This dissertation analyzes the role of financial services in an attempt to understand how they can reduce vulnerability to income risk for female street vendors in Durban, South Africa. The literature review discusses the relationship between risks, vulnerability, poverty and financial services in order to give an introduction to the problem behind the stated hypothesis. Good financial services must include factors such as financial sustainability, impact on poverty and customer satisfaction.

Structure

Even if the case study concerns street traders, the dissertation will not specifically focus on gender-related issues in theory. Chapter four is a background section for the case study and deals with the informal economy, legislation and street trading women in South Africa. Following the findings, chapter seven will link the literature review, theory chapter and case study introduction to the results in a discussion.

2 RISKS, POVERTY, AND FINANCIAL SERVICES

- The Nature of Risks

- The Concept of Vulnerability and Poverty

- The Role of Income and Assets in Poverty Reduction

- Risk Management and Savings

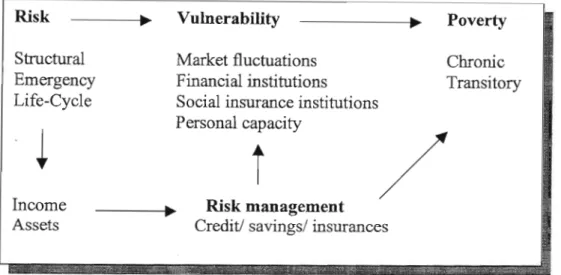

The effect of risk on income and poverty depends on an individual's level of vulnerability to a particular risk, as will be highlighted in the next section. Economic portfolios refer to total income and assets available for use. The risk management strategy that this dissertation focuses on is the use of financial services, especially savings, and how this affects income and assets.

3 THEORETICAL FRAMEWORK

- The Cost of an Imperfect Market

- Impact on Income and Assets

- The Lack of a Formal Financial Market

- The Economic Implication of Moral Hazard and Adverse Selection Both Hulmel Mosely and Ray's arguments are based on the market failure of

- Alternative Financial Services

- Informal Financial Institutions

- Microfinance Institutions

- The Poverty Impact

- Microfmance and Poverty Reduction

In the first case, where the households have no loan commitment, the production decision can be characterized as a portfolio choice problem in two periods. If output is low in the first period, the household chooses consumption to maximize utility U(CIJ+U(Cn ), with the constraint that all assets in the second period are consumed: (~L-CILXl +r)+~ at interest r. Lifetime utility in a two-period model is then in the low-income scenario and the high-income scenario respectively UL ( • ) UHC·.

This is evident from the role of 8'0 in the denominator of the left-hand side in equation (2.2). Alternative solutions to 'insurance' will be discussed in the next section, 3.3, in relation to informal and microfinance institutions, where Ghatak's example will again be used to explain how group lending also includes a 'safe' type, leading to a lower interest rate and higher repayment rate. Because of information problems, the bank cannot distinguish between "safe" and "risky" borrowers, so the interest rate will be set to cover the average probability of success in the population rp =p.

The latter institution has played an important role in the development debate and is largely the brainchild of microfinance organizations, as will be discussed in section 3.2.3. Groups tend to be homogeneous in terms of income, occupation and age, and members are in most cases friends or neighbours. Social insurance and homogeneity will be further discussed in relation to microfinance in the next section (Bouman, 1995).

This section will link the above discussion and outline the impact financial institutions, with a particular focus on microfinance, can have on poverty alleviation in terms of increased income, wealth building and welfare. In some cases in the AIMS study, merit had an impact on increasing boys' school attendance. If the financially better performing institutions become a benchmark in the further development of the microfinance organization, the particularly poor in the core group may be excluded from schemes and the impact on poverty reduction is likely to be less effective.

4 INTRODUCTION TO THE CASE STUDY

- The Informal Economy

- Policies and Legislation in the SMME Sector

- Women Street Traders in Durban

- Provision of Financial Services

But the history of apartheid is another factor that has shaped the development and nature of the informal economy in the country. The Department of Trade and Industry aims to increase the competitiveness of the local economy in the global market. Lund (1998) describes the connection between gender, race and women's position on the labor market in South Africa.

As a result, policies do not focus on the growth of the informal and flexible market. (Employment in the formal sector is declining as the unemployment rate rises and the informal economy expands. Statistics show that 57 percent of workers in the informal sector are women and 70 percent of women are involved in low-skilled domestic work and basic occupations such as street vendors (Valodia, 2001).This is a critical obstacle, especially for the development of women engaged in livelihood in the informal sector (Valodia, 2001). ).

