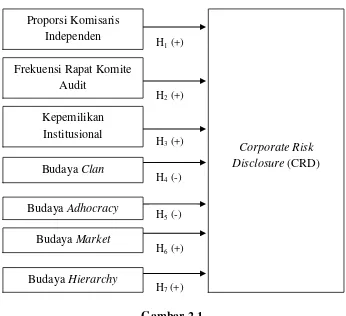

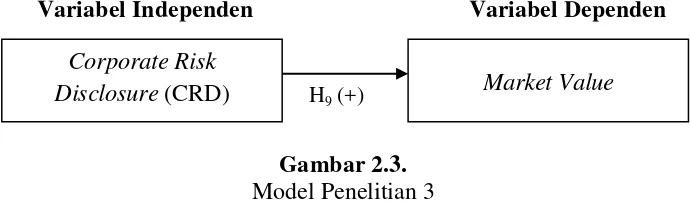

PENGARUH MEKANISME CORPORATE GOVERNANCE DAN BUDAYA PERUSAHAAN TERHADAP CORPORATE RISK DISCLOSURE SERTA DAMPAKNYA PADA FIRM VALUE DAN MARKET VALUE (Studi Empiris pada Perusahaan Non-Keuangan yang terdaftar di Bursa Efek Indonesia pada tahun 2015)

Teks penuh

Gambar

Garis besar

Dokumen terkait

: Corporate Governance and Risk Management Information Disclosure in Malaysian Listed Banks: panel Data Analysis. 4 (Empat)

Untuk hasil koefisien Adjusted R 2 menunjukkan bahwa penerapan Corporate Governance, Firm Age, Firm Size, Growth Asset, dan Business Risk mampu menjelaskan

Responsibility (CSR) terkait dengan firm value dapat dilihat dari harga

However, at the same time, good corporate governance has a positive influence on firm value, meaning that the firm value will increase if the company implements good corporate

Discussion H1: Good corporate governance affects the value of the firm in manufacturing companies that go public on the Indonesia Stock Exchange Based on the results of multiple

In this study, tax avoidance could mediate an independent board of commissioners on firm value but failed to mediate the effect of institutional ownership and CSRD with firm value..

Disclosure of CSR can increase firm value because stakeholder theory emphasizes that companies must disclose information CSR activities as a form of corporate responsibility towards

Penelitian yang dilakukan oleh Mukhtaruddin, Relasari dan Felmania 2014 bertema “Good Corporate Governance Mechanism, Corporate Responsibility Disclosure on Firm Value: Empirical Study