As the title of the book indicates, we cover practical applications of credit derivatives as well as the most current pricing models applied by asset managers and traders. We will then discuss some of the basic building blocks in the credit derivatives market: credit default swaps, asset swaps, and total return swaps.

About the Authors

Credit derivatives are financial instruments designed to transfer the credit exposure of an underlying asset or assets between two parties. Credit derivatives include credit default swaps, asset swaps, total return swaps, credit linked notes, credit spread options and credit spread forwards.

ROLE OF CREDIT DERIVATIVES IN FINANCIAL MARKETS

Understanding credit derivatives is critical, even for those who do not wish to use these instruments. Credit defaults, of course, do exactly that, presumably embodying in the process all relevant market prices of the financial instruments issued by potential borrowers.

MARKET PARTICIPANTS

TYPES OF CREDIT RISK

For example, mergers and acquisitions have historically been a common occurrence in the high-yield corporate bond market. Like the high-yield bond market, bank loans are susceptible to the risk of credit downgrades (downgrade risk) and the risk of widening credit spreads (credit spread risk).

VISUALIZING CREDIT RISK

In Figure 1.2 we present the frequency return distribution for high yield bonds over the time period 1990–2000. Emerging market debt has an even greater negative skewness as well as a greater value of kurtosis compared to high yield bonds.

RISKS OF CREDIT DERIVATIVES

The "fat" negative tail associated with emerging market bonds reflects the risk of downgrades, defaults and widening credit spreads. The prices of credit derivatives are therefore very sensitive to the assumptions in the model used.

FUTURE GROWTH OF THE CREDIT DERIVATIVES MARKET

Figure 1.4 lists the 25 commercial banks and trust companies in the United States as of March 2002 with the most exposure to derivatives. In later chapters we will discuss the general principles of valuation of credit derivatives.

CREDIT DEFAULT RISK

The rating agency also examines the quality of the bank providing the backup facility. The default loss rate is then the sum of the default loss of the principal and the default loss of the coupon.

CREDIT SPREAD RISK

To understand credit spread risk, it is necessary to understand the fundamental factors that influence credit spreads. As a result, credit spreads may change based on an expected change in the economic cycle that does not materialize.

DOWNGRADE RISK

It shows the percentage of expenditure rated AA at the beginning of the year that has been downgraded to A by the end of the year. Again, using Exhibit 2.7, look at the row showing issues rated AA at the beginning of the year.

BASIC ELEMENTS OF CREDIT DEFAULT SWAPS

3. First to Default Exchange: The maximum payout is $10 million for the first referral organization to default. 5. Exchange of the fifth in default: The maximum payout for the fifth reference entity in default is USD 10 million.

MARKET TERMINOLOGY

For example, assume that the first reference entity's loss in default is 10% of the hypothetical amount. A cash market position where the value of the position increases when interest rates rise is a short bond position. The terminology of the counterparty position in a credit default swap can be unclear.

LEGAL DOCUMENTATION

When a credit-risk bond is the underlying asset, it is the credit spread that affects the price of the bond. So the price performance mechanism for an option is as follows: changes in the credit spread affect the price of the underlying bond, which in turn changes the price of the option. In the case of a credit default swap, the change in credit spread directly affects the price of the transaction and not through its effect on the reference obligation (i.e. the underlying bond).

CREDIT EVENTS

A downgrade means a downgrade of the reference entity's credit rating or if the reference obligation is no longer rated by any credit rating agency. Basically, if the reference entity refuses to pay any of its obligations, the buyer of the insurance can declare a credit event on the reference obligation. There is a limit on the reference obligations in connection with the restructuring of credits given by the insurance buyer to the borrower who is the debtor of the reference obligation.

TERMINATION VALUE AND SETTLEMENT

It is these revised definitions that apply to the confirmation form presented in the appendix. When the old restructuring is used, a long term bond can be delivered and therefore the delivery option has market value. The physical settlement also allows the protection seller to participate in creditor negotiations with the administrators of the reference entity, which may result in improved terms for them as holders of the obligation.

CONDITIONS TO PAYMENT

Almost always, the dealer selling the credit derivative wants to remain the calculation agent. It is rare for the parties to a trade in credit derivatives to use an external calculation agent. In this case, the third party is known as a verification agent and not a calculation agent.

