The outlook remains highly uncertain, and the economic consequences of the pandemic have far-reaching results. Therefore, the sustainability of the municipality will depend a lot on how they collected and spent their own income.

2021/2022 REVENUE

HIGH LEVEL BUDGET SUMMARY

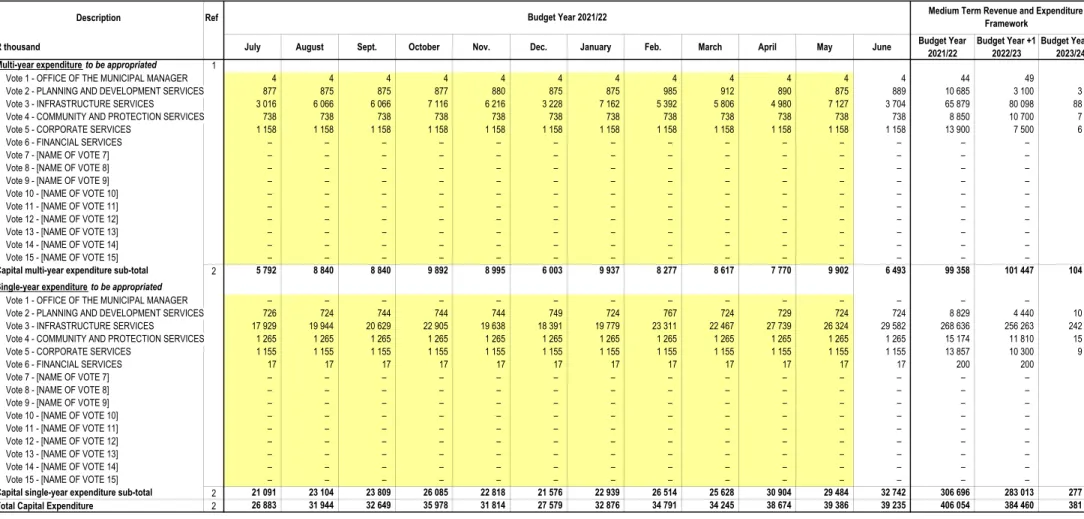

ANNUAL BUDGET TABLES

Total expenses by functional classification must agree with total operating expenses shown in Budgeted Financial Performance (Revenues and Expenses). Must be reconciled with financial results ('Income and expenses by functional classification' and 'Income and expenses') 3.

