Will the relationship-oriented offer model prevail over the commoditization trend in the lending business. Is the company's banker involved in credit rating issuance, review and control and what is the nature of the rating assignment process.

Chapter Outline

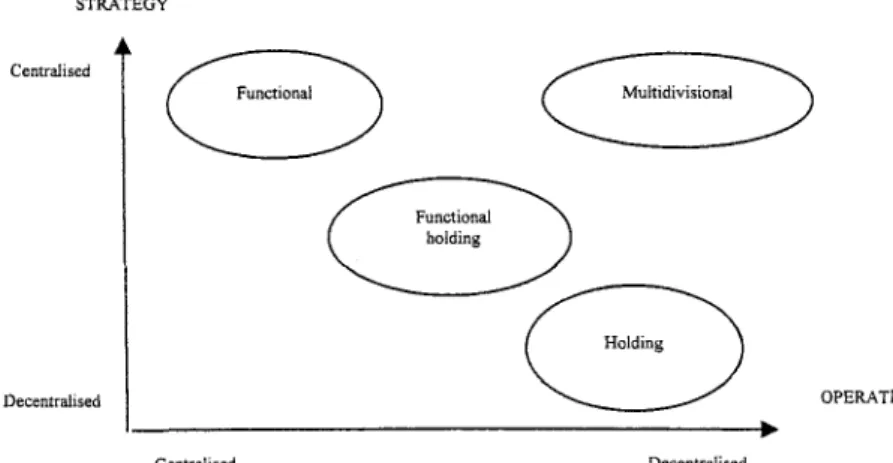

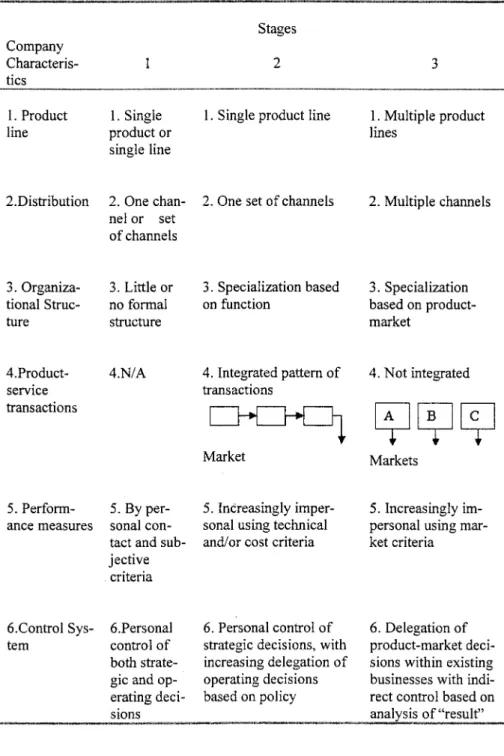

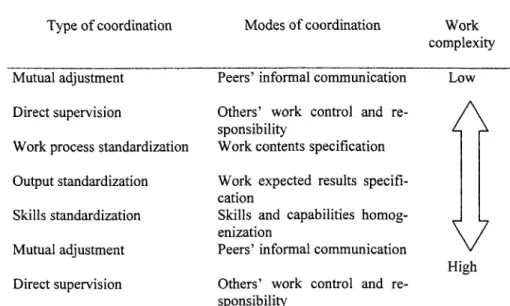

The corporate level of analysis studies the fit between the strategy of the corporation as a whole and its organizational structure. At the corporate level of analysis, the most important work is Chandler's (1962) study of the strategy-structure relationship where he argues that structure follows strategy and it is the correct fit between strategy and structure that leads to performance.

Foundations of Organization Theory - Main Approaches

Theorists of the strategy-structure-performance paradigm have emphasized the relationship between strategy and structure and its effect on performance. Another contribution is its expansion of organizational thinking by bringing the concept of uncertainty and im-.

Characteristics of Basic Organizational Structures and the Multidivisional Form

It is worth noting that the general management of the M-form usually requires the support of specialized personnel to carry out its functions effectively. The picture that emerges from the comparison of the banking group and the universal bank in various aspects shows that diversification can be achieved more easily through the group structure.

