The purpose of the study was to analyze and investigate the effect of e-commerce on the profitability of the banking sector. FBC Holdings Limited should continuously introduce new lines of e-commerce products, services and channels to remain competitive.

INTRODUCTION

BACKGROUND TO THE STUDY

THE ARCHITECTURE OF FBC HOLDINGS LIMITED

FBC Holdings Limited is the holding company for FBC Bank Limited, a privately held company formerly established as First Banking Corporation. FBC Bank also offers internet banking, mobile banking (short message service (SMS) banking and mobile moola), telephone banking, online financial services, international MasterCard and operates a call center (www.fbc.co.zw).

STUDY CONTEXT

The study sought to investigate whether e-commerce has resulted in the alignment of FBC structure with ICT development. Most e-commerce studies seem to focus more on the factors influencing e-commerce adoption rather than e-commerce profitability.

STATEMENT OF THE PROBLEM

This study sought to find out the impact of the adoption of e-commerce technologies and products such as internet banking, online banking and cards on the profitability of FBC Holdings Limited. 10 this research was to investigate the impact of e-commerce on the profitability of the banking sector using FBC as a case study.

RESEARCH OBJECTIVES

RESEARCH QUESTIONS

RESEARCH HYPOTHESES

JUSTIFICATIONOF THE STUDY

SCOPE OF THE RESEARCH

DISSERTATION OUTLINE

13 Chapter two focused on e-commerce literature, assessing the competitiveness of the ICT sector and associated costs. A variety of sources and references have been used to identify gaps in the literature relevant to the e-commerce, profitability and competitiveness of the Zimbabwean banking sector.

SUMMARY

Chapter Three focused on the research methodology, research philosophy, research design, plan or method, research process, population and sampling techniques, research procedure, ethical issues and limitations. The data analysis was done in Chapter Four where data was analyzed using Microsoft Excel and IBM SPSS version 20, presented through graphs and tables, interpreted with reference to literature review and concepts mastered from the MBA courses.

INTRODUCTION

DISTINCTION BETWEEN E-COMMERCE AND E-BUSINESS

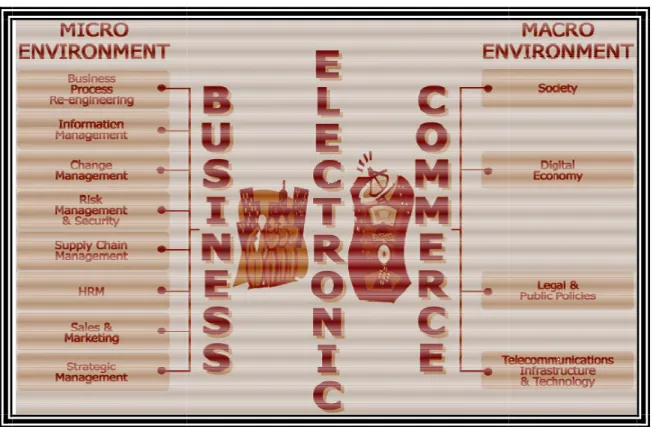

16 In Figure 2.1, e-commerce was then referred to as the large-scale exchange of tangible and intangible goods between countries electronically using the Internet, while e-business is the process of managing or operating businesses that are electronic in nature (Tassabehji, 2003). The main difference is that e-commerce encompasses telecommunication technology, socio-economic variables and commercial infrastructure in the context of the macro environment (Tassabehji, 2003).

E-banking (Internet Banking or Online Banking)

Indirect business activities include business process redesign and change management as they affect the microenvironment (Tassabehji, 2003). 17 the extent to which FBC employees have accepted online banking and to establish awareness of e-commerce products in FBC.

