It avoids the need to transfer ownership of every single asset of the acquired company to the acquiring company. 1996) argue that the above statement means that the shareholders of the acquired firm can demand that the acquiring firm buy back their shares at fair value.

Other Motives

In the late 1970s, changes in the oil industry included lowering expectations for the future price of oil, increasing research and development costs, and rising real interest rates. Mergers and acquisitions can be seen as part of the job market for senior management.

CHAPTER FOUR

Where Synergy

Comes From

Debt Capacity

It is possible that one of the firms did not use enough debt financing (optimal debt). In fact, the announcement or even the rumor of a possible merger is likely to draw attention to the stock and cause it to be offered to such a level that it is no longer undervalued.

CHAPTER FIVE

The Agency Theory

Sudarsanam (1995) explains that the disciplinary role of the market for corporate control is of particular relevance to acquisitions. Sudarsanam (1995) argues that hostile bids opposed by incumbents are a necessary part of the market's disciplinary role of corporate control, and indeed are its defining characteristic.

CHAPTER SIX

How to Identify Takeover Target

According to Earl and Fisher (1986), there are essentially three features of the research phase that should be emphasized. The worst consequences of carelessness will be a dramatic, upward movement in the share price of a quoted target under the watch of the company's researchers.

CHAPTER SEVEN

The Tax Forms of Mergers and Acquisitions

As long as a merger meets the previous three conditions, it is treated as tax-free. It is treated as tax-free only if the payment is made entirely in the form of voting shares and if the acquisition gives the buyer ownership of at least 80% of the total voting rights.

CHAPTER EIGHT

Accounting for Mergers and Acquisitions

The presumption behind merger accounting is that the shareholders of the merging companies combine their interests and continue to retain their interests in their companies, albeit now together. In addition, the assets of the acquired firm are recorded in the books of the shareholders in acquisition accounting.

CHAPTER N IN E Conclusion

Sudarsanam (1995) argued that managers release cash flow to finance diversifying acquisitions, which may be negative NPV investments. He also argued that there are a number of control mechanisms that can be used to reduce the occurrence and costs of agency conflict for shareholders Le. When deciding on corporate goals, the director should ask the most profound questions, namely which industry, which project, which market, which market share, which market size, which capital expenditure, why overseas, which country, on which risk and others.

There are a number of conditions that must be met before tax status can be determined.

CHAPTER TEN Introduction

CHAPTER ELEVEN

The success (or failure) of mergers and Acquisitions

- Carleton, Guilkey, Harris and Swart in 1983

- Travlos in 1987

- Franks, Harris and Titman in 1991

- Kaplan and Weisbach in 1992

Travlos (1987) determines the role that the medium of exchange plays in the return of the shareholders. He examines the common stock returns of the bidding firms upon the announcement of takeover bids. If the investment in the target firm is small relative to the value of the acquiring firm, the increase in value from the merger may not cause much change in the acquirer's share price.

The evidence presented in the study by Carleton et al. 1983) show that abnormal returns to acquirers increased as the size of the target firm increased relative to the size of the acquirer. The results show that the relative size of the target relative to the acquirer has a positive and significant effect on the cumulative average residual (CAR) earned by the acquiring firm's shareholders. Any benefits obtained in the cash offering in excess of the target shareholders' tax liabilities result in synergy.

This explanation proposes that the medium of exchange in a merger signals private information of the value of the bidding firm. The objective of the bidding firm is to act in the most profitable way for its shareholders.

CHAPTER TWELVE

The Agency Problem in Mergers and Acquisitions

Asquith and Han Kim in 1982

When we distinguish between the acquiring firm and the acquired firm, the mean returns during the announcement month for the acquiring firms are positive. For acquired firms, returns are positive and continue to be positive after the announcement month. On the contrary, the results show, for acquired firms, significant positive abnormal returns for the announcement month in all securities.

An alternative interpretation of bidders' poor performance is that bidding firms pay too much for the targets they acquire. To the extent that acquisitions serve these objectives, Morck et al. (1990) conclude that managers of bidding firms are willing to pay more for targets than they are worth to the bidding firm's shareholders. It is said that when a company makes an acquisition or any other investment, the manager considers both his personal benefits from the investment and the impact on the company's market value.

Based on the study conducted by Morck et al. 1990), there is support for the statement that management objectives drive acquisitions. They argue that growth is one of the management objectives pursued either for its sake. own sake or for the sake of ensuring the continued existence of the bidding firm and the continuity of its top management.

