He introduced me to the use of the Enneagram, which provided a structure around the classification of trading personalities. Much of this wisdom has been passed down from one trader to another so many times that it has entered the realm of cliché. If you follow these guidelines, you can avoid many of the pitfalls experienced by those who have been before you.

THE MARKET IS ALWAYS

THE MARKET IS ALWAYS RIGHT

With a margin account, you can borrow money from your broker using the market value of stocks or other securities held in your account. One last key issue: When respect for the market becomes fear of the market and how it can affect your trading. But if you are too right-brain dominated, you will eventually get into a difficult situation where you will cross the risk limits and exit the market.

IT’S ALL IN YOUR HEAD

You know you have a passion for the market if you can answer yes to all the following questions: You need to be able to distinguish whether it is your trading system that is really working or if the market is only temporarily cooperating. You look at the market and you can only tell what it's going to do.

YOU CAN’T PREPARE

ENOUGH

It is a contour map showing the elevations of the valley floor and surrounding hills. It is at this point that they experience a ground-moving climax: the hunt is on. For example, the first thing a sniper does when returning from the bush is to clean his weapon, then his equipment and finally himself – that's the priority.

SUPPLY AND DEMAND RULE

As a trader, you only care about the number in the market when you are trading. What did it take in the past for the stock to break the long-term trend line and move in the opposite direction creating a new trend. If the trend seems stuck in the middle of a move, the thermal overload zone is often used.

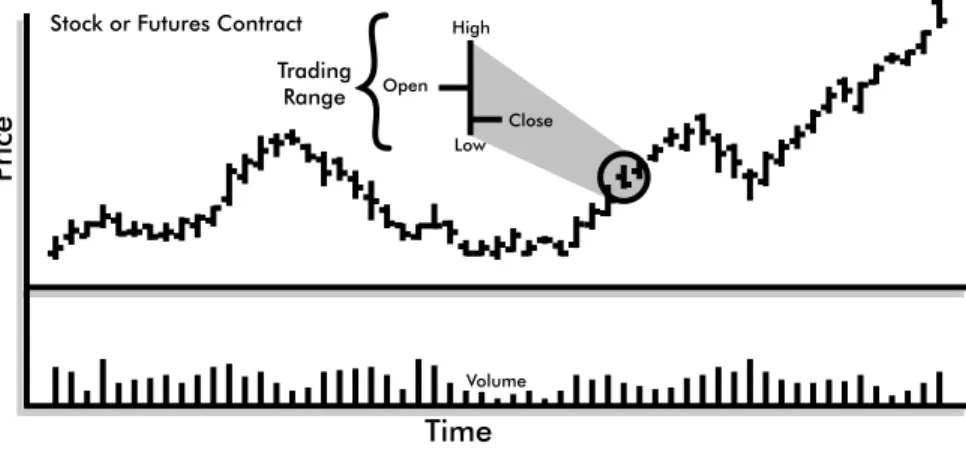

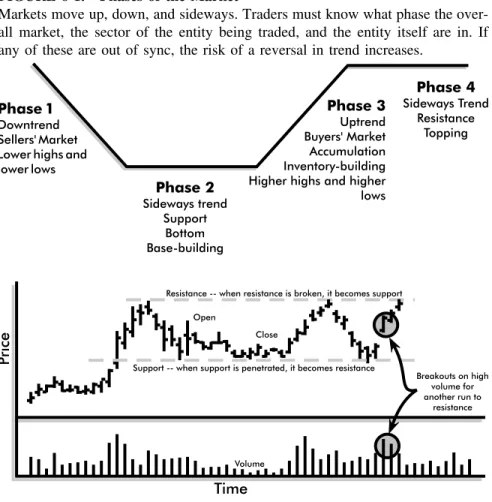

When stocks are in the base-building phase, investors accumulate shares without driving prices up. This is the equilibrium region in the supply-demand equation when the number of sellers (measured in share volume) is approximately equal to the number of buyers. The biggest risk of trading for short-term traders is staying in the market too long.

Where long-term traders control risk by limiting the number of shares they own from each shareholder to dollar cost averaging, short-term traders limit risk by not being in the market for long periods of time. As they say on the trading floors, "All good news comes out on top." Analysts are touting the stock like there's no tomorrow. Plus, they are very rich, owning or handling almost all of the world's free grain reserves.

This tip is especially important for active traders who are in the market most trading days.

COMMIT YOUR THOUGHTS TO

You should have some kind of written document to refer to when you encounter one of the many obstacles you encounter. If you are aware of your shortcomings, you have an opportunity to deal with them. You, like everyone else on earth, have traits that are part of your personality and will be magnified when you start trading.

If you don't deal with them now, it will be too late when you are in the heat of battle. If you start trading on a trading floor, you will find that many of the regular stock traders are completely unknown to you. In your written plan, include a list of specifications about what you plan to trade.

