The study found that management at Bidvest Bank Ltd felt that the current practice of performance management needed revision. It was also found that a low level of understanding regarding the components of effective performance management occurred among managers at Bidvest Bank Ltd.

Introduction

Motivation for the study

Focus area of the study

Problem Statement

Research questions

Objectives

Limitations of the study

Summary

Introduction

Definition of performance management (pm)

There are different views on achievement as Kane (1996) argues that achievement is something the person leaves behind. Bernadin et al (1995: p. 83) are concerned that performance should be defined as "the results of work because they provide the strongest link to the organization's strategic goals, customer satisfaction and financial contributions." The reviewed literature presents different ideas about performance, but the underlying impression is that performance management is largely concerned with organizational success, and this is caused by individuals and teams working together to achieve larger organizational goals.

History of performance management

McGregor's book, "The Human Side of Enterprise" (1960) introduced Theory X and Theory Y assumptions about human behavior in the workplace. McGregor (1960: p. 33) suggested that: “the outstanding fact about relationships in modern industrial organization is that they involve a high degree of interdependence.

Purpose/objectives of performance management

Armstrong's view is similar to that of Schultz et al. 2003), who emphasized that performance management is the day-to-day management of people to achieve the overall goals of the organization. To achieve effective performance management, there must be an understanding of the relationship between strategy, people and organizational form/design and performance systems.

Evolution of performance management systems research

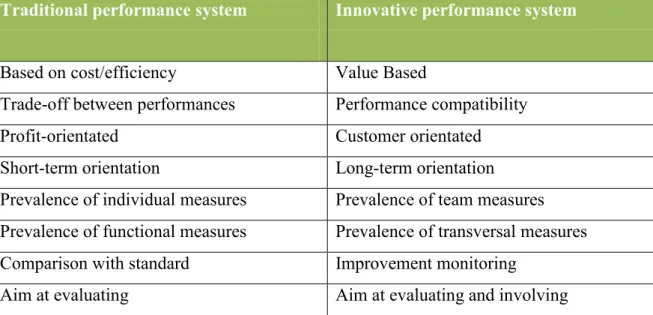

Short-term orientation Long-term orientation Prevalence of individual measures Prevalence of team measures Prevalence of functional measures Prevalence of transversal measures Comparison with the standard Monitoring of improvements. Purpose of assessment Purpose of assessment and inclusion. 1995), ``Performance measurement system plans a literature review and research program'', International Journal of Operations.

Definition and description of performance appraisal (pa)

According to Bratton & Gold (1994: page 214), "Performance appraisal is arguably the most controversial and least popular activity in the human resource management cycle." Since job performance appraisal is described as an activity that determines the future of an employee in an organization, such systems should be based on fairness, accuracy, and correct application of job performance appraisal results. This process supports the employee's status in the work group, self-image, motivation, career opportunities, promotion, rewards, and commitment to performance or improvement.

South africa’s performance appraisal dilemma

PA systems must not only accurately measure how well an employee performs a specific job, but must also contain mechanisms to reinforce strengths, identify shortcomings and feed such information back to employees so that they can improve future performance.” Cascio, (1995: pg 275) considers PA "as the systematic description of work-relevant strengths and weaknesses of an individual group." Leap and Crino, (1993) view PA as a process by which quantitative aspects of an employee's job performance are evaluated. Despite the above problems, Carell et al. 1998) was of the opinion that the existence of a good performance appraisal system can be of great value to the organization and the employees in order to improve and improve organizational and employee performance (Carrell et al, 1998).

Who should evaluate performance

- The Immediate Supervisor

- Customer Appraisals

- Self-Appraisals

- Peers

- Subordinates

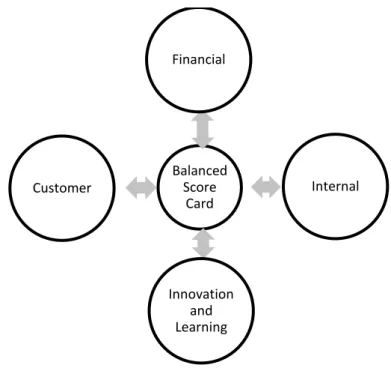

- Balanced Scorecard (BSC)

However, Nel et al. 2001: p. 522) also stated that "the disadvantage of using a direct supervisor is that he or she may be too biased in evaluating the employee in order to gain the employee's support". 2001: p. 522) “it cannot be expected that the goals of the parties will fully correspond to the goals of the individual or the organization.