Women engaged in the informal economy face risks related to their daily lives and their businesses, and the most important question for these street traders is how to protect themselves from and manage the risks they face. Lund and Skinner (1999) discuss the need for and barriers to organizing women in the informal economy. An example of a union organized by women in the informal economy in Durban is the Self Employed Women's Union.

Due to the lack of government protection and support for the survival sector, financial services as an optional risk management tool specific to this sector will be discussed in the next section.

5 METHOD OF THE CASE STUDY

- Qualitative method

- The Choice of Financial Institution

- The Sample

- The Source of Information

- Research Questions

The qualitative method is based on focus group discussions and individual in-depth interviews, in this case with female street traders who are members of the microfinance organization FINCA. The clients who participated in the group interviews were not the same as those who participated in the individual interviews. Another reason is that a higher percentage of street vendors in Durban are women (Lund, 1998).

One reason for this is that a higher percentage of the world's poor live in rural areas. The choice of street traders in the informal economy is based on the lack of financial services and government protection that this sector faces, resulting in high risks and vulnerability for the people involved. A translator was used as most of the women spoke Zulu as a first language, although most of the women understood some English and the translator was only needed to explain some responses.

There are a number of factors that may have influenced the nature of the situation. Furthermore, the location of the interviews may have influenced the nature of the responses, as the women may have wanted to portray themselves as 'good' clients. Even if the interviewee's participation was completely voluntary, the women's desire to perform well within the organization may have made them extremely reluctant to respond negatively or to question the interviewer's role.

The characteristics of the group interviews are not comparable to the characteristics of the individual interviews.

6 FINDINGS FROM THE CASE STUDY

- Findings Regarding Income and Consumption

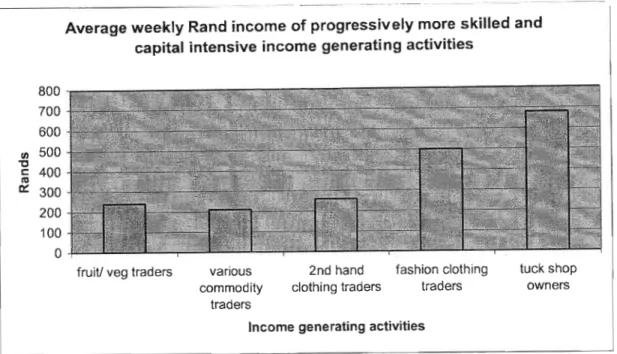

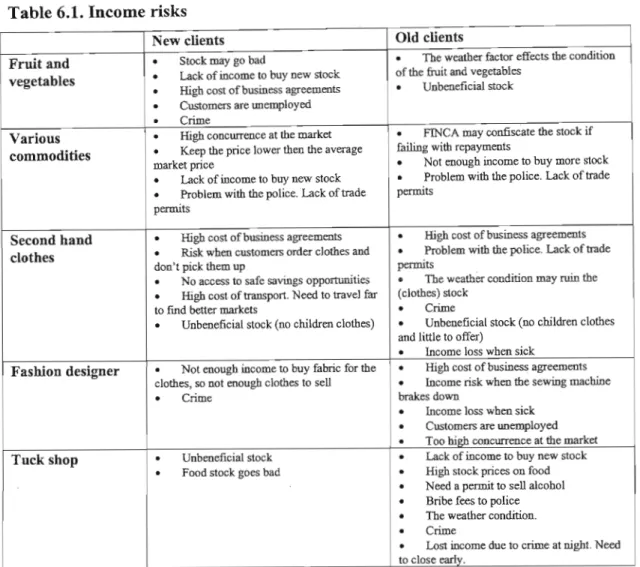

- Source of Income

- Findings Regarding Savings

- Saving Channels

- Motives of Saving

- The Role and Impact of FINCA

- Administration, Methodology, Communication and Information The group size is between 8 and 15 individuals and the lending cycle is often eight

- The Deposit Schemes

- Summary of the Findings

The findings regarding savings are divided into four paragraphs; 6.2.1 describes the different saving channels used by street traders, paragraph 6.2.2 describes the motives for saving and the last paragraph, 6.2.3, discusses the optimal saving channels. Saving motives were more related to the family economy than to the enterprise, although some of the clients saved to develop their business. Most customers found it easy to save money, but some encountered problems when they wanted to open a bank account.

