Operating expenses – Expenses for the daily expenses of the Municipality such as salaries and wages. Taking over water and sewerage services from the Joe Gqabi District Municipality, resulting in the erosion of the municipality's revenue base.

Description

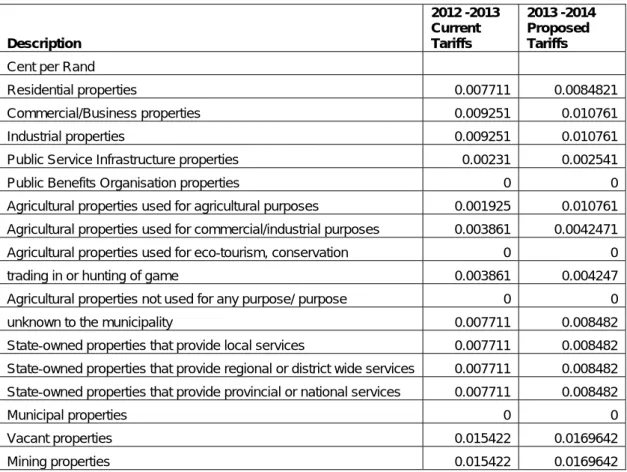

Every year, the National Treasury issues a circular to municipalities advising them of the budget parameters within which municipalities must work when preparing their budgets. This is due to the fact that the tariff structure in force does not cover the effect of the cost of services, therefore an increase above the amount of inflation is proposed for the MTREF period 2013/14.

2012 -2013 Current

These growth parameters apply to tariff increases in property prices, user fees and other charges collected by municipalities and municipal entities to ensure that all spheres of government support national macroeconomic policies, unless external factors can be shown to influence otherwise.

2013 -2014 Proposed

Service charges – Electricity Revenue

An 8 percent increase in Eskom's wholesale electricity tariff for municipalities will take effect from 1 July 2013. Based on the above increase, the municipality has proposed a 10 percent tariff increase to offset the cost of providing services.

2014(Proposed) ELECTRICITY tariff

In addition, a tariff is proposed for nursing homes, children's shelters and social organizations. Table 4 Proposed electricity prices for the financial period 2013/14.