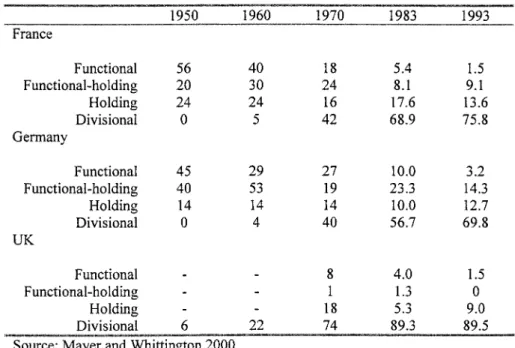

Divisionalization and its Evolution in Industrial Segments

Analysis of the evolutionary trends revealed a significant growth in diversification strategies in the population. They extend existing studies of the post-war period to the 1990s and allow for longitudinal and international comparisons.

Types of Divisionalization

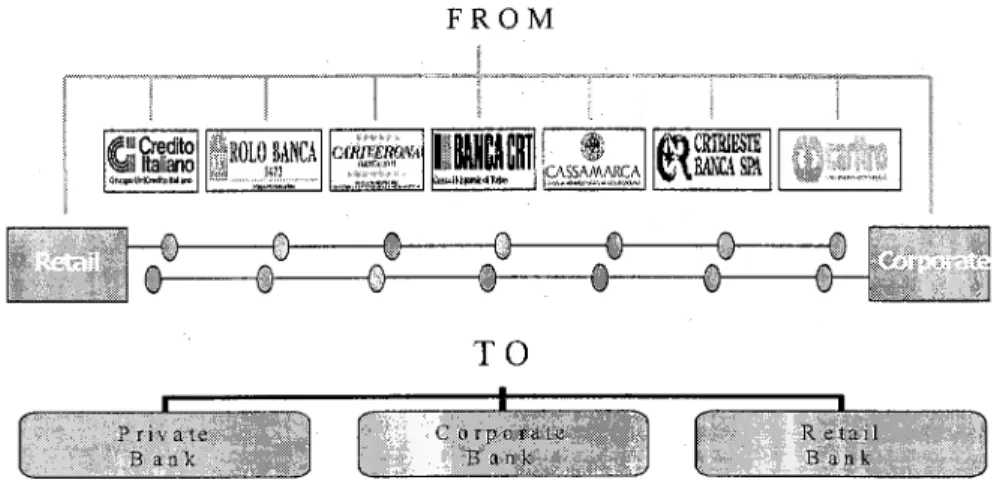

Regional areas can function as profit centers where area managers are tasked with directing, coordinating and controlling the distribution channels of their zones. The accepted solution was the reorganization of the company into divisions corresponding to each market segment (Chandler 1977).

Role of Divisionalization by Market Segments

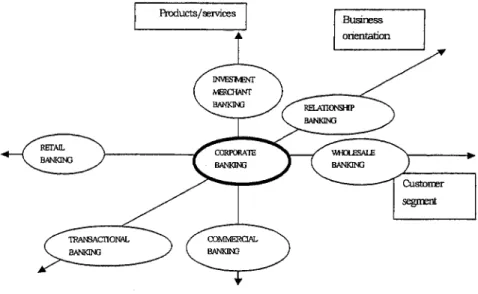

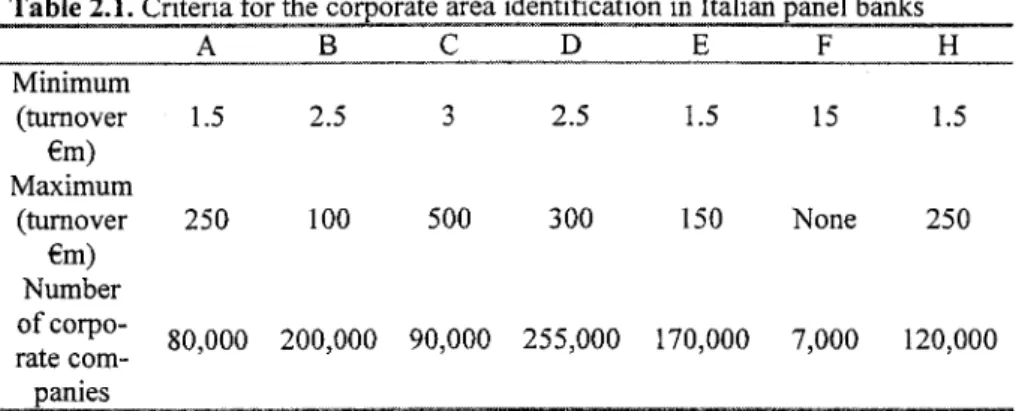

In corporate banking, the segmentation of small and medium-sized companies is strictly linked to the definition of the bank's business area and to. In this approach, any segmentation process starts by identifying a range of products offered and a possible group of companies that represent the bank's target market (Caselli 2001).