Problems with performance appraisals (pa)

Rater errors

- Central Tendency

- Bias

According to Lindsey, (1986: pg 7) “if the individual values the product evaluation, the individual will be willing to change his behavior. If, however, the individual does not give any value to the product, the process will not give any positive feedback.” If a PA system is to be successful, it must be accepted by the evaluator.

Summary

Introduction

Research design

- Exploratory Study

- Descriptive Study

- Case Study Analysis

- Hypothesis Testing

The purpose of this study is to understand the effectiveness of performance management in Bidvest Bank Ltd. This study seeks to identify and understand how management personnel view performance management in Bidvest Bank Ltd. The findings of this study may later lead to a research study to determine how effective the performance management structure in Bidvest Bank Ltd. really is.

Aims and objectives

Aim

Schindler and Cooper (2006) state that a hypothesis directs the direction of a particular study by identifying those facts that are relevant and irrelevant to the study. As explained by Kothari (2004), the purpose of a descriptive study is to discover what causes a certain outcome without trying to control the variables within that particular situation. The study in no way attempts to control the management staff's perceptions regarding performance management practices within the organization, but simply attempts to identify these perceptions and understand the impact they may have on the effectiveness of performance management at Bidvest Bank Ltd.

Objectives

Participants and location of study

Sampling

Sampling Design

Sekaran (2006) explained that judgment sampling involves selecting the subjects best suited to provide the required information, in this case managers, supervisors and experts are best placed to provide the information needed for the study. The effectiveness of performance management is related to organizational success and based on the information obtained in this study, conclusions will be drawn from the answers obtained. The sample size was based on a table designed by (Krejcke and Morgan 1970, cited in Sekaran 2006).

Data collection strategies

Questionnaire Design

Brace (2008) suggested that objectives usually provide a guideline for what data should be collected. In designing the questionnaire used for the purpose of this study, particular attention was paid to the objectives mentioned earlier in this chapter. The questionnaire was designed to answer the purpose of the study, with a view to providing recommendations regarding the best practice in relation to performance management at Bidvest Bank Ltd.

Scaling

A specific number of choices helped make the process easier for the respondent (Sekaran and Bougie 2010). Sekaran and Bougie (2010) described the Likert scale as an interval scale, this type of scale allows performing arithmetic operations. LeClaire (2008) suggested that QuestionPro is a user-friendly tool that allows the respondent to explore a variety of questioning techniques.

Validation and pretesting

Validation

Internal validity: It is free from bias in making accurate inferences about cause and effect in the data. External validity: concerns the generalizability of conclusions drawn from a sample to other cases. A pilot study and feedback from the research supervisor helped establish content validity for this study.

Pretesting

In this case the objective was to identify the effectiveness of performance management in Bidvest Bank Ltd.