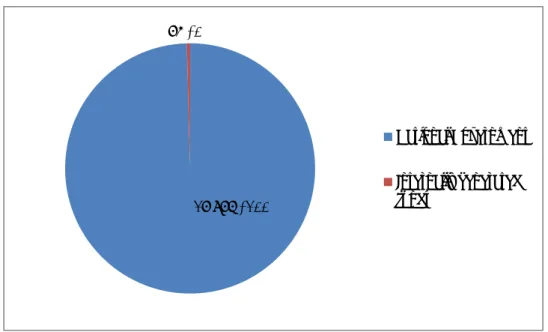

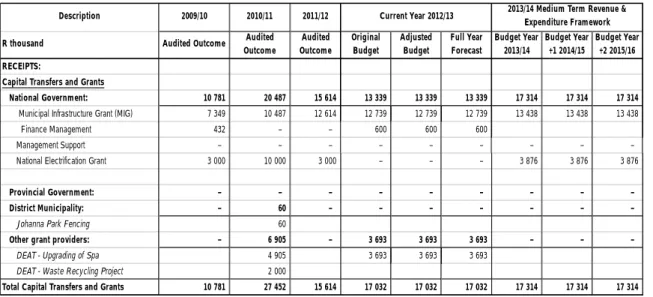

Grant Funding

Refuse removal

REFUSE REMOVAL

2012-13 Current

VAT Inclusive

2013‐14 Proposed

Tariffs VAT Incisive

Percentage Change

Overall tariff increases

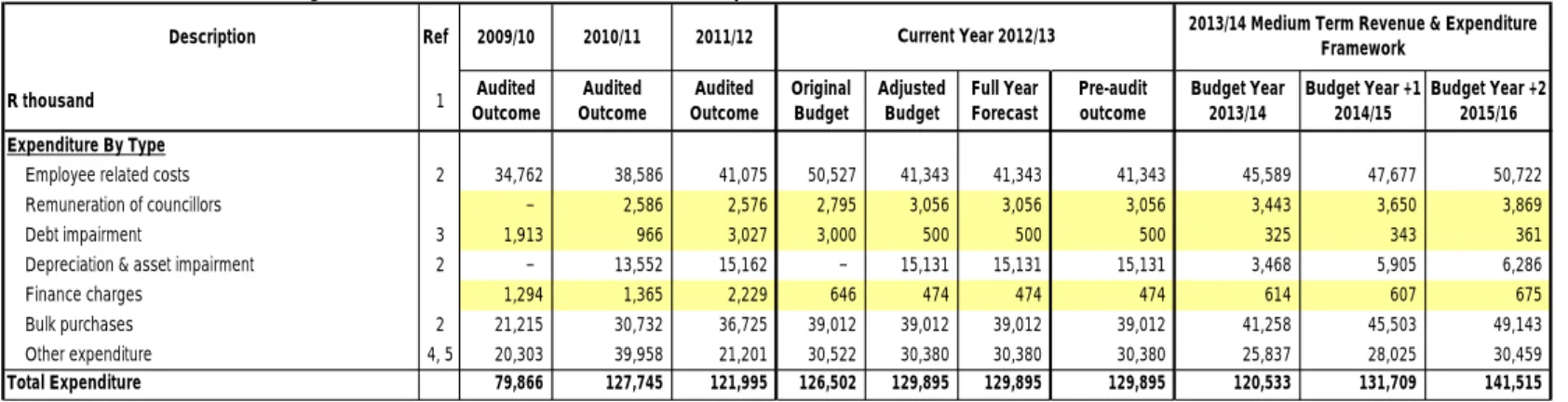

1 .5.Operating Expenditure Analysis

The municipality has had to fill in critical items and that has contributed enormously to the increased expenditure. However, the fee structure used by the municipality differs from that of Eskom.

Outcome

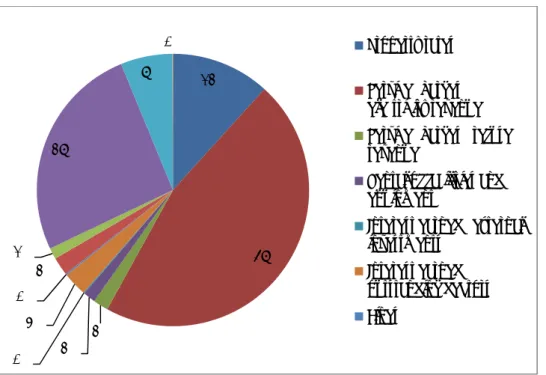

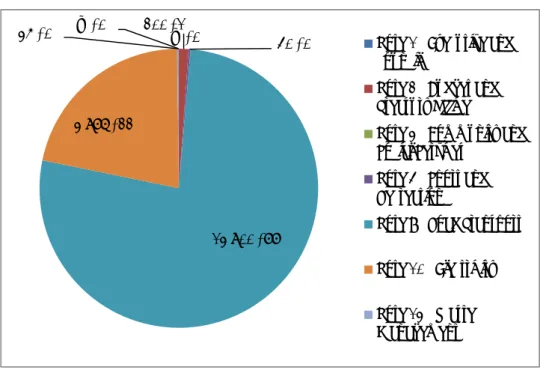

As can be seen from income table 2 and figure 1, the municipality generates most of its income from electricity (46%). Eskom also charges the municipality for exceeding the carrying capacity, which often happens in the winter months when consumption is high.

Audited Outcome

The analysis of operating expenses reveals that the operating income from own funds was never sufficient to cover the increasing expenses in the period from the financial years 2009/10 to 2012/13. Eskom uses a sliding block tariff system and can increase electricity costs during periods of high consumption, while the municipality uses a flat rate throughout the period.

Original Budget

High unemployment in the area means that many people fall behind on payments for services, increasing the incidence of bad debt.

Adjusted Budget

Full Year Forecast

Pre-audit outcome

Budget Year 2013/14

Budget Year +1 2014/15

Budget Year +2 2015/16

Framework

Employee related costs

It is anticipated that employee-related costs will stabilize in the future, as most of the critical positions have been filled. The latest executive order to this effect has been taken into account when drawing up the municipality's budget.

Bulk Pu

MTREF 2013/14

14/15 MTRE

85 this

Repairs and maintenance

Aging municipal infrastructure required the municipality to prioritize the budget for repairs and maintenance. R7.3 million was allocated for repairs and maintenance in the 2013/14 financial period and this is expected to increase to R8.3 million in the 2015/16 financial period.