Performance Measurement in Divisionalized Form

In their model, as business diversification increases, the autonomy of the profit center manager increases and the character of profit measurement is closer to "comprehensive realism" (Vancil 1979). The difficulty is likely to arise when a division's affairs cannot be sufficiently disentangled from other parts of the business.

Drivers of Divisionalization and Future Trends in Banking Organizational Change

The bank's strategic options are several and depend on the choice of segment, specific needs to meet, product/service lines to offer, characteristics of technological investments and the structure of the distribution process. The adaptive capabilities of the division will be a central theme in the evolutionary model of banks as they strive to adapt to their rapidly changing environments.

Markets and Channels

Chapter Outline

Therefore, the research aims to answer the above questions by analyzing the evidence provided by the questionnaires. This will allow us to get an accurate picture of the existing phenomena and thus interpret them correctly at the end of this work.

Mission of the Corporate Banking Area

- Comparative Analysis by Country and by Bank Size

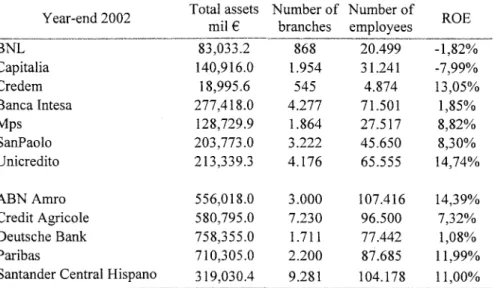

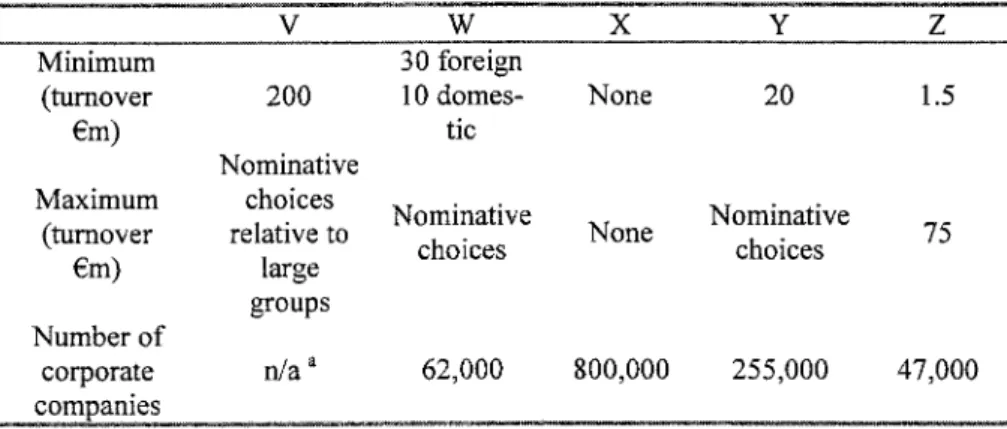

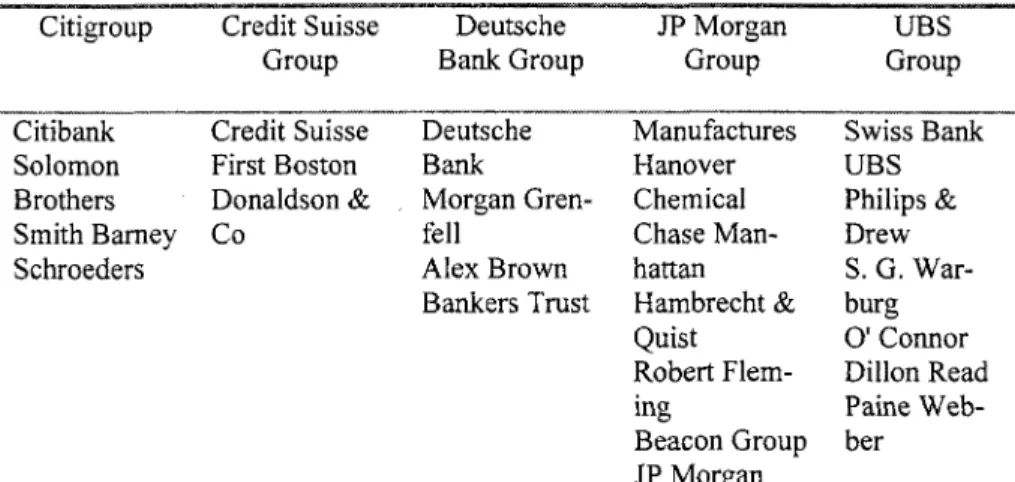

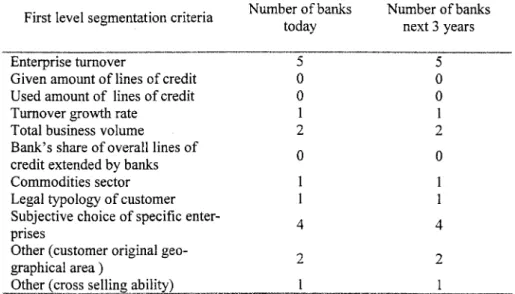

The expansion of the business area is a function of the basic criterion that identifies the target companies (Bloch 1989; Geisst 1995). Even at the five other European banks, company turnover is the most important factor in determining the boundaries of the business park (table 2.2).

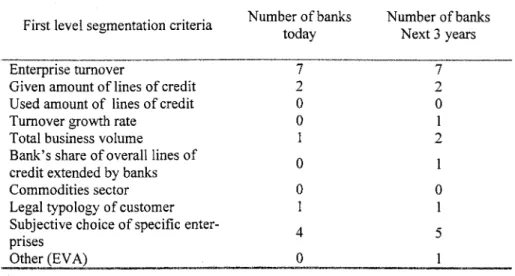

Market Segmentation of Corporate Banking Area

- Segmentation Models Usage and Maintenance

