ANNUAL BUDGET

M AYOR ’ S R EPORT (B UDGET SPEECH )

In its efforts for youth development, the municipality prioritizes the implementation of educational programs that will promote a culture of learning and lead to an independent society that will contribute to the overall development of the locality. During the 2021 award ceremony, a total of seven educators who died due to complications from covid-19 were remembered. Hosting the Mayor's Matric Awards for three consecutive years has contributed immensely to the overall improvement in Matric results in the municipality.

We carried out a solid engagement with community members through intense meetings where the proposed budget and integrated development plan for the financial year 2021/2022 were discussed.

C OUNCIL R ESOLUTIONS

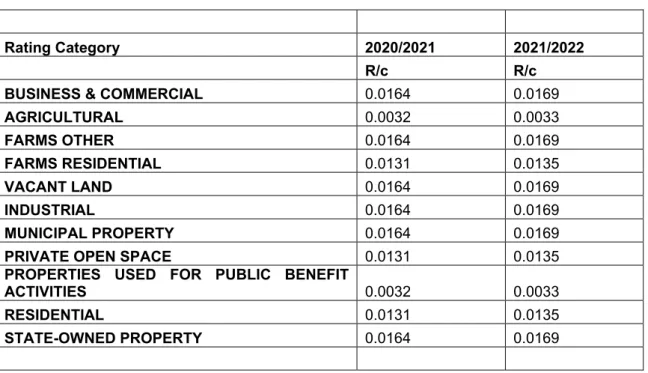

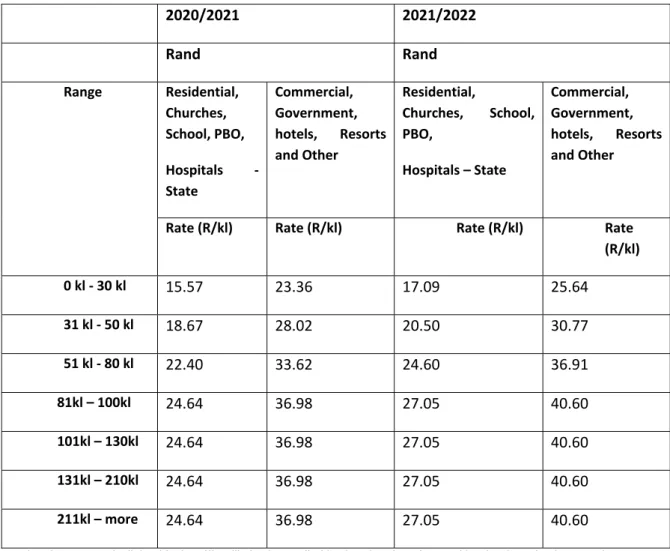

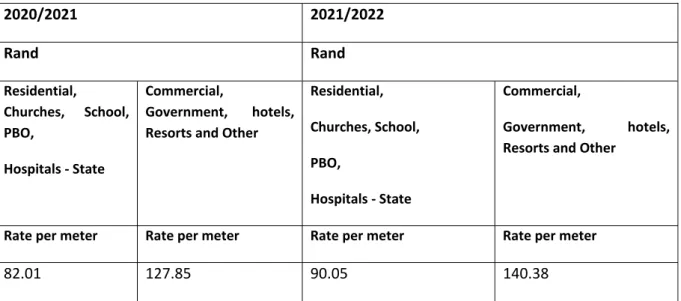

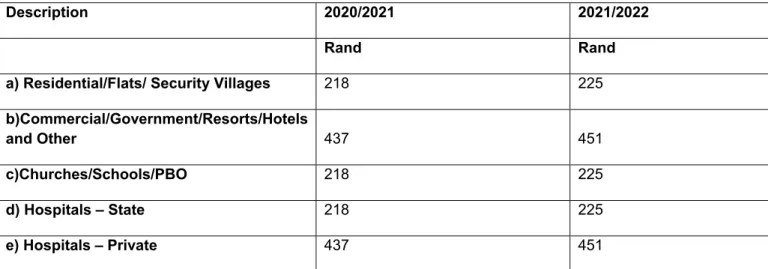

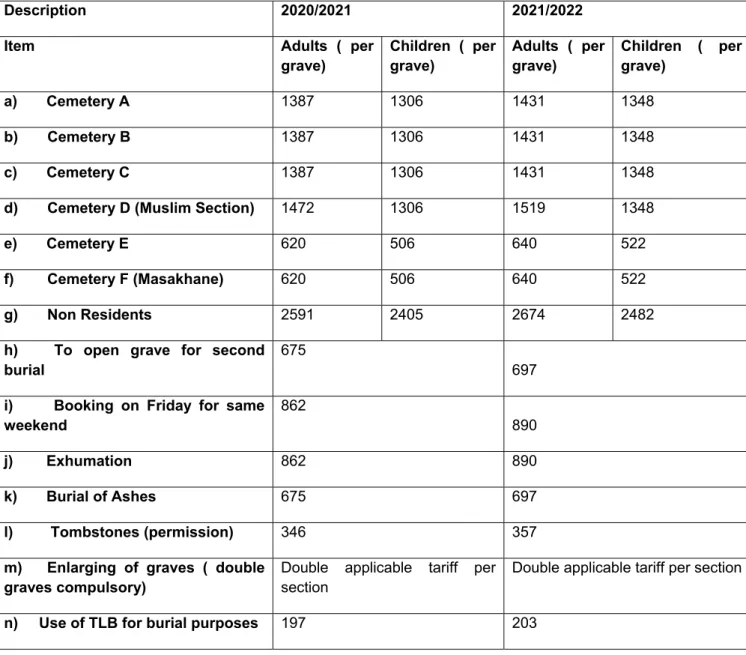

The Council of Bela-Bela Local Municipality, acting in terms of section 75A of the Act on Local Government: Municipal Systems (Act 32 of 2000), approves and accepts with effect from 1 July 2021 the rates and tariffs as set out in Schedule 2; . That the municipality does not budget to take out long-term loans to finance the capital budget. That the Accounting Officer complies with all prescribed requirements in terms of legislation regarding the submission of the budget document to the respective institutions.

E XECUTIVE S UMMARY

Prior to the preparation of the planning and budget process 2021/2022 to 2023/2024, a review of the municipality's service priorities was carried out. Sustainability – the estimates for income, expenses and cash flows are achievable in the short to medium term. The council has a role in drawing up policies that are used in the municipality's operations.

The municipality's Property Tax Policy approved in terms of the Municipal Property Tax Act, 2004 (Act 6 of 2004) (MPRA);. The municipality expects to use contracted services in the 2021/2022 with spending of R58 million of the total operating expenses of R459 million. To receive these free services, households must register in terms of the municipality's Needy Policy.

