Finally, I would like to thank God for giving me the strength, both physically and mentally, to complete this research as part of my graduate studies. We found that BDMS's share price is relatively low compared to peers, with an increase of almost 40%.

HILIGHTS

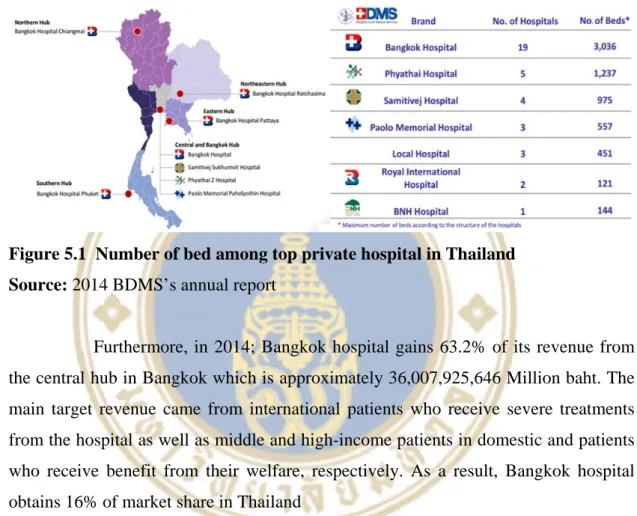

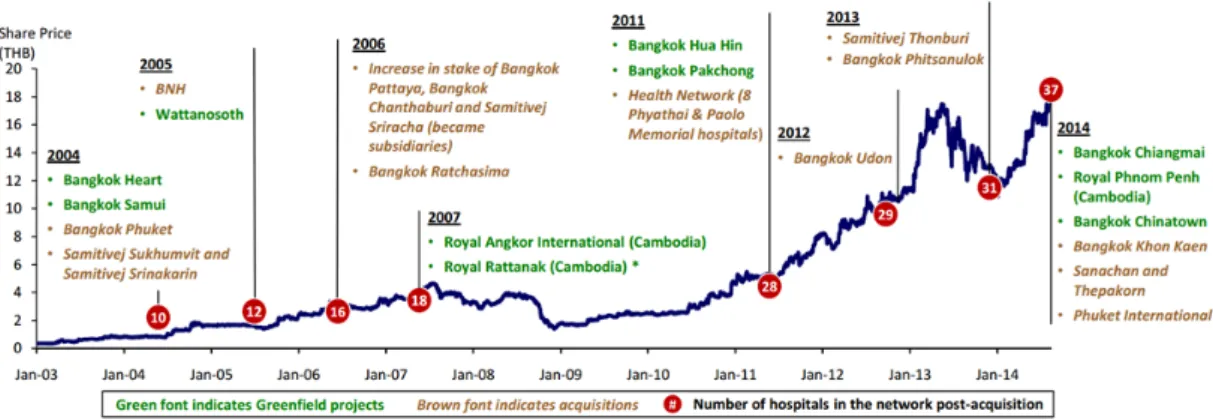

The number of hospital establishments has doubled over the past 4 years to 42 hospitals in 2015 with available patient beds of 6,000 beds. However, the hospitals abroad are in a big city/province like Phuket, Pattaya, Huahin, where a significant number of foreigners live.