In the second case, the subjectivity of choice is closely related to information and credit ratings. This issue is directly related to the complexity of the model and the underlying information system.

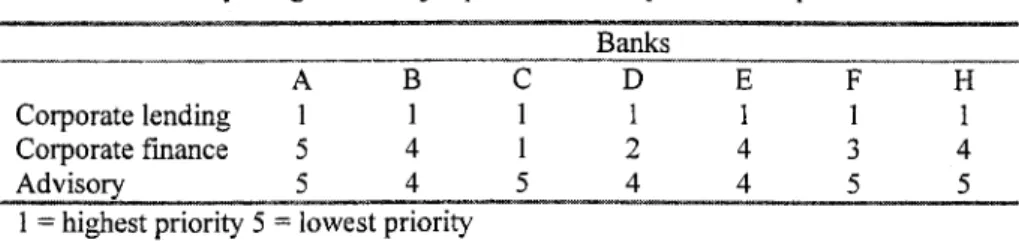

Products and Services Designed for Corporate Customer

Looking at the other European banks, the elements of the analysis show significant differences compared to Italian banks. This can be observed through several aspects already explored within the overall evaluation of business mission.

Lending

Financial risk management Exchange risk management services

- IT and Training Emerging Needs

- Critical Aspects of Market, Product and Channel Strategies in the Corporate Area

- Chapter Outline

- The Level of Divisionalization of Corporate Banking Structures

- Models of Macro-Structure Organization

Secondly, the typology of competitive strategies in corporate banking should be differentiated according to the size of the bank. The Corporate Division interacts with the Commercial Functions of banks dedicated to corporate clients (MPS, BT, BAM, CRPrato) as well as product companies (for consumer loans, investment banks, rural banks and commercial banks).

M HRM

Basic Models for the Structure at Head Office Level

- Micro-Structure of Corporate Banking Division

Only in the most advanced models (Bank B and some of the other European banks) do such central functions represent the essence of the corporate center (Box 3.1.); elsewhere they are still assigned to the head office of the parent bank. Organizational structure of the corporate banking units in a non-fully divisional bank: the case of Bank E.

The Structure Of Regional Offices And Branch Network

- Regional Offices

They include all the product specialists of the group's companies and work in close contact with banks and also support them in customer relations. Furthermore, in almost all the banks, area managers are not specialized in the corporate market, but they are multi-market.

