And while the municipal council of Bitou Municipality wants to adopt a policy to guide the municipal manager in the management of the municipality's assets. Depreciation is the systematic allocation of the depreciable amount of an asset over its useful life.

C LASSIFICATION OF C APITAL A SSETS

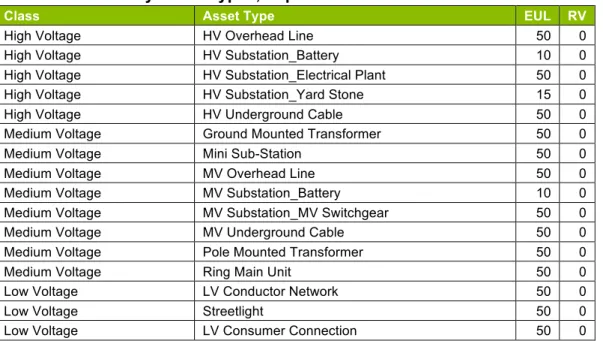

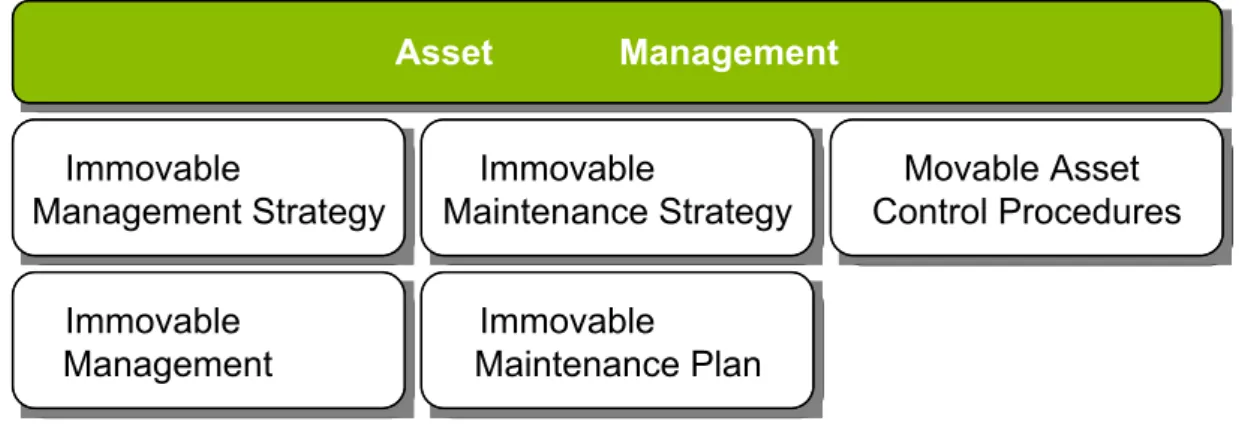

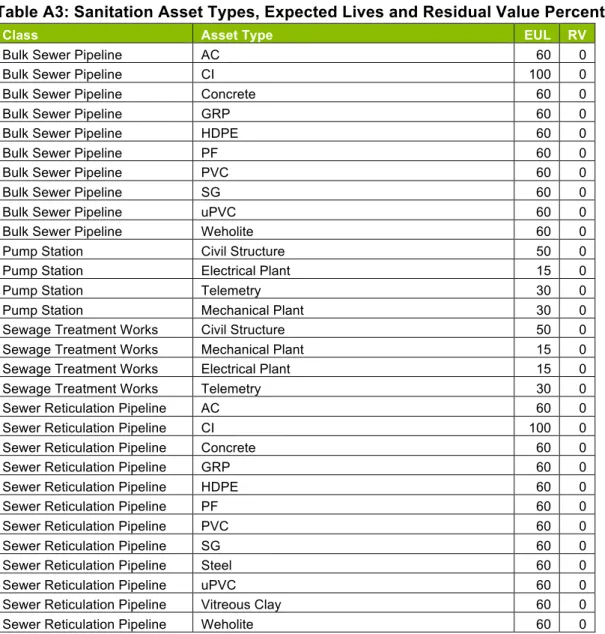

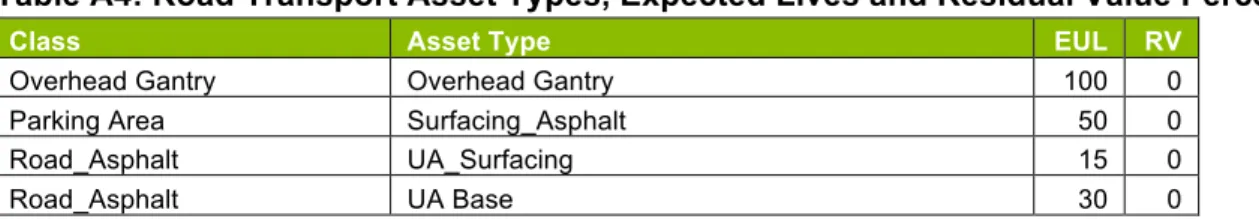

The most important challenges associated with the management of fixed assets can be characterized as follows: p) Movable assets – the control of acquisition, location, use and disposal (over a relatively short term lifetime). To facilitate the practical management of infrastructure assets and asset register data, infrastructure assets have been further classified.

I DENTIFICATION OF A SSETS

The CFO will ensure that the classifications as specified by the National Treasury, GRAP, and those accepted by the municipality are adhered to. Each head of department must ensure that all fixed assets under their control are correctly classified.

A SSET R EGISTER

The CFO must define the format of the asset register in consultation with the heads of department and must ensure that the asset register format complies with legislative requirements. The department heads must provide the CFO with the information needed to compile and maintain the asset register.

R ECOGNITION OF C APITAL A SSETS : I NITIAL M EASUREMENT

In such a case, the municipality must capitalize the cost of the asset together with VAT. The municipality should not recognize the cost of daily service of the item in the carrying amount of an item of capital asset.

S UBSEQUENT M EASUREMENT OF C APITAL A SSETS

When there is no significant transfer of the risks and rewards of ownership, the lease is considered an operating lease and the payments are expensed in the income statement on a systematic basis. The CFO will ensure that all properties, facilities and equipment are correctly recorded in the asset register and revalued (if applicable) in accordance with municipal policies.

R ECOGNITION OF I NVENTORY I TEMS (N ON C APITAL I TEMS )

However, the reduction is charged directly to a revaluation reserve in the amount of any credit balance in the revaluation reserve relating to that asset. Consumption in the production process of goods that are distributed free of charge or for a nominal fee.

P ROPERTY , P LANT AND E QUIPMENT : L AND AND B UILDINGS

After initial recognition, the Municipality chooses the cost model as the accounting policy for its Land and Buildings. The CFO will ensure that all land and buildings are correctly recorded in the asset register and revalued (if applicable) in terms of the municipality's policies.

