Fifth, we need to strengthen the capacity of the country to address the needs of the people. In April 2019, the municipality started a public participation process, in which it obtained community opinions on the draft budget. During the preparation of the final MTREF budget for the period 2020-2022, the contributions of both communities, the Treasury and the audit committee were taken into account.

Among the inputs were the reduction of the wage bill, the charging of interest on unpaid debtors in view of the unrest in Vuwani and the reduction of the collection rate which was 100% in the draft budget. The state of the economy is having a negative effect on the consumers of Collins Chabane Local Municipality in the current budget year 2018/19. 82, 93, 94 along with the State of the Nation Address, the Finance Minister's Budget Speech and the State of the Province Address were used to guide the preparation of the MTREF budget.

Ensuring the health of the asset base (especially income generating assets) by increasing spending on repair and maintenance and asset renewal; Municipalities were strongly urged to follow the cost containment measures approved by councils and align their budgetary policies as closely as possible with these guidelines. Municipal real estate valuation policy, approved in accordance with the Municipal Real Estate Valuation Act; 2004 (Act 6 of 2004) (MPRA) as amended.

The table above includes the loss of revenue arising from the discounts and rebates associated with the council's tariff policy, notably the exemption of R15 000 per residential property value.

User / Levied Charges Basic Refuse = R 15.78

The tariff for rubbish removal has been adjusted to be cost-reflective as the municipality currently provides the service at a loss. In accordance with the formats prescribed by the Municipal Budget and Reporting Regulations, capital transfers and contributions are excluded from the operating statement, as inclusion of these sources of income would distort the calculation of the operating surplus/deficit. Departments have been requested to review the rates of these items on an annual basis to ensure that they are cost reflective and market related.

Rates-

Property Rates

Therefore, the determination of the effective property rate is an integral part of the municipality's budgeting process. 51, among other things, concerns the implementation of the Law on Municipal Property Norms, with the regulations issued by the Department of Cooperative Governance. The implementation of these regulations was done in the 2010/11 budget process and the policy of property fees in the Municipality was changed accordingly.

The first R15 000 of the market value of a property used for residential purposes is excluded from the taxable value (Section 17(h) of the MPRA). For pensioners, physically and mentally disabled persons, the rebate is granted on a sliding scale basis depending on the income category of the registered owner/proprietor and the threshold of R3500 applies to this category. It was highlighted provincially by COGHSTA that our municipality does not comply with regulations on rate ratio between residential and non-residential categories of properties, and it was told that during the tabling of our budget of 2019/2020 FY we must comply.

We've found that when we adjust our non-residential category down or no more than 25% of the Residential category, our rate will be no charge. The relevant taxable home may only be occupied by the applicant and his/her spouse, if any, and by dependents without income;