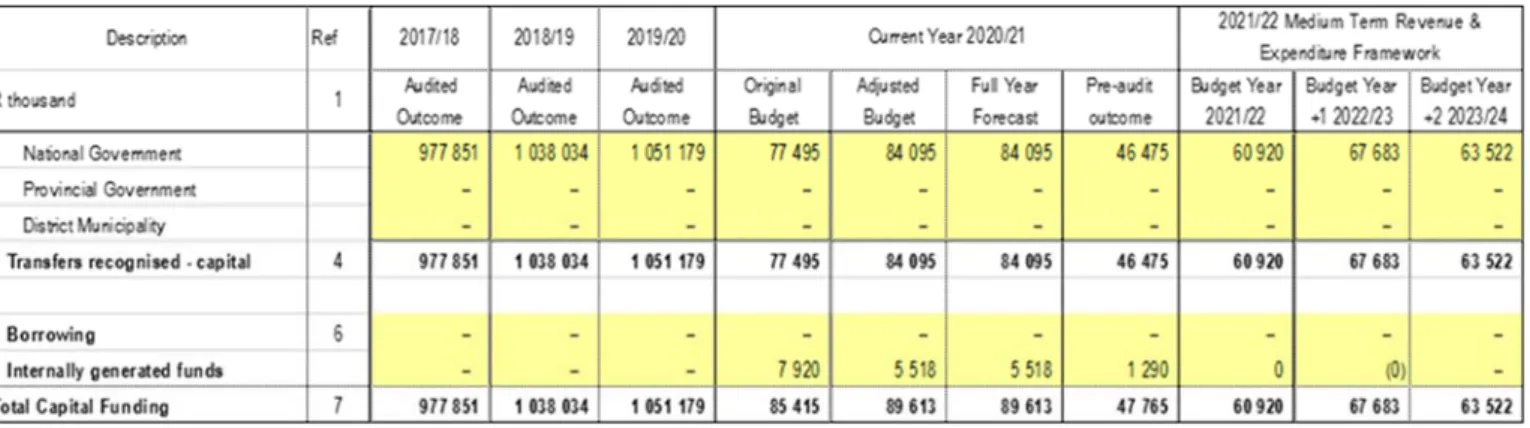

C APITAL EXPENDITURE

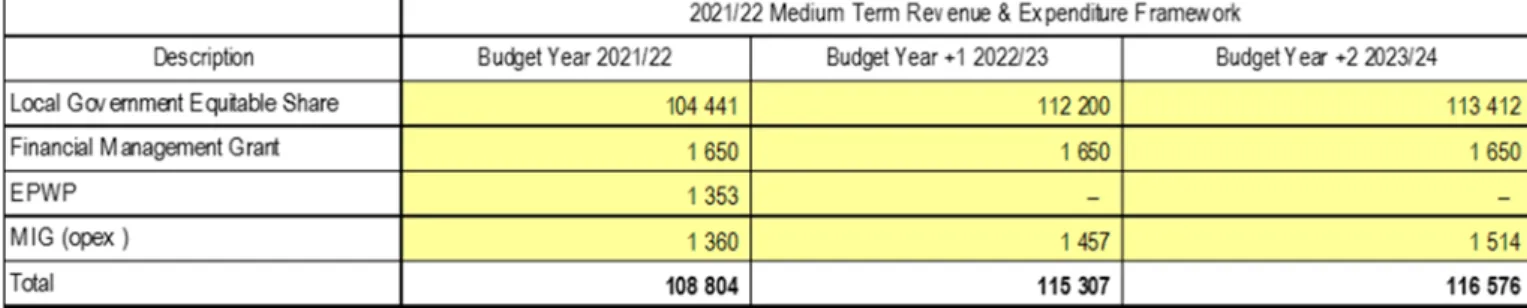

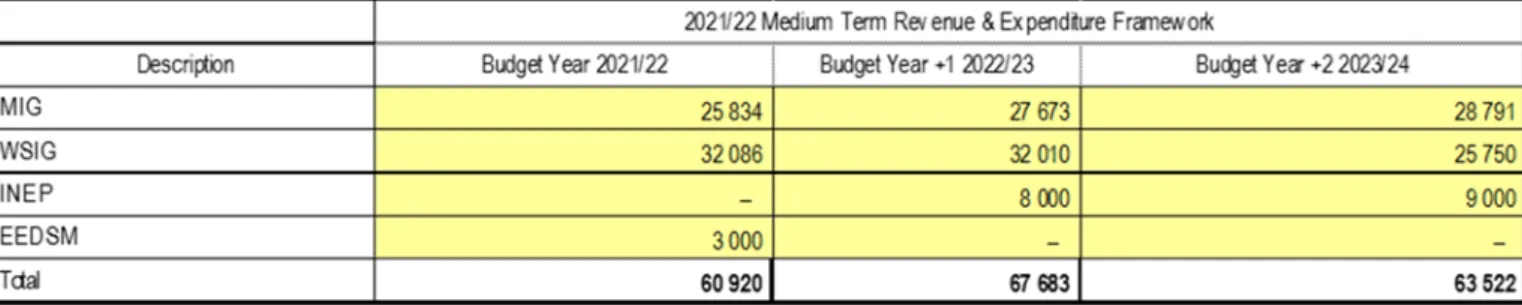

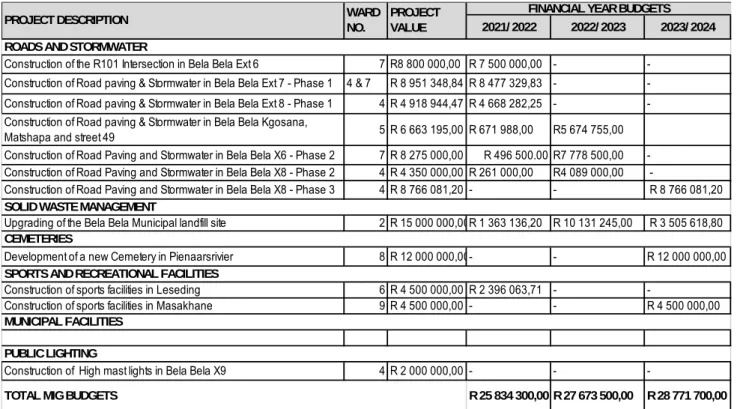

Tables 13 below describe the municipality's three-year consolidated MIG infrastructure investment program for 2021/2022 to 2023/2024 MTREF. Municipality is awarded R27 million in municipal infrastructure grant (MIG) after PMU costs of R1.3 million are taken into account. The table above shows the allocation of R32 million of WSIG which will be used according to the conditions of the allocations.

Construction of sewer discharge from Aventura PS to WWTW 1 & 2 R Renovation of the sewer network and garden connections in. The grant allocation as below is in accordance with the Division of Revenue Act issued for 2021/2022 MTREF.

