Be approved by adopting a resolution approving the budget of the municipality, c) Must be approved together with the resolution as may be necessary, and.. d) The accounting officer of the municipality must report the approval of the annual budget to the National and Provincials ahead. Treasury. By the end of the current financial year, the municipality will have estimated financial obligations of R 370,132 million, which. We have ensured that the budget process is a collective effort, where various departments have been consulted and informed, and the budget allocations are based on principles that reflect the financial situation of the municipality.

This is part of the budget reform measures that the municipality is taking to ensure that the process is in line with best practice. 78 and 79 and other previous MFMA circulars were used as guidance for the compilation of the 2016/17 MTREF. The need to re-prioritize projects and expenses within existing resources given the cash flow reality and the council's declining cash position.

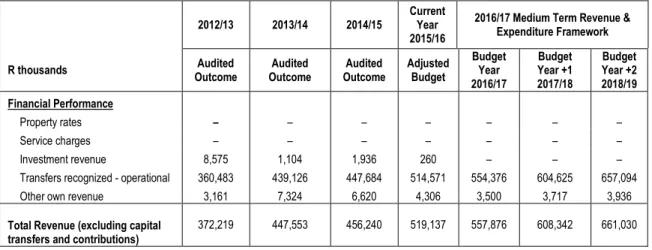

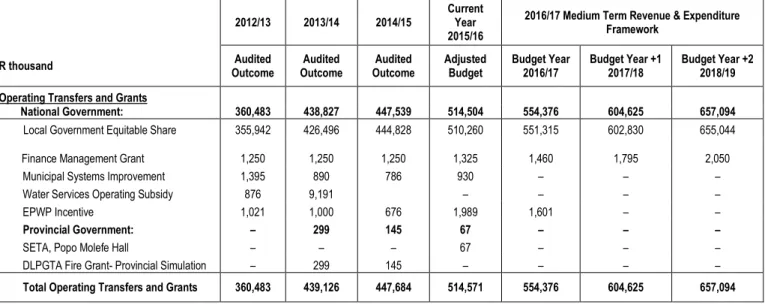

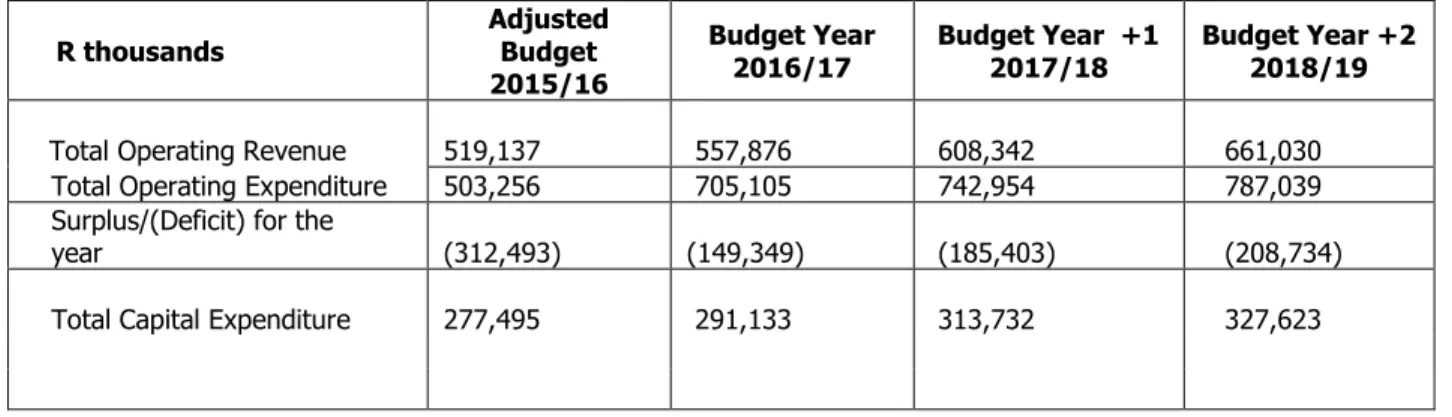

In these tough economic times, strong revenue and expenditure management is essential for the municipality's sustainability. The table below gives a breakdown of the various operating grants and grants that have been awarded to the municipality in the medium term. Financing of the budget in the medium term as stated in the MFMA § 18 and 19; and.

