MULTI-YEAR BUDGET 2020/21 – 2022/2023

- OVERVIEW OF THE 2020/21 MTREF

- Revenue: Tariff increases

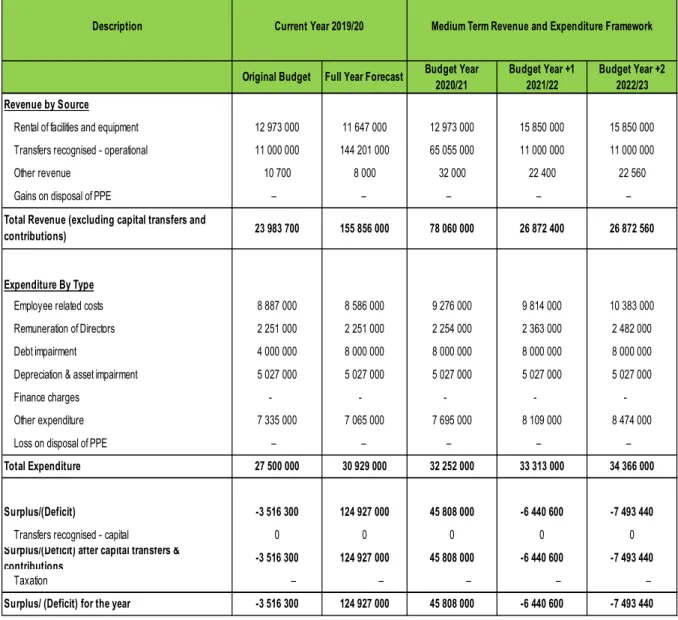

- Revenue by Source

- Operating Transfers and Grant Receipts

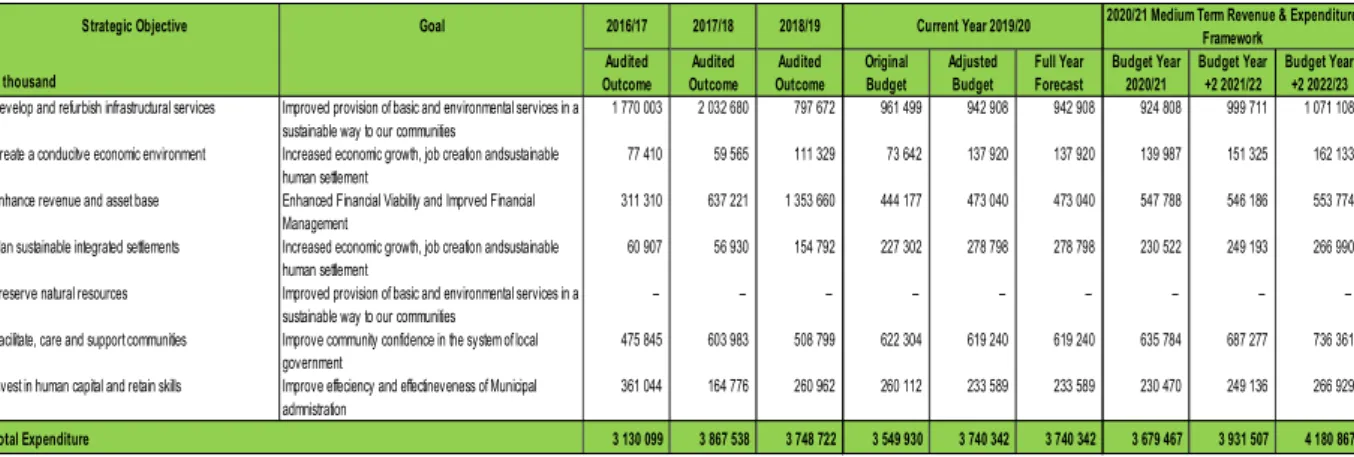

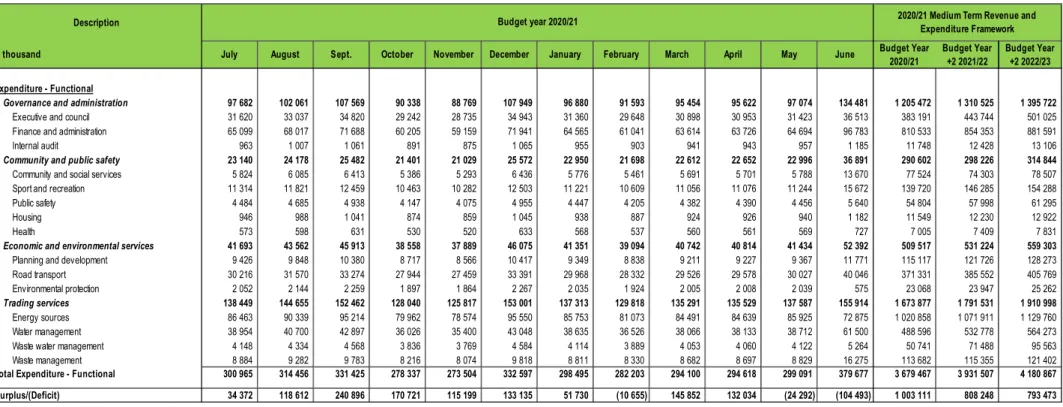

- Expenditure by Type

- Summary of operating expenditure by standard classification item

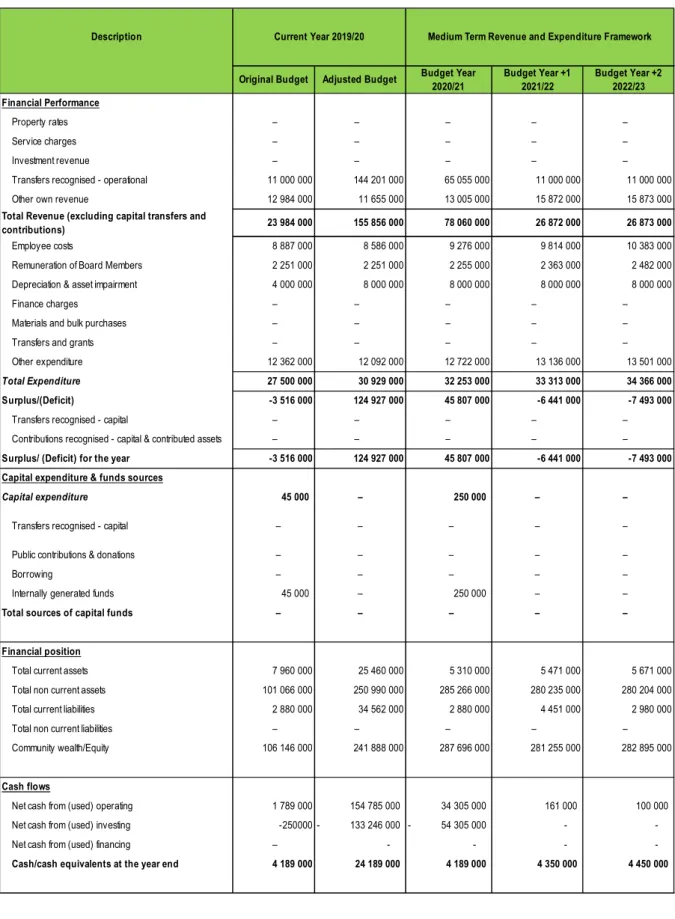

- Grant Allocations

Below are some of the DISTRIBUTION MEASURES that will apply to the 2020/21 medium term budgets in order to comply with National Treasury cost control guidelines. The allowed subsidy exceeds the National norm and extends the threshold of affordability of the municipality. Municipal property rates policy adopted in terms of the Municipal Property Rates Act, 2004 (Act 6 of 2004) (MPRA);.

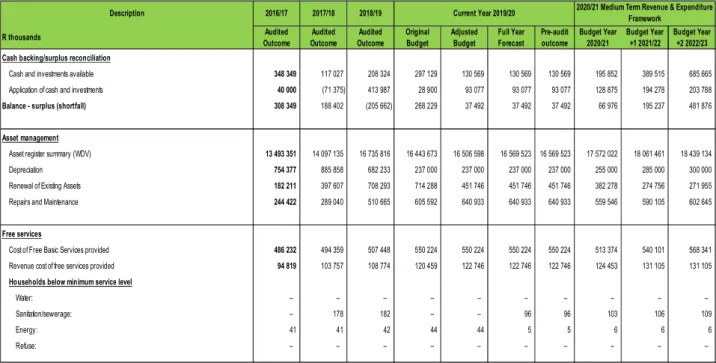

Income generated from rates, service charges and operating allowances form a significant percentage of the income basket for the Municipality. The table above includes revenue foregone resulting from discounts and rebates related to the tariff policies of the Municipality. Budget allocations in this regard amount to R255 million for the 2020/21 financial and are equal to 7.2 per cent of total operating expenditure.

Other expenses consist of various line items related to the daily work of the municipality. In this mid-term budget, the following allocations of grants designed for the municipality are included in connection with the 2020/21 Revenue Division Bill.

OVERVIEW OF BUDGET RELATED POLICIES

The policy is aimed at implementing the requirements and provisions of the Municipal Finance Management Act when drawing up, drawing up and approving the annual budgets. To give effect to the provisions of Section 217 of the Constitution of the Republic of South Africa, 1996; To implement the provisions of the local government: Law on the management of municipal finances (Law No. 56 of 2003).

Enforce the provisions of the Public Procurement Preferential Policy Act 5 of 2000 and the regulations of 2011. Provide procedures and mechanisms for the collection of all monies owed and payable to the municipality, arising from the provision of services and annual fees, in order to ensure financial sustainability and the implementation of communal services in the interest of the community. To prescribe procedures for the calculation of tariffs, if the municipality wishes to appoint service providers in the sense of Article 76(b) of the Act.