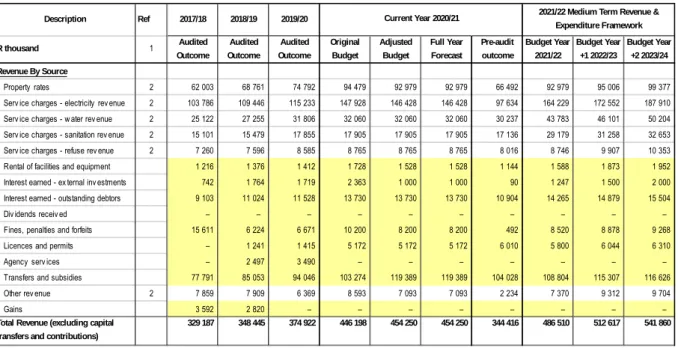

A NNUAL B UDGET T ABLES

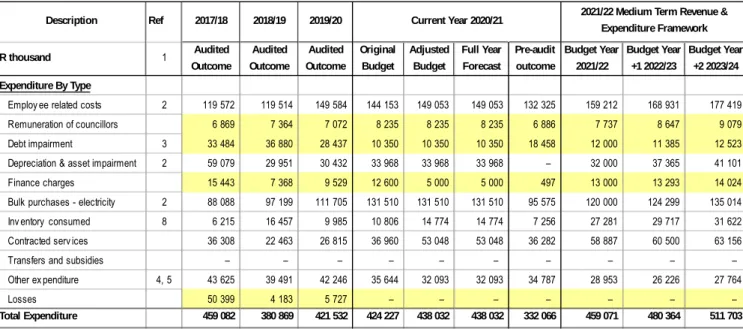

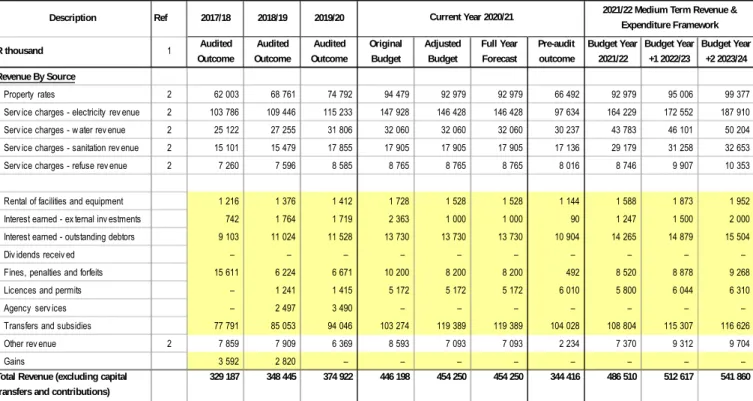

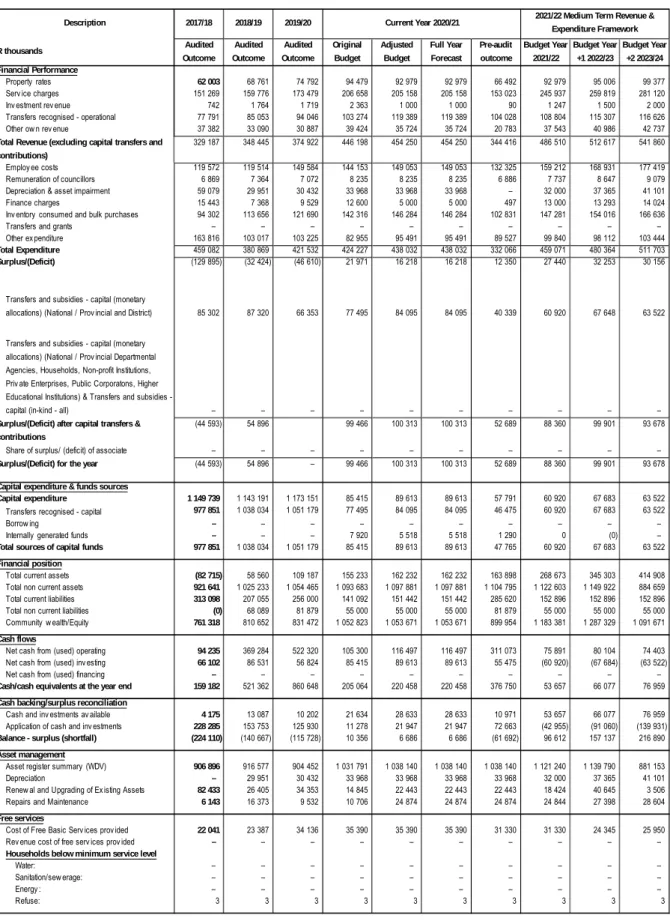

The table above is a budget summary and provides a summary overview of the municipality's budget from all key financial perspectives (operating, capital expenditure, financial position, cash flow and compliance with MFMA funding). The table provides a summary of the Council's approved amounts for operational performance, resources allocated to capital expenditure, financial position, cash and funding compliance, and the municipality's commitment to eliminate basic service delivery gaps. This table facilitates the view of the budgeted operational performance in relation to the organizational structure of the municipality.

This is due to the size of the department and its responsibility for service delivery projects such as water, electricity and sanitation. Service charges represent 64% of the total revenue base (excluding grants) and including 50% of total grant revenue. The rationale is that ownership and net assets of the municipality belong to the community; and.

As an example, the collection rate assumption will have an impact on the cash position of the municipality and subsequently inform the level of cash and cash equivalents at the end of the year. These budget and planning assumptions form a critical link in determining the appropriateness and relevance of the budget as well as the determination of ratios and financial indicators. The cash position will continue to be managed through strict implementation of the credit control policy and cost containment measures.

Essentially, the table evaluates the funding levels of the budget by firstly forecasting the cash and investments at the end of the year and secondly reconciling the available funding with the liabilities/commitments that exist. Non-compliance with section 18 of the MFMA is assumed because a deficit would indirectly indicate that the annual budget is not properly funded.

