Given this environment, this research aims to explore risks attributed to cross-border project-financed projects and understand why South African companies should or should not use Project Finance for their cross-border projects. The first phase led to a broad description of the theory of risks associated with cross-border project-financed projects and those specific risks and allocation or mitigation methods addressed in cross-border projects that used Project Finance as their financing vehicle.

Chapter 1 – Introduction to the Research Problem

- Introduction

- Project Finance and Associated Risks

- The Need for Research on Risk Management in Cross Border Project Finance

- Research Problem

- Research Objectives

- Research Motivations

- Scope of the Research

Given the need for infrastructure projects in the multinational arena and considering the risks involved for different project stakeholders (which means that risk management research on cross-border project finance transactions is required), the research topic will focus on risk allocation and mitigation methods for Project Finance of cross-border projects. This study will contribute to the establishment of a framework for systematic risk management in cross-border project finance transactions.

Chapter 2 – Literature Review

Project Finance

- Definition of Project Finance

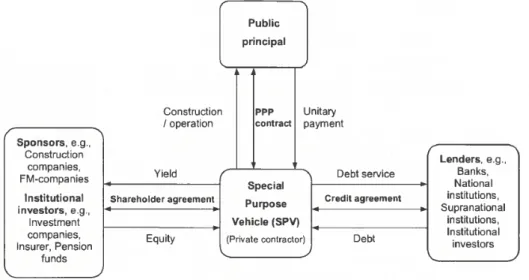

- Structure of Project Finance

- Motivations to Use Project Finance

- Advantages and Disadvantages of Using Project Finance

- Project Finance in Energy Projects

With this nature of Project Finance being a special area of expertise, what are the motivations? This and other motivations towards the risks associated with project financing will be discussed in the next section.

Cross Border Projects

- Introduction to the Cross Border Projects

- Different Scenarios for Project Finance in Cross Border Environments

- Cross Border Exposures and Financial Contagion

- The Impact of Law, Regulations, and Culture on Cross Border Projects

An international joint venture is an important form of foreign direct investment that has generated a large literature base. At a firm level, US firms are more likely to form cross-border joint ventures in the case of technology transfer between the joint venture partners in deals involving partners.

Project Risks

- Definition

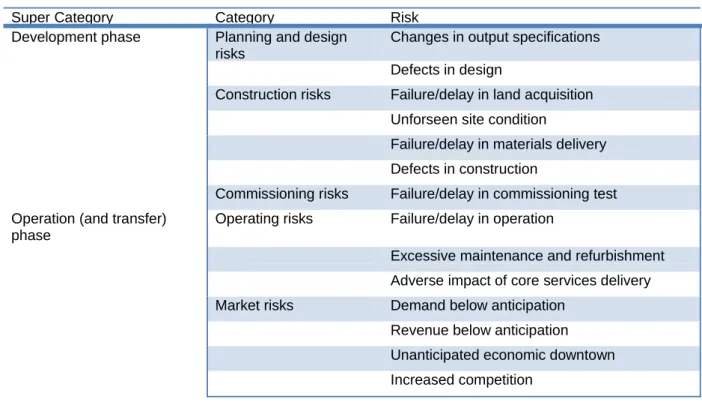

- Specific Types of Project Risks

- Project Political Risks

Second, the participation of development banks in the loan syndicate also contributes to political risk management. Their contribution to the literature is therefore to investigate how political risk influences the choice between project financing and full-recourse loans and the syndicate structure of these loan contracts.

Project Risk Allocation

- Introduction

- Basic Elements of Risk Allocation Method in Project Finance

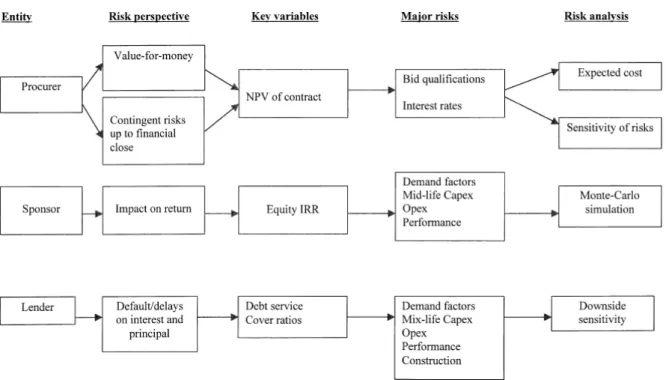

Another aspect of risk allocation is the transfer of risks between public and private sectors involved in Project Finance transaction. Incentives from risk – participants can be inspired to manage risk in the most effective and efficient way.

