This research project identified practice management principles as applied to the personal financial planning process. The second phase was an empirical study that was made on the responses received to the research instrument to establish principles of practice management.

MAIN CONTRIBUTIONS OF THIS RESEARCH 99

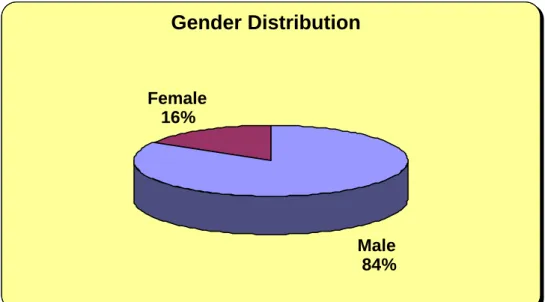

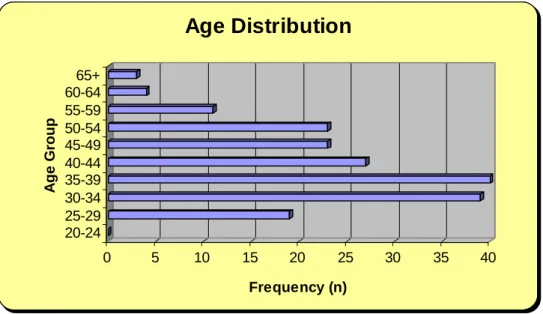

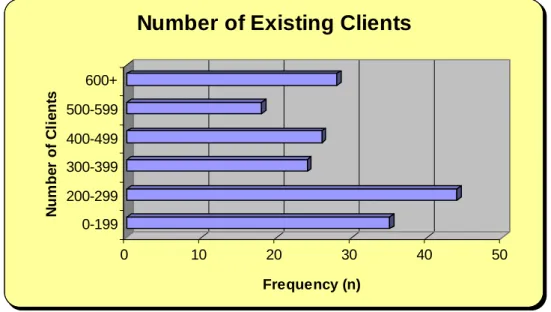

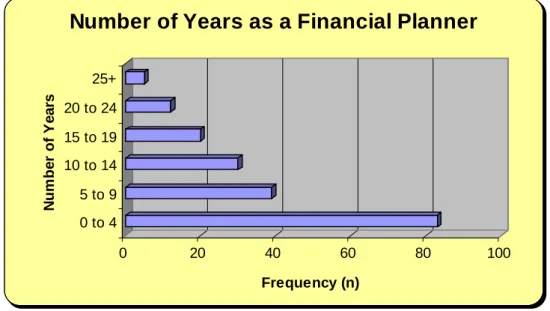

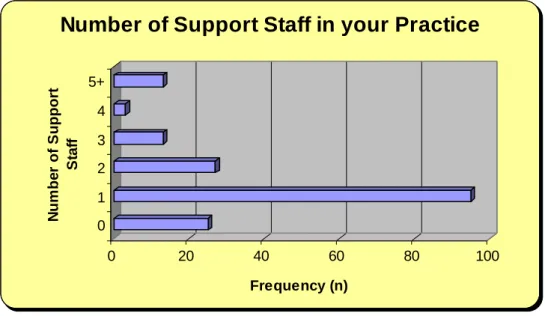

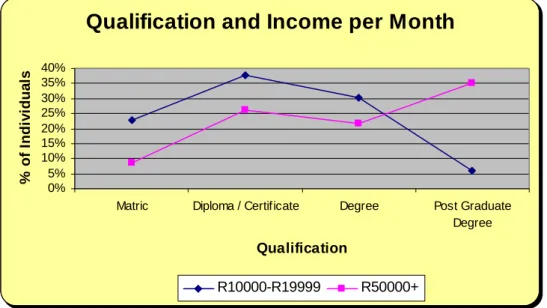

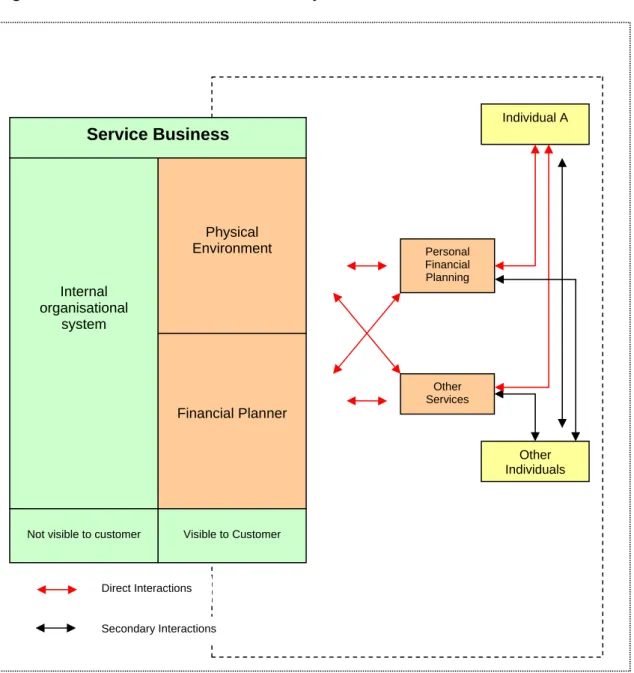

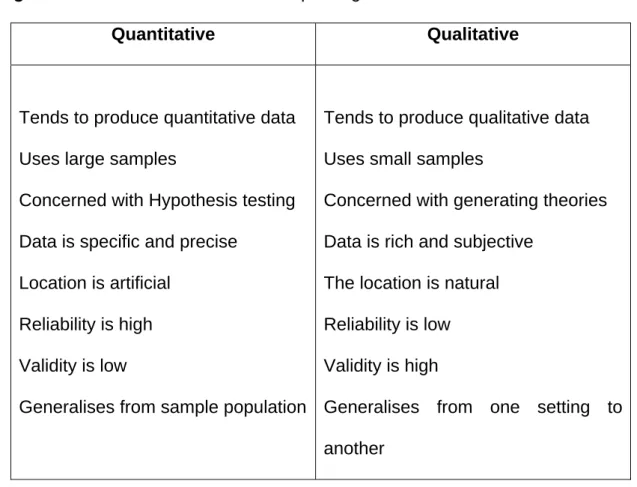

Page Figure 2.1: The Service Business as a System 17 Figure 2.2: Practice Management as a Service System 28 Figure 4.1: Opposing Approaches to the Major Research Paradigms 36 Figure 4.2: Characteristics of the Two Major Paradigms 37 Figure 5.1: Gender Distribution of Respondents 48 Figure 5.2: Age Distribution of Respondents 49 Figure 5.3: Highest level of education distribution of respondents 50 Figure 5.4: Total monthly income (before tax) distribution of respondents 51 Figure 5.5: Number of existing clients distribution of respondents 52 Figure 5.6: Number of years as a financial planner distribution of.

THE PERSONAL FINANCIAL PLANNING PROCESS 3

CHAPTER INTRODUCTION

THE PERSONAL FINANCIAL PLANNING PROCESS

INDUSTRY STRUCTURE

The size of the industry has led to a high degree of complexity for an individual who wants to purchase a financial product. This complexity can lead the individual to purchase a financial product that does not meet the future financial goal or that achieves the future financial goal but not in the most efficient way.

FINANCIAL PLANNERS

