The Big Tech Score offers readers a rare opportunity—a chance to gain insight into the investment process at work from one of Wall Street's true superstars. In the winter of 1990, having just sold the computer consulting firm I had run for 10 years and craving a new challenge, I set out to conquer Wall Street.

A WORD ON OUR ADVICE

I was lucky enough to work with some of the smartest people in the business and even luckier that many of them agreed to be quoted in this book. Thanks to Hans Roderich, who was my partner in crime for much of the research contained in this book.

The Big Tech Score

Over time, I have come to believe that there are certain characteristics that the best companies share. Many people can't resist the thought of big money, and there's no denying that playing the stock market can sometimes lead to good rewards.

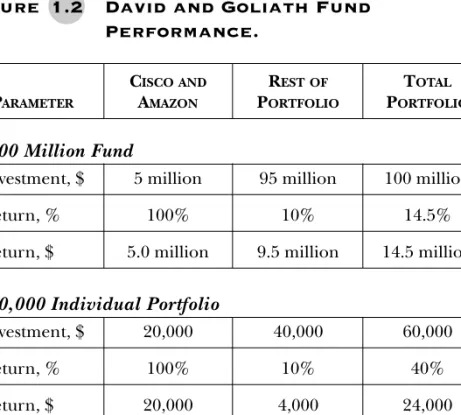

As a Wall Street analyst, I've been lucky enough to be one of the select few who has been granted consistent access to the strategic thinking at a number of high-flying technology companies. But if you know what to look for in a company, even if the media is proclaiming its demise and everyone else is scrambling to sell, then it shouldn't matter what the conventional wisdom says about it - you have the resources to are needed to judge. yourself.

A FEW KEY POINTS

You don't have to listen 24/7 to Moneyline or memorize the Wall Street Journal. You don't need to be on top of every industry that comes down the pipe or informed about every merger and acquisition that takes place. The number of stocks you own should be a reflection of the time you can spend following them.

W HY YOU CAN BEAT THE PROS

When building your stock portfolio, think about the range of 4 to 7 stocks. If you are not willing to invest your time before investing your money, don't bother with this book.

W HY THIS BOOK?

The math involved in this barbaric bubble test is similar in difficulty to what's in these pages. If your kids can learn the math for the SAT, then you can learn the math on these pages.

P LAYING THE STOCK MARKET

And believe me, the concepts in this book will improve your financial situation much more than a college degree ever could. You have a very good shot at it if you follow the advice in this book.

S UMMING UP

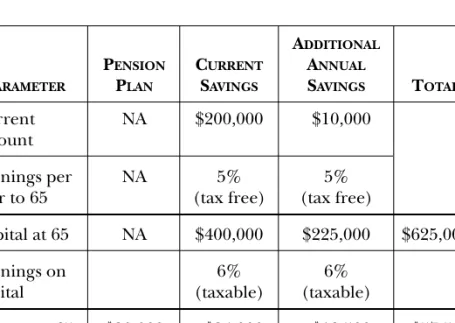

If you make the mistake of putting your savings into risky ventures when there is no need, you are foolish. In the law, there is a famous phrase: "The punishment must fit the crime." I have my own slogan for the potential investor: "The strategy must fit the objective." You wouldn't give a jaywalker 10 years in prison.

C ONCENTRATE Y OUR I NVESTMENTS ON A

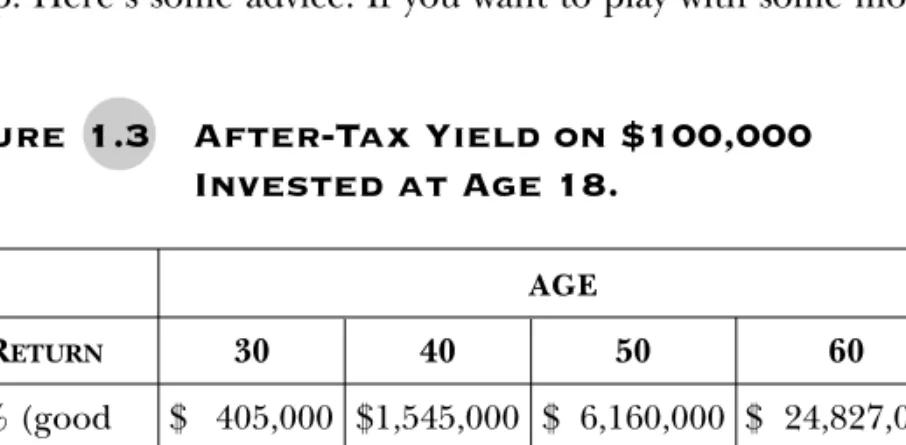

Why risk your future and take the chance of ending up with less than you need?” (See Figure 2.1.). Likewise, a 60-year-old who wants to retire in style shouldn't put his entire nest egg in high-risk stocks.