APPLICATIONS OF CREDIT DEFAULT SWAPS

So, for example, the asset manager would buy protection in one fund and sell protection in another fund. Using structured notes such as credit-linked notes linked to assets in the asset manager's reference pool, trading credit exposures are crystallized as added yield to the asset manager's fixed income portfolio. In this way, the asset manager has enabled other market participants to gain exposure to the credit risk of a pool of assets, but not to any other aspect of the portfolio, and without having to hold the assets themselves.

APPENDIX: CONFIRMATION FOR CREDIT DERIVATIVES TRANSACTION

In an asset swap, the investor enters into two transactions at the same time: he buys the credit-risk fixed rate bond and enters into an interest rate swap. It is because of this shortcoming of an asset swap that other types of derivatives and structured products, especially credit default swaps, have emerged. To understand an asset swap, it is necessary to understand an interest rate swap.

INTEREST RATE SWAP

Thus, an increase in interest rates will increase the value of a fixed rate interest rate swap to the payer. A swaption gives the option buyer the right to enter into an interest rate swap at a future date. A pay-fixed swaption (also known as a payer swaption) gives the option buyer the right to enter into an interest rate swap in which the buyer of the option pays a fixed interest rate and receives a variable interest rate.

INVESTOR STRUCTURED ASSET SWAP

This means that at the end of two years, the buyer of this fixed-payment swaption has the right to enter into a 3-year interest rate swap in which the buyer pays 6% (the swap rate which is equal to the beat rate) and takes the reference rate. In a fixed acceptance swap (also called a receiver swap) the buyer of the swaption has the right to enter into an interest rate swap that requires the payment of a variable rate and the receipt of a fixed rate. Effectively, the investor has converted a 5-year fixed-rate one-A bond into a 5-year floating-rate bond at a spread over 6-month LIBOR.

ASSET SWAP STRUCTURE (PACKAGE) CREATED BY A DEALER

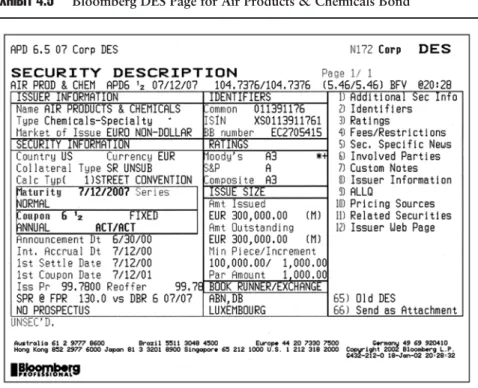

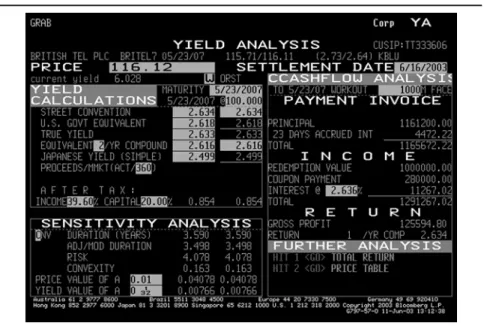

The dealer agrees to pay the investor every six months 6-month LIBOR plus an asset swap spread of 30 basis points. In our first asset swap illustration we gave earlier, an investor creates a synthetic floater without a trader. The asset swap spread for a credit risk corporate bond can be illustrated using Bloomberg screens.

USING SWAPTIONS TO REMOVE UNWANTED STRUCTURAL FEATURES

However, the investor would also be entering into a swap in which the investor has the right to effectively terminate the swap from the time of the first call date on the bond to the bond's maturity date. In a swaption, since the investor pays fixed and receives floating, the swaption must be one in which the investor receives fixed and pays floating. The transaction can be structured so that the asset swap terminates if the bonds are called.

THE ASSET SWAP—CREDIT DEFAULT SWAP BASIS

The default swap buyer is exposed to counterparty risk during the term of the trade, unlike the cash mortgage holder. We now consider the credit default swap page on Bloomberg for the same bond, shown in Exhibit 4.8. Prices observed in the market will always show this pattern of difference between the asset swap price and the credit default swap price.