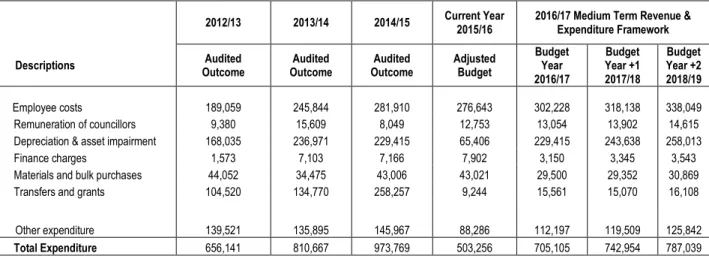

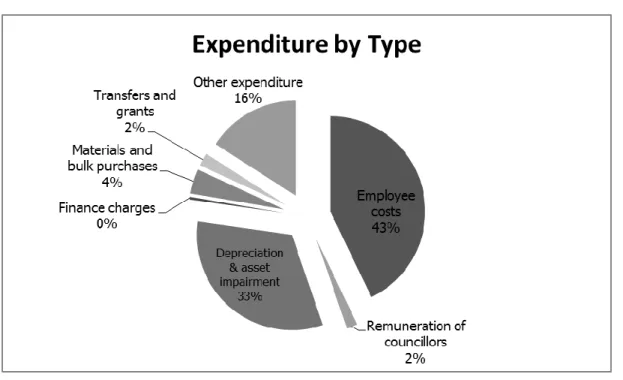

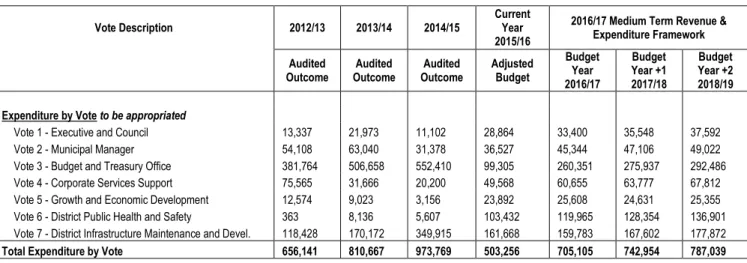

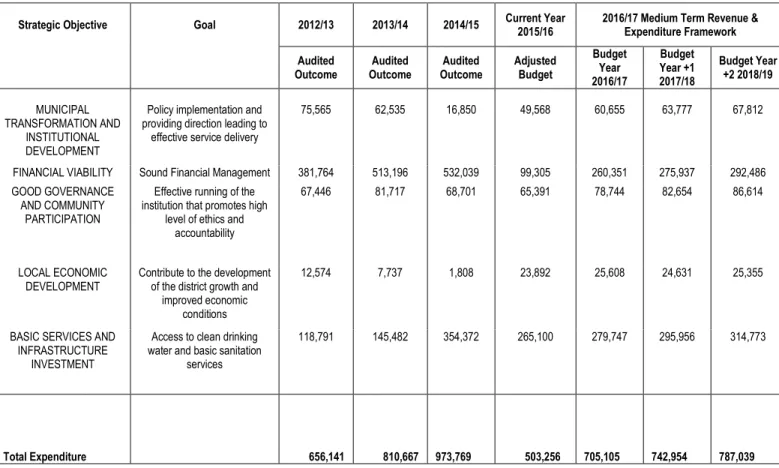

The following table is a high-level summary of the 2016/17 budget and the MTREF (classified by main type of operational expenditure).