H ANDFUL OF C OMPANIES

It's much harder to achieve a goal if you don't know what you're aiming for. Once you have a number in mind, ask yourself if you can get there without taking much risk.

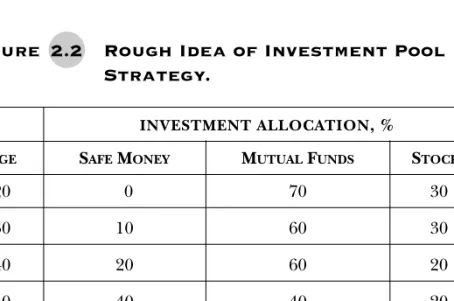

C REATING INVESTMENT POOLS

Safe Money

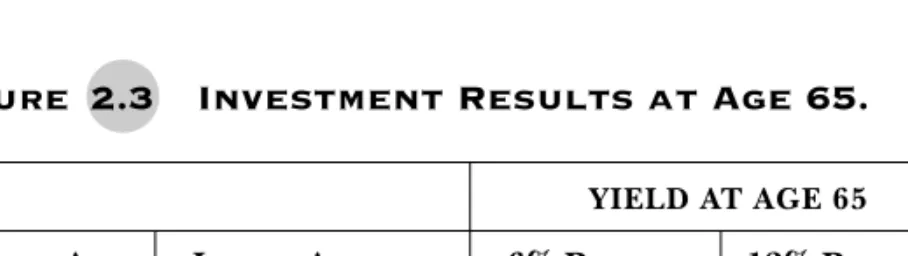

If you are 55 or older, this pool on its own, with the expected return, should be enough to meet your retirement goals. Once you're old enough for the senior discount, you'll come in handy.

Mutual Funds

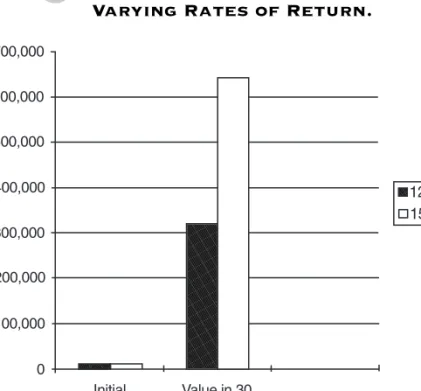

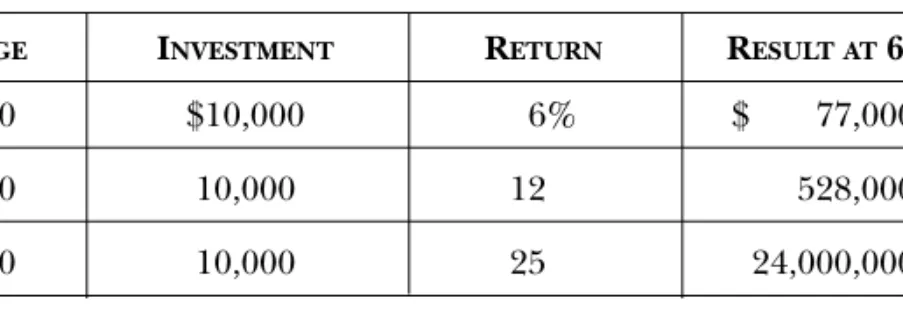

The best way to earn 12 percent of your money is to put it in an index fund. Over a long period of time, the best portfolio managers can earn 15 percent or more per year.

Stocks

SCARED MONEY RARELY WINS

T IMING IS EVERYTHING

Respect the law of averages—never put money into the stock market if you need it in the short term. I'll tell you the key to winning in the stock market if you promise not to laugh: Buy low, sell high.

If you've identified six or seven winners, then they're a good buy regardless of the news that's making everyone else nervous. If you do the calculations presented in the following chapters for each of the stocks in your portfolio, you'll have a fairly close idea of the level at which each should be trading.