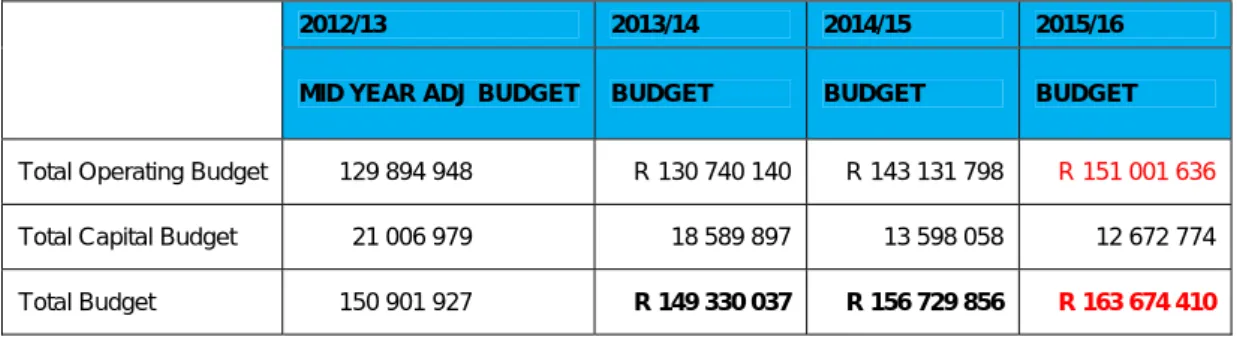

Capital Expenditure

- Capital Expenditure

- Vote 1 ‐ Executive and council

- Vote 2 ‐ Budget and Treasury Office

- Vote 3 ‐ Community and Social Services

- Vote 4 ‐ Sport and Recreation

- Vote 9 ‐ Road Transport

- Vote 10 ‐ Electricity

- Vote 13 ‐ Waste Management

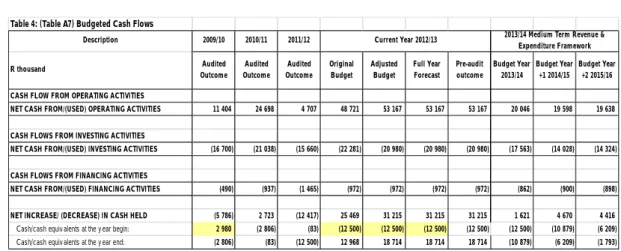

- Cash Flows

The budgeted cash flows are monitored by the municipality to ensure that they are kept at an acceptable level and to ensure sufficient funds for future projects. The municipality's cash position is under pressure, but steps have been taken to improve the cash position over the next three years.

Explanatory notes to MBRR Table A1 - Budget Summary

Table A1 is a budget summary and provides a concise overview of the Municipality’s budget from all of the major financial perspectives (operating, capital expenditure, financial position,

The table provides an overview of the amounts approved by Council for operating performance, resources deployed to capital expenditure, financial position, cash and funding

Financial management reforms emphasises the importance of the municipal budget being funded. This requires the simultaneous assessment of the Financial Performance, Financial

The Cash backing/surplus reconciliation shows that in previous financial years the municipality was not paying much attention to managing this aspect of its finances, and consequently many

Even though the cash- flow position of the municipality in not favourable, Council has emphasised on the need to provide quality services to the citizens

EC143 Maletswai - Table A2 Budgeted Financial Performance (revenue and expenditure by standard classification) Standard Classification Description Ref 2009/10 2010/11 2011/12

Standard Classification Descriptio 2009/10 2010/11 2011/12

Budget Year +1 2014/15

Budget Year +2 2015/16

Expenditure - Standard

Expenditure Framework

Explanatory notes to MBRR Table A2 - Budgeted Financial Performance (revenue and expenditure by standard classification)

Table A2 is a view of the budgeted financial performance in relation to revenue and expenditure per standard classification. The modified GFS standard classification divides the

The Total Revenue on this table includes capital revenues (Transfers recognised – capital) and so does not balance to the operating revenue shown on Table A4

Other functions that show a deficit between revenue and expenditure are being financed from rates revenues and other revenue sources

