My daughters: Nolwazi, Nomaswazi, Bongiwe and Melissa, thank you for your love, support and encouragement for me to complete my PhD. I would like to thank you for accompanying me when I went to distant places to collect data.

BACKGROUND TO THE STUDY

- S TATEMENT OF THE P ROBLEM

- O BJECTIVES OF THE S TUDY

- R ESEARCH Q UESTIONS

- T HE S OCIO -E CONOMIC S TATUS OF W OMEN

- M ICROFINANCE FOR D EVELOPMENT

- M ICROFINANCE P OLICIES AND P ROGRAMMES IN THE K INGDOM OF E SWATINI

- The Inhlanyelo Fund

- R ATIONALE AND M OTIVATION FOR THE S TUDY

- T HEORETICAL F RAMEWORK

- T HE S TRUCTURE OF THE T HESIS

- C HAPTER S UMMARY

How have Inhlanyelo Fund beneficiaries learned from their experiences using the Fund. How do the female beneficiaries of the Inhlanyelo Fund feel the fund has impacted their lives?

THE RESEARCH CONTEXT

- D ESCRIPTION OF E SWATINI

- Geographical Setting

- L OCATION OF THE S TUDY A REA

- Climate of the Study Area

- H ISTORICAL AND P OLITICAL C ONTEXT

- T HE M ARRIAGE C ONTEXT

- T HE R ELIGIOUS C ONTEXT

- E CONOMIC S TATUS

- S OCIO - ECONOMIC S TATUS OF W OMEN

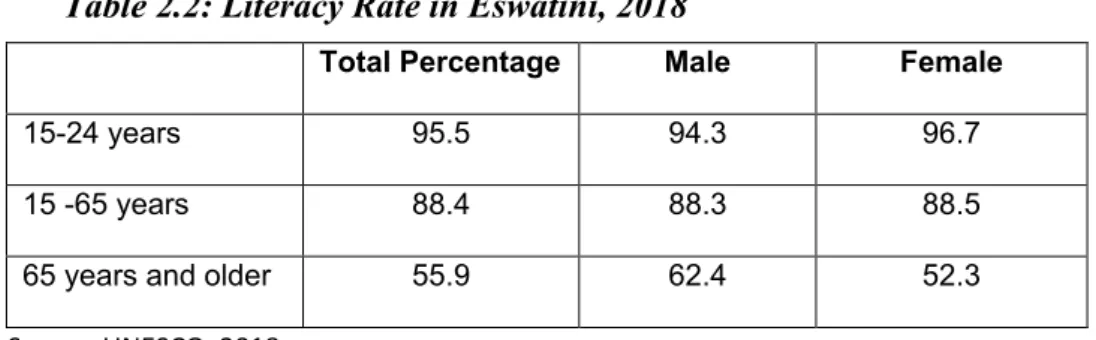

- Women and Education

- F INANCIAL I NCLUSION

- Brief History of the Inhlanyelo Fund

- S UMMARY

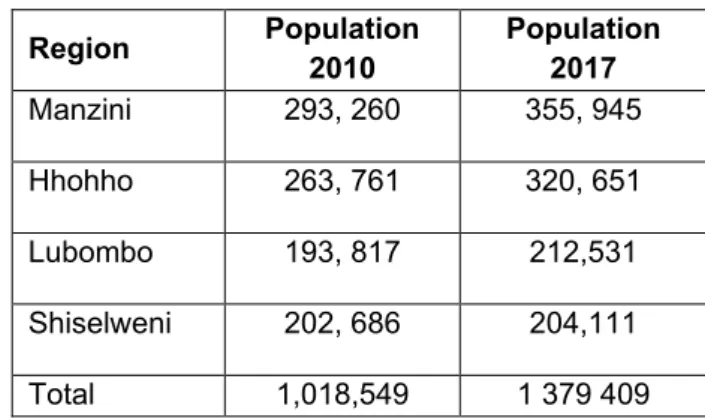

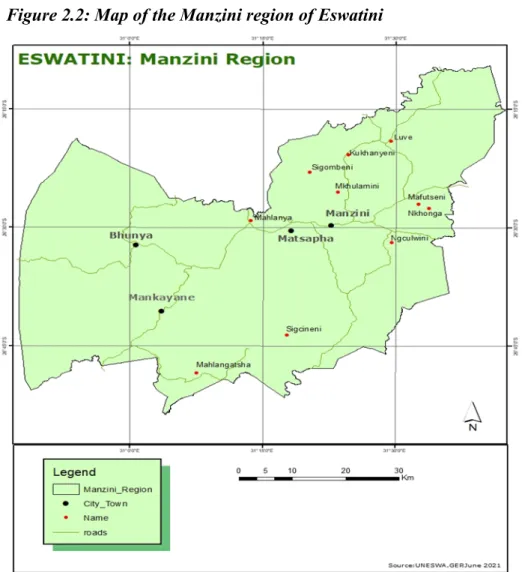

Recent statistics in Eswatini show that 11% of the agricultural labor force consists of women (World Bank, 2019). Manzini is located in the mid-west of the country, in the Middelveld and it is the country's main industrial and commercial centre.