Data capture method

Analysis of the data

Introduction

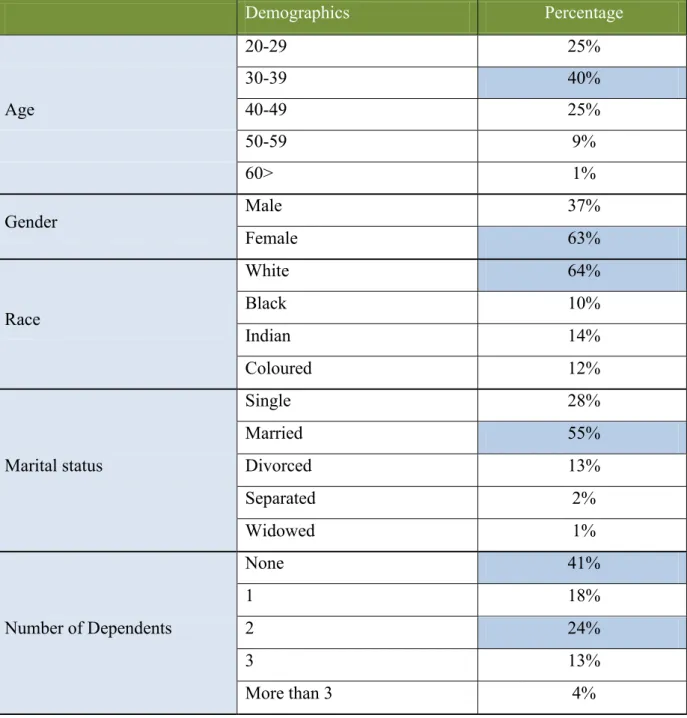

Demographic profile of respondents

Performance management as a constructive process

- Relationship between age and performance management as a constructive

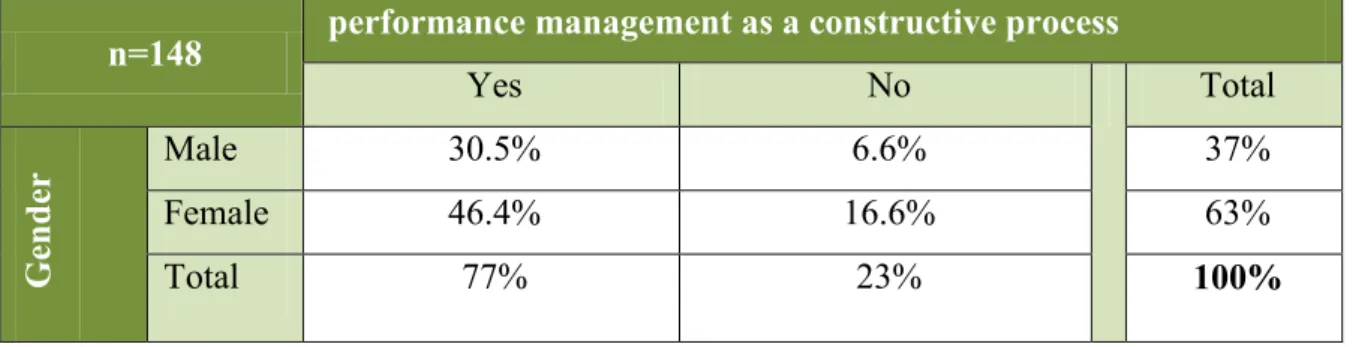

- Relationship between gender and performance management as a constructive

- Relationship between race and performance management as a constructive

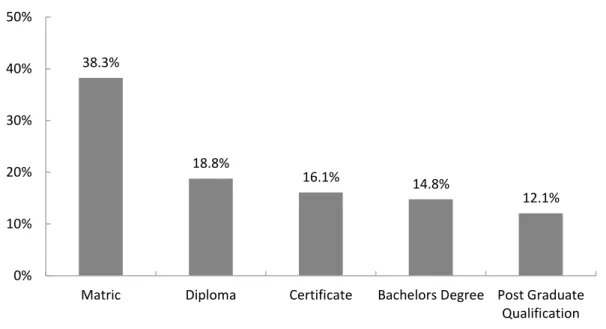

- Highest level of education achieved

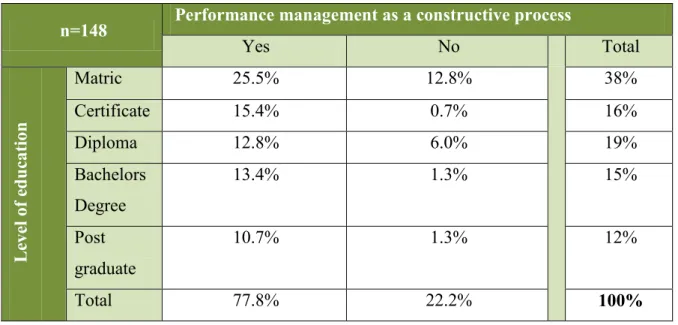

- Relationship between highest level of qualification achieved and performance

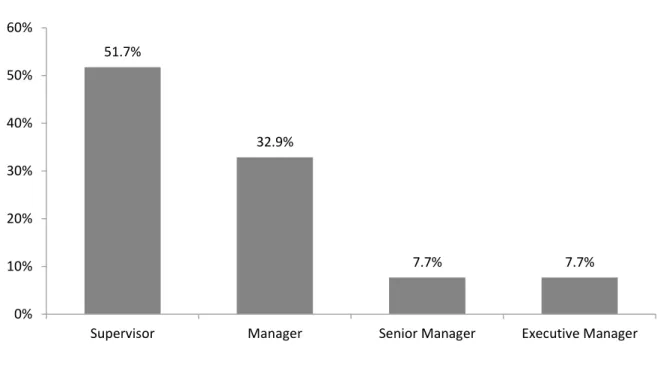

- Current level of employment

- Relationship between current level of employment and performance