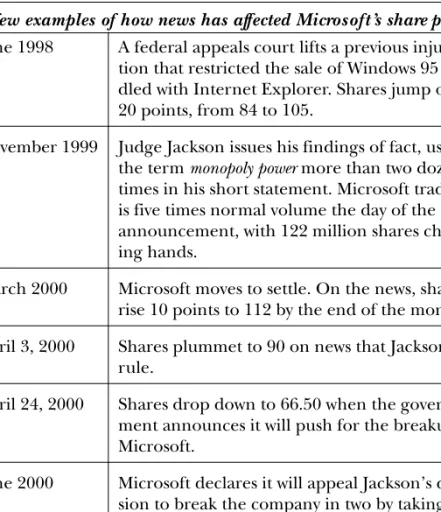

F EEDING THE FRENZY

Worry caused a depreciation in tech stocks that was completely out of proportion to the scale of the problem. And if I was right, tech stocks were actually a bargain, with the prices being so low because everyone was expecting a crash.

G ETTING SPECIFIC

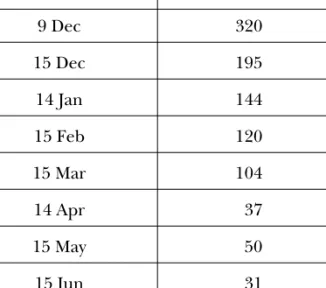

I told my clients to wait until May, by which time I expected the stock to be at a very good price. Much of the stock's rally came because the Street was once again excited about HP.

I N AND OUT?

The rapid rise in the stock had almost nothing to do with performance and everything to do with perception. It was a company that grew 5 to 15 percent annually, and now it was trading at a premium to the S&P 500, not a discount.

T HE LONG-TERM PORTFOLIO

If any of them are trading well below what your analysis thinks you're worth, take advantage of bad news and buy more shares. If you've identified six or seven winners, they're a good buy, regardless of the news that makes everyone else nervous.

T HE SEVEN DEADLY SINS

You would never expect to argue and win a case before the Supreme Court without poring over a stack of law books. Yet many investors expect to make a fortune by investing in companies completely blindly, with absolutely no knowledge to guide them.

She also didn't buy Ask Jeeves, the search engine she used to write her first book and described prebuzz as "the best thing you can go to on the web." Heart breaking. Use the homework you've done with this book and take advantage of unusual turns in the market.

I NVEST IN G REAT M ANAGEMENT

In the relatively new world of e-commerce, he understood what most others didn't – the Web was a branding game. After spending two hours with Ted Waitt, it was clear that behind his bohemian demeanor was one of the best minds in the industry.

W HAT TO LOOK FOR

The Wal-Mart story made me hesitant, but it wasn't the only reason I didn't get pulled from the stock. In the few minutes we were sitting there, the stock went up a few points.

H AIL THE FOUNDER

The company's founder, Ken Olsen, was one of the smartest people in the entire industry - but at some point he lost track of where the market was headed. It was clear to anyone who knew Noorda in his prime that he wasn't as strong as he used to be - and it was clear that with Noorda at the helm, the company was in trouble.

H ELP WANTED

Hiring Topfer and Meredith to lead operations gave Michael Dell the freedom to lead the company's overall vision. Unfortunately, a few years later, Sculley staged a coup d'état and kicked Jobs out of the company.

O BSERVING A COMPANY IN HOT WATER

Well, the announcement has been made, and guess who took the offer - the employees who could get another job in a heartbeat, or the people who spent years trying to look useful. It wasn't an analyst who figured it out - it was Ben Rosen, who backed Compaq financially in the beginning and was now chairman of the board.

H IRING THE BEST PEOPLE, PERIOD

Like any good sports scout, Microsoft recruiters descend on colleges across America, looking for the best and brightest. Apart from the technical part of the interview, there are questions that have nothing to do with software design, from.

L OOK FOR C OMPANIES

Put them on the same course, at the same time, on the same day, under the same conditions. The same quality that distinguished the runners and made one engine purr while the other just ran.

WITH A C OMPETITIVE A DVANTAGE

Take two bishops of equal skill; give one a pair of sneakers and let the other run barefoot. Regardless of the reasons, a competitive advantage can make the difference between winning and losing.

T HE VIRTUAL ENTERPRISE

It didn't matter what price Microsoft had to offer, what deal it had to offer - the most important first step was to become pervasive. The increasing feedback loop, like the virtual enterprise, is a self-perpetuating phenomenon - the more people who get on board, the more likely others will follow.

T HE ECONOMIC ADVANTAGE

For a long time, Apple charged a premium for its machines to help float the cost of operating system R&D. This gives Dell an extra 4 to 5% in leverage—the remainder of its 10 percent financial advantage.