Project Risk Mitigation

- Introduction

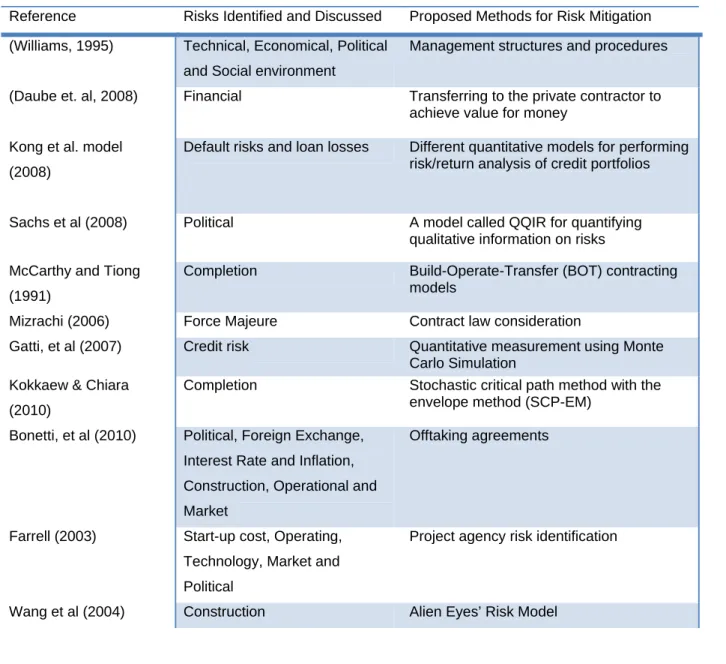

- Mitigation Methods Introduced in the Literature

It can be argued that in the risk allocation process we should not ignore the relationship between risks and the impact(s) each risk may have on another type of risk. The approach proposed in their paper can be useful for both sponsors and lenders to better assess the risk of the project and to support careful risk allocation.

Mitigating risks in Cross Border Projects

They discuss that governments see Build-Operate-Transfer (BOT) schemes as a method of financing the construction of projects without the need for a direct sovereign loan guarantee. To ensure the success of project financing, BOT sponsors must negotiate indirect government undertakings, such as the creation of offshore escrow accounts, foreign exchange guarantees, and concessions to operate existing facilities. Each country has its own method of forming concessions and BOT projects are more likely to be sponsored when the necessary legal framework already exists.

Concession holders typically use fixed-price turnkey construction contracts to transfer construction risks to builders.

Project Finance as a Risk Management Tool

Conclusion of Literature Review

Chapter 3 – Research Questions

Introduction to the Research Questions

The Research Questions

Chapter 4 – Research Methodology

- Introduction to the Research Methodology

- Research Approach

- Research Design

- Population and Unit of Analysis

- Data Collection, Data Analysis and Data Management

- Research Instrument / Measurement

- Developing The Research Instrument

- Data Validity and Reliability

- Research Limitations

Given the previous intention to focus on one of the Cross Border Project Finance deals in the chemical industry, three of the interviewees were selected from one of the leading South African companies in the chemical industry. The researcher's main intention was to conduct this research under the full supervision of his tutor at GIBS, to ensure as much objectivity as possible in the process. Initially, the intention was to conduct a fully detailed interview with one of the Project Finance Expert teams in the South African industry and conduct a case study.

After the literature review and case study analysis were completed and reviewed, the results of both guided the researcher to find the main headings of the questionnaire. In Gillham's words, “Content analysis is about organizing the substantive content of the interview” (2000, p. 59). Constant comparative analysis was done to gain a deeper understanding of the issues at hand and an iterative process was used.

Where the respondents tell a story in the interview, Narrative Analysis was used to try to gain a deeper understanding of the meaning behind the story.

Chapter 5 – Research Results

Phase 1 – Case Study Analysis

- Introduction to Case Study Analysis

- The Chad-Cameroon Petroleum Development and Pipeline Project

- Australia-Japan Cable: Structuring the Project Company

- Calpine Corporation: The Evolution from Project to Corporate Finance

- BP Amoco: Financing Development of the Caspian Oil Fields

- Airbus A3XX: Developing the World’s Largest Commercial Jet

- Nghe An Tate & Lyle Sugar Company (Vietnam)