BUSINESS DESCRIPTION

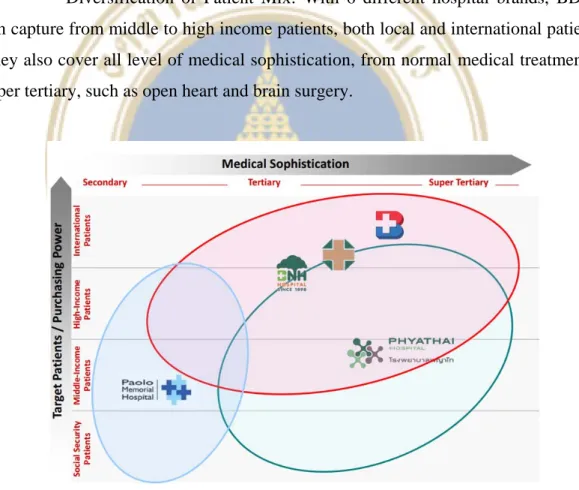

BNH Hospital: the hospital offers medical services of the highest quality, with specialists and general practitioners fully involved with the patient, from consultation and diagnosis to planning and carrying out treatment, monitoring results, and in surgical cases and a postoperative card with a concept of general practitioner. Paolo Memorial Hospital: The 260-bed private hospital offers exceptional services in all major areas such as neurology, cardiology, bones and joints, spine center, surgery, gastrointestinal liver, women's center, fertility center, pediatrics, dental center, rehabilitation and control center up .

MACRO-ECONOMIC ANALYSIS

- Thailand Healthcare Industry Overview

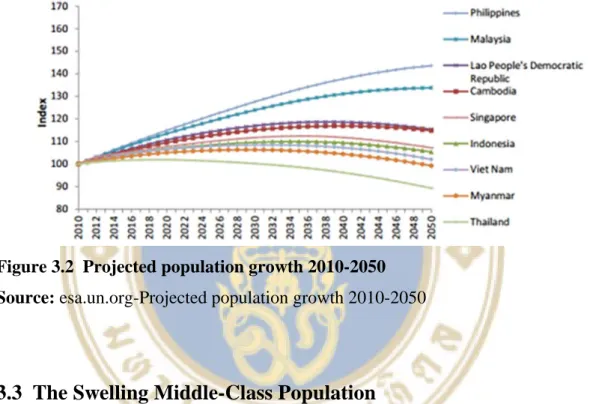

- The Population Trend, Which Supports The Business

- The Swelling Middle-Class Population

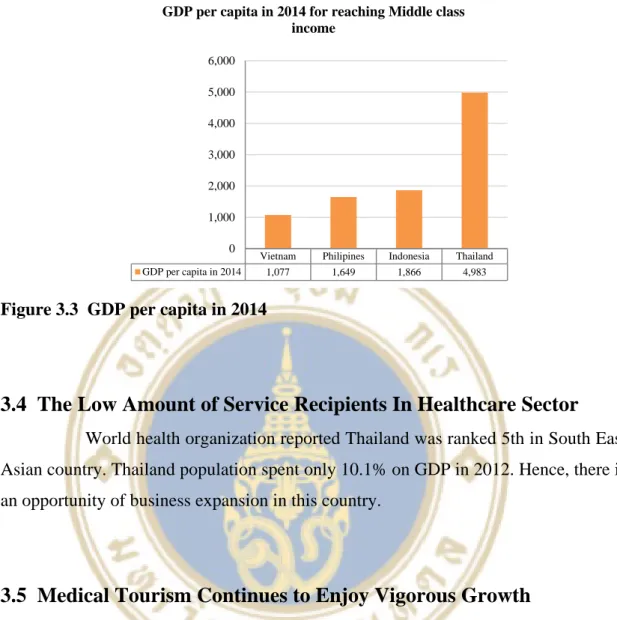

- The Low Amount of Service Recipients In Healthcare Sector World health organization reported Thailand was ranked 5th in South East