A PRODUCT THAT CAN’T BE REPLICATED

Southwest has dominated its market segment because it has a real cost advantage. Many of the most important technological inventions of this decade were developed at the Xerox Research Center: the mouse, the graphical user interface (GUI), Ethernet, and the laser printer.

T HE UNBEATABLE BRAND

A good portion of the people watching the ad will have no interest in what the company is selling, but the company paid for every eyeball. For example, if the soda market is not growing as fast and Coca-Cola's share is large but fairly stable, a large market share is not enough.

A LMOST, BUT NOT QUITE

At the same time, they had a tremendous understanding of the consumer handset market – how the market was likely to grow in each segment. One of the easiest ways to make customers loyal is to treat them well early on.

L OVE C OMPANIES C USTOMERS L OVE

Before investing in any company, it is important to analyze what the typical customer thinks of the company. In business, this is often easier to achieve than one might think, because the typical company does very little (besides sales and other short-term incentives) to endear customers to them.

P ROVIDING BETTER SERVICE

I would buy a car from them even if it cost 5 percent more than I thought it should. If there was only one Audi dealer, I would have blamed the dealer, but since there were more than one, I associated the misbehavior with the company as a whole.

C REATING AN ELITE PRODUCT

At the time, most pens on the market averaged 29 cents. The price was high, let me tell you – but the salesman told me: “If you buy a Porsche, you will be one of the masses.

D ELIVERING MORE VALUE

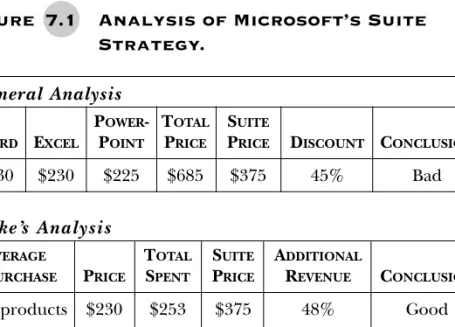

Microsoft entered the suite race with a huge advantage—the company was the only competitor with compelling products in all three product categories. One of the things that made Microsoft such a superpower was Bill Gates' philosophy of pricing for the masses.

P UTTING IT TOGETHER

In a way, Gates was the heir to the throne of the great monopolists like Henry Ford. Similarly, before Microsoft, many of the software manufacturers created a custom piece of software for a single type of hardware.

L OOK FOR L ONG - T ERM T HINKERS

So he knelt down, let the scorpion climb aboard, and set off across the river. Strange as it may seem, the fable of the scorpion and the frog beautifully illustrates the concept of long-term thinking.

P RIME EXAMPLES OF SHORT-TERM THINKING

In its heyday, GM had about a 50 percent market share of the global auto industry. The company became so preoccupied with maximizing annual profits that it lost all sense of its larger mission.

G OING LONG

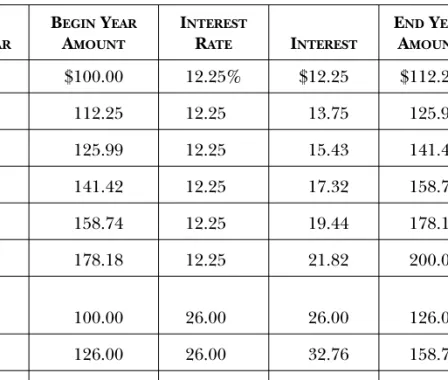

This was not the best way to reinforce the Cadillac's image as a luxury vehicle. Your mom offers you a choice: she'll give you an allowance of $30 a week to buy all the video games and candy your little heart desires, or you can choose to receive zippo until the end of the year, where you'll get a lump sum of $5,000 .

P RIME EXAMPLES OF LONG-TERM THINKING

In addition, there is no hold time, no charge and no working day - the system is operational 24 hours a day, 7 days a week. I convinced myself that nothing had really changed - the companies had always acted this way - and that I could not afford not to own the shares.

A LWAYS L OOK F ORWARD , N OT

Because the stock market is biased towards companies that are not part of the crowd. The in-crowd consists of old-timers with a proven track record and newcomers anointed as sure winners.

B ACKWARD

That said, it might surprise you to learn that the stocks that seem the safest—the ones that have a pedigree from the most entrenched and established companies out there—are often the dogs of the Dow.