Salaries and Wages

As part of the council's costing and cash management strategy, a moratorium has been put in place on all new normal appointments. As part of the assumptions and planning interventions, all new vacancies are not budgeted, except for the municipal manager vacancies and the five managers who report directly to the municipal manager.

Remuneration of Councillors

Depreciation and Assets Impairment

Finance Charges

Materials and bulk purchases

Contracted Services

Other expenditure

Executive and Council

Municipal Manager

Corporate Services Support

Growth and Economic Development

District Public Health and Safely

District Infrastructure Maintenance and Development

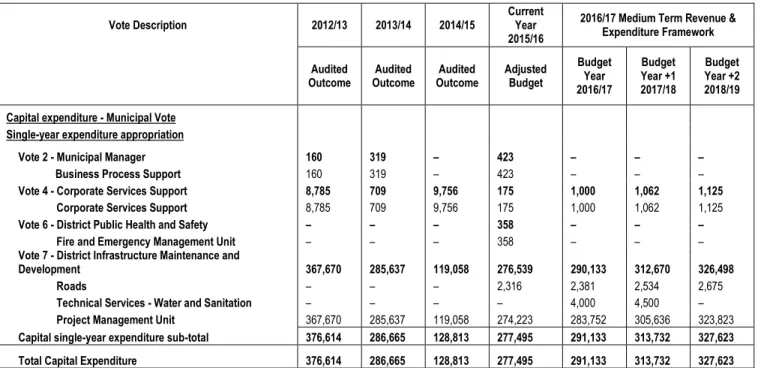

CAPITAL EXPENDITURE FRAMEWORK

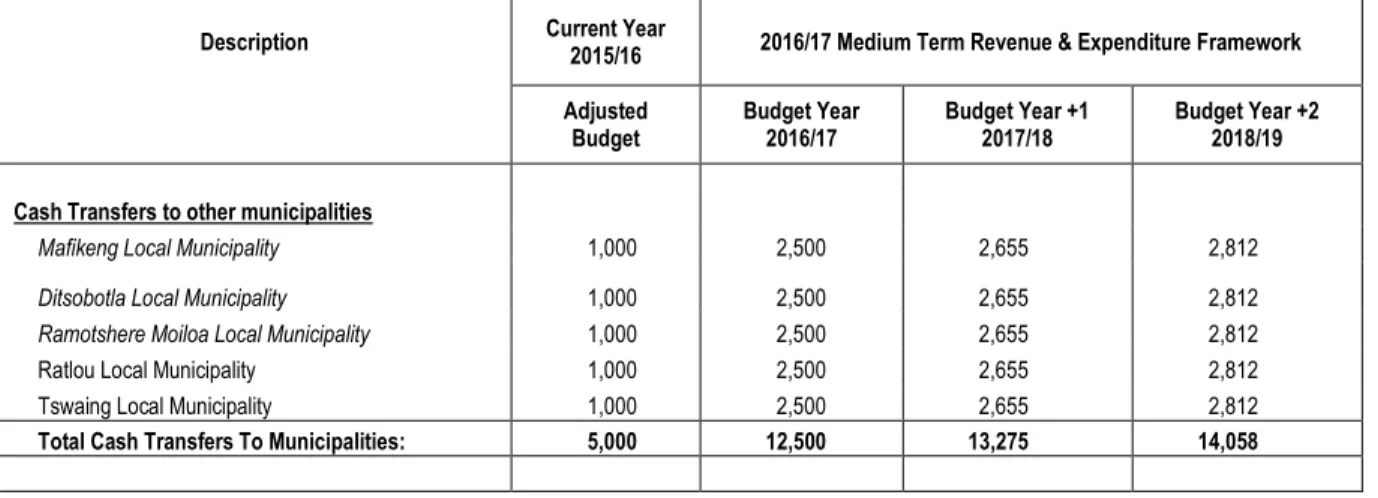

- Allocations Made By District Municipality to Local Municipalities

The Division of Revenue Bill (DoRA) stipulates that the nationally collected revenue for the fiscal year 2016/17 must be divided among the state, state and local levels of government. In addition, Section 29 of the DoRA provides that within 10 days of the enactment of the Act, the Category C municipality must file with the National Treasury and all Category B municipalities within the municipality's jurisdiction the budget as filed under Section 16 of the DoRA . the MFMA, for the 2016/17 financial year. Therefore, Ngaka Modiri Molema District Municipality must declare as category C that all allocations of their fair share and conditional allocations must be transferred to each local municipality within the jurisdiction.

