58 Table 20: MBRR Table SA4 - Reconciliation between the IDP strategic objectives and budgeted income Table 21: MBRR Table SA5 - Reconciliation between the IDP strategic objectives and budgeted operating expenses. CRRF Capital Replacement Reserve Fund DBSA Development Bank of South Africa DoRA Division of Revenue Act.

ANNUAL BUDGET

Mayor’s Report

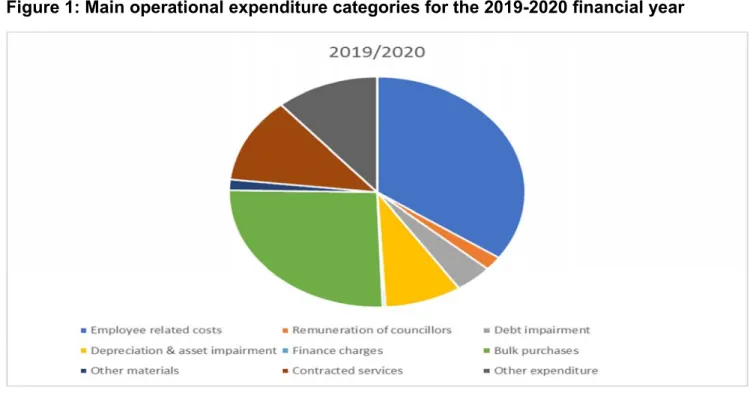

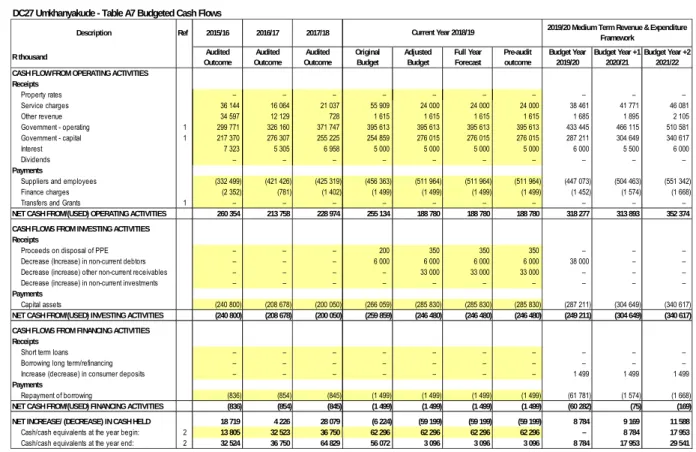

The other expenses consist of various items related to the day-to-day operations of the municipality. Applied to the municipality, matters of national and provincial importance should be reflected in the RDP of the municipality. The expected cash position of the municipality was discussed as part of the budgeted cash flow statement.

Council Resolution

EXECUTIVE SUMMARY

- Introduction

- Strategic priorities for 2019‐2020 .......................................... Error! Bookmark not defined