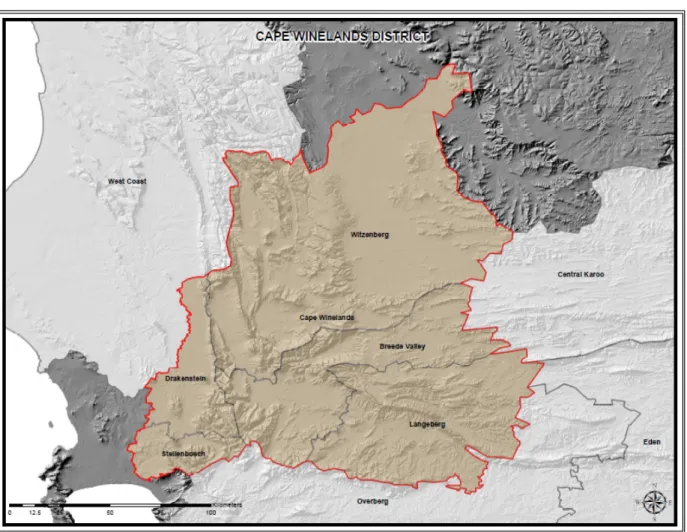

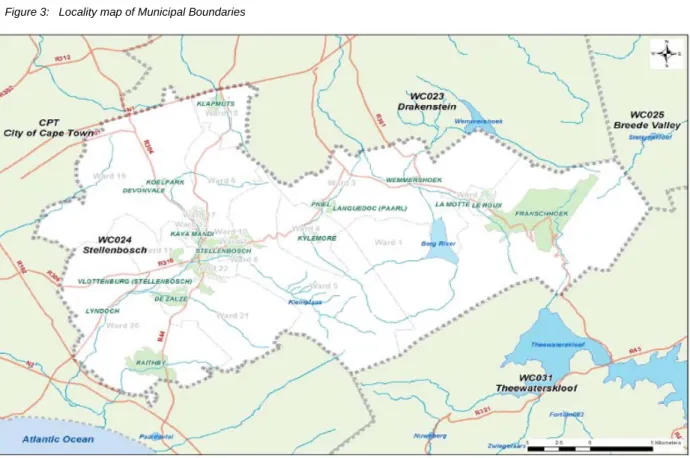

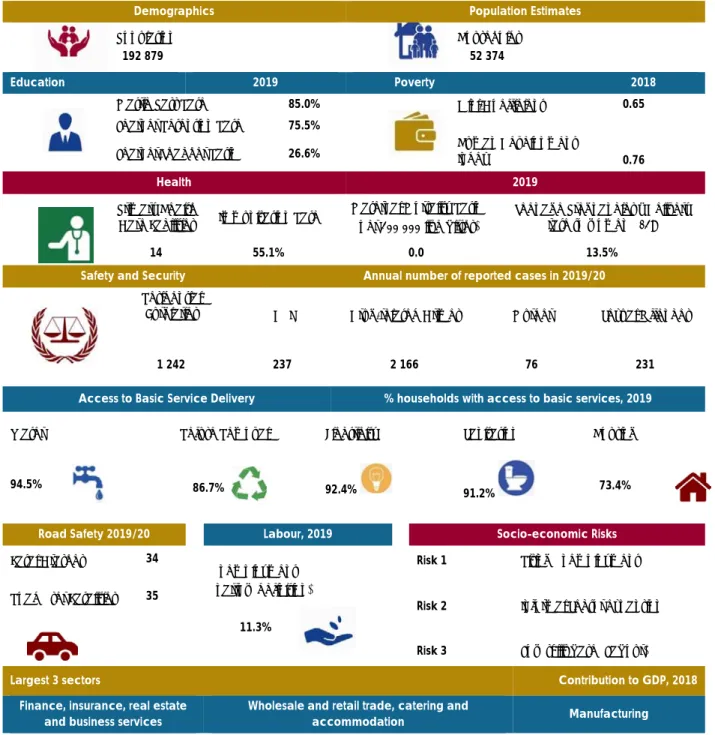

OVERVIEW OF STELLENBOSCH MUNICIPALITY Background

- Population Growth

- Wards

- State of the Greater Stellenbosch

- Stellenbosch at a Glance

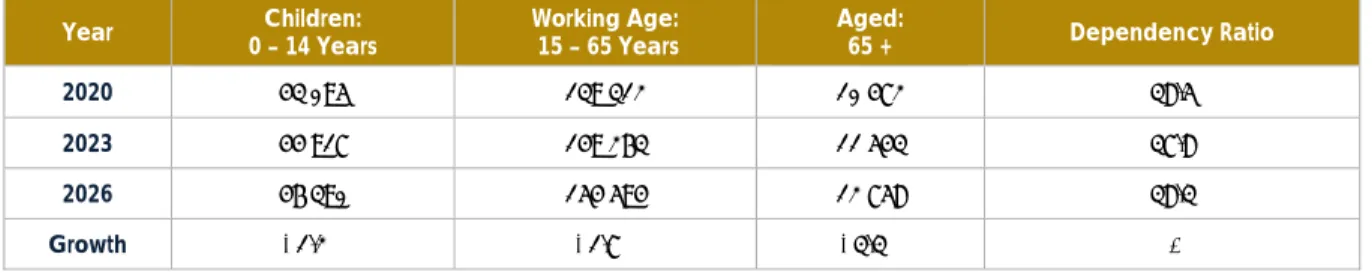

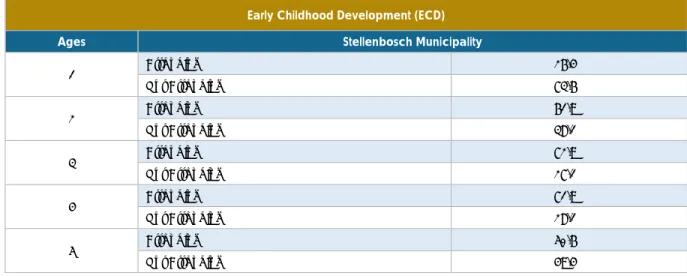

- Socio-Economic Context .1 Population

- Sex Ratio

- Age Cohorts

- Household sizes

- Population density

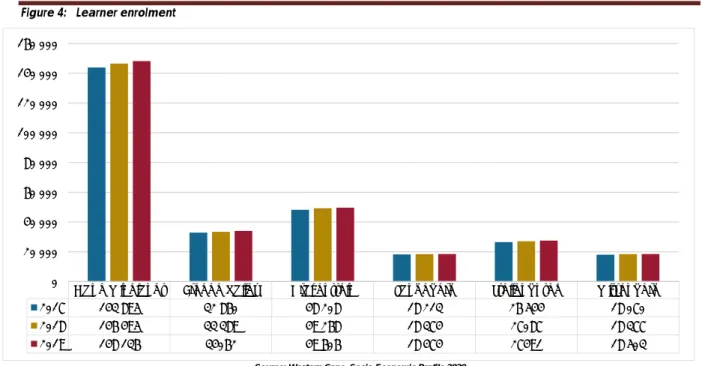

- Education

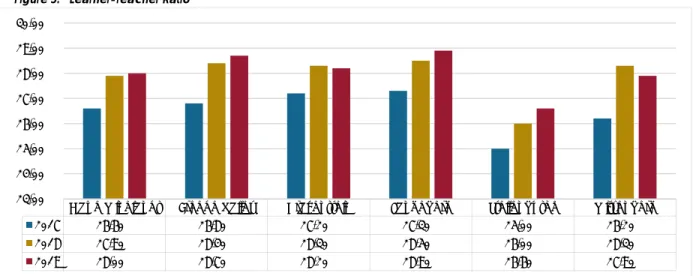

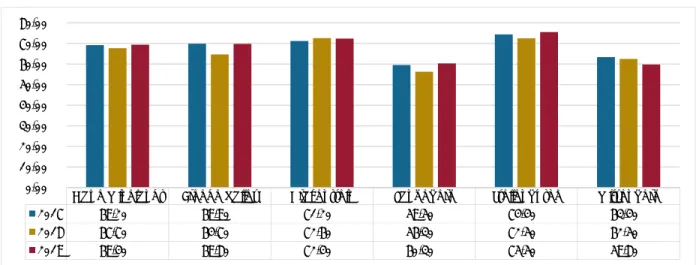

- Learner enrolment, the learner-teacher ratio and learner retention rate

- Number of schools and no-fee schools

- Schools with libraries and media centres

- Schools with libraries

- Education Outcomes (Matric Pass Rates)

- Health

- Emergency Medical Services

- HIV / AIDS / TB

- Child Health

- Maternal Health

- Poverty

- GDPR Per Capita