SUPPORTING DOCUMENTATION

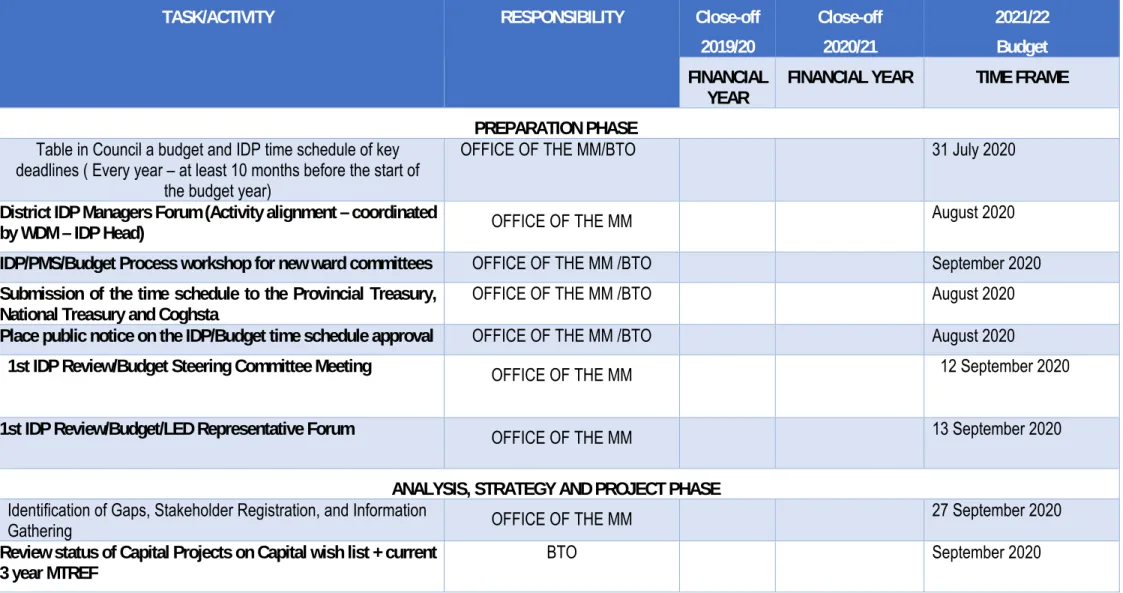

O VERVIEW OF THE ANNUAL BUDGET PROCESS

IDP AND S ERVICE D ELIVERY AND B UDGET I MPLEMENTATION P LAN

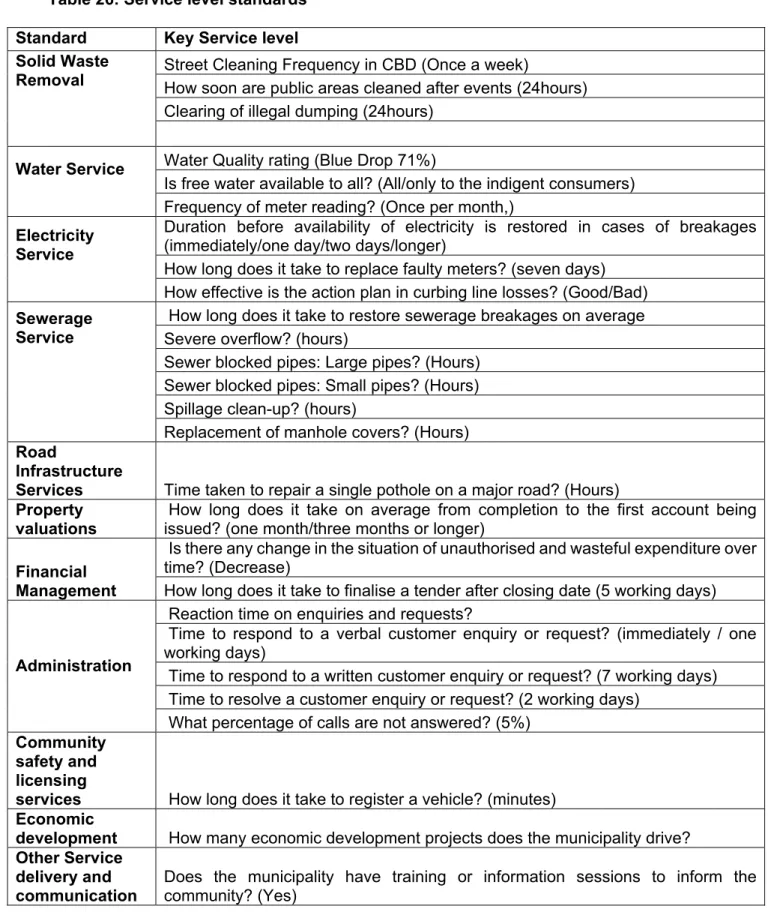

How long does it take on average from completion to issuing the first account. one month/three months or longer).