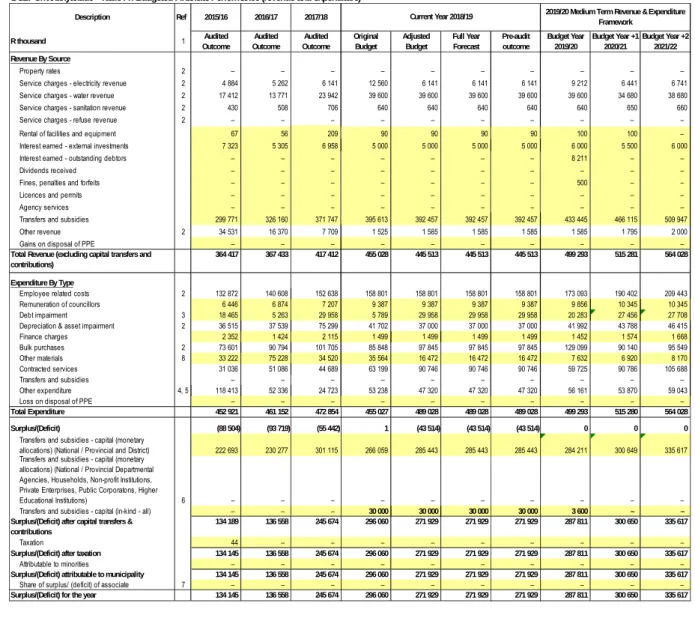

Operating Revenue Framework

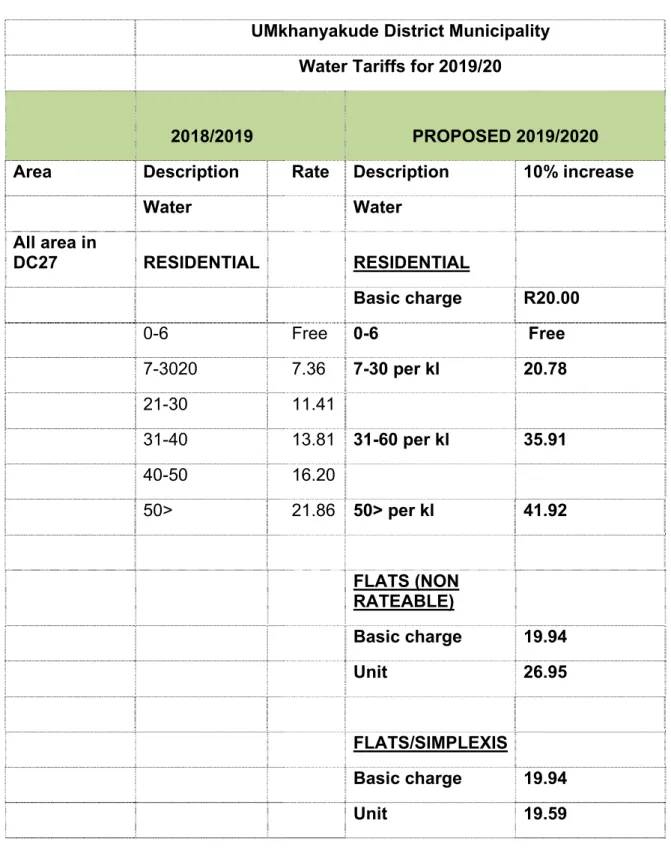

- Sale of water and impact on tariff increases ..................... 23Error! Bookmark not defined

Revenues generated from service fees constitute an insignificant percentage (23%) of the revenue basket for the municipality. In accordance with the municipality's repair and maintenance plan, this group of expenses has been prioritized to ensure the sustainability of uMkhanyakude's infrastructure. Indicate the necessary organizational arrangements to ensure the successful implementation of the integrated development planning process;

All five local municipalities in the area of the quarter municipality should be consulted about the proposed amendment; and. A deficit (deposits > cash and investment) indicates non-compliance with section 18 of the MFMA requirement that the municipal budget must be 'funded'. Any poor collection performance could put upward pressure on the municipality's ability to meet its debt obligations.

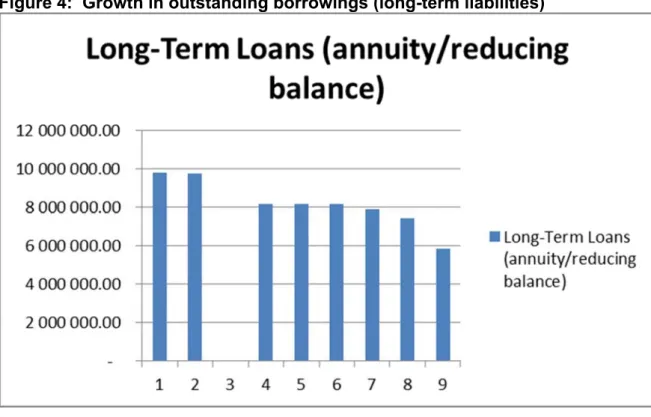

Long-term investments primarily consist of the sinking funds for repayment of future loans. This trend must be carefully monitored and managed with the implementation of the budget. There are currently no vacant positions in the upper management structure of the Water Services Department.

