First of all, we would like to take this opportunity to extend our deepest gratitude to the University Tunku Abdul Rahman (UTAR) for providing us with a precious opportunity to carry out this research project. Everyone is important in the completion of this research project and thanks for the contribution and valuable time from the group members in the completion of this research. Mr. Lee Chee Long, our supervisor of this research project for his patient, and valuable guidance and support throughout this research project.

They have given us the greatest encouragement and endless support as we have completed this research project. In this study, we state the relationship between investor attention gained by Google Search Volume Index (GSVI) and Malaysia Stock Market Performance on the Covid-19 pandemic. Results revealed that the keyword "Coronavirus" has no insignificant results for Kuala Lumper Composite Index (KLCI) performance, and the keyword "Covid-19" is tested to be significant to indicate the relationship between investors' attention and the Malaysia stock market.

To indicate the validity of the regression model, several tests were performed in this research project, such as the Augmented Dickey-Fuller test, the Philips-Perron test, the Breusch-Godfrey LM test, the Jacque-Bera test and the White heteroscedasticity test.

RESEARCH OVERVIEW

Research background

- COVID-19 Pandemic …

- The Impact of COVID-19 on the Stock Market....2-3

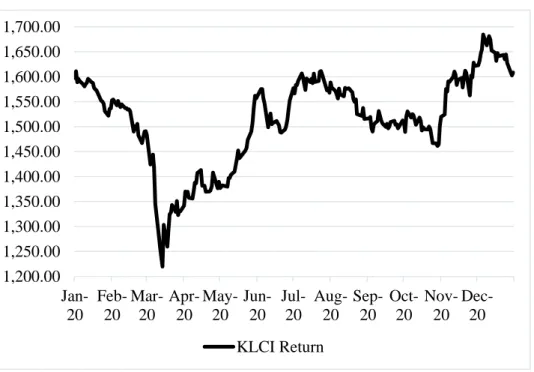

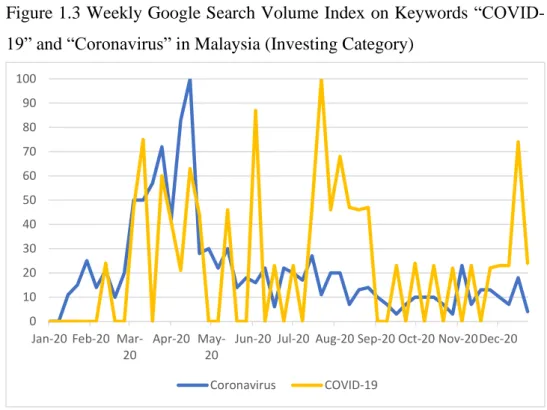

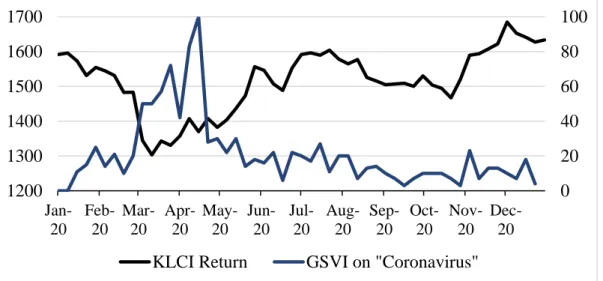

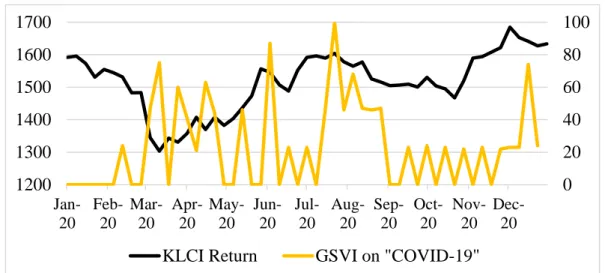

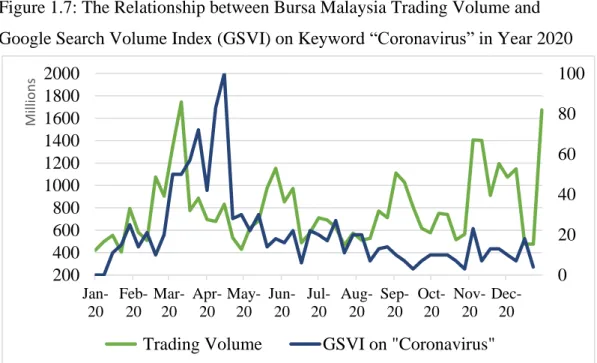

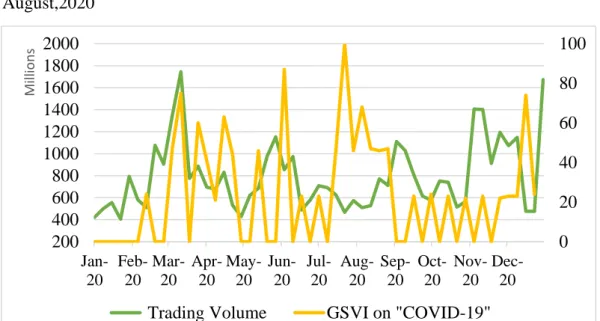

The downward trend of GSVI on the keyword "Coronavirus" may be due to the announcement of the official name of "COVID-19" in March. On the other hand, the correlation between the GSVI for "COVID-19" and the return of the KLCI showed a positive relationship despite some fluctuations between months. In Figure 1.4, the KLCI return recorded the lowest point when the GSVI on "COVID-19" climbed to its first new high in March.

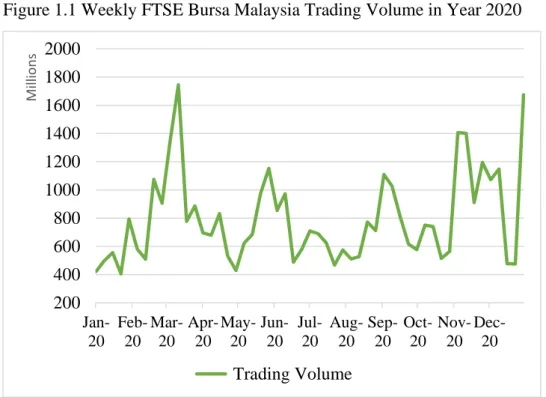

The trends of GSVI on "COVID-19" and the KLCI return then showed positive relationships for the following months. From the point of view of Bursa Malaysia trading volume, it is shown that the Bursa Malaysia trading volume increases when the GSVI on "COVID-19" and. In short, the chart shows that the GSVI on "COVID-19" and "Coronavirus" and Bursa Malaysia's trading volume are moving in the same direction.