14 The following table provides a breakdown of district transfers and grants to local municipalities.

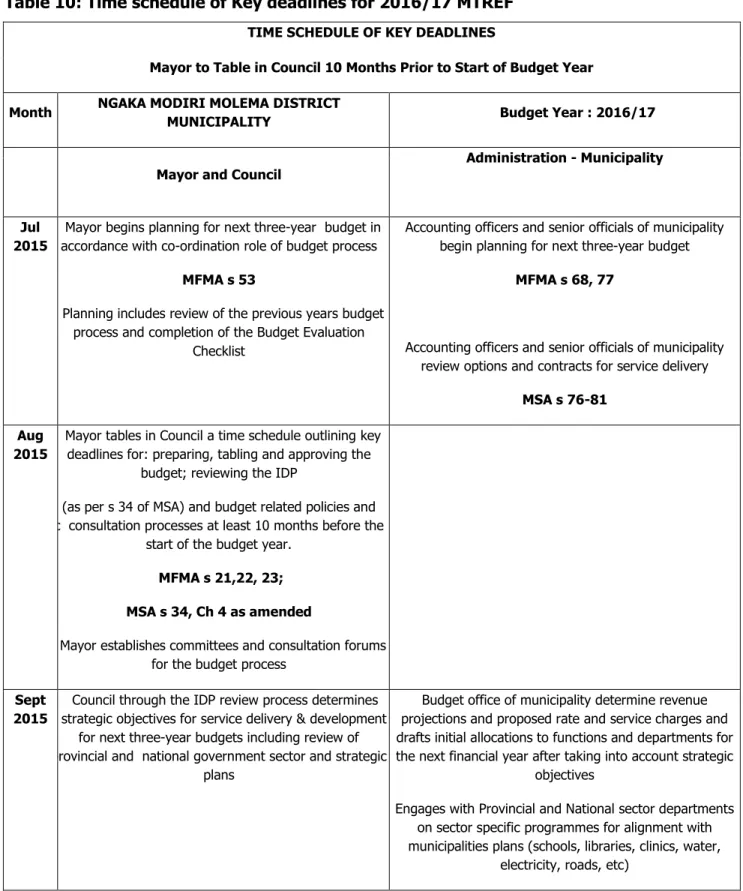

OVERVIEW OF THE ANNUAL BUDGET PROCESS

The Mayor initiates the planning of the next three-year budget in accordance with the coordinating role of the budget process. Planning includes reviewing the previous year's budget process and completing the budget evaluation. The accounting officer conducts initial review of national policies and budget plans and potential bulk price increases.

Accounting Officer and senior officials consolidate and prepare the proposed budget and plans for the following financial year. taking into account last year's performance according to audited financial statements. Accounting officer reviews proposed national and provincial allocations to municipality for inclusion in. the draft budget for submission. The accounting officer finalizes the proposed budgets and plans for the next three years and submits them to the mayor.

Accountant to inform relevant municipalities about allocated grants for the next three budget years 120 days. The Accounting Officer publishes submitted budget, plans and proposed revisions to the IDP, invites community comments and sends to NT, PT and others as prescribed. Council consider the views of the local community, NT, PT, other provincial and national government agencies and.