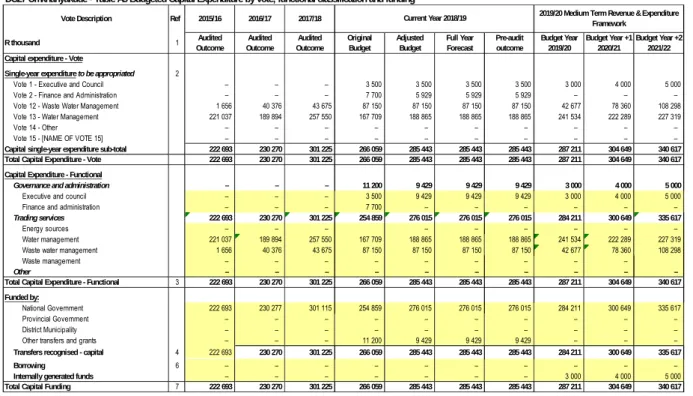

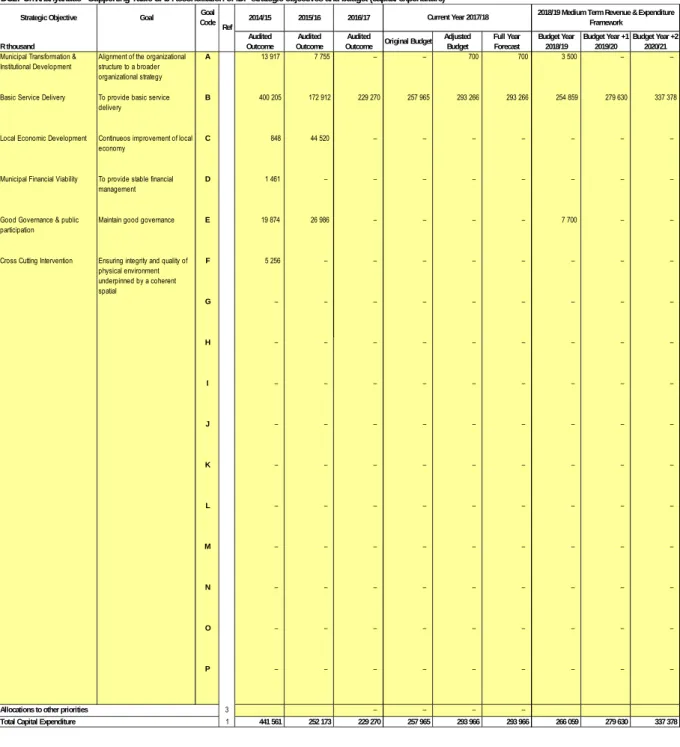

The following three tables present details of the municipality's capital expenditure program, first for new assets, then for repairs and maintenance.

Capital expenditure

Annual Budget tables

Supporting Documentation

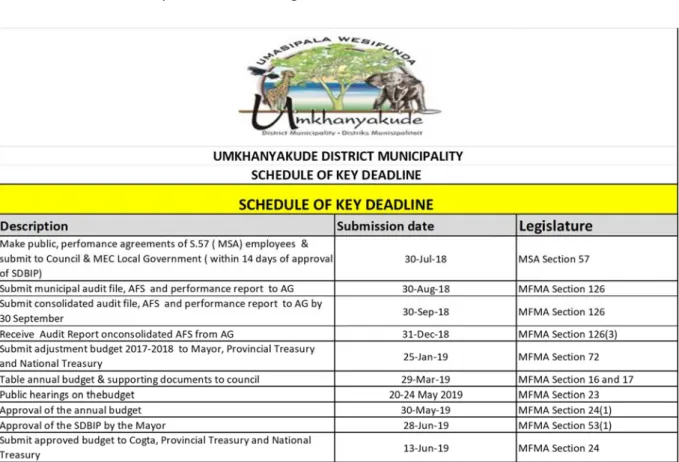

Overview of the annual budget process

- Budget Process overview

- Key IDP Processes and Deliverables

- Financial Modeling and Key Planning Drivers

- Community Consultation

The budget, together with the IDP, is reviewed annually in accordance with section 21 of the Municipal Finance Management Act no. 56 from 2003 and S34 of the Municipal Systems Act no. 32 from 2000. The municipality decided to eliminate unnecessary expenses, pay creditors and increase debt recovery. This annual review is the result of relevant regulations and priorities that are reviewed from year to year. Setting up an environment for managing the planning process and legal requirements in planning for the introduction of an integrated planning system;.

The outline of appropriate mechanisms, processes and procedures on how the public, stakeholders, state organs can participate in the drafting of the IDP and formulation of the budget structures that will be used to ensure this participation;. Program that specifies how the process will be monitored to manage the progress of the IDP and budget processes. During the compilation of the 2019-2020 MTREF, extensive financial modeling was undertaken to ensure affordability and long-term financial sustainability.

