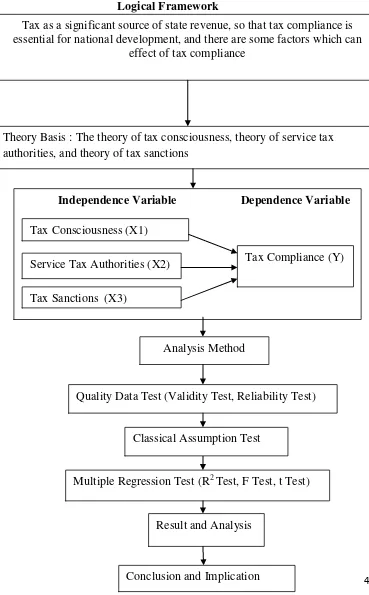

The Influence of Tax Consciousness, Service Tax Authorities and Tax Sanctions on Tax Compliance (Survey On Individual Taxpayer Conducting Business Operations and Professional Service in Jakarta)

Teks penuh

Gambar

Dokumen terkait

The purpose of this research was to find out whether the number of taxpayers, taxpayer compliance, and number of tax inspection have a significant influence

• Eksplorasi sifat bahan dan pemanfaatannya laporan rancangan pemecahan masalah laporan deskripsi proyek Perangkat presentasi dan perangkat berkarya (proyek berbasis

This study aims to analyze whether digital transformation, tax policy, company characteristics and perceptions of weaknesses in the tax system have an influence

"The Effect of Religiosity and Tax Socialization on Taxpayer Compliance With Taxpayer. Awareness as an

To investigate the effect of consciousness, the sanctions, the attitude of the tax authorities, environment, knowledge of tax regulations influence simultaneously on tax compliance

Through secondary information and documents, summary reports of tax authorities, articles assessing fairness in the legal tax system, regulations on tax exemption and

What is the effect of the simultaneous dissemination of taxation information, tax rates, and tax sanctions on individual taxpayers' annual tax return reporting compliance at

3 Abdur Rahman Al Juzairi. Fiqih Empat Madzhab.. Maka Allah menyesatkan, siapa yang Dia kehendaki, dan memberi petunjuk kepada siapa yang Dia kehendaki. dan Dia-lah