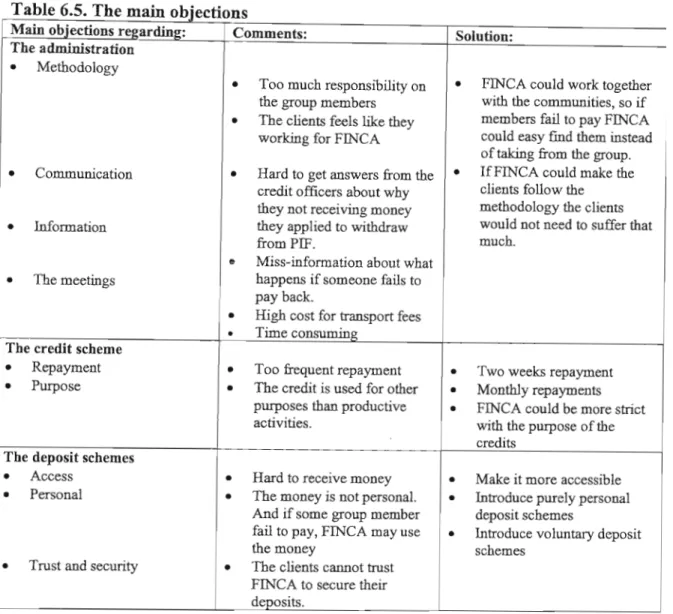

The table also contains a column with solutions to the outlined objections that the clients mentioned. Secondly, to reduce the risk of handling cash both for FINCA and for customers. There seems to be a lack of understanding among customers of the method and the mandatory deposit schemes.

Customers also found it difficult to get clear answers about why they were not receiving money from their personal deposit schemes and found the deposit schemes confusing. The customers must also provide a reason why they want to withdraw the money. Purpose • The credit is used for monthly repayment purposes other than productive • FINCA may be stricter.

Most customers find it easy to save money, but they had poor options on where to save the money. Customers found that they have little knowledge and education about how savings and banks work. There appeared to be a lack of understanding by customers about the group lending methodology and the compulsory deposit schemes.

7 DISCUSSION AND CONCLUSION

- The Livelihood among Women Street Traders

- The Importance of Assets

- Savings as a Risk Management Strategy

- The Role and Impact ofFINCA

- Administration, Methodology, Communication and Information According to Morduch (1999) there are different ways of alternative methods

- Impact on Income, Assets and Business Development

- The Use and Impact of the Deposit Schemes

- Challenges for South Africa

- Conclusion

This case study of female street vendors underscores Moser's conclusions about the importance of assets. Most risks related to income and expenditure restrictions are mentioned in the motivations for savings, which may imply that savings are recognized as a risk management strategy among street traders. The failure of the groups was often related to a lack of understanding of the method of group lending and frequent payment.

One of the reasons for the lack of understanding of the group methodology is due to incorrect information from the credit officers. The advantages are that the credit officers can take more responsibility for the success of the groups. The objections, from the clients, about the regular repayment scheme used by FINCA are also evidence for the lack of understanding of the group loan methodology.

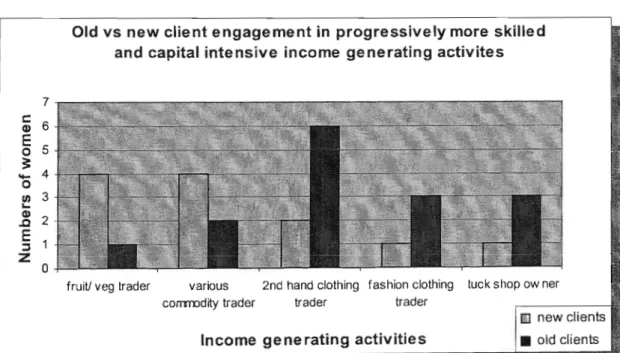

There is thus a difference between 'new' and 'old' customers with regard to the purpose of the credit. The survey showed that a majority of the street traders often felt that they lacked knowledge and skills regarding business development. Savings has been argued in this thesis as one of the most important financial services.

Financial services can be an important way for street traders to get out of rock bottom.

Advancing the interests of women in the informal economy: an analysis of street vendor organizations in South Africa. Local government in transition - A gender analysis of trends in urban policy and practice regarding street trading in five South African cities.