- Duration of time in current position

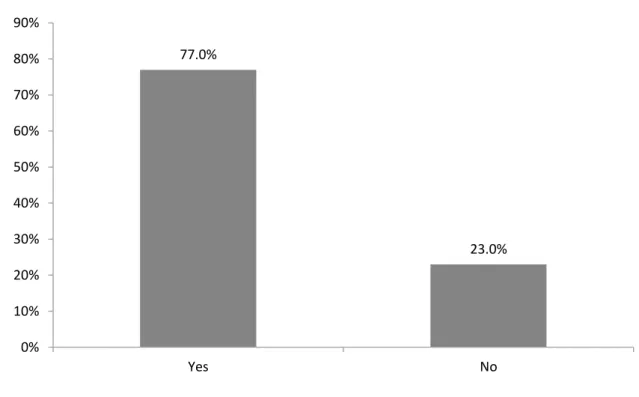

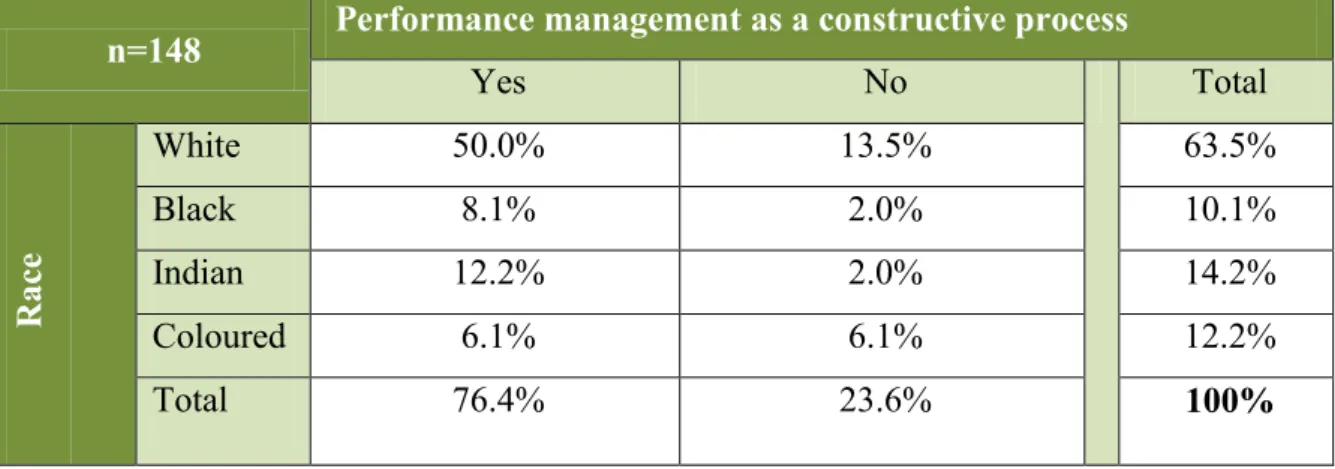

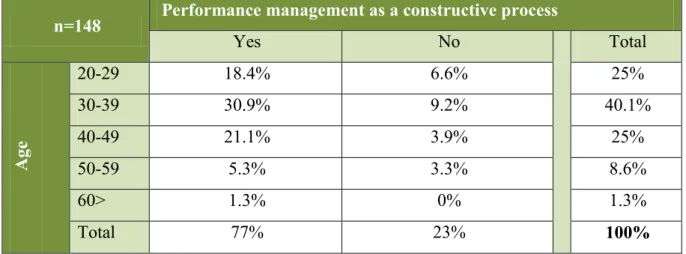

As reflected in Figure 4.1, the majority of respondents 77% agreed that performance management is seen as a constructive process. It is important to note that the same age group was the highest (9.2%) who did not see performance management as a constructive process. From Table 4.4 it is evident that the white race constitutes the majority of respondents who believed that performance management is a constructive process (50%).

Level of responsibility

Analysis of the objectives

- Objective 1: To determine the effectiveness of performance management at bidvest

