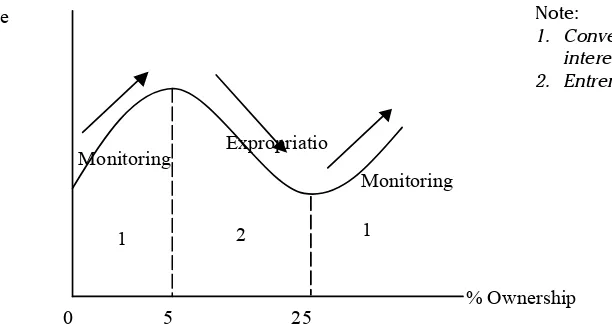

How Ownership Structure Influences Firm Performance in Relation to Its Life Cycle

Teks penuh

Gambar

Dokumen terkait

Multiple linear regression results above show that the variable Liquidity and Solvency has a positive influence on the Capital Structure, while the variable

The family members of controlling owners serving on the board (FMBD) has a positive association with controlling family ownership (FML), suggesting that family-controlled firms are

The results of multiple linear regression analysis can be concluded, that environmental responsibility affect cash holding negatively, growth has a positive influence direction on

92-109 The Effect of Ownership Structure and Corporate Social Responsibility on Financial Performance and Firm Value in Mining Sector Companies in Indonesian Fadrul 1, Budiyanto

Although profitability does not have a significant influence on stock prices, liquidity has a significant positive impact, while capital structure, managerial ownership, and sales

The regression results for the model 2 shows that there is no significant impact for the Institutional Ownership and the Bank’s age on the banks performance, and that there is a

Findings: The results revealed that airlines with the majority of private domestic and private foreign ownership showed a significant positive effect on financial performance ROA and

Based on the results of research conducted, it was found that the variables of capital ownership, digital payment and digital sales have a significant positive influence, so it can be