LITERATURE REVIEW

T HEORETICAL F RAMEWORK

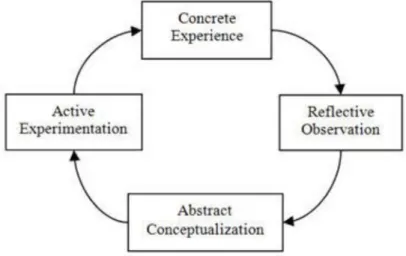

- Experiential Learning Theory

- Kolb’s Experiential Learning Model

- Jarvis’ Experiential Learning Model

- Experiential Learning Theory and Microfinance

- Women and the Concept of Empowerment

- Empowerment, Women’s Empowerment and Microfinance

- How Women’s Empowerment can be measured

- The Micro-level of Empowerment

- The Meso-level of Empowerment

- The Macro-level of Empowerment

- Buen Vivir as an Alternative Concept to Development

- The Concept of Ubuntu

- Social Context

- Cognitive Context

- Emotional Context

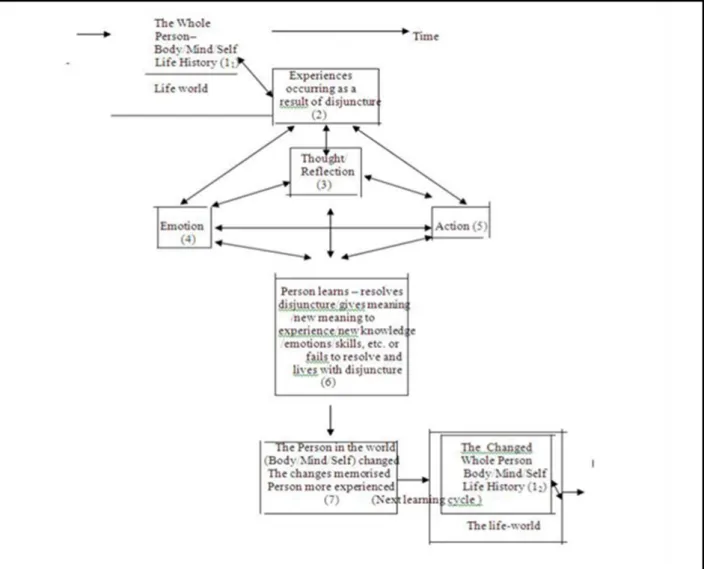

Experience is important in the learning process because it is based on direct experiences, activity and acting (Odendaal, 2018). This includes determining: i) "the existence of choice, the use of choice, and ii) "the achievement of the desired outcome.

M ICROFINANCE AND M ICROCREDIT

- Background to Microfinance

- Microfinance Institutions

- Forms of Microfinance Institutions

- What is Microcredit?

- Microfinance Credit Lending Models

- Microcredit and Employment Opportunities

Microfinance generally refers to financial services such as credit, savings, insurance and remittances that are tailored to include financially excluded people to meet the needs of individuals and households (Abdelkader et al., 2013). Microfinance institutions provide small loans to people who do not have access to cash loans (Marconatto et al., 2017). Grameen Bank is a Community Development Bank organization that provides small amounts of money without requiring collateral to access loans (Banerjee et al., 2017).

C RITIQUES OF M ICROFINANCE AND M ICROCREDIT

M ICROFINANCE AND W OMEN

- Argument on Women, Poverty and Economic Growth

However, other researchers in sub-Saharan Africa have discovered that microfinance does not automatically alleviate poverty and has a number of negative consequences (Rooyen et al., 2012). Women who participate in decision-making processes have the ability to contribute to their household's well-being (Duflo, 2012; De Brauw et al., 2014). Consequently, women are a lower credit risk and there are greater possibilities that they will share the benefits of the loans with other family members, especially children (Vaessen et al., 2014).