B ETTING ON THE OLD-TIMERS

B ETTING ON THE NEW WUNDERKIND

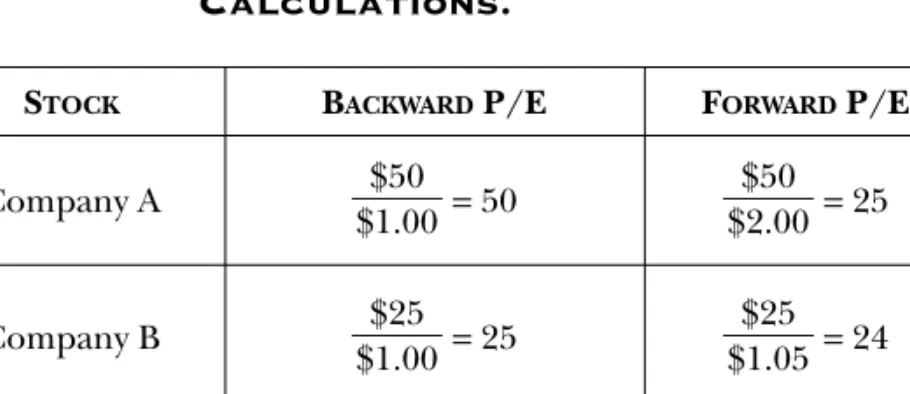

VA Linux turned out to be the most successful IPO ever on its first day of trading, closing more than 700 percent above its IPO price. Despite the numbers, however, VA Linux stock currently trades at $33 per share, which is less than 14 times next year's consensus earnings estimate (compared to about 100 times at the end of the first day of trading).

T HE DO-IT-YOURSELF MENTALITY

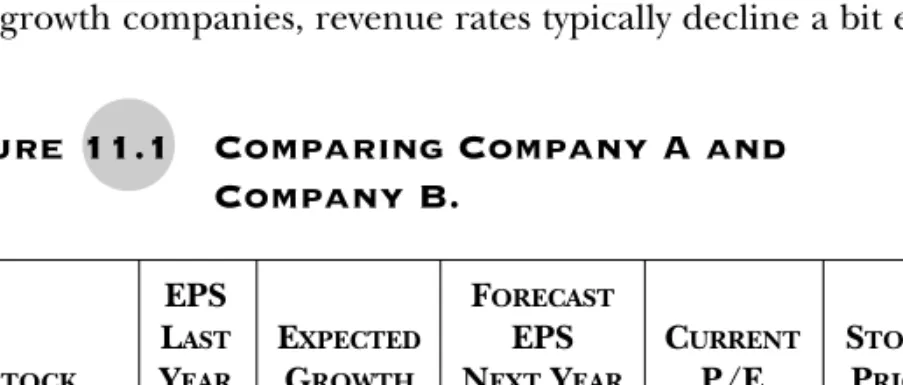

Let's assume that the consensus estimate for Company A's earnings next year is $2.00 per share, because Company A is expected to grow at 100 percent. The closer your match is, the easier it is to find out the value of the company you are dealing with.

P ICK O NLY H IGH -G ROWTH

You have the option to select Michael Jordan, but you will have to trade three players to do so. It would be ideal if the entire team performed with scoring ability, but employing a few Michael Jordans doesn't hurt.

C OMPANIES

You want the stock that will win the championship six out of seven years, not the one that will make the playoffs. Stocks that match the criteria for big tech scores are the best of the breed and are usually in the highest growth sectors of the economy.

W HAT SPURS GROWTH?

People would say to me, “Mike, Intel has a monopoly, it has the majority of the market, and it's cheaper. Sometimes your business can grow quite a bit in a slow-growing market, but once it has a larger market share, it will peak.

T HE STOCKHOLDER SCREEN TEST

In the first years, the profit growth can be astronomical, as the company constantly improves its business model. As the company matures and becomes more profitable, its revenue growth will actually outpace revenue growth—.