EC143 Maletswai - Table A3 Budgeted Financial Performance (revenue and expenditure by municipal vote)

Vote Description Ref 2009/10 2010/11 2011/12

Explanatory notes to MBRR Table A3 - Budgeted Financial Performance (revenue and expenditure by municipal vote)

Table A3 is a view of the budgeted financial performance in relation to the revenue and expenditure per municipal vote. This table facilitates the view of the budgeted operating

EC143 Maletswai - Table A4 Budgeted Financial Performance (revenue and expenditure)

Description Ref 2009/10 2010/11 2011/12

Outcome Audited

Expenditure By Type

Surplus/(Deficit) after capital transfers &

Expenditure FrameworkCurrent Year 2012/13

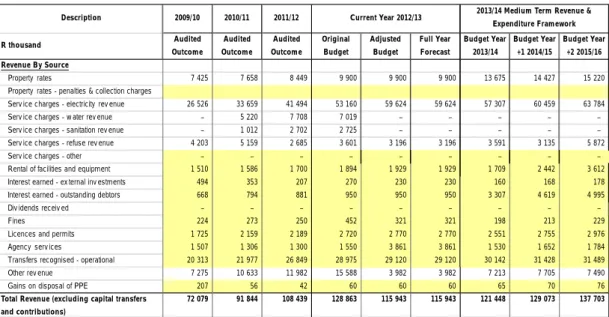

- Revenue to be generated from property rates is R13.68million in the 2013/14 financial year and increases to R15.22million by 2015/16 which represents 10 per cent of the operating

- Services charges relating to electricity and refuse removal constitutes the biggest component of the revenue basket of the Municipality totalling R60.9million for the 2011/12 financial year

- Transfers recognised – operating includes the local government equitable share and other operating grants from national and provincial government

- Employee related costs and bulk purchases are the main cost drivers within the municipality and alternative operational gains and efficiencies will have to be identified to lessen the impact

The revenue to be generated from property rates is R13.68 million in the 2013/14 financial year and increases to R15.22 million by 2015/16 representing 12.0 per cent of the operating and increasing to R15.22 million by 2015/16 representing a substantial 12 per cent operating base of the municipality. . It remains relatively constant in the medium term and fee increases are factored in at 10 percent for each of MTREF's respective financial years. Utility charges related to electricity and waste removal form the largest component of the Municipality's revenue basket amounting to R60.9 million for the 2011/12 financial year of the total Municipality's revenue basket of R60.9 million for the 2011/12 financial year and increasing to R69.0 million by 2014/13

For the 2013/14 financial year, service charges amount to 50 percent of the total revenue base and increase by 1 percent annually in the medium term. This growth can be attributed mainly to the rise in electricity prices. Employee-related costs and bulk purchases are major cost drivers in the municipality, and alternative operating profits and efficiencies will need to be identified to minimize the impact and alternative operating profits and efficiencies to minimize the impact of large-scale wage and rate increases in future years.

EC143 Maletswai - Table A5 Budgeted Capital Expenditure by vote, standard classification and funding

Explanatory notes to Table A5 - Budgeted Capital Expenditure by vote, standard classification and funding source

Table A5 is a breakdown of the capital programme in relation to capital expenditure by municipal vote (multi-year and single-year appropriations); capital expenditure by standard

The MFMA provides that a municipality may approve multi-year or single-year capital budget appropriations

Road transport and electricity votes receive the bulk of the budget

Current assets

Non current assets

LIABILITIES Current liabilities

Non current liabilities

COMMUNITY WEALTH/EQUITY

2013/14 Medium Term Revenue &

Explanatory notes to Table A6 - Budgeted Financial Position

Table A6 is consistent with international standards of good financial management practice, and improves understandability for councilors and management of the impact of the budget on the

This format of presenting the statement of financial position is aligned to GRAP1, which is generally aligned to the international version which presents Assets less Liabilities as

Table 16 is supported by an extensive table of notes (SA3) providing a detailed analysis of the major components of a number of items, including

The municipal equivalent of equity is Community Wealth/Equity. The justification is that ownership and the net assets of the municipality belong to the community

Any movement on the Budgeted Financial Performance or the Capital Budget will inevitably impact on the Budgeted Financial Position