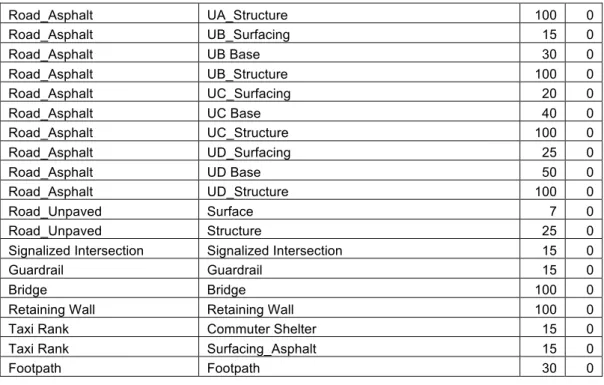

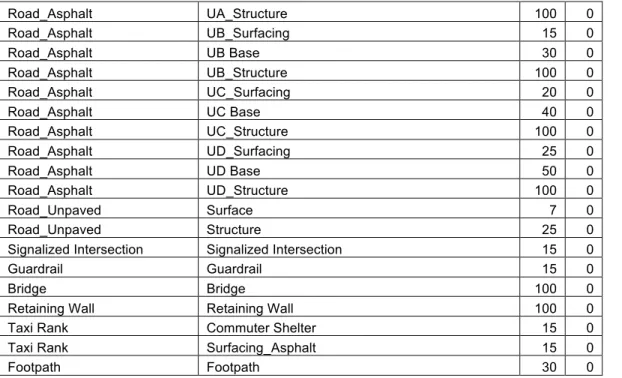

P ROPERTY , P LANT AND E QUIPMENT : I NFRASTRUCTURE A SSETS

If the municipality elects the cost model for its land and buildings, then upon recognition as an asset, the land and buildings will be carried at cost less any accumulated depreciation and any accumulated impairment losses. If the municipality chooses the revaluation model for its land and buildings, then after recognition as an asset, the land and buildings whose fair value can be measured reliably will be carried at a revalued amount, being its fair value in revaluation date less any subsequent accumulated impairment and subsequent accumulated impairment losses. The CFO will ensure the recognition and measurement of land and buildings in terms of GRAP 17.

P ROPERTY , P LANT AND E QUIPMENT : C OMMUNITY A SSETS

However, if costs cannot be determined, infrastructure assets are valued at amortized replacement cost. The CFO determines the level of detail of the infrastructure asset register in consultation with the heads of department. The CFO ensures the recognition and valuation of Infrastructure Assets in terms of GRAP 17.

P ROPERTY , P LANT AND E QUIPMENT : O THER A SSETS

H ERITAGE A SSETS

If the cost price of heritage assets is not known, the heritage asset will be valued at fair value. For reporting purposes, the existence of such heritage assets will be disclosed by means of an appropriate entry in the asset register. The CFO, in consultation with the department heads, will ensure that all heritage assets are appropriately recorded and valued in terms of the municipality's policies.

I NTANGIBLE A SSETS

I NVESTMENT P ROPERTY

Investment properties are accounted for in terms of GRAP 16 and are not classified as PPE for the purpose of preparing the statement of financial position of the municipality. If the council of the council decides to construct or develop a property for future use as an investment property, such property will be classified as personal protective equipment in all respects until it is ready for its intended use, at which point it will be reclassified as an investment property . After initial recognition, all investment properties are valued according to the municipality's accounting policies.

B IOLOGICAL A SSETS

If an investment property is acquired for free or at nominal cost, the cost is equal to its fair value at the date of acquisition. The CFO ensures the recognition and valuation of Investment Properties in terms of GRAP 16. The CFO ensures the recognition and valuation of biological assets in terms of GRAP 27.

DISCONTINUED OPERATIONS (GRAP 100)

The CFO, in consultation with department heads, will ensure that all biological assets benefiting from a managed agricultural activity, such as livestock and crops, are valued on June 30 of each year by a recognized valuer in the line of biological assets in words.

I NVENTORY P ROPERTY (GRAP 12)

CFO will ensure recognition and measurement of Biological Assets in terms of GRAP 27. b) consumption in the production process of goods that will be distributed free of charge or at a nominal fee, then they will be measured at the lowest and current cost. replacement cost. The CFO will ensure the recognition and measurement of Inventory Assets in terms of GRAP 12.

M INOR A SSETS (C APITAL A SSETS B ELOW A PPROVED T HRESHOLD )

A CQUISITION OF A SSETS

S ELF - CONSTRUCTED A SSETS

Department heads will ensure that proper records of staff time, transport and material costs are kept so that all costs associated with the construction of these assets are fully and accurately accounted for. Department heads will open a postcard for each infrastructure project built by the municipality. Upon completion of the infrastructure project, the department heads will ensure that all costs (both direct and indirect) associated with the construction of the assets are added up and capitalized to the assets that make up the project.

D ONATED A SSETS

U SEFUL L IFE OF A SSETS

R ESIDUAL V ALUE OF A SSETS

Changes in depreciation resulting from such reviews must be recorded as a change in accounting estimates in accordance with GRAP 3. The CFO must ensure that residual values and changes thereof are correctly recorded and posted in the asset register and general ledger. The CFO must ensure that an asset's residual value is reviewed at each reporting date.