Therefore, it is important to find out whether there are associations between the Bursa Malaysia trading volume and GSVI on "Coronavirus" and "COVID-19" and between the KLCI return and the GSVI on "Coronavirus" and "COVID-19".

Research Objectives

- General Research Objective

- Specific Research Objectives

Research Significance

- Investors …....................................................................13-14

- Researchers …

In short, this study is useful for investors in choosing the time to invest in the stock market. The results of this study will be a useful reference for policy makers and regulators such as the Securities and Exchange Commission (SC) to supervise and monitor the stock market from the impact of the crisis. For example, the Securities and Exchange Commissions have suspended short selling activities from March 2020 until the end of 2020, to minimize stock market fluctuations from the impact of the COVID-19 pandemic (The Star, 2020).

Therefore, the results of the study can contribute to regulators and governments responding to the uncertainties caused by the crisis. This is important to still ensure the stability and sustainability of the stock market, strengthening the financial market in its capacity to absorb losses during the crisis (Couppey-Soubeyran, 2010). From the perspective of behavioral finance, the results of this study will be useful to researchers by giving them more insight into the impact of investors' attention on stock market performance.

However, a study by Iyke and Ho (2021) shows that there is a positive relationship between investor attention and stock returns in Ghana and Tanzania.

LITERATURE REVIEW

Introduction …

Underlying Theories …

- Efficient Market Hypothesis …......................................16-19

- The Concept and Measurement of Investor Attention....23-25

Many researchers have examined investor attention to Covid-19 by using the GSVI to reveal a significant effect on the financial stock market. The searches for the Covid-19 related keywords act as a proxy to indicate the investor's attention in the African stock market to the Covid-19 pandemic. Recent research into Covid-19 attention has shown that the increase in investor attention leads to negative stock market returns.

In contrast, little research has shown that an increase in investor attention leads to positive stock returns. A study by Zhang et al. 2020) investigates investor attention and stock of the mask concept during the Covid-19 outbreak and finds that they have a positively significant impact. Several studies have examined the effects of investor attention on stock trading volume and volatility to demonstrate that attention is related to stock volatility.