Officials and councilors clearly and comprehensively understand the procedures they must follow when dealing with unauthorized, irregular, fruitless and wasteful expenditures; This council approves the re-publication of road concession projects listed in the capital program.

Legislative Mandate

Public participation was later held on local radio stations and online through social media platforms.

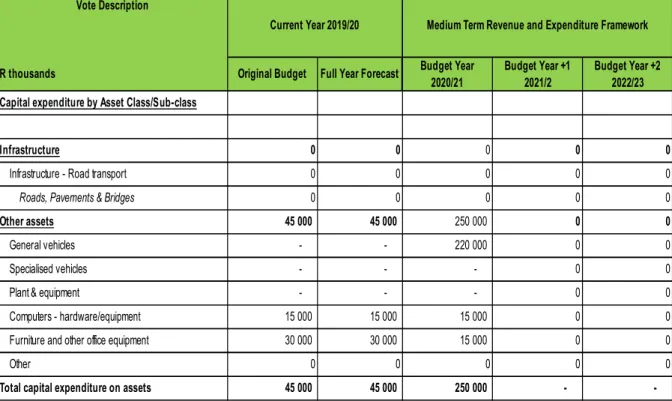

Capital Infrastructure program for the 2020/21 financial year

The municipality decided to include in the program the modernization of roads in rural municipalities in order to eliminate the backlog. Providing water in accordance with the municipality's obligations as a water authority is a priority for the municipality. The service areas consist of the city and urban areas and a large part of the countryside.

The infrastructure of the three main sources of water supply in the municipality (Dap Naude, Ebenezer and Olifantspoort Schemes) is old and inadequate in terms of capacity. After identifying the water challenges, the municipality appointed a service provider who will take care of mitigation methods for the municipality. The Water Master Plan was developed to address water challenges in the urban and rural parts of the municipality.

Most rural programs in the 'rural areas' are supplied with groundwater, as are the Ebenezer and Olifantspoort programs. Polokwane was identified as a secondary city for the IUDF program implementation pilot project. The (CEF) has been approved by the CoGTA to support the current Spatial Development Framework.

The Integrated Urban Development Framework (IUDF) is one of the basic policies of the government that seeks to act the national development plan for future needs. In relation to Table 66 of the current Spatial Development Framework, 2010, it was noted that the IUDF needs to be developed. 57 The first three years of the CEF are in accordance with the MTEF approved by the Polokwane Local Municipality.

Country identified in the planning phase. The development is a medium-term plan for additional sports codes that look at the future of the city's demand. The municipality has already allocated the land amount to 274ha of land for the development of the Science Park, the studies of which have already started. The development includes mixed use with the main applications being Industrial for the development of the Sasol Depot and Truck-inn.

Detailed Budget Tables

Investments for the municipality are made in accordance with and compliance with the MFMA's Municipal Investment Ordinance, the Municipality's Investment Policy and other relevant matters. When making investments, the primary focus is on the risk profile, the liquidity needs of the city and the return on investments. As far as investment and lending activities are concerned, all requirements of the MFMA have been met.

The existence of the PHA is reported by the SMART pillar, which forms one of the municipal SMART pillars. The extent of the impact of COVID-19 on the entity's operational and financial performance will depend on future developments, including the spread of the outbreak and related developments. Contract period The period is not fixed but is subject to annual reviews in terms of section 93A of the Schemes Act.

Executive Mayor Cllr Thembi Nkadimeng's budget speech at the adoption of the 2020/21 budget. Council President, Mayor Mariri Ralefatane Chief Council Leader, Mayor Mamedupi Teffo Members of the Mayor's Committee. Speaker, we are meeting here this morning under the unusual circumstances that our Council meeting must be held virtually via video conference due to the COVID-19 pandemic, which has put our country and the rest of the world at a standstill and many people uncertain about the future.

We have the comfort that this budget is based on the interests and will of the people of Polokwane. The effect of the lockdown and the ongoing crisis means that the economy will experience a significant downturn, while there will be a greater need for government services and assistance. The impact of COVID-19 on operating and financial performance will depend on future developments, including the duration and spread of the outbreak and related economic impact on job retention or losses, all of which could lead to declines due to reduced consumer demand.

As a collective, we have a great responsibility to uphold the hopes of the majority of our constituencies – the people of Polokwane. Speaker, We need to consider some of the challenges that affect putting this budget together, including the ongoing difficulties in the national and local economy. At the same time, reductions in transfers are expected with the implications that the municipalities will have to redefine some of the projects.

The cost pressures of bulk water and electricity purchase tariffs continue to rise faster than the rate of inflation. Dear Chairman, As in previous years, we have taken measures to provide free basic services to members of our community who cannot afford it - the poor. Dear Chairman, the largest part of the budget has been allocated to the Water and Sewerage Services for infrastructure projects in accordance with the strategy of the municipality for the renewal of its assets with the sole objective of optimizing the provision of services.

We will continue to ensure that the municipality remains financially sustainable and continue to invest in measures to protect the state's resources, which are intended for the development of the people's lives.