In such markets, users on one side of the market can create value for participants on the other side. The following sections describe efforts to tax digital services in different parts of the world and discuss the emerging theories of digital taxation. A fraction of the remaining profit is the tax base which can be apportioned according to market jurisdictions.

These companies will remain subject to the rules of the domestic tax system in their respective jurisdictions. He claims that this gives the right to the country where the platform's users are located to tax these digital platform companies. Many digital platforms offer users free access in exchange for their personal data and this enables value creation for other users on the other side of the market and for the platform itself.

Much of the literature on the incidence of digital services taxes focuses on DSTs. One of the key variables in the BCD model is one that reflects the amount of personal data that users voluntarily disclose to the platform. Shi (2018) has a very good discussion of the state of digital taxation research and a summary of the taxation implications.

Note that the introduction of VAT at one end of a two-sided digital market will have potential direct and indirect effects at the other end of the market.

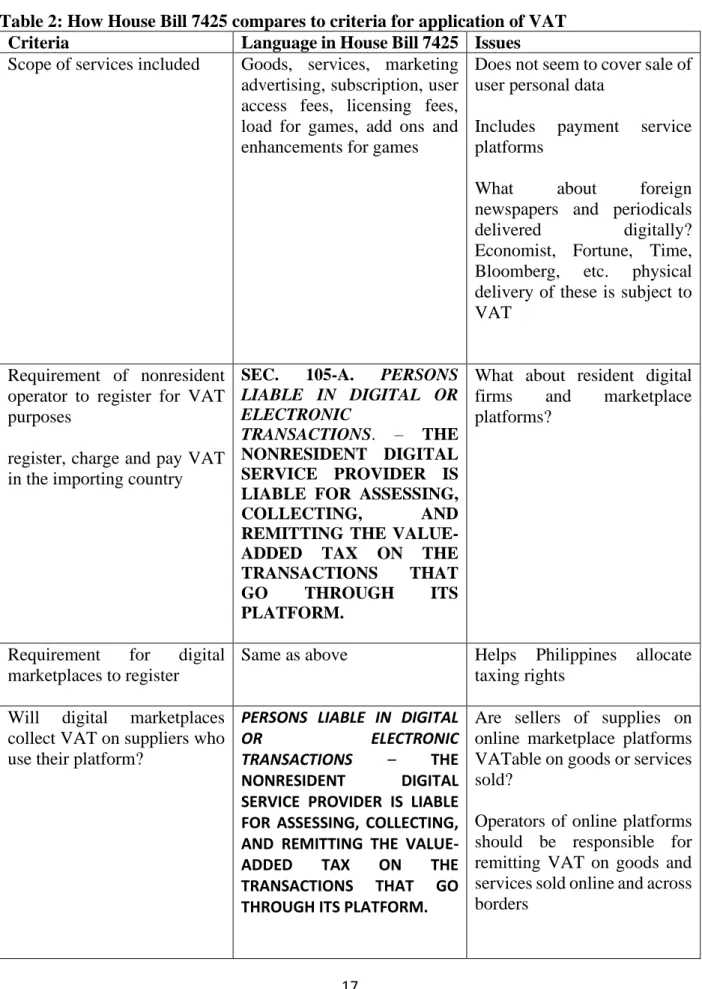

Classifying activities and monetization strategies in digital space, which accompanies efforts to impose digital service taxes, or DSTs and VAT

In addition, there are strong capital reasons for imposing VAT on digital transactions.2. If, in addition to VAT, the Philippines starts imposing DST on digital transactions, then the following effects may occur. The digital platform may increase the platform subscription price and advertising price.

A monopolistic platform internalizes some externalities and the tax reduces its incentive to include more consumers. A classification of activities and monetization strategies in the digital space accompanying efforts to introduce digital service taxes or DST and VAT. Because of this, the number and nature of users can be important determinants of monetization strategies.

Technological improvements and enhanced capabilities of digital businesses enable them to eliminate, change and/or adapt elements of traditional business models that underlie conventional taxation. The friction between new digital business paradigms and traditional taxation, in addition to the need to exploit new sources of revenue, has become an important driver of global efforts to legislate Digital Service Taxes (DSTs) to upgrade tax legislation to adapt to new realities. Mas and Junquera-Varela (2021) attempted to develop a fairly precise taxonomy of fiscally disruptive digital business models.

In addition, a market-seeking motive can also strengthen the argument for taxation - the motive to provide the service in various markets is the primary motive for developing the digital service for profit.

