Wiley Publishing, Inc., is not affiliated with any product or vendor mentioned in this book. THIS WORK IS SOLD WITH THE UNDERSTANDING THAT THE PUBLISHER IS NOT ENGAGED IN PROVIDING LEGAL, ACCOUNTING, OR OTHER PROFESSIONAL SERVICES.

Introduction

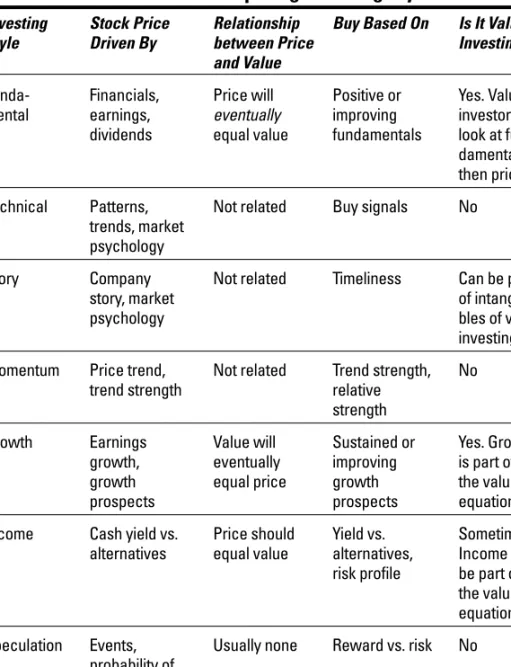

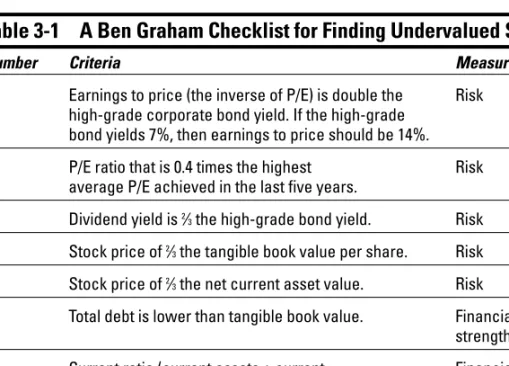

When the price of a stock is less than the value of the business, the value investor gets hot and may get excited to buy it. And when the price of the stock soars above the value of the company, yes, the value investor sells or avoids it altogether.

The What and Why of Value Investingof Value Investing

Value Investing For Dummies, Second Edition, assumes some level of familiarity and experience with investing and investing. So you don't have to read the book cover to cover if you don't want to.

Fundamentals for Fundamentalists

The book assumes that you understand what stocks are and how the markets work, and that you have already bought and sold some stocks. If you're starting from scratch, you may want to refer to Eric Tyson's Investing For Dummies or a similar introductory treatment of the world of investing.

So You Wanna Buy a Business?

Becoming a Value Investor

The Part of Tens

The What and Why of Value Investing

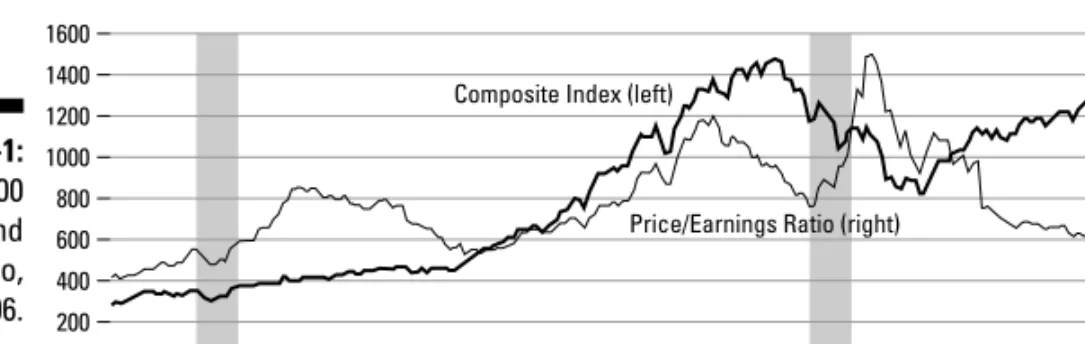

We place value investing in context with a discussion of markets, market history and overall performance, with an emphasis on market nature – key market behaviors and idiosyncrasies that have repeatedly presented opportunities for the value investor throughout history. We examine the history of the value investing approach and the fantastic success of some who practice it, most notably the master himself, Warren Buffett.