G ROWTH IS HARD TO MAINTAIN

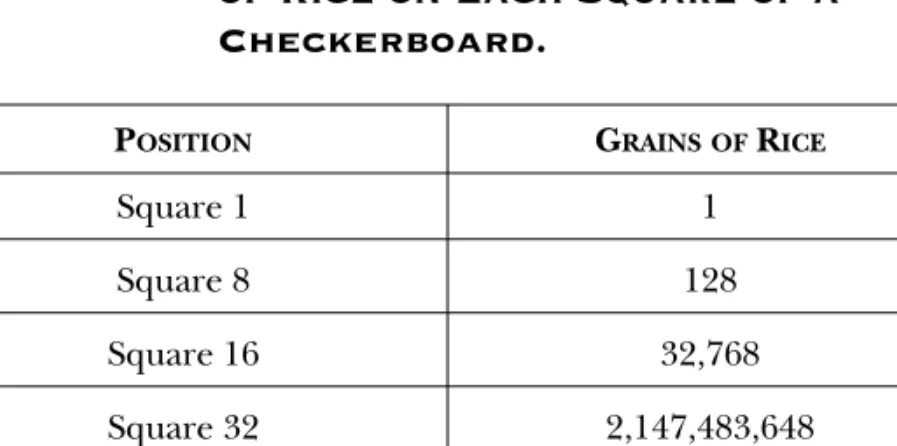

Amount of decline = current year's growth × rate of decline Ballpark estimate of next year's growth. Regardless of what analysts predict for this company, you have to think next year's growth will be around 34 percent.

T HE B EST S TOCKS A RE C HEAPER T HAN

It's pretty cool to be treated for a while like you got the word from God about which stocks will fall and which ones will disappear (not to say that God has nothing better to do than watch stock prices fall). market). But the truth is, genius or no genius, guru or no guru, no industry expert knows for sure in advance how well a company is going to do.

Y OU T HINK

As a company becomes more mature, management can sometimes make a pretty good guess—but it's just a guess. If you've ever played Monopoly, you know that different players approach risk in different ways.

T HE GAME

Unless there is evidence of something truly radical on Company A's horizon, you should buy Company B. Consensus is the average of all analysts' forecasts for a company's future estimated earnings per share (EPS).

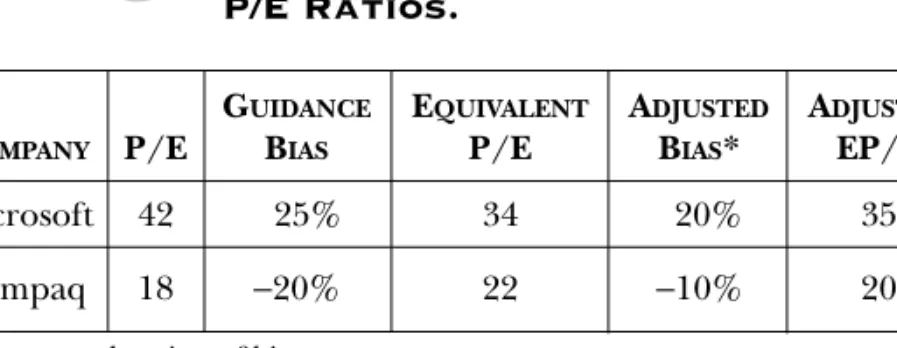

A PPLYING GUIDANCE BIAS TO VALUATION

Once you've done that, place your calculations next to the relevant quarter in the table. This skepticism often leads to what is known in the industry as the whisper number. The whispering phenomenon is a direct result of guidance bias.

A WORD OF WARNING

Then (in 1998) I decided to focus my fund on companies that improved the creation of the Internet infrastructure. By the end of the millennium, optics was the Wall Street buzzword as robust growth on the Internet continued and service providers invested heavily in building out the infrastructure of the Internet – an area in which SDL Inc., with its proprietary DWDM, with dense wavelength division multiplexing, which were located almost alone.

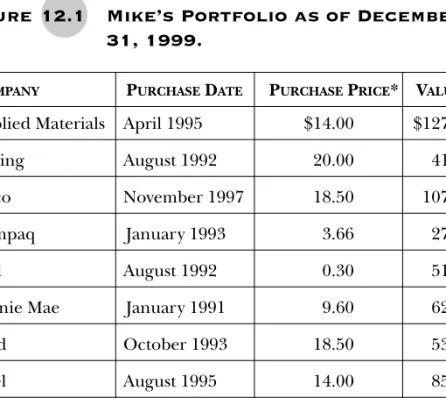

M IKE’S PORTFOLIO

The bad choices together now make up less than 0.1 percent of my total portfolio. I keep the disasters in my wallet to remind me of flashes of extreme stupidity, so that every time I'm tempted to hit the road again half-assed, I'll think twice.

M IKE AND D ANIELLE ’ S P ORTFOLIOS

I bought Intel in 1995, in the midst of the PC gold rush, but at a time when the company itself was having problems. Indeed, in the time I've held the stock, the company has bought almost three or four times.

T HE UNKNOWN PORTION OF THE PORTFOLIO