They are on both sides of the markets they trade at the same time. You will find a similar situation at the end, usually the second most volatile time of the trading session. You will also be hit by the SROs (or self-regulatory organizations), i.e. the New York Stock Exchange, NASD, NFA, etc.

What will it cost you in living expenses if you plan to trade full time.

Guidelines for a Written Plan

DEVELOPING AND

PERFECTING

YOUR TRADING SHTICK

The reason for the NYSE, of course, is the size of the float of these stocks and the specialized system. Keep in mind, it's just a summary of one of the many strategies that Brian has learned and used over the years of trading. As you become more experienced, you will find that many of the strategies you first learned are outdated.

The culprits who abandoned the trading strategy following were revisions to SOE rules in favor of market makers and decimalisation. The criteria will vary depending on the complexity of the market you will be trading and your level of experience. Therefore, you should pay close attention to the selection of stocks or futures that you put on your watch list.

If the price is above one of the long-term moving averages, it is considered bullish. If the trend of the sector and the market as a whole is up, the downside risk decreases geometrically. I'd like to address volume because it's usually one of the key factors, at least for me.

Brian struggles to know the price and size of short positions in the stocks he is shepherding.

ENHANCING YOUR SHTICK

This is part of what is meant by understanding and being attuned to the complexion of the market. But there is another edge that the house or a public trading floor has, and that is the basis of the casino syndrome. One of the most serious pitfalls for the newbie is a tendency to overtrade when on a floor with a number of experienced traders.

This is one of the reasons why most active traders switched to direct access trading when it became available. My advice is to first get a feel for the day-to-day operation of the floor. Your mentor does not have to be one of the instructors or staff members.

If you can, try to get a feel for the trading style of traders who you think might be good mentors. Then you find out the person is retired and the spouse wants them out of the house and it's just a hobby. On the other hand, if someone who works for the floor comments on the success of one of the traders, don't trust it too much.

But it can also be dangerous if you don't get a good fix on the type and quality of the mentor candidate's trade.

DEALING WITH ONE OF THE

TOUGHEST

PARTS OF THE GAME

DISCIPLINE

As you try to pick the top, the bottom falls out of the market and you give back half of your profit. In most trades you are trying to take a nice chunk out of the middle of the move. Every time Microsoft or corn moves higher, you take more profit and therefore lower the price per share until you are out of the trade.

As my old Irish grandpa used to say, "Madam, never try to turn a sow's ear into a silk purse." The harder you try to turn a gutsy loser into a world-class winner, the more. This may end up being just a few hours of actual trading - from the end of one session to the start of the next. Because a gap is an unexpected event and has changed the face of trade.

As we say in the industry: "Open belongs to amateurs, close belongs to professionals!" Therefore, it is crucial to pay close attention to the conclusion for a clue as to what will happen the next day. These are the professionals (meaning institutions, mutual funds, hedge funds and brokerage firms) who adjust their portfolios for the evening. As in the old joke about the three most important qualities of a good retail store - location, location and location - which are the three most important qualities of a good retailer - the ability to anticipate, anticipate and anticipate.

The answer is that experts buy stocks in anticipation of a split.

STAYING THE COURSE

But the most meaningful method of comparing the two months is to calculate the standard deviation of the two. The next step is to calculate the arithmetic mean or average value of the series of flips. The way I see it is that the money has been taken out of the account due to trading activity.

One of the most critical is how long it takes you to recover from a losing streak. Your average loss, your draw, and the standard deviation of your losses are just three of the many numbers you should monitor daily, weekly, monthly, quarterly, and annually. Some of the better known are MAR Qualified Universe Indices, Barclay CTA Index and Norwood Index.

It adds the CTA to its index at the start of the CTA's fifth trading year. Or leaving it out of the BNAV because the trader only used half of the money for the month can make the rate of return look better than it is. My point is that much of the data you might need to analyze your trade is available on these sites.

You might think that I think insights like this are the real value of the reports and analysis you do on your trading.

ON BECOMING THE IDEAL

TRADER

The psychology of the trader is not very different from that of the explorer. From all this, you have to choose some of the thousands of stocks, futures or options available for trading. Over time, you will remove these negative breakouts without losing the rest of your trading sessions.

The problem for this type of loser is that there is just no point left in life if the trader is not in the middle of the trading arena. This is only the tip of the iceberg, the part you see above the water line. This is simply an introduction to the subject of discovering self-knowledge using one of the many techniques available.

This guy is usually one of the most aggressive traders on any trading floor. They will be the ones you turn to if you can't understand the market. This guy can be considered a party person or a scatterbrain on the floor.

Self-knowledge can bring the negative aspects of being seven under control to such an extent that he or she can become a connoisseur of the market.