- Income Inequality

- Human Development

- Basic Service Delivery

- Housing and Household Services

- Free Basic Services

According to the above comparison, Stellenbosch has the highest densities in the Cape Winelands District. Stellenbosch, with 6,960 patients, represents 21.5 percent of patients receiving ART in the Cape Winelands District.

Total number of households

Safety and Security .1 Murder

- Sexual Offences

- Drug-related Offences

- Driving under the influence (DUI)

- Road user fatalities

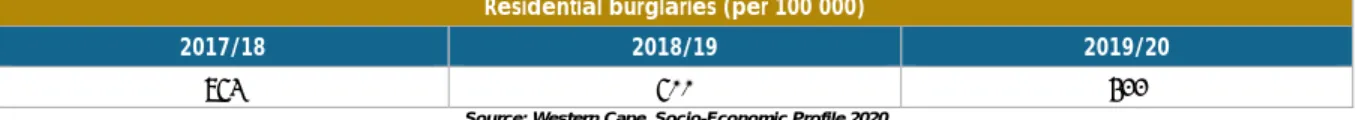

- Residential Burglaries

Drug-related crimes refer to the situation where the perpetrator is found to be in possession of, under the influence of, or selling illegal drugs. A situation where the driver of a vehicle turns out to be above the legal blood alcohol limit. The number of cases of driving under the influence of alcohol or drugs in the Stellenbosch area shows a decrease from 309 in 2019 to 237 in 2020.