An Investor’s Guide to Value Investing

Towards a definition, here's one you may have read in the first edition of Value Investing For Dummies. Value investing is buying shares in a company as if you were buying the company itself.

Evaluating your values

The value investing style requires building in margins of safety by buying at a fair price. If you decide to take the value investing approach, know that it doesn't have to be an all-or-nothing commitment.

How Value Investors View the Markets — and Vice Versa

Saddam Hussein kicked off the 1990s with his invasion of Kuwait in September 1990, resulting in the "First Gulf War." The investors held their breath, but in January 1991 we could all breathe easy again. Like most booms, there was a reason: the cost of doing business would fall, sales would rise, and everyone would happily march to the bank.

The Value Investing Story

But when you factor in the intangibles of enjoying one of investment history's classics – and the prospect of making good investments – the fairly high price per pound is justified. What we just said about working capital – the more, the better – is generally true.

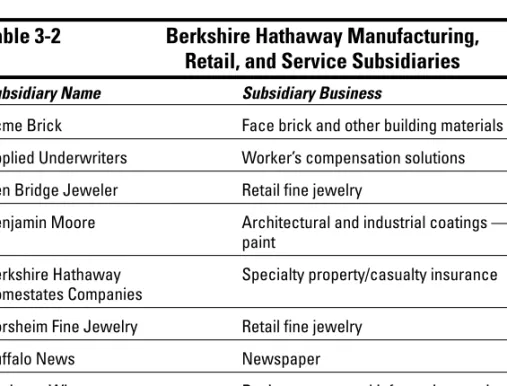

Acquisition criteria: Telling it like it is

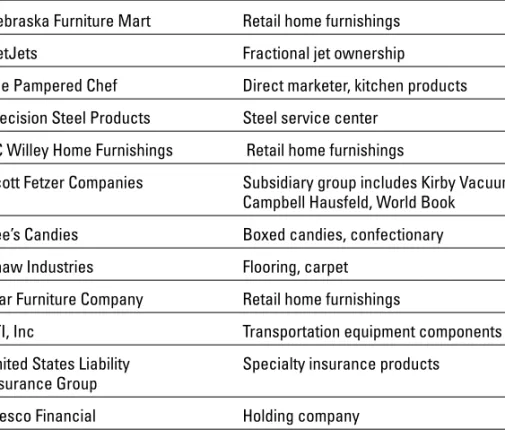

Bill Nygren: Nygren is the Portfolio Manager of The Oakmark Fund and The Oakmark Select Fund, two widely held and admired mutual funds. Better yet, keep up with the changes by reviewing SEC 13F filings - do that search on "George Soros 13F Filings" instead.

Fundamentals for Fundamentalists

We open the Value Investor Toolkit by first engaging in a brief exploration of investment math and showing how a few simple mathematical principles can make you a better investor. Finally, we help you find and interpret the non-numerical influences in the value equation.

A Painless Course in Value Investing Math

Time Value of Money

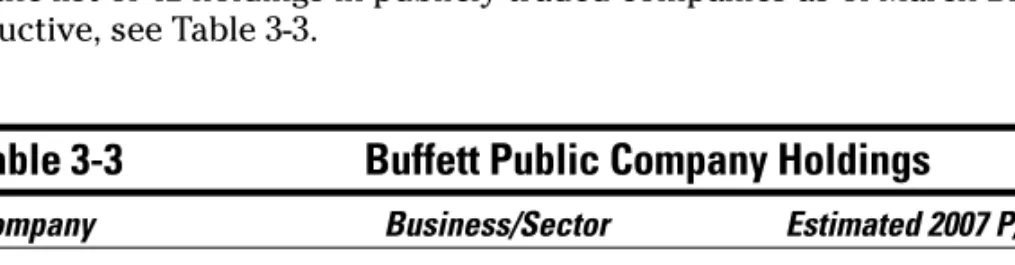

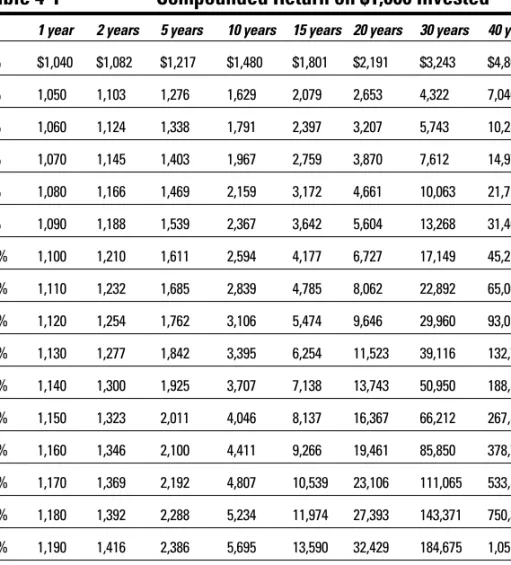

Note that there will be exponents in this discussion, but keep the faith - the calculations are easy, and today's calculators and spreadsheets perform them easily. Time value of money helps you estimate or determine the future value of an investment held over time.