Mobile E-Commerce

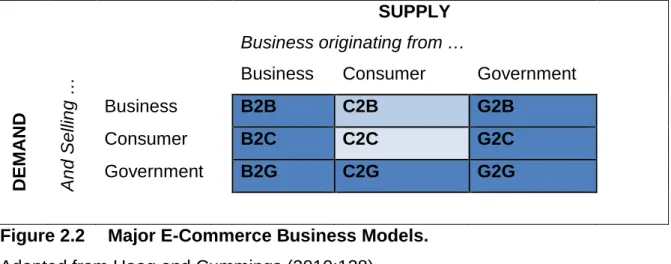

TYPES OF E-COMMERCE BUSINESS MODELS

ADOPTION OF E-COMMERCE

- ATTITUDE AND BEHAVIOUR OF THE INTENDED USER

- GENDER

- PERCEPTION OF RISK

- PERCEIVED USEFULNESS

- CUSTOMER INVOLVEMENT IN THE IMPLEMENTATION OF

- ALIGNING ORGANISATIONAL STRUCTURE TO TECHNOLOGY 20

- TRUST

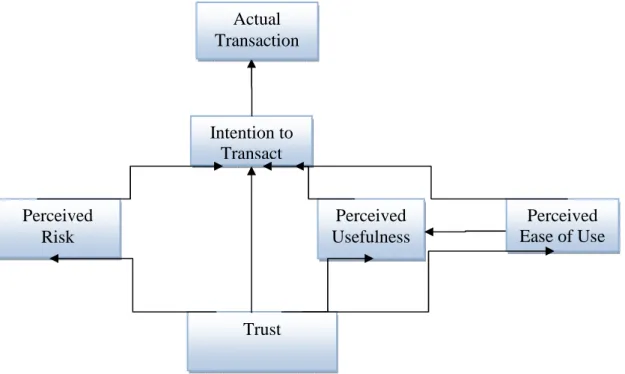

- JUSTIFICATION AND APPLICABILITY OF THE E-COMMERCE

- GOVERNMENTSUPPORT

- MACRO AND MICRO ENVIRONMENT FACTORS

Zhou (2011) suggested that variables such as structural assurance and information quality affect the initial trust of potential users of e-commerce products or services such as mobile banking. These factors were also found to influence the perceived usefulness of m-commerce.

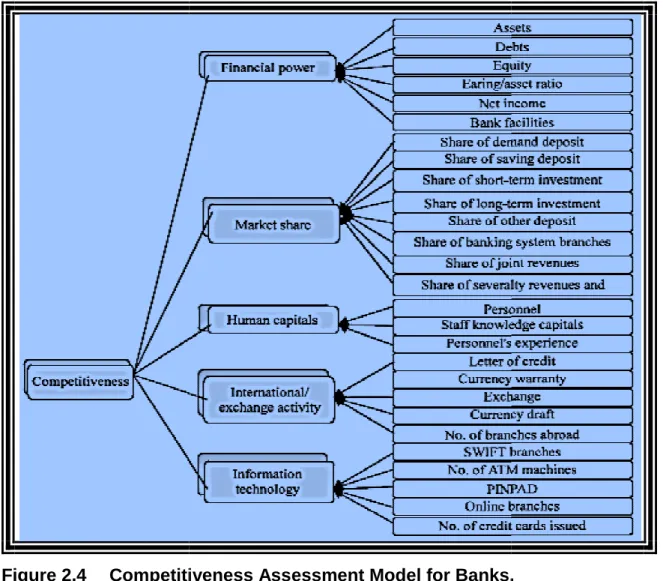

BANKING SECTOR COMPETITIVENESS

- FINANCE POWER

- MARKET SHARE

- HUMAN CAPITAL

- INFORMATION TECHNOLOGY

A study on the competition of private and state-owned Iranian banks showed that the branch network or number of branches, age of the banking institution and geographical distribution determined the size of the banking institution (Givi et al., 2010). The availability and quality of personnel and the experience of employees have an impact on the level of competitiveness of banks (Givi et al., 2010).

REVENUE AND COST STRUCTURE OF BANKING INSTITUTIONS

Other expenses include provisions for impairments, provisions and amortization, which may appear in the statement of cash flows (cash flow statement) (KPMG IFRG Limited, 2011). The statement of financial position may also include items such as real estate, equipment and software.