H,W,Y,XCorporate area strategic marketing manage-

- Branches

- Professional Roles

- Major Interactions Between the Corporate Area and Other Bank Units

- Objectives and Performance Valuation in the Corporate Area

- External Communication and Brand Choices

- Critical Aspects for the Successful Design of Divisionalized Organizational Structures

The microstructure of the corporate branch is subdivided into relationship roles (the SL), product roles, back office roles, coordination roles (branch managers, team leaders). The role consists of supporting the team leader or senior SL in managing the various stages of customer relations.

The value creation model, which lies at the basis of the organizational decisions, must start with the analysis of the value created for the customer. As for the internal consistency of the divisional organizational structure, there are many areas of shadow.

Management

Chapter Outline

The Corporate Banker's Tasks

The lack of one or more "common" tasks in the configuration of the corporate banker role in some banks is due to various factors. As for the promotion of product specialists, the decision is sometimes made by the corporate branch manager rather than individual corporate bankers.

The Tasks of the Corporate Banker's Assistant

The actual interaction with product specialists and area or division managers, as well as the actual involvement in loan approval and pricing, depends on the structure of the corporate branch where the corporate banker is usually located and on the orientation of the operating mechanisms. Indeed, each philosophy seems to have important advantages and disadvantages (Table 4.3): instead of identifying the best model, it would therefore be advisable to make sure that all the operating mechanisms are consistent with the chosen role configuration in order to reduce the weaknesses and maximize the strengths of the choice.

The Corporate Banker's Portfolio

There are several explanatory factors for the varying number of customers in CB's portfolios within the same bank, without any significant concentration on one specific factor. Only one Italian bank explicitly aims to concentrate clients in commercial banks' portfolios by economic sector; however, this choice, contrary to expectations, does not match CB's particular commitment to credit management and valuation.

The Corporate Banker's Involvement in Loan Underwriting

Bank CBs have lending authority. CBs are involved in the loan approval processes. A Yes, this is quite limited and correlated. B Yes, it is important if CBs are executive cadres; in corporate and regional centers there are credit officers with lending authority who report to the bank's credit function.

Credit Risk Analysis and Rating System Structure

The independence of the rating assignment process can be achieved through a range of practices that will be carefully assessed by regulators. The time horizon varies among the banks examined, without a precise relationship with the more or less mechanical nature of the methodologies applied.

Credit Risk Control

As for the three other European banks that provide indications on the sources of information they consider important for the analysis of credit risks, we can observe the following situations: Bank W attaches very little importance to guarantees and corporate assets, medium importance to balance sheets and high importance to corporate bonds . and sector qualitative aspects; Bank X, on the other hand, attaches great importance to balance sheets and guarantees; both banks regard bank relationship and credit register data as relatively unimportant; Bank V attaches great importance to balance sheet analyzes (both historical and synoptic), sector strategic analyzes and data on credit behavior. The other European panel banks show, on average, limited differences compared to Italian banks.

The Management of Non-Performing Loans

It should be noted the absence of a special monitoring unit in Bank W and the presence of a credit review unit in Banks X and V, which is responsible for reviewing and harmonizing the ratings assigned by credit structures. with legal offices, with the possible assistance of the credit function. Such new procedures will enable the bank to quantify and then use historical collection rates: a) for management purposes, as LGD estimates are an important component of expected loss and expected returns; b) for regulatory purposes, as the LGD estimate is required in the advanced approach, which is based on internal assessments of the new proposal of the Basel Committee on bank capital.

The Exploitation of Information Synergies

A Focusing on commercial and research roles in the investment banker (although the credit risk analysis system is mainly mechanical). B Focusing on commercial and risk management functions in corporate banking and on teamwork across industries.

The Corporate Banker's Competencies and Tools

The role of the corporate banker and the implementation of internal assessment systems imply strong needs for innovative information systems. A distinctive feature of the corporate banker is the extraordinary activity developed towards the client, outside the premises of the bank.

The Corporate Banker's Role and Credit Risk Management: Critical Aspects

This issue is more serious in Italian banks due to the broader definition of the corporate segment and the more mechanical approaches to assigning the rating. The third critical aspect concerns the consistency of training processes and information tools that support the activity of the corporate banker with the mission of the corporate area, in order to align the client's expectations with the client's perceived added value of the structure of organizational cloud of the bank.