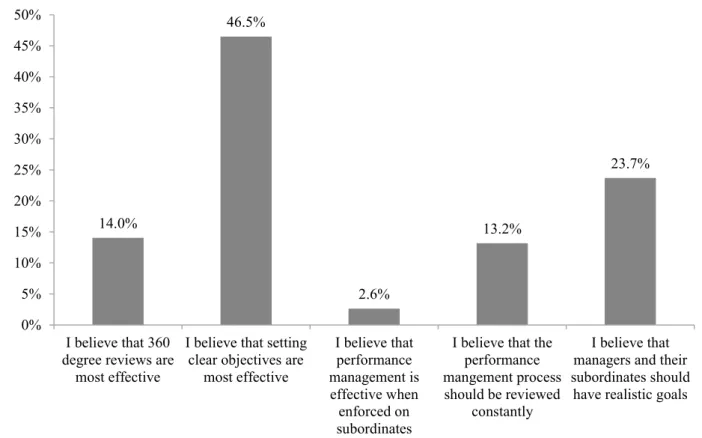

- What do you believe encourages effective performance management

- Which of the options best describes the current performance management

- Do you feel that the current performance management system within the bank

- Objective 2: To determine how management view performance management

- Do you see performance management as a constructive process

- Factors supporting performance management as a constructive process

- Which of the following factors most appeals to management at Bidvest Bank

- I believe that performance management is

- Objective 3: To determine how management views the appraisal procedure related

- How many performance appraisals have management completed

- Important factors considered when appraising subordinates

- Time taken to perform the appraisal process

- Managements level of understanding of the Balanced Scorecard

- Important criteria related to conducting performance appraisals

- How often do you review your subordinates key performance areas (KPA’s) 58

- Would an online electronic performance management system appeal to you as

- To what degree would the following performance management criteria be

- Objective 5: To examine how strategic intent of the organization links to

- Performance management supports operational success

It shows that 58.9% of the sample believed that performance management contributes to organizational success. The entire management at Bidvest Bank Ltd agreed that performance management is the key to the success of the organization. A recorded 23.4% of the respondents believed that they were not interested in electronic performance management as managers.

Summary

Introduction

Demographics

Findings from the cross-tabulation results indicated that Whites made up the majority of respondents who felt that performance management should be seen as a constructive process. Whites and Indians shared the highest percentage with 62.2% of all respondents believing that performance management can be seen as a constructive process. The survey reported that 25.2% of managers at Bidvest Bank Ltd also agreed that performance management is a constructive process.

Objective 1: To determine the effectiveness of performance management at bidvest

What encourages effective performance management?

Current performance management at Bidvest Bank Ltd

Current delivery of performance management at Bidvest Bank Ltd

Objective 2: Determine how management view performance management

- Does management see performance management as a constructive process

- Factors supporting performance management as a constructive process

- Factors appealing to managers at Bidvest Bank Ltd

- Respondents belief of what is performance management

A recorded 58.9% of respondents believed that performance management was at the heart of the success of the business. Bernadin (1995) explained that performance management provides the strongest link to strategic objectives of any organization. The findings of the study indicated that effective performance management is critical to the success of Bidvest Bank Ltd and therefore supports the literature examined.

Objective 3: To determine how management view the appraisal process

Management’s understanding of the balanced scorecard

Respondents were asked what their level of understanding with regard to the balanced scorecard was. Another 1.8% and 3.6% reported a below average and low level of understanding of the balanced scorecard. This suggests that the research conducted is inconsistent with the literature regarding the balanced scorecard.

Frequency of key performance area (kpa) reviews

Objective 4: To determine how management feel with regards to new age performance

The findings of the study clearly show that online performance management tools would add great value to the organization.

Objective 5: To examine how strategic intent of the organisation links to effective

Summary

Introduction

Implications of this research

Recommendations to solve the research problem

Most of the respondents felt that an electronic performance management system would add value to the effectiveness of performance management in Bidvest Bank Ltd. An electronic performance management system would increase the effectiveness of performance management in Bidvest Bank Ltd. This supports the need to incorporate an effective performance management system within Bidvest Bank Ltd.

Recommendations for future studies

An electronic performance management system can eliminate the time-consuming practices currently seen in existing performance management practice. Future studies can be conducted on effective performance management criteria and its relationship with career succession planning and reward initiatives within Bidvest Bank Ltd. Once an electronic performance management tool is in place, further studies can be conducted using this very tool.

Summary

1996, ``The lean organization, management-by-process and performance measurement'', International Journal of Operations & Production Management, Vol. 1990, The New Performance Challenge - Operations Measurement for World Class Competitiveness, DowJones-Irwin, Homewood, IL. 2000, Human Resource Management, Studies in Economics and Business, Heinemann Educational Publishers, pg 69. Taylor: an assessment”, Academy of Management Review, Vol. 1954, Motivation and Personality, Harper & Row, New York, NY. 1994, ``How the right measures help teams excel'', Harvard Business Review, May/June, p. Basic concepts in social science methodology. 1995, “Performance measurement system design: a literature review and research agenda”, International Journal of Operations & Production Management, Vol. 1998, “Measuring business performance – why, what and how”, The Economist, London.

Which of the options best describes the current performance management practices at Bidvest Bank Ltd. Which of the following is important when conducting performance appraisals. Please rank your choices with 1 being the most important and 6 being the least important. To what extent would the following performance management criteria be more effective if available online?