Factors That Affect Stock Prices At The Manufacturing Companies Listed On The Indonesia Stock Exchange

Teks penuh

Gambar

Dokumen terkait

CONCLUSION Based on the results of the analysis and discussion that has been carried out on financial ratios in manufacturing companies in the cosmetics and household sub-sectors

This research supports the result of Elfira 2014, which shows the bonus compensation have a positive and significant effect on creative accounting in the kind of earnings management..

The analysis of independent sample t-test shows that there are significant difference between the S-Score performance of Cement companies that comprises of INTP, SMGR, SMBR, SMCB and

The first hypothesis testing Signific ance level T- statistics Standardized coefficients Non-standard coefficients Model Standar Beta d error Beta 0.000 15.06 0.16 -0.255 Fixed

Logistic Regression Model The test tool used in this study is logistic regression analysis that is by seeing the effect of public account- ing firm size, financial distress,

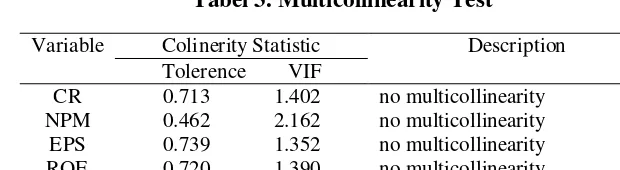

4.3.1 Autocorrelation Test Durbin Watson Test 4.3.2 Heteroscedasticity Breusch-Pagan- Godfrey Test 4.3.3 Multicollinearity VIF Test 4.4 Regression Analysis OLS 4.4.1 Regression Model

To test this prediction, the following hypothesis will be analyzed: H3: Relational capital has a negative effect on the indication of financial statement fraud DATA, METHODS, AND

Multiple Linear Regression Results Hypothesis tcount Significance Conclusion H1 Price Earnings Ratio->Stock Return -1.864 0.068 H1 Rejected H2 Price to Book Value->Stock Return