A financial planner guides individuals through a consultative financial planning process to identify the individual's future financial goals. This is because an individual's personal and financial information and financial goals may change, requiring adjustments to the plan.

PRACTICE MANAGEMENT

Once the financial product is in place, the financial planner will regularly and continuously review the progress of the personal financial plan with the individual. These elements, the identification of individuals, the personal financial planning process, review and infrastructure, form the foundation of the practice management process and are fundamental both to the achievement of future financial goals in the individual's financial plan and to the financial success of the financial planner.

LEGISLATIVE TRENDS

A financial planner's ability to acquire and implement them will determine their ability to implement practice management principles. The impact of FAIS on practice management is increased compliance costs and lengthening of the financial planning process.

PROBLEM STATEMENT

SCOPE OF THE RESEARCH

THE NEED FOR PERSONAL FINANCIAL PLANNING 13

CHAPTER INTRODUCTION

LIMITATIONS OF THE THEORY BASE

THE NEED FOR PERSONAL FINANCIAL PLANNING

The personal financial planning process is an exercise in applying risk management techniques at the individual level. Elgar (2004) suggests that the tools for financial planners to use in the personal financial planning process will become increasingly sophisticated and the skill level of financial planners will also need to increase.

CHARACTERISTICS OF PERSONAL FINANCIAL PLANNING

The Service System Model

People” which in the context of the personal financial planning process would be the Financial Planner and their interaction with the individual. Processes” that differentiate the personal financial planning process or give efficiencies experienced by the individual in the personal financial planning process.