Receipts

Explanatory notes to Table A7 - Budgeted Cash Flow Statement

The budgeted cash flow statement is the first measurement in determining if the budget is funded

It shows the expected level of cash in-flow versus cash out-flow that is likely to result from the implementation of the budget

The approved 2013/14 MTREF provides for a further net decrease in cash of R10.1 million for the 2013/14 financial year

The municipality has embarked on efforts to improve the cash flow position of the municipality in the near future. Expenditure has been drastically curbed as an effort to improve the cash

In addition the Municipality has undertaken an extensive debt collection drive in order to improve the collection of arrear debts. It is envisaged that these interventions will translate into

EC143 Maletswai - Table A8 Cash backed reserves/accumulated surplus reconciliation

Explanatory notes to Table A8 - Cash Backed Reserves/Accumulated Surplus Reconciliation

The cash backed reserves/accumulated surplus reconciliation is aligned to the requirements of MFMA Circular 42 – Funding a Municipal Budget

In essence the table evaluates the funding levels of the budget by firstly forecasting the cash and investments at year end and secondly reconciling the available funding to the

The outcome of this exercise would either be a surplus or deficit. A deficit would indicate that the applications exceed the cash and investments available and would be indicative of non-

Non-compliance with section 18 of the MFMA is assumed because a shortfall would indirectly indicate that the annual budget is not appropriately funded

From the table it can be seen that for the period 2010/11 to 2011/12 the deficit deteriorated from R1.6 million to R12.1million

Considering the requirements of section 18 of the MFMA, it can be concluded that the adopted 2011/12 MTREF was not funded owing to the significant deficit

Explanatory notes to Table A9 - Asset Management

Table A9 provides an overview of municipal capital allocations to building new assets and the renewal of existing assets, as well as spending on repairs and maintenance by asset class

EC143 Maletswai - Table A9 Asset Management

SUPPORTING DOCUMENTATION Overview of annual budget process

Budget Process Overview

There were no deviations from key dates in the budget timetable submitted to the Council. The budgeting process is integrated with the assessment of the IDP through the IDP assessment mechanism. The outcome of the consultation is taken into account in the budgeting process and feeds into the IDP assessment.

A statutory period of consultation follows the tabling of the draft budget in Council on 27 March 2013. Meetings with the local community will be advertised in the local press after the tabling of the draft budget. The Executive Mayor will consider the outcomes of these consultation meetings and a report detailing the responses will be tabled at the same meeting where the budget will be tabled for final approval.

Budget Process 2013/14

Overview of alignment of the annual budget with the Integrated Development Plan

The alignment of the budget with the objectives set in the IDP is as follows

The Integrated Development Plan process aims to continuously meet service needs by identifying new needs or areas for improvement. To provide adequate sustainable basic services for a better quality of life for our communities by eliminating service gaps and providing water of sustainable quality. Social development Creating a healthy and sustainable environment by improving social facilities and maintaining public facilities and buildings.

EC143 Maletswai - Supporting Table SA5 Reconciliation of IDP strategic objectives and budget (operating expenditure)

R thousand

Current Year 2012/13 2013/14 Medium Term Revenue & Expenditure Framework

To provide adequate sustainable basic services for a better quality of life of our communities by eliminating service backlogs and providing quality waste management services. Provide support services to all departments and contribute to the provision of sustainable basic services. Creating and maintaining public spaces, sports fields and resorts for the benefit of the community.

Financial viability Create an environment of effective, responsible and viable financial management with reliable information technology and accurate database by fully implementing all MFMA regulations and reforms. Creating an environment of effective, responsible and viable financial management with reliable information technology and an accurate database throughout. Safety & Security Creating a safe and secure environment by offering traffic and related services.

Allocations to other priorities

Outcome Audited

Outcome Original

Budget Adjusted

Budget Full Year Forecast

Budget Year

Budget Year +1

PART 3–Measurable performance objectives and indicators Key financial indicators and ratios

EC143 Maletswai - Supporting Table SA8 Performance indicators and benchmarks

Overview of budget related policies

Name of Policy

Type Date of Council adoption (if already done) Purpose / Basic areas covered by Policy

Summary of changes Responsible Manager

REVENUE RELATED

N/A CFO

BUDGET AND EXPENDITURE

Overview of budget assumptions Budget Assumptions

There is no real growth in the municipal area as the number of people, as well as the number of households, remains fairly consistent.