ECONOMICS OF A TOTAL RETURN SWAP

The total return may not initially pay the owner of the reference asset until the exchange is completed. Therefore, the dealer's profit is the spread times the nominal amount of the total return swap. First, the total return recipient does not need to finance the purchase of the reference asset himself.

APPLICATIONS OF A TOTAL RETURN SWAP

Therefore, the total return swap can accommodate the insurance company's investment horizon while the term loan does not. In exchange for paying this fee, the insurance company received the total proceeds on the Riverwood International term loan. The total return swap with the insurance company allowed the bank to reduce its credit exposure and collect a fee.

TOTAL RETURN INDEX SWAPS

This approach requires the asset manager to follow an indexing strategy for the credit sector of the target index. Another option is to overload the index sector based on the asset manager's view. Total return swaps can be used to match the duration of the portfolio's credit spread risk to the credit spread risk of the target index.

APPENDIX: THE VALUATION OF TOTAL RETURN SWAPS

The advantage of the total return swap is that it can short circuit the credit industry, a task that is extremely difficult and costly for individual credit industry bond issues. Later we show that the future benchmark expectation of an asset indicates the forward price of the asset. This value is reduced by the nominal value of the reference asset to which the CLN is linked.

DESCRIPTION OF CLNS

Exhibit 6.3 shows the Bloomberg screen CLN and a list of the different types of CLNs issued. In the case of the default reference name, the note is immediately invoked. Investors in a CLN will have exposure to a reference asset or entity, and the repayment of the CLN is linked to the performance of the reference entity.

THE FIRST-TO-DEFAULT CREDIT-LINKED NOTE

If a credit event occurs, the maturity date of the CLN is shown and the note is settled as par minus the value of the reference asset or entity. In practice, it is not the "recovery value" that is used, but the market value of the reference asset at the time the credit event is verified. If no credit event occurs during the life of the note, the investor will receive the face value of the note at maturity.

REVIEW OF COLLATERALIZED DEBT OBLIGATIONS

In a synthetic CDO, the credit risk on the underlying loans or bonds is thus transferred to the SPV using credit default swaps and/or total return swaps (TRS). However, the reference assets remain static for the lifetime of the trade in both cases. A fully funded CDO is a structure where the credit risk of the entire portfolio is transferred to the SPV via a credit default swap.

CDO ANALYSIS

To illustrate the returns on the European market, Figure 7.15 shows the spreads of a selected range of debt securities on January 25, 2002 in the credit spectrum. In Exhibit 7.17, we show the disputed securities spread for a select number of synthetic CDOs closed in 2001–2002. EXHIBIT 7.15 Credit rating spreads for synthetic CDOs in the European market in January 2002 for deals issued in the last quarter of 2001.

CASE STUDIES

The role of the collateral manager was therefore critical to the rating analysis of the transaction. Purchase of cash assets, funded by the proceeds of the note issue and the liquidity facility. However, the equity element of the structure is called "preference shares". The CDO collateral manager is PIMCO, an investment advisory firm based in California.

COMPLEXITIES IN CREDIT RISK MODELING

The absolute priority rule is the principle that senior creditors are paid in full before junior creditors are paid anything. For secured creditors and unsecured creditors, the absolute priority rule guarantees their seniority to shareholders. Studies of actual reorganizations under Chapter 11 have found that the violation of absolute priority is the rule rather the exception.1.

OVERVIEW OF CURRENT MODELS

In the United States, for example, the Bankruptcy Act of 1978, as amended, sets out the rights of parties involved in a bankruptcy proceeding. The use of option pricing theory put forth by Black-Scholes-Merton (BSM) provides a significant improvement over traditional methods for valuing bonds with default risk. 3Fischer Black and Myron Scholes, “Option Pricing and Corporate Liability,” Journal of Political Economy 81, no.

THE BLACK-SCHOLES-MERTON MODEL

BSM assumed that the dynamics of the asset value follows a lognormal stochastic process of the form. Note that the second term in the last equation is the present value of probability-weighted face value of the debt. Looking at the stock markets, we estimate that the volatility of the asset value is 30%.

GESKE COMPOUND OPTION MODEL