Crime statistics for 2019/20 released by the SAPS and Stats SA indicate that the number of residential burglaries fell by 6.7 per cent in South Africa. Within the Western Cape province, residential burglaries fell by 8.5 percent between 2019 and 2020.

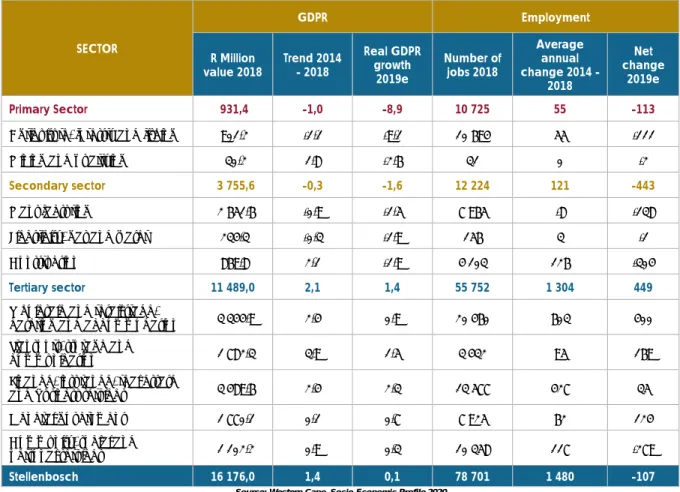

Economy and Labour Market Performance

- Sectoral Overview

- Formal and Informal Employment

- Unemployment

The broad definition generally refers to people who are able to work but are not actively seeking employment.

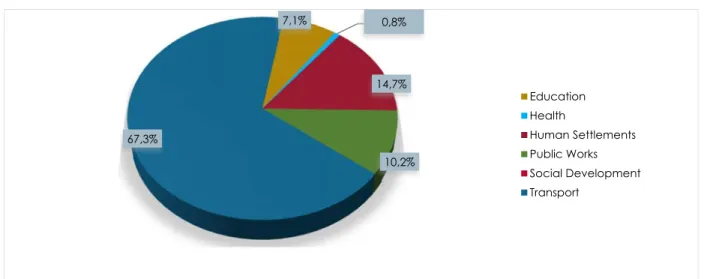

Public Infrastructure Spending .1 Spending on Social Infrastructure

- Spending on Economic Infrastructure

- Spending on Trading Services

Given the sluggish economic growth across the country, spending on economic infrastructure is critical to stimulating economic activity. The WCG allocated R169.256 million (77.5 percent) to economic infrastructure, more specifically to transport (R147 million) and public works (R22.256 million). Transport and public works infrastructure go a long way towards unlocking the region's economic potential, particularly due to its tourist destination and proximity to the city's economic hub.

As part of the economic infrastructure allocation, the municipality will also contribute 52.5 million rana for planning and development and 1.8 million rana for environmental protection. Basic services are key to improving the living conditions of citizens in the municipal area and enabling economic activity for companies through access to water, electricity, sanitation and garbage collection. Most of the municipality's budget for infrastructure is dedicated to providing basic services.

The majority of trade services expenditure has been allocated to waste water management (R109.7m). Planning and development Road transport Environmental protection Social development Sport and leisure Public safety Housing Health Electricity Water Waste water management Waste management Other Figure 15: Municipal infrastructure expenditure.

LEGISLATIVE ENVIRONMENT Legal Requirements

Local Government: Local Government Financial Management Act, 2003 - Municipal Cost Containment Regulations (Draft) - 16 February 2018/ Cost Containment Regulations issued June 2019. Local Government Conditional Grants & Additional Grants and Changes to the Structure of Conditional Grants. The guidelines in the above circulars, appendices and other financial factors were taken into account and informed budget formulation and preparation.

OVERVIEW OF ANNUAL BUDGET PROCESS

Improve educational outcomes and opportunities for growth and jobs (2) Enhance well-being, security and address social problems (3). To achieve an accountable, effective and efficient local governance system (9) To create a better South Africa and a better and safer Africa and the world (11). Building an efficient, effective and development-oriented public service and an empowered, fair and inclusive citizenship (12).