The study on Zhang et al. 2020) found that the higher attention in the stock market is significantly related to stock volatility. Smales (2020) studied investor attention and the global stock market during the Covid-19 period and found that the increase in investor attention would lead to higher stock volatility. The investor reflects his trading behavior based on his attention to the stock information that could shock the market.

Investors' attention is focused on the stock's performance, which could reduce their uncertainty about fears during the crisis. Research by Brochad (2016) proved that an increase in investor attention leads to higher stock volatility. A study on Bui and Nguyen (2019) proved that investor attention is quite positive on the volatility of Vietnam stock market on VN-100 stocks from 2014 to 2018.

Although there are many researchers who have studied the effects of investor attention on the stock market in developed countries such as the US, in our research, we are focusing on the Malaysian stock market using the latest data on the Covid-19 pandemic.

METHODOLOGY

- Research Design

- Data Collection Methods…

- Analytical Tool – EViews

- Empirical Framework …............................................................................33-34

- Augmented Dickey-Fuller Test (ADF Test) ....................34-35

- E-GARCH Model …

- Diagnosis Checking

- Autocorrelation …

- Normality of Resident Test

- Heteroscedasticity ...........................................................38-39

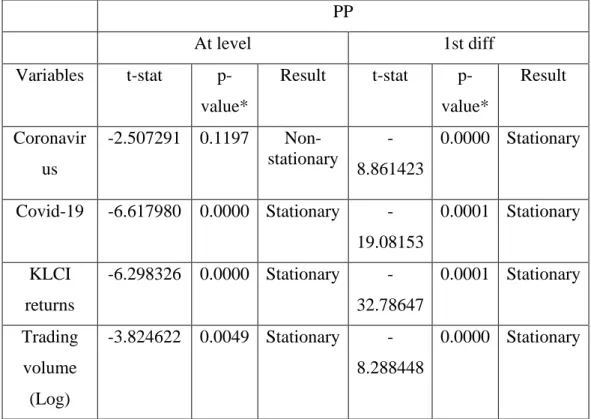

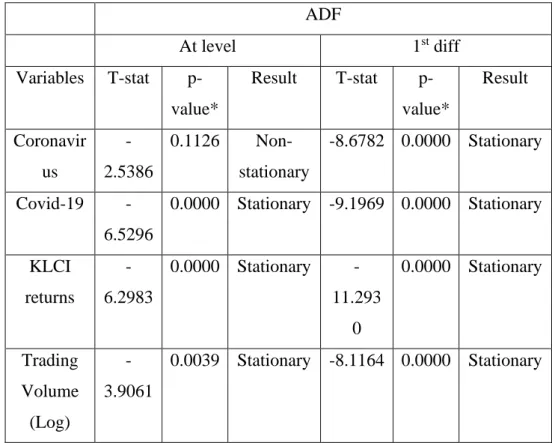

- Variance Decomposition

Keywords used include “coronavirus” and “COVID-19”, the geographic area covered is Malaysia and we focused on investments in the finance category. The null hypothesis will be rejected when the obtained p-value is less than the set significance level (be it 10%, 5% or 1%), by rejecting the null hypothesis the time series is now analyzed to be stationary (Chaudhary, 2020). The null hypothesis for the PP test is the same as the ADF test where a unit root is present in the time series, the alternative hypothesis for both tests is that the unit root is not present in the time series, indicating a stationary time series.

The conditional variance data set will also be used in the following Granger causality test. In this research, we will use this LM test to determine if there is autocorrelation in our time series. If the p-value is lower than the significance level used (it can be 10%, 5% or 1%), the null hypothesis will be rejected and the time series data will not be automatically correlated.

The Jarque-Bera test will be performed to help test the normality of the residuals for our data. The null hypothesis of the JB test is that the error term is normally distributed and the alternative hypothesis will be that the error term is not normally distributed. If the obtained p-value is less than the significance level, the null hypothesis will be rejected.

Null hypothesis for White test is that homoscedasticity exists between error terms (constant variance), while alternative hypothesis suggests that heteroscedasticity exists between error terms (variance not equal). We will reject the null hypothesis and accept the alternative hypothesis if the p-value we obtained is less than significance level of 5%, otherwise we do so. If the null hypothesis is rejected, it can be said that there are heteroskedasticity problems in the model.

The null hypothesis will be rejected if the result contains at least one element that is not significantly equal to zero. When a short input signal, also known as impulse, is generated in signal processing, an impulse response function (IRF) will be the output.