THE IMPACT OF E-COMMERCE ON BANK PROFITABILITY

- PERFORMANCE ANALYSIS MODELS

- Return On Investment (ROI)

- Earnings Growth

- Market Share Analysis

- Total Cost of Ownership

- Customer Awareness and Satisfaction

Similarly, the adoption of e-commerce as part of an organization's business model or strategy can have a negative impact on profitability in the short term and a positive impact on profitability in the long term (Siam, 2006). The size of an organization's market can also help determine the extent to which the adoption of an information system can increase profitability.

STRATEGIC THRUSTS

- Differentiation

- Cost

- Innovation

- Growth

- Alliance

- Time

Innovation involves the introduction of variations and modifications to products and services that lead to significant changes in the way business is conducted in an industry (Frenzel and Frenzel, 2004). In the 7Ss model, D'Aveni and Gunther (1995) defined speed as the strategy that prepares the company to respond as quickly as possible to changes in market conditions.

BUSINESS PROCESS RE-ENGINEERING (BPR)

In line with this idea, Frenzel and Frenzel (2004) indicated that companies can gain competitive advantage by establishing joint ventures, entering into agreements or strategically acquiring other companies. Frenzel and Frenzel (2004) indicated that a company can achieve competitive advantage by responding quickly to any changes in market conditions as well as by timely supply of products or services to the market.

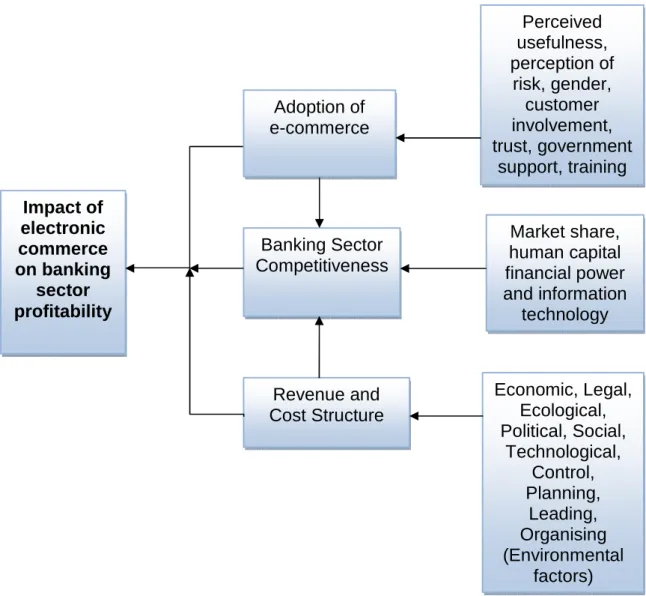

CONCEPTUAL FRAMEWORK

Revenue and cost structure also has an impact on the profitability of an e-commerce driven institution like FBC Holdings Limited. Micro and macro environmental variables such as PESTLE, organization, management, planning and control affect the revenue and cost structure of banks.

SUMMARY

41 The conceptual model adopted for this research was derived after exploring the factors influencing e-commerce adoption such as perceived usefulness, trust, government support and customer involvement.

INTRODUCTION

RESEARCH PHILOSOPHY

The philosophy also suggests that natural and social science should apply the same approaches to data collection and explanations. The rationale behind the data collection was based on the fact that FBC Holdings Limited invested in e-commerce with the hope of producing positive results such as reducing costs, increasing market share, improving competitive advantage and improving efficiency.