Council to consider approval of budget and plans at least 30 days before the beginning of the budget year. The Council must approve the annual budget by resolution, set taxes and rates, approve changes to IDP and budget-related policies, approve measurable performance goals for revenue by source and expenditures by vote before the beginning of the budget year. Accounting officer assists the Mayor in the preparation of the final budget documentation for consideration for approval at least 30 days before the beginning of the budget year taking into account consultative processes and any other new.

The Mayor must approve the SDBIP within 28 days of approving the budget and ensure that annual implementation contracts are entered into accordingly. The accountant submits the draft SDBIP to the mayor no later than 14 days after the adoption of the budget. 18 There were deviations from the key dates set out in the budget timeline tabled in council due to challenges faced by the municipality during the intervention period, limited financial resources and non-participation of the provincial sector department in the IDP representative forum meetings.

IDP AND SERVICE DELIVERY AND BUDGET IMPLEMENTATION PLAN

OVERVIEW OF ALIGNMENT OF ANNUAL BUDGET WITH IDP

The IDP is therefore a key instrument that municipalities use to provide vision, leadership and direction to all those who have a role to play in the development of a municipal area. The IDP allows municipalities to make the best use of scarce resources and accelerate the provision of services. Integrated development planning in the South African context is, among other things, an approach to planning that aims to involve the municipality and the community to find together the best solutions towards sustainable development.

Furthermore, integrated development planning provides a strategic environment for the management and leadership of all planning, development and decision-making in the municipality. Therefore, one of the main objectives is to ensure that there is alignment between national and provincial priorities, policies and strategies and that municipalities respond to these requirements.

OVERVIEW OF BUDGET RELATED-POLICIES

OVERVIEW OF BUDGET FUNDING

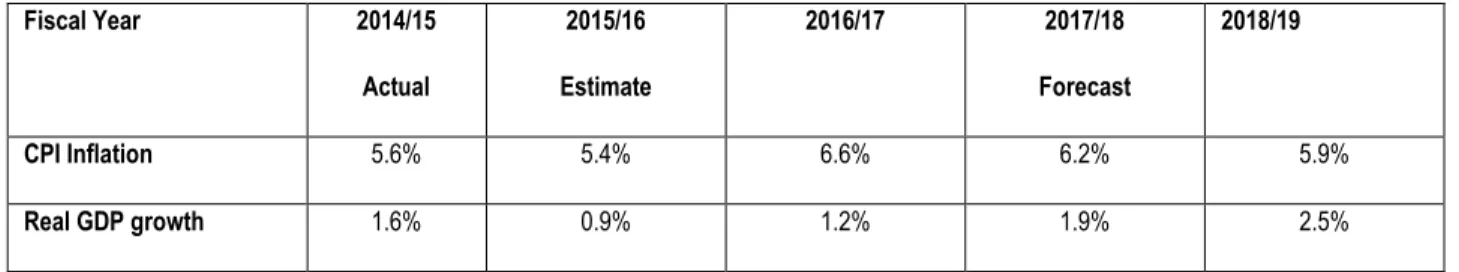

OVERVIEW OF BUDGET ASSUMPTIONS

22 The salaries, allowances and related benefits of the staff for the financial year 2016/2017 have been set at 7.6%, which is inflation plus 1% according to the three-year salary and wage collective agreement for the period 01 July 2015 up to and including 30 June 2018. All income from grants and grants is budgeted according to the allocation of the Division of Revenue Act, including estimates for the last two years. Operating expenses have been increased according to current estimated inflation targets, previous fiscal year performance and needs analysis.

The current budget has been prepared in accordance with the Municipal Budget and Reporting Regulation of 2009.

CAPITAL TRANSFERS AND GRANTS PROGRAMME

CAPITAL BUDGET DETAILS

Any changes to the approved budgeted projects will only be made by the municipality's council decision subject to the municipality's delegation to the Mayor on approval of such changes and in consultation with the affected local municipality. The capital projects allocations by Ngaka Modiri Molema District Municipality to local municipalities are implemented by the Ngaka Modiri Molema District Municipality on behalf of local municipalities for monitoring purposes as no funds are transferred directly to the local municipalities but only completed projects. The transfer to the local municipalities is only in the form of the completed capital projects handover to the local municipalities, unless otherwise, stated funds can be transferred according to the service level agreement.