C OMMUNITY C ONSULTATION

O VERVIEW OF ALIGNMENT OF ANNUAL BUDGET WITH IDP

District IDP Managers Forum (Activity Alignment – Coordinated by WDM – IDP Head) OFFICE OF THE MM August 2020. IDP/PMS/Budget Process Workshop for New District Committees OFFICE OF THE MM/BTO September 2020 Submission of Timetable to Provincial Treasury,. Post a public notice on the IDP/Budget Timetable Approval OFFICE OF THE MM/BTO August 2020 1st IDP Review/Budget Steering Committee Meeting.

Mayor Roadshow OFFICE OF THE MM /BTO November 2020 Managers of respective departments to submit prioritized ward. Budget Steering Committee Meeting - Half Year Review and Performance Evaluation (2017/18 Budget): Capex including Draft Capital Budget Request (Round 2). Budget Steering Committee Meeting – Mid-Year Review and Performance Appraisal (2017/18 Budget): Opex performance including draft 2018/2019 opex.

Tariffs and Final Budget Adjustment Budget Review) OFFICE OF MM /BTO February 2021 BTO distributes all operating budget requests to managers for. Budget Steering Committee Meeting - to discuss and review operating costs, capital costs, new jobs, revenue projections and filling vacancies to determine salary contingencies. 2016/17 Oversight Report submitted by Council to MPAC URAD MM/BTO 31 March 2021 Advertise draft IDP and budget for public comment URAD MM/BTO April 2021.

Budget steering committee meeting - consideration of budget comments (review budget comments to make a decision on comments). Post Final IDP Review/Budget documents on website OFFICE OF MM/BTO June 2021 Advertise Final IDP Review/Budget and Rates in media OFFICE OF MM/BTO June 2021 Submission of Final Budget and IDP to NT, PT and Coghsta OFFICE OF THE MM/BTO June 2021.

F REE B ASIC S ERVICES : BASIC SOCIAL SERVICES PACKAGE FOR HOUSEHOLDS

To ensure an integrated and focused service delivery between all spheres of government, it was important for the municipality to align its budget priorities with those of national and provincial governments. All spheres of government give high priority to infrastructure development, economic development and job creation, effective service delivery, poverty alleviation and building sound institutional arrangements.