Performance Management is a system intended to manage and monitor service progress against identified strategic objectives and priorities. Measurability: Performance indicators are well-defined and verifiable, and goals are specific, measurable, and time-bound. Relevance: Performance indicators have a logical and direct relationship to an aspect of the municipality's mission and the achievement of its strategic goals and objectives.

Stellenbosch Municipality targets, monitors, assesses and reviews organizational performance which in turn is directly linked to individual employee performance. The performance of the municipality is directly related to the extent to which it has succeeded in realizing its goals and objectives, meeting legislative requirements and meeting the expectations of stakeholders. The Five Year Top Level Service Delivery and Budget Implementation is part of the Integrated Development Plan and the financial performance objectives are captured in supporting table SA7.

OVERVIEW OF MUNICIPAL BY-LAWS BUDGET RELATED POLICIES The following policies are new

The purpose of the policy is to regulate spending and implement cost containment measures in the Stellenbosch Local Municipality. The goals of this policy are to ensure the effective, efficient and economic use of the municipality's resources and to implement measures to limit costs. This policy provides the accounting framework applicable to the municipality's finances and is set out in the Municipal Finance Management Act (Act No 56 of 2003).

Tariffs will be calculated in different ways depending on the nature of the service being provided. In accordance with Article 75(1) of the Systems Act, the municipal council must adopt by-laws for the implementation and enforcement of its tariff policy. The policy will enforce the requirements and provisions of the Municipal Finance Management Act and the Municipal Budget and Reporting Framework in terms of the approved budget and will apply to all municipal employees and councilors who participate in the implementation of the budget.

The policy aims to give effect to the requirements and provisions of the Act on Municipal Financial Management and Municipal Budgeting and Reporting Framework in terms of the planning, preparation and approval of the annual and adjustment budgets. The policy aims to give effect to the requirements and provisions of the Act on Municipal Financial Management and Municipal Budgeting and Reporting Framework. This policy will apply to all active industry sectors within the Stellenbosch Municipal area and must be read together with the supply chain management policy of the municipality.

OVERVIEW OF KEY BUDGET ASSUMPTIONS

Budgetary constraints and financial challenges meant that the council had to employ a combination of cost-cutting measures and higher than headline CPI revenue increases to ensure a sustainable budget in the medium term. This was reiterated in National Treasury Budget Circular 108, which states that "...municipalities should take a conservative approach when projecting their expected revenue and cash receipts. Municipalities should also pay particular attention to managing all revenue and cash flows effectively and carefully evaluate all spending decisions.”

In the previous financial year, the municipality took measures to control telephone use, which resulted in a reduction in telephone costs. During the new fiscal year, the municipality plans to implement measures that will reduce legal expenses by focusing more on internal capacity building rather than using hired/outsourced consulting and legal services. These are some of the initiatives that the municipality wants to implement under the budget theme.

HIGH LEVEL BUDGET OVERVIEW

As mentioned in the aforementioned text and in the Council point; significant investment in infrastructure is critical to maintaining a sustainable level of service provision.