12C your way clearly

The Amazing Power of Compoundingof Compounding

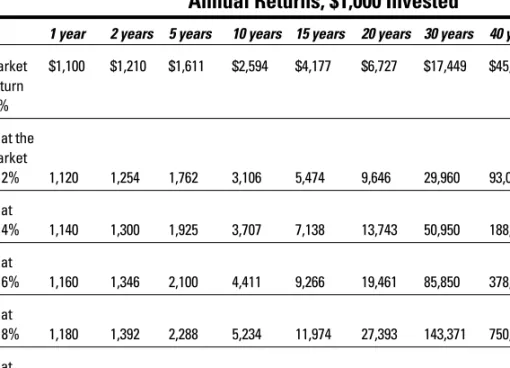

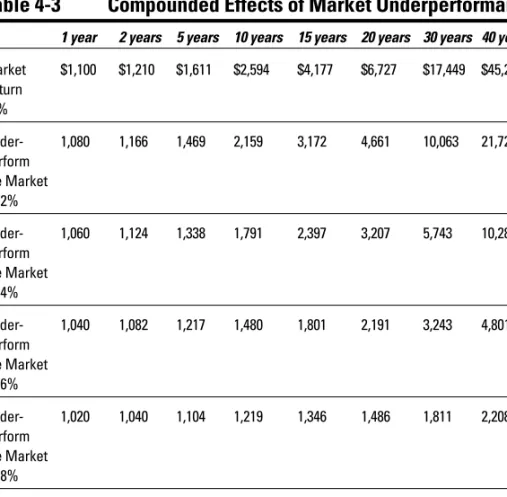

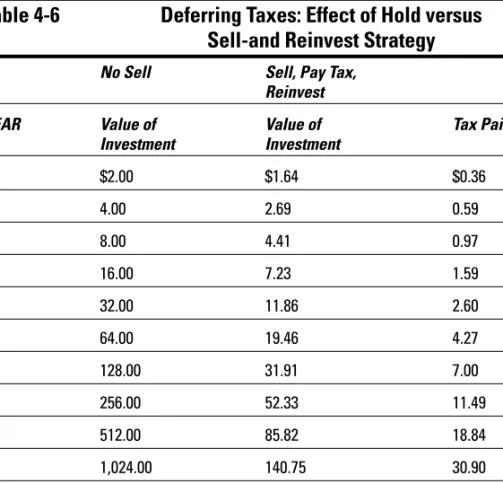

Compounding may be the greatest and most powerful investment principle ever "discovered". In fact, Albert Einstein called the compound "the greatest mathematical discovery of all time." The formula for calculating these values is—you guessed it—the time value of money formula presented in Lesson 1 of this chapter.

The Amazing Rule of 72

The power of compounding takes on its full glory (and your investments reach their full size) as the i, or return, increases, and the n, or duration, lengthens. Value investors are looking for a few more points of return and want to hold on to the productive investment for as many years as possible.

How to make 40 quintillion dollars (in 500 years)

The Frugal Investor, or How Being Cheap Really PaysHow Being Cheap Really Pays

The chance of a 50 percent return - returning to the intrinsic value - is much greater than with a share at value or an overvalued value of €100. But as a bonus, you also get the return on intrinsic value, which can effectively convert returns of 6 percent, 8 percent and 10 percent into returns of 12 percent, 14 percent, 16 percent and higher.

Investment gravity

Opportunity Lost

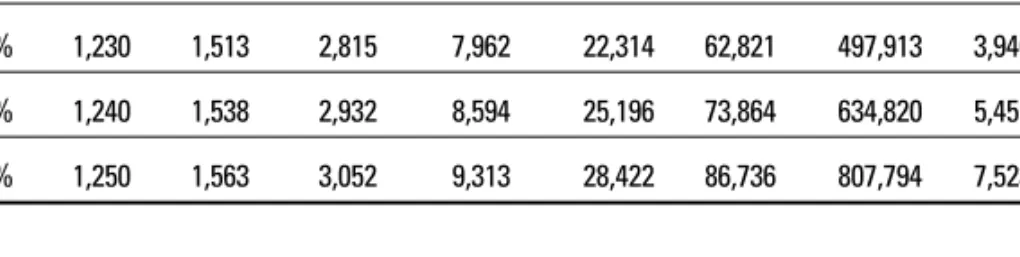

A 6 percent underperformer loses 43 percent, 67 percent, and 81 percent to the market outperforming investor over 10, 20, and 30 years, respectively. Value investors like cheap stocks, but if the stock is made cheaper by an investor, the investor should consider a serious reassessment of a company's prospects.