General inflation outlook and its impact on the municipal activities

Borrowing

Average Interest Rate - Investments

Rates

Electricity – monthly consumption tariff

Assumed collection rate (service charges)

The following table shows the assumed average percentage increase in MTREF for fees, charges and fees;.

Administrative, professional, technical, clerical & manual

Debt impairment provision

The municipality's ability to provide quality services depends on its staff and ability to provide services to the population of Maletswai at a level that is successful. Failure by the municipality to invest in its staff to ensure that the capacity and skills are in place to meet the challenges facing Maletswai will ultimately result in service delivery failure.

Capital Budget

Funding compliance

Overview of budget funding Funding the Budget

Funds only activities in accordance with the revised EDP and vice versa ensuring that the EDP is realistically achievable given the municipality's financial constraints; Contains projections of revenues and expenses that are consistent with current and past performance and supported by documented evidence of future assumptions; It does not endanger the financial stability of the municipality (it ensures that the financial position is kept within generally accepted prudent limits and that obligations can be fulfilled in the short, medium and long term); and.

Therefore, the community should have a realistic expectation of receiving these promised levels of service provision and understand the associated financial implications. Gross underspending due to insufficient revenue collection or poor planning is a clear example of a budget that is not credible and unrealistic. In addition, budgets submitted for consultation at least 90 days before the start of the fiscal year should already be credible and fairly close to the final approved budget.

Fiscal Overview of Maletswai Municipality

Sources of funding

Contributions and donations

Sale of assets

Parent municipality

Expenditure Framework Investment type

Investments by Maturity Period of Investment

Capital Guarantee

Yes/ No)

Variable or Fixed

Interest Rate 3

Monetary value

Interest to be realised

Type of Investment

Expiry date of

The ratios defined in the cash investment and management policy are used to establish prudent levels of borrowing in terms of affordability and the overall debt of the Municipality. As can be seen from table 27, the municipality does not have a high leverage, as long-term liabilities are budgeted at R2.6 million in 2013/14 MTREF, falling to R2.

National Government

Provincial Government

Other grant providers

Disclosure of Salaries, Allowances &

In-kind benefits

Total Package

Councillors

Senior Managers of the Municipality

TOTAL COST OF COUNCILLOR, DIRECTOR and EXECUTIVE

Allowances

Bonuses

Monthly targets for revenue, expenditure and cash flow

Annual budgets and service delivery and budget implementation plans – internal departments

Annual budgets and service delivery agreements – municipal entities and other external mechanisms

Other Service Delivery Mechanisms

Contracts having future budgetary implications

1. 5Capital expenditure details

EC143 Maletswai - Supporting Table SA34a Capital expenditure on new assets by asset class

Municipal Vote/Capital project Asset Sub-Class GPS co-ordinates

2011/12 Current Year

Budget Year +2

2015/16 Ward location New or renewal

Project information

Program/Project description

Prior year outcomes Total Project

Estimate

2013/14 Medium Term Revenue & Expenditure Framework

Legislation compliance status

The MFMA and the budget

The mayor must coordinate the budget preparation process and the revision of the Council's PDP and budget policies, with the help of the municipal manager. At this time, the local community should be invited to submit representations about what the budget contains. When the draft budget is presented, the Council must consider the views of the local community, the National Treasury and the relevant provincial Treasury and municipalities and other government departments that may have made budget submissions.

The Council would then have to consider approving the budget before 31 May and formally approve the budget by 30 June at the latest. This gives the Council 30 days to review the budget several times before final approval. After approval, the municipal clerk must place the budget on the municipality's website within five days.

BUDGET IMPLEMENTATION

If a council fails to approve its budget at its first meeting, it must reconsider it, or an amended draft, again within seven days, and it must continue to do so until it is finally approved - by July 1. The adjustment budget must contain certain prescribed information, it must not result in further increases in taxes and rates, and it must contain appropriate justifications and supporting material when approved by the Council.

Requirements of the MFMA relating to the contents of annual budgets and supporting documentation

Other Legislation

Other supporting documents

- M tha

Municip

P. Nonjo at the annu

Nonjola unicipal Ma

Rates and tariffs 2013/14