M ICROFINANCE AS AN E MPOWERMENT T OOL

It is argued that microfinance can lead to national economic growth because it can help grow small, medium and micro enterprises, which then contribute to the national economy through job creation, income generation and wealth creation (Peprah, 2012). Furthermore, it is argued that microfinance services lead to women's empowerment by empowering women's decision-making and power in their homes and socioeconomic status (Kato & Kratzer, 2013). Microfinance enables women to achieve financial independence, which can lead to greater learning opportunities as they become more aware of how to improve their lives.

W OMEN AND E DUCATION

In this regard, financial services are important to increase women's participation in credit programs that will improve their livelihoods. Women's empowerment is a process by which women are given power and equal opportunities to pursue personal, economic and social activities and participate on an equal footing with their male counterparts (Cornwall, 2016). Dlamini and Dlamini (2021) find that women had other sources of capital to start income generating projects such as NGOs, MPs and the government which is encouraging.

E MPIRICAL S TUDIES ON M ICROFINANCE AND W OMEN ’ S E MPOWERMENT

According to the literature, education is an investment in human capital that increases an individual's productive capacity (Mago, 2014). So my research will take into account the effects of patriarchal systems when women talk about their experiences with the fund's loans to improve their lives. Therefore, in times of disagreement over defaults in rural communities, women often become isolated from the group and vulnerable to microfinance institutions.

S TUDIES ON M ICROFINANCE IN G ENERAL

The purpose of the qualitative study is to gain in-depth information about women in Ganja and to gain better insight into their experiences of how microfinance has affected them. Participants were interviewed using semi-structured interviews with women who were or are currently beneficiaries of the microcredit bank Viator in Ganja. In addition, this study examines the impact of women as recipients. a microfinance program using indices that include domestic violence and economic empowerment.

M ICROFINANCE IN E SWATINI

Consequently, such findings can be expected in my study, as some of the women in my study come from impoverished communities with limited economic power. The government and other development stakeholders have implemented various policies and programs to help alleviate poverty, high unemployment rate and increase economic growth of the country. The unit aims to facilitate the development and sustainability of the microfinance sector in Eswatini (Finmark Trust, 2017).

S TUDIES ON M ICROFINANCE IN THE E SWATINI C ONTEXT

The results of the study reveal that keeping records of the business, the size of the loan needed to start a business, the size of the business, the age of the business person and interest rates are important factors that influence the choice of agricultural SME owners from formal. , semi-formal or informal credit providers. In this study, there are many different aspects that could improve my understanding of the Inhlanyelo Fund results, such as keeping records of the business, the loan size needed to start a business, and the age of the business person and interest rates. These questions can have an impact on how women feel that the foundation has affected their lives and the companies' lives.

S TUDIES ON M ICROFINANCE AND W OMEN IN E SWATINI

At the same time, education acts as a mitigating factor, as women with a higher level of education have more access to seed capital than their less educated female counterparts. The findings suggest that policies to promote female entrepreneurship should go beyond improving the business environment and include proactive measures such as networking of female entrepreneurs and financiers, as well as financial literacy training. This study provides evidence for the beneficial role of networks in raising seed capital and improving business performance.

C HAPTER S UMMARY

However, what is not covered is the learning process women go through in the Eswatini microfinance studies. In addition, microcredit beneficiaries are more able to make household decisions as well as participate in the economic spheres of their lives. So I will fill this gap to understand how the women in the funds learn, with a focus on experiential learning.

RESEARCH DESIGN AND METHODOLOGY

R ESEARCH D ESIGN

- Research paradigm

The study used an interpretive paradigm to understand women's experiences and determine whether or not their lives were improved as beneficiaries of the fund. The goal of the interpretive paradigm in this study was to understand and interpret the meaning behind human behavior, not to generalize and predict causes and effects (Neuman, 2006). This allowed for a better understanding of the women's experiences, particularly their learning experiences with the Inhlanyelo Fund.

R ESEARCH A PPROACH

- Advantages of the Qualitative Research Approach

- Disadvantages of the Qualitative Research Approach

However, to counter this, I used different types of data collection methods to gather rich information to enable contextualization of the participants' stories. Qualitative research offers the opportunity to explore human experiences and create meaning in unique ways that depend on the situations and settings of the world they are trying to interpret (Daher et al., 2017). This approach allowed me to gain a comprehensive understanding of the experiences of female beneficiaries of the Inhlanyelo Foundation.

R ESEARCH S TYLE

- Limitations of a Case Study

- Strength of a Case Study

Thus, a case study was appropriate to understand the diverse experiences of the women of the Inhlanyelo Fund. The difference between a single case study and multiple case studies is that multiple case studies can be used to compare findings (Yin, 2003). A case study has unique data which means it cannot be duplicated.