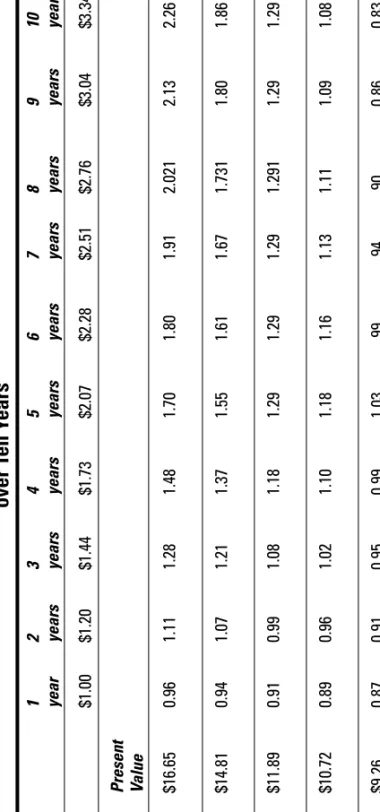

Discounting

To figure out the PV, you need to estimate each year's cash flow and discount it according to the year the cash is received and the discount rate chosen. Instead of burning energy trying for an exact discount rate (“it's better to be about right than exactly wrong,” he says), Buffett suggests using a minimum of 10 percent, and 15 percent if you want. stay conservative.

Residual value

Be Wary of Large Numbers

Basically, a beta greater than 1.0 means that the stock tends to swing more in the same direction than the underlying market index or the portfolio of stocks it is compared to. A beta less than 1.0 means that the share price moves less in the same direction or even in a different direction.

A Guide to Value Investing Resources

Hobby and special interest magazines can also help; the latest PC magazines can keep you up to date with the computer industry. Beyond the facts and the "soft stuff," value investors occasionally use specially curated tools to help select companies to watch or to develop a value analysis.

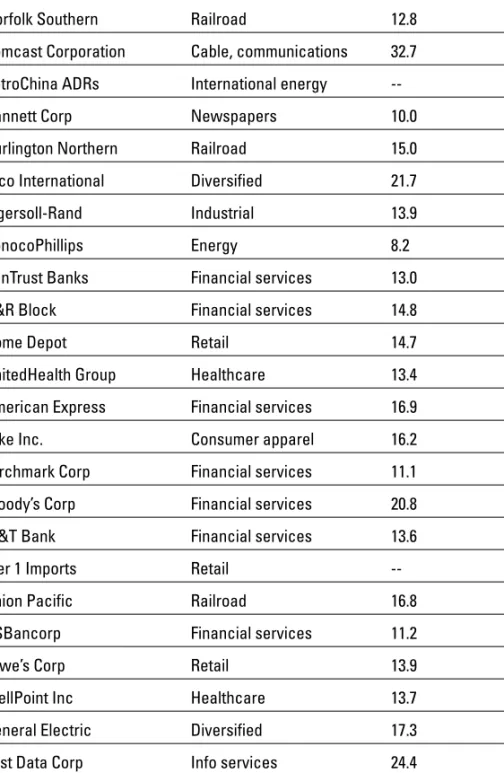

Follow the leader

The Value Line Investment Survey costs $598/year for the print version and $538 for the online version. Many libraries and brokerage firms with brick-and-mortar offices still carry the printed Value Line Investment Survey on their shelves.

Statements of Fact Part 1

Understanding Financial Statements

The highlights section is usually a one-page graphical summary of key financial results: sales, earnings, and a few productivity measures that are key to a company's industry. While some managers are honest in describing and confronting a company's difficulties, others are not.

Does (report) size matter?

The accountant's assessment is normally a standard one-page text somewhere at the back of the annual report. The purpose of the auditor's audit is to provide concrete evidence of the assessment and acceptance of a company's accounting and financial practices.

Going long(er)

Quality: Investors should assess the quality of the company and the story surrounding it. Consistency: Financial statements can provide important evidence of consistency, and the more history the better.