The need for tariffs increases compared to the community's ability to pay for services;. All documents in the appropriate format (electronic and hard copy) have been forwarded to the National Treasury and other national and provincial departments in accordance with section 23 of the MFMA to enable them to contribute.

Overview of alignment of annual budget with Integrated Development Plan

- Strategic objectives

Other stakeholders to be involved in the consultation are churches, non-governmental institutions and community-based organisations. The constitution requires local government to link its management, budgeting and planning functions to its objectives. Only a member or committee of the municipal council can present the proposal for changing the integrated development plan of the municipality to the council.

Any proposal to amend the municipality's integrated development plan must be accompanied by a memorandum setting out the reasons for the proposal. An amendment to the integrated development plan of the municipality shall be approved by a decision taken by a municipal council in accordance with the rules and orders of the Council. The proposed amendment is published for public comment for a period of at least 21 days in a manner that enables the public to make representations about the proposed amendment.

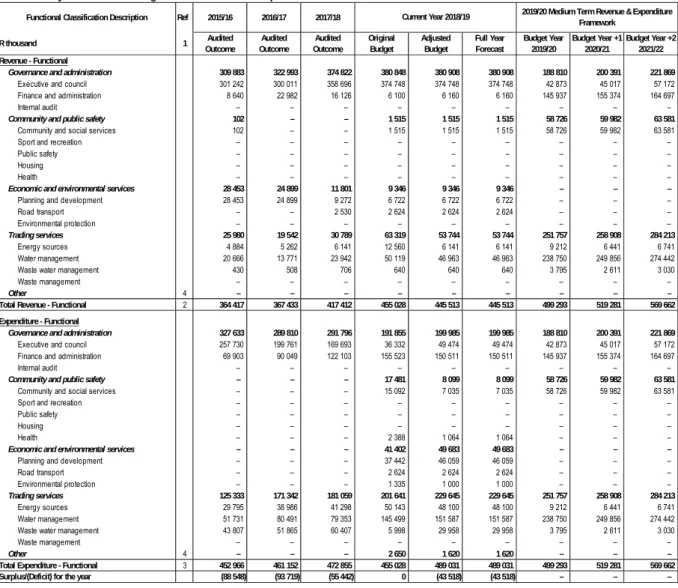

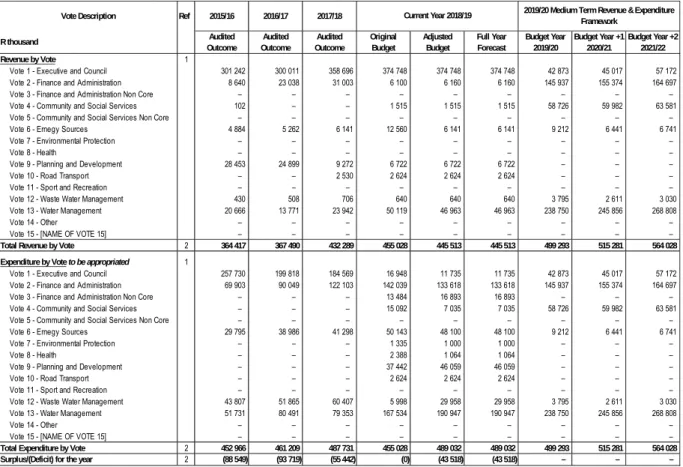

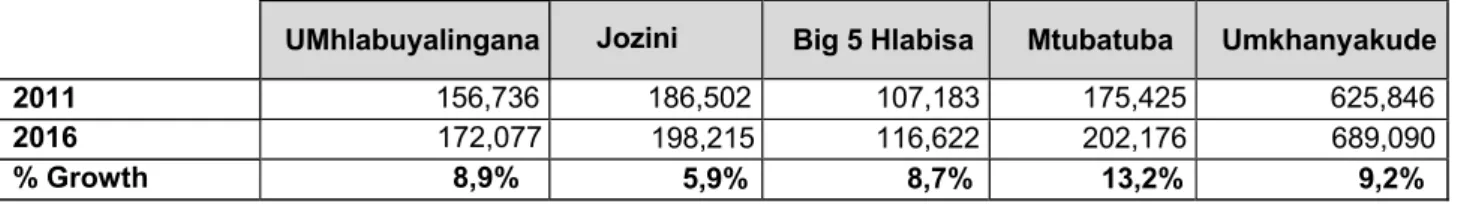

Take into account all comments submitted to it by the local councils in the area concerned before making a final decision on the proposed change. MTREF 2019-2020 has therefore been directly informed by the IDP review process and the following tables provide reconciliation between the IDP's strategic objectives and operating income, operating expenditure and capital expenditure.