- Contractual Innovation in the U.K. Energy Markets

- Bidding for Antamina

- Petrolera Zuata, Petrozuata C.A

- Poland’s A2 Motorway

- Restructuring Bulong’s Project Debt

- Financing the Mozal Project

- Chase’s Strategy for Syndicating the Hong Kong Disneyland Loan

- Basel II: Assessing the Default and Loss Characteristics of Project Finance46

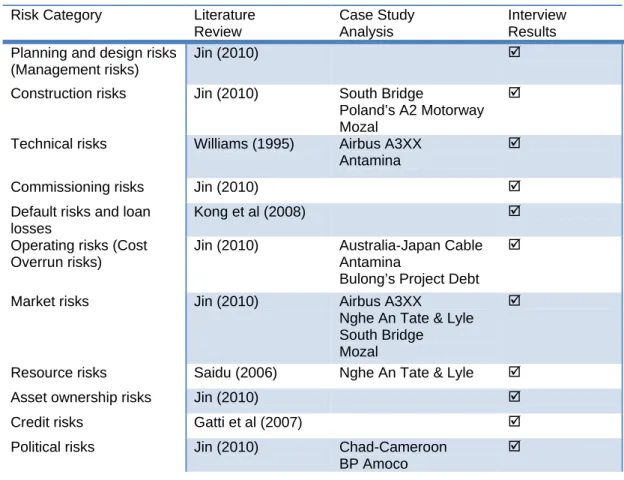

The following risks, allocation and mitigation methods are detailed for this case as shown in the table below. Esty, Lysy and Ferman (2003) outline the risks, allocation and mitigation methods for this case as shown in the table below. Esty and Tufano (2003) discuss the matter and outline the following risks, allocation and mitigation methods as shown in the table below.

Esty (2002) discusses this case and outlines the following risk, allocation and mitigation methods shown in the table below. Esty (2003) analyzes this case and outlines the following methods of risk, allocation and mitigation. Esty and Kane (2003) analyze this case and outline the following risk, allocation and mitigation methods which are shown in the table below.

Esty (2003) analyzes this case and discusses the following risks, deployment and mitigation methods shown in the table below.

Phase 2 – Interview Results

- Introduction to Interview Results

- Section 1 – Project Finance, Applications and Limitations in South Africa

- Section 2 – Cross Border Projects

- Section 3 – Risks Identification and Allocation

- Section 4 – Risk Mitigation

- Section 5 - Examples of Cross Border Project Financed projects

- Conclusion on the Interview Results

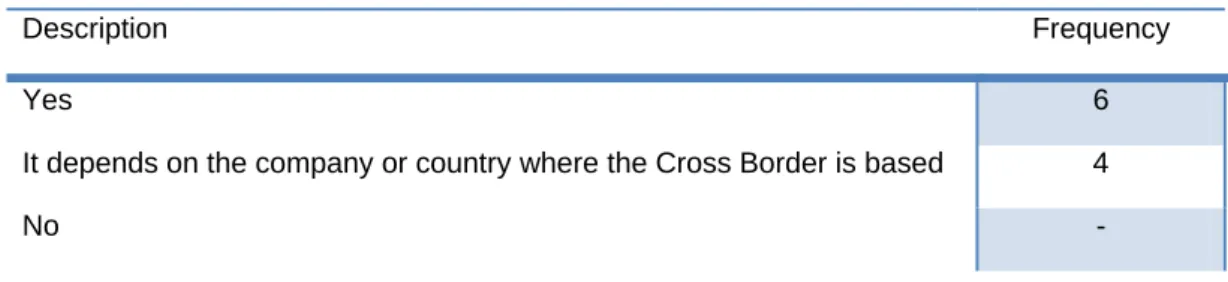

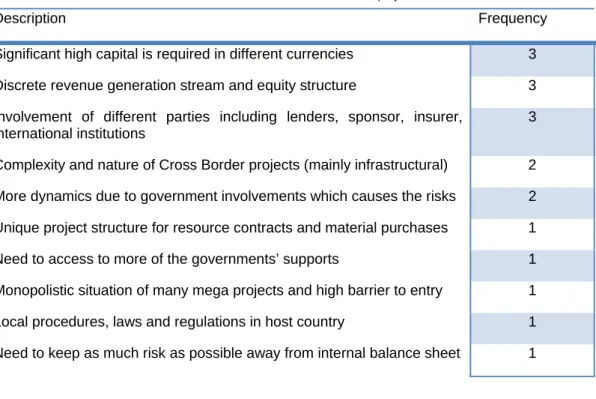

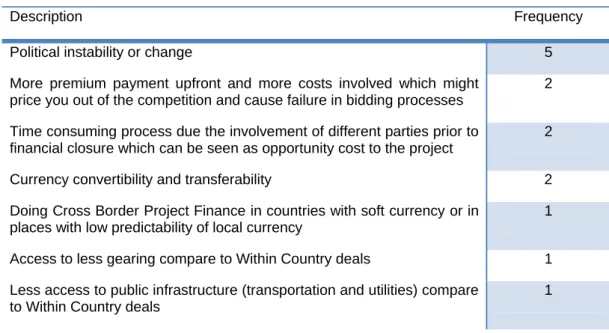

The table below summarizes the main characteristics of cross-border projects identified in the interviews, in order of frequency with which they were mentioned. While many of the benefits of using Project Finance have already been described in previous questions, the table below summarizes the losses of using Project Finance in cross-border projects identified in the interviews. The table below summarizes the risk categorization methods identified in the interviews for cross-border project-funded projects, in order of frequency with which they were mentioned.