The Enron effect

Financial statements help you understand trends and undercurrents in profitability, asset utilization, and other factors that can be leading indicators of new trends. Financial statements and the reports that companies build around them, along with press releases and other communications, provide a wealth of information that is critical to the business valuation process.

Statements of Fact Part 2

The Balance Sheet

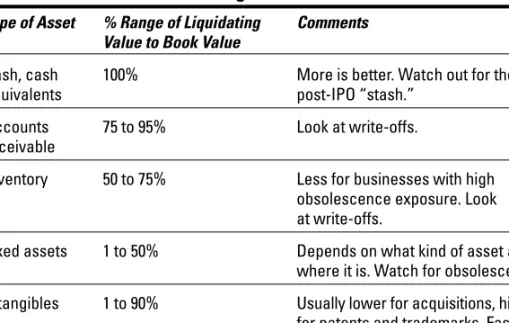

These assets are acquired and paid for through loans or through a contribution from the business owners. If you build a Space Shuttle, the operating cycle, or completion of a deliverable product, takes longer than a year.)

Balance Sheet

The question is how much commitment to debtors is needed to support the business. The size of accounts receivable relative to sales and other assets: Is a company that overextends itself to sustain or grow the business.

Dreaded diamonds

Although investment value is disclosed in the 10-K (discussed in Chapter 6), read carefully to find a statement such as You may have to dig through the "Notes" of the annual or 10-K report to find out.

Statements of Fact Part 3

Earnings and Cash Flow Statements

Other important lines in the earnings statement reveal important factors and trends in the business. Value investors look at individual lines in the earnings statement, not just the bottom line.

Income Statement

Income from continuing activities Total Other income/expenses Net earnings before interest and tax Interest expenses.

Don’t fall off the cyclical

Many investors use SG&A costs as an indicator of management effectiveness; a solid management team keeps SG&A costs under control. For an example of a SG&A analysis, see the sidebar “Practical Example: SG&A Expenses at Simpson.”

Simpson: A look at the top

For example, software companies get very large R&D as a percentage of sales, but insurers or retailers have small R&D percentages. Because you won't know the detail of R&D expenses, it's probably best to track the trend and changes in R&D as a percentage of sales.

Practical example: SG&A at Simpson

Thus, accountants show depreciation as a separate add-on item on the cash flow statement. Many intrinsic value models base projections on the most recently reported net income numbers.

A bit of EBITDA

Value investors therefore use the statement of cash flows as a standard part of the financial statement package. After an “adjustments to net income” category comes “Changes in receivables” of $7.1 million.

Cash Flow

More often than not, the total "cash flow from investing activities" is negative, and that's perfectly normal. If positive cash flows from operating activities exceed negative cash flows from investing activities, then the company is generating more cash than it is spending.

How changes in current assets and liabilities affect cash

It is possible to generate positive cash flow in this part of the statement, either by selling PP&E or by selling investments owned by the company. By comparing net cash flows from operations and net cash flows from investing activities, you can get a first look at whether a company is productive and healthy.

Games Companies Play

Irrational Exuberance in the Financial Statements

Out of that outrage came new rules, clarifications and important legislation – the Sarbanes-Oxley Act of 2002 – to put responsibility for the numbers on those who report them. And for many executives, hitting the numbers means cashing in on the bonuses and stock options they covet in the first place to encourage aggressive financial reporting.

FYI: FASB

But in the real world of accruals, revenue recognition (at least in theory) follows the business activity, not the receipt of cash. But there is an exception in the treatment of intellectual property acquired through the purchase of another company.

Focus on tangible value

Proforma is really an extension of the EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) reporting concept that became popular in the 1980s (see Chapter 8). But some very cash real expenses, such as interest expense, are written out of the pro forma.

The watchdogs are looking across borders

Some of you may be familiar with the technique of inserting a toothpick into a cake to determine if it is done. For those of you who haven't tried it, if you poke a toothpick into a cake and it comes out clean, it's done.) Try it a few times in different parts of the cake to verify your conclusion . Understand what practice the company uses, and whether it is consistent with others in the industry - and common sense.

On Your Ratio Dial: Using Ratios to Understand Financial Statements

Services that "do" the numbers, and especially the comparisons, for you are hard to find, especially for free. Furthermore, the excess of operating cash over investing cash ($99.1m vs $60.5m) tells you that the underlying business is generating cash, although one needs to ensure that this is the case in subsequent periods so that avoids distortions from large capital. outlays or special items in a single year.