Measurable performance objectives and indicators

- Performance indicators and benchmarks

- Free Basic Services: basic social services package for indigent households

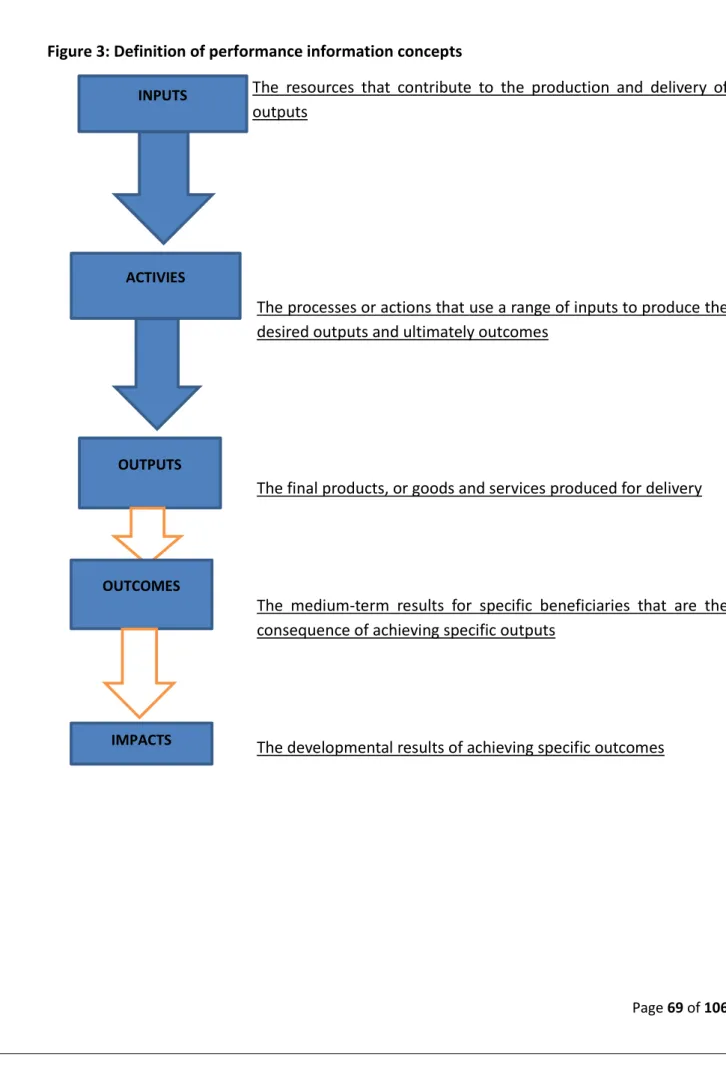

The performance of the municipality is directly related to the extent to which it has succeeded in achieving its goals and objectives, in accordance with legislative requirements and meeting the expectations of interested parties. The table below provides the key measurable performance targets that the municipality undertakes to achieve this financial year. Capital expenditures in local government can be financed by capital grants, own revenues and the municipality does not plan to have a long-term borrowing in 2019-2020.

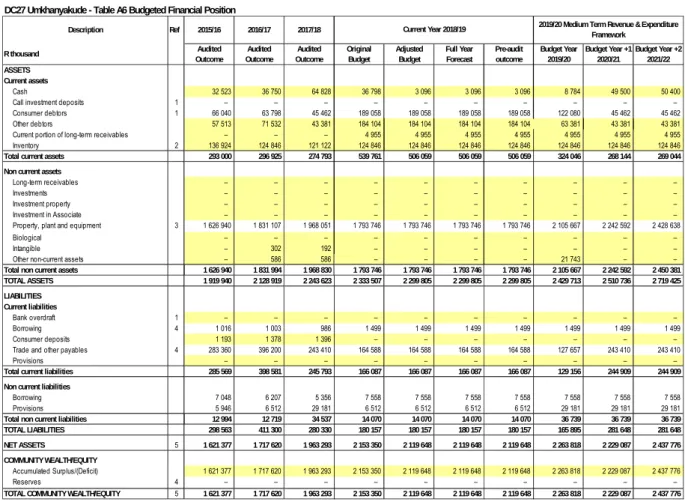

The debt ratio is a key figure that indicates the relative proportion of equity and debt used to finance the municipality's assets. The municipality has managed to ensure that creditors are settled within the statutory 30 days after invoice. While the level of liquidity is a cause for concern, by applying daily liquidity management, the municipality has managed to ensure compliance with this statutory obligation.