P ROVIDING CLEAN WATER AND MANAGING WASTE WATER

M EASURABLE PERFORMANCE OBJECTIVES AND INDICATORS

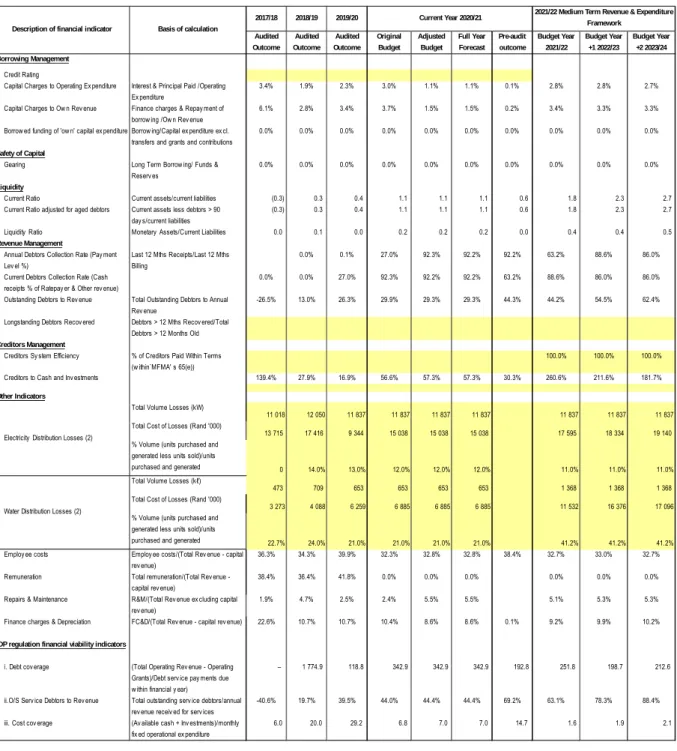

Cost of capital for own income Borrowing costs and repayment of loans/own income. Borrowed financing of 'own' capital expenditure Loans/Capital expenditure excl. Long-term debtors collected Debtors > 12 months collected/total debtors > 12 months old Creditor management.

Debt Coverage (Total Operating Income - . Grants)/Debt Service Repayments due within the financial year).

O VERVIEW OF BUDGET RELATED POLICIES

The main changes to the Supply Chain Management Policy include alignment with supply chain management regulations.

O VERVIEW OF BUDGET ASSUMPTIONS

Section 17(3)(k) of the MFMA states that as part of the budget decisions the proposed cost to the municipality for the budget year of the salary, allowances and benefits of each political office bearer, Municipal Manager, Chief Financial Officer and senior manager assigned to the Municipal Manager reports must be made public. The focus will be to strengthen the link between policy priorities and expenditure in order to ensure the achievement of the national, provincial and local objectives. However, it is also important to note the fact that some of these.

This following table complies with the requirements of MFMA Circular 42 which deals with the funding of a municipal budget in accordance with sections 18 and 19 of the MFMA. What is the forecasted cash and investments available at the end of the budget year. A deficit (application > cash and investments) is indicative of non-compliance with section 18 of the MFMA requirement that the municipality's budget must be 'funded'.

Landskassen requires the municipality to assess its financial sustainability in relation to fourteen different measures that look at different aspects of the municipality's financial health. The funding compliance measurement table essentially measures the extent to which the proposed budget complies with the funding requirements of the MFMA. A "positive" liquidity for each year of the MTREF will generally be a minimum requirement, depending on the intended use of those funds, such as cash backing reserves and working capital requirements.

If the municipality's cash flow forecast is negative, for any medium-term budget year, the budget is very unlikely to meet MFMA requirements or be sustainable. A detailed capital budget requirement (since MFMA Circular 28 which was issued in December 2005) is to categorize each capital project as a new asset or a renovation/rehabilitation project.

E XPENDITURE ON ALLOCATION AND GRANT PROGRAMME

The purpose of these measures is to establish whether budgeted reductions in outstanding debtors are realistic. 2 measures are shown for this factor; the change in current debtors and the change in long-term receivables, both from the budgeted financial position. Both initiatives show a deficit trend in accordance with the municipality's policy to settle debtor accounts within 30 days.

This measure should be considered important within the context of the funding measures criteria because a trend indicating that insufficient funds are committed to asset restoration may also indicate that the overall budget is not credible and/or sustainable in the medium to long term because the income budget is not protected. The objective is to summarize and understand the proportion of budgets provided for new assets and also asset sustainability. A declining or low level of renewal funding may indicate that a budget is not credible and/or sustainable and future income is not protected, similar to the justification for 'repairs and maintenance'.

In summary, the funding compliance measurement above shows that serious efforts have been made to keep the budget funded. The municipality has not budgeted to make any awards or grants to individuals or external parties.

A NNUAL BUDGET AND SDBIP – I NTERNAL DEPARTMENTS

C ONTRACTS HAVING FUTURE BUDGETARY IMPLICATIONS

M ONTHLY TARGET FOR REVENUE , EXPENDITURE AND CASH FLOW

L EGISLATION COMPLIANCE STATUS

Q UALITY CERTIFICATION

BUDGET TABLES

TARIFF BOOK

AMENDED BUDGET RELATED POLICIES AND BY‐LAWS

ORGANIZATIONAL STRUCTURE

SERVICE STANDARDS

STRATEGIC RISK REGISTER