D EPRECIATION OF A SSETS

Each department manager must determine the reasonable useful life of the asset classifications under their control. Alternative depreciation methods can exceptionally be used if it is motivated by the head of department who controls the asset vis-à-vis the municipal manager and in consultation with the finance director. The CFO must ensure that an asset's residual value, useful life and depreciation method are reviewed at each reporting date.

I MPAIRMENT L OSSES

In the case of an asset that is not listed in the asset classification list, the Head of Department shall determine a useful operating life, in consultation with the CFO, and shall be guided in determining such useful life by the likely pattern in which the asset's economic benefits or service potential will be consumed. The CFO will ensure that the depreciation is updated on a monthly basis and reconciled between the asset register and the general ledger. The CFO will ensure that impairment losses, or reversals thereof, are properly recorded and accounted for in the asset register and general ledger.

M AINTENANCE OF A SSETS AND THE A SSET R EGISTER

The CFO, in consultation with department heads, should ensure that regular damage testing and surveys are carried out. Department heads must ensure that operating expenses are incurred against the operating budget and not the capital budget. Department heads will ensure that maintenance plans anticipate the additional maintenance burden of future infrastructure to be acquired.

R ENEWAL OF A SSETS

All department heads responsible for the control and use of infrastructure assets monitor the maintenance measures and budget for the operation and maintenance needs of each asset or asset class under their control. Operating expenses must include all labor and material costs for the repair and maintenance of assets. Heads of departments report annually to the council on the extent of compliance with the approved maintenance plan and the extent of deferred maintenance.

R EPLACEMENT O F A SSETS

T RANSFER OF A SSETS

E XCHANGE OF A SSETS

A LIENATION / D ISPOSAL OF A SSETS

The Council delegates to the town clerk the power to approve the disposal of assets with a book value of less than R5 000 (five thousand rand). Donations: Donations may be considered a form of alienation, but such requests must be submitted to the town clerk for approval. Demolition: Demolition of assets that cannot be otherwise disposed of may be considered a method of disposal, but such requests must be justified with the town clerk.

S ELLING OF A SSETS

When the assets have been disposed of, the CFO must write off the relevant assets in the asset register. No municipal property may be rented out free of charge without prior approval from the relevant treasury. If, on the other hand, the proceeds from the sale are greater than the book value of the asset in question, the difference must be recognized as a gain for the department or vote in question in the income statement.

W RITING - OFF OF A SSETS

Transfer of assets to other municipalities, municipal entities (whether under the sole or partial control of the municipality) or other governmental bodies shall take place in accordance with the above procedures, except that the disposal process shall be by private agreement.

P HYSICAL C ONTROL / V ERIFICATION

I NSURANCE OF A SSETS

S AFEKEEPING OF A SSETS

If a biological asset is lost, stolen or destroyed, the matter must be reported in writing by the relevant head of department in exactly the same way as if the asset were an ordinary asset. Loss of assets identified during the physical verification process and not reported to the appropriate stakeholders shall be investigated by each respective department head and reported to the CFO.

C APITAL R EPLACEMENT R ESERVE (CRR)

Interest earned on the CRR investments is recorded as interest earned in the Statement of Financial Performance and must then be transferred to the CRR in the Statement of Changes in Net Assets.

F UNDING S OURCES

D ISASTER

The municipality will correspond with Eden County Municipality to obtain funding for the repair of disaster damaged assets. The municipality must adhere to the disaster management plan for disaster prevention and mitigation in order to be able to attract disaster management input during or after the disaster.

L EGAL F RAMEWORK

R ATIONALE FOR M ANAGEMENT OF A SSETS

The municipality has and maintains a management, accounting and information system in which its assets and liabilities are accounted for; The assets of the municipality are valued according to generally recognized accounting practices; And. The OHSA requires the municipality to provide and maintain a safe and healthy work environment, and in particular to keep its infrastructure safe.

P RINCIPLES OF A SSET M ANAGEMENT

P OLICY O BJECTIVE

P OLICY P RINCIPLES

The municipality strives to offer its customers services that are technically, ecologically and financially sustainable. The municipality strives to be a responsible custodian and guardian of the community's wealth for present and future generations. The municipality strives to manage its real estate transparently for all its customers now and in the future.