Note that the number of households in informal areas receiving free services and the costs of these services (eg delivery of water through standpipes, water tankers, etc.) are not taken into account in the table above. The municipality is the water service authority for the whole municipality under the Water Services Act of 1997 and acts as a water supply supplier.

Overview of budget related‐policies

- Asset Management Policy

- Expenditure management policy

- Risk management framework and risk management policy

- Indigent policy

UMkhanyakude Municipality decided in terms of section 111 of the Municipal Finance Management Act, No 56 of 2003, to have and implement a Supply Chain Management Policy giving effect to section 217 of the Constitution; and Part 1 of Chapter 11 and other applicable provisions of law is fair, equitable, transparent, competitive and cost-effective; complies with the Regulations; and any norms and minimum standards that may be prescribed in terms of Article 168 of the law, are in accordance with other legislation in force, e.g. Broad-Based Black Economic Empowerment (BBBEE), does not affect the objective of uniformity in Supply Chain Management Systems between state bodies in all spheres; and is in accordance with the national economic policy regarding the promotion of investments and doing business with the public sector, assigns the responsibility for the implementation of the policy to the Accounting Officer of the Municipality. Pursuant to Article 65 of the MFMA, the accounting officer of each municipality is required to take all reasonable steps to ensure that expenditures including payments and their financial documents are properly controlled and managed.

Risk management is recognized as an integral part of responsible management and the Institution therefore follows a comprehensive approach to the management of risk. It is expected that all departments/divisions, operations and processes will be subject to the risk management framework. Effective risk management is essential for the Institution to fulfill its mandate, the service delivery expectations of the public and the performance expectations within the Institution.

The provision of basic services to the community is sustainable, within the financial means of the Council and to provide procedures and guidelines for the subsidization of fees and service charges for its families in poverty, using part or all of the equal share for this purpose. The Council also recognizes that many residents simply cannot afford to pay the required service charges and fees and the Council will endeavor to ensure affordability.

Overview of budget assumptions

It should be noted that these allocations were conservatively estimated and as part of the cash coverage of reserves and provisions. Any deviations in this regard will be addressed as part of the mid-term review and budget adjustments. What are the projected funds and investments available at the end of the fiscal year.

As a starting point, unless there are special circumstances, the municipality is obliged to return unspent conditional grant funds to the national revenue fund at the end of the financial year. The following graph provides an analysis of the cash and cash equivalents trends and the reconciliation of cash-backed reserves/accumulated funds over a seven-year perspective. Landskassen requires the municipality to assess its financial sustainability in relation to fourteen different measures that look at different aspects of the municipality's financial health.

Regardless of the annual cash position, an assessment must be made of the municipality's ability to meet monthly payments on time. This measure aims to analyze the assumed base rate of collection for the MTREF to determine the relevance and reliability of the budget assumptions contained in the budget. A detailed capital budget requirement (since MFMA Circular 28 which was issued in December 2005) is to categorize each capital project as a new asset or a renovation/rehabilitation project.

The following three tables present details of the municipality's capital expenditure programme, firstly on new assets, then the renewal of assets and finally on the repair and maintenance of assets.

Overview of budget funding .......................................................... Error! Bookmark not defined

Councillor and employee benefits

Annual budgets and SDBIPs – internal departments

The department is primarily responsible for the distribution of drinking water within the municipal boundary, including the treatment of raw water, maintenance of the grid and the implementation of the departmental capital program. As part of the performance targets for the financial year, the expansion of the Water Demand Management functional unit will entail an adjustment of the department organization chart and the associated filling of vacancies. The departmental strategy ensures that the economic value and lifespan of the water network and infrastructure are maintained.

Contracts having future budgetary implications

Capital expenditure details