Waste Removal and Impact on Tariff Increase

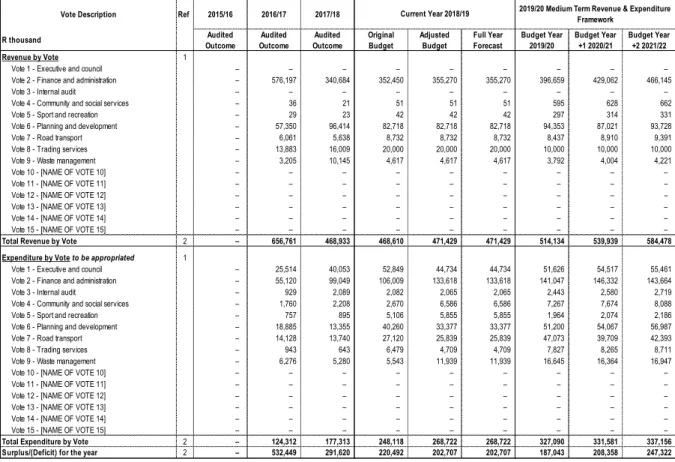

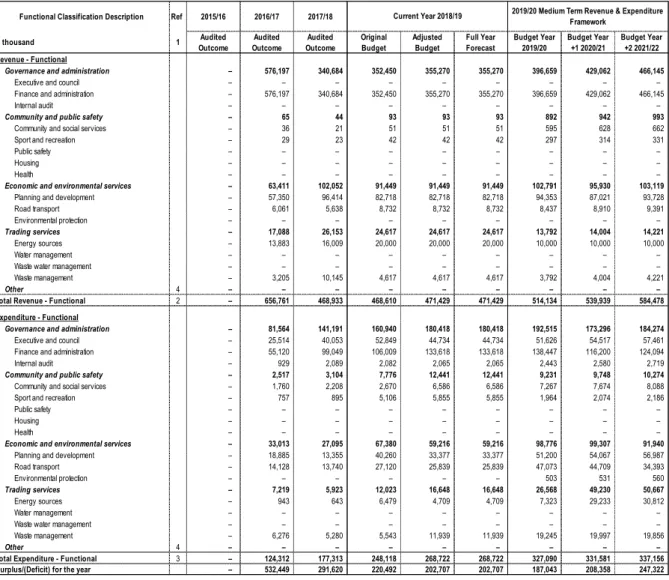

Operating Expenditure Framework

15 Employee related

Employee Salaries and Allowances

Employee Social Contributions

Other Expenditure

Several other spending votes were not increased in line with top management's decision not to increase the overall budget by a 5.4% inflation increase to contain spending costs.

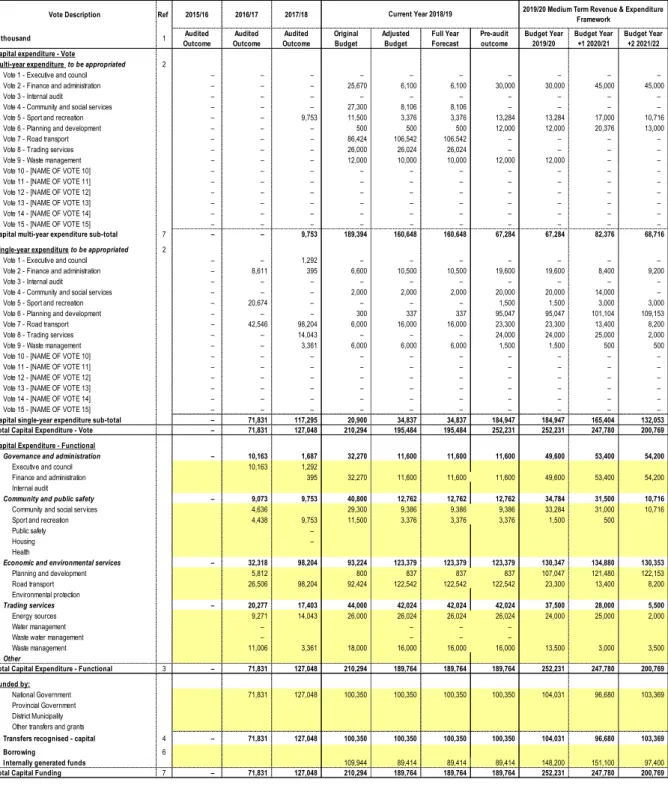

20 1.6 Capital Expenditure Framework

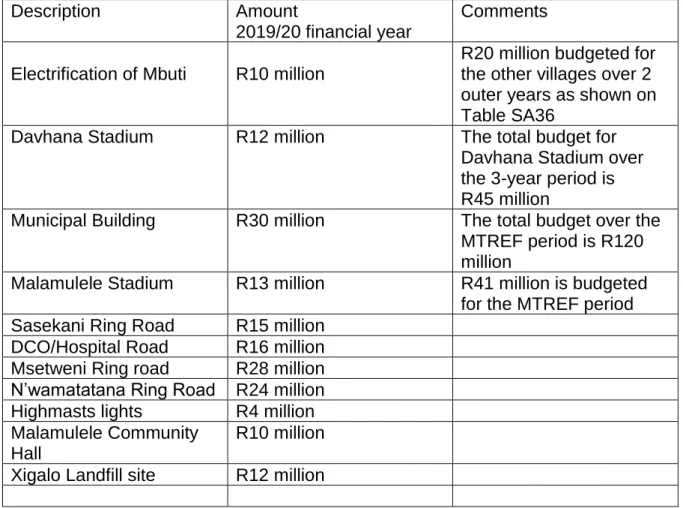

The capital budget is divided into three as shown below, namely capital expenditure on new assets (Table SA34a), capital expenditure on renewal of existing assets (Table SA34b) and capital expenditure on improvement of existing assets (Table SA34e). Davhana Stadium R12 million The total budget for Davhana Stadium over the 3-year period is R45 million DCO Road/Hospital R16 million Msetweni Ring Road R28 million N'wamatatana Ring Road R24 million Highmasts Lights R4 million Malamulele Community.