DATA ANALYSIS

Data Collection

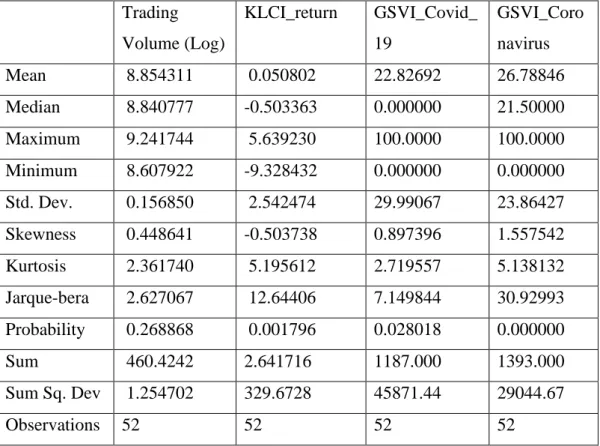

Descriptive Statistics .....................................................................42-43

- Augmented Dickey-Fuller Test (ADF Test) ...................44-45

- Breusch-Godfrey LM Test ...............................................49-51

Trading volume (Log) reacts positively when one standard deviation of the stock is given to GSVI_Covid_19. The impulse function plot shows the KLCI risk fluctuations when shocks are applied to GSVI_Covid_19. For the strike on GSVI_covid-19 in the short term it contributes 0.3638% to the change in trading volume.

The percentages have increased, showing that KLCI_risk is more affected by GSVI_Covid_19 in the long term. This study examines the impact of COVID-19 attention on the stock market performance in Malaysia. Instead, the GSVI on the keyword “COVID-19” plays an important role in this study when investigating the relationship between investor attention and stock market performance in Malaysia.

Using Google's Search Volume Index (GSVI), our results add to the growing literature on investor attention during the COVID-19 pandemic. Also, the researchers can use this study as a reference and should correct the limitations of this study for comparison and completeness to get a full picture of the impact of COVID-19 attention on stock market performance. The results obtained showed that there is an insignificant relationship between the Google Search Volume Index on keywords "COVID-19" and "Coronavirus" and the stock market performance, the empirical results supported by Kim, et al.

This study proved that the Covid-19 pandemic has no insignificant impact among investors' attention on the stock market of Malaysia. In this study, the data collected to investigate the investors' attention on the stock market performance during the COVID-19 pandemic only includes data from the year 2020. In addition, other major stock indices such as S&P 500, Nasdaq, Shanghai Composite Index, Nikkei not included. in this study for comparison and completeness to get the overall picture of the impact of COVID-19 attention on the stock market performances.

Therefore, attention to COVID-19 in stock market performance can be investigated from the whole picture. Therefore, it is recommended to include data from other markets such as major indices such as the Nikkei 225 and the Hang Seng index to compare the impact of the attention of COVID-19 on stock market performance. This study found that the impact of COVID-19 attention on stock market performance in terms of stock volatility and stock return in Malaysia is insignificant.

Investor and stock market attention during the outbreak of the COVID-19 based on the data from Mask Concept Stocks.

Descriptive statistics

Augmented Dickey-Fuller test ...............................................73-75

Undergraduate Research Project Page 74 of 87 Faculty of Business and Finance Null hypothesis: LOG_TRADING_VOLUME_ has a root of unity. Undergraduate Research Project Page 75 of 87 Faculty of Business and Finance Null hypothesis: D(GSVI_CORONAVIRUS) has a root of unity. Undergraduate Research Project Page 76 of 87 Faculty of Business and Finance Null hypothesis: KLCI_RETURN has a root of unity.

Undergraduate Research Project Page 77 of 87 Faculty of Business and Finance Null hypothesis: D(GSVI_COVID_19) has a root of unity.

KLCI_Return & GSVI_Covid-19

Log_Trading_Volume & GSVI_Covid-19 …

KLCI_Risk & GSVI_Covid-19

LM Test Result: KLCI_Return & GSVI_Covid-19 …

LM Test Result: Log_Trading_Volume & GSVI_Covid-19

LM Test Result: KLCI_Risk & GSVI_Covid-19

Undergraduate Research Project Page 86 of 87 Faculty of Business and Finance VAR Granger Causality/Block exogeneity Wald tests.

Normality Jarque-Bera Test …...............................................81-83

Variance Decomposition of Trading_Volume …

Variance Decomposition of KLCI_Risk …