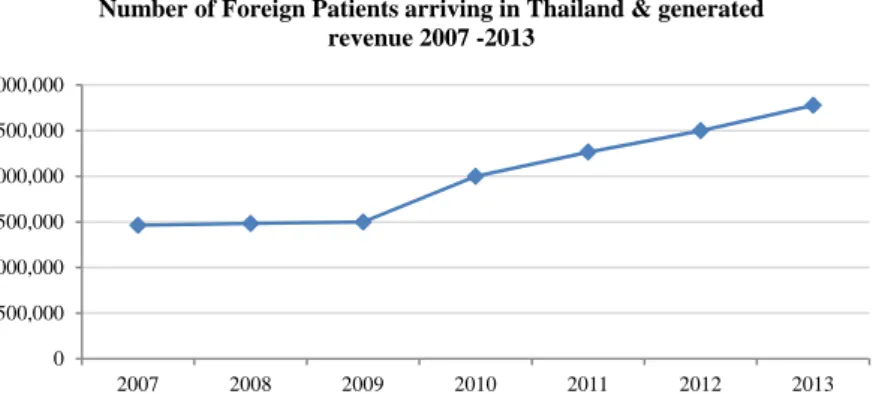

- Medical Tourism Continues to Enjoy Vigorous Growth

- Health Insurance Boosts the Demand for Health Care Services Up National Statistical Office of Thailand disclosed the number of people who

- The Challenges Confronting Public Hospitals In Thailand Leads To the Higher Opportunity for Private Hospital

So the number of elderly citizens in Thailand will be ranked 2nd among the countries in Southeast Asia (1st is Singapore). The rate of clinical staff penetration in Thailand is lower in other Southeast Asian countries compared to Singapore and Malaysia, which have clinical staff penetration rates of 87 and 89 respectively.

INDUSTRY ANALYSIS

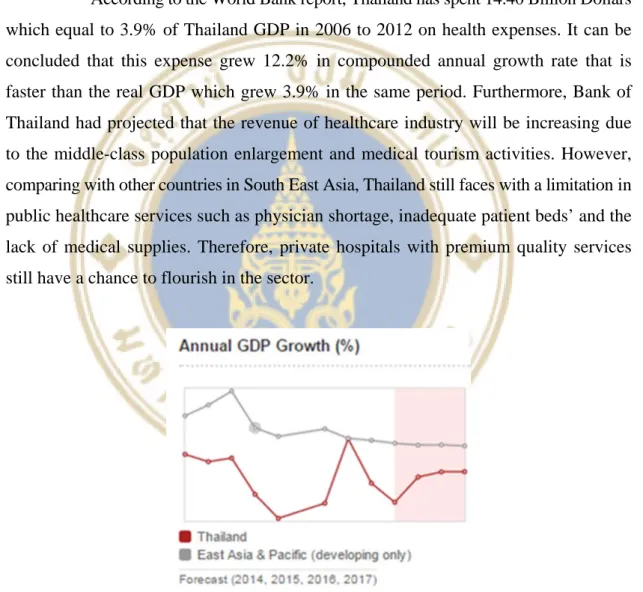

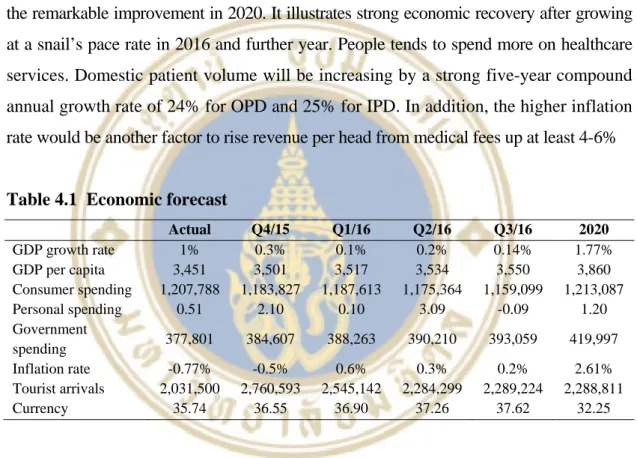

Well Macroeconomics: Rising In Domestic Healthcare Demand According to the forecasted GDP growth rate and GDP per capita shows

Tourism Booming Leads Thailand to Be A Hub Of Medical

As a result, many visitors choose to have surgery in the country as part of their holiday stay, leading to an increase in medical revenue, which flew to Thailand almost 2.5 times more than in 2007. With more than 1,000 public and 400 private hospitals operating in accordance with the international standard and fully equipped with internationally qualified doctors, the Thai Medical Service provides excellent medical care at very competitive prices.