CHAPTER THIRTEEN

Prior Mergers and Acquisitions at the Johannesburg Securities

Exchange

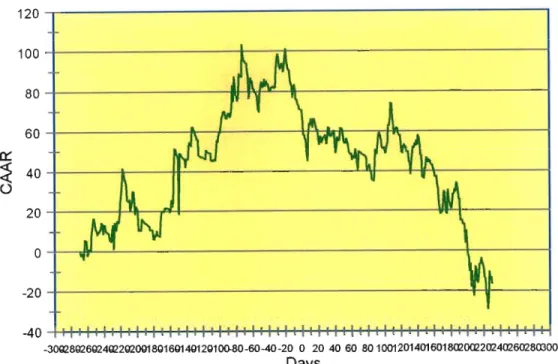

Of the specific criteria included in the acquisition profile, the available amount was assigned the lowest priority. The results indicate that the shareholders of the acquired firms earn significant positive abnormal returns in the ten weeks preceding the merger announcements. On the other hand, there is no evidence of positive abnormal returns accruing to the shareholders of the acquiring firms.

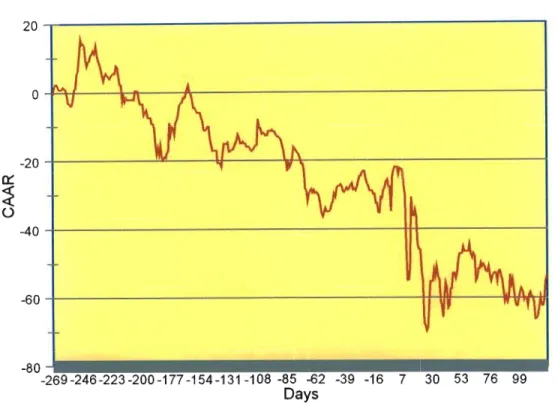

The results also show that shareholders of absorbing firms earn negative abnormal returns in the year following the merger announcement. The results also show that CARs have a random pattern similar to that of acquiring companies until approximately 13 weeks after the announcement. This indicates that the shareholders of the acquired companies earn quite significant abnormal returns around the time of the merger announcement.

Van den Honert et al. 1988) argue that this indicates a deterioration in investor confidence and expectations about the company's future cash flows. The results also show the CAAR plot of the sample of acquiring firms in the related acquisitions.

CHAPTER FOURTEEN Conclusion

However, mergers and acquisitions can also be a solution, as they end up replacing bad management with new (hopefully good) management. It appears that empirical evidence on mergers and acquisitions in South Africa does not differ significantly from the findings presented in overseas studies reviewed under Chapter 12 above. 1988) conclude that, on average, merger announcements have no effect on the stock prices of the acquiring firms, and acquired firms achieve quite significant abnormal returns around the time of the merger announcements.

Van den Honert et al. 1988) conclude that there is no evidence that acquiring firms achieve positive returns. Overall, there is no evidence that mergers and acquisitions 'pay' South African shareholders large dividends (if any).

CHAPTER FIFTEEN

A Case Study of Mergers and Acquisitions' Performance at the

Johannesburg Securities Exchange

Introduction

Importance/Benefits of this Study

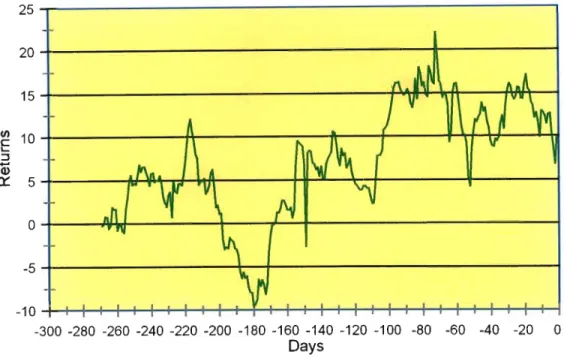

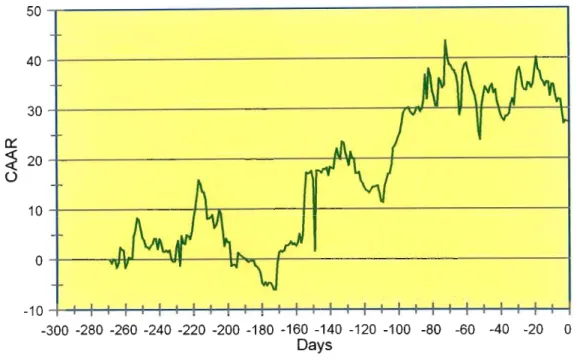

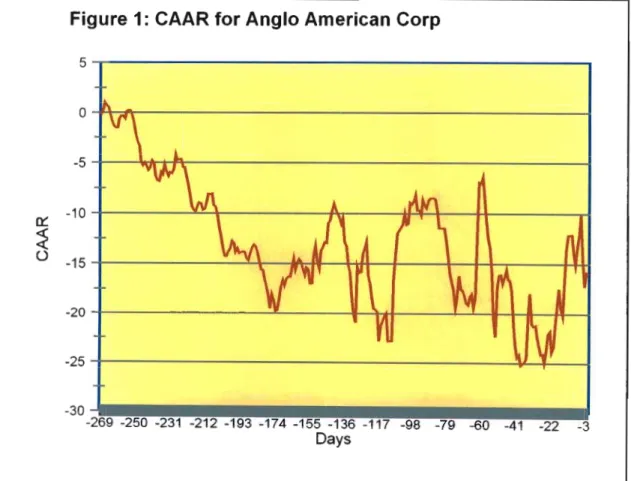

That is one year before the merger announcement and one year after the first merger announcement. The CAAR plot for AAC shows a downward trend in the year prior to the merger. This trend is being revised around the merger announcement, as the CAAR for AAC has increased from approximately negative 25 percent (that is, 30 days before the merger announcement) to approximately negative 10 percent (that is, four days before the merger announcement). the fusion).