S AMPLING M ETHODS

- Sampling Selection

- Sampling Techniques

- Probability Sampling

- Types of Probability Sampling

- Non-probability Sampling

- Types of Non-probability Sampling

- Purposive Sampling

- Stratified Purposive Sampling

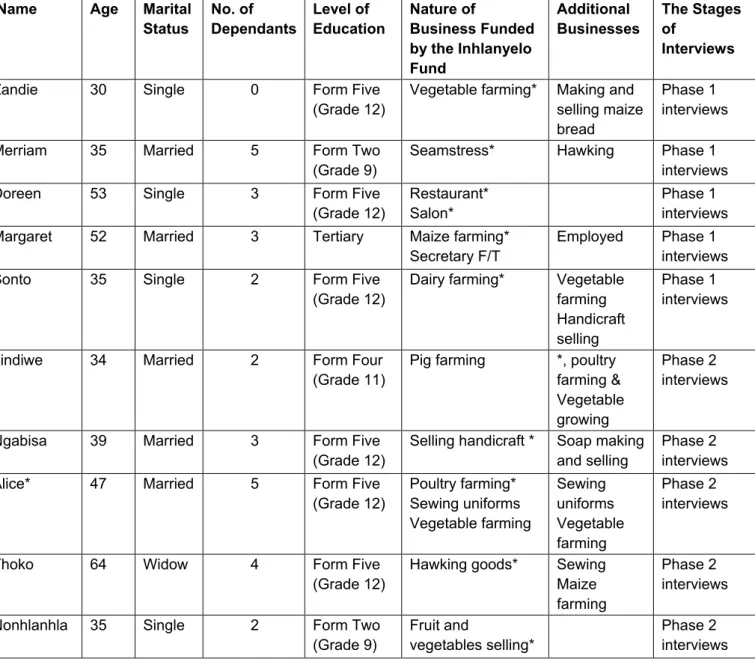

The non-probability sampling technique selects samples based on the researcher's subjective judgment rather than random selection and fits a qualitative approach (Creswell, 2013). Convenience sampling is a non-probability sampling technique where subjects where participants are selected because of themselves. Despite these limitations, I used purposive sampling for its power to select “information-rich cases” for the study to answer the research problem (Patton, 2015). The selection criteria were that the sample a) must be a woman and b) must have been a beneficiary of the fund for one to five years.

S AMPLE S IZE

- Stages of Data Collection

The purposive sample size is primarily determined by data saturation rather than influenced by statistical analysis (Hammarberg, 2016). Also, the sample size is affected by the nature of the data collection method that captures the depth of information that the data can achieve. In a qualitative approach that explores experiences, a small sample size is sufficient to achieve data saturation (Moser & Korstjens, 2001).

D ATA C OLLECTION M ETHODS

- Semi-structured Interviews

- Life History Method of Data Collection

- Photovoice Method of Data Collection

Semi-structured interviews, using open-ended questions, were used to facilitate the interaction, which allowed the respondents to talk about their experiences in relation to the Inhlanyelo Foundation. The use of semi-structured interviews in this study required women to express their experiences and their views on the Inhlanyelo Foundation. After the training, participants were asked to take pictures related to their experiences with the foundation.

D IRECT O BSERVATIONS

D ATA A NALYSIS

Step one: I became acquainted with the data by reading and rereading it and writing down my initial thoughts (Braun & Clarke, 206). To make sure the themes were correct, I had to read and re-read the data to become familiar with it. It was the final stage, which focused on analyzing the data and writing a story on the theme, as well as making arguments related to the research questions, to produce a concise, coherent, logical, non-repetitive and interesting report. of the story the data tell within and between themes (Braun & Clarke, 2006).

T RUSTWORTHINESS

To facilitate transferability, I provided a detailed description of the process and context of the participants so that the reader of my research report could understand the context of my study (Geertz, 1973).

E THICAL C ONSIDERATIONS

M Y P OSITIONALITY IN R ELATION TO D ATA C OLLECTION

I was familiar with some of the events they described, but I needed the respondents to articulate them for the purposes of the study. My previous experiences working with various community members, especially women, in the local communities, as well as being a recipient of the fund myself, piqued my interest in conducting the study. Despite the effects of being interviewed about their life experiences, participants expressed no concerns or regrets about their decision to participate in the study.