High Requirement in Medical Devices and Pharmaceutical Products National Statistical Office estimated that Thailand's population would

COMPETITION ANALYSIS

Competitive Positioning

- Background and Location

- Staff and Technical Capabilities

Unlike many other aspects of a hospital experience, the sheer technical capabilities of a hospital are somewhat easy to quantify, and it is in this aspect that Bangkok Hospital most outperforms its competitor. It is unparalleled in Southeast Asia, and the Bangkok hospital has one of the only two clinical PET-CT scanners in Thailand.

Target Market and Marketing Strategies

Bangkok Hospital has focused enormous resources on cutting-edge medical technology, Bangkok Hospital's high-tech drive falls into two general areas: advanced imaging and non-invasive surgery. While other hospitals in Thailand simply do not compete in this field, giving Bangkok Hospital a decisive advantage in the specific operations that these advanced machines enable; reducing risk, discomfort and length of hospital stay.

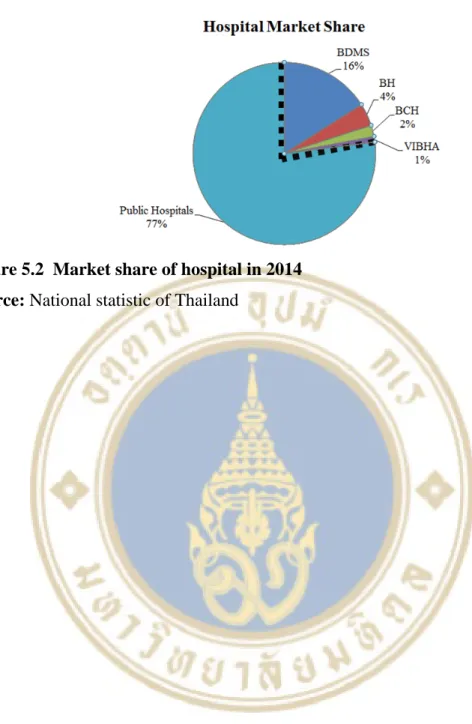

Market Share Analysis

INVESTMENT SUMMARY

- Aggressive Expansion

- Big market for growing

- Excellent Center

- Strategic Marketing in both local and international

BDMS will continue to invest, not only in the number of hospitals, it also plans to invest heavily in a specialized clinical center to improve the quality of services. BDMS will focus on the Heart, Brain and Cancer Clinic with support from the MD Anderson Institution. In these three cases, there is an increasing trend in the number of patients that generate relatively high revenue and margin.

BDMS will increase spending on marketing to gain better brand awareness to both domestic and international target patient. It will also include a direct strategic marketing with partner overseas to bring in more international patients and medical tourists.

RELATIVE VALUATION

Assumptions

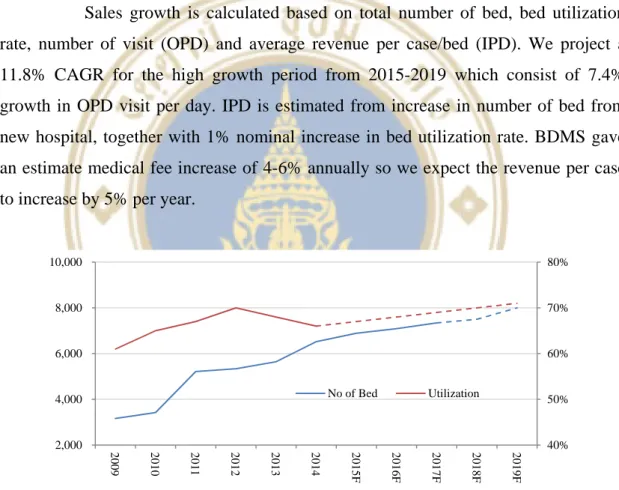

- Sales growth

- Cost of Hospital Operation & Administrative Expense

After the first few years of operation, the utilization rate will increase and help lower the average fixed cost. Administrative expenses remain very stable at 20%, so we keep this expense/sales ratio stable over the next 5 years.

