM).

The purpose of this research is to determine whether corporate governance mechanisms are more significant between Family-Controlled in Malaysia and Singapore. Corporate governance mechanisms adopted in this research are number of board sizes (BS), percentage of independent directors (%ID), number of women directors (NOWD), number of foreign directors (NOFD), number of foreign qualifications (NOFQ), number of foreign directors in audit committee ( NOFDAC), and number of board meetings (NOBM). The samples used in this research are 27 Malaysian family-owned companies and 13 Singaporean family-owned companies in the periods 2013-2020.

From previous research, there is a significant relationship with Malaysian family-controlled firms that are on BS (ROA & ROE), as the current research shows that NOWD (ROA & ROE) and NOBM Tobin Q) have a significant relationship with firm performance. In Singapore, NOWD (ROA & Tobin's Q), NOFD (Tobin's Q), NOFDAC (ROA & ROE) and NOBM (ROA & ROE) have a significant relationship with Singapore family-controlled firms.

INTRODUCTION

- Introduction

- Research Background

- Problem Statement

- Research Objectives

- Research Questions

- Significance of Study

- Chapter Layout

According to Agyei & Owusu (2014), they have said that better corporate governance will influence a company's strategic decisions such as finance, valuation, company growth and management system. Look for the relationship between the number of foreign directors on the audit committee and the performance of the company. Does CG impact the performance of Bursa Malaysia listed family businesses with globalized boardrooms?

Does the number of foreign directors affect company performance? .. v) Could there be a relationship between the number of directors with foreign qualifications and company performance? . vi). Does the number of foreign directors on the audit committee have a substantial impact on the firm's performance? Malaysia Institute of Corporate Governance (MICG), Malaysia Accounting Standards Board (MASB), Bursa Securities Malaysia (BM), Companies Commission of Malaysia (CCM), and Securities Commission are the regulators (SC) (Hassan, Marimuthu, & Johl, 2015 ) .

Singapore's corporate governance rules are built on a principles-based approach that is heavily influenced by Western countries. To establish corporate governance procedures, the Singapore Code uses the principles-based approach, also known as the compliance or explanation approach.

LITERATURE REVIEW

- Introduction

- Family-Controlled Companies

- Globalizing Boardroom

- Corporate Governance

- Corporate Governance in Malaysia

- Corporate Governance in Singapore

- Theoretical Model

- Agency Theory

- Stewardship Theory

- Stakeholder Theory

- Resource Dependency Theory (RDT)

- Dependent Variables

- ROA

- ROE

- Tobin’s Q

- Independent Variables

- Number of Board Sizes (BS)

- Percentage of Independent Directors (%ID)

- Number of Women Directors (NOWD)

- Number of Foreign Directors (NOFD)

- Number of Foreign Qualifications (NOFQ)

- Number of Board Meetings (NOBM)

- Number of Foreign Directors in Audit Committee (NOFDAC)

- Research Framework

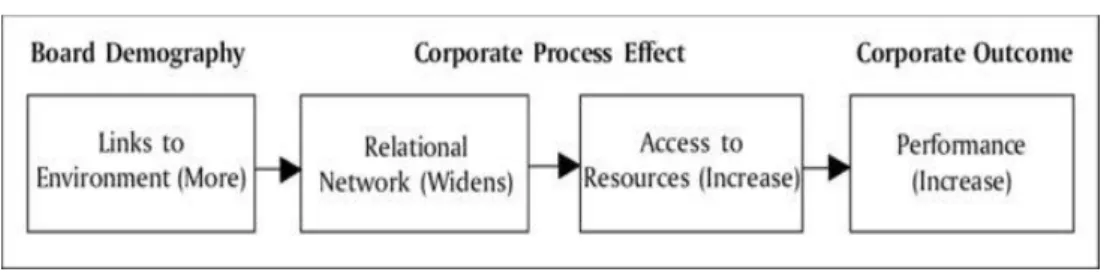

However, previous research on the relationship between corporate governance and commercial performance has shown mixed findings. Economically, corporate governance is essential for directing limited cash to the most successful investment initiatives. This research used board sizes and board independence, two important internal indices of corporate governance.

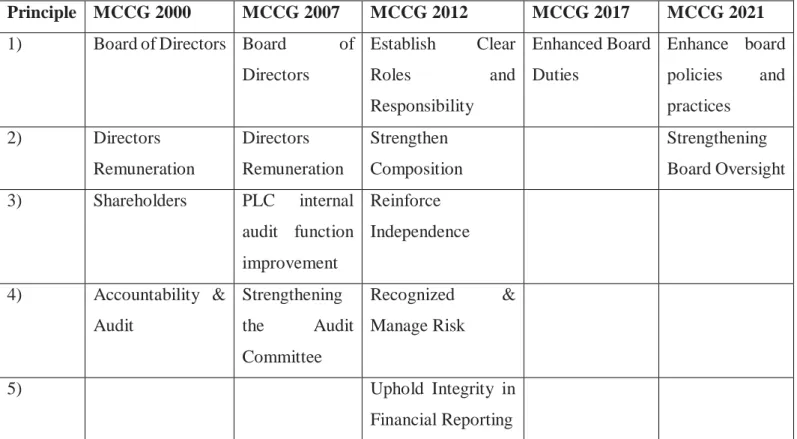

MCCG promotes global corporate governance principles and practices that go beyond law, norms and the Malaysian Stock Exchange. Therefore, focusing only on agency theory would hinder the understanding of corporate governance practices in these economies. Additionally, stakeholders establish a corporate governance framework by appointing a board to monitor management (Nalukenge, Nkundabanyanga, & Ntayi, 2018).