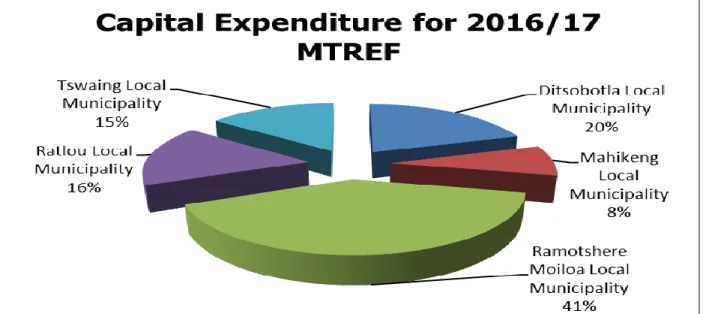

25 For Ditsobotla Local Municipality, table 15 above shows that for the year 2016/17 R57,165 million has been allocated for the development of water supply and sanitation infrastructure representing 19.72% of the total capital budget. Bulk sewers and spillways receive the highest allocation of R51,165 million in 2016/17 which equates to 17.65% followed by water supply infrastructure at 1.83% or R6 million. 28 For Mahikeng Local Municipality, table 16 on above illustrates that for the year 2016/17 an amount of R23, 149 million has been allocated for the development of water and sanitation infrastructure representing 7.98% of the total capital budget.

Water supply receives the highest allocation of R18,750 million in 2016/17, equal to 6.46%, followed by the rural sanitation program and waste water treatment infrastructure at 1.51% or R4,399 million. 30 For the local municipality Ramotshere Moiloa Table 17 above shows that for the year 2016/17 an amount of R114 906 million was allocated for the development of water and sanitation infrastructure, representing 39.64% of the total capital budget. For Ratlou Local Municipality, Table 18 above shows that for the year 2016/17 an amount of R46,167 million was allocated for water infrastructure development, representing 15.92% of the total capital budget.

Water supply receives the highest allocation of R 46.167 million in 2016/17 which is equivalent to 15.92% water supply construction. For Tswaing Local Municipality, table 19 above illustrates that for 2016/17 an amount of R42, 063 million was allocated for water and sanitation infrastructure development.

COST CONTAINMENT MEASURES

34 remain a sphere of government and therefore should be aligned to the maximum extent possible with that of national and provincial government. As a result, the implementation of austerity measures introduced in the 2015/16 financial year has led to a reduction in municipal expenditure. Currently, the municipality is reviewing the threshold and clarifying its implementation with current municipal policies and expenses related to the moratorium approved by the council in the 2015/16 financial year.

LEGISLATION COMPLIANCE STATUS

- In year reporting

- Internship programme

- Audit Committee

- Service Delivery Budget and Implementation Plan

- Annual Report

- MFMA Training

- Policies

The Office of the Budget and Treasury has been established in accordance with the MFMA, but the position of the Chief Financial Officer is still vacant and is expected to be filled after the next local government elections in 2016. Currently, the position of the Chief Financial Officer is appointed on the basis of action by the Department of Local Government and Human Settlements since intervention in 2014. The detailed SDBIP document is at a draft stage and will be finalized following the approval of the 2016/17 MTREF in May 2016, directly linked to and informed by the 2016/ 17 MTREF.

The municipality, in collaboration with the National Treasury, has registered 16 municipal officials in the municipality for minimum competency requirements as stipulated in Government Gazette No. 29967, which was published in July 2007. It should be noted that out of 16 municipal officials registered with the University of Pretoria, 9 of them are appointed managers, and the training is expected to be completed in October this year. The Municipal Tariff Policy was adjusted accordingly in line with the Consumer Price Index of 6.6% as outlined in MFMA Circular 79.