The total budget of the market for the financial year 2015/16 is R118 million, which includes a financial allocation. For the ongoing monitoring and maintenance of the current CCTV network infrastructure, an amount of R54.8 million has been allocated for the 2015/16 financial year. iv).

COUNCIL RESOLUTIONS

EXECUTIVE SUMMARY

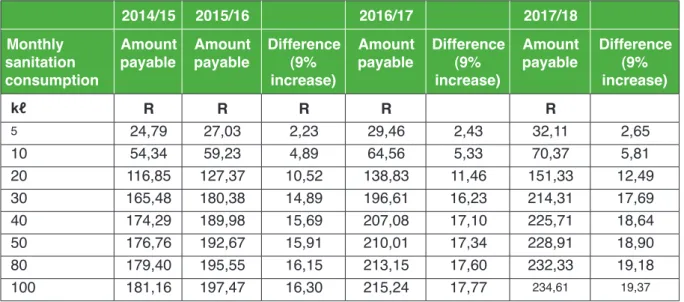

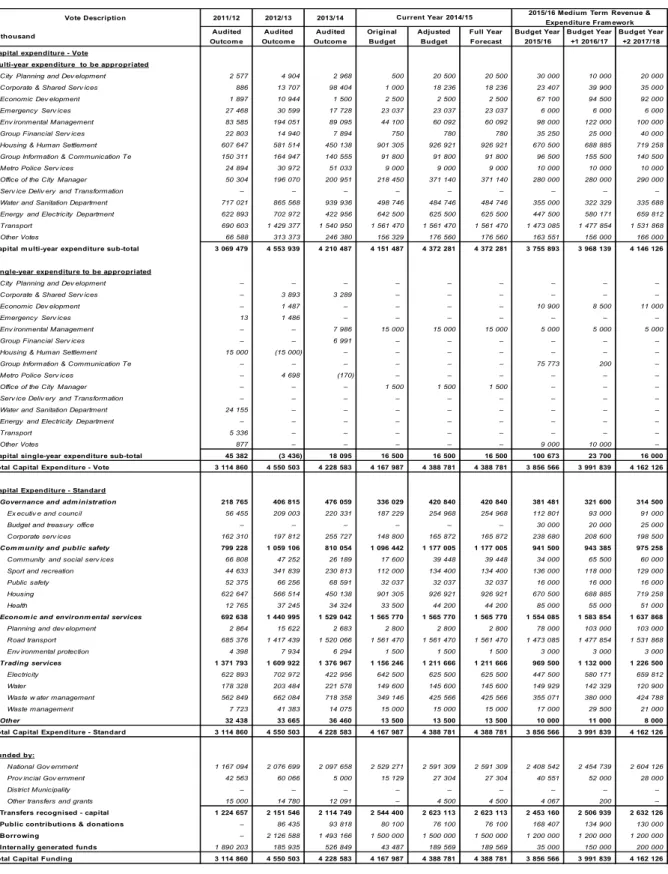

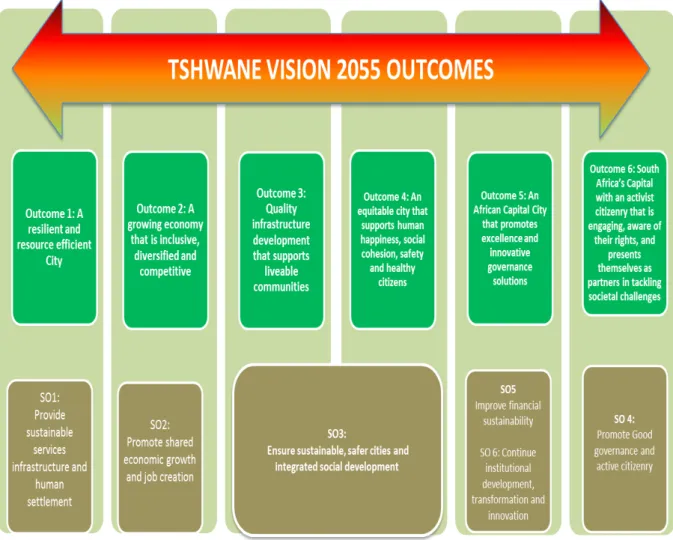

Subsequently, through the development of Tshwane Vision 2055, the City has established a long-term development agenda that will guide all future initiatives of the City. The financing capacity of the capital budget amounts to R3.9 billion, R4.0 billion and R4.2 billion over the medium term.

OPERATING REVENUE FRAMEWORK (PARENT)

- PROPERTY RATES

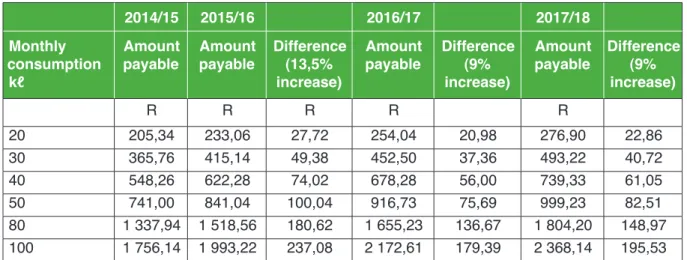

- SALE OF WATER AND IMPACT OF TARIFF INCREASES

- SANITATION AND IMPACT OF TARIFF INCREASES

- SALE OF ELECTRICITY AND IMPACT OF TARIFF INCREASES

- REFUSE REMOVAL AND IMPACT OF TARIFF INCREASES

- OTHER TARIFFS

- OVERALL IMPACT OF TARIFF INCREASES ON HOUSEHOLDS

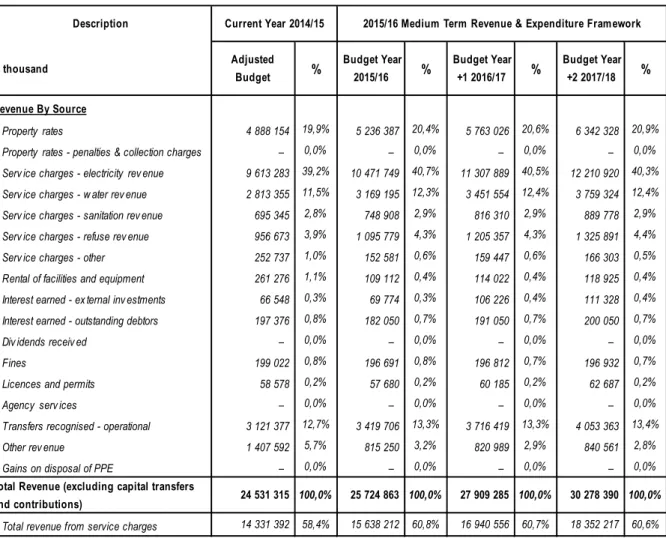

In the 2014/15 financial year (adjustment budget), revenue from fees and service charges amounted to R19.2 billion (78.3%) of total revenue, excluding capital transfers and contributions. Klipkruisfontein Resort is operational and rates will be the same as Kwaggaspruit Resort.

OPERATING EXPENDITURE FRAMEWORK (PARENT)

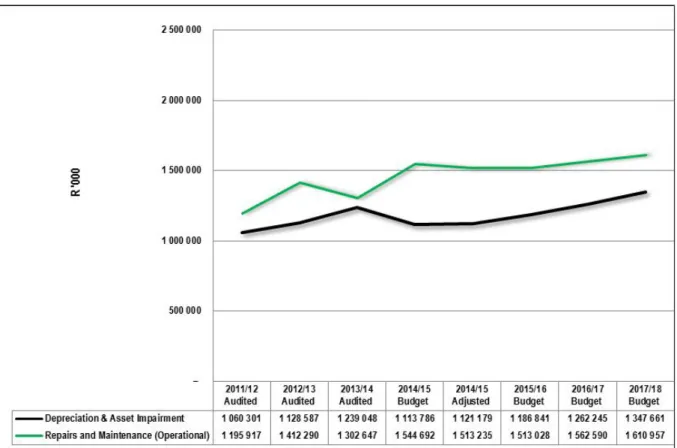

REPAIRS AND MAINTENANCE

In terms of National Treasury rules and formats, repairs and maintenance are divided among other materials, contracted services, and other expenses. In terms of the National Treasury MFMA Circular 55, only primary costs related to repairs and maintenance were included in the draft 2015/16 MTREF.

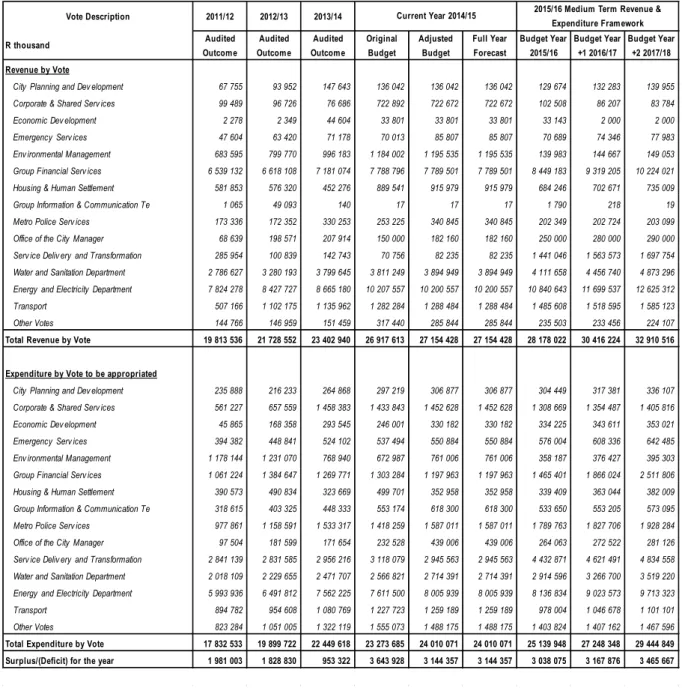

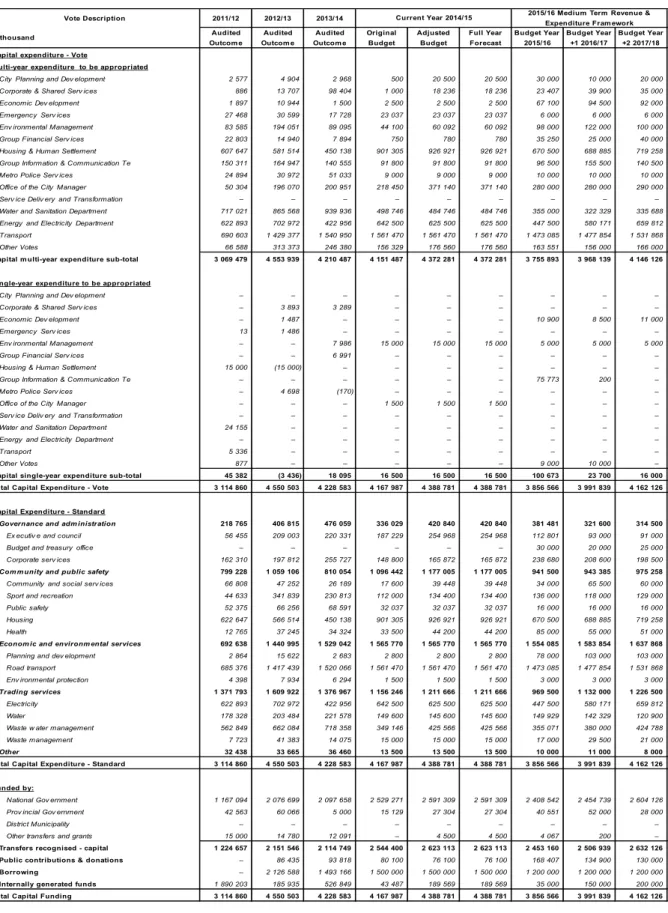

CAPITAL EXPENDITURE

FUTURE OPERATIONAL COSTS OF NEW INFRASTRUCTURE

ANNUAL BUDGET TABLES – PARENT MUNICIPALITY

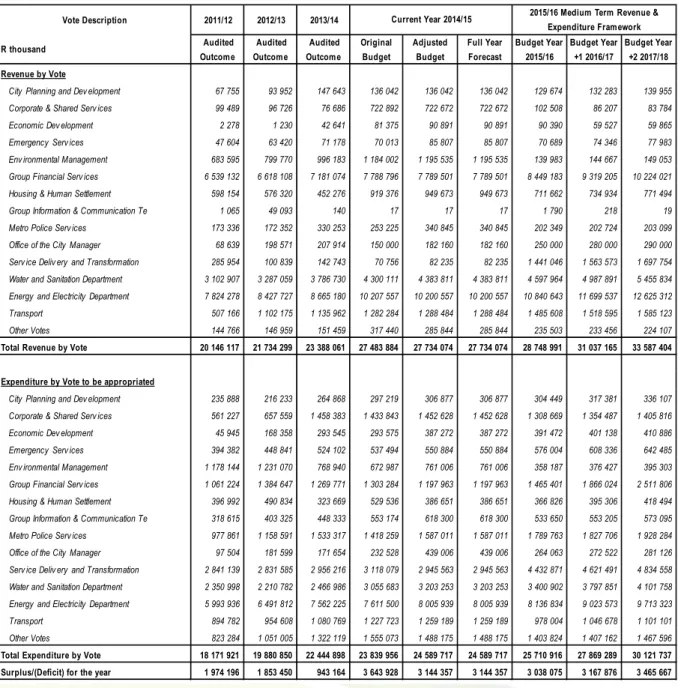

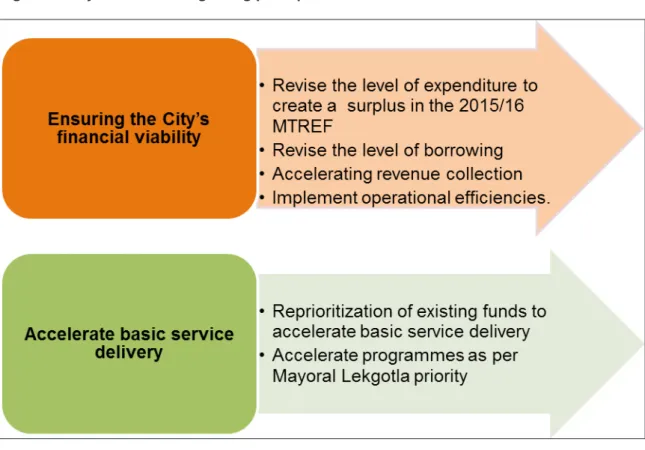

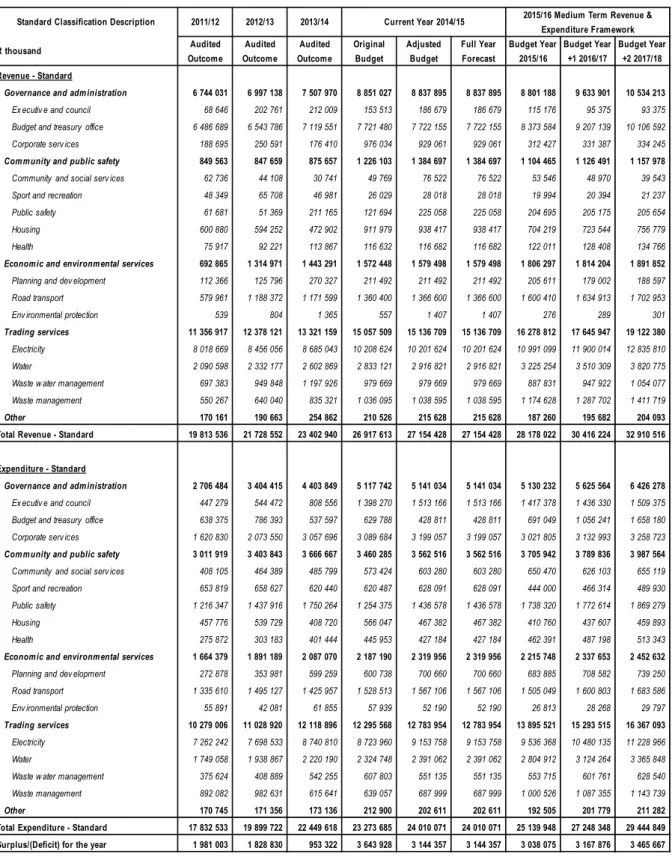

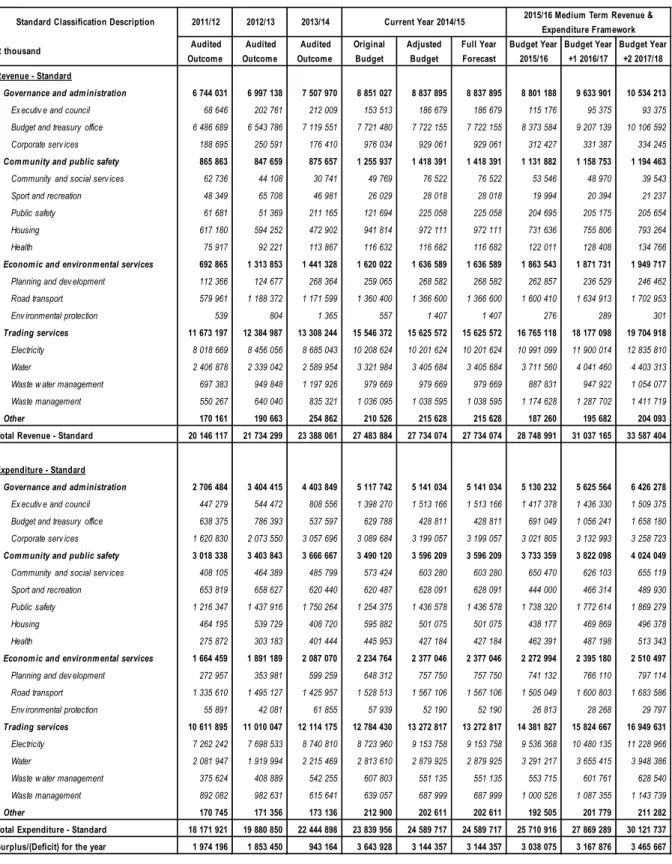

This requires the simultaneous assessment of financial performance, financial position and cash flow budgets, along with the capital budget. MBRR A2 provides an overview of the budgeted financial performance in relation to income and expenditure per standard classification. MBRR A3 provides an overview of budgeted financial performance in relation to revenue (including capital transfers and contributions) and expenditure by municipal vote.

This table facilitates the view of the budgeted operational performance in relation to the organizational structure of the city. The justification is that the property and net assets of the municipality are owned by the community. MBRR A10 provides an overview of service delivery levels, including backlogs (below the minimum service level), for each of the main services.

The table summarizes the amounts for operating performance, resources committed to capital expenditures, financial position, cash and funding compliance. The decrease in Other income of 35.0% compared to FY 2014/15 should be taken into account, mainly due to a non-recurring amount of R500.0 million for the sale of land during FY 2014/15. This represents 19.9% of the city's operating revenue base (2015/16) and therefore remains a major source of funding for the council.

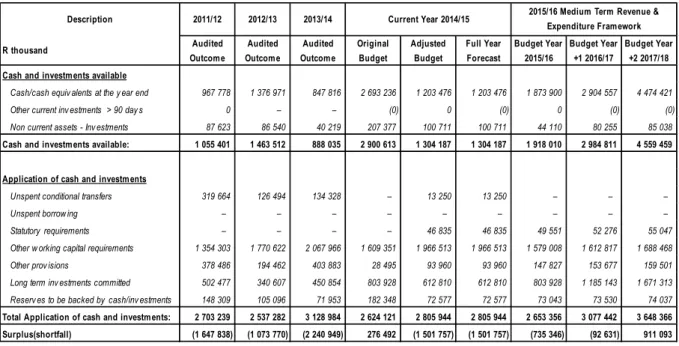

A decrease of 35.0% in other income compared to the 2014/15 financial year should be taken into account, mainly due to a one-off amount of R500.0 million for the sale of land in the 2014/15 financial year. For example, the assumption of the collection rate will affect the cash position of the municipality and in turn inform the level of cash and cash equivalents at the end of the year. A cash flow statement shows the expected level of cash inflow versus cash outflow likely to result from budget execution.

OVERVIEW OF THE ANNUAL BUDGET PROCESS

BUDGET PROCESS OVERVIEW

In terms of section 21 of the MFMA, the Executive Mayor is required to present a timetable to Council ten months before the start of the new financial year (August) outlining the process for reviewing the IDP and presenting the budget prepare. The Executive Mayor tabled the required IDP and budget timetable in Council on 28 August 2014. To table the draft 2015/16 MTREF 26 March 2015 Public consultation and outreach April 2015 Approval of Municipal Entities' budgets by Council 30 April 2015 State of the Capital Address by Executive Mayor 14 May 2015.

While the IDP represents the city's strategic intent, there is also an understanding of the challenges to achieving the strategic objectives. The ultimate objective remains the approved implementation of the City's five-year strategy and ensuring improved responsiveness to community needs over time. In the meantime, the city has developed a draft long-term strategy to achieve long-term results and vision, ie. Tshwane Vision 2055 and Growth and Development Strategy.

FINANCIAL MODELLING AND KEY PLANNING DRIVERS

COMMUNITY CONSULTATION

OVERVIEW OF ALIGNMENT OF ANNUAL BUDGET WITH IDP

In 2055, Tshwane is liveable, resilient and inclusive, where citizens enjoy a high quality of life, have access to social, economic and enhanced political freedoms and where citizens are partners in developing Africa's capital of excellence. The vision set out six outcomes to be achieved over the next four decades. The alignment between the Tshwane Vision 2055 outcomes and the approved IDP strategic objectives is shown in the diagram below.

MEASURABLE PERFORMANCE OBJECTIVES AND INDICATORS

PERFORMANCE INDICATORS AND BENCHMARKS

- Borrowing management

- Liquidity

- Revenue management

- Creditors’ management

- Other indicators

The City's borrowing strategy is to access financing at the best and most competitive market terms, including the longest terms available. Therefore, the city will use any of the financing mechanisms available to it, or a combination thereof, to borrow funds as long as its financing strategy is satisfied. The city is in the process of implementing its credit optimization strategy in order to create capacity for future borrowings, reduce the overall cost of borrowing and achieve an optimal loan portfolio.

The city has set aside money to cancel bullet long-term loans as they mature and continues to build up these funds for the same purpose. A Joint Operating Committee (JOC) for Revenue was established to improve revenue collection and pool revenue collection efforts in the city. The city has ensured that creditors with completed and approved documents are paid within the legal deadline of 30 days after the declaration, while SMEs are paid within 15 days.

Free basic services: Basic social services package (applicable to registered indigent households)

This plan introduced monthly water loss meetings that address issues related to rehabilitation of outdated distribution networks, water leakage detection and water pressure management. The incorporation of the Metsweding areas contributed to higher percentages of both electricity and water distribution losses.

Providing clean water and managing waste water (Blue Drop and Green Drop performance rating)

Former Kungwini Local Municipality, now incorporated into the City of Tshwane as of July 1, 2012, received an overall score of 95.76% and Former Nokeng Tsa Taemane Local Municipality, which was also incorporated at the same time, received a score of 90.75 %. The City of Tshwane's Waste Water Treatment Works (WWTWs) received an average Municipal Green Drop rating of 63.8% for the 2011 Green Drop rating. The waste water treatment plants of the former Kungwini Local Municipality received an Average Municipal Green Drop rating of 29.3% and the former Nokeng Tsa Taemane Local Municipality a score of 70.5% for the 2011 Green Drop rating.

However, the Department of Water and Sanitation faces various challenges in order to increase the Green Drop rating for the greater city of Tshwane and successfully obtain Green Drop certifications for all wastewater treatment works. In 2011, a thorough strategic review of the wastewater treatment works in the greater Tshwane area was completed and an upgrade program was drawn up to meet the wastewater treatment constraints. The Water Security Plan Version 2 for the City of Tshwane was finalized and signed in January 2013.

OVERVIEW OF BUDGET-RELATED-POLICIES

- REVIEW OF CREDIT CONTROL AND INDIGENT-RELATED PROCEDURES OR POLICIES

- MUNICIPAL PROPERTY RATES POLICY

- ASSET MANAGEMENT, INFRASTRUCTURE INVESTMENT AND FUNDING POLICY

- ADJUSTMENT BUDGET POLICY

- SUPPLY CHAIN MANAGEMENT POLICY

- BUDGET POLICY

- CASH MANAGEMENT AND INVESTMENT POLICY

- TARIFF POLICIES

- LONG-TERM FINANCIAL MODEL

- THE FOLLOWING BUDGET-RELATED POLICIES ARE AVAILABLE ON THE CITY’S WEBSITE

MFMA section 78, subsection 1, requires that the municipality's assets and liabilities must be managed effectively and that assets must be secured and maintained to the extent necessary. The budget policy, which includes the transfer of funds policy, aims to provide senior managers with an effective financial and budgetary amendment and control system to ensure optimal service delivery within the legislative framework of the MFMA and the City's delegation system. The municipality's strategy for cash backing of the capital reserves, capital provisions and unused conditional grants as well as external borrowing aims to ensure the city's sustainability in the medium to long term.

The strategy is informed by, among others, the relevant GRAP accounting standards, sections 18 and 19 of the MFMA, and National Treasury Circular 48. The monthly cash flow status of the City, including the status on certain critical dates of the following calendar month, is submitted monthly to the MMC for Finance. The Long Term Financial Model directly informed the composition of the 2015/16 MTREF with an emphasis on affordability and long term sustainability.

OVERVIEW OF BUDGET ASSUMPTIONS

- EXTERNAL FACTORS

- GENERAL INFLATION OUTLOOK AND ITS IMPACT ON THE MUNICIPAL ACTIVITIES

- CREDIT RATING OUTLOOK

- INTEREST RATES FOR BORROWING AND INVESTMENT OF FUNDS

- COLLECTION RATE FOR REVENUE SERVICES

- GROWTH OR DECLINE IN THE TAX BASE OF THE MUNICIPALITY

- SALARY INCREASES

- IMPACT OF NATIONAL, PROVINCIAL AND LOCAL POLICIES

- ABILITY OF THE MUNICIPALITY TO SPEND AND DELIVER ON THE PROGRAMMES

The municipality's strategy is to gain access to funds on competitive terms and for the longest possible duration, with the aim of ensuring that the liability exposures taken on match the useful life of the assets financed through these liabilities. The city has an existing DMTN program through which it raises bonds, and the bond market remains an opportunity for the city to access long-term borrowing. The municipality therefore has an option to use any of the financing mechanisms available to it, or a combination thereof, as long as such a mechanism supports its financing strategy.

The city is in the process of implementing its credit optimization strategy with the aim of creating capacity for future borrowings, reducing the overall cost of borrowing and achieving an optimal loan portfolio. Debtors' income is assumed to grow at a rate that is affected by the collection rate of consumer debtors, the rate or price of the rate, the real growth rate of the city, the growth rate of household formation, and the weak rate of household turnover. A salary increase of 5.4% was foreseen in the budget, in terms of the latest directive from SALGA, but negotiations on wages and salaries have not been finalized.

OVERVIEW OF BUDGET FUNDING

- MEDIUM-TERM OUTLOOK: OPERATING REVENUE

- MEDIUM-TERM OUTLOOK: CAPITAL REVENUE

- CASH FLOW MANAGEMENT

- CASHBACKED RESERVES OR ACCUMULATED SURPLUS RECONCILIATION

- Cash or cash-equivalent position

- Cash plus investments less application of funds

- Monthly average payments covered by cash or cash equivalents

- Surplus or deficit excluding depreciation offsets

- Property rates or service charge revenue as a percentage increase less macro-inflation target

- Cash receipts as a percentage of ratepayers and other revenue

- Debt impairment expense as a percentage of billable revenue

- Capital payments as a percentage of capital expenditure

- Borrowing as a percentage of capital expenditure (excluding transfers, grants and contributions)

- Consumer debtors change (Current and non-current)

- Repairs and maintenance expenditure level

- Asset renewal/rehabilitation expenditure level

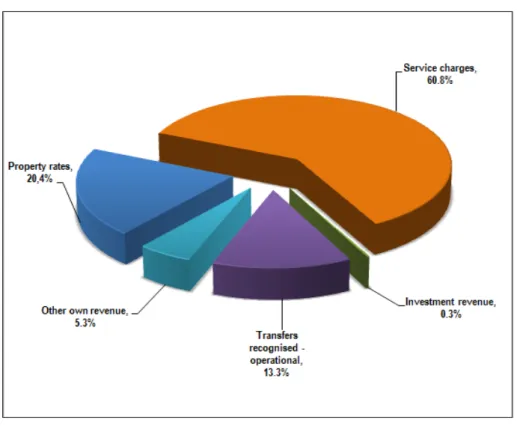

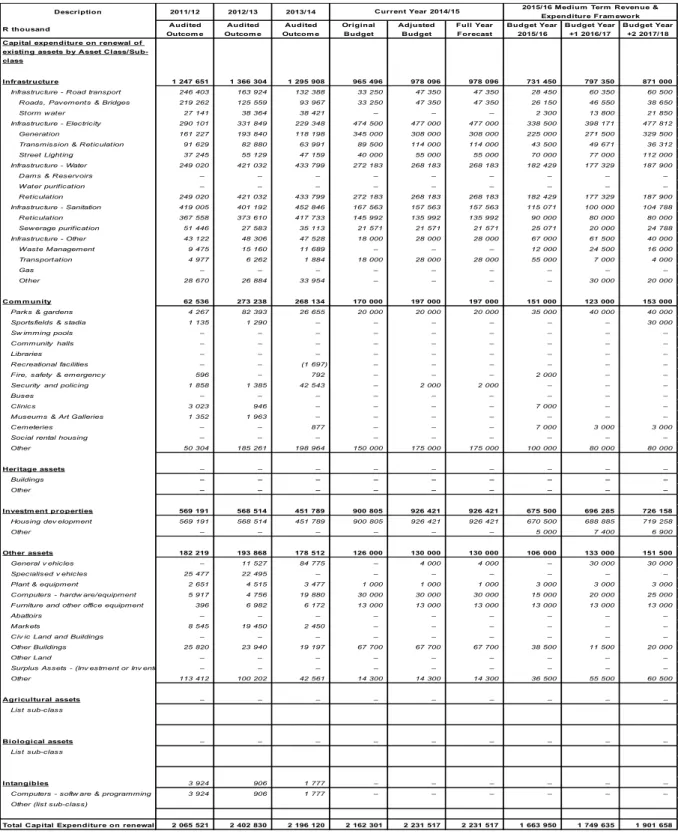

The following graph is a breakdown of the operating income per main category for the financial year 2015/16. Investment income contributes marginally to the City's revenue base with a budget allocation of R69.8 million, R106.2 million and R111.3 million for the respective financial years of the 2015/16 MTREF. The table below is a breakdown of the funding composition of the medium term capital program 2015/16.

Capital support and benefits represent 63.6% or R2.5 billion of the total funding source for the 2015/16 financial year. The city's forecasted cash position was considered as part of the projected cash flow statement. Details of the City's asset management and repair and maintenance strategy are contained in MBRR SA34c.

EXPENDITURE ON GRANTS AND RECONCILIATIONS OF UNSPENT FUNDS

TRANSFERS AND GRANTS MADE BY THE MUNICIPALITY

COUNCILLOR AND EMPLOYEE BENEFITS

CONTRACTS WITH FUTURE BUDGETARY IMPLICATIONS

CAPITAL EXPENDITURE DETAILS

Post-Vote Future Operating Expenses City Planning and Development Corporate and Community Services Economic Development Emergency Services Environmental Management Group Financial Services Housing and Settlement Group Information and Communications Metro Police Services. City Manager's Office Services Ice Delivery and Conversion Department of Water and Sanitation Department of Energy and Electricity Transportation. Property Rates - Penalties and Collections Service Charges - Electricity Revenues Service Charges - Water Revenues Service Charges - Sanitary Revenues Service Charges - Garbage Revenues Service Charges - Other Premises and Equipment Rentals List other sources of revenue if applicable, list entity summary , if applicable.

Boikanyo c/o Maboea & Ndongeni str Atteridgeville Ke a leboga c/o Tweele & Tsele str Saulsville Itumeleng c/o Mamatshe & Manakolela str Atteridgeville. Sephetho sa peleng Ngwaga wo o swanetšego go Phetha Ngwaga wa Bjale Tlhako ya Letseno le Ditshenyegelo tša Lebaka la Magareng Voutu ya Mmasepala/Motsemošate Protšeke Leina la Protšeke Nomoro ya Protšeke Sehlopha sa Letlotlo 3 Letlotlo Sehlopha sa ka fasana sa 3.

STATUS OF COMPLIANCE WITH LEGISLATION

MUNICIPALITY SUPPORTING TABLES