This study examines the evolution of agricultural commodities trading, spot transactions executed on commodities exchanges and the fundamentals of transactions. There has been a major paradigm shift in agricultural commodities trading in recent years. Moreover, trade in agricultural commodities has been influenced by the growing demand for sustainable and socially responsible investments (Foglie & Keshminder, 2022; Langly & Giugale, 2000).

The growing demand for sustainable and socially responsible investments has also affected trade in agricultural commodities. Amidst the paradigm shift in the agricultural commodity trading industry and the increasing demand for sustainable investments, the need for innovative Islamic capital market products is becoming apparent. This article aims to explore the paradigm shift in the agricultural commodity trading industry and the potential it holds for Islamic finance.

Furthermore, the growing demand for sustainable and socially responsible investments and its impact on the agricultural commodities trading sector will be analyzed. By uncovering the opportunities presented by Yellow Sukuk, this research aims to shed light on the untapped potential of integrating agricultural commodity trading within Islamic finance. The exploration of the paradigm shift in the agricultural commodity trading industry, the potential of Islamic finance, the challenges of traditional commodity exchanges and the introduction of innovative concepts such as Yellow Sukuk will contribute to the existing literature.

Trading in agricultural products used to exchange tradable agricultural products in a physical or electronic environment.

Methodology

It will provide insight into the functioning, benefits and challenges associated with these systems in the context of agricultural commodity trading. In addition, a thorough review of the literature on Yellow Sukuk will be conducted to understand its underlying principles, structure and potential applications in the agricultural sector. Using secondary data and conducting a rigorous desk research approach, this study seeks to contribute to the existing literature through a comprehensive understanding of the licensed warehouse system, e-WhRs, and their role in facilitating the issuance and trading to provide Yellow Sukuk.

The findings of this research will form the basis for the design of a Yellow Sukuk model that integrates agricultural commodities represented by e-WhRs and provides insight into the potential benefits, challenges and opportunities of this innovative financial instrument. The methodology used in this study provides a systematic and in-depth analysis of the licensed warehouse system, e-WhRs and Yellow Sukuk, adding value to the existing knowledge and contributing to the development of sustainable and socially responsible investment practices in the trade in agricultural commodities.

Discussion

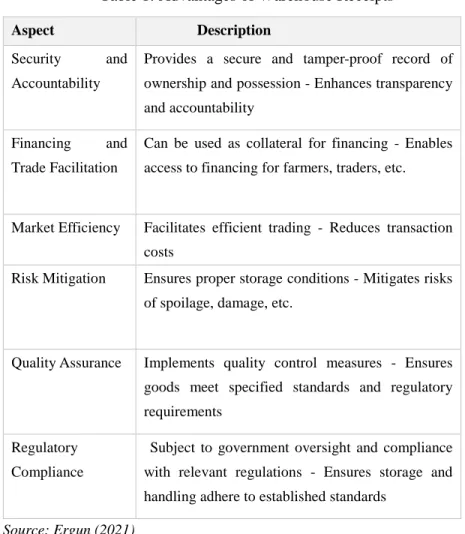

Licensed storage; the classification and quality of agricultural products suitable for storage and which can be standardized are determined by laboratories called authorized classifiers, their storage in healthy environments with modern infrastructure, the marketing of these products through product certificates that represent the ownership of the product; It is a system that envisages becoming a product specialty exchange that can also work in the international arena (Nadirgil, 2017; Höllinger et al., 2009; Coulter, 2009). Effective coordination of licensed warehouses and other interested parties, mainly authorized classifiers, integration, control and audit of their work and processes in accordance with legislation, effective risk management in transactions and processes, for the safe realization of trade and -WhR to be traded in the Specialized Market of Agricultural Products and Commodities with the Licensed Warehouse System (Höllinger et al., 2009). Trust is a priority for LWS, which is still in the development phase and trying to expand.