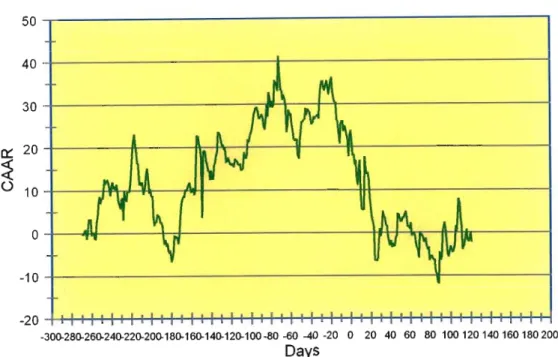

This indicates that BOE shareholders experience positive abnormal returns in the first part of the year after the merger announcement. The CAAR continues to decline after the merger and reaches zero (which is ten months after the merger announcement). This is especially true because the CAAR plot for BOE showed a sharp upward trend at the beginning of the year prior to the merger announcement.

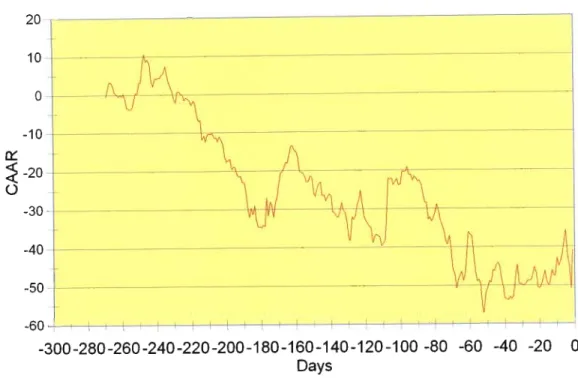

The CAAR chart shows a positive but declining CAAR for Gold Fields of South Africa (GFSA) approximately ten months prior to the merger announcement. The average abnormal returns of these two firms were negative and declining 11 months before the merger announcement.

Summary and Conclusions

Looking at the average cumulative returns of all three companies, they are positive, six months before the merger announcement. The average cumulative returns of Anglo American Corporation and BoE Group are consistent with the latter overall results mentioned above; they are positive six months before the merger and are maintained at that level. The average cumulative results of Gold Fields of South Africa and BoE Group are also consistent with the last two results mentioned above: they are positive six months before the merger announcement.

Their returns start to decline a few weeks before the merger announcement and eventually turn negative a few weeks after the merger announcement. The average results of Anglo American Corporation and Gold Fields of South Africa are negative about six months before the merger and continue to be negative. Therefore, one could suggest that the overall results are negative, months before the merger is announced.

However, the BoE results are positive in such a way that they are capable of distorting the combined results. This argument is supported by the fact that the BoE's results are negative a few weeks after the merger announcement - indicating poor post-merger performance and thus declining investor expectations and confidence.

Bibliography

Brews, PJ, (1987), Corporate Growth through Mergers and Acquisitions: Viable Strategy or a Road to Ruin? South African Journal of Business Management. Cartwright S and CL Cooper, (1996), Managing Mergers and Acquisitions and Strategic Alliances: Integrating People and Cultures, Butter-Heineman. Dodd, P, (1992), The market corporate control: A review of the evidence, as in Stern and Chews (eds): Revolution in Corporate Finance, second edition, Blackwell, Cambridge, Massachusetts.

Foster, G, (1987), Comments on M&A analysis and the role of investment bankers, The Revolution in Corporate Finance, 391-393. Holderness, CG and DP Sheehan, (1987), Why corporate raiders are good news for shareholders, The Revolution in Corporate Finance, Basil Blackwell, 402-414. Jensen, MC, (1994), The Takeover Controversy: Analysis and Evidence, as in: The Revolution in Corporate Finance by Stern JM and DH Chews, Second Edition, Blackwell, Cambridge, Massachusetts.

Larker, DA, (1988 and 1994), Managerial Incentives in Mergers and Their Effect on Shareholder Wealth, as in Stern and Chew (ed), The Revolution in Corporate Finance, Blackwell. Lev, B, (1987), Observation on the Merger Phenomenon and a Review of the Evidence, Revolution in Corporate Society, Blackwell, 357-367.

APPENDIX A

APPENDIX B

Where BOERET1, c, MKTRETB and FINRETB are BoE returns, permanent, market returns and financial sector returns, respectively.