The Personal Financial Planning Process

Elements in the six steps are requirements of the FAIS for the Financial Planner to be compliant (Republic of South Africa, 2002). These goals allow the financial planner to be specific in the personal financial planning process.

Principles of Practice Management

A financial planner who understands where the individual is in the life cycle model is better able to do financial planning for the individual. Botha et al (2006) suggest qualifying clients before starting the personal financial planning process to ensure that the financial planner is able to meet the individual's anticipated needs.

LEGISLATION

In addition, the FAIS provides an ombudsman with the power to sanction financial planners if they breach these minimum standards of service. Where similar legislation has been introduced in Australia and the UK, significant numbers of financial planners left the industry (Life. The report goes on to suggest that a restructuring of the remuneration model, while FAIS embeds itself, would increase Financial Planners' costs to a point that a significant number of Financial Planners would leave the industry.

Legislation requires Financial Planners to integrate the legislative requirements into practice management principles by both adopting the spirit of the regulations and managing the risks of non-compliance.

REASONS FOR SELECTION OF RESEARCH QUESTIONS 33

CHAPTER INTRODUCTION

REASONS FOR SELECTION OF RESEARCH QUESTIONS

RESEARCH QUESTIONS

DETERMINATION OF SAMPLE SIZE AND METHDOLOGY 39

CHAPTER INTRODUCTION

RESEARCH PARADIGMS

The quantitative research design exposes the participants to an intervention that they would not be exposed to in the normal course of events. Criticism of the qualitative paradigm suggests that the researcher does not observe reality but an interpretation of reality when they become engrossed in the research process and over-reliance on relying on secondary sources of information.

SELECTED METHODOLGY

DEFINITION OF UNIT OF ANALYSIS

POPULATION OF RELEVANCE

DETERMINATION OF SAMPLE SIZE AND METHDOLOGY

RESEARCH INSTRUMENT

A Likert rating scale was used on twenty statements about the principle of practice management, divided into the four components of practice management. A separate statement was compiled for the four components of practice management, but these were not graded statements. Five different attitude parameters were asked for each statement and a non-applicable parameter was included.

The first question asked respondents to select and rank practice management statements used in the survey.

DATA COLLECTION

DATA ANALYSIS

RESEARCH LIMITATIONS

Planner and Total Monthly Income (Before Tax) The ratio between the number of existing customers and .

ANALYSIS OF STATEMENTS ON PRACTICE MANAGEMENT

Ranking of the Lowest Mean Score Statement from each

CHAPTER INTRODUCTION

THE SAMPLE

ANALYSIS OF DEMOGRAPHIC DISTRIBUTION

Gender Distribution

Age Distribution

Age Distribution

Highest level of Education Distribution

Highest Level of Education Distribution

Total Monthly Income (before tax) Distribution

Total Monthly Income (before tax)

Number of Existing Clients Distribution

Number of Existing Clients

Number of Years as a Financial Planner Distribution

Number of Years as a Financial Planner

Number of Direct Support Staff in Your Practice Distribution

Number of Support Staff in your Practice

Relationships between Demographics

- The Relationship between Highest Level of Qualification and Total Monthly Income (Before Tax)

The analysis found that 9% of financial planners with matric earned R50 000+ month compared to 35% of financial planners with postgraduate qualifications. This was further supported by results in the lower income category of R10 000 to R19 000, with 23% of respondents with a Matric earning this income compared to 6% of Post Graduate Degree in the same income category.

Qualification and Income per Month

The Relationship between number of Years as Financial Planner and Total Monthly Income (Before Tax)

The frequency of responses was summed for the number of years as a financial planner and demographic data on total monthly income (before tax). Two high and low income categories were selected and the percentage of persons reaching these income levels in the years of service category was calculated. The analysis showed that 6% of financial planners with 0 to 4 years experience earned R50 000+ month compared to 60% of financial planners with 25 years+ experience.

This was further supported by results in the lower income category of R10 000 to R19 000 where 46% of respondents in the 0 to 4 years category earned this income compared to 0% in the 25 years + category.

The Relationship between number of Existing Clients and Total Monthly Income (Before Tax)

Clients and Income per Month

ANALYSIS OF STATEMENTS ON PRACTICE MANAGEMENT PRINCIPLES

- Component Analysis

- Individual Component Analysis

- Personal Attributes Component Analysis

- Personal Skills Component

- Customer Strategies Component

- Business Strategies Component

- Ranking of the Highest Mean Score Statement from each Component

- Ranking of the Lowest Mean Score Statement from each Component

- INDIVIDUAL STATEMENT ANALYSIS

- Ranking of Mean Scores

- Ranking of Standard Deviation Scores

Statement Highest average score 7 An ability to communicate with customers. which are in different stages of the life cycle 4.63. Terminate customer relationships where the value gained is less than the costs of maintaining the relationship” had the lowest mean score of 3.07. The third highest mean score of 4.61 was given to the statement "Ability to communicate with clients who have different money personalities."