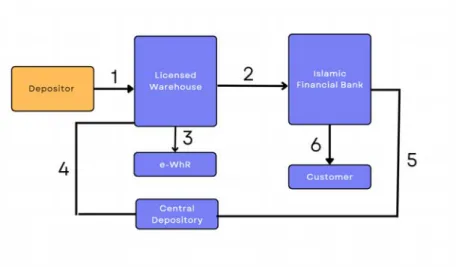

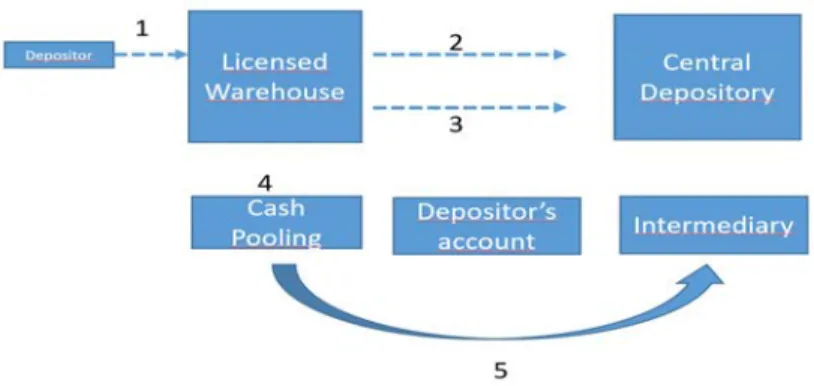

In the field of modern commerce, the integration of electronic warehouse receipts and the creation of licensed warehouse systems have ushered in a new era of efficiency and transparency in the storage, tracking and trading of goods (Putri, 2021). Product invoices are created in the group account through the export transaction carried out by the Licensed Warehouse Operator (within the limit set by the Authorized Classifier). Electronic Warehouse Receipts (e-WhR) generated in the Licensed Warehouse Operator's group account are automatically transferred to the depositor's account at the brokerage firm or bank notified by the depositor upon delivery.

In the Islamic economy and way of life, there is such a wide area that an answer to any problem can be found. In addition, the storage of perishable products such as produced grains and pulses and the creation of documents pertaining to the stored products are examples that we have encountered and used in the history of Islam. According to what is reported in the Qur'an in the sura of Yusuf, a dream that the king of Egypt saw.

In the verses it says that there were seven years of famine and seven years of plenty during the time of Hz.Yusuf (AS). Yusuf (AS) was the head of the Ministry of Finance and took the products to the warehouses to keep them in his ears. It is believed that the receipts given to the owners who store their products in the warehouses built by Yusuf (AS) are used for endorsement.

Cardi can be applied to various items such as money, gold, silver, barley, wheat, oil, honey, eggs and nuts, which can be weighed, measured and found in the market. Since agricultural products are supplied at specific times, it is normal for there to be price fluctuations in the market. Based on the estimated value of the deposited goods, borrowers are given access to financing in the form of credit or credit.

In addition, to illustrate the practical application of securitization in the context of e-WhRs, a possible modus operandi for Yellow Sukuk can be outlined. The 'Yellow Sukuk' represents proportional beneficial ownership in the e-WhR and entitles the investors to periodic payments from the SPV based on the underlying contract.

Conclusion

They should also encourage the adoption of Electronic Warehouse Receipts (e-WhRs) to improve accessibility, transparency and risk management, among other things, which could boost the growth and development of agricultural commodity trading and Islamic capital markets. Qur'anic Narratives In Introducing Messages and Values: An Analysis of the Story of the Prophet Yusuf A.S. Islamic finance and trade in food commodities: is there an opportunity to hedge against price volatility and improve food security?

An innovative financing tool to promote the development of Islamic microfinance through socially responsible investments Sukuk. The future, the rise of the speculator and the origins of the world's largest markets. Blue Sukuk as a solution to the maritime economic crisis in Indonesia due to the global Covid pandemic.

A review of the role of commodity exchanges in supporting market linkages and smallholder income.