Projected Cash Flow

Relative Valuation

- P/E Band Method

- Trailing Multiple Method

- Forward Multiple Method

We have found that BDMS multiples are mostly overvalued (yellow - amber color) when compared across the other company. We take a simple average of each multiple and use it to find BDMS's target price. Target price from each multiple gives a significantly lower price, which means that BDMS is overvalued.

Because BDMS is undergoing aggressive expansion, the rolling data may not reflect higher expected returns in the future. This method gives us a broader picture of how the current market share price reflects future expected returns. However, this method requires extensive analysis to get a good prediction about future performance and not.

So we only take companies that have forecasts from analysts, that is Bumrungrad, Bangkok Chain Hospital and Chularat Hospital.

FINANCIAL STATEMENT ANALYSIS

- Summary Figures From Financial Statement

- Income Statement

- Balance Sheet

- Common Size Analysis

- Income Statement

- Balance Sheet

- Trend Analysis

- Sales growth: Sales Growth

- Inventory

- Debt level

- DSO / DIO / DPO = Required Working Capital

- Bed utilization & Profitability

- International Patients Portion Drop

- OPD / IPD

- Financial Ratios : Return

- Operating margin

- Profit margin

- Return on asset (ROA)

- Return on equity (ROE)

- Return on invested capital

- Fixed asset turnover

- Financial Ratios: Risk

- Short-term risk

- Long-term solvency risk

But surprisingly BDMS total asset is 93.2 billion Baht against 19.1 billion Baht of BH but operating asset is not so different 12.7 against 8.5 billion Baht for BDMS and BH respectively. Considering the number of hospital, we can say that BDMS performance is significantly better in terms of current asset management. But BDMS's non-operating assets are relatively larger, 86.4% versus 55.5%, because BDMS invests 16.3% of total assets in many other associated companies.

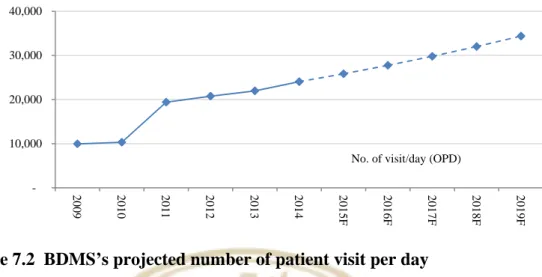

However, if we compare inventory with the number of hospitals, we will find that BDMS works much more efficiently (46 hospitals versus 1 hospital). Due to its aggressive expansion, BDMS's source of funds relies heavily on external financing, mainly from the issuance of debentures. Income from OPD, we divide into 2 compositions, number of visits multiplied by average income per visit.

This may help contribute to revenue growth for BDMS, but primarily in relation to the number of visits, which we expect to grow by 10% each year. This is driven by an increase in catchment hospitals, which generate lower than average revenue per bed. BDMS has opened many new hospitals, so we cannot expect efficiency to reach BH's level in the near future.

AS we can see that the ROE of BDMS is increasing while BH is decreasing. We saw a decline in BDMS ROIC as they invested heavily to support their aggressive expansion.

INVESTMENT RISK AND DOWNSIDE POSSIBILITIES

- Investment Risk

- Financial Risk

- Downside Possibilities

- Sensitivity Analysis

Anyway, Bangkok hospital should have different kinds of plans to serve the different levels of emergencies. Currency Risk: The Bangkok Hospital and its network hospitals are exposed to currency risk in the form of acquisition of medical tools and equipment. Bangkok hospital enters into forward currency contracts with maturity within one year to protect against volatility.

However, the Bangkok Hospital concludes an interest rate replacement contract to deal with this volatility. Risk Measurement: The Bangkok Hospital usually has a moderate level of strategic risk, as the company owns 34,031 beds across the country. This means that the Bangkok Hospital has a better leadership team than its rivals, but there are still some bad options that make the leadership teams mistaken in their decision.