Chapter Outline

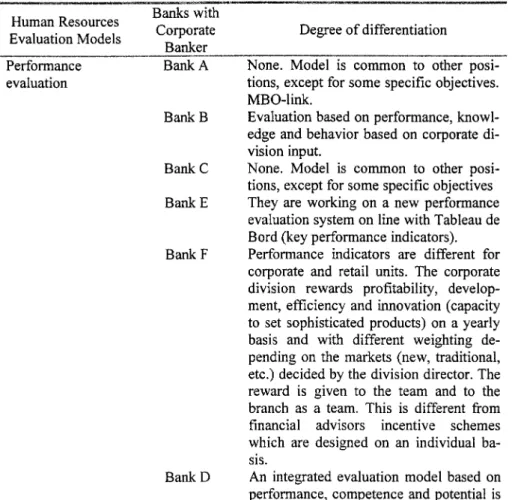

The Degree of Differentiation in Human Resources Management

The Assistant Corporate Banker has direct access to the position of Corporate Banker and Corporate Banker to Branch Manager. Bank B Used for access to the position of corporate banker (from assistant position) and branch manager (from corporate banker) and higher positions.

The Degree of Differentiation in Planning and Management Control

Prices from the different banks to the same customer may differ (even if rationalization of credit lines has already been done). There are no measurement and incentive tools for the contribution made by the back office staff in the corporate branch, other than sharing the goals of the branch office.

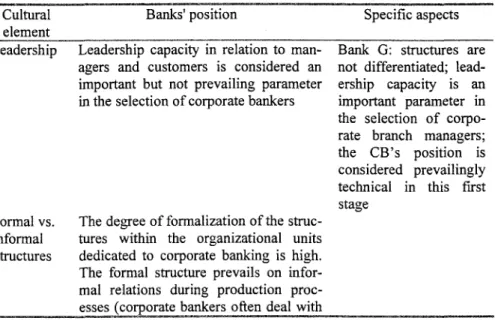

Specificity Required/Pursued in Leadership and Corporate Culture

The responses (Table 5.3) reveal a low interest in the subject of culture, and only a few steps have been taken to communicate and disseminate new cultural models, also in terms of socialization and exchange between the corporate bankers. Formal structures dominate, but in fact corporate units are more effective when corporate bankers can establish good informal links with other banking units (retail branches, regional offices, etc.).

IT and Training Emerging Needs

Case observation reveals that not all panel banks yet have organized training courses specifically for corporate bankers (Table 5.5). If anything, so far the courses have only met the need to improve technical competence.

Choosing the Operating Mechanisms: Critical Aspects

Chapter Outline

Differentiation and Organizational Separation of IT for the Corporate Area

Organizational Basic Models for the Corporate Area Information Systems

Sometimes area managers help IS people identify development trends even if they have no control over IT resources and their allocation (e.g. Bank F). The same applies to best practice benchmarks for the individual characteristics of business information systems.

Application Acquisition/Development Basic Models

When it comes to application implementation and management, the central topic at the heart of the debate is still which areas to outsource, how to structure outsourcing and the relationship with outsourcers. The role of consultants and, in general, market representatives of ICT products and services seems to be reduced.

Involvement of the Corporate Area Operating Units in IT Decisions

Choosing the right mix between internal and external activities seems to be more important than the problem of the availability and implementation of specialized applications for corporate banking. Only a few banks had structured agreements with consultants, suppliers or ICT firms regarding the development and management of corporate banking applications.

Information Technology Solutions for Emerging Needs

This strategy is justified by the need for speed and efforts to separate past investments in infrastructure. In all cases where we refer to product "factories", it is essential to understand the connection between the industrialization of the product and the clear needs of managing commercial relations with the market.

Management of IT Investments in the Corporate Area

In the case of Bank B, for example, they are waiting for a clearer overall picture of the organizational and management model before determining the areas of investment and IS autonomy for corporate banking. We mean, for example, the use of electronic spreadsheets and databases that are managed outside the banking information system.

Management of Information Systems in Corporate Banking: Critical Aspects

We see the risk of general underestimation of the IS problem as crucial to the development of corporate banking. One bank envisages the differentiation of the structure of the corporate division into two segments (small companies and SMEs).