RESEARCH DESIGN

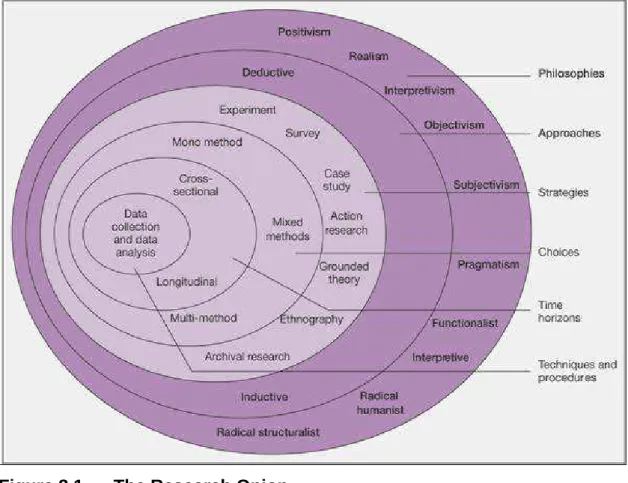

- RESEARCH ONION

- Research Purpose

- RESEARCH APPROACHES

- Deductive Approach

- RESEARCH STRATEGY

- Case Study Research Strategy

The research focused primarily on a single organization, FBC Holdings Limited; therefore, a case study research strategy was adopted. A single case study design was more appropriate because the research problem is unique and specific to FBC (Saunders et al., 2009).

DATA COLLECTION PROCESS

- UNIT OF ANALYSIS AND UNIT OF DATA COLLECTION

- Population and Sample

- Sampling and Sampling Techniques

- Multiple Data Collection Methods

- Questionnaires

- Interviews

- Data and Data Sources

- Primary and Secondary Data

- Internal and External Data

These are facts and figures that have been collected by the researcher through conducting interviews and administering questionnaires. The researcher was able to collect data that was required for the purposes of the research.

DATA ANALYSIS PROCESS

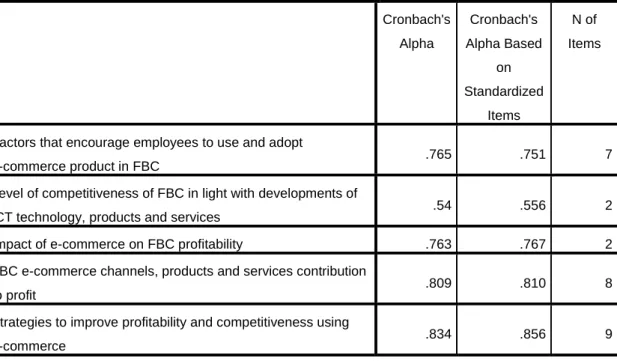

VALIDITY AND RELIABILITY

54 The data entered into SPSS showed a Cronbach's Alpha of 0.774, indicating the reliability of the data. Most of the data collected from the respondents had a Cronbach's alpha above 0.7, which indicates the degree of validity of the data.

LIMITATIONS

Most items in the questionnaire showed consistency in the way the answers were given. The FBC competitiveness data collected had a Cronbach's alpha of 0.545 and a Cronbach's alpha based on standardized items was 0.556, mainly due to the structure of the question being derived not from existing literature but from the researcher.

ETHICAL CONSIDERATIONS

Information relating to e-commerce is widely available on the internet; however, some of the information about FBC Holdings Limited was not readily accessible. The researcher sought permission to conduct the research and only used information that was used and any other information that was in the public domain.

SUMMARY

INTRODUCTION

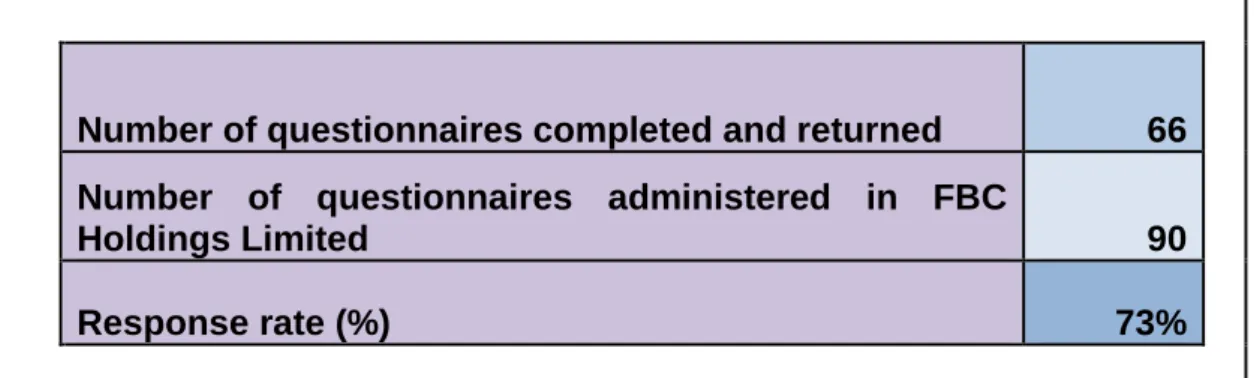

RESPONSE RATE

DEMOGRAPHIC INFORMATION

GENDER

AGE AND POSITION

The study used a stratified random sampling method because most of the executives who know a lot about the adoption of e-commerce at FBC are over the age of 20.

DEPARTMENTS

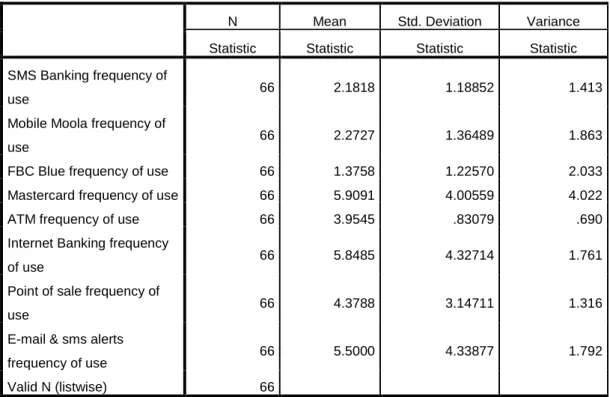

E-COMMERCE CHANNELS AND PRODUCTS AWARENESS,

FACTORS THAT ENCOURAGE EMPLOYEES TO USE AND

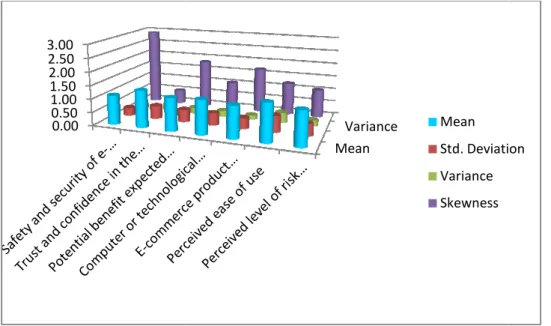

In general, the respondents agreed with the fact that factors such as the level of trust and confidence in e. This was also supported by a low variance of 0.151 and a skewness of 1.689, which was more inclined to rank 2, which represented "agree" on the Likert scale used in the study.

LEVEL OF COMPETITIVENESS OF FBC HOLDINGS IN LIGHT OF

UNIQUE PRODUCTS OFFERED BY FBC HOLDINGS LIMITED

In 2013, the bank relaunched mobile moola, which was originally launched in 2012 in partnership with Telecel and Zimswitch. The findings show that Mobile Moola, FBC Blue and MasterCard are not popular among employees.

E-COMMERCE PRODUCTS NOT OFFERED BY FBC

Automated Statements - Internet banking, SMS banking and Mobile Moola have helped reduce requests for hard copies of bank statements, especially for individual customers. This type of facility sends statements to customers at the end of the day from the core banking system.

STRATEGIC ALLIANCES

66 suggested that companies can gain competitive advantage by reducing the costs incurred by customers to access a product or service.

IMPACT OF E-COMMERCE ON FBC PROFITABILITY

FBC PRODUCTS CONTRIBUTION TO PROFIT

Business loans are thought to have made the greatest contribution to profit, as indicated by a mean of 4.1818 on a ranking scale of 1 to 5, where 1 represents the least contribution to profit, 3 represents moderate contribution, and 5 represents the highest contribution to profit. Insurance services are thought to have the least contribution to profit as shown by a mean of 2.333, with a skewness of 0.652.

FBC E-COMMERCE PRODUCTS CONTRIBUTION TO PROFIT

Individual customers who withdraw cash from the branches make use of the branch-installed point of sale machines. Some customers who buy products in supermarkets such as TM, Pick "n" Pay and Spars use the merchant point of sale.

FBC HOLDINGS FINANCIAL PERFORMANCE

The increase in e-commerce adoption levels is expected to result in an increase in the number of daily transactions at FBC, which would ultimately result in an increase in fees and commission income for FBC. This is because personnel costs are a function of the number of employees and other variables such as qualification level and position.

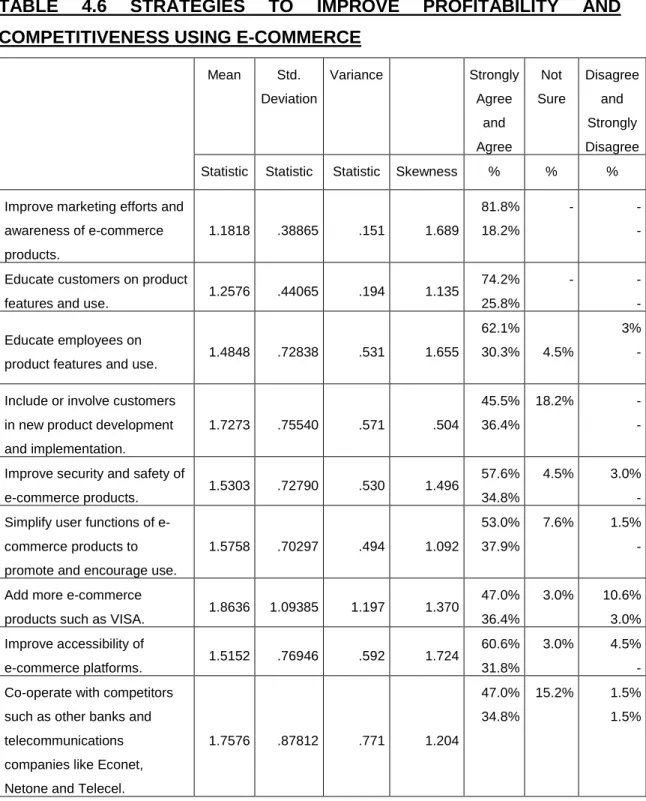

STRATEGIES TO IMPROVE PROFITABILITY AND

73 From table 4.6 most of the respondents (92.4%) agreed and strongly agreed that FBC should improve the safety and security of e-commerce products although 4.5% of the respondents were not sure while 3% were not agree and disagree completely. A total of 92.4% of respondents indicated that employees should be educated about product features and usage in order to encourage e-commerce adoption.

SUMMARY

The bank has worked with Netone through m-wallet and Econet, Netone and Telecel on mobile moola. However, banks such as CBZ are working with companies such as Econet on the eco-cash platform.

INTRODUCTION

CONCLUSIONS

HOW THE ADOPTION OF E-COMMERCE HAS CONTRIBUTED

LEVEL OF COMPETITIVENESS OF FBC HOLDINGS IN LIGHT OF

IMPACT OF E-COMMERCE ON THE COST STRUCTURE OF FBC

RESEARCH HYPOTHESIS VALIDATION

Hypothesis 1

Hypothesis 2

Hypothesis 3

RECOMMENDATIONS

ADOPTION OF E-COMMERCE

E-COMPETITIVENESS

This will help reduce costs and time on both the bank's side and the customer's side. This will also help promote a "paperless" environment and reduce office and office equipment costs.

STRATEGIES TO IMPROVE PROFITABILITY AND

This helps pass the time and allows employees to focus on other customer retention strategies such as promotions and targeted marketing. This will help FBC focus more on customers who contribute a larger share of revenue and give appropriate consideration to customers who contribute less to FBC's overall revenue or earnings.

AREAS FOR FURTHER RESEARCH

The International Journal of Applied Economics and Finance, Volume 4. Mobile banking: can elephants and hippos tango. Payment services in the Netherlands: An analysis of revenues and costs for banks, final report, 10 July, page 25.

QUESTIONNAIRE

Which of the following e-commerce products do you think contributed to FBC's profitability. What do you think the bank should do to improve the profitability of e-commerce products.

INTERVIEW GUIDE

FBC HOLDINGS LIMITED FINANCIAL HIGHLIGHTS