In terms of operational risks, high staff turnover, apart from a large amount of money that the Bangkok hospital has to spend on staff training activities, leads to chaos in the company. Therefore, Bangkok Hospital must carefully focus on the selection and training of its staff to avoid the increase in personnel costs. However, the Bangkok hospital has already entered into a foreign currency and interest rate swap contract to deal with the volatility.

APPENDICES

Appendix A: Business Structure and Hospital Network

Appendix B: Corporate Governance Policy

- Shareholders’ Rights

- Equal treatment of shareholders

- Policy on stakeholders’ interests

- Disclosure and transparency

- Responsibility of the Board of Directors and sub-committees

- Directors’ Knowledge Enhancement

- Sub-Committees

Every new employee is expected to attend orientation to be informed about the work process of the various departments within the organization. BDMS has the policy of disclosing the financial statements, important information and any other information that may affect the interests of the shareholders or the decision to invest in the Company, which in turn may affect the price of the shares and securities of the Company. influence. The main purpose is to ensure that the decision to invest in securities of the Company is made fairly and with equal information.

In addition, independent directors must not have business or be involved in the interests of the Company, subsidiaries, associates or related companies, which may adversely affect the interests of the Company and shareholders. Is not/has not been an executive director, staff, employee, salaried consultant or person with controlling power of the Company, parent company, subsidiaries, related companies, subsidiaries of the same level, major shareholders or persons with controlling power, unless this status has ended no less than 2 years before appointment. Is not a director who has been appointed as a representative of the Company's directors, major shareholders or a shareholder who is a person related to a major shareholder.

Any other duties of the Directors as stipulated in notifications, laws or enactments governing the Company. BDMS has the policy of encouraging directors of the company and subsidiaries to attend the Director Certification Program (DCP) and the Director Accreditation Program (DAP) organized by the Thai Institute of Directors (IOD). The Company also encourages directors to attend training courses on amendments and updates to the regulations, policies and guidelines of the Stock Exchange and the SEC.

Appendix C: SWOT Analysis

- Strength - Complete medical hub solutions with the great efficacy operations

- Weakness - Lack of System Integration and slow technology adoption

- Opportunities - Rising in retirement population

- Threats - The lack of retaining medical personnel or crucial executives

The increase in older populations such as Thailand (a high percentage of people over 65) requires more investment in the healthcare sector. According to the BBC, medical tourism in Thailand is gradually growing at an annual rate of 16%, while in financial terms the foreign medical services sector is expected to earn as much as 100 billion baht in 2015. Currently, medical tourism makes up 0.4% of total turnover. GDP, while tourism accounts for 6% to 7% in total, the third most important economic driver in Thailand.

Thus, the failure of maintaining healthcare staff or key executives and inability to replace them with comparable staff may have negative effects on the company. BDMS must compete with other hospitals operators in maintaining and attracting trained medical staff all the time, which can affect the operational cost of the company. It is important for the company to obtain a license to run health care activities and health clinics.

In addition, any changes in the interpretation of current regulations or enforcement of laws or new regulations or policies that are likely to be more stringent could affect the Company's operations. The application of laws or new regulations that protect persons who have received damages from healthcare services makes the company plan to introduce protection funds with the standard compensation rate higher to pay to its patients. Therefore, the Company may not guarantee that future changes to laws and regulations or the issuance of new regulations or new policies related to the Company's business will not affect the Company's operations and business opportunities.

Appendix D: Five Force Analysis

Bargaining power of suppliers Bangkok hospital sticks with the same supplier base in order to lift the bargaining power. In 2014, Bangkok hospital and its

Bargaining power of customers Patients who use benefit from welfares or health insurances in medical treatment hold a certain degree of bargaining leverage,

Threat of new entrants Large capital costs are required for acquisition activities, improving high medical technologies both in Bangkok and upcountry hospitals

Threat of substitute products Since the cost medical treatment in Thailand is far lower than Europe and other Asian country, with the equal quality of

Appendix E: Projected Income Statement

Appendix F: Projected Balance Sheet