The lowest mean score of 3.07 was given to the statement "End customer relationships when the value gained is less than the costs of maintaining the relationship" (statement 15).

ANALYSIS OF OPEN-ENDED QUESTIONS

- ANALYIS OF QUESTION 1

- ANALYSIS OF QUESTION 2

The responses for each statement were summed for each ranking and a percentage was calculated using the number of responses for each statement and the total number of respondents. Statement number 1 was the highest statement with 61.4% of respondents choosing it as the most important statement out of all twenty statements. Statement number 2 was the highest statement with 24.6% of respondents choosing it as the most important statement out of all twenty statements.

Statement number 12 was the highest statement with 14.5% of respondents choosing it as the most important statement out of all twenty statements.

CHAPTER INTRODUCTION

ANALYSIS OF RESEARCH QUESTION 1

- Demographic Results

- Finding Number 1 - Highest Level of Education Demographic

- Finding Number 2 - Number of Years as a Financial Planner Demographic

- Finding Number 3 - Number of Existing Clients Demographic

- Statements on Principles of Practice Management

- Findings on all Statements

- Findings for Components of Practice Management

- Conclusion on Research Question 1

These principles mean that more years as a financial planner should result in increased income streams. The research found a direct correlation between the demographic's number of years as a financial planner and the demographic's monthly income (before taxes). The objective of the demographic analysis of the number of existing clients and its effect on income was to determine whether the number of existing clients increased the monthly income (before taxes) of a financial planner.

The research found that the average score attributed to all practice management principles statements was above 4 with a standard deviation value of 0.76.

ANALYSIS OF RESEARCH QUESTION 2

- Conclusion on Research Question 2

It is clear from the overall mean scores that all the principles of practice management were validated and further insight was gained into the role of specific principles of practice management such as trust as well as demographic drivers and their effect on income. Without it, the personal financial plan does not stay current with individuals' changing personal and financial goals, the financial planner does not build a practice, and a commitment to after-sales service does not exist. It is an important principle and is not out of place as one of the three selected principles.

ANALYSIS OF RESEARCH QUESTION 3

- Conclusion on Research Question 3

Aspects of the legislation and its impact on financial planners have required financial planners to change the way they operate; further analysis showed that financial planners who had been in the industry longer were more likely to say compliance was a problem. This would mean that this category of financial planners has problems adapting to the new legislative requirements. The practice management issue is a clear indication that financial planners either lacked the skills when it came to the matter in their practice or were experiencing a high level of dissatisfaction with how their practices were run.

Two clearly identifiable issues facing Financial Planners in their practices were articulated and expressed in the research output.

SUMMARY OF RESEARCH

CONCLUSIONS AND RECOMMENDATIONS

How financial planners are able to adapt in this environment will be a critical factor in success. The implications for financial planners are that no breach of these standards should be tolerated at any cost. Additionally, the need to retain financial planners in the industry over a longer period will be an advantage.

However, it is recommended that financial planners collect information that can help answer these questions.

MAIN CONTRIBUTIONS OF THIS RESEARCH

These are what is the ideal size for the number of clients per financial planner and how effectively does the financial planner manage the client base.

RECOMMENDATIONS FOR FUTURE RESEARCH

Ultimately, this research has presented principles that we hope will deepen understanding of the personal financial planning process and the role of practice management, thereby expanding the body of knowledge related to this area. 2002) Wealth accumulation and the propensity to plan. 1998) Acquiring New Customers in Financial Services: Using Relationship Marketing and Information Technology in Consumer Financial Services. Republic of South Africa (2002) Financial Advisory and Intermediary Services Act, No. Exploring the role of emotional intelligence and organizational commitment.

An assessment of the expected and actual delivery of service quality at Standard Bank Financial Consultancy.

Demographic Information

If you will submit the survey by e-mail, do not forget to save the changes to the document and forward the e-mail to the address provided.

Statements on Practice Management Strategies

Open Ended Questions

Please select from the list of attributes, skills and strategies in section 2, which in your view are the three most important practice management

Do you have any general comments on practice management issues that you feel are relevant to the survey?