C HAPTER S UMMARY

PROFILE OF THE PARTICIPANTS

B ACKGROUND OF THE R ESEARCH P ARTICIPANTS

- Demographic Data and Social Characteristics of the Participants

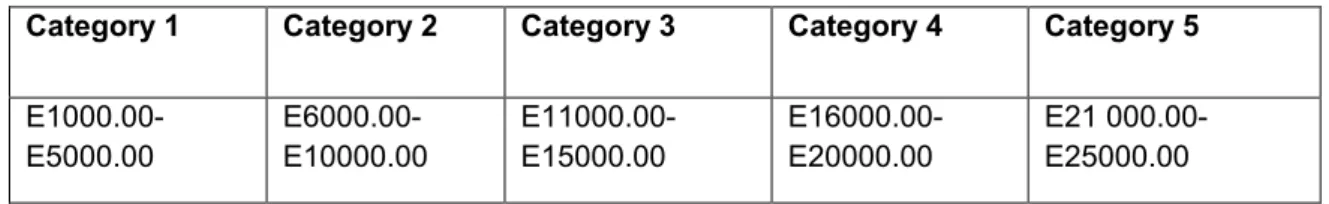

Regarding the levels of education, I compare their education levels with the South African education system. Two women had Form 2 which corresponds to the South African Grade 9, which means they have completed nine years of education. Despite having completed their matric, the women were dissatisfied with their education levels.

- Zandie

- Merriam

- Doreen

- Margaret

- Sonto

- Lindiwe

- Ngabisa

- Alice

- Thoko

- Nonhlanhla

Life became easier as a result and she was able to contribute to the welfare of the household. Her mother suggested that she look for work because she was responsible for the other children. She was surprised when she was told that her husband had to provide a guarantor for the loan.

S UMMARY

C HAPTER S UMMARY

PRESENTATION OF FINDINGS

- Loan Application and Repayment Procedures

- Loan Amount Provided to Participants

- Loan Repayment Timelines

- The Nature and Diversification of Participants’ Businesses

This was a general fund request for all heads and was submitted along with the loan request. Part of the loans received through the fund were not used only for business. This section deals with the nature of the participants' businesses and the experience they bring to the fund.

- Learning from their Experiences

- Critical Moments of Learning: The Learning Curve

- Reflective Experiences on Learning of the Participants

- Interactive Learning

- Transformative Learning

- Learning through Ubuntu

- Solidarity and Collaboration

- Training Provided to Participants

It examines how the women beneficiaries of the Inhlanyelo Fund learned from their participation in the fund credit scheme. I will show how some of the participants learned from their interaction with other people as beneficiaries of the Inhlanyelo Fund. The purpose of the tour was for me to learn from them [farmers] because they produced quality vegetables every time and they also provided NAMBord [National Agricultural Marketing Board].

H OW THE B ENEFICIARIES OF THE F UND FEEL IT HAS AFFECTED THEIR L IVES

- Participants Socio-economic Status in Relation to the Fund

- Patriarchal Systems

- Female-headed Households

- Unpaid Work

- Financial Control and Decision-making Power

- COVID-19

This part of the research is tailored to the specific intersectional conditions of women beneficiaries of the Inhlanyelo Fund in Eswatini. Therefore, I have to do most of the things in the household, since he does not have a stable income. When he got a temporary job, he would also contribute to the maintenance of the household (Primary data, 2020).

M ICROFINANCE AND THE P ROMISE OF A ‘B ETTER L IFE ’

- The Promise of Empowerment

- Better Life as Empowerment

- Better Life as Buen Vivir, an alternative way of living

C HAPTER S UMMARY

DISCUSSION AND ANALYSIS OF THE FINDINGS

- Bureaucracy with accessing the Loan

- Loan Repayment

- Women Household Heads

- The Influence of the Whole Person’s Life History on Decisions

- The Influence of a Disjuncture

- Learning through Training

- Ubuntu

- Transformation through Reflection

- Lifelong Learning

H OW THE W OMEN FELT THE F UND HAD AFFECTED THEIR L IVES

- Poverty Reduction

- Gender Power Relations with Partners

- Perceptions of Women’s Empowerment

- Self- perception

- Buen Vivir

- Empowerment in Terms of Micro, Meso, and Macro Levels

C HAPTER S UMMARY

CONCLUSION AND RECOMMENDATIONS

C ONCLUSIONS

- Understanding the Experiences of Rural Women with the Inhlanyelo Fund

- Understanding how the Participants Learnt from their Experiences with the Inhlanyelo Fund . 221

S IGNIFICANCE OF THE S TUDY

R ECOMMENDATIONS