The renewal of the existing assets budget relates to the reconstruction of some roads in Malamulele town as they have reached a stage beyond repair. The municipality has made a full assessment of the state of the property during the financial year 2016/2017 and this has been followed up with annual assessments in the financial year 2017/18.

LIM345 Collins Chabane - Supporting Table SA34a Capital expenditure on new assets by asset class

LIM345 Collins Chabane - Supporting Table SA34b Capital expenditure on the renewal of existing assets by asset class

Payment/inquiry points Building plan Offices Workshops Shipyards Shops Laboratories Training centers Manufacturing facilities Depots Capital spare parts.

LIM345 Collins Chabane - Supporting Table SA34c Repairs and maintenance expenditure by asset class

Railway constructions Railway furniture Drainage Collection Rainwater Transport Damping MV Substations LV Networks Capital reserves.

LIM345 Collins Chabane - Supporting Table SA34d Depreciation by asset class

LIM345 Collins Chabane - Supporting Table SA34e Capital expenditure on the upgrading of existing assets by asset class

LIM345 Collins Chabane - Supporting Table SA36 Detailed capital budget

R thousand

Ward Location Budget Year 2019/20

Budget Year +1 2020/21

Budget Year +2 2021/22

Parent municipality

2019/20 Medium Term Revenue & Expenditure Framework

Entities

37 1.7 Financial Position

LIM345 Collins Chabane - Table A6 Budgeted Financial Position

Cash flow forecasting

Cash flow, as shown in the table above, will remain positive from the full year forecast of R332,943 million. Cash and cash equivalents at the end of the year do not include the amount of R120 million that was invested with VBS Mutual Bank having been fully devalued in the 2017/2018 financial year (restated figures).

LIM345 Collins Chabane - Table A7 Budgeted Cash Flows

LIM345 Collins Chabane - Table A8 Cash backed reserves/accumulated surplus reconciliation

LIM345 Collins Chabane - Table A9 Asset Management

43 1.10 Reconciliation of Grants and Subsidies

SUPPORTING DOCUMENTATION

- Overview of the Annual Budget Process

LIM345 Collins Chabane - Supporting Table SA18 Transfers and grant receipts

- Budget Process Review

- IDP and Service Delivery and Budget Implementation Plan

- Financial Modelling and Key Planning Drivers

- Community Consultation

- Overview of Alignment of Annual Budget with IDP

The Mayor must establish a Budget Management Committee to provide technical assistance to the Mayor in carrying out the tasks set out in section 53 of the Act. With regard to section 21 of the MFMA, the Mayor must submit to the Council ten months before the start of the new fiscal year, August 2018 , a schedule that sets out the process for revising the IDP and preparing the budget. The municipality's IDP is its most important strategic planning instrument, directly guiding and informing its planning, budgeting, management and development actions.

This framework has evolved into objectives, key performance indicators and performance targets that directly inform the service delivery plan and budget. The need for tariffs increases compared to the community's ability to pay for services. In addition, strategic guidance from National Treasury's MFMA Circular 93 and 94 was considered in the planning and prioritization process.

The constitution obliges the local government to bear responsibility for local development and cooperative governance. The plan aligns a municipality's resources and capacity with its overall development objectives and gives direction to the municipal budget. Leadership and direction to all those who have a role to play in the development of a municipal area.

The IDP enables the municipality to make the best use of scarce resources and speed up service delivery. IDP is an approach to planning that aims to involve the municipality and the community to find the best solutions for sustainable development. It should aim to coordinate the work of local and other spheres of government in a coherent plan to improve the quality of life of all the people living in the area.

Applied to the towns, issues of national and provincial importance must be reflected in the IDP of the municipality. A clear understanding of such an intention is therefore essential to ensure that the municipality strategically meets the key national and provincial priorities.