Implementing VAT on digital services and DST in the Philippines and in other countries

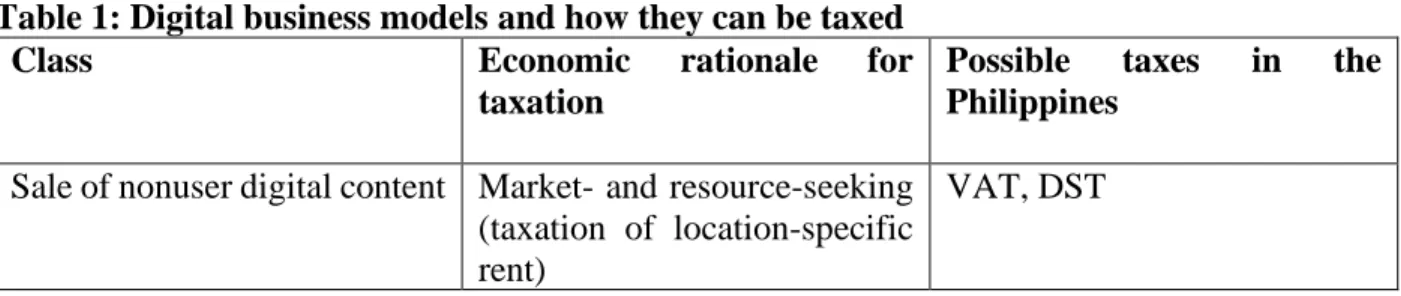

REASONABLE REASONS TO BELIEVE THAT THE GROSS SALES OR RECEIPTS OF THE DIGITAL SERVICES COMPANY FOR THE NEXT TWELVE (12) MONTHS FROM THE DATE OF SUBMISSION OF THE VAT RETURN, OTHER THAN THOSE EXEMPT UNDER ARTICLE 109(A) UNTIL ( BB), WILL EXCEED THREE MILLION PESOS (P3,000,000); PRESCRIBED BY THE SECRETARY OF FINANCE ON THE RECOMMENDATION OF THE COMMISSIONER OF DOMESTIC REVENUE. The two matching pieces of information form the basis for Company A to conclude that the customer is from the Philippines and is not charging Singaporean GST on the sale of the movie.

It charges Philippine VAT on the sale of the movie and remits it to the Philippines. Requiring the digital marketplaces to register increases the effectiveness and efficiency of the supplier collection regime. Mullins (2022) and Cebreiro-Gómez, Clavey, Estevão, Leigh-Pemberton, and Stewart (2021) provide good summaries of digital taxes, including VAT and DSTs in the Asian region and other parts of the world.

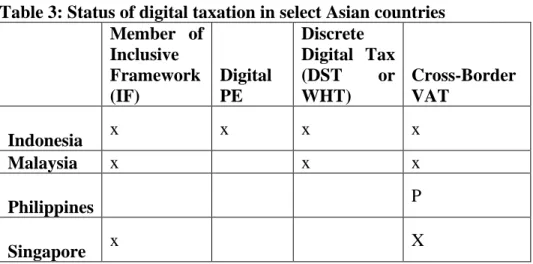

The Philippines is one of the few countries in Asia still without VAT for foreign suppliers of digital goods and services. Along the way, however, the country must be aware of the implications of efforts being undertaken in other parts of the world and also the growing progress in economic research regarding the effects of such taxes. It is one of the few countries in Asia within its income bracket that does not have such a VAT framework, so it is a laggard in this regard.

The Philippines also has the option of imposing DST on digital transactions, independent of VAT. Work on different aspects of DST is taking place in different parts of the world, at different levels and at different speeds. Despite recent advances in the analysis of the economic structure of two-sided markets, which can be applied to digital platforms, the theory of taxation of digital platforms has not yet emerged with a solid consensus regarding the incidence of taxation.

However, despite advances in theory, even newer models do not take into account the possible interaction between digital marketplaces and traditional physical-type marketplaces. Therefore, their results are useful for policy guidance, but additional analysis is needed to get a more complete picture of the effects of VAT or DST. Along the way, however, the country must be aware of the implications of efforts being made in other parts of the world and of the increasing progress in economic research on the effects of such taxes.

Part of the answer is improving the permanent establishment and nexus rules (as highlighted in DST laws in other countries) and also establishing guidelines to isolate consumption jurisdictions in the digital space. Much of the progress in digital taxation over the last decade has come in the form of the allocation of taxing rights between jurisdictions.