The table below outlines the main tools used to anticipate project risks in cross-border project-financed projects identified in the interviews and the frequency with which they were cited. The table below lists the impact of legislation in the risk allocation process of cross-border project financed project. The table below lists the impact of a sustainable agreement with the host country government in cross-border projects identified in the interviews.

The table below lists the risk mitigation methods identified in the interviews in response to each risk associated with cross-border projects.

Chapter 6 – Discussion of Results

Introduction to the Result Discussion

The following analysis does not attempt to capture the full perspective of projects financed by cross-border projects. Rather, the purpose of this chapter is to explore the various risks, allocation methods and mitigations in cross-border project-financed projects so that the reader or researcher can have a good understanding of the theory and practices, the similarities and differences between the two, and ultimately enable future project finance research.

Results Discussion

- Section 1 – Risks in Cross Border Project Financed projects

- Risk Categorisation

- Why Project Finance for Cross Border Projects

- Benefits of Project Finance for Cross Border Projects

- Section Summary

- Section 2 – How does Project Finance help allocate or mitigate risks?

- Cross Border projects, more or less risky?

- Implications of using Project Finance for Cross Border projects

- Risk Categorisation Methods

- Risk Allocation Methods

- How does Project Finance help Risk Management Processes?

- Principles and Lessons to be learnt in view of Cross Border projects81

- Section 3 – Current Status of Risk Management in Cross Border Project

- Disadvantages of using Project Finance for Cross Border projects

- Implication of laws and regularities

- Comparative Study of Risk Mitigation Methods

- Further Implications of Risk Mitigation Methods

- Section Summary

- Conclusion on the Result Analysis

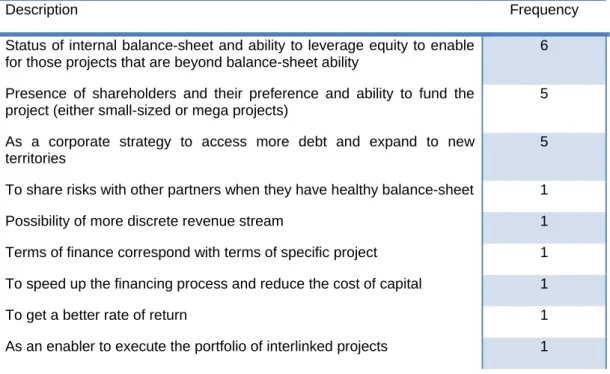

Therefore, project finance theory indicates the benefits and suitability for large cross-border investments. In practice (interview responses recorded in Chapter 5), nine different reasons have been identified why companies should use project finance for their cross-border projects. Reasons why project financing for cross-border projects Elements of project financing (Esty, 2003, p 4) Status of internal balance and ability to leverage equity.

Project Finance provides an opportunity to understand the legality and regularity involved for the project; in the cross-border environment, attention should be paid to these elements. The benefits of using Project Finance were illustrated in the context of the research area identified in Chapter 1. Some of these losses are due to project finance methodologies and some are due to the specific nature of cross-border projects.

Using Project Finance results in some losses for cross-border projects; some of these losses are due to project financing methods (cost and time consuming) and some are due to the specific nature of cross-border projects (political risks and currency implications).

Chapter 7 – Conclusion

- Introduction

- The Central Research Problem

- The Research Objectives

- Recommendations to Stakeholders

- Future areas for research

- Suggestions for Project Finance Practitioners

- Concluding Statement

The first objective was to develop a broad theory base for risks attributed to those cross-border projects that use Project Finance as their financing vehicle. The second objective was to understand why companies (in this research; South African companies) should or should not use project finance for their international cross-border projects. The third objective of this research was to identify how risk allocation and mitigation methods can help companies (in this research; South African companies) manage their Project Finance transactions in their international cross-border project context.

To this end, Chapter 6 covers further lessons to be learned by companies involved in project finance. Companies are suggested to choose the right cross-border partner and apply for project financing. All this suggests that project finance is a recommended means of financing cross-border projects, provided that the required due diligence and homework is done in advance.

A comparison of project financing and the forfeiture model as forms of financing for PPP projects in Germany.

List of Interview Respondents

Questionnaire

I am conducting exploratory research on project finance and particularly focusing on the risks associated with cross-border project finance. I also aim to find out where more research needs to be done in the area of Project Finance. Our interview is expected to last 60 to 90 minutes where I will ask a series of questions about your experience of project finance or cross-border projects within the context of South African Companies.

In specific case of cross-border projects, what are the advantages and losses of Project Finance. In light of the above question, do you agree with the following risk classification for Project Finance Risks. Please comment on the following quote*: “Capital expenses and selling prices are of great importance to the overall risk of Project Finance transactions.”.

The Journal of Structured Finance Which of the following Project Finance models is riskier;.