Abid, Khan, Rafiq, & Ahmed, 2014) specified that it focuses on the share of insiders on the board to analyze the relationship with firm performance. A larger board contains more directors who monitor and manage the firm's performance in the best interest of stakeholders. According to (Viet, 2013), it was found that there is a significant relationship between board sizes and firm performance.

This study had found that BS had a positive relationship with board independence and firm performance (Kanakriyah, 2021). For example, Malaysia's Code of Corporate Governance requires at least three independent directors to monitor management (Fuzi, Halim, & M.K., 2016). The experiences of its foreign directors expose companies to corporate governance aspects and board processes in multinational companies (Alshirah, Rahman, & Mustapa, 2019).

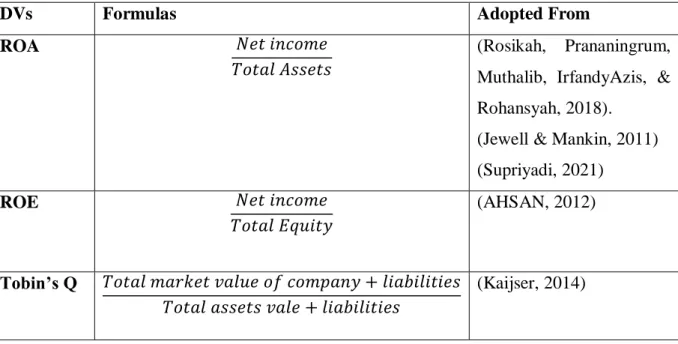

According to (Jusoh, Rashid, & Ajis, 2020) found that there was a positive relationship between foreign directors and firm performance. According to (Al-Daoud, Saidin, & Abidin, 2016), it had shown that the board meeting is significantly and positively related to the firm's performance. DVs were used to refer to firm performance as assessed by ROA, ROE and Tobin's Q.

RESEARCH METHODOLOGY

- Introduction

- Research Design

- Data Collection Method

- Secondary Data

- Sampling Design

- Target Population

- Sampling Frame

- Sampling Element

- Sampling Technique

- Sampling Size

- Research Instruments

- Construct Measurement

- Origin of Construct

- Scale of Measurement

- Data Processing

- Data Analysis

- Descriptive Analysis

- Inferential Analysis

- Panel Data Analysis

The statistics in the annual reports were reliable and accurate as everything was checked by the Malaysian authorities. This is decided based on whether individuals from the general population meet the selection criteria or not. The population for this study was selected from all family-controlled companies registered in Bursa Malaysia for which annual reports and financial data were available.

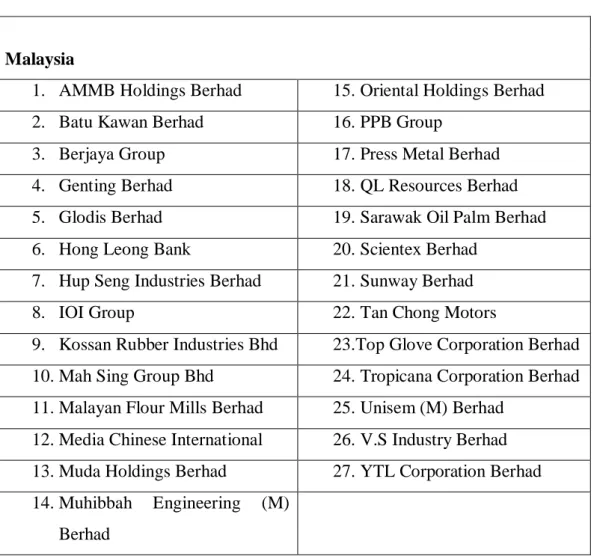

Consequently, the total population of this study includes 27 Bursa Malaysia and 13 Singapore listed family-controlled companies. 34;Family Controlled Companies in Bursa Malaysia" provided this list of family controlled companies by Tan (2016). Not all the family controlled companies included in Tan's (2016) book "Family Controlled Companies in Bursa Malaysia" were used in this study.

This ensures that each sample in the population has an equal probability of being selected. To get all the numbers and data for the IVs, all the annual reports were downloaded from the official websites of the different firms. NOBM Total number of board meetings (Al-Daoud, Saidin, & . Abidin, 2016) NOFDAC Total number of audit of foreign directors.

According to the diagram shown, there were five steps of data processing in this study. The first phase was to identify the dependent and independent variables that were relevant to this study based on previous research. The data entry procedure then began by obtaining and entering all essential data into various files, DVs and IVs.

In the absence of high-quality causal analysis, data in itself does not constitute descriptive research. Inferential statistics can be used to investigate the differences between groups and the relationships between variables (Guetterman, 2019). Since the data in this study includes both cross-sectional and time dimensions, which are the specifics of family businesses in Bursa Malaysia presented in different variables, as well as time series information for a six-year period, the changes within the studied businesses over the course of time were reflected in the data.

DATA ANALYSIS

Introduction

Descriptive Analysis

- Dependent Variables

- Independent Variables

Panel Data Analysis

- Random Effect Model of ROA

- Hausman Test for ROA Malaysia

- ROE Malaysia

- Random Effect Model of ROE

- Hausman Test for ROE Malaysia

- Tobin’s Q Malaysia

- Random Effect Model of Tobin’s Q

- Hausman Test of Tobin’s Q Malaysia

- ROA Singapore

- Fixed Effect Model

- Hausman Test for ROA Singapore

- ROE Singapore

- Fixed Effect Model

- Hausman Test for ROE Singapore

- Tobin’s Q Singapore

- Fixed Effect Model

- Hausman Test for Tobin’s Q Singapore

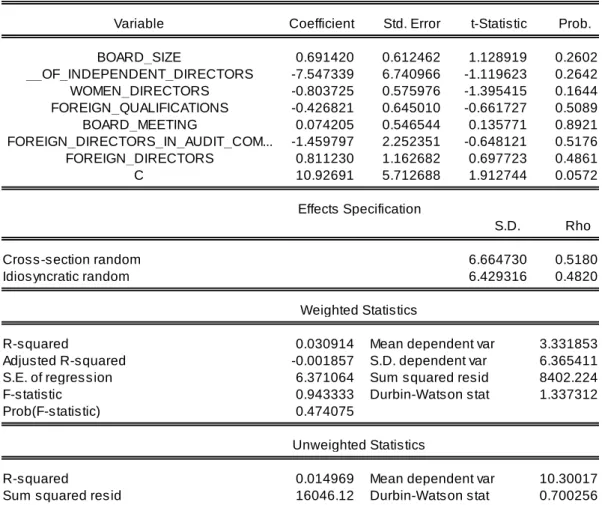

The Hausman test was performed to decide which regression would be most appropriate between a fixed-effect model and a random-effect model. H0: The random effect model is the most appropriate model H1: The fixed effect model is the most appropriate model. According to the formulated equation, it showed that BS, NOBM, and NOFD have a positive effect on ROE, while %ID, NOWD, NOFQ, and NOFDAC have a negative effect on ROE.

The results show that only BS with a P-value of 0.057 had an impact on ROE because its P-value was more than 0.05. In this case, 3.09 percent of the difference in ROE can be explained by how different the seven IVs were. According to the comparison formed, it showed that BS, %ID, NOWD, NOBM and NOFD have a positive effect relationship with Tobin's Q, meanwhile NOFQ and NOFDAC have a negative effect on Tobin's Q.

In this research, eight years were used to perform Tobin's Q in a random effect model with Tobin's Q. According to the formulated equation, it showed that BS, %ID, NOFD and NOFQ have a positive relationship between effects and ROA, while NOWD , NOBM and NOFDACs have a negative impact on ROA. NOBM, NOWD and NOFDAC all affected ROA because their P-value was lower than 0.05 and 0.10.

56.8% of the difference in ROA could be explained by the difference in the seven IVs. According to the equation formed, it showed that BS, %ID and NOFD have a positive effect relationship with ROE, while NOWD, NOBM, NOFQ and NOFDAC have a negative effect on ROE. 58.6% of the difference in ROE could be explained by how many IVs were in each of them.

In this research, eight years were used to run Tobin's Q in a fixed effect model with Tobin's Q. 85.2% of the difference in Tobin's Q could be explained by the difference in the seven IVs.

DISCUSSION AND CONCLUSION

Introduction

Hypothesis Testing

- Hypothesis Testing Summary of ROA Results

- Hypothesis Testing Summary of ROE Results

- Hypothesis Testing Summary of Tobin’s Q Results

- The Summary of Hausman Specification Test

- Hypothesis Tests Summary

60

60

61

61

62

62

62

- Summary of Test

- Descriptive Analysis

- Inferential Analysis

- Discussion on Findings

- Limitations in Research

- Recommendations for Future Research

- Conclusion

It is possible to conclude that NOFDAC has no significant relationship with company performance (ROA, ROE and Tobin's Q). According to the research, NOWD in Malaysia and Singapore shows a statistically significant relationship with company performance (ROA, ROE and Tobin's Q) at 5% and 10% levels. Furthermore, the research revealed that NOFD in Malaysia had no statistically significant relationship with firm performance (ROA, ROE and Tobin's Q) at the 5% and 10% levels.

According to the research, NOBM in Malaysia has no statistically significant relationship with firm performance (ROA, ROE and Tobin's Q) at the 5% and 10% levels. Broadly speaking, most of the factors have been shown to be unrelated to the firm performance of family-controlled businesses. Analyzing board size and firm performance: Evidence from NSE companies using panel data approach.

The impact of corporate governance structures on firm performance among family-owned firms in Nairobi County Kenya.