OVERVIEW OF THE BUDGET FUNDING Financing of the Capital Budget

ALLOCATIONS AND GRANTS MADE BY THE MUNICIPALITY

- SUBJECT

- DELEGATED AUTHORITY

- EXECUTIVE SUMMARY

- RECOMMENDATIONS

- DISCUSSION / CONTENTS 1. Background

- Discussion

- Financial Implications

- Legal Implications

- Staff Implications

- Previous / Relevant Council Resolutions

- Risk Implications

- Comments from Senior Management

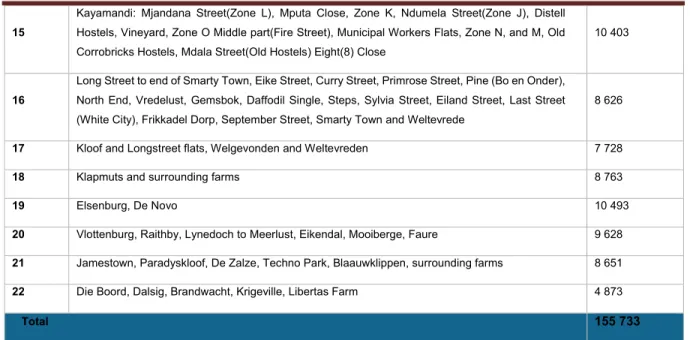

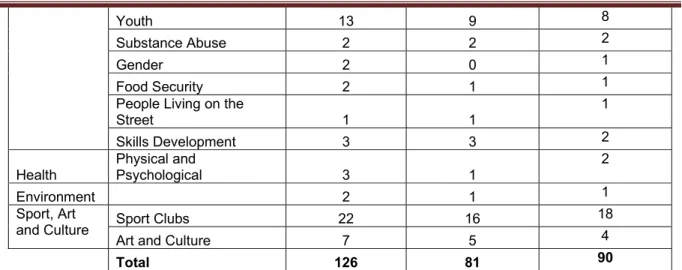

To obtain Council approval of Grant-in-Aid (GiA) applications and recommended donations for the financial year 2021-2022. The application is in the form of the annual GiA donations made to non-governmental organizations (NGOs), community-based organizations (CBOs), non-profit organizations (NPOs) or non-profit enterprises (NPC) and bodies used by the Government as an agency to serve the poor, marginalized or otherwise vulnerable as envisaged by the grant in the aid policy approved at the May 2020 Council meeting. a) This Council considers and approves the recommended donations to organizations under the detailed list. In accordance with the council's aid policy, proposals were invited by announcement in the press on 1 October 2020 (Eikestad Nuus) and on the municipality's website and Facebook page.

These intended donations were advertised as part of the draft budget for public comment with a closing date of 26 April 2021. Grant in Aid comments consist of appeals and the submission of feedback reports on previous funding received. Some of the organizations that have been conditionally approved for a donation have indicated that they were either unable to spend all of the funding received or could only spend a portion of the funds due to Covid-19 and the resulting containment regulations .

Organizations would be recommended to make a donation for the following fiscal year equal to the amount spent in the previous donation round and for which they could provide proof of expenditure. Due to the closing date for grant applications, the time it takes to complete assessments, the council's recess, staff on leave, and the deadline for submitting the draft budget, this report could not be sent to the entire senior management are sent. Funding of the grant to aid donations will be arranged under the Medium-Term Income and Expenditure Framework (MTREF/Budget).

COUNCILLOR AND BOARD MEMBER ALLOWANCES AND EMPLOYEE BENEFITS

COUNCILLOR AND BOARD MEMBER ALLOWANCES AND EMPLOYEE BENEFITS (continue)

MONTHLY TARGETS FOR REVENUE, EXPENDITURE AND CASH FLOW

CONTRACTS HAVING FUTURE AND BUDGETARY IMPLICATIONS

DETAIL CAPITAL BUDGET 2021-2024

MUNICIPAL MANAGER

PLANNING AND DEVELOPMENT SERVICES

CAPITAL BUDGET 2021 - 2024 INFRASTRUCTURE SERVICES

Environmental Management: Urban Greening Design and implement electronic Urban Forestry management tool COMMUNITY AND CONSERVATION SERVICES.

CAPITAL BUDGET 2021 - 2024

Environmental Management: Irrigation Systems for Urban Greening Environmental Management: Urban Greening Storage Containers: Fertilizers & Pesticides.

CORPORATE SERVICES

FINANCIAL SERVICES

LEGISLATION COMPLIANCE

Budget and Treasury Office - In accordance with ZUFMA, the Budget and Treasury Office was established. Formulation of the budget - The annual budget is prepared in accordance with the requirements prescribed by the State Treasury and the MFMA. Financial Reporting - 100% compliance with monthly, quarterly and annual reporting to the Executive Mayor, Mayoral Committee, Council, Provincial and National Treasury.

Annual report - The annual report is prepared in accordance with MFMA and National Treasury requirements.

OTHER SUPPORTING DOCUMENTS

WC024 Stellenbosch - Supporting table SA2 Matrix Financial Performance Budget (income source/expenditure type and department). National/provincial branch offices, households, non-profit institutions, private enterprises, public enterprises, higher education institutions). Total investments must match budgeted financial position ('current' call investment deposits plus 'long-term' investments). WC024 Stellenbosch - Supporting Table SA23 Salaries, Allowances